| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Calcium Formate Market Size 2024 |

USD 675.7 million |

| Calcium Formate Market, CAGR |

4.87% |

| Calcium Formate Market Size 2032 |

USD 989.1 million |

Market Overview

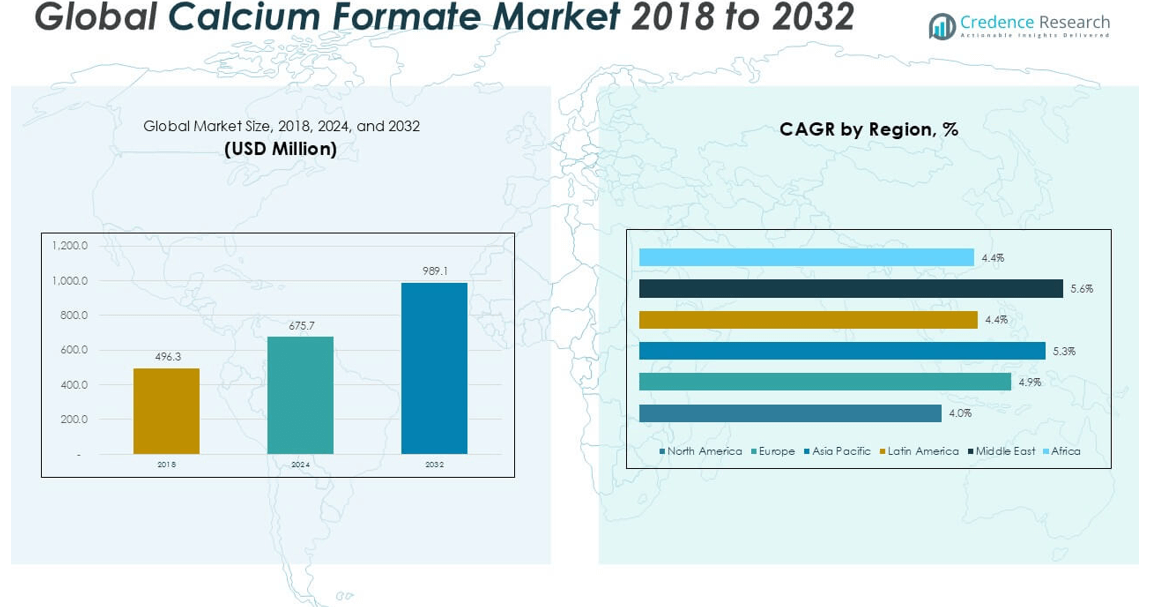

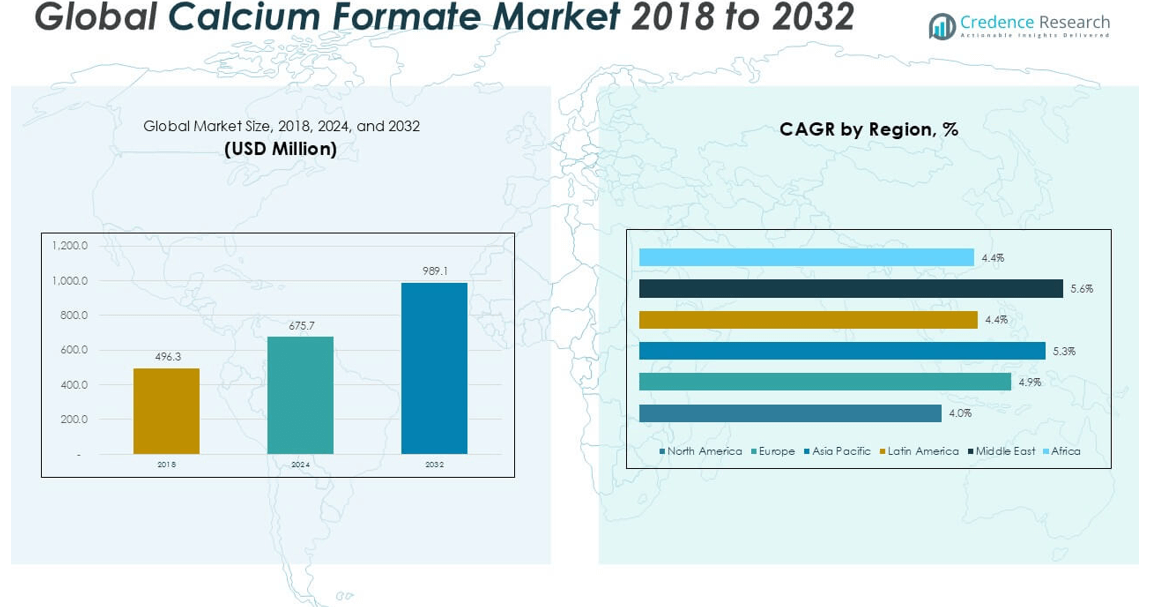

The Global Calcium Formate Market is projected to grow from USD 675.7 million in 2024 to an estimated USD 989.1 million by 2032, with a compound annual growth rate (CAGR) of 4.87% from 2025 to 2032.

The calcium formate market is driven by its accelerating role in concrete and cement additives, which improves setting time and strength development under cold weather conditions. Growing infrastructure development projects, especially in emerging economies, are fueling demand for performance-enhancing construction chemicals. Additionally, the compound’s adoption in animal feed as a preservative and acidifier supports its market expansion due to rising awareness of food safety and livestock health. Trends also point to increasing utilization in leather tanning and textile processing, where calcium formate serves as an eco-friendly and efficient additive.

Geographically, Asia Pacific holds a significant share of the global calcium formate market, owing to large-scale construction activities and robust industrial output in countries like China and India. Europe and North America follow closely, supported by well-established building sectors and stringent regulations favoring non-toxic additives. Key players operating in the market include Perstorp Group, Lanxess AG, Geo Specialty Chemicals, Henan Botai Chemical Building Materials Co., Ltd., and Zibo Ruibao Chemical Co., Ltd., among others.

Market Insights

- The Global Calcium Formate Market is projected to grow from USD 675.7 million in 2024 to USD 989.1 million by 2032, registering a CAGR of 4.87% from 2025 to 2032.

- Rising demand for fast-setting, non-chloride cement additives in cold weather concreting is a key factor driving calcium formate adoption in the construction industry.

- The compound’s role as a feed preservative and acidifier supports its growing use in livestock nutrition, particularly in antibiotic-free farming practices.

- Increasing regulatory pressure for sustainable and low-toxicity additives fuels demand for calcium formate across construction, agriculture, and industrial sectors.

- Fluctuating prices of key raw materials such as formic acid create cost uncertainties and impact profit margins for manufacturers.

- Asia Pacific held the largest market share in 2024, led by China and India, driven by strong construction activity, manufacturing growth, and cost-effective production.

- Europe and North America show stable demand due to established construction sectors and strict regulations promoting non-toxic chemical additives

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand from Construction Industry Drives Market Expansion

The Global Calcium Formate Market is gaining momentum due to its widespread use in the construction sector. It serves as an effective additive in cement and concrete formulations, enhancing setting times and early strength development, particularly in cold climates. The compound supports improved workability and durability, making it a preferred choice for infrastructure and residential projects. Governments across Asia Pacific and the Middle East are increasing investments in large-scale infrastructure, which fuels product demand. Calcium formate also complies with regulations encouraging non-chloride accelerators, which enhances its appeal. Its role in energy-efficient and sustainable construction practices continues to support market growth.

- For instance, over 42,000 tons of calcium formate were consumed in cement and concrete applications for infrastructure projects across Asia Pacific in that year, reflecting its growing adoption in the construction industry.

Growing Use in Animal Feed Applications Enhances Market Growth

In the Global Calcium Formate Market, increasing use in animal nutrition is a key growth driver. It acts as a feed preservative and acidifier, promoting better gut health and enhancing nutrient absorption in livestock. This usage improves weight gain and overall animal productivity, addressing growing demand for efficient meat and dairy production. The livestock industry is adopting calcium formate to reduce reliance on antibiotics, aligning with global regulatory changes. The European Union and North America are leading in enforcing safe feed additive policies, which supports consistent demand. It has become a preferred ingredient in feed formulations for poultry, swine, and aquaculture.

- For instance, according to a 2024 report by the European Feed Additives Authority, more than 18,500 tons of calcium formate were incorporated into animal feed formulations for poultry and swine across Europe, illustrating its significant role in modern livestock nutrition.

Rising Adoption in Leather and Textile Processing Boosts Market Demand

Calcium formate is widely used in the leather tanning and textile finishing sectors due to its ability to accelerate chrome penetration and enhance dyeing efficiency. The Global Calcium Formate Market benefits from this trend, especially in countries with strong leather exports like India, China, and Brazil. It ensures smooth processing and improves end-product quality without harming the environment. With increasing restrictions on harmful chemicals, manufacturers are seeking safer alternatives, and calcium formate fits this need. The textile industry also favors it for its role in pH control and process stabilization. Its multifunctional performance strengthens its value across industrial applications.

Focus on Environmentally Safe Chemicals Strengthens Market Position

Environmental regulations and rising awareness about non-toxic chemicals support long-term prospects for the Global Calcium Formate Market. Regulatory bodies are pushing industries to adopt eco-friendly materials across construction, animal feed, and manufacturing. Calcium formate meets these requirements with its low toxicity, biodegradability, and safe handling profile. Its use aligns with sustainable development goals, attracting industries seeking to minimize environmental impact. The product also facilitates compliance with REACH and EPA guidelines, which is crucial for market access in Europe and North America. It continues to gain preference where sustainability and safety are top priorities.

Market Trends

Increased Focus on Cold Weather Concrete Accelerators Spurs Innovation

The Global Calcium Formate Market is witnessing a strong trend toward the development of advanced concrete accelerators for cold weather construction. Calcium formate enhances hydration rates, allowing construction activities to continue efficiently in low temperatures. This trend is especially prevalent in regions with harsh winters, such as Northern Europe, North America, and parts of East Asia. Manufacturers are investing in product formulations that combine calcium formate with other additives for superior strength and reduced curing times. Construction companies prefer it due to its compatibility with non-corrosive and chloride-free systems. This trend reinforces its strategic role in modern construction practices.

- For instance, the concrete additive segment—dominated by calcium formate—accounted for 40% of the total market share, with manufacturers launching over 30 new cold weather accelerator formulations in the past two years to support infrastructure projects in cold climates

Shift Toward Antibiotic-Free Animal Feed Drives Consistent Demand

A significant trend in the Global Calcium Formate Market is the increasing shift toward antibiotic-free animal husbandry. Calcium formate improves animal gut health and serves as a natural preservative, aligning with new regulatory frameworks and consumer expectations. Governments and industry leaders are promoting alternative feed additives that enhance livestock performance without compromising food safety. Feed manufacturers are incorporating calcium formate into swine, poultry, and aquaculture diets to meet these standards. Its ability to lower feed pH and inhibit harmful microbial growth makes it a reliable choice. This trend supports stable demand from the livestock nutrition sector.

- For instance, a 2024 industry survey reported that feed-grade calcium formate was included in the diets of more than 120 million livestock globally, with over 60 feed manufacturers adopting calcium formate-based formulations for antibiotic-free swine and poultry production in the past year

Sustainable Leather and Textile Processing Fuels Market Integration

Rising sustainability requirements in the leather and textile sectors have positioned calcium formate as a preferred processing agent. The Global Calcium Formate Market is benefiting from its use in chrome tanning and textile dyeing, where it improves operational efficiency and meets environmental regulations. Brands and manufacturers are focusing on reducing chemical discharge and replacing hazardous substances with safer alternatives. Calcium formate meets these goals while maintaining the required product quality and consistency. Countries with strong export-driven leather and textile industries are driving this trend. The market is aligning with global shifts in clean and sustainable manufacturing.

Expansion of Industrial Applications Broadens Market Scope

Industrial diversification is shaping a new growth trajectory for the Global Calcium Formate Market. Its adoption is expanding beyond construction and agriculture into areas such as de-icing agents, lubricants, and gas exploration. These applications require reliable additives that enhance performance without posing environmental risks. Calcium formate provides functional benefits such as corrosion resistance and thermal stability in various processes. The shift toward multifunctional chemicals is encouraging producers to develop high-purity grades suited for specialized industrial uses. It is gaining traction in new markets where performance and compliance are key drivers.

Market Challenges

Fluctuating Raw Material Prices and Supply Chain Instability Restrain Market Growth

The Global Calcium Formate Market faces challenges from volatile raw material prices, especially formic acid and calcium hydroxide. These fluctuations impact production costs and profit margins, making it difficult for manufacturers to maintain consistent pricing. Uncertainties in global trade and logistics disruptions contribute to irregular supply cycles. Small and medium enterprises often lack the flexibility to absorb these cost variations, leading to reduced competitiveness. It also affects timely delivery and inventory planning, particularly in export-driven markets. These supply chain inefficiencies continue to pose significant risks to sustained market expansion.

- For instance, the price of formic acid in China, a key raw material for calcium formate, ranged from 2,800 to 3,800 yuan per ton during 2023, with monthly price swings of up to 500 yuan per ton, while calcium hydroxide prices in Europe fluctuated between €120 and €180 per ton over the same period, reflecting the volatility that manufacturers must manage in their cost structures.

Limited Awareness and Regulatory Compliance Create Market Barriers

The market struggles with limited awareness about calcium formate’s benefits in several developing regions. Potential consumers in construction, agriculture, and animal feed sectors often opt for traditional additives due to cost concerns or lack of technical knowledge. Regulatory differences across countries complicate global marketing and distribution strategies. The Global Calcium Formate Market must navigate complex compliance requirements, especially in animal feed and food-related applications. It takes time and investment for companies to meet these standards and build customer trust. These challenges slow market penetration in price-sensitive and highly regulated regions.

Market Opportunities

Rising Infrastructure Development in Emerging Economies Creates New Demand Channels

Rapid urbanization and industrial expansion across Asia Pacific, Latin America, and the Middle East present significant opportunities for the Global Calcium Formate Market. Governments are increasing investments in transportation, housing, and energy infrastructure, which requires performance-enhancing construction materials. Calcium formate, used as a setting accelerator and strength enhancer, meets these needs in both residential and commercial projects. It performs well under varying climatic conditions and supports faster project completion. Construction firms in developing countries are beginning to adopt advanced chemical admixtures, opening new markets. These large-scale infrastructure programs will continue to drive long-term demand growth.

Growing Preference for Eco-Friendly Additives Strengthens Market Outlook

Stricter environmental regulations and growing consumer awareness are driving interest in non-toxic, biodegradable additives across multiple industries. The Global Calcium Formate Market is positioned to benefit from this trend due to its favorable safety and sustainability profile. It offers a reliable alternative to chloride-based additives in construction and hazardous preservatives in feed and tanning applications. Industries are shifting toward materials that meet both performance standards and environmental compliance. Calcium formate aligns with global regulatory goals and supports the shift to green manufacturing practices. This demand for cleaner industrial inputs presents a strong growth avenue in both established and emerging markets.

Market Segmentation Analysis

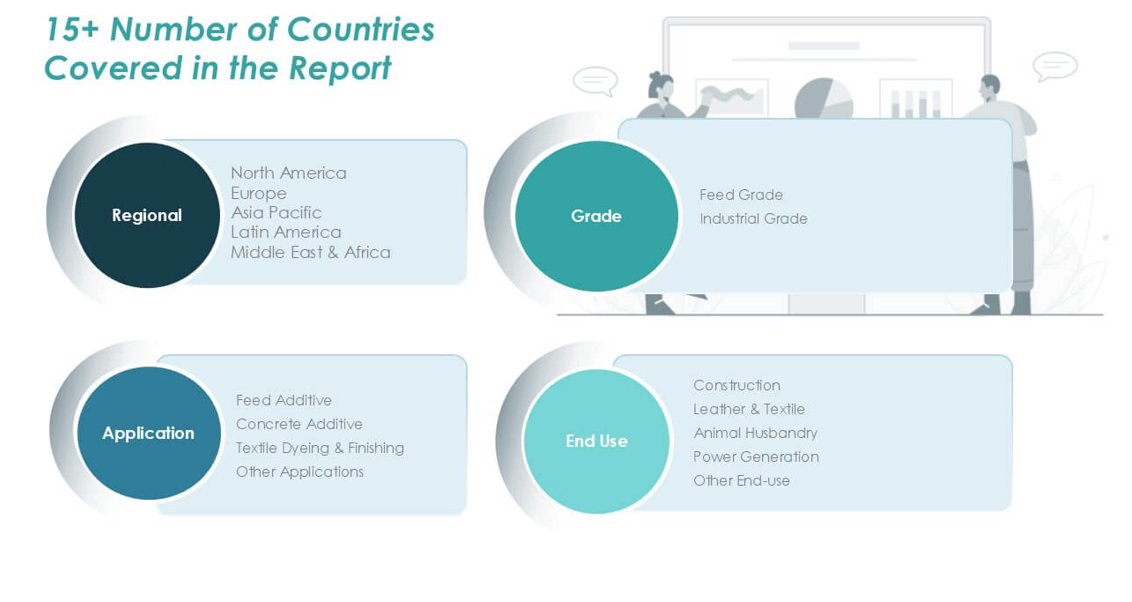

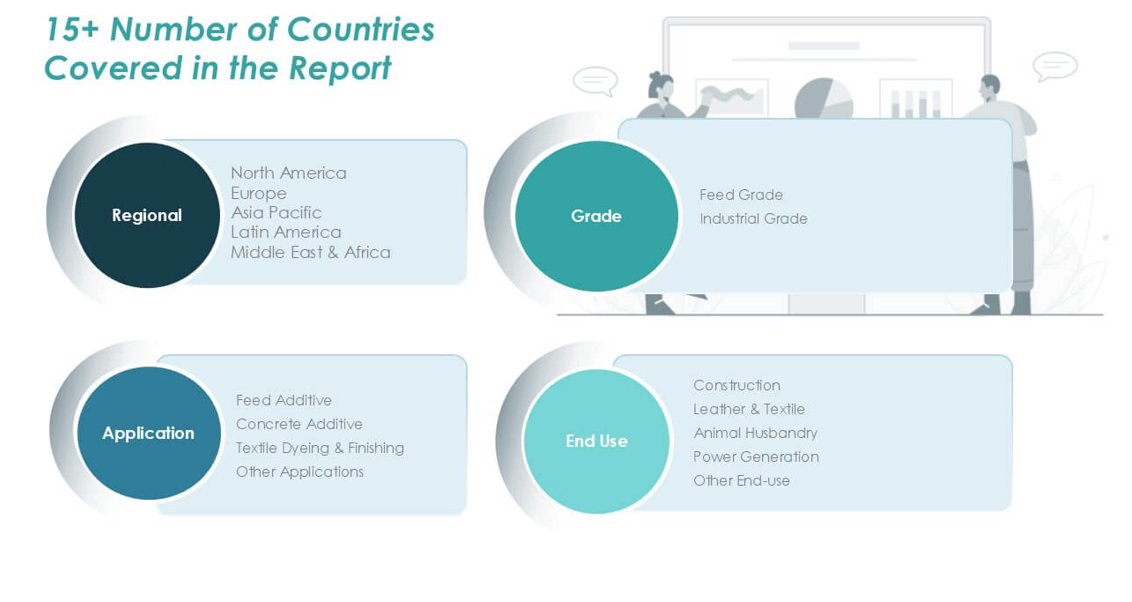

By Grade

The Global Calcium Formate Market is segmented into feed grade and industrial grade, with each serving distinct applications. Feed grade calcium formate holds a substantial share due to its use in animal nutrition, where it functions as an acidifier and preservative. It improves gut health, promotes weight gain, and supports antibiotic-free livestock production. Industrial grade calcium formate is widely used in construction, leather processing, and other chemical manufacturing. It enhances setting time in concrete, accelerates chrome tanning, and improves dye fixation. Demand for both grades continues to rise as industries adopt specialized formulations to meet performance and regulatory standards.

- For instance, in 2023, global usage of feed grade calcium formate reached approximately 850,000 tonnes, while industrial grade usage was around 650,000 tonnes.

By Application

The market is divided into feed additive, concrete additive, and textile dyeing and finishing segments. Feed additives represent a major application, driven by the global shift toward safe and sustainable animal feed solutions. In construction, calcium formate is gaining popularity as a non-chloride concrete accelerator, especially in cold climates. Textile and dyeing industries rely on it for process stability and efficient dye uptake. Each application segment supports consistent growth, reflecting the compound’s multifunctional utility across industrial processes. The Global Calcium Formate Market leverages these varied applications to maintain strong commercial relevance across sectors.

- For instance, annual consumption in 2023 included about 700,000 tonnes for feed additives, 500,000 tonnes for concrete additives, and 300,000 tonnes for textile dyeing and finishing.

By End Use

Key end-use segments include construction, leather and textile, animal husbandry, power generation, and others. Construction dominates the market due to the widespread use of calcium formate in concrete admixtures and cement formulations. The leather and textile industry utilizes it for efficient tanning and dyeing processes. In animal husbandry, it improves feed quality and supports regulatory compliance in livestock production. Power generation and other sectors adopt it in niche applications such as corrosion inhibition and gas treatment. Each end-use contributes to expanding the market’s industrial footprint and global reach.

Segments

Based on Grade

- Feed Grade

- Industrial Grade

Based on Application

- Feed Additive

- Concrete Additive

- Textile Dyeing & Finishing

Based on End Use

- Construction

- Leather & Textile

- Animal Husbandry

- Power Generation

- Other End-use

Based on Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America Fidget Toys Market

The North America Fidget Toys Market reached a value of USD 108.66 million in 2024 and is projected to grow to USD 148.36 million by 2032, registering a CAGR of 4.0% during the forecast period. It accounted for approximately 16.08% of the global market share in 2024. The region is characterized by strong demand from schools, therapy centers, and households where fidget toys are used for stress relief, focus enhancement, and support in managing ADHD. The United States remains the dominant contributor due to its established toy market and widespread consumer awareness. Retail chains and e-commerce platforms play a critical role in sustaining product accessibility. It continues to benefit from growing awareness of mental health and focus-related tools.

Europe Fidget Toys Market

Europe recorded a market value of USD 126.87 million in 2024 and is expected to reach USD 185.75 million by 2032, growing at a CAGR of 4.9%. In 2024, it represented 18.78% of the global market. The region shows steady adoption of fidget toys across educational, therapeutic, and office environments. Countries like Germany, the UK, and France are at the forefront, driven by consumer preference for tactile learning aids and wellness products. Rising stress levels in professional environments further contribute to product demand. The Fidget Toys Market in this region is supported by innovation in design and sustainability-driven product preferences.

Asia Pacific Fidget Toys Market

Asia Pacific held the largest share of the global market, valued at USD 241.64 million in 2024, projected to reach USD 365.95 million by 2032, growing at a CAGR of 5.3%. It accounted for 35.76% of the total market in 2024. China, Japan, and India are leading contributors due to high population density, increasing disposable income, and growing awareness around stress management tools. The education sector and urban parents are key consumer segments adopting fidget toys. It also benefits from rapid e-commerce growth, enabling broader market penetration. Manufacturers in the region are expanding offerings with cost-effective and innovative designs.

Latin America Fidget Toys Market

Latin America reached a market size of USD 91.60 million in 2024 and is projected to grow to USD 129.67 million by 2032, registering a CAGR of 4.4%. It contributed to 13.56% of the global market in 2024. Brazil and Mexico dominate regional sales due to increasing demand for toys that support focus and relaxation. Growing mental health awareness and school integration of sensory tools support steady demand. It is gradually expanding through local retail and online platforms. Regional manufacturers are leveraging affordability to compete with global brands and capture new consumer segments.

Middle East Fidget Toys Market

The Middle East Fidget Toys Market was valued at USD 64.14 million in 2024 and is estimated to reach USD 98.91 million by 2032, growing at the fastest CAGR of 5.6%. It accounted for 9.49% of the global market share in 2024. The region is seeing rising adoption among children and working professionals seeking stress relief solutions. Gulf countries, particularly the UAE and Saudi Arabia, are key markets due to their higher purchasing power and emphasis on wellness. Retailers are promoting fidget toys as part of lifestyle and personal productivity categories. It is gaining traction through educational campaigns and corporate wellness initiatives.

Africa Fidget Toys Market

Africa recorded a market size of USD 42.83 million in 2024, expected to reach USD 60.43 million by 2032, with a CAGR of 4.4%. It accounted for 6.34% of the global market in 2024. Market growth is driven by expanding urban populations and increased awareness of developmental and educational tools. South Africa, Nigeria, and Kenya are emerging as growth hubs due to rising school enrollments and mental health advocacy. Distribution remains a challenge, but local and regional retailers are working to improve accessibility. The Fidget Toys Market in Africa is steadily evolving with the introduction of low-cost and culturally tailored products.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key players

- Chongqing Chuandong Chemical (Group) Co. Ltd.

- Feicheng Acid Chemical Co. Ltd.

- GEO Specialty Chemicals

- Hangzhou Focus Chemical Co. Ltd.

- Hubei Hengxin Chemical Co. Ltd.

- LANXESS AG

- Perstorp Holding AB

- Shandong Baoyuan Chemical Co. Ltd.

- ZIBO RUIBAO CHEMICAL CO. LTD.

Competitive Analysis

The Global Calcium Formate Market is highly competitive, with several regional and international players operating across diverse segments. Key manufacturers such as LANXESS AG, Perstorp Holding AB, and GEO Specialty Chemicals focus on product innovation and capacity expansion to maintain market leadership. Chinese companies including Chongqing Chuandong Chemical, Feicheng Acid Chemical, and ZIBO RUIBAO CHEMICAL dominate volume-based production due to cost advantages and established domestic networks. It remains fragmented, with companies competing on pricing, distribution, and grade customization. Strategic partnerships, technological advancement, and compliance with international quality standards are central to gaining a competitive edge. Players also focus on expanding their geographic presence and aligning with end-user industries to strengthen market position.

Recent Developments

- In 2024, Perstorp Holding AB reported a 30% increase in sales of its “Pro-Environment” product line and received a platinum sustainability rating from EcoVadis.

Market Concentration and Characteristics

The Global Calcium Formate Market shows moderate concentration, with a mix of global chemical giants and numerous regional players contributing to supply. It features strong competition driven by price sensitivity, product grade differentiation, and application-specific formulations. China holds a dominant share in production capacity, influencing global pricing and trade flows. The market is characterized by stable demand from construction, animal nutrition, and leather industries, supported by regulatory acceptance and growing sustainability concerns. It remains fragmented in emerging regions, where local manufacturers cater to cost-conscious end users. Key players compete through quality assurance, supply reliability, and tailored solutions aligned with industry needs.

Report Coverage

The research report offers an in-depth analysis based on Type of Cartilage, Treatment Modalities, Treatment Type, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The construction industry will continue adopting calcium formate to accelerate concrete setting, especially in cold regions. Demand will rise with infrastructure investments across Asia Pacific, Europe, and North America.

- Calcium formate will gain broader acceptance as a feed preservative and acidifier. Global shifts toward antibiotic-free livestock farming will support long-term usage.

- Countries like India, Brazil, and Southeast Asian nations will see increased consumption. Rising industrialization and awareness of performance-enhancing additives will drive regional growth.

- Manufacturers will focus on developing high-purity and application-specific grades. Customization for feed, construction, and textile use will strengthen product portfolios.

- The market will benefit from increasing demand for eco-friendly chemicals. Calcium formate’s low toxicity and biodegradability align with global environmental standards.

- E-commerce and digital platforms will streamline product access and global reach. SMEs and regional distributors will leverage digital tools to compete more effectively.

- Key players will invest in new facilities and strategic alliances. These moves will aim to increase production capacity and secure supply chain resilience.

- The leather and textile industries will expand calcium formate use in tanning and dyeing. Regulatory pressures on hazardous chemicals will encourage this shift.

- Calcium formate will explore use in applications like de-icing, oil drilling, and anti-corrosion agents. Market expansion will benefit from technical performance in these sectors.

- The Global Calcium Formate Market will continue its upward trend through 2032. A balanced mix of end-use applications and geographic demand will ensure long-term market stability.