Market Overview

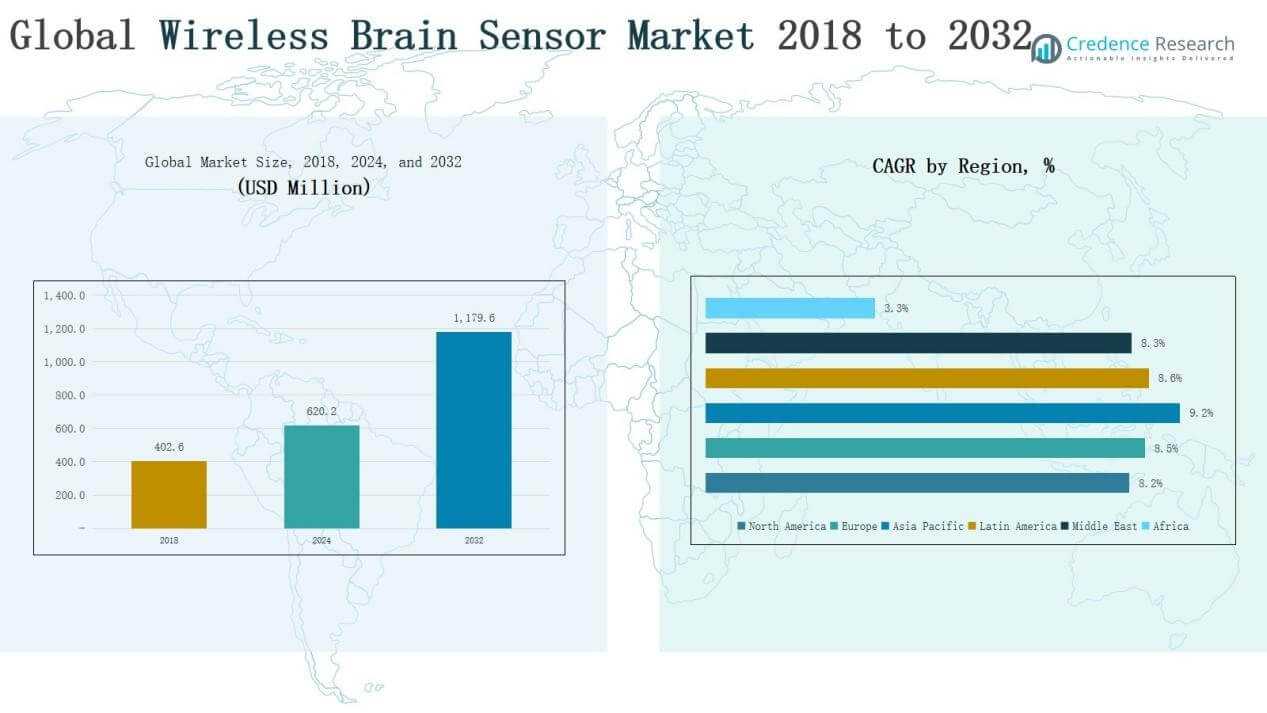

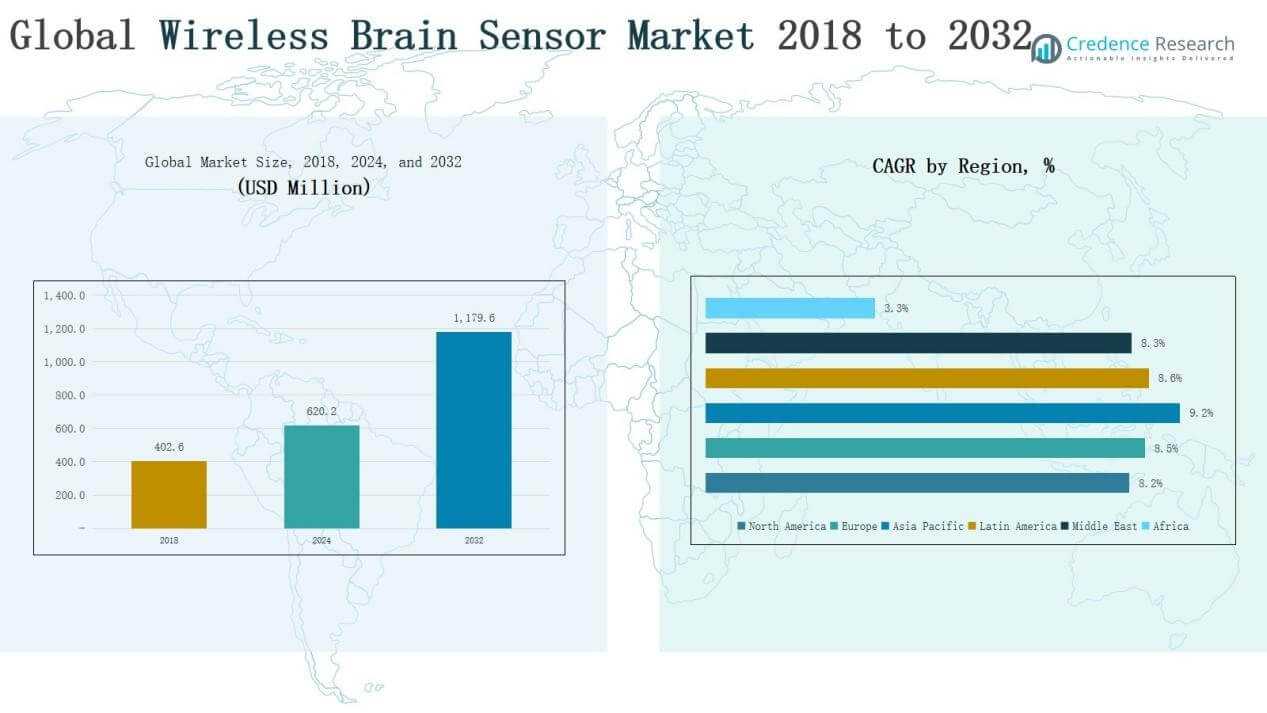

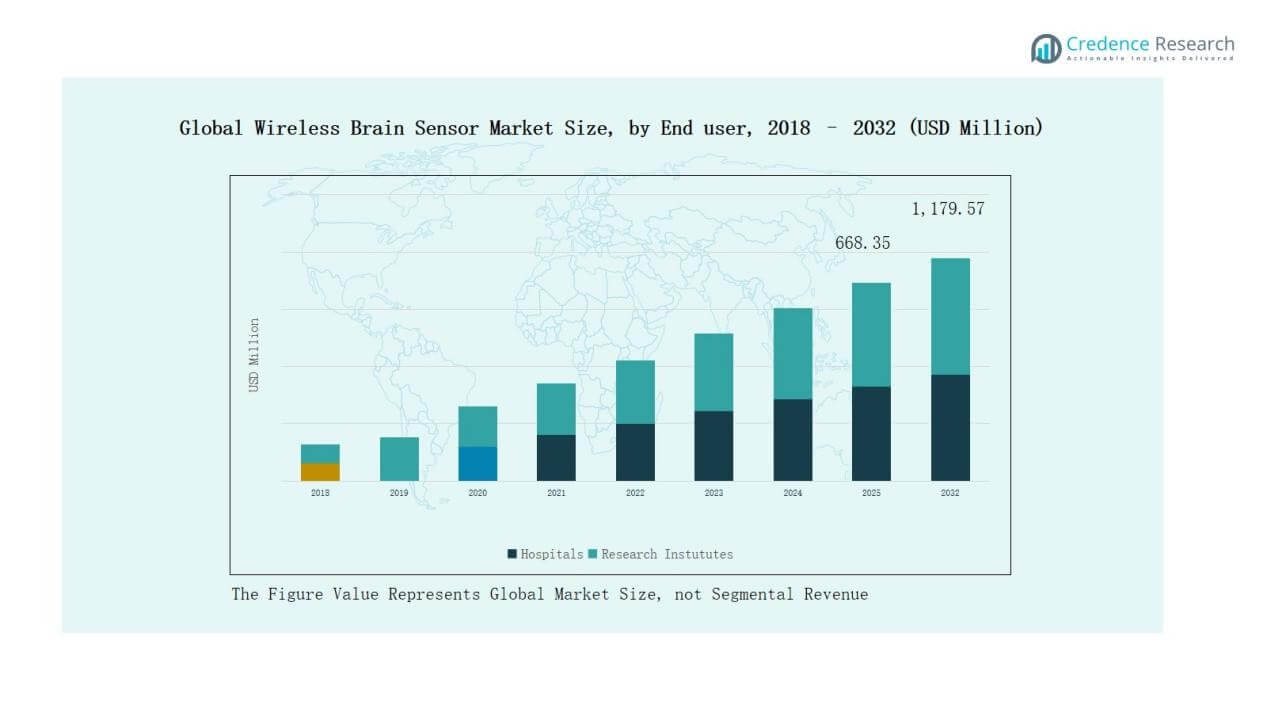

Global Wireless Brain Sensor Market size was valued at USD 402.6 million in 2018 to USD 620.2 million in 2024 and is anticipated to reach USD 1,179.6 million by 2032, at a CAGR of 8.45% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Wireless Brain Sensor Market Size 2024 |

USD 620.2 Million |

| Wireless Brain Sensor Market, CAGR |

8.45% |

| Wireless Brain Sensor Market Size 2032 |

USD 1,179.6 Million |

The Global Wireless Brain Sensor Market is shaped by key players such as EMOTIV, Inc., Muse, NeuroSky, Advanced Brain Monitoring, Inc., and Neuronetrix Solutions, LLC, along with other emerging innovators. These companies focus on wireless EEG devices, wearable brain monitoring solutions, and integration with AI-driven platforms to strengthen their market positions. Strategic collaborations with hospitals and research institutes, coupled with product advancements in accuracy and portability, are central to their growth strategies. Regionally, North America led the market in 2024 with a 36% share, supported by advanced healthcare infrastructure, strong adoption of neurodiagnostic technologies, and significant R&D investments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Global Wireless Brain Sensor Market grew from USD 402.6 million in 2018 to USD 620.2 million in 2024 and is projected to reach USD 1,179.6 million by 2032, expanding at 8.45%.

- Electroencephalography (EEG) devices led the product segment in 2024 with 41% share, driven by strong use in neurological diagnostics, brain-computer interface research, and patient monitoring.

- Epilepsy dominated the application segment in 2024, holding 37% share, supported by the need for continuous wireless monitoring and growing demand across clinical and home care settings.

- Hospitals remained the top end users in 2024, capturing 62% share, supported by integration of wireless sensors in neurology wards, surgical monitoring, and critical care departments.

- North America led regionally with 36% share in 2024, followed by Europe at 29% and Asia Pacific at 19%, highlighting strong adoption in developed healthcare markets.

Market Segment Insights

Market Segment Insights

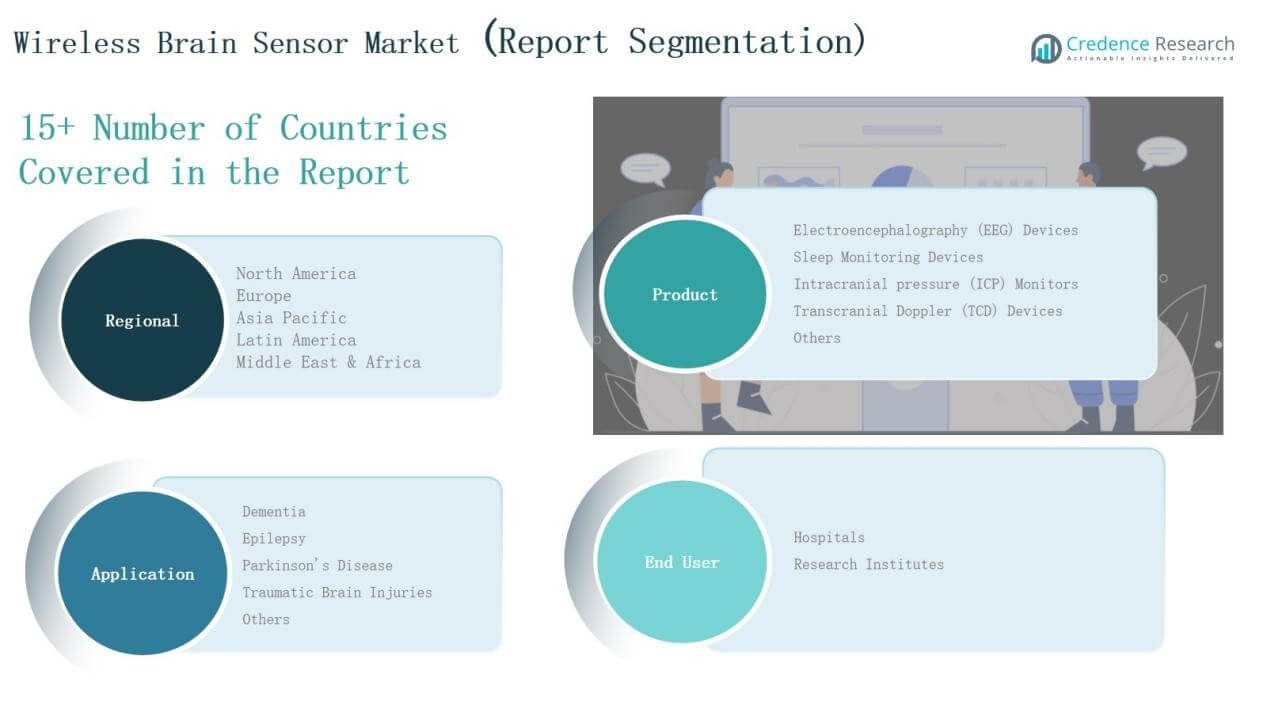

By Product

Electroencephalography (EEG) devices dominated the product segment in 2024, accounting for 41% of the market share. Their strong adoption stems from widespread use in neurological diagnostics, brain-computer interface research, and continuous patient monitoring. Sleep monitoring devices followed closely, driven by rising sleep disorders and growing consumer health awareness. Intracranial pressure (ICP) monitors and transcranial Doppler (TCD) devices hold niche applications in critical care and stroke management, while the “Others” category includes emerging innovations targeting specialized neurology use cases.

For instance, Philips Healthcare introduced its SmartSleep Analyzer, expanding its portfolio of consumer sleep monitoring devices in response to growing demand in the U.S. market.

By Application

Epilepsy emerged as the leading application segment, representing 37% of the market share in 2024. The high prevalence of epileptic disorders and the need for continuous, wireless monitoring in both clinical and home settings are fueling growth. Dementia applications are also expanding, supported by aging populations and early-detection initiatives. Parkinson’s disease and traumatic brain injuries contribute significantly as demand for portable monitoring and rehabilitation tools rises. The “Others” category covers research in mental health and neurodevelopmental disorders, further diversifying adoption.

For instance, BioSerenity has its own FDA-cleared EEG platform for remote epilepsy monitoring and partners with over 300 hospitals, while Cleveland Clinic is independently advancing similar diagnostic technology, often through collaborations with other AI and health IT companies.

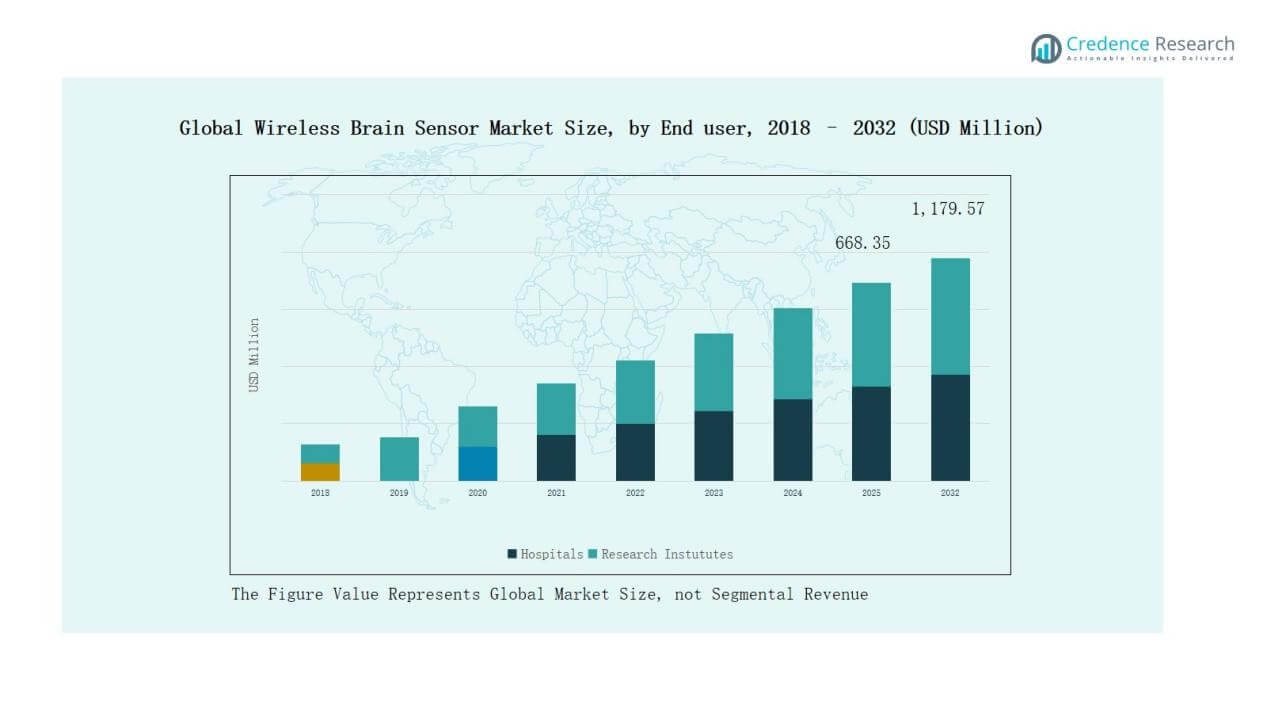

By End User

Hospitals remained the largest end-user segment, securing 62% of the market share in 2024. Their dominance is attributed to the integration of wireless brain sensors in critical care, neurology wards, and surgical monitoring. The clinical setting’s demand for accuracy, regulatory compliance, and real-time patient tracking reinforces this position. Research institutes accounted for the remaining share, leveraging these devices for advanced neuroscience studies, clinical trials, and brain-computer interface development. Growing investments in academic and private research are expected to strengthen this segment over the forecast period.

Key Growth Drivers

Rising Prevalence of Neurological Disorders

The global burden of neurological diseases such as epilepsy, dementia, and Parkinson’s is steadily increasing. This trend is driving demand for advanced brain monitoring technologies that can offer real-time insights and improve patient outcomes. Wireless brain sensors are particularly valuable as they enable remote monitoring and non-invasive diagnostics, reducing hospitalization needs. With growing healthcare expenditure and aging populations worldwide, healthcare providers are adopting these devices to manage chronic neurological conditions more efficiently, fueling consistent market expansion.

For instance, NeuroOne Medical Technologies announced the U.S. FDA clearance of its Evo sEEG electrode system designed for minimally invasive brain activity monitoring in patients with epilepsy.

Advancements in Wireless and Wearable Technologies

Rapid progress in wireless communication, miniaturized sensors, and wearable electronics has significantly enhanced the performance of brain monitoring devices. Modern wireless brain sensors now offer improved accuracy, portability, and integration with mobile health platforms. These advancements reduce patient discomfort and allow seamless data transfer for clinicians. Enhanced connectivity also supports telemedicine and remote patient monitoring solutions. As healthcare systems worldwide push toward digitalization, the integration of wireless sensors with AI and cloud-based analytics is driving widespread adoption.

For instance, Neuroelectrics introduced its Starstim Home Research Kit, a wireless EEG and transcranial stimulation system designed for remote brain monitoring and neuroscience research.

Growing Adoption in Research and Clinical Trials

Research institutes and academic centers are increasingly adopting wireless brain sensors to support neuroscience studies and clinical trials. These devices enable continuous brain activity monitoring in naturalistic settings, offering more reliable data compared to traditional wired systems. Pharmaceutical companies also rely on brain sensors to evaluate neurological drug efficacy and side effects during clinical trials. This rising research demand, combined with investments in brain-computer interface (BCI) technologies, is strengthening adoption across both academia and industry, positioning the market for sustained growth.

Key Trends & Opportunities

Key Trends & Opportunities

Integration with AI and Digital Health Platforms

Wireless brain sensors are increasingly being integrated with artificial intelligence (AI) algorithms and digital health ecosystems. This integration allows automated data interpretation, predictive analytics, and early disease detection. Cloud connectivity and mobile apps also enhance patient engagement by providing real-time feedback. These developments create opportunities for more personalized treatments and faster decision-making in clinical environments. As digital health infrastructure expands globally, the demand for intelligent, connected wireless brain sensors is expected to grow substantially in the coming years.

For instance, Cognixion launched Cognixion One, a wireless brain-sensor–based AR headset that leverages AI and cloud connectivity to support communication for patients with severe speech and motor impairments.

Expanding Applications Beyond Healthcare

While clinical use remains the primary market driver, opportunities are emerging in non-medical sectors such as cognitive training, gaming, and mental wellness. Wireless EEG headsets, for example, are being adopted by consumers for stress management and focus improvement. The sports industry is also exploring these technologies to monitor brain activity for performance optimization and injury prevention. This diversification beyond traditional healthcare applications provides manufacturers with new revenue streams, positioning wireless brain sensors as multipurpose tools in both clinical and consumer markets.

For instance, BrainBit introduced its BrainBit Flex wireless EEG headband, targeting wellness and sports applications by allowing athletes to monitor neural signals for stress and fatigue management.

Key Challenges

High Costs and Limited Accessibility

Despite their benefits, wireless brain sensors remain expensive, limiting adoption in low- and middle-income regions. High device costs, coupled with the need for supporting digital infrastructure, restrict market penetration. Many healthcare providers in developing economies face budget constraints, reducing investment in advanced monitoring technologies. This affordability gap poses a significant challenge for manufacturers aiming to expand globally, as they must balance innovation with cost-effective solutions to meet diverse market needs.

Data Privacy and Security Concerns

Wireless brain sensors generate sensitive neurological data, raising concerns about privacy and data security. Unauthorized access or misuse of this information could lead to ethical and legal issues, particularly in regions with stringent data protection regulations. Healthcare providers and manufacturers must ensure compliance with standards such as HIPAA and GDPR. Building secure, encrypted platforms for data transmission and storage is essential. However, maintaining robust security measures while ensuring seamless data accessibility remains a persistent challenge for the industry.

Technical Limitations and Reliability Issues

Although wireless brain sensors have advanced, challenges remain regarding signal accuracy, interference, and device reliability. Motion artifacts and environmental noise can distort readings, limiting clinical effectiveness. Battery life and device durability also pose constraints for long-term monitoring applications. In critical care settings, reliability and accuracy are paramount, and any technological shortcomings may hinder adoption. Overcoming these limitations through continuous innovation in sensor design and wireless communication protocols will be essential for strengthening trust in these devices.

Regional Analysis

North America

North America led the global wireless brain sensor market, reaching USD 233.37 million in 2024, up from USD 153.38 million in 2018. It is projected to attain USD 436.44 million by 2032, growing at a CAGR of 8.2%. The region accounted for 36% of the global share in 2024, supported by advanced healthcare infrastructure, strong adoption of innovative neurodiagnostic technologies, and significant investments in R&D. High prevalence of neurological disorders and supportive reimbursement frameworks continue to fuel regional demand, reinforcing North America’s dominant market position.

Europe

Europe represented the second-largest market, valued at USD 186.34 million in 2024, up from USD 120.45 million in 2018, and is forecast to reach USD 356.35 million by 2032 at a CAGR of 8.5%. The region held 29% of the global market share in 2024, with strong growth driven by rising healthcare digitization, expanding applications of wireless brain sensors in hospitals, and government initiatives supporting neurological research. Countries such as Germany, France, and the UK are key adopters, supported by robust healthcare spending and early integration of digital health technologies.

Asia Pacific

Asia Pacific is the fastest-growing region, with revenues increasing from USD 76.09 million in 2018 to USD 122.51 million in 2024, and expected to reach USD 246.41 million by 2032, at a CAGR of 9.2%. The region contributed 19% of the global share in 2024, driven by rising healthcare investments, large patient pools, and increasing awareness of neurological disorders. Growth is further supported by rapid adoption of wearable health technologies in China, Japan, South Korea, and India. Expanding digital health infrastructure and government-backed healthcare initiatives position Asia Pacific as a key driver of global market expansion.

Latin America

Latin America’s market grew from USD 22.83 million in 2018 to USD 35.46 million in 2024, and it is projected to reach USD 68.18 million by 2032, with a CAGR of 8.6%. The region held 6% of the market share in 2024, supported by increasing adoption of wireless monitoring technologies in Brazil, Mexico, and Argentina. Growing healthcare expenditure, improving hospital infrastructure, and rising incidence of brain injuries and neurological diseases are driving adoption. However, limited affordability and uneven healthcare access remain challenges, though expanding private healthcare investments are helping to bridge the gap.

Middle East

The Middle East market expanded from USD 19.24 million in 2018 to USD 29.35 million in 2024, and is forecast to reach USD 55.09 million by 2032, at a CAGR of 8.3%. The region accounted for 5% of the global share in 2024, driven by rising adoption of advanced neurodiagnostic solutions in GCC countries, Israel, and Turkey. Increasing investments in healthcare modernization and strong demand for high-precision monitoring devices are supporting growth. Government-backed healthcare reforms and the expansion of private hospitals further position the Middle East as a steadily growing wireless brain sensor market.

Africa

Africa represented the smallest regional market, valued at USD 13.17 million in 2024, compared with USD 10.59 million in 2018, and projected to reach USD 17.10 million by 2032, registering a CAGR of 3.3%. The region contributed only 2% of the global share in 2024, reflecting slower adoption due to limited healthcare infrastructure, affordability challenges, and lack of awareness. However, South Africa and Egypt are emerging as early adopters, driven by gradual investments in healthcare modernization and research collaborations. Despite its small size, Africa holds long-term potential as healthcare systems evolve.

Market Segmentations:

Market Segmentations:

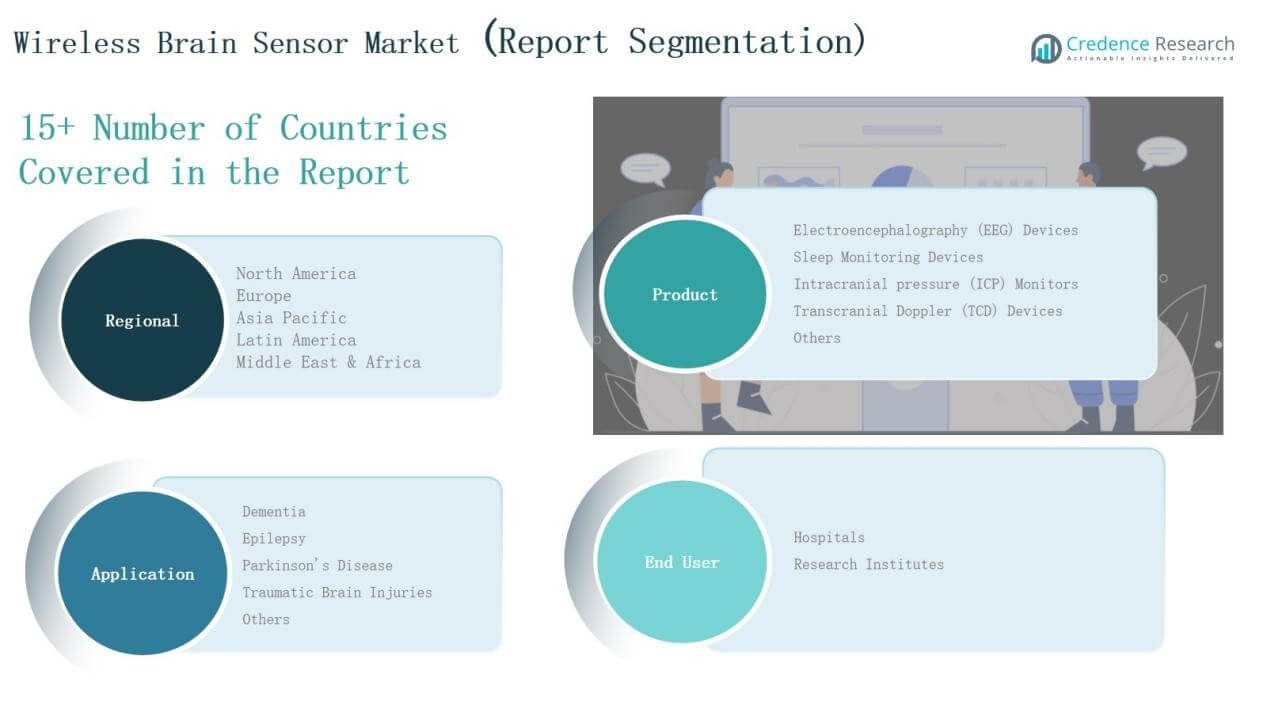

By Product

- Electroencephalography (EEG) Devices

- Sleep Monitoring Devices

- Intracranial Pressure (ICP) Monitors

- Transcranial Doppler (TCD) Devices

- Others

By Application

- Dementia

- Epilepsy

- Parkinson’s Disease

- Traumatic Brain Injuries

- Others

By End User

- Hospitals

- Research Institutes

By Region

North America

Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

Latin America

- Brazil

- Argentina

- Rest of Latin America

Middle East

- GCC Countries

- Israel

- Turkey

- Rest of Middle East

Africa

- South Africa

- Egypt

- Rest of Africa

Competitive Landscape

The global wireless brain sensor market is moderately consolidated, with a mix of established medical device companies and emerging neurotechnology firms competing for market share. Key players such as EMOTIV, Inc., Muse, NeuroSky, Advanced Brain Monitoring, Inc., and Neuronetrix Solutions, LLC are at the forefront, focusing on product innovation, wearable EEG devices, and integration with digital health platforms. These companies emphasize expanding their product portfolios, strengthening R&D capabilities, and forging partnerships with healthcare providers and research institutes to broaden adoption. Startups and niche firms are also entering the market with AI-enabled solutions, low-cost wireless EEG headsets, and specialized applications in sleep monitoring, dementia care, and brain-computer interface development. Competition is driven by advancements in sensor accuracy, portability, and data analytics capabilities. With increasing global demand, players are strategically investing in regional expansions, clinical trials, and regulatory approvals to secure strong market positions while addressing cost and accessibility challenges.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- EMOTIV, Inc.

- Muse

- NeuroSky

- Advanced Brain Monitoring, Inc.

- Neuronetrix Solutions, LLC

- Other Key Players

Recent Developments

- In January 2025, Emotiv launched the MW20 EEG Active Noise-Cancelling Earphones, merging premium audio with EEG-based wellness insights.

- In April 2025, Starlab and Neuroelectrics joined the PREDICTOM project to advance AI tools for early Alzheimer’s detection.

- In April 2025, Precision Neuroscience received FDA clearance for its Layer 7 Cortical Interface, a 1,024-electrode array capable of recording and stimulation for up to 30 days.

Report Coverage

The research report offers an in-depth analysis based on Product, Application, End User and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for wireless EEG devices will rise with increasing neurological disorder diagnoses.

- Integration of brain sensors with AI will enhance predictive analytics and early detection.

- Remote patient monitoring will expand due to telemedicine and homecare adoption.

- Consumer applications in mental wellness, gaming, and sports will grow steadily.

- Hospitals will continue to dominate usage, supported by advanced neurology departments.

- Research institutes will adopt sensors more for brain-computer interface innovations.

- Miniaturization and wearable designs will improve patient comfort and adoption rates.

- Partnerships between tech firms and healthcare providers will accelerate market penetration.

- Regional growth will be strongest in Asia Pacific due to large patient pools.

- Data privacy and regulatory compliance will remain critical for wider market acceptance.

Market Segment Insights

Market Segment Insights Key Trends & Opportunities

Key Trends & Opportunities Market Segmentations:

Market Segmentations: