Market Overview

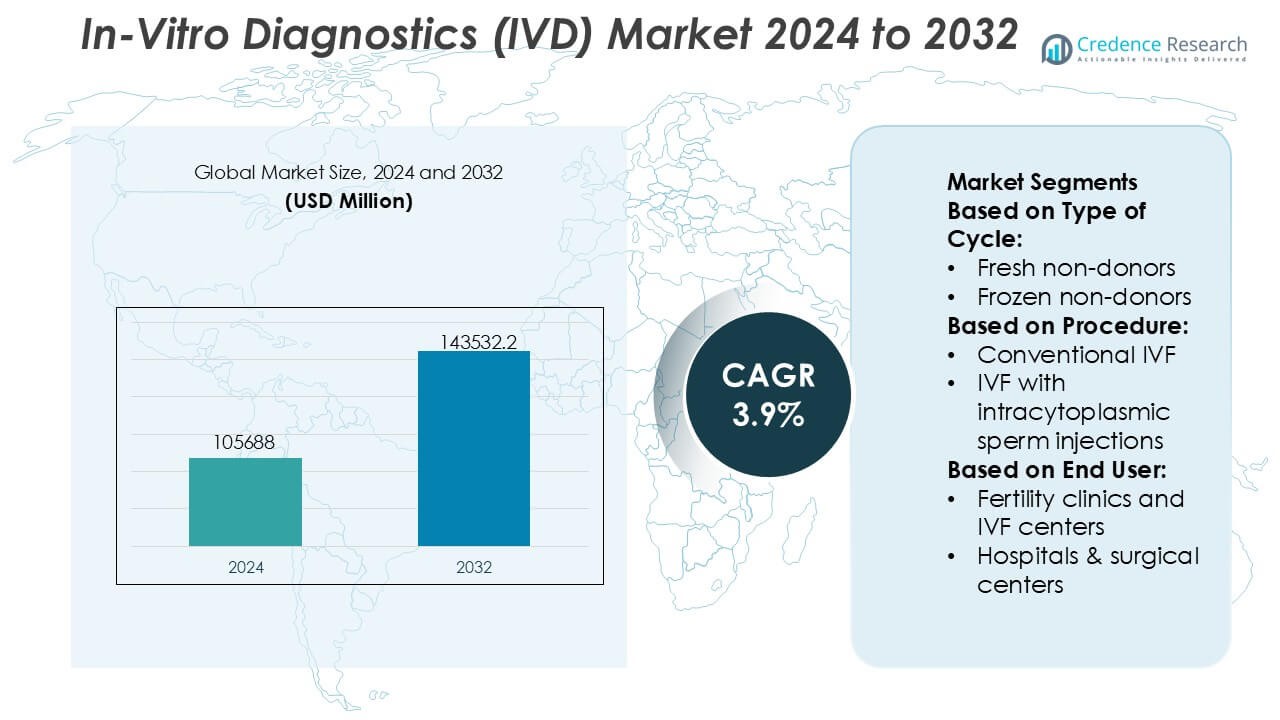

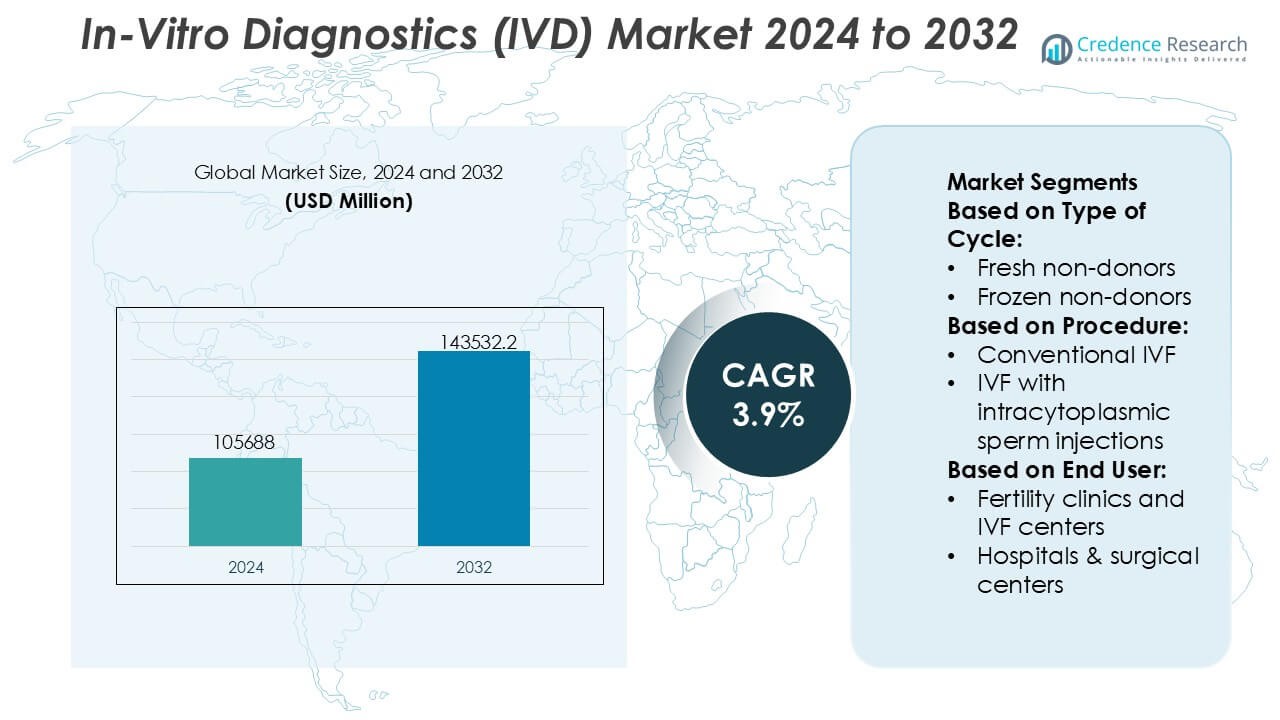

In-Vitro Diagnostics (IVD) Market size was valued USD 105688 million in 2024 and is anticipated to reach USD 143532.2 million by 2032, at a CAGR of 3.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| In-Vitro Diagnostics (IVD) Market Size 2024 |

USD 105688 Million |

| In-Vitro Diagnostics (IVD) Market , CAGR |

3.9% |

| In-Vitro Diagnostics (IVD) Market Size 2032 |

USD 143532.2 Million |

The In-Vitro Diagnostics (IVD) market is dominated by a group of large, globally established players that compete through broad assay portfolios, automated diagnostic platforms, and strong regulatory and clinical validation capabilities. These companies focus on molecular diagnostics, immunoassays, clinical chemistry, and point-of-care testing to address rising demand for early diagnosis, disease monitoring, and personalized medicine. Continuous investment in automation, digital connectivity, and menu expansion strengthens laboratory efficiency and long-term customer relationships. Regionally, North America leads the global IVD market with an exact 41% market share, supported by advanced healthcare infrastructure, high diagnostic testing volumes, favorable reimbursement frameworks, and rapid adoption of innovative diagnostic technologies across hospitals, clinical laboratories, and decentralized care settings.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The In-Vitro Diagnostics (IVD) Market size was valued at USD 105,688 million in 2024 and is projected to reach USD 143,532.2 million by 2032, expanding at a CAGR of 3.9% during the forecast period, supported by sustained diagnostic testing demand across clinical and decentralized settings.

- Market growth is driven by increasing emphasis on early disease detection, chronic disease monitoring, and personalized medicine, with molecular diagnostics and immunoassays emerging as the most widely adopted segments due to their accuracy and clinical relevance.

- Key market trends include rising automation in laboratories, expansion of point-of-care testing, and integration of digital connectivity to improve workflow efficiency, turnaround time, and data-driven clinical decision-making.

- The competitive landscape is characterized by globally established players focusing on broad assay menus, installed-base expansion, regulatory compliance, and long-term reagent contracts to secure recurring revenues.

- Regionally, North America leads with an exact 41% market share, driven by advanced healthcare infrastructure and high testing volumes, while Asia-Pacific shows strong momentum supported by expanding healthcare access and diagnostic capacity.

Market Segmentation Analysis:

By Type of Cycle

By type of cycle, Fresh non-donors represent the dominant sub-segment with an exact 38% market share, supported by higher clinical preference for immediate embryo transfer and reduced complexity compared with cryopreservation workflows. Fresh cycles benefit from shorter treatment timelines, lower laboratory handling requirements, and favorable outcomes in younger patient cohorts with strong ovarian response. Frozen non-donor and frozen donor cycles continue to expand due to improved vitrification techniques and scheduling flexibility, while fresh donor cycles maintain steady demand in cases of diminished ovarian reserve. However, cost efficiency, clinical familiarity, and streamlined diagnostics sustain the leadership of fresh non-donor cycles.

- For instance, Danaher’s laboratory platforms support various clinical workflows. Beckman Coulter Life Sciences offers high-throughput hematology analyzers, such as the DxH 900, which is capable of processing up to 100 samples per hour for rapid blood diagnostics in clinical laboratories.

By Procedure

By procedure, IVF with intracytoplasmic sperm injection (ICSI) dominates the segment with an exact 46% market share, driven by its effectiveness in addressing male-factor infertility and complex fertilization challenges. ICSI enables precise sperm selection and controlled fertilization, increasing success rates in cases involving low sperm count or motility issues. Conventional IVF maintains relevance for select patient profiles, while minimal IVF gains traction among cost-sensitive and low-stimulation protocols. IVF with donor eggs supports patients with age-related infertility. Nevertheless, widespread clinical adoption, strong diagnostic integration, and predictable outcomes reinforce ICSI’s dominant position.

- For instance, bioMérieux’s VIDAS immunoassay systems used in fertility and clinical laboratories support a full hormone panel including FSH, LH, AMH, and progesterone with results typically available in 35 to 60 minutes per test, offering rapid, on-demand testing capabilities.

By End-user

By end-user, Fertility clinics and IVF centers lead the market with an exact 52% market share, supported by their specialized infrastructure, high patient volumes, and integrated diagnostic capabilities. These centers prioritize advanced IVD solutions for hormonal profiling, genetic screening, and embryo assessment to improve treatment accuracy and outcomes. Hospitals and surgical centers contribute through multidisciplinary reproductive care, while research institutes drive innovation and protocol optimization. Cryobanks support long-term sample storage and donor programs. However, the concentration of expertise, procedure throughput, and patient trust firmly position fertility clinics and IVF centers as the primary end users.

Key Growth Drivers

Rising Prevalence of Chronic and Infectious Diseases

The increasing global burden of chronic conditions such as diabetes, cardiovascular disorders, and cancer, along with recurring outbreaks of infectious diseases, strongly drives demand for in-vitro diagnostics. IVD tests enable early detection, disease monitoring, and therapy selection, supporting improved clinical outcomes and cost-effective care. Growing emphasis on preventive healthcare and routine screening programs further expands test volumes across clinical laboratories and hospitals. In parallel, aging populations with higher diagnostic needs sustain long-term demand for reliable, high-throughput, and clinically validated IVD solutions.

- For instance, Quest Diagnostics processes more than 50 million patient encounters annually and offers a menu of over 3,500 diagnostic tests, while its centralized laboratories are designed to handle tens of thousands of samples per day using automated chemistry, immunoassay, and molecular testing systems, enabling rapid turnaround for chronic disease monitoring and infectious disease detection.

Technological Advancements in Diagnostic Platforms

Continuous innovation in molecular diagnostics, immunoassays, and clinical chemistry systems significantly accelerates IVD market growth. Automation, digital imaging, and integrated data analytics improve test accuracy, turnaround time, and laboratory efficiency. Advances in PCR, next-generation sequencing-based assays, and high-sensitivity biomarkers enable precise disease characterization and personalized treatment decisions. These improvements enhance clinician confidence and expand test adoption across decentralized and centralized settings, reinforcing the role of advanced IVD platforms in modern healthcare delivery.

- For instance, QIAGEN’s QIAstat-Dx Analyzer delivers fully automated syndromic PCR results in approximately 70 minutes per run and can detect up to 22 pathogens from a single sample, while the Rotor-Gene Q real-time PCR system achieves temperature ramp rates of up to 20 °C per second, enabling rapid cycling and highly reproducible amplification for high-sensitivity molecular diagnostics.

Expansion of Point-of-Care and Decentralized Testing

The shift toward rapid, near-patient testing environments acts as a major growth driver for the IVD market. Point-of-care diagnostics support immediate clinical decision-making in emergency departments, outpatient clinics, and resource-limited settings. Demand increases as healthcare systems prioritize faster diagnosis, reduced hospital stays, and improved patient management. Portable analyzers, simplified workflows, and minimal sample preparation broaden accessibility, particularly in rural and home-care environments, strengthening overall market penetration.

Key Trends & Opportunities

Growth of Precision Medicine and Companion Diagnostics

Precision medicine continues to shape new opportunities within the IVD market by linking diagnostic results directly with targeted therapies. Companion diagnostics play a critical role in identifying suitable patient populations, especially in oncology, autoimmune diseases, and rare disorders. This trend supports closer collaboration between diagnostic developers and pharmaceutical companies, accelerating assay development aligned with therapeutic pipelines. Increasing clinical reliance on biomarker-driven treatment decisions sustains demand for advanced molecular and immunodiagnostic tests.

- For instance, Abbott’s m2000 RealTime System supports molecular companion diagnostic workflows by processing 96 patient samples per run with automated extraction and plate preparation (requiring a manual transfer step to the amplification instrument).

Digitalization and Laboratory Automation

Digital transformation represents a key trend as laboratories adopt automated sample handling, connected analyzers, and laboratory information systems. Automation reduces manual errors, improves throughput, and optimizes workforce utilization amid skilled labor shortages. Integration of artificial intelligence and advanced analytics enhances result interpretation and workflow management. These developments create opportunities for vendors offering end-to-end diagnostic ecosystems that combine instruments, reagents, software, and service support.

- For instance, Siemens Healthineers’ Atellica Solution integrates chemistry and immunoassay testing on a single track system and can process up to 440 tests per hour per module, while the Atellica Process Manager automation platform supports continuous sample routing across multiple analyzers with track speeds exceeding 0.5 meters per second, enabling high-volume laboratories to maintain consistent turnaround times with minimal manual handling.

Emerging Markets and Healthcare Infrastructure Expansion

Rapid healthcare infrastructure development in emerging economies presents strong growth opportunities for IVD manufacturers. Increasing healthcare spending, rising awareness of early diagnosis, and expanding access to diagnostic services drive test adoption. Governments and private providers invest in laboratory modernization and screening programs, supporting demand for cost-effective, scalable IVD solutions. Localization of manufacturing and distribution further strengthens market entry and long-term growth potential.

Key Challenges

Regulatory Complexity and Compliance Burden

Stringent and evolving regulatory frameworks pose a significant challenge for the IVD market. Compliance with quality standards, clinical validation requirements, and post-market surveillance increases development timelines and costs. Regulatory divergence across regions complicates global product launches and market access strategies. Smaller manufacturers, in particular, face resource constraints in meeting extensive documentation and approval processes, which can delay innovation and limit competitive participation.

Pricing Pressure and Reimbursement Constraints

Pricing pressure from healthcare providers and payers remains a persistent challenge in the IVD market. Cost-containment initiatives, bundled payments, and reimbursement limitations reduce margins for diagnostic tests and systems. Laboratories increasingly demand high-performance solutions at lower costs, intensifying competition among suppliers. Balancing innovation investment with affordability expectations requires operational efficiency, value-based product positioning, and strong evidence demonstrating clinical and economic benefits.

Regional Analysis

North America

North America leads the In-Vitro Diagnostics (IVD) market with an exact 41% market share, supported by advanced healthcare infrastructure, high diagnostic awareness, and strong reimbursement frameworks. The region benefits from widespread adoption of molecular diagnostics, immunoassays, and point-of-care testing across hospitals and clinical laboratories. High prevalence of chronic diseases and infectious conditions sustains consistent testing volumes. The presence of major IVD manufacturers, continuous product innovation, and early adoption of automation and digital pathology further strengthen market leadership across the United States and Canada.

Europe

Europe holds an exact 28% market share in the global IVD market, driven by well-established public healthcare systems and strong emphasis on early disease detection. Countries such as Germany, France, and the United Kingdom support large-scale screening programs and laboratory modernization initiatives. Regulatory standardization under EU frameworks enhances product quality and clinical reliability. Rising adoption of molecular diagnostics and companion diagnostics in oncology and genetic testing supports steady growth. Aging populations and increasing chronic disease burden further reinforce demand across hospital laboratories and diagnostic service providers.

Asia-Pacific

Asia-Pacific accounts for an exact 22% market share and represents the fastest-growing regional IVD market. Rapid healthcare infrastructure expansion, rising healthcare expenditure, and increasing awareness of early diagnosis drive adoption across China, India, Japan, and Southeast Asia. Large patient populations and growing incidence of infectious and lifestyle-related diseases significantly increase testing demand. Governments continue to invest in laboratory capacity, screening programs, and rural healthcare access. Expansion of private diagnostic chains and improving affordability of advanced tests further accelerate regional market growth.

Latin America

Latin America captures an exact 6% market share in the IVD market, supported by gradual improvements in healthcare access and diagnostic infrastructure. Brazil and Mexico lead regional demand due to expanding private laboratories and rising chronic disease prevalence. Increasing focus on preventive healthcare and infectious disease surveillance supports test volume growth. However, budget constraints and uneven reimbursement systems limit rapid adoption of high-end diagnostics. Despite these challenges, growing public-private partnerships and modernization of laboratory networks continue to support steady market development.

Middle East & Africa

The Middle East & Africa region holds an exact 3% market share, driven by rising healthcare investments and expanding diagnostic capabilities in Gulf countries. Governments prioritize early disease detection, particularly for diabetes, cardiovascular conditions, and infectious diseases. The UAE and Saudi Arabia lead adoption of automated laboratory systems and point-of-care testing. In Africa, improving access to basic diagnostics and donor-supported healthcare programs drive incremental growth. Although infrastructure gaps persist, increasing healthcare funding and diagnostic awareness support long-term market potential.

Market Segmentations:

By Type of Cycle:

- Fresh non-donors

- Frozen non-donors

By Procedure:

- Conventional IVF

- IVF with intracytoplasmic sperm injections

By End User:

- Fertility clinics and IVF centers

- Hospitals & surgical centers

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the In-Vitro Diagnostics (IVD) market players such as Danaher, BIOMÉRIEUX, Quest Diagnostics Incorporated, QIAGEN, Abbott, Siemens Healthineers AG, Quidel Corporation, BD, F. Hoffmann-La Roche Ltd., Bio-Rad Laboratories, Inc. the In-Vitro Diagnostics (IVD) market is characterized by intense competition among global manufacturers and diagnostic service providers operating across instruments, reagents, consumables, and testing services. Market participants compete through continuous innovation in molecular diagnostics, immunoassays, microbiology, and point-of-care platforms to enhance accuracy, throughput, and workflow efficiency. Strong emphasis on automation, menu expansion, and digital integration supports laboratory productivity and data-driven clinical decision-making. Companies also pursue strategic collaborations, acquisitions, and geographic expansion to strengthen portfolios and address evolving regulatory and reimbursement requirements. Long-term reagent rental agreements, service contracts, and installed-base expansion remain critical to sustaining recurring revenues. Overall, competitive differentiation depends on technological depth, regulatory expertise, global distribution capabilities, and the ability to deliver integrated, end-to-end diagnostic solutions across hospitals, laboratories, and decentralized care settings.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Danaher

- BIOMÉRIEUX

- Quest Diagnostics Incorporated

- QIAGEN

- Abbott

- Siemens Healthineers AG

- Quidel Corporation

- BD

- Hoffmann-La Roche Ltd.

- Bio-Rad Laboratories, Inc.

Recent Developments

- In February 2025, ABL Diagnostics will manufacture and commercialize a full range of UltraGene PCR tests acquired from its parent company, Advanced Biological Laboratories. These tests cover over 100 pathogens, supporting infectious disease diagnostics across multiple conditions.

- In January 2025, QIAGEN secured U.S. FDA clearance for its QIAstat-Dx Gastrointestinal Panel 2 Mini B&V, a targeted syndromic test for bacterial and viral gastrointestinal infections. The company is planning a product launch to expand QIAGEN’s syndromic testing portfolio, offering comprehensive and targeted options to improve inpatient and outpatient diagnostics.

- In August 2024, Sysmex Corporation did expand its strategic alliance with QIAGEN to boost genetic testing, focusing on R&D, production, clinical development, and global commercialization, especially for high-end oncology and inherited disease tests in Japan, leveraging Sysmex’s Plasma-Safe-SeqS tech and QIAGEN’s expertise for liquid biopsies.

Report Coverage

The research report offers an in-depth analysis based on Type of Cycle, Procedure, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue to benefit from rising demand for early disease detection and preventive healthcare across global healthcare systems.

- Adoption of molecular diagnostics and high-sensitivity immunoassays will expand to support personalized and precision medicine.

- Automation and digital integration will increasingly define laboratory workflows, improving efficiency and consistency of test results.

- Point-of-care and decentralized testing will gain broader acceptance in emergency, outpatient, and home-care settings.

- Integration of artificial intelligence and data analytics will enhance diagnostic accuracy and clinical decision support.

- Demand for companion diagnostics will grow alongside targeted therapies, particularly in oncology and rare diseases.

- Emerging economies will see higher test volumes due to expanding healthcare infrastructure and diagnostic access.

- Regulatory focus on quality, traceability, and post-market surveillance will shape product development strategies.

- Cost-effective and scalable diagnostic solutions will gain preference among laboratories facing pricing pressures.

- Strategic partnerships and acquisitions will continue to reshape portfolios and strengthen global market presence.