Market Overview

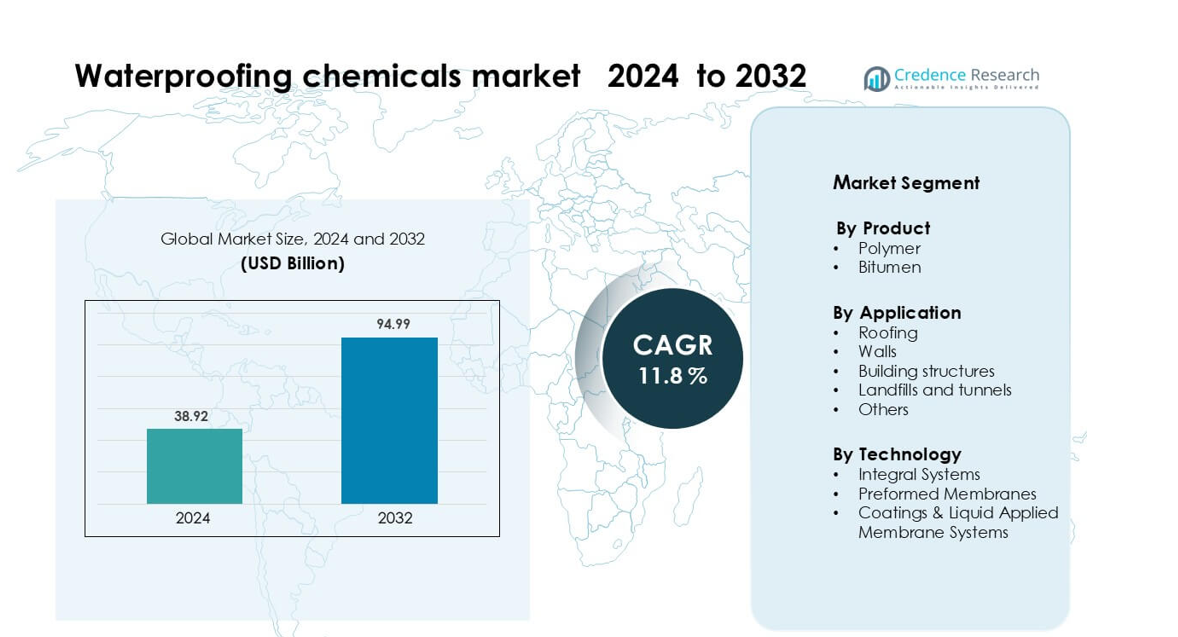

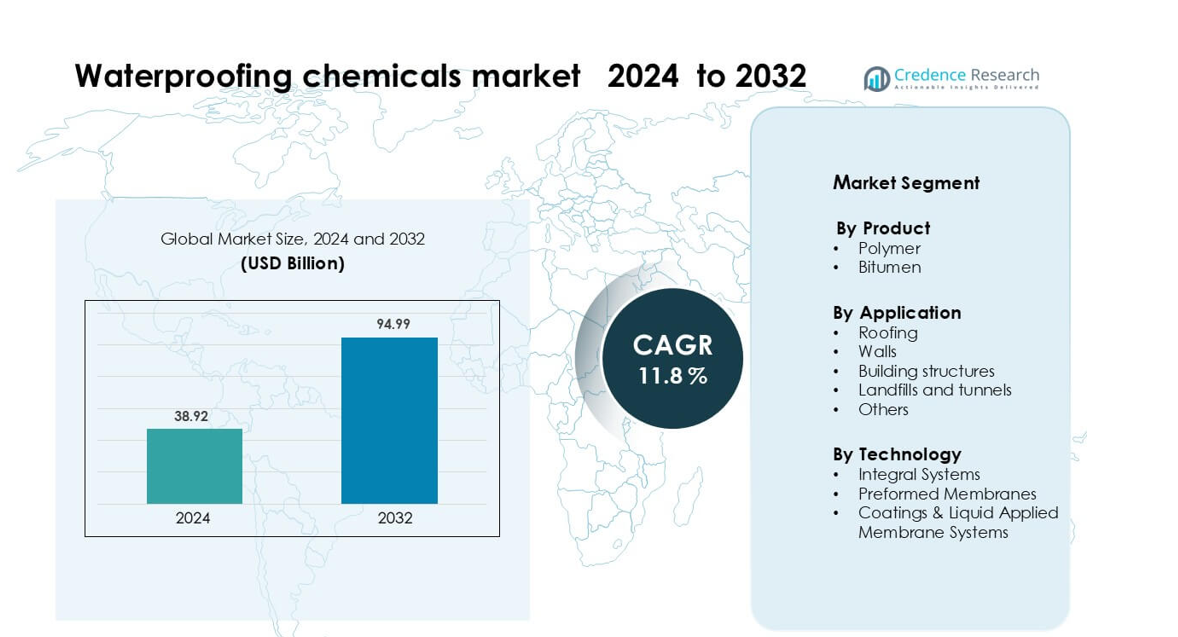

Waterproofing chemicals market was valued at USD 38.92 billion in 2024 and is anticipated to reach USD 94.99 billion by 2032, growing at a CAGR of 11.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Waterproofing Chemicals Market Size 2024 |

USD 38.92 billion |

| Waterproofing Chemicals Market, CAGR |

11.8% |

| Waterproofing Chemicals Market Size 2032 |

USD 94.99 billion |

Top players in the waterproofing chemicals market include BASF SE, Johns Manville, SOPREMA Group, Sika AG, DOW, Minerals Technologies Inc., MBCC Group, Firestone Building Products Company, EverGuard TPO Walkway Roll, and Carlisle Companies Inc. These companies strengthen their position through advanced polymer membranes, liquid-applied coatings, and durable bitumen systems used across large construction projects. Continuous product innovation, regional capacity expansion, and strong contractor partnerships help these firms maintain competitiveness in rapidly growing markets. Asia Pacific remained the leading region in 2024 with about 41% share, driven by large-scale infrastructure spending, urban housing demand, and rising adoption of high-performance waterproofing solutions.

Market Insights

- Waterproofing chemicals market was valued at USD 38.92 billion in 2024 and is anticipated to reach USD 94.99 billion by 2032, growing at a CAGR of 11.8% during the forecast period.

- Growth drivers include rapid urbanisation, expanded infrastructure development, and increasing demand for durable buildings, which push segment share for polymer-based products higher.

- Key trends highlight a shift toward sustainable, low-VOC waterproofing solutions and wider adoption of liquid-applied membranes, especially in the roofing and building-structures applications.

- Competitive analysis shows major chemical and construction companies leveraging innovations, geographic expansions and strategic partnerships to secure stronger positions, though high raw material costs act as a market restraint.

- Regionally, Asia Pacific dominated the market with a share of approximately 41 % in 2023; product segments such as roofing accounted for leading application shares.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

Polymer products dominated the waterproofing chemicals market in 2024 with about 46% share. Strong demand came from construction firms that favored acrylic, polyurethane, and EPDM solutions for flexibility and long service life. Builders used polymer barriers in large projects due to fast curing and strong UV resistance. Bitumen stayed important in mass roofing and roadwork, but rising need for lighter and more durable materials helped polymer systems grow faster across both residential and commercial sites.

- For instance, Sika AG applied 3.3 million m² of its Sikaplan® polymer‑based waterproofing membrane in the Gotthard Base Tunnel project, demonstrating both excellent flexibility and long-term durability.

By Application

Roofing remained the dominant application in 2024 with nearly 42% share. Contractors chose roofing systems because they offered strong leak protection, easy installation, and wide compatibility with modern membranes. Market growth also came from urban housing upgrades and warehouse expansion. Walls and building structures showed steady demand as high-rise projects increased, while landfills and tunnels used advanced barriers for chemical resistance and long-term moisture control in regulated environments.

- For instance, Sika deployed its Sikalastic‑833 R pure polyurea membrane at a large exposed roof project with a coverage rate of ~2.0–2.4 kg/m², delivering a dry film thickness of 2.0–2.4 mm and a tensile strength of ~16 MPa, which provided excellent crack bridging and UV resistance.

By Technology

Coatings & liquid applied membrane systems led the market in 2024 with around 49% share. These systems gained traction due to seamless coverage, easy handling, and strong adhesion on complex surfaces. Construction firms preferred liquid membranes for large roofs, podium slabs, and refurbishment jobs. Preformed membranes stayed relevant in tunnels and basements, while integral systems expanded as developers added admixtures during concrete mixing to improve long-term structural durability across new infrastructure projects.

Key Growth Drivers

Rising Construction and Infrastructure Investment

Global construction growth acts as a major catalyst for the waterproofing chemicals market. Urban housing demand continues to rise, while governments invest in transportation networks, smart cities, and industrial corridors. These projects require long-lasting moisture barriers to protect foundations, roofs, and structural components from water damage. Builders now follow stricter quality norms, which boosts the use of advanced membranes and polymer-based coatings. Climate variation also increases the need for strong waterproofing solutions in flood-prone and high-rainfall areas. Together, these factors push steady adoption across residential, commercial, and public infrastructure developments worldwide.

- For instance, Sika supplied approximately 3.3 million m² of its Sikaplan® waterproofing membrane for the Gotthard Base Tunnel in Switzerland, leveraging its long-term durability for high stress, water-bearing underground infrastructure.

Increasing Focus on Durability and Building Safety

Developers now prioritize structural safety as building failures linked to water seepage become more common. Moisture intrusion accelerates corrosion, weakens concrete, and raises repair costs for large assets. Waterproofing chemicals help extend service life, reduce lifecycle spending, and improve overall building durability. Commercial complexes, warehouses, and industrial units use liquid membranes and integral systems to protect heavy-use areas. Better awareness among builders and facility managers drives wider compliance with safety codes. This shift supports strong growth for high-performance coatings, modified bitumen sheets, and polymer membranes across key global markets.

- For instance, Sika’s Sikagard® M 790 crack-bridging membrane provides high resistance to carbon dioxide diffusion, thereby protecting embedded rebar in concrete from corrosion

Growth in Industrial and Waste Management Projects

Demand rises as industries expand storage units, processing plants, and utility buildings that require strong waterproofing barriers. Chemical plants, warehouses, water-treatment projects, and power facilities use membranes to prevent leaks that may affect operations or safety. Landfill sites and tunnels also need specialized waterproofing layers to block hazardous runoffs and groundwater intrusion. Regulations encourage the use of protective coatings in waste containment zones, pushing wider adoption. These needs make waterproofing chemicals essential for long-term protection in sectors where exposure risks remain high and maintenance windows stay limited.

Key Trend & Opportunity

Shift Toward Polymer and Liquid Membrane Technologies

The market shows a clear shift toward flexible, seamless polymer coatings and liquid-applied membranes. Builders value these technologies for their ease of application, faster installation, and strong adhesion to complex surfaces. Urban redevelopment, green buildings, and lightweight construction materials further support this shift. Companies now innovate with elastomeric acrylics, polyurethanes, and hybrid membranes that offer longer durability and UV resistance. This trend opens opportunities for manufacturers to introduce low-VOC, fast-curing, and energy-efficient solutions aligned with modern architectural needs.

- For instance, Sika’s Sikalastic®‑560 (a one-component, waterborne polyurethane‑acrylic dispersion) cures to rain resistance in about 8 hours and reaches full cure in 4 days at 20 °C, with a dry film thickness of 0.3–0.5 mm when applied at 0.9–1.4 kg/m².

Adoption of Sustainable and Low-Emission Waterproofing Solutions

Sustainability creates new opportunities as buyers prefer materials with reduced environmental impact. Regulations encourage lower solvent use, recyclable membranes, and products that reduce VOC emissions. Leading brands now develop bio-based polymers and water-borne coatings that meet green-building certifications. Roofing and facade systems adopt reflective and heat-resistant coatings, helping reduce energy use in high-temperature regions. This shift enables companies to expand their portfolios with eco-friendly options while capturing demand from developers aiming for LEED, BREEAM, and similar ratings.

- For instance, GCP Applied Technologies offers its SILCOR® 560 LVOC, a one-part, fast-curing polyurethane elastomer with a VOC content low enough to qualify as low odor/low VOC.

Technological Integration in Application and Monitoring

Automation and digital tools now support waterproofing work through improved accuracy and quality control. Spray-applied robotics, moisture sensors, and advanced curing monitors help contractors achieve consistent membrane thickness and long-term reliability. Smart infrastructure projects integrate waterproofing with real-time monitoring systems that detect leaks early. This trend opens opportunities for suppliers to partner with construction-tech firms and deliver value-added, technology-enabled solutions. Adoption rises in commercial complexes, tunnels, and high-risk industrial facilities where downtime due to failures is costly.

Key Challenge

Price Sensitivity and High Installation Costs

Cost remains one of the biggest challenges in the waterproofing chemicals market. Advanced polymer membranes and liquid systems cost more than traditional options, which reduces adoption among small contractors and low-budget projects. Skilled labor is required for proper installation, especially for spray-based and multi-layer membrane systems, raising service charges. In developing regions, many buyers choose lower-grade materials that compromise long-term performance. These factors slow premium-product penetration, despite strong awareness of lifecycle benefits.

Lack of Standardization and Quality Compliance

The market faces gaps in regulatory enforcement, especially across emerging economies. Many projects use non-certified materials that fail to meet performance standards, leading to leakage issues and premature repairs. Inconsistent installation practices also reduce membrane effectiveness, as contractors may skip curing steps or apply uneven thickness. Limited training and fragmented supply chains add to the problem. These issues hinder uniform adoption of advanced systems and create challenges for manufacturers aiming to maintain consistent quality across large construction markets.

Regional Analysis

North America

North America held about 28% share of the waterproofing chemicals market in 2024. Strong residential repair activity and large commercial upgrades supported steady demand across the United States and Canada. Builders used polymer coatings and liquid membranes to meet strict moisture-control and energy-efficiency codes. Infrastructure spending on bridges, tunnels, and public utilities further increased adoption. Roofing refurbishment dominated applications, while green-building programs encouraged low-VOC and durable solutions. Industrial facilities and warehouses expanded their use of waterproofing systems to protect slabs and containment areas from long-term water exposure and operational risks.

Europe

Europe accounted for nearly 25% share in 2024, driven by stringent environmental rules and strong focus on sustainable construction. Western Europe adopted advanced polymer membranes and low-emission coatings for housing retrofits and commercial structures. Eastern Europe expanded infrastructure work, pushing demand for preformed sheets in tunnels, rail corridors, and wastewater facilities. Energy-efficient building standards boosted interest in reflective coatings and water-borne systems. Growing renovation cycles across Germany, France, and the UK supported steady use of liquid-applied membranes, while industrial upgrades increased adoption of integral systems in long-life concrete projects.

Asia Pacific

Asia Pacific dominated the global market with around 41% share in 2024. Massive investments in housing, transport networks, and industrial facilities drove strong growth across China, India, Indonesia, and Vietnam. Contractors preferred cost-effective polymer membranes and bitumen systems for large-scale roofing and foundation work. Rising urban flooding and extreme rainfall pushed developers to adopt stronger waterproofing layers in high-rise construction. Expanding manufacturing zones and logistics parks increased the use of coatings in warehouses and utility structures. Government-backed smart-city projects further boosted demand for advanced sealing systems and durable liquid membranes.

Latin America

Latin America captured about 4% share in 2024, supported by infrastructure recovery and housing upgrades. Brazil and Mexico led consumption as public-sector spending focused on transport, water management, and urban renewal. Builders favored liquid-applied membranes for refurbishment due to simple installation and lower labor cost. Industrial plants, especially in mining and agro-processing, used reinforced membranes to protect storage units and containment basins. Uneven economic growth limited premium adoption, but rising awareness of moisture-related structural failures encouraged broader use of high-performance waterproofing products across commercial and residential projects.

Middle East & Africa

The Middle East & Africa region held nearly 6% share in 2024, driven by large construction pipelines across the Gulf and rising urban development in African economies. Harsh climatic conditions increased demand for heat-resistant polymer coatings and long-life membranes. Mega-projects in Saudi Arabia and the UAE used advanced waterproofing systems for tunnels, basements, and transport corridors. Africa showed growing use of bitumen and liquid membranes in housing and public infrastructure. Water scarcity concerns also encouraged adoption of protective coatings in desalination plants, utility structures, and wastewater treatment facilities.

Market Segmentations:

By Product

By Application

- Roofing

- Walls

- Building structures

- Landfills and tunnels

- Others

By Technology

- Integral Systems

- Preformed Membranes

- Coatings & Liquid Applied Membrane Systems

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The waterproofing chemicals market features strong competition among global manufacturers that focus on durable membranes, advanced polymer solutions, and liquid-applied coatings for large construction needs. BASF SE, Johns Manville, SOPREMA Group, Sika AG, DOW, Minerals Technologies Inc., MBCC Group, Firestone Building Products Company, EverGuard TPO Walkway Roll, and Carlisle Companies Inc. lead the landscape with broad product portfolios and strong project networks. These companies invest in improved elastomeric coatings, hybrid membranes, and low-VOC systems to meet rising sustainability goals. Partnerships with contractors, quick-installation technologies, and region-specific product lines help expand market presence. Companies also strengthen their positions by expanding production capacity and enhancing distribution networks in fast-growing regions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- BASF SE (Germany)

- Johns Manville (U.S.)

- SOPREMA Group (France)

- Sika AG (Switzerland)

- DOW (U.S.)

- Minerals Technologies Inc. (U.S.)

- MBCC Group (Germany)

- Firestone Building Products Company (U.S.)

- EverGuard TPO Walkway Roll (U.S.)

- Carlisle Companies Inc. (U.S.)

Recent Developments

- In October 2025, SOPREMA Group (France) SOPREMA US announced the full transition of Tropical Roofing Products to the SOPREMA brand, consolidating TRP’s roof coatings and maintenance products under a unified waterproofing portfolio while keeping product performance unchanged for contractors and building owners.

- In October 2024, Johns Manville (U.S.) Johns Manville launched its JM EPDM FIT SA self-adhered EPDM roofing membrane, designed to install up to three times faster than traditionally adhered membranes and to be applied in temperatures as low as 20°F, while eliminating separate adhesives and associated VOC emissions.

- In April 2024, BASF SE (Germany) BASF signed a memorandum of understanding with Oriental Yuhong to expand joint development of solutions for the construction sector, including new technologies in waterproof materials, architectural coatings, and insulation systems for sustainable building projects

Report Coverage

The research report offers an in-depth analysis based on Product, Application, Technology and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise as cities expand housing, transport links, and commercial sites.

- Builders will adopt more polymer membranes for long service life and flexibility.

- Liquid-applied coatings will gain wider use due to faster installation needs.

- Green construction rules will push producers to develop low-VOC and eco-safe products.

- Smart application tools and sensors will improve accuracy and reduce project failures.

- Industrial zones will increase use of waterproofing for storage, utilities, and process units.

- Renovation work in aging buildings will boost demand for high-performance membranes.

- Companies will expand regional production to cut lead times and serve fast-growing markets.

- Rising climate risks will increase adoption in flood-prone and high-rainfall regions.

- New product blends combining polymers and hybrid materials will take larger market share.