Market Overview:

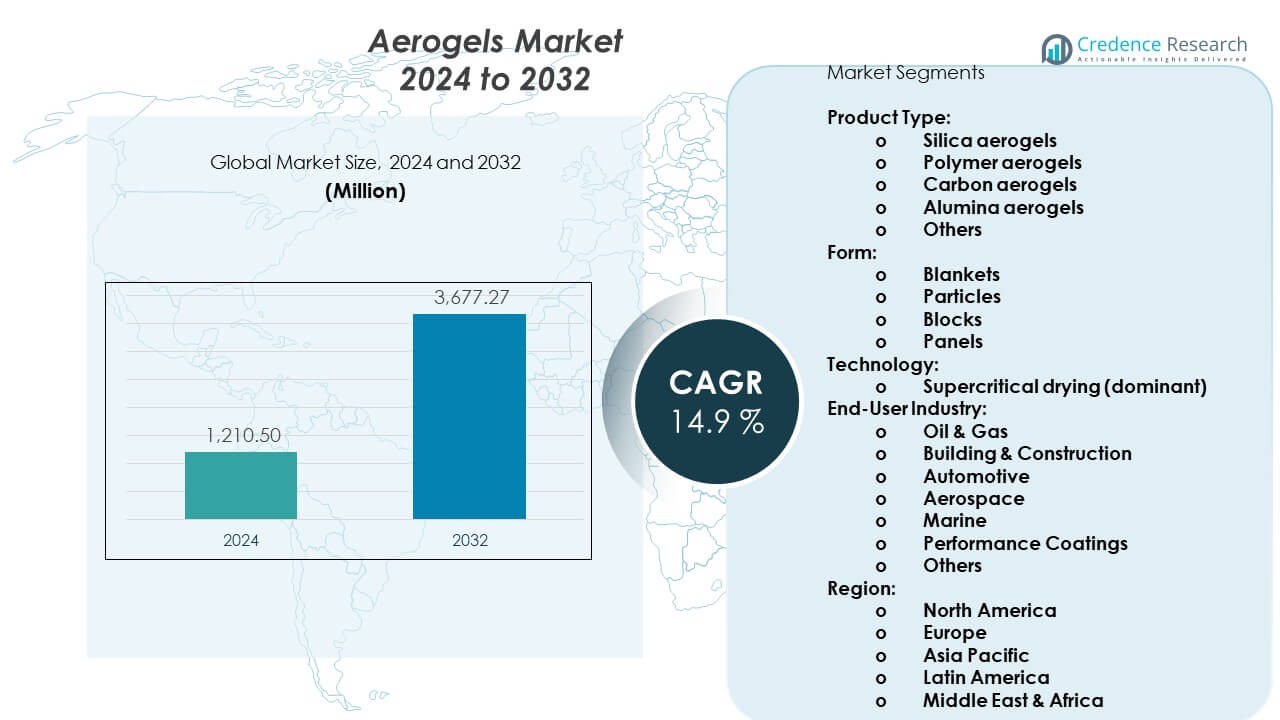

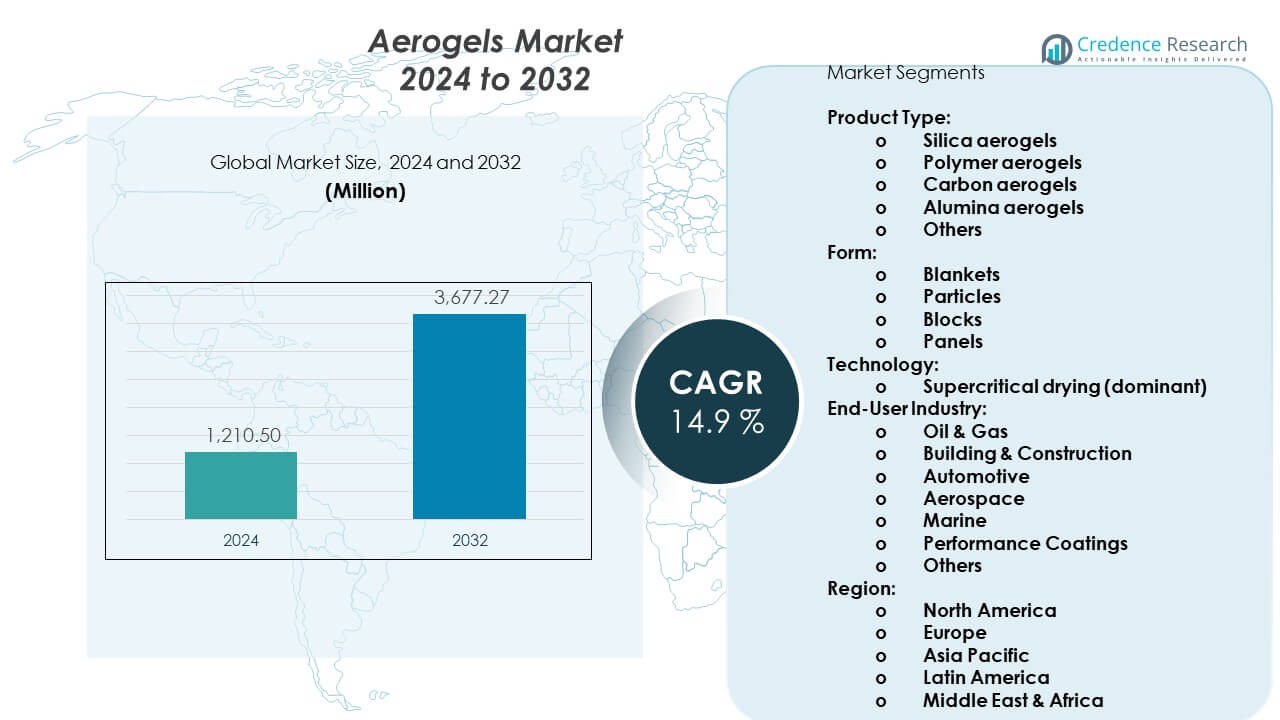

The Aerogels Market is projected to grow from USD 1,210.5 million in 2024 to an estimated USD 3,677.27 million by 2032, with a compound annual growth rate (CAGR) of 14.9% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Aerogels Market Size 2024 |

USD 1,210.5 Million |

| Aerogels Market, CAGR |

14.9% |

| Aerogels Market Size 2032 |

USD 3,677.27 Million |

Growing demand for lightweight insulation drives adoption across energy, aerospace, and construction industries. Manufacturers prefer aerogels because the material offers high thermal resistance and very low density. Companies integrate aerogel panels into pipelines, automotive parts, and building envelopes to cut energy loss. The shift toward greener materials strengthens demand for silica and polymer-based variants. Producers expand output to support rising use in batteries and electronics. Buyers value durability and performance across harsh climates. These factors support wider commercial and industrial penetration.

North America leads due to strong uptake in oil & gas insulation and advanced material R&D. Europe follows with high adoption in building retrofits and automotive lightweighting efforts. Asia Pacific is emerging fast as China and India scale infrastructure and EV manufacturing. The Middle East grows through energy-sector upgrades, while Latin America expands steadily with industrial modernization. Each region advances at a different pace based on policy support, industry maturity, and investment strength.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Aerogels market is projected to grow from USD 1,210.5 million in 2024 to USD 3,677.27 million by 2032, at a CAGR of 14.9% between 2024 and 2032.

- North America holds about 38% share, Europe about 29%, and Asia Pacific about 24%, driven by strong oil and gas insulation demand, strict building efficiency rules, and rapid industrial expansion with EV and construction projects.

- Asia Pacific is the fastest-growing region with around 24% share, supported by rising EV production, large-scale infrastructure projects, and growing use of advanced insulation across China, India, and Southeast Asia.

- By product type, silica aerogels account for roughly 55% share, with polymer aerogels at about 18% and carbon aerogels near 12%, reflecting strong preference for high-performance thermal insulation in energy, construction, and mobility uses.

- By form, blankets hold around 50% share, followed by particles at about 20% and panels near 15%, as blankets dominate pipeline and building insulation while particles and panels gain ground in coatings and energy-efficient façades.

Market Drivers:

Rising Demand for High-Performance Thermal Insulation Across Industrial Systems

The Aerogels market grows due to strong interest in materials that cut heat loss. Energy companies use aerogel blankets to maintain stable pipeline efficiency. Construction firms depend on the material to support high-grade wall and roof insulation. Aerospace designers integrate aerogels to lower weight in thermal shields. Battery makers adopt aerogel layers to enhance thermal control in compact cells. Automotive suppliers value the insulation boost in electric vehicle modules. Buyers choose aerogels to meet strict energy rules. The driver lifts long-term adoption across major industrial sectors.

- For instance, Aspen Aerogels, Inc.’s Cryogel® Z aerogel blankets have been tested to reduce insulated pipe diameter by up to 40%, enabling a 24% decrease in pipe insulation diameters, enhancing space efficiency and installation speed by 30% compared to traditional rigid insulations, with successful certifications to ISO-20088-3 and ISO-22899 standards for thermal and fire insulation.

Growing Use of Lightweight Materials to Improve Efficiency in Transport and Energy Projects

Transport developers shift toward lighter components to reduce fuel and power demand. Aerogels offer low density that supports weight-cutting goals in several platforms. Aviation teams use the material in cabin insulation for better cabin comfort. Rail operators apply aerogel sheets to improve thermal performance in harsh climates. EV firms rely on aerogels to improve module stability at peak load. Energy firms upgrade systems with aerogel insulation to limit heat leaks. Several projects focus on better performance in cold and hot regions. The Aerogels market benefits from rising global efficiency targets.

- For instance, Cabot Corporation’s ENTERA® aerogel particles deliver a 50% reduction in insulation pad weight and a 40% reduction in barrier thickness versus non-aerogel materials in hot-cold plate testing, demonstrating superior thermal efficiency in transport-related applications.

Rising Adoption of Advanced Materials in Renewable Energy and High-Temperature Systems

Renewable energy systems need durable insulation that withstands heavy thermal shifts. Solar plants use aerogel panels to limit heat loss in storage units. Wind turbine operators apply the material in nacelle insulation for stable cooling. Industrial heaters integrate aerogel pads for controlled heat containment. Several refineries seek aerogels to cut process inefficiencies. Research groups test new aerogel composites for higher resilience. Manufacturers broaden supply lines to meet advanced production needs. The driver supports wider use of aerogels in clean-energy platforms.

Expansion of High-Value Applications in Electronics, Batteries, and Specialty Manufacturing

Electronics designers depend on aerogels to manage heat in tight circuits. Battery producers use aerogel barriers to reduce the risk of thermal runaway. Semiconductor plants integrate the material to stabilize temperature in sensitive tools. Aerospace manufacturing teams deploy aerogel layers in complex thermal assemblies. Fireproofing units value aerogels for high flame resistance. Several industries adopt aerogels to meet safety standards. New processing lines support faster production of silica and polymer variants. The Aerogels market moves forward through diversified high-value applications.

Market Trends:

Shift Toward Polymer-Reinforced Aerogels for Higher Flexibility and Strength in Modern Designs

Producers invest in polymer-reinforced grades that provide stronger durability. Several industries need flexible sheets that support bending without cracks. Electronics firms prefer reinforced layers for compact system layouts. EV suppliers explore polymer blends to improve crash resistance. Construction firms use flexible boards for safer installation. The Aerogels market reflects rising interest in hybrid materials. R&D teams test reinforced structures that handle repeated stress. The trend supports broader design freedom across sectors.

- For instance, research on hybrid organic–inorganic aerogels has demonstrated mechanical property improvements up to 100 times stronger than plain silica aerogel while maintaining thermal conductivity below 0.018 W/m·K, enabling flexible, durable, and high-performance insulation solutions in advanced electronics and EV safety systems.

Growing Integration of Aerogels in Next-Generation EV Thermal Platforms and Battery Safety Systems

Automakers focus on thermal stability across battery packs. Aerogels enter new EV platforms to control heat spikes. Suppliers design aerogel inserts to improve fire protection. OEMs explore thin aerogel panels for cabin insulation. Charging-station developers adopt aerogels to stabilize high-load units. Research groups study aerogel coatings for heat-shielding layers. Several EV brands examine aerogels for pack-level thermal balance. The Aerogels market gains traction in electric mobility upgrades.

- For instance, Aspen Aerogels’ PyroThin® barriers enable ultra-thin, lightweight fire protection at the cell-to-cell and module levels in lithium-ion battery packs, supporting major OEMs worldwide with proven volume production; these barriers have demonstrated thermal stability under extreme conditions and contribute to meeting critical thermal runaway safety regulations.

Rising Development of Transparent Aerogels for Daylighting and Advanced Architectural Designs

Construction developers explore transparent aerogels for high-efficiency windows. Designers value daylight control without major heat loss. Several buildings adopt aerogel glazing to support energy rules. Research teams refine clarity and strength in new transparent grades. HVAC demand declines where aerogel windows reduce thermal transfer. Architects test aerogel-filled panels for acoustic performance. Urban developers seek materials that improve green-building ratings. The trend expands the Aerogels market into architectural innovation.

Increased Focus on Automated Production and Scalable Manufacturing for Consistent Quality Output

Producers install automated equipment to standardize aerogel quality. New lines support faster curing and reduced waste. Industrial buyers prefer consistent thickness across batches. Automation lowers manual errors in blanket preparation. Several firms test modular plants to scale output. Robotics support cutting and shaping of aerogel panels. R&D teams target lower cost without hurting performance. The Aerogels market advances through precision-driven production trends.

Market Challenges Analysis:

High Production Costs, Complex Processing Requirements, and Limited Large-Scale Manufacturing Capacity

Producers face high costs due to complex drying and processing stages. Several plants struggle to scale output without large investments. Buyers hesitate when prices exceed competing insulation materials. Supply chains need specialized equipment that raises setup costs. The Aerogels market contends with constraints tied to raw material purity. Manufacturers must maintain strict control of pore structure for performance. Limited trained labor slows expansion in emerging regions. Firms work to reduce cost gaps to widen mainstream adoption.

Mechanical Fragility, Performance Variability, and Slow Penetration in Cost-Sensitive End-Use Segments

Aerogels remain fragile in certain applications despite progress in reinforced grades. Some industries prefer tougher alternatives for high-impact tasks. Buyers report performance swings across unoptimized production lines. Firms need to tailor aerogels for specific temperature ranges. Cost-sensitive markets delay adoption due to price barriers. The Aerogels market encounters resistance in sectors that prioritize budget over efficiency. Producers explore coatings and composites to strengthen resilience. These hurdles influence long-term competitiveness across regions.

Market Opportunities:

Expansion of Aerogel Use in EV Thermal Protection, Renewable Energy Systems, and High-Growth Construction Markets

EV platforms adopt aerogels to improve module stability and safety. Renewable-energy sites depend on the material to manage high thermal loads. Construction developers integrate aerogels for energy-efficient walls and glazing. Several governments promote green-building rules that improve demand. The Aerogels market gains new openings in infrastructure upgrades. Manufacturers launch lighter and stronger variants for growing sectors. These areas present long-term growth potential. More firms move toward tailored aerogel solutions.

Growth in Transparent Aerogels, Industrial Fireproofing, and Advanced Electronics Cooling Applications

Transparent aerogels support modern designs that balance daylight and insulation. Fire-safety teams adopt aerogels for heat-resistant barriers. Electronics suppliers use aerogels to stabilize components in compact spaces. Several industries look for high-purity variants for sensitive systems. The Aerogels market benefits from research that improves clarity and strength. Multiple plants expand output to serve these niches. These opportunities encourage long-term innovation. New applications strengthen value across global supply chains.

Market Segmentation Analysis:

Product Type

Silica aerogels lead adoption due to strong thermal resistance and broad industrial approval. Polymer aerogels gain interest where flexibility and tougher handling are required. Carbon aerogels support energy storage and conductive systems with high performance. Alumina aerogels serve high-temperature environments in demanding operations. Other variants meet niche needs in specialized sectors. Producers expand output to support diverse engineering goals. Buyers evaluate each type based on thermal load, durability, and environmental exposure. The Aerogels market benefits from a wide mix of advanced material options.

- For instance, Aspen Aerogels advances the application of its aerogel technology in lithium-ion batteries by providing thermal barriers, like its commercial product PyroThin®, to prevent thermal runaway. While the company does hold patents on carbon aerogel technologies for potential use in batteries, their primary commercial offering for battery enhancement focuses on safety rather than electrode performance.

Form

Blankets dominate usage due to easy installation across pipelines, buildings, and industrial systems. Particles find use in coatings and filler applications that need lightweight insulation. Blocks support structural and high-load environments. Panels gain traction in architectural designs that target energy efficiency and controlled daylighting. Each form aligns with specific handling and performance needs. Firms choose formats based on project scale and integration demands. Research teams refine thickness and durability across forms. The segment structure supports broad commercial deployment.

- For instance, Aspen Aerogels’ Cryogel® and Pyrogel® insulating blankets provide robust thermal protection over temperature ranges from −200°C to +650°C, supporting major oil, gas, and petrochemical infrastructure needs while enabling reduced diameter insulation that simplifies installation.

Technology

Supercritical drying remains the dominant method due to reliable pore formation and strong insulation output. Producers depend on this method to achieve uniform material quality. The process improves structural stability across product lines. Manufacturing teams use controlled environments to maintain performance. Buyers trust the method for high-grade thermal demands. Engineers integrate outputs into advanced systems. The technology segment shapes material reliability. The Aerogels market gains strategic strength from proven production processes.

End-User Industry

Oil and gas operators rely on aerogels for pipeline insulation and asset protection. Building and construction firms adopt the material to meet energy reduction goals. Automotive and aerospace units need lightweight thermal solutions for modern platforms. Marine applications use aerogels to handle harsh environmental shifts. Performance coatings use particles to enhance durability and heat control. Other industries test the material for specialized uses. End users evaluate safety, efficiency, and regulatory demands before integration. The segment diversity supports stable long-term demand.

Segmentation:

Product Type:

- Silica aerogels

- Polymer aerogels

- Carbon aerogels

- Alumina aerogels

- Others

Form:

- Blankets

- Particles

- Blocks

- Panels

Technology:

- Supercritical drying (dominant)

End-User Industry:

- Oil & Gas

- Building & Construction

- Automotive

- Aerospace

- Marine

- Performance Coatings

- Others

Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America Regional Outlook

North America holds the leading share of about 38% in the global landscape. The Aerogels market benefits from strong demand tied to oil and gas insulation, building upgrades, and advanced material adoption. Energy firms use aerogel blankets to cut thermal loss across long-distance pipelines. Construction contractors rely on aerogel panels to meet tough energy codes across major cities. Aerospace and automotive producers adopt these materials to reduce weight in thermal assemblies. Research groups in the region support innovation in transparent and reinforced variants. Expansion in infrastructure and industrial capital spending sustains long-term traction.

Europe Regional Outlook

Europe secures roughly 29% of global share due to strict efficiency laws and large-scale building retrofits. The Aerogels market gains steady support from construction programs that target lower emissions. Automotive manufacturers use aerogels to improve cabin insulation and EV battery safety. Several countries introduce stronger building rules that push higher insulation standards. Aerospace companies deploy aerogels in thermal shield components. Industrial firms purchase aerogel forms to stabilize operations across high-temperature environments. The region moves forward through strong regulatory compliance and sustainability targets.

Asia Pacific Regional Outlook

Asia Pacific accounts for nearly 24% of global share and stands out as the fastest-growing region. The Aerogels market expands with rising industrial activity and infrastructure investment across China, India, and Southeast Asia. EV manufacturers increase demand for thermal barriers that enhance battery safety. Construction firms integrate aerogel panels in high-rise structures to improve energy performance. Oil and gas developers use aerogel blankets to support efficiency in harsh climates. Aerospace and marine sectors explore aerogels for lighter insulation packages. The region strengthens growth through rapid urbanization and manufacturing scale.

Key Player Analysis:

- Aspen Aerogels Inc.

- Cabot Corporation

- BASF SE

- Aerogel Technologies LLC

- Active Aerogels LDA

- Armacell

- Dow

- Guangdong Alison Hi-Tech Co., Ltd.

- Svenska Aerogel AB

- Thermablok Aerogels Limited

Competitive Analysis:

The Aerogels market features a moderately consolidated landscape with a mix of global leaders and regional specialists. Aspen Aerogels Inc., Cabot Corporation, BASF SE, and Dow set benchmarks in technology, scale, and OEM relationships. These companies invest in EV battery protection, energy infrastructure, and high-performance building insulation. Mid-sized players such as Svenska Aerogel AB, Active Aerogels LDA, and Guangdong Alison Hi-Tech Co., Ltd. target niche applications and cost-sensitive customers. Armacell and Thermablok focus on insulation solutions that integrate aerogels into building and industrial systems. Competition centers on thermal performance, form flexibility, certification, and price. Strategic partnerships with automotive, energy, and construction customers strengthen long-term contracts and lock-in effects. New capacity in Asia raises price pressure and accelerates innovation cycles.

Recent Developments:

- In Cabot Corporation, headquartered in Boston, Massachusetts, the company focused on innovations in advanced silica aerogels, investing in cost-effective manufacturing methods like ambient pressure drying and green synthesis techniques. Cabot continued expanding its applications in aerospace, energy storage, and electronics markets, adapting its aerogel technology for high-performance industrial uses. The company appointed Bill Masterson as senior vice president and president of Reinforcement Materials in November 2025 to strengthen leadership in material innovation.

- In Aspen Aerogels, Inc. , the company secured a PyroThin® contract with a leading American OEM for a next-generation lithium iron phosphate vehicle platform set for 2028 production. Aspen also expanded partnerships with major automotive OEMs such as GM, Toyota, Audi, Porsche, and Mercedes-Benz, focusing on thermal management in electric vehicles. It took a $152.4 million impairment charge on a Georgia plant and highlighted cost-cutting and profitability initiatives as of Q3 2025.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Product Type, Form, Technology, End-User Industry, and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for the Aerogels market will rise with tighter global energy-efficiency rules.

- Adoption in EV battery packs will expand with stronger focus on thermal runaway safety.

- Use in building retrofits will grow as cities chase lower carbon footprints.

- Producers will lower unit costs through automation and higher-capacity supercritical drying lines.

- Transparent aerogels will gain share in façade and daylighting applications in premium projects.

- Asia Pacific capacity will expand, intensifying price competition and regional sourcing shifts.

- Oil and gas operators will maintain steady demand for pipeline and subsea insulation upgrades.

- Hybrid polymer-reinforced grades will capture applications that need impact resistance and flexibility.

- New uses in personal care and consumer goods will open niche revenue streams.

- Strategic partnerships between material suppliers and OEMs will shape long-term specifications.