Market Overview

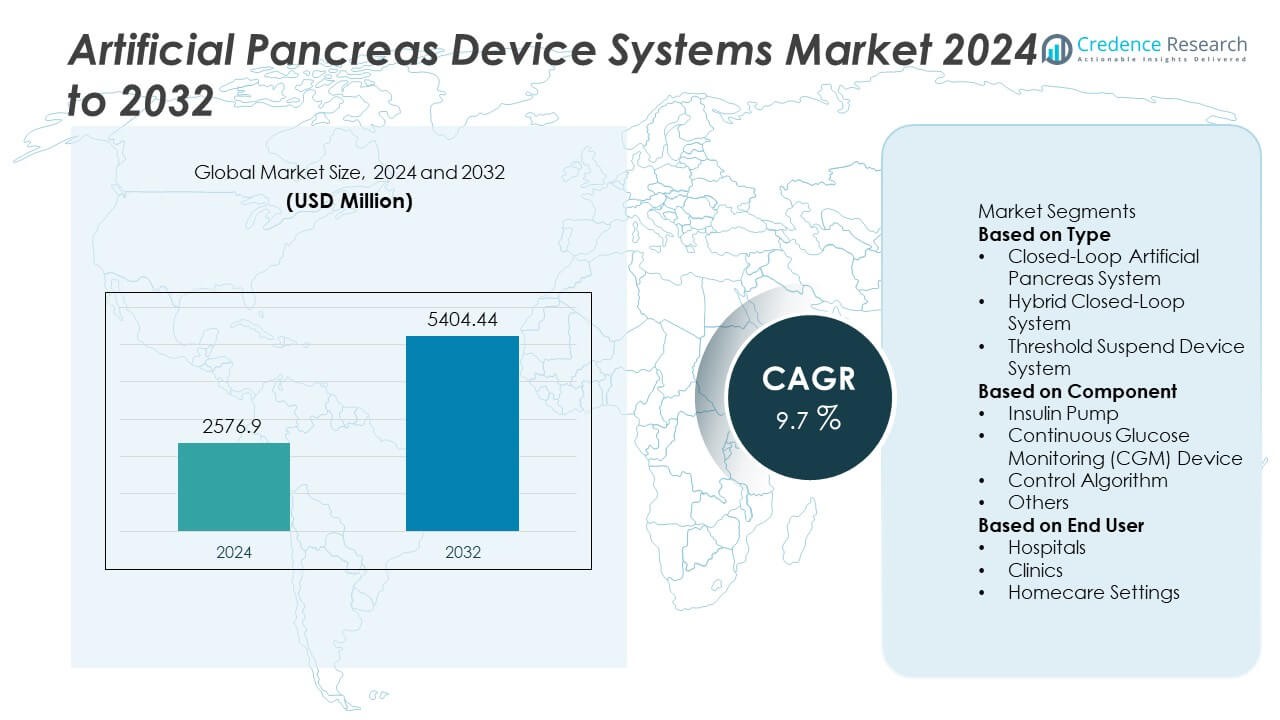

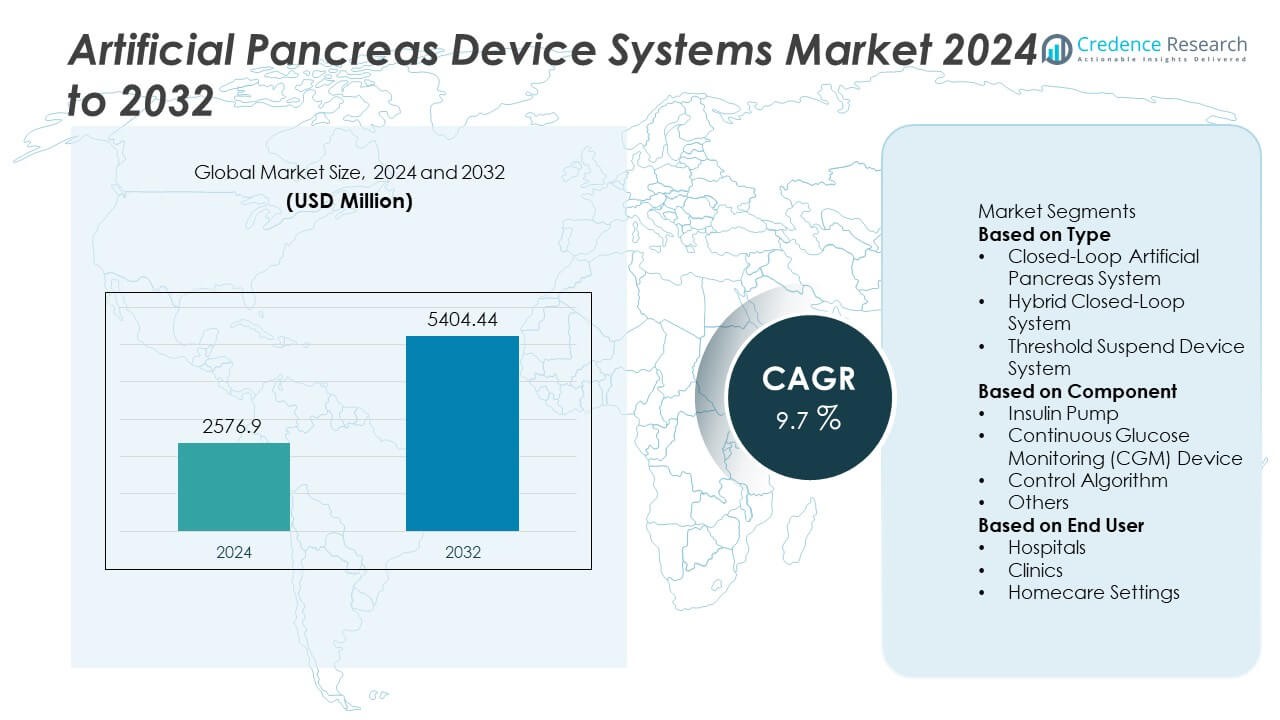

The Artificial Pancreas Device Systems Market reached USD 2,576.9 million in 2024 and is projected to rise to USD 5,404.44 million by 2032, registering a strong CAGR of 9.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Artificial Pancreas Device Systems Market Size 2024 |

USD 2,576.9 Million |

| Artificial Pancreas Device Systems Market, CAGR |

9.7% |

| Artificial Pancreas Device Systems Market Size 2032 |

USD 5,404.44 Million |

The Artificial Pancreas Device Systems market is shaped by leading companies such as Medtronic plc, Tandem Diabetes Care, Insulet Corporation, Abbott Laboratories, Dexcom Inc., Beta Bionics, Diabeloop SA, Bigfoot Biomedical, SOOIL Development Co., Ltd., and Ypsomed Holding AG. These players strengthen their positions through advancements in closed-loop automation, improved CGM accuracy, and enhanced pump–sensor integration. North America leads the market with a 42% share supported by strong adoption of automated insulin delivery and robust reimbursement systems. Europe follows with a 32% share driven by clinical acceptance and structured diabetes programs, while Asia Pacific holds a 19% share fueled by rising diabetes prevalence and expanding digital health ecosystems.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Artificial Pancreas Device Systems market reached USD 2,576.9 million in 2024 and will grow at a CAGR of 9.7% through 2032.

- Demand rises as closed-loop systems gain adoption, with closed-loop devices holding a 48% share and CGM components leading the segment with a 55% share.

- Trends strengthen around AI-driven insulin prediction, connected health ecosystems, and improved CGM accuracy supporting safer and more automated glucose management.

- Competition intensifies among Medtronic, Tandem, Insulet, Abbott, Dexcom, and others as they advance sensor–pump integration, predictive algorithms, and remote monitoring features, despite restraints tied to high device costs and limited reimbursement.

- North America leads with a 42% share, followed by Europe at 32%, Asia Pacific at 19%, Latin America at 4%, and the Middle East & Africa at 3%, supported by expanding homecare adoption and improved digital health infrastructure.

Market Segmentation Analysis:

By Type

Closed-loop artificial pancreas systems lead the market with a 48% share, driven by growing demand for fully automated insulin delivery and improved glucose regulation. These systems offer real-time adjustments based on continuous monitoring, reducing the burden of manual intervention for patients with type 1 diabetes. Hybrid closed-loop systems hold a strong secondary share as they combine automation with user input for mealtime dosing. Threshold suspend device systems continue to serve patients needing low-glucose protection. Rising adoption of advanced diabetes technologies and strong clinical evidence supporting improved outcomes accelerate growth across all system types.

- For instance, Medtronic’s MiniMed 780G system demonstrated a significant reduction in mean glucose levels (approx. 0.9-2.5 mmol/L or 17-45 mg/dL) and a notable increase in Time in Range (TIR) during various large-scale, multicenter real-world analyses involving thousands of patients, while delivering automated micro-boluses every five minutes.

By Component

Continuous glucose monitoring (CGM) devices dominate the segment with a 55% share due to their critical role in real-time glucose tracking and automated insulin adjustment. CGMs drive system accuracy and safety by providing high-frequency data essential for algorithm-based decision-making. Insulin pumps follow with steady adoption as integrated pump-sensor systems gain popularity. Control algorithms advance rapidly as manufacturers enhance predictive capabilities for closed-loop operation. Other components, including connectivity modules and mobile apps, support seamless system functionality. Increasing preference for connected and automated diabetes management solutions strengthens demand across all components.

- For instance, Dexcom’s G7 CGM delivers a 30-minute warm-up time and records readings every five minutes, generating 288 data points daily. Its MARD accuracy score reached 8.2% during a clinical performance trial involving 316 adult participants.

By End User

Homecare settings hold the dominant position with a 61% share, supported by rising patient preference for self-management and remote monitoring. Artificial pancreas systems offer convenience, fewer hospital visits, and improved glucose stability, making them ideal for home use. Hospitals maintain a notable share as they manage initiation, training, and complex diabetes cases requiring advanced monitoring. Clinics contribute steadily through routine follow-ups and device optimization. Growth across all end-user groups is driven by expanding awareness, improved insurance coverage, and strong clinical outcomes that support long-term adoption of automated insulin delivery technologies.

Key Growth Drivers

Rising Prevalence of Diabetes and Need for Automated Management

The rising global prevalence of type 1 and insulin-dependent type 2 diabetes strengthens demand for artificial pancreas device systems. Patients seek automated glucose control to reduce daily management challenges and limit risks of hypo- and hyperglycemia. Closed-loop technologies deliver precise insulin adjustments using continuous monitoring, improving clinical outcomes and quality of life. Increasing awareness of long-term complications drives adoption of advanced automated systems. Supportive reimbursement policies and wider clinical acceptance further accelerate market growth as healthcare providers prioritize safer and more reliable diabetes management solutions.

- For instance, Tandem Diabetes Care reported that its Control-IQ technology reduced patient-initiated correction boluses by 2.1 actions per day in a controlled study of 168 users. The system delivered automated adjustments every five minutes, totaling more than 250 algorithm-driven decisions daily.

Advancements in CGM Technology and Insulin Delivery Systems

Rapid improvements in continuous glucose monitoring sensors enhance accuracy, reduce calibration needs, and support seamless integration with insulin pumps. These advancements strengthen the performance of closed-loop and hybrid systems, making them more appealing for daily use. Predictive algorithms and machine-learning models boost responsiveness to glucose fluctuations. Miniaturized and longer-wear CGM devices increase patient comfort and system reliability. Manufacturers invest in enhanced interoperability, enabling smoother data flow between pumps, sensors, and control platforms. These technological upgrades drive accelerated adoption in both homecare and clinical settings.

- For instance, Abbott’s FreeStyle Libre 3 sensor automatically records glucose every minute, producing 1,440 readings each day. Clinical data from a study involving 100 participants aged 4 and older demonstrated an overall MARD (Mean Absolute Relative Difference) accuracy score of 7.8% (or 7.9% in some reports).

Growing Preference for Home-Based Diabetes Management

A strong shift toward home-based diabetes care fuels market expansion as patients seek more autonomy and convenience. Artificial pancreas systems reduce manual dosing decisions and support 24/7 glucose control, making them ideal for home use. Remote monitoring features allow healthcare providers to track patient progress and adjust therapy settings without frequent clinic visits. Increased digital health adoption encourages integration with mobile apps and cloud platforms. Rising comfort with technology among patients and caregivers further supports widespread home-use uptake. This trend enhances long-term system adherence and strengthens market demand.

Key Trends & Opportunities

Expansion of AI-Driven and Personalized Insulin Delivery Systems

Artificial pancreas technologies increasingly adopt artificial intelligence to optimize insulin dosing and personalize therapy. AI-based algorithms forecast glucose patterns, enhance predictive responses, and adapt to lifestyle variations such as diet and activity levels. These enhancements reduce glucose variability and support greater automation. Opportunities grow as manufacturers pursue closed-loop systems with minimal user input. Personalization features also improve patient satisfaction and long-term adherence. The rising integration of cloud analytics and real-time data sharing creates new pathways for remote care and continuous algorithm refinement.

- For instance, Beta Bionics’ iLet Bionic Pancreas uses adaptive learning that recalibrates dosing from more than 100 user data points collected each day. Trials involving 440 participants documented automated basal adjustments every five minutes, totaling more than 280 algorithmic decisions daily.

Increasing Integration with Connected Health and IoT Ecosystems

IoT-based connectivity becomes a major opportunity as artificial pancreas systems integrate with smartphones, wearables, and digital health platforms. Connected health ecosystems support seamless data sharing, remote supervision, and early identification of glucose deviations. This enhances provider decision-making and strengthens patient engagement. Manufacturers develop app-based interfaces for easier tracking, alerts, and device adjustments. The trend aligns with broader healthcare digitalization, making automated insulin systems part of larger remote-care networks. Expanding telehealth infrastructure further supports the integration of artificial pancreas systems across global markets.

- For instance, Insulet’s Omnipod 5 platform communicates with Dexcom sensors through a secure Bluetooth channel, exchanging data every five minutes and generating up to 288 automated dosing updates per day. The companion app stores 90 days of user history and transmits device logs through encrypted cloud sync.

Key Challenges

High Device Costs and Limited Reimbursement Access

High upfront costs for insulin pumps, CGM devices, and integrated control algorithms remain a major barrier for many patients. Limited insurance coverage, especially in developing regions, restricts widespread adoption. Ongoing expenses related to sensors, infusion sets, and consumables add financial burden. Manufacturers must balance innovation with affordability to expand market reach. Healthcare systems continue to evaluate long-term cost benefits, but slow reimbursement approval processes hinder rapid uptake. These financial challenges delay accessibility for broad patient populations.

Regulatory Complexity and Stringent Safety Requirements

Artificial pancreas systems face rigorous regulatory scrutiny due to their direct impact on glucose management and patient safety. Approval processes require extensive clinical evidence, precise algorithm validation, and robust hardware reliability. Variations in regulatory standards across regions create challenges for global product rollout. Ensuring cybersecurity and data protection adds further complexity, especially with cloud-connected systems. Manufacturers must maintain continuous updates and compliance monitoring. These regulatory hurdles increase development timelines and limit the speed of market introduction for next-generation systems.

Regional Analysis

North America

North America holds a 42% share of the Artificial Pancreas Device Systems market due to strong adoption of advanced diabetes technologies and high awareness of automated insulin delivery. The United States leads regional demand with well-established reimbursement coverage for insulin pumps and continuous glucose monitoring devices. Rising prevalence of type 1 diabetes and increased preference for home-based management support broader system integration. Major manufacturers expand clinical research partnerships and upgrade digital platforms to enhance real-time monitoring. Strong healthcare infrastructure, technological readiness, and rapid regulatory approvals further strengthen regional leadership and support continued market expansion.

Europe

Europe accounts for a 32% share driven by strong clinical acceptance of closed-loop and hybrid systems backed by favorable regulatory frameworks. Countries such as Germany, the United Kingdom, France, and the Netherlands promote early adoption through structured diabetes management programs. Growing emphasis on reducing hypoglycemia risks and improving long-term glycemic control supports rapid system uptake. Manufacturers collaborate with local research institutions to develop AI-enhanced dosing algorithms and sensor-pump integration. Rising use of digital health tools and remote monitoring strengthens adoption across both adult and pediatric populations, positioning Europe as a key hub for next-generation diabetes technologies.

Asia Pacific

Asia Pacific holds a 19% share and demonstrates rapid growth fueled by rising diabetes prevalence and increasing demand for advanced glucose management solutions. China, Japan, South Korea, and India invest in modernizing diabetes care through connected insulin pumps and continuous glucose monitoring systems. Growing middle-class adoption, improving healthcare expenditure, and expanding digital health ecosystems support faster integration of closed-loop systems. Partnerships between global manufacturers and regional distributors enhance accessibility and training for patients and clinicians. Government efforts to strengthen chronic disease management and telehealth services boost long-term market potential across the region.

Latin America

Latin America captures a 4% share, with adoption led by Brazil and Mexico due to rising insulin-dependent diabetes cases and improving access to diabetes technologies. Growing awareness of automated glucose management supports gradual acceptance of hybrid and closed-loop systems. Healthcare providers increasingly recommend continuous glucose monitoring to reduce hospital admissions and improve treatment outcomes. Limited reimbursement remains a constraint, but private insurance coverage expands in urban areas. Training programs by global diabetes device manufacturers strengthen adoption in clinical and homecare settings, supporting steady regional growth.

Middle East & Africa

The Middle East & Africa region holds a 3% share, driven by increasing diabetes prevalence and growing interest in modern insulin delivery technologies. Countries such as the UAE, Saudi Arabia, and South Africa lead adoption through investments in advanced glucose monitoring systems. Healthcare modernization initiatives support integration of automated devices in hospitals and specialty clinics. Despite limited awareness in some markets, rising use of digital health platforms accelerates patient engagement. Partnerships with international device manufacturers improve access to closed-loop systems. Long-term growth is supported by national diabetes control programs and expanding private healthcare infrastructure.

Market Segmentations:

By Type

- Closed-Loop Artificial Pancreas System

- Hybrid Closed-Loop System

- Threshold Suspend Device System

By Component

- Insulin Pump

- Continuous Glucose Monitoring (CGM) Device

- Control Algorithm

- Others

By End User

- Hospitals

- Clinics

- Homecare Settings

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape or analysis of the Artificial Pancreas Device Systems market includes major players such as Medtronic plc, Tandem Diabetes Care, Insulet Corporation, Abbott Laboratories, Dexcom Inc., Beta Bionics, Diabeloop SA, Bigfoot Biomedical, SOOIL Development Co., Ltd., and Ypsomed Holding AG. These companies compete by advancing closed-loop and hybrid insulin delivery technologies that improve glucose accuracy and reduce patient burden. Market leaders invest heavily in continuous glucose monitoring integration, predictive algorithms, and interoperability between pumps and sensors. Partnerships with hospitals, digital health platforms, and research institutions accelerate clinical validation and expand product adoption. Manufacturers also enhance remote monitoring, smartphone connectivity, and cloud-based analytics to strengthen user experience. Rising focus on pediatric adoption, expanding regulatory approvals, and increased reimbursement support further intensify competition. Key players prioritize innovation, strong safety performance, and long-term reliability to maintain leadership in a rapidly evolving diabetes technology market.

Key Player Analysis

- Medtronic plc

- Tandem Diabetes Care, Inc.

- Insulet Corporation

- Abbott Laboratories

- Dexcom, Inc.

- Beta Bionics, Inc.

- Diabeloop SA

- Bigfoot Biomedical

- SOOIL Development Co., Ltd.

- Ypsomed Holding AG

Recent Developments

- In May 2024, Tandem Diabetes Care, Inc. and Dexcom, Inc. entered into an Amended and Restated Commercialization Agreement, effective as of May 21, 2024, and an Amended and Restated Development Agreement, entered into on May 22, 2024.

- In January 2024, Abbott Laboratories announced its FreeStyle Libre 2 Plus CGM sensor now integrates with Tandem’s t:slim X2 pump to support automated insulin-delivery systems.

- In April 2023, Medtronic plc announced U.S. FDA approval of its MiniMed 780G system, which automates insulin dosing and corrections.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Component, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of automated insulin delivery systems will expand as patients seek safer glucose control.

- Closed-loop technologies will advance with more accurate sensors and faster algorithm responses.

- AI-driven personalization will enhance dosing precision and adapt to individual glucose patterns.

- Integration with smartphones and wearables will strengthen remote monitoring capabilities.

- Pediatric adoption will increase as devices become smaller, safer, and more user-friendly.

- Hybrid systems will transition toward full automation with minimal patient input.

- Telehealth connectivity will support broader use in homecare diabetes management.

- Battery efficiency and device miniaturization will improve user comfort and long-term adherence.

- Regulatory approvals for next-generation systems will accelerate global market penetration.

- Partnerships between device makers and digital health companies will drive innovation and expand care ecosystems.