Market Overview

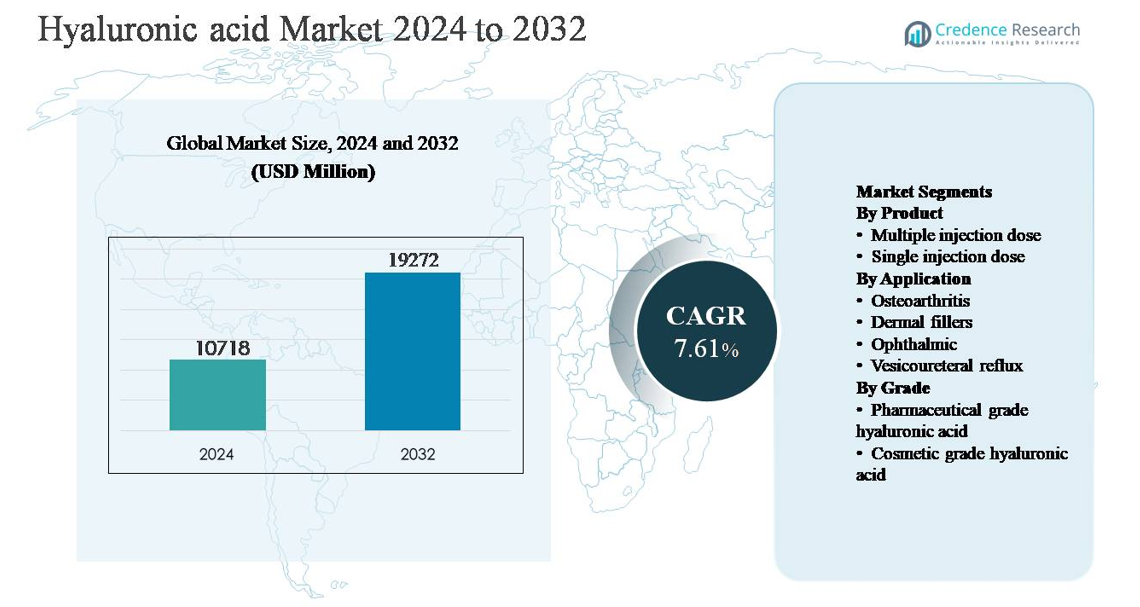

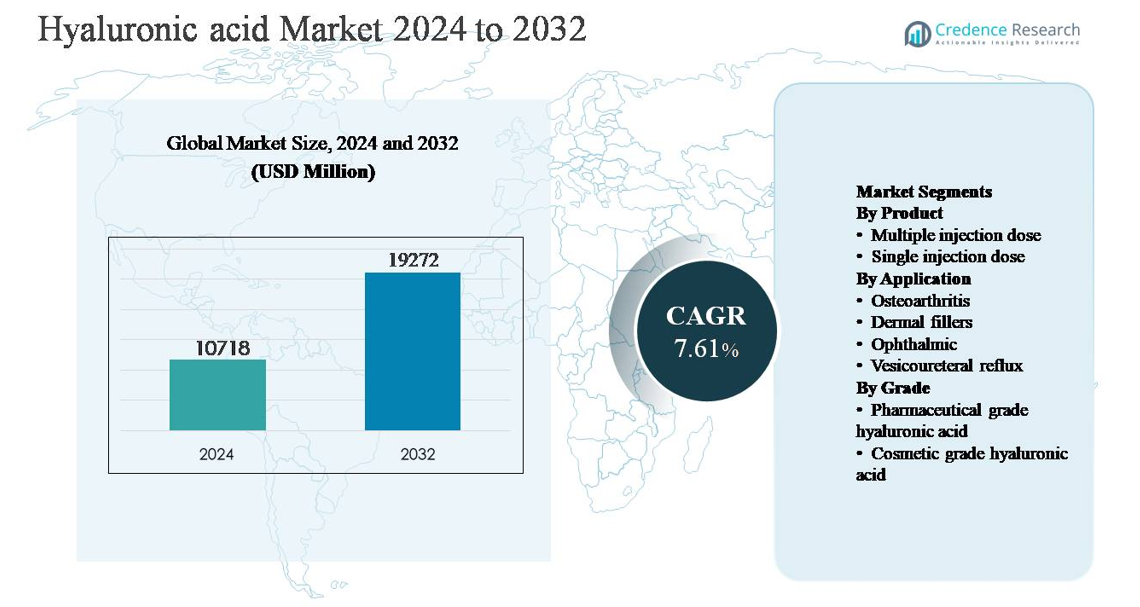

The global hyaluronic acid market was valued at USD 10,718 million in 2024 and is projected to reach USD 19,272 million by 2032, expanding at a compound annual growth rate (CAGR) of 7.61% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Hyaluronic Acid Market Size 2024 |

USD 10,718 million |

| Hyaluronic Acid Market, CAGR |

7.61% |

| Hyaluronic Acid Market Size 2032 |

USD 19,272 million |

The hyaluronic acid market is led by a group of well-established players, including Allergan Aesthetics, Galderma, ANIKA, Ferring Pharmaceuticals, Bioventus, LG Chem, Lifecore Biomedical, BLOOMAGE, Kewpie, and Altergon, which compete across pharmaceutical, aesthetic, and ophthalmic applications. These companies differentiate through advanced bio-fermentation capabilities, high-purity production, and innovation in cross-linked and long-acting formulations. Strategic focus on regulatory compliance and clinical validation strengthens their positioning in injectable and therapeutic segments. North America is the leading region, accounting for approximately 36% of the global market, supported by high adoption of viscosupplementation therapies, strong demand for dermal fillers, advanced healthcare infrastructure, and the presence of major manufacturers and aesthetic treatment providers.

Market Insights

- The global hyaluronic acid market was valued at USD 10,718 million in 2024 and is projected to reach USD 19,272 million by 2032, expanding at a CAGR of 7.61% during the forecast period.

- Market growth is primarily driven by rising demand for osteoarthritis treatments and minimally invasive aesthetic procedures, with osteoarthritis applications holding ~38% share and single-dose injectables accounting for ~62% due to safety, convenience, and clinical preference.

- Key trends include rapid adoption of bio-fermentation–based production and innovation in cross-linked, long-acting formulations, particularly in dermal fillers, which represent nearly 30% of total application demand.

- Competition is shaped by established pharmaceutical and aesthetic leaders focusing on product purity, formulation longevity, and regulatory compliance, while pricing pressure from regional producers intensifies market rivalry.

- Regionally, North America leads with ~36% share, followed by Europe (~28%) and Asia Pacific (~24%), with Asia Pacific showing the fastest growth driven by expanding cosmetic procedures and healthcare access.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product:

The hyaluronic acid market by product is dominated by single injection dose formulations, which account for an estimated ~62% market share. Their leadership is driven by strong adoption in orthopedic viscosupplementation and aesthetic procedures, where sterility, dosing accuracy, and patient convenience are critical. Single-dose products reduce contamination risk and simplify clinical workflows, making them preferred in hospitals, clinics, and ambulatory surgical centers. In contrast, multiple injection dose formats retain relevance in cost-sensitive settings and high-volume treatments, but regulatory scrutiny around preservative use and handling safety continues to favor single-dose adoption.

- For instance, Anika Therapeutics’ MONOVISC® is supplied as a single prefilled syringe containing 88 mg of hyaluronan in 4 mL, designed for one-time intra-articular administration in knee osteoarthritis, eliminating the need for repeat dosing and reducing procedural handling steps.

By Application:

Among applications, osteoarthritis treatment represents the dominant sub-segment with approximately ~38% market share, supported by the widespread use of hyaluronic acid injections for knee and hip joint viscosupplementation. Rising prevalence of age-related joint disorders, growing preference for minimally invasive pain management, and expanding clinical evidence supporting symptomatic relief drive this segment. Dermal fillers follow closely, propelled by aesthetic procedure growth and longer-lasting cross-linked HA formulations. Ophthalmic uses remain stable due to routine cataract surgeries, while vesicoureteral reflux and other applications contribute niche but consistent demand.

- For instance, Sanofi’s Synvisc®-One delivers a single 6 mL intra-articular injectioncontaining hylan G-F 20 with an average molecular weight for Hylan A of approximately 6 million Daltons (6,000,000 Da).

By Grade:

The market by grade is led by pharmaceutical grade hyaluronic acid, holding an estimated ~68% share, reflecting its extensive use in injectables, ophthalmic solutions, and intra-articular therapies. Stringent regulatory requirements, high purity standards, and clinical safety profiles underpin its dominance. Growth is reinforced by expanding therapeutic indications and rising healthcare expenditure. Cosmetic grade hyaluronic acid continues to gain momentum in topical skincare and non-invasive aesthetic products, driven by consumer awareness of hydration and anti-aging benefits, though its market share remains secondary due to lower pricing and regulatory thresholds.

Key Growth Driver

Rising Prevalence of Osteoarthritis and Musculoskeletal Disorders

The increasing global burden of osteoarthritis and other degenerative joint conditions remains a primary growth driver for the hyaluronic acid market. Aging populations, sedentary lifestyles, obesity prevalence, and sports-related injuries are significantly expanding the patient pool requiring joint pain management solutions. Hyaluronic acid–based viscosupplementation is widely adopted as a minimally invasive treatment that improves joint lubrication, reduces pain, and delays surgical intervention. Its favorable safety profile compared to long-term NSAID or corticosteroid use further strengthens physician and patient acceptance. Growing clinical endorsement, expanded reimbursement coverage in several healthcare systems, and rising awareness of non-surgical orthopedic treatments continue to accelerate demand for pharmaceutical-grade hyaluronic acid across hospitals, specialty clinics, and ambulatory care settings.

- For instance, Ferring Pharmaceuticals’ Durolane® is produced using non-animal stabilized hyaluronic acid technology and supplied as a sterile, prefilled syringe containing 60 mg of hyaluronic acid in 3 mL, designed for single-session viscosupplementation.

Expanding Demand for Aesthetic and Cosmetic Procedures

Rapid growth in minimally invasive aesthetic procedures is strongly driving hyaluronic acid consumption, particularly in dermal fillers and skin rejuvenation applications. Increasing disposable income, urbanization, and heightened focus on appearance across both aging and younger populations have expanded demand for facial volumization, wrinkle reduction, and lip enhancement. Hyaluronic acid’s biocompatibility, reversibility, and natural skin integration make it the preferred material for injectable fillers. Product innovations such as cross-linked formulations with extended longevity and improved viscoelasticity are enhancing treatment outcomes and repeat procedure rates. The proliferation of aesthetic clinics, growing acceptance of cosmetic procedures among men, and strong social media influence continue to support sustained growth in cosmetic-grade and injectable hyaluronic acid markets.

- For instance, Allergan Aesthetics’ JUVÉDERM® VOLUMA® XC is manufactured using Vycross® technology and contains 20 mg/mL of hyaluronic acid, engineered to achieve high gel cohesivity and lifting capacity for deep midface injections, with clinical evaluations demonstrating structural volumization maintained for up to 24 months following treatment.

Growth in Ophthalmic and Drug Delivery Applications

The expanding use of hyaluronic acid in ophthalmic formulations and advanced drug delivery systems is contributing significantly to market growth. In ophthalmology, hyaluronic acid is widely used in artificial tears, post-surgical viscoelastic agents, and intraocular solutions due to its lubrication, moisture retention, and tissue-protective properties. Rising cataract surgery volumes and increasing prevalence of dry eye syndrome are strengthening demand. Beyond ophthalmics, hyaluronic acid is increasingly utilized as a drug carrier for targeted delivery in oncology, dermatology, and regenerative medicine. Its ability to enhance bioavailability and controlled release supports adoption in next-generation therapeutic formulations, broadening its clinical and commercial relevance.

Key Trend & Opportunity

Shift Toward Bio-Fermentation and Sustainable Production

A notable trend shaping the hyaluronic acid market is the shift from animal-derived sources toward bio-fermentation-based production. Manufacturers are increasingly adopting microbial fermentation technologies to ensure consistent molecular weight control, higher purity, and improved batch-to-batch reproducibility. This transition addresses ethical concerns, reduces contamination risks, and aligns with regulatory and sustainability requirements. Bio-fermented hyaluronic acid is particularly favored in pharmaceutical and cosmetic applications, supporting premium product positioning. Opportunities exist for producers investing in scalable fermentation infrastructure and advanced purification technologies. As sustainability becomes a procurement priority for pharmaceutical and personal care brands, bio-based hyaluronic acid is expected to gain stronger market preference.

- For instance, Bloomage Biotech operates large-scale microbial fermentation facilities in China using Streptococcus strains, with individual fermentation tanks exceeding 20 m³ in working volume and downstream purification systems capable of producing pharmaceutical-grade hyaluronic acid with endotoxin levels controlled below 0.5 EU/mg, supporting injectable and ophthalmic applications.

Innovation in Cross-Linked and Long-Acting Formulations

Technological advancements in cross-linking chemistry and molecular modification are creating significant growth opportunities for the hyaluronic acid market. New formulations offer improved stability, prolonged residence time, and enhanced mechanical strength, particularly in dermal fillers and osteoarthritis injections. These innovations reduce injection frequency and improve patient compliance, driving higher adoption rates. Manufacturers are also developing hybrid products that combine hyaluronic acid with anesthetics or regenerative agents to enhance therapeutic outcomes. Continued investment in formulation science and clinical validation is enabling differentiation in competitive markets, supporting premium pricing strategies and expanding use across emerging therapeutic indications.

- For instance, Teoxane’s Teosyal® PureSense range incorporates 0.3% lidocaine hydrochloride into cross-linked hyaluronic acid gels, enabling immediate local anesthesia during injection while preserving elastic modulus and gel cohesivity.

Key Challenge

High Production Costs and Price Sensitivity

High production and purification costs pose a significant challenge to the hyaluronic acid market, particularly for pharmaceutical-grade products. Advanced fermentation processes, stringent quality control requirements, and complex downstream purification steps increase manufacturing expenses. These costs can limit affordability in price-sensitive markets and constrain adoption in emerging economies. Additionally, competitive pressure from low-cost producers intensifies pricing challenges, impacting profit margins for established manufacturers. Balancing cost efficiency with regulatory compliance and product quality remains a critical concern. Companies must optimize production yields, invest in scalable technologies, and improve supply chain efficiency to remain competitive while maintaining product standards.

Regulatory Complexity and Product Differentiation Barriers

The hyaluronic acid market faces regulatory challenges stemming from varying classification frameworks across regions, where products may be regulated as drugs, medical devices, or cosmetics. Navigating these complex regulatory pathways increases approval timelines and compliance costs, particularly for injectable and therapeutic applications. Additionally, market saturation in dermal fillers and viscosupplementation has intensified competition, making product differentiation increasingly difficult. Clinicians often perceive products as interchangeable, limiting brand loyalty. To overcome these challenges, manufacturers must invest in clinical evidence, formulation innovation, and post-market surveillance to clearly demonstrate safety, efficacy, and performance advantages.

Regional Analysis

North America:

North America leads the hyaluronic acid market, accounting for approximately 36% of global market share, driven by strong demand across osteoarthritis treatment, dermal fillers, and ophthalmic applications. The region benefits from advanced healthcare infrastructure, high adoption of minimally invasive aesthetic procedures, and widespread availability of FDA-approved viscosupplementation products. An aging population and rising prevalence of joint disorders continue to support pharmaceutical-grade hyaluronic acid demand. In addition, the presence of major manufacturers, robust clinical research activity, and favorable reimbursement pathways in the U.S. further reinforce market leadership across both therapeutic and cosmetic segments.

Europe:

Europe represents nearly 28% of the global hyaluronic acid market, supported by strong uptake in orthopedic care, aesthetic medicine, and ophthalmology. Countries such as Germany, France, Italy, and the UK drive regional demand due to well-established healthcare systems and growing preference for non-surgical treatments. The region also benefits from high regulatory standards that favor pharmaceutical-grade and bio-fermented hyaluronic acid products. Increasing adoption of dermal fillers, expanding geriatric population, and consistent innovation in cross-linked formulations contribute to steady growth, while rising medical tourism in Southern Europe further supports aesthetic application demand.

Asia Pacific:

Asia Pacific accounts for approximately 24% of the global hyaluronic acid market and is the fastest-growing regional segment. Growth is driven by expanding healthcare access, rising disposable income, and rapidly increasing demand for cosmetic and aesthetic procedures in countries such as China, South Korea, Japan, and India. A growing aging population and increasing incidence of osteoarthritis further boost therapeutic demand. The region also benefits from expanding local manufacturing capacity, particularly for cosmetic-grade hyaluronic acid, and strong consumer awareness of skincare and anti-aging products, supporting broad-based adoption across medical and personal care applications.

Latin America:

Latin America holds around 7% of the global hyaluronic acid market, with growth supported by increasing demand for aesthetic treatments and gradual expansion of orthopedic care services. Brazil and Mexico are the primary contributors, driven by a strong cosmetic surgery culture and rising awareness of minimally invasive facial rejuvenation procedures. Improving healthcare infrastructure and growing private clinic networks support uptake of viscosupplementation therapies. However, price sensitivity and limited reimbursement coverage constrain faster adoption of pharmaceutical-grade products. Despite these challenges, rising urbanization and expanding middle-class populations continue to create steady growth opportunities.

Middle East & Africa:

The Middle East & Africa region accounts for approximately 5% of the global hyaluronic acid market, driven mainly by aesthetic and dermatology applications. Countries such as the UAE and Saudi Arabia lead regional demand due to growing medical tourism, expanding private healthcare facilities, and increasing acceptance of cosmetic procedures. Ophthalmic applications also contribute, supported by rising cataract surgery volumes. However, limited access to advanced orthopedic treatments and uneven healthcare infrastructure across parts of Africa restrict broader market penetration. Gradual improvements in healthcare investment and specialist availability are expected to support moderate long-term growth.

Market Segmentations:

By Product

- Multiple injection dose

- Single injection dose

By Application

- Osteoarthritis

- Dermal fillers

- Ophthalmic

- Vesicoureteral reflux

By Grade

- Pharmaceutical grade hyaluronic acid

- Cosmetic grade hyaluronic acid

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the hyaluronic acid market is characterized by the presence of global pharmaceutical companies, specialty biopolymer manufacturers, and aesthetic-focused innovators competing across therapeutic, cosmetic, and ophthalmic segments. Market participants emphasize product purity, molecular weight control, and regulatory compliance to strengthen positioning, particularly in pharmaceutical-grade applications. Companies actively invest in bio-fermentation technologies, advanced cross-linking chemistries, and scalable manufacturing to improve consistency and cost efficiency. Strategic initiatives such as portfolio expansion, clinical validation, and geographic market entry remain central to competition. In the aesthetic segment, differentiation is driven by formulation longevity, viscoelastic performance, and safety profiles. Meanwhile, partnerships with clinics, distributors, and research institutions support market penetration. Overall, competition intensifies as innovation cycles shorten and manufacturers seek to balance premium performance with pricing pressures across diverse end-use markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- ANIKA

- Allergan Aesthetics

- altergon

- BLOOMAGE

- bioventus

- FERRING PHARMACEUTICALS

- GALDERMA

- kewpie

- LG Chem

- Lifecore BIOMEDICAL

Recent Developments

- In September 2025,“Allergan Aesthetics Naturally You with Injectable Hyaluronic Acid Fillers” Campaign, Allergan Aesthetics launched a dedicated education campaign centered on HA injectable fillers (“Naturally You with Injectable Hyaluronic Acid Fillers”), anchored by the release of The Hyaluronic Acid Injectable Fillers Report to boost clinical and consumer understanding of HA filler safety, usage, and outcomes.

- In July 29, 2025, Anika highlighted its ongoing leadership in HA innovation across key products including MONOVISC®, ORTHOVISC®, CINGAL®, and HYALOFAST® while reaffirming strategic emphasis on HA-based regenerative solutions in orthopedics.

Report Coverage

The research report offers an in-depth analysis based on Product, Application, Grade and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for hyaluronic acid will continue to rise due to the growing aging population and increasing prevalence of joint-related disorders.

- Minimally invasive aesthetic procedures will remain a key growth catalyst, supporting sustained adoption of dermal filler formulations.

- Bio-fermentation–based production will increasingly replace animal-derived sources to improve purity, safety, and regulatory acceptance.

- Pharmaceutical-grade hyaluronic acid will maintain dominance, driven by expanding therapeutic and ophthalmic applications.

- Innovation in cross-linked and long-acting formulations will enhance clinical outcomes and reduce treatment frequency.

- Asia Pacific will emerge as the fastest-growing regional market due to rising healthcare access and cosmetic awareness.

- Integration of hyaluronic acid into advanced drug delivery and regenerative medicine applications will expand clinical relevance.

- Manufacturers will focus on scalable production and cost optimization to address price sensitivity in emerging markets.

- Regulatory scrutiny will intensify, encouraging stronger clinical validation and quality standardization.

- Strategic partnerships and geographic expansion will remain critical for sustaining competitive positioning.