Market Overview

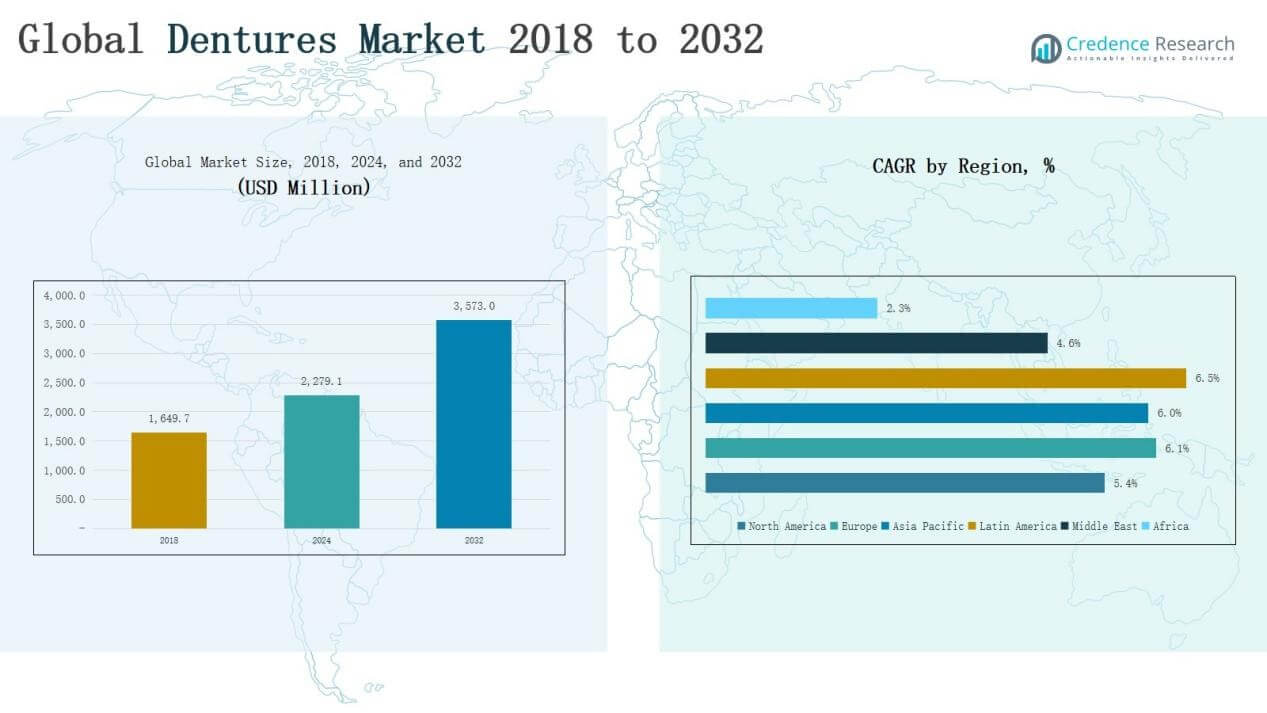

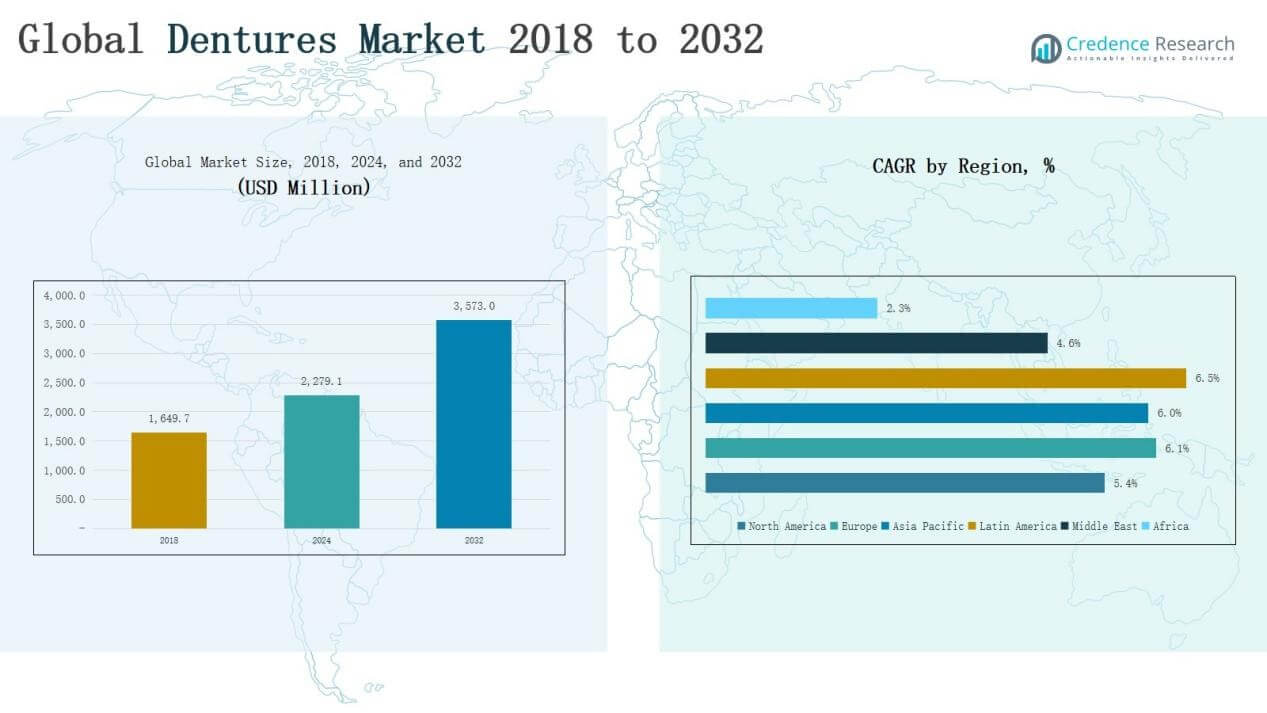

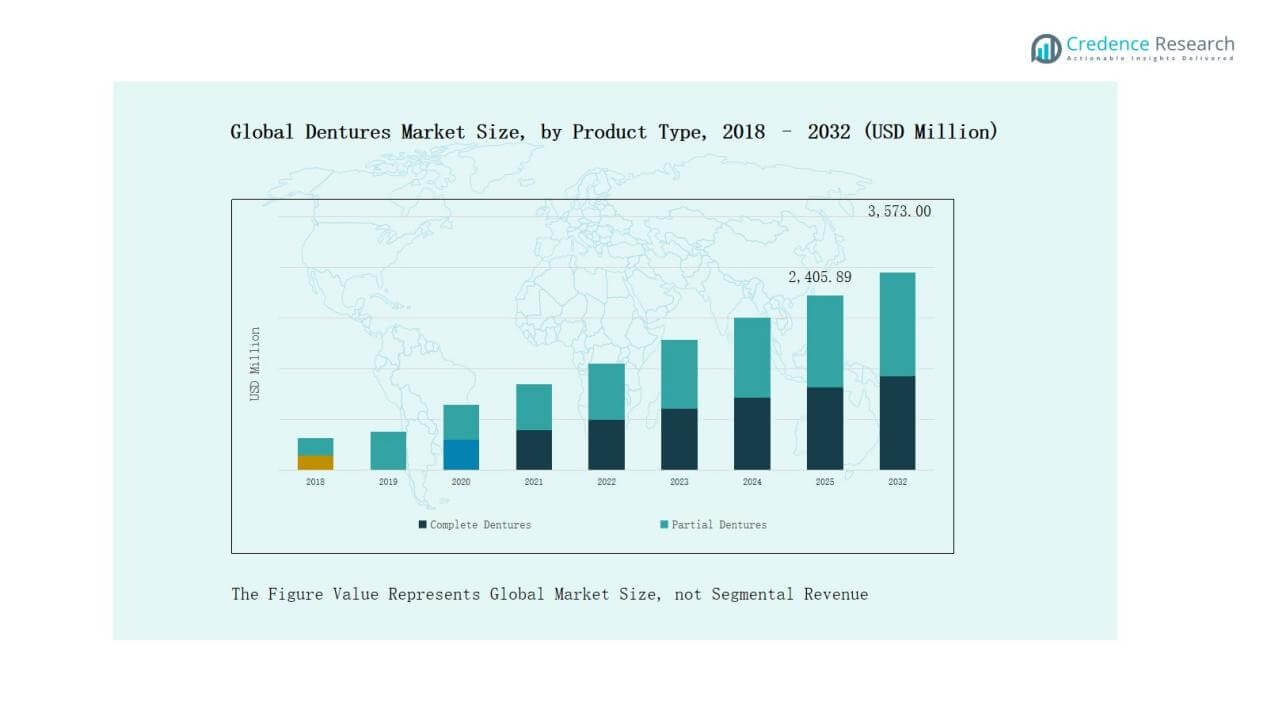

Global Dentures Market size was valued at USD 1,649.7 million in 2018 to USD 2,279.1 million in 2024 and is anticipated to reach USD 3,573.0 million by 2032, at a CAGR of 5.81% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Dentures Market Size 2024 |

USD 2,279.1 Million |

| Dentures Market, CAGR |

5.81% |

| Dentures Market Size 2032 |

USD 3,573.0 Million |

The Global Dentures Market is led by major players such as Dentsply Sirona, Envista Holdings Corporation, Ivoclar Vivadent AG, Coltene, Zimmer Biomet, Mitsui Chemicals, Modern Dental Group Limited, Heraeus Kulzer GmbH, and Glidewell Dental. These companies maintain strong market positions through advanced product portfolios, digital dentistry solutions, and global distribution networks. They focus on CAD/CAM integration, 3D printing, and premium materials to enhance customization and clinical adoption. Among regions, Europe dominated the market in 2024 with a 35% share, supported by high edentulism prevalence, robust reimbursement frameworks, and strong presence of established dental manufacturers.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Global Dentures Market was valued at USD 2,279.1 million in 2024 and is projected to reach USD 3,573.0 million by 2032, growing steadily.

- Europe led with a 35% share in 2024, supported by high edentulism rates, favorable reimbursement policies, and strong presence of established dental manufacturers.

- By material, Acrylic Resin dominated with 62% share in 2024, driven by cost-effectiveness, comfort, and wider adoption in both developed and developing markets.

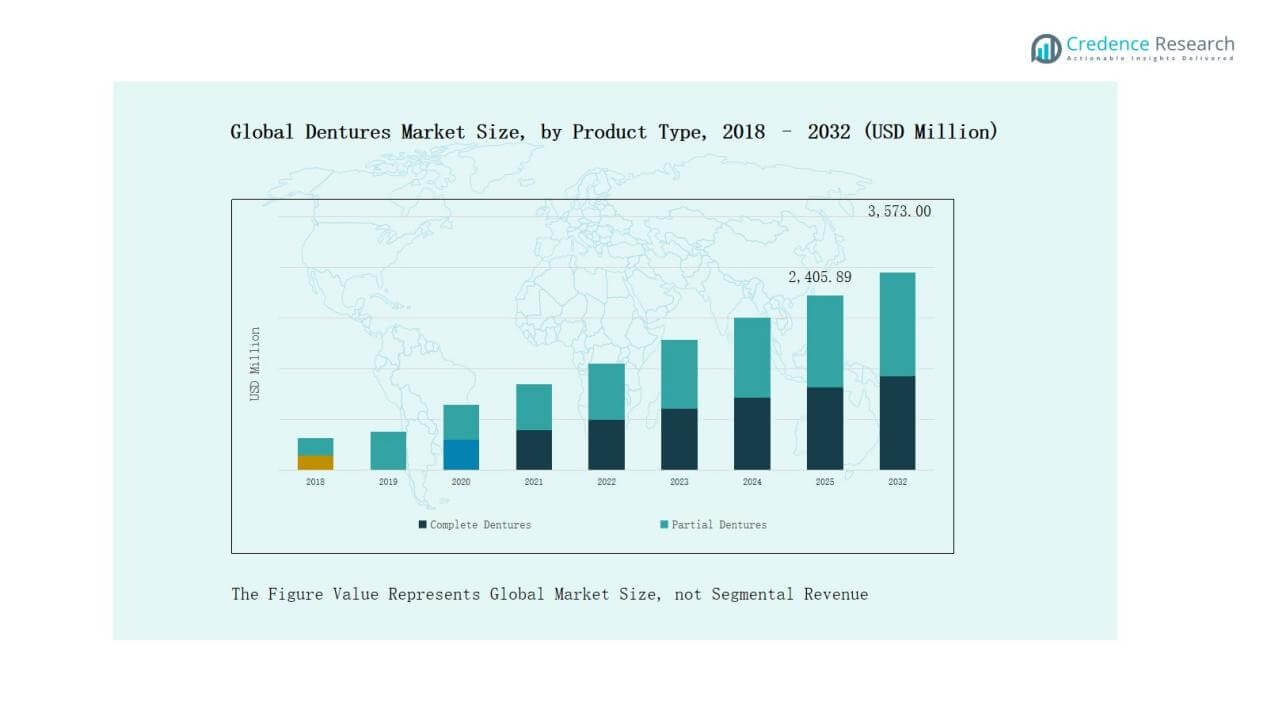

- By product, Complete Dentures held 66% share, supported by rising cases of full tooth loss among the aging population and affordability compared to implants.

- By usage, Removable Dentures accounted for 71%, reflecting their affordability, ease of maintenance, and strong adoption in low- and middle-income countries.

Market Segment Insights

By Material

Acrylic resin dominated the global dentures market in 2024 with a 62% share. Its leadership stems from cost-effectiveness, ease of adjustment, and lighter weight compared to porcelain. Dentists and patients prefer acrylic resin for removable dentures due to improved comfort and repair flexibility. Growing adoption in developing economies further strengthens its position. Porcelain held 28% share, supported by superior durability and natural appearance. The remaining 10% came from other materials, including flexible polymers that are gaining traction for aesthetics and patient comfort.

- For instance, Dentsply Sirona offers acrylic-based Lucitone 199 denture resin, widely used for its fracture resistance and ease of relining.

By Product

Complete dentures accounted for the largest share in 2024, representing 66% of the market. Rising cases of complete tooth loss among aging populations and cost-efficient full-mouth replacement solutions supported dominance. Widespread adoption in both developed and emerging markets highlights their essential role in oral rehabilitation. Partial dentures contributed 34%, driven by increasing demand among younger patients with partial tooth loss, especially where implants remain less affordable. Growing customization and better material integration are expected to expand this segment further.

- For instance, Ivoclar introduced its BPS® (Biofunctional Prosthetic System) complete dentures, which are widely adopted for high-precision full-mouth restorations in both North America and Europe.

By Usages

Removable dentures led the market in 2024 with a 71% share, reflecting their affordability, non-invasive fitting process, and patient-friendly maintenance. Their strong presence in low- and middle-income countries reinforces their demand. Fixed dentures, accounting for 29%, are expanding steadily with rising disposable incomes and patient preference for permanent, stable solutions. Increasing reliance on advanced dental technologies, such as implant-supported dentures, is accelerating the fixed segment’s adoption in developed regions.

Market Overview

Key Growth Drivers

Rising Geriatric Population

The growing elderly population is a primary driver of the dentures market. Aging individuals face higher rates of complete or partial tooth loss, creating sustained demand for prosthetic solutions. Longer life expectancy and improved awareness of oral healthcare are expanding adoption worldwide. Developed markets such as North America and Europe lead due to advanced care infrastructure, while emerging economies see rising demand with increasing access to dental services. This demographic shift continues to ensure long-term growth for denture products.

- For instance, Dentsply Sirona launched its Lucitone Digital Print Denture System in 2019, enabling labs to manufacture stronger, lighter dentures tailored to geriatric patients

Increasing Prevalence of Dental Disorders

Dental disorders such as periodontal disease, cavities, and oral trauma are increasing across age groups. Poor dietary habits, tobacco use, and inadequate oral hygiene contribute significantly to tooth loss. Dentures remain the most cost-effective solution for restoring oral functionality and aesthetics in such cases. Hospitals, clinics, and independent labs are witnessing rising cases, reinforcing product demand. With expanding patient awareness and better affordability in emerging countries, this factor acts as a strong growth engine for the global dentures market.

Technological Advancements in Dental Prosthetics

Advancements in dental technology, including CAD/CAM systems and 3D printing, are transforming denture design and production. These innovations enable higher precision, shorter turnaround times, and improved customization to match patient-specific requirements. Enhanced aesthetics, comfort, and durability are boosting acceptance among both dental professionals and patients. Digital workflows also reduce costs for labs and clinics, supporting affordability. The integration of advanced materials like flexible polymers further expands product adoption. This wave of innovation significantly strengthens the market’s long-term prospects.

- For instance, Stratasys introduced the J5 DentaJet 3D printer in 2021, which can print multiple denture parts in a single run using biocompatible resins, reducing production steps and turnaround times.

Key Trends & Opportunities

Growing Adoption of Implant-Supported Dentures

Implant-supported dentures are gaining traction due to superior stability, comfort, and long-term performance compared to traditional removable types. Patients increasingly view implants as a premium solution, supported by rising disposable incomes and better access to advanced procedures. Dental clinics in developed regions are investing in implant infrastructure, while emerging markets gradually adopt the approach with expanding affordability. This trend creates new opportunities for manufacturers to innovate and target the premium segment of the dentures market.

- For instance, Nobel Biocare’s Trefoil system allows patients to receive a fixed implant-supported prosthesis in one day, significantly reducing treatment time compared to traditional methods.

Expanding Access in Emerging Economies

Emerging economies represent a high-growth opportunity for the dentures market. Rising healthcare investments, increasing awareness of oral health, and expanding insurance coverage are making dentures more accessible. Countries such as India, Brazil, and China are experiencing rapid uptake, driven by urbanization and improving standards of living. The growing presence of dental clinics and labs in these regions creates fresh opportunities for global players. Targeted strategies for affordable products and localized manufacturing will be vital in capitalizing on this trend.

- For instance, India’s National Health Mission has expanded oral health programs, enabling dental prosthetic care to reach rural districts through government-supported dental units.

Key Challenges

High Cost of Advanced Dentures

While traditional acrylic dentures remain affordable, advanced solutions like implant-supported or CAD/CAM-based dentures involve significant costs. High treatment and material expenses limit accessibility for middle- and low-income populations, particularly in developing countries. Lack of sufficient insurance coverage for dental prosthetics also adds to patient burden. These barriers restrict market penetration and slow adoption of premium dentures despite their clinical advantages. Addressing cost concerns remains a key challenge for industry players and healthcare systems.

Limited Awareness in Developing Regions

In many low- and middle-income countries, awareness of oral health and available dental solutions remains limited. Patients often delay seeking treatment due to cultural factors, low prioritization of oral care, or lack of education. This results in untreated cases of tooth loss and reduced demand for dentures compared to potential need. Outreach programs, education campaigns, and government-led awareness initiatives are critical to overcoming this challenge. Without stronger awareness efforts, market growth in emerging regions may remain constrained.

Competition from Alternative Treatments

Dental implants and cosmetic dentistry procedures are increasingly competing with traditional dentures. Younger patients with partial tooth loss often prefer implants for their permanence and aesthetics. As implant technology becomes more accessible, it threatens the long-term dominance of conventional dentures. While dentures still serve as the most affordable solution, growing competition from alternatives may limit future growth potential. Manufacturers must innovate and differentiate denture offerings to sustain relevance in the evolving oral healthcare landscape.

Regional Analysis

North America

North America held a 26% share of the global dentures market in 2024, valued at USD 493.07 million. The region is projected to reach USD 750.33 million by 2032, growing at a CAGR of 5.4%. Strong demand is supported by an aging population, widespread cases of dental disorders, and high awareness of oral healthcare. The U.S. leads due to advanced dental infrastructure and adoption of digital prosthetics. Insurance coverage and rising preference for implant-supported dentures further enhance market penetration across the region.

Europe

Europe accounted for 35% share in 2024, reaching USD 678.10 million and projected at USD 1,087.98 million by 2032, with a CAGR of 6.1%. High prevalence of edentulism among the elderly and favorable reimbursement policies support strong demand. Germany, the UK, and France dominate due to advanced clinical setups and increasing use of premium denture solutions. Growing digitalization in dental labs and strong presence of key manufacturers also reinforce Europe’s leadership. Preventive oral health programs further strengthen long-term growth in the region.

Asia Pacific

Asia Pacific captured 33% share in 2024, with revenue of USD 785.58 million, projected to reach USD 1,250.55 million by 2032 at a CAGR of 6.0%. Rising disposable incomes, expanding dental care infrastructure, and increasing awareness of oral health drive demand. China, India, and Japan remain key contributors due to their large patient populations and rapid adoption of modern prosthetics. Affordable acrylic resin dentures dominate, but premium fixed solutions are growing. Expanding urbanization and government initiatives in healthcare access boost growth further.

Latin America

Latin America represented 8% of the market in 2024, generating USD 177.22 million and expected to reach USD 293.34 million by 2032, with a CAGR of 6.5%, the fastest among all regions. Brazil leads due to its well-developed dental tourism industry and high awareness of oral aesthetics. Rising middle-class income levels and increasing prevalence of dental issues across Argentina and Mexico support expansion. While affordability challenges persist, growing presence of dental clinics and expanding access to prosthetic care drive regional growth.

Middle East

The Middle East accounted for 3.5% share in 2024, valued at USD 69.22 million, and is projected to reach USD 99.33 million by 2032 at a CAGR of 4.6%. Demand is supported by increasing investment in dental infrastructure, particularly in GCC countries, where cosmetic dentistry is gaining traction. Rising urbanization and growing adoption of advanced oral care practices strengthen demand. However, limited affordability outside urban hubs restrains widespread uptake. Israel and Turkey also contribute significantly due to advanced healthcare systems and higher dental care awareness.

Africa

Africa held a 2.5% share in 2024, amounting to USD 75.93 million, projected to reach USD 91.47 million by 2032 at a CAGR of 2.3%, the slowest among all regions. Market growth remains constrained by limited awareness, affordability issues, and underdeveloped healthcare infrastructure. South Africa and Egypt lead regional adoption, driven by urbanization and growing private dental clinics. However, rural populations still lack sufficient access to denture solutions. International investments in healthcare modernization may provide moderate opportunities for expansion in the long term.

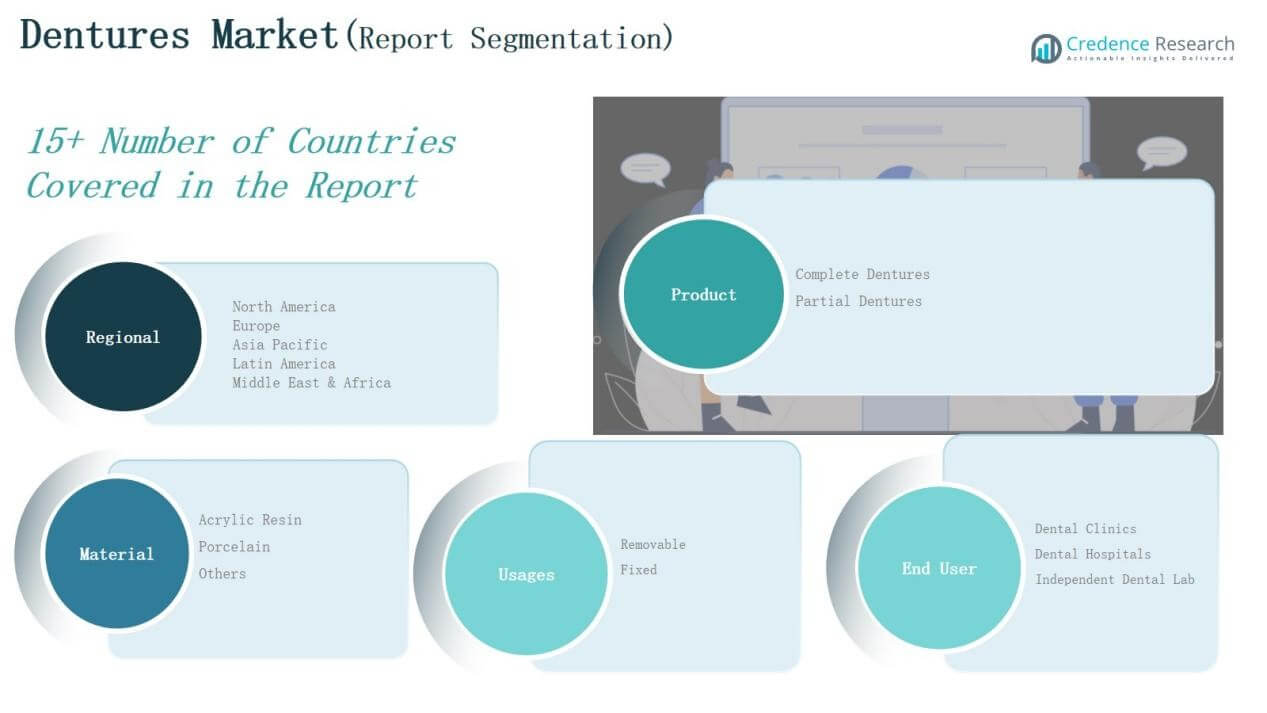

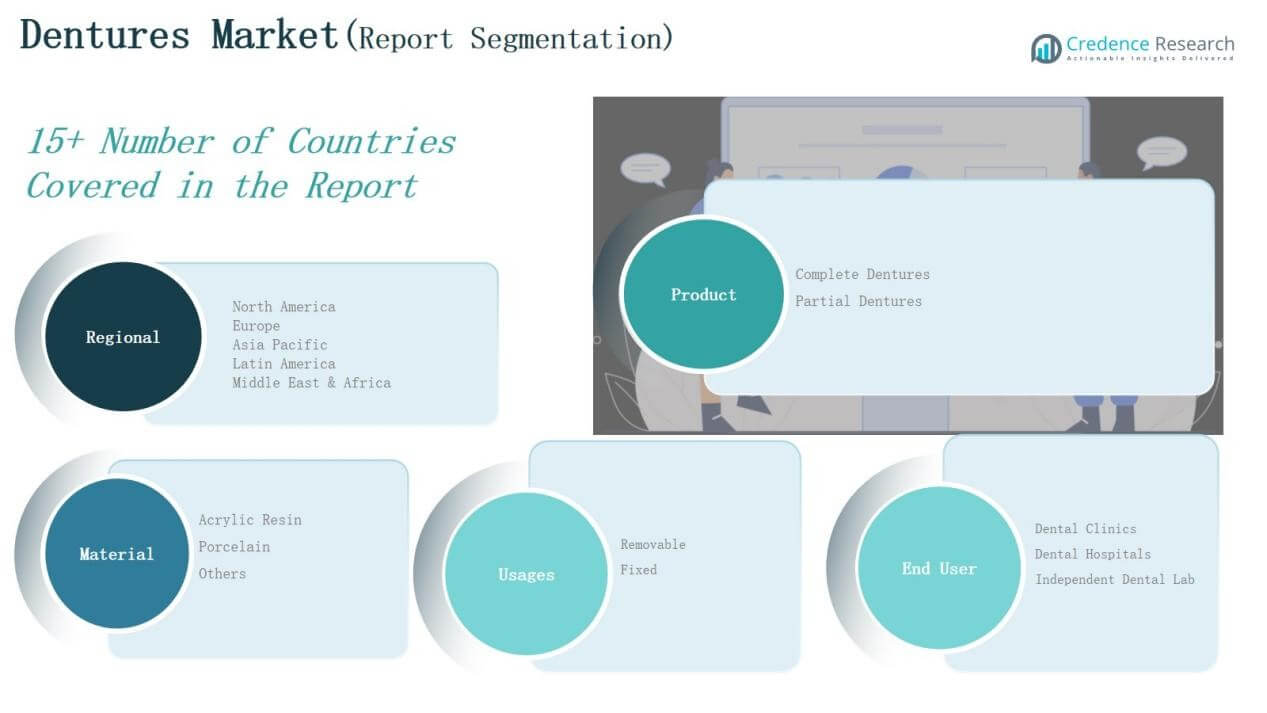

Market Segmentations:

By Material

- Acrylic Resin

- Porcelain

- Others

By Product

- Complete Dentures

- Partial Dentures

By Usages

By End User

- Dental Clinics

- Dental Hospitals

- Independent Dental Lab

By Region

North America

Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

Latin America

- Brazil

- Argentina

- Rest of Latin America

Middle East

- GCC Countries

- Israel

- Turkey

- Rest of Middle East

Africa

- South Africa

- Egypt

- Rest of Africa

Competitive Landscape

The global dentures market is moderately consolidated, with a mix of multinational corporations and regional manufacturers competing for market share. Leading players such as Dentsply Sirona, Envista Holdings Corporation, Ivoclar Vivadent AG, Coltene, Zimmer Biomet, and Mitsui Chemicals dominate through strong product portfolios, extensive distribution networks, and continuous investments in advanced prosthetic technologies. These companies focus on digital dentistry solutions, including CAD/CAM and 3D printing, to enhance customization and efficiency. Modern Dental Group Limited, Glidewell Dental, and Heraeus Kulzer GmbH further strengthen competition by offering affordable and innovative dentures across diverse markets. Strategic collaborations with dental clinics and laboratories, coupled with investments in training and education programs, allow companies to expand clinical adoption. At the same time, smaller regional firms compete by providing cost-effective acrylic dentures to price-sensitive markets. Ongoing product innovation, patient-centric designs, and expansion into emerging economies remain central to sustaining competitiveness.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

Recent Developments

- In August 2024, Ultradent Products Inc. acquired Medicinos Linija UAB, a dentures manufacturer based in Lithuania. The acquisition strengthens Ultradent’s global presence and expands its product portfolio in dental materials and denture solutions.

- In early 2023, Keystone Industries and Carbon partnered to develop a partially flexible removable denture resin. The product is based on dual-cure materials.

- In March 2023, Prodways launched the Provivic Denture Base resin at IDS 2023. It has been available in the U.S. since April 2023 for 3D printing both full and partial denture bases.

- In March 2025, Detax introduced dx denture impact, a premium denture-base material presented at IDS 2025. It offers enhanced strength, longevity, and fits without adhesive when paired with the company’s matching crown material.

Report Coverage

The research report offers an in-depth analysis based on Material, Product, Usage, End User and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise with the aging global population and higher life expectancy.

- Digital dentistry and 3D printing will improve customization and production speed.

- Implant-supported dentures will gain traction as a premium solution.

- Affordable acrylic dentures will remain dominant in developing regions.

- Dental clinics and labs will expand adoption of CAD/CAM technologies.

- Emerging economies will see rapid growth due to improving oral healthcare access.

- Rising awareness campaigns will boost early adoption of denture solutions.

- Aesthetic-focused dentures will attract younger and middle-aged patient groups.

- Strategic partnerships between manufacturers and dental providers will strengthen market reach.

- Sustainability in dental materials will become a key focus for innovation.