Market Overview

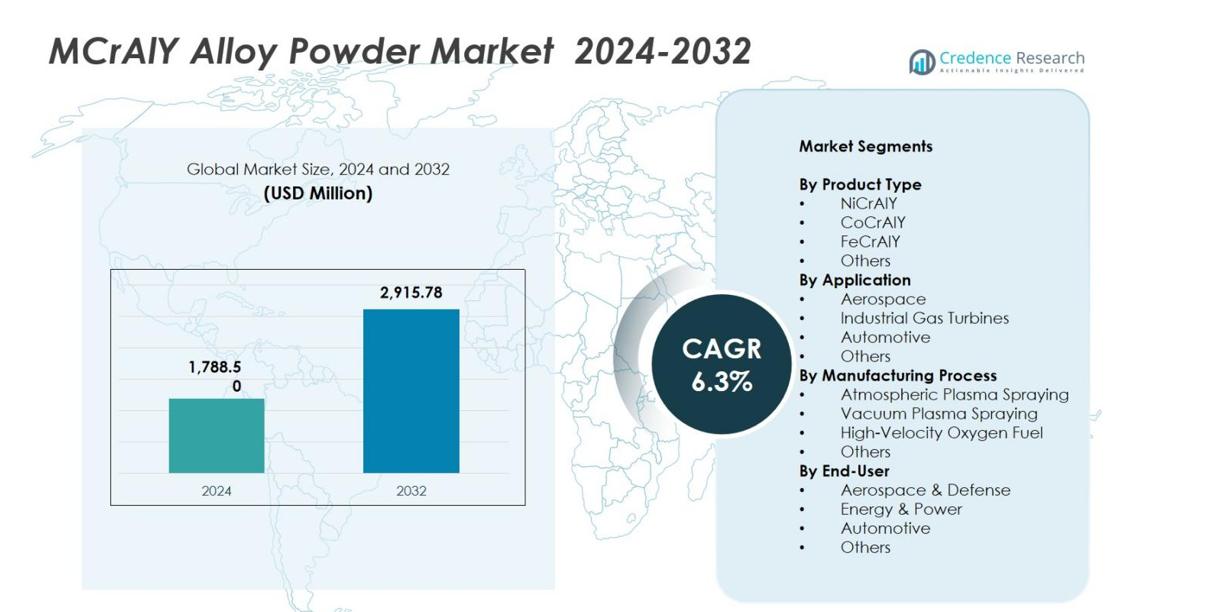

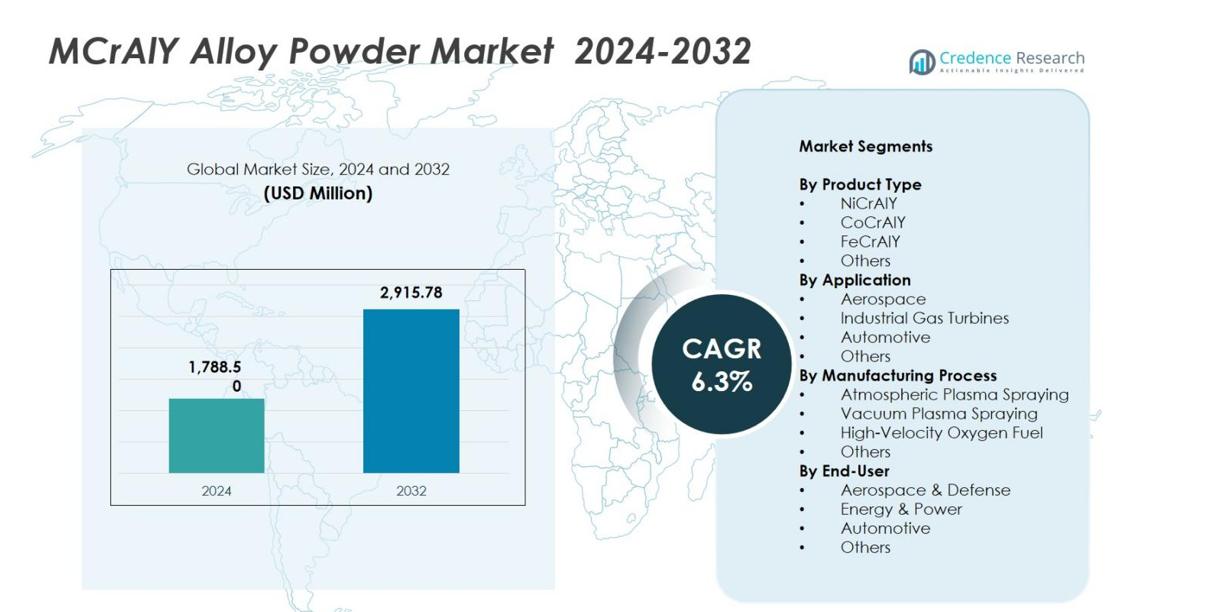

The MCrAlY Alloy Powder Market size was valued at USD 1,788.50 Million in 2024 and is anticipated to reach USD 2,915.78 Million by 2032, at a CAGR of 6.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| MCrAlY Alloy Powder Market Size 2024 |

USD 1,788.50 Million |

| MCrAlY Alloy Powder Market, CAGR |

6.3% |

| MCrAlY Alloy Powder Market Size 2032 |

USD 2,915.78 Million |

The MCrAlY Alloy Powder Market is shaped by leading players such as Praxair Surface Technologies, Oerlikon Metco, Höganäs AB, Sandvik AB, Carpenter Technology Corporation, Powder Alloy Corporation, H.C. Starck GmbH, Kennametal Inc., Metallisation Ltd., and Durum Verschleißschutz GmbH, all of which compete through advancements in alloy purity, thermal spray compatibility, and high-temperature performance. These companies support aerospace, energy, and industrial sectors with specialized powder solutions tailored for turbine efficiency and component durability. Regionally, North America dominated the market in 2024 with 34.2% share, driven by strong aerospace production, extensive MRO activity, and continuous technological innovation.

Market Insights

- The MCrAlY Alloy Powder Market was valued at USD 1,788.50 million in 2024 and is projected to reach USD 2,915.78 million by 2032, growing at a CAGR of 6.3%.

- Strong demand from aerospace and industrial gas turbine sectors drives market expansion, supported by the need for advanced thermal barrier and corrosion-resistant coatings in high-temperature turbine components.

- Additive manufacturing adoption, advancements in plasma spraying, and development of high-purity alloy powders shape key market trends, enhancing durability and performance in next-generation turbines.

- Major players such as Praxair Surface Technologies, Oerlikon Metco, Höganäs, Sandvik, and Kennametal strengthen competitiveness through R&D, coating technology innovation, and strategic OEM partnerships, led by the dominant NiCrAlY segment with over 42.6% share.

- Regionally, North America leads with 34.2% market share, followed by Europe at 28.7% and Asia-Pacific at 24.5%, reflecting strong aerospace ecosystems and increasing turbine modernization initiatives globally.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis

By Product Type

The MCrAlY Alloy Powder Market is led by the NiCrAlY segment, accounting for 42.6% of the market share in 2024, driven by its superior oxidation and hot-corrosion resistance, making it the preferred choice for high-temperature turbine components. CoCrAlY follows, supported by its strong sulfidation resistance in marine and industrial environments. FeCrAlY remains a cost-effective alternative for lower-temperature applications, while the Others category includes advanced compositions tailored for niche performance needs. Increasing demand for durable thermal barrier coatings across aerospace and power generation continues to propel NiCrAlY dominance.

- For Instance, coatings based on CoCrAlY (thermal-sprayed by APS or HVOF) have demonstrated strong resistance to hot corrosion and sulfidation in marine or salt-laden industrial environments outperforming uncoated substrates when exposed to molten salt conditions at elevated temperatures

By Application

Aerospace emerged as the dominant segment, 48.3% market share in 2024, owing to the extensive use of MCrAlY coatings in turbine blades, combustors, and transition components that require exceptional temperature stability and oxidation resistance. The Industrial Gas Turbines segment also shows strong growth as energy producers adopt efficiency-boosting coating technologies for longer component life. Automotive applications benefit from rising adoption of turbocharger and exhaust system coatings. The Others category spans marine and industrial machinery. Growing emphasis on operational efficiency and extended maintenance cycles continues to strengthen aerospace leadership in this segment.

- For instance, in industrial gas turbines, companies such as Sulzer apply MCrAlY coatings to turbine blades and vane segments, resulting in improved corrosion resistance and extended component life for energy producers.

By Manufacturing Process

Atmospheric Plasma Spraying (APS) dominated the market with 39.7% share in 2024, attributed to its cost-effectiveness, versatility, and widespread industrial adoption for applying uniform MCrAlY coatings. Vacuum Plasma Spraying (VPS) is gaining momentum due to its superior coating density and reduced oxidation, making it suitable for advanced turbine applications. High-Velocity Oxygen Fuel (HVOF) technology offers high bond strength and wear resistance, appealing to aerospace and energy industries seeking enhanced durability. Other emerging processes support specialized coating requirements. APS continues to lead due to its scalability and broad applicability across end-use sectors.

Key Growth Drivers

Rising Demand from Aerospace and Gas Turbine Industries

The MCrAlY Alloy Powder Market is significantly driven by the expanding aerospace and industrial gas turbine sectors, which require advanced thermal barrier and corrosion-resistant coatings to improve engine efficiency and lifespan. Increasing production of next-generation aircraft, coupled with the global shift toward lightweight materials and high-performance turbine components, fuels the adoption of MCrAlY powders for critical parts such as blades, vanes, and combustors. Additionally, the rising emphasis on fuel efficiency and reduced maintenance cycles encourages OEMs to integrate high-quality MCrAlY coatings into their designs. Industrial gas turbines used in power generation also rely heavily on these coatings to withstand extreme temperatures and aggressive operating environments. As governments and industries prioritize sustainable and efficient energy systems, turbine upgrade programs and refurbishment activities continue to expand, further driving demand for MCrAlY alloy powders across both aviation and power generation applications.

- For instance, Rolls-Royce applies MCrAlY layers across high-pressure turbine components in its Trent 1000 and Trent XWB engines, supporting higher operating temperatures essential for fuel-efficiency improvements.

Advancements in Thermal Spray and Coating Technologies

Technological innovations in thermal spray processes play a critical role in accelerating MCrAlY Alloy Powder Market growth. Advancements in atmospheric plasma spraying, vacuum plasma spraying, and high-velocity oxygen fuel methods have improved coating density, uniformity, adhesion strength, and oxidation resistance, making MCrAlY powders more effective for high-temperature applications. These innovations support the development of next-generation turbine engines that operate at higher combustion temperatures, increasing demand for robust protective coatings. Enhanced process automation, robotics, and in-line monitoring systems also boost production consistency and reduce operational costs, encouraging wider industrial adoption. Furthermore, research into nano-structured and high-purity alloy powders enables superior performance, opening opportunities in high-stress aerospace and energy environments. As coating technologies continue to evolve, manufacturers increasingly rely on MCrAlY powders to achieve greater thermal stability and component durability.

- For instance, Oerlikon Metco’s advanced APS and VPS systemssuch as the Metco 9M and UniCoatPro platformsincorporate automated parameter control and real-time monitoring, enabling highly repeatable MCrAlY bond-coat deposition for turbine blades and combustor hardware.

Expansion of Renewable and Distributed Energy Systems

The expanding global shift toward renewable and distributed energy systems substantially contributes to the demand for MCrAlY alloy powders, particularly in the refurbishment and enhancement of gas turbines that serve as backup or balancing power sources. As wind and solar installations increase, gas turbines play a vital role in load balancing, requiring high-performance coatings to maintain operational efficiency during frequent ramp-up cycles. MCrAlY powders help extend turbine component life, reduce corrosion, and support higher operational temperatures, making them essential for modern energy landscapes. Additionally, emerging micro-turbine systems used in decentralized energy generation depend on advanced coatings to achieve efficient combustion and reduced maintenance needs. Government investments in energy security, modernization of turbine fleets, and retrofitting programs further strengthen market demand. As renewable integration intensifies worldwide, the need for durable, thermally resistant components ensures sustained growth for MCrAlY alloy powders.

Key Trend & Opportunity

Growing Adoption of Additive Manufacturing for High-Performance Components

The adoption of additive manufacturing presents a major opportunity for the MCrAlY Alloy Powder Market, as industries increasingly shift toward 3D-printed turbine components with tailored performance characteristics. MCrAlY powders are gaining importance in AM due to their ability to produce near-net-shape parts with enhanced microstructural control, improved coating adhesion, and reduced material wastage. Aerospace and power generation sectors benefit from the precision and customization offered by AM, enabling the production of complex components capable of withstanding extreme environments. Continued advancements in powder metallurgy, atomization processes, and AM-compatible alloy formulations are accelerating market adoption. As manufacturers pursue cost-efficient, high-performance solutions, integration of MCrAlY powders into laser powder bed fusion and direct energy deposition systems presents strong growth potential and new revenue opportunities for suppliers.

- For instance, Siemens successfully 3D-printed and tested gas-turbine burner tips using alloy powders compatible with MCrAlY coating systems, reducing production time by over 70% while enabling complex geometries previously impossible with conventional machining.

Increasing Focus on Sustainability and Longer Component Lifecycles

A growing emphasis on sustainability and cost efficiency is creating new opportunities for MCrAlY alloy powders, particularly as industries seek to extend the life of high-value components and reduce waste. MCrAlY-coated turbine blades and hot section parts significantly reduce the need for frequent replacements, supporting circular maintenance strategies and lowering environmental impact. Companies across aerospace and energy sectors are investing in refurbishment and repair programs where high-performance coatings play a central role. The development of environmentally friendly coating processes and reduced-emission manufacturing methods further aligns with global ESG mandates, enhancing the appeal of MCrAlY powders. As industries prioritize lifecycle optimization, durability, and reduced downtime, demand for high-quality MCrAlY materials is expected to accelerate, opening avenues for suppliers offering advanced and eco-efficient alloy solutions.

- For instance, Lufthansa Technik’s engine overhaul facilities use MCrAlY thermal spray coatings during blade refurbishment, enabling components to regain oxidation-resistant surfaces and remain in service longer while minimizing material consumption.

Key Challenge

High Production Costs and Material Complexity

The production of MCrAlY alloy powders poses a significant challenge due to the complexity of their composition and the precision required during manufacturing. The use of high-purity metals such as nickel, cobalt, and aluminum elevates raw material costs, while sophisticated atomization and powder refinement processes add operational expense. Maintaining strict control over powder morphology, particle size distribution, and chemical homogeneity is essential for achieving reliable coating performance, further increasing production difficulty. These high costs create barriers for smaller manufacturers and restrict wider adoption in cost-sensitive industries. As economic pressures intensify and competition grows, producers must innovate to reduce manufacturing costs without compromising quality, posing an ongoing challenge for market expansion.

Technical Limitations and Performance Variability Across Processes

Despite their advantages, MCrAlY alloy powders face performance variability depending on the coating process, operational environment, and component design, creating challenges for end-users seeking consistent results. Variations in plasma temperatures, deposition rates, and oxidation control during spraying can impact coating uniformity, adhesion, and long-term stability. Differences between atmospheric plasma spraying, vacuum plasma spraying, and high-velocity oxygen fuel processes require specialized expertise and highly controlled environments, making it difficult for some manufacturers to achieve optimal performance. These technical limitations also complicate adoption in emerging manufacturing methods such as additive construction. As industries push for higher engine temperatures and greater efficiency, overcoming these variability issues becomes essential to ensuring reliable, high-performance coatings across diverse applications.

Regional Analysis

North America

North America held the largest share of the MCrAlY Alloy Powder Market, accounting for 34.2% in 2024, driven by strong aerospace manufacturing capabilities, high adoption of advanced turbine technologies, and continuous investments in defense aviation programs. The region benefits from the presence of major engine OEMs and coating technology providers that rely heavily on MCrAlY powders for turbine blade protection and performance enhancement. Growing refurbishment activities in industrial gas turbines, coupled with the modernization of energy infrastructure, further strengthen regional demand. Supportive R&D initiatives and technological advancements continue to position North America as a dominant market.

Europe

Europe captured 28.7% of the market share in 2024, supported by its well-established aerospace industry, stringent emission regulations, and strong focus on high-efficiency turbine technologies. Countries such as Germany, the UK, and France contribute significantly due to their advanced manufacturing ecosystems and leading turbine component suppliers. The region’s shift toward cleaner energy systems increases demand for high-performance coatings used in gas turbine refurbishment and life-extension programs. Additionally, continuous innovation in thermal spray techniques and alloy development reinforces Europe’s position as a key consumer of MCrAlY alloy powders.

Asia-Pacific

Asia-Pacific accounted for 24.5% of the MCrAlY Alloy Powder Market in 2024, driven by rapid industrialization, expansion of aerospace manufacturing hubs, and significant investments in energy infrastructure. China, Japan, and India are major contributors, supported by the rising adoption of industrial gas turbines for power generation and growing MRO activities in aviation. The region’s increasing focus on domestic aircraft production and modernization of turbine facilities boosts consumption of MCrAlY powders. Accelerated technological adoption and government support for advanced manufacturing further position Asia-Pacific as the fastest-growing regional market.

Latin America

Latin America 6.4% market share in 2024, with demand primarily driven by the gradual modernization of power generation assets and increasing use of industrial gas turbines in Brazil, Mexico, and Argentina. Although aerospace manufacturing is limited compared to other regions, the region benefits from rising MRO requirements and industrial upgrades requiring high-performance coatings. Economic reforms and infrastructure development programs support broader adoption of advanced materials. However, slower technological integration and reliance on imported thermal spray systems limit faster expansion, keeping the region in a steady but moderate growth phase.

Middle East & Africa

The Middle East & Africa region accounted for 6.2% share in 2024, supported by strong demand from the energy and petrochemical sectors where gas turbines play a central operational role. Countries such as Saudi Arabia, UAE, and South Africa increasingly invest in turbine refurbishment to enhance efficiency and reliability in harsh operating environments. Growing initiatives to diversify energy portfolios and strengthen industrial capabilities contribute to rising use of MCrAlY coatings. However, limited local manufacturing and dependency on international suppliers constrain rapid market growth, although ongoing industrialization is expected to gradually enhance adoption.

Market Segmentations

By Product Type

- NiCrAlY

- CoCrAlY

- FeCrAlY

- Others

By Application

- Aerospace

- Industrial Gas Turbines

- Automotive

- Others

By Manufacturing Process

- Atmospheric Plasma Spraying

- Vacuum Plasma Spraying

- High-Velocity Oxygen Fuel

- Others

By End-User

- Aerospace & Defense

- Energy & Power

- Automotive

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the MCrAlY Alloy Powder Market is characterized by a mix of global materials specialists and advanced coating technology providers focused on delivering high-performance alloy formulations for demanding aerospace and industrial turbine applications. Key players such as Praxair Surface Technologies, Oerlikon Metco, Höganäs AB, Sandvik AB, Carpenter Technology Corporation, Powder Alloy Corporation, H.C. Starck GmbH, Kennametal Inc., Metallisation Ltd., and Durum Verschleißschutz GmbH actively compete through innovations in alloy chemistry, powder morphology, and thermal spray process compatibility. These companies prioritize R&D investments to enhance oxidation and corrosion resistance, improve powder flow characteristics, and support next-generation turbine operating temperatures. Strategic partnerships with aerospace OEMs, turbine manufacturers, and MRO service providers further strengthen market presence, while capacity expansions and advancements in atomization technologies enable consistent supply of high-purity powders. Growing adoption of additive manufacturing also drives competition as players develop AM-ready MCrAlY formulations to meet evolving industry requirements.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Metallisation Ltd.

- Praxair Surface Technologies, Inc.

- Durum Verschleißschutz GmbH

- Oerlikon Metco (Switzerland) AG

- Powder Alloy Corporation

- Kennametal Inc.

- Carpenter Technology Corporation

- H.C. Starck GmbH

- Höganäs AB

- Sandvik AB

Recent Developments

- In October 2025, the Co-Based MCrAlY Alloy Powder Market was estimated at USD 9.65 million for 2025, with projections to reach USD 13.78 million by 2034.

- In January 2024, Sandvik signed a distributor agreement with KBM Advanced Materials for metal powders for additive manufacturing in the U.S. although the public announcement refers broadly to “metal powders / AM powders,” and does not explicitly mention MCrAlY.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application, Manufacturing Process, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience steady demand growth as aerospace and gas turbine manufacturers prioritize high-performance coating solutions.

- Advancements in thermal spray technologies will enhance coating efficiency and expand application potential.

- Additive manufacturing adoption will increase the use of MCrAlY powders for complex, high-temperature components.

- Refurbishment and life-extension programs for industrial gas turbines will continue to support market expansion.

- Development of next-generation turbine engines will drive demand for higher-purity and more oxidation-resistant alloy powders.

- Increased focus on operational efficiency will boost the adoption of durable, corrosion-resistant coatings.

- Emerging energy systems, including distributed and hybrid power solutions, will create new application opportunities.

- Strategic collaborations between powder suppliers and OEMs will accelerate innovation and product optimization.

- Regional manufacturing investments, particularly in Asia-Pacific, will strengthen global supply capabilities.

- Sustainability-driven initiatives will promote longer component lifecycles and greater reliance on advanced coating materials.