Market Overview

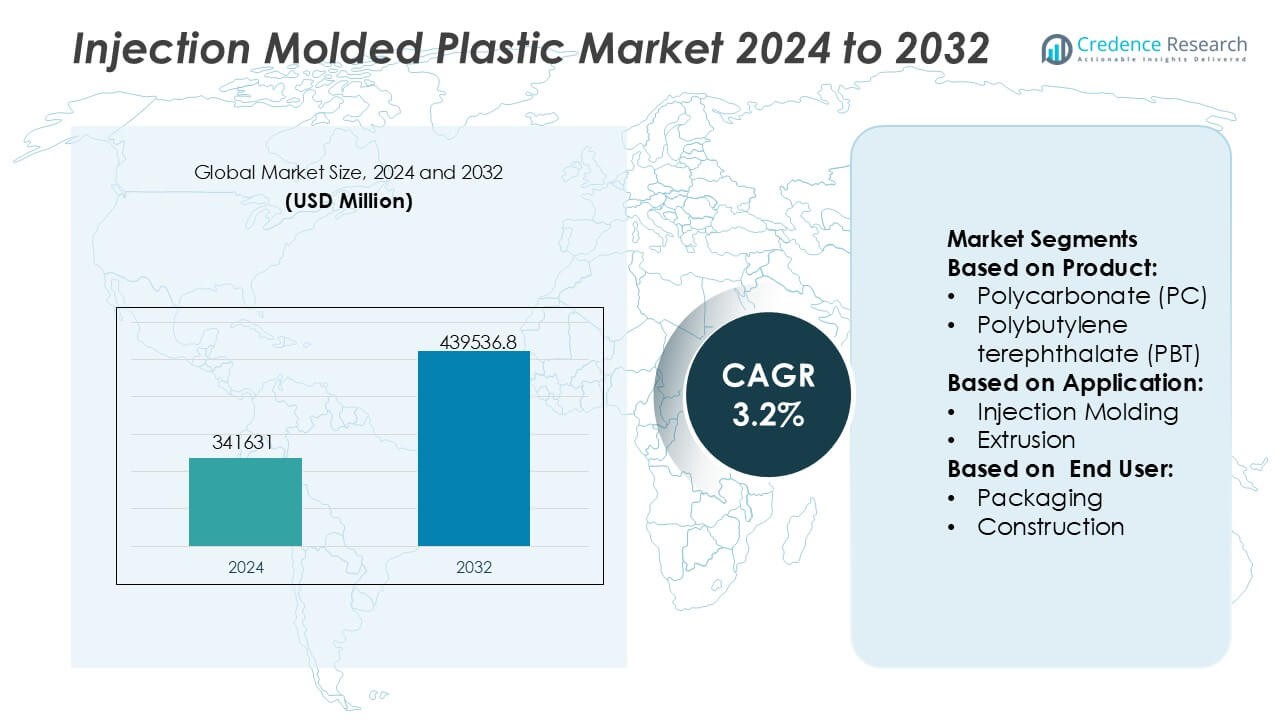

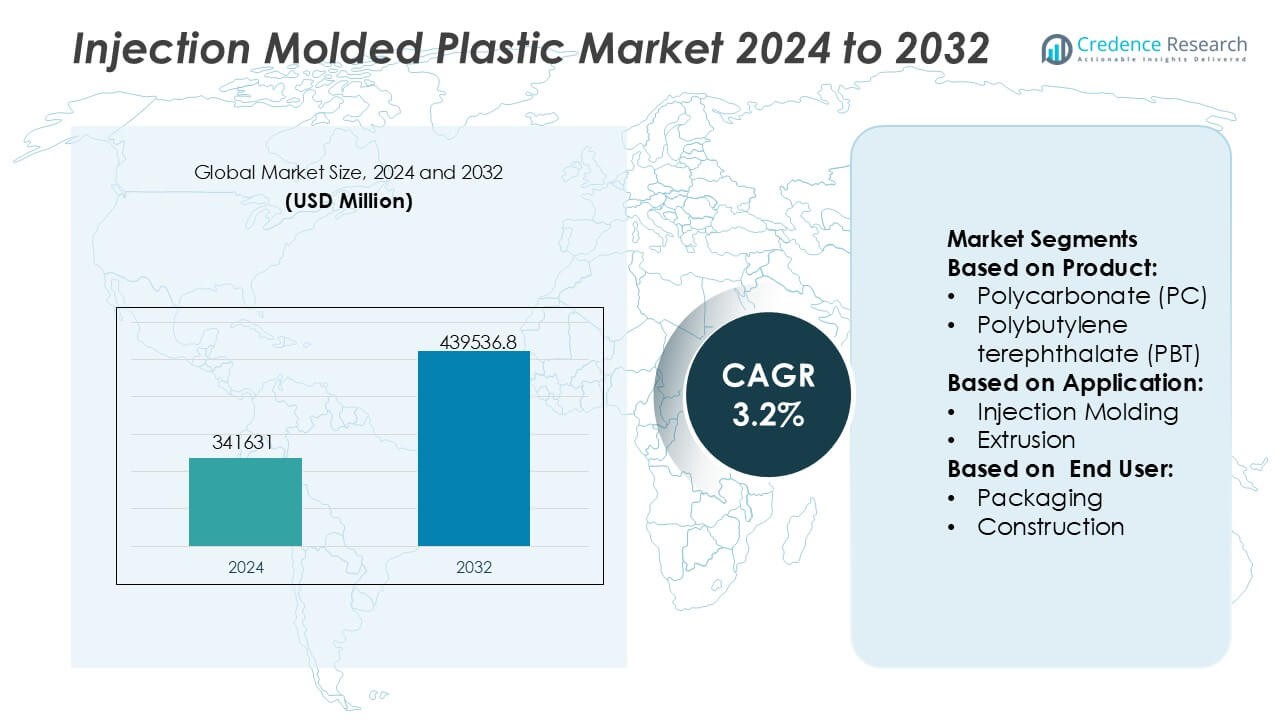

Injection Molded Plastic Market size was valued USD 341631 million in 2024 and is anticipated to reach USD 439536.8 million by 2032, at a CAGR of 3.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Injection Molded Plastic Market Size 2024 |

USD 341631 Million |

| Injection Molded Plastic Market, CAGR |

3.2% |

| Injection Molded Plastic Market Size 2032 |

USD 439536.8 Million |

The injection molded plastic market is led by a group of globally established material producers and integrated manufacturers that compete through scale, material innovation, and strong downstream linkages. Companies such as LyondellBasell Industries Holdings B.V., BASF SE, Dow, Inc., SABIC, ExxonMobil Corporation, DuPont de Nemours, Inc., INEOS Group, Eastman Chemical Company, Huntsman International LLC, and Magna International, Inc. strengthen their positions by expanding high-performance polymer portfolios, supporting application-specific molding requirements, and maintaining extensive global manufacturing footprints. These players focus on automotive lightweighting, packaging efficiency, healthcare-grade materials, and sustainable resin development. Regionally, Asia-Pacific leads the global market with an exact 38% market share, supported by large-scale manufacturing capacity, strong consumer demand, cost-efficient production, and rapid growth across packaging, electronics, and automotive industries.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Injection Molded Plastic Market size was valued at USD 341,631 million in 2024 and is anticipated to reach USD 439,536.8 million by 2032, growing at a CAGR of 3.2% during the forecast period.

- Market growth is driven by rising demand from automotive, packaging, healthcare, and consumer goods industries, where injection molding supports high-volume production, lightweighting, and consistent product quality.

- Packaging represents the dominant application segment, supported by large-scale demand for containers, closures, and consumer packaging, while automotive and healthcare segments show steady expansion through precision and performance-driven components.

- Competitive dynamics remain strong, with leading global players focusing on high-performance polymers, sustainable resin development, capacity expansion, and close collaboration with OEMs to strengthen downstream integration.

- Regionally, Asia-Pacific leads the global market with an exact 38% market share, driven by extensive manufacturing capacity, cost-efficient production, strong domestic consumption, and rapid growth across packaging, electronics, and automotive industries.

Market Segmentation Analysis:

By Product

The injection molded plastic market by product is led by Polypropylene (PP), which holds the dominant position with an estimated 28% market share due to its balanced combination of low density, chemical resistance, fatigue strength, and cost efficiency. PP sees extensive adoption in packaging, automotive interiors, consumer goods, and medical disposables where lightweight and durability remain critical. Polyethylene (PE) and ABS follow as key contributors, supported by flexibility and impact resistance. Engineering plastics such as Polycarbonate (PC), Polyamide (PA), and PBT gain traction in high-performance applications, driven by demand for heat resistance, dimensional stability, and electrical insulation.

- For instance, LyondellBasell Industries Holdings B.V. manufactures high-flow PP injection grades within its Moplen and Hostacom portfolios that deliver melt flow rates up to 80 g/10 min, Vicat softening temperatures reaching 160 °C, and tensile strengths exceeding 30 MPa, enabling thin-wall packaging and precision automotive components.

By Application

By application, Injection Molding itself represents the dominant sub-segment, accounting for approximately 64% market share, supported by its ability to deliver high-volume production, complex geometries, tight tolerances, and minimal material waste. The process remains the preferred choice for automotive components, packaging containers, medical devices, and consumer products. Extrusion and blow molding maintain strong relevance in pipes, films, and bottles, while thermoforming and compression molding serve niche applications requiring lower tooling costs or thicker sections. The continued automation of molding lines and adoption of multi-cavity molds reinforce injection molding’s leadership.

- For instance, BASF SE supports injection molding advancement through its Ultramid® and Ultradur® engineering plastics, where specific grades achieve tensile strengths above 170 MPa, heat deflection temperatures up to 220 °C, and flow lengths exceeding 1,000 mm in thin-wall mold tests.

By End User

Among end users, Packaging dominates the injection molded plastic market with an estimated 34% market share, driven by rising consumption of rigid containers, caps, closures, and food-grade packaging solutions. Demand benefits from urbanization, growth in processed foods, and the shift toward lightweight, shatter-resistant materials. Automotive follows as a major segment, supported by vehicle lightweighting initiatives and component integration. Electrical & electronics and medical devices show strong growth due to precision requirements and material consistency. Construction and consumer goods contribute steadily, supported by durability, design flexibility, and long service life of molded plastic components.

Key Growth Drivers

Rising Demand from Automotive and Transportation Industries

The automotive and transportation sectors continue to drive demand for injection molded plastics due to the need for lightweight, durable, and cost-efficient components. Manufacturers increasingly replace metal parts with engineered plastics to improve fuel efficiency, enhance design flexibility, and reduce production complexity. Injection molding supports high-volume production of interior trims, under-the-hood components, connectors, and safety systems with consistent dimensional accuracy. The process also enables integration of multiple functions into single molded parts, reducing assembly steps and material waste while supporting evolving vehicle design requirements.

- For instance, Magna International, Inc. operates large-scale injection molding systems with clamp forces up to 4,500 tons, enabling single-shot production of large structural modules.

Expansion of Consumer Goods and Packaging Applications

Growing consumption of packaged goods, household products, and personal care items strongly supports the injection molded plastic market. Injection molding enables rapid, scalable production of containers, caps, closures, and consumer product housings with consistent quality and surface finish. The ability to mold complex geometries, apply color directly during processing, and maintain tight tolerances enhances product differentiation and branding. Manufacturers benefit from short cycle times, repeatability, and material versatility, making injection molding a preferred solution for mass-market consumer applications across global markets.

- For instance, INEOS Group supplies injection molding grades through its INEOS Olefins & Polymers portfolio, including polypropylene resins designed for high-speed packaging lines that achieve cycle times below 5 seconds per cavity and melt flow rates exceeding 70 g/10 min, as documented in INEOS technical datasheets.

Advancements in Medical and Healthcare Manufacturing

The healthcare industry represents a major growth driver due to rising demand for precision-engineered plastic components used in medical devices, diagnostics, and disposable products. Injection molding delivers high repeatability, contamination control, and compliance with stringent regulatory standards. Applications include syringes, inhalers, diagnostic cartridges, surgical instruments, and device housings. Increasing adoption of single-use medical products, combined with growth in healthcare infrastructure, accelerates demand for high-purity polymers and cleanroom-compatible injection molding technologies.

Key Trends & Opportunities

Shift Toward Sustainable and Recyclable Materials

Sustainability initiatives increasingly shape material selection and product design in the injection molded plastic market. Manufacturers focus on recyclable polymers, bio-based resins, and reduced material usage without compromising performance. Injection molding supports precise material control, enabling lightweighting strategies and lower scrap rates. Opportunities emerge for suppliers that offer sustainable resin alternatives compatible with existing tooling. Brand owners also favor molded products that support circular economy goals, driving innovation in material formulations and process optimization.

- For instance, Dow, Inc. has expanded its REVOLOOP™ portfolio of mechanical-recycled polyethylene and polypropylene resins engineered for injection molding applications, with specific grades formulated using 700 kilograms of recycled polymer per metric ton of resin, verified in Dow’s product stewardship documentation.

Adoption of Advanced Automation and Smart Manufacturing

Automation and digital manufacturing technologies create significant opportunities across injection molding operations. Smart machines equipped with sensors, real-time monitoring, and data analytics improve process stability, reduce downtime, and enhance quality assurance. Automated material handling, robotic part removal, and inline inspection systems increase throughput while lowering labor dependency. These advancements support consistent production across high-volume runs and complex parts, enabling manufacturers to meet demanding customer specifications and tighter delivery schedules.

- For instance, SABIC has also deployed digital material qualification tools that generate datasets exceeding 1,000 processing parameter points per grade, enabling molders to optimize cycle stability and automation performance using verified processing windows published in its application development guides.

Growth in Electrical and Electronics Applications

Rising demand for electronic devices, electrical infrastructure, and connectivity solutions expands opportunities for injection molded plastics. Molded components provide electrical insulation, dimensional stability, and design flexibility for connectors, housings, cable management systems, and device enclosures. Miniaturization trends and increasing component density favor injection molding due to its precision and repeatability. Demand continues to grow across consumer electronics, industrial automation, and energy-related applications.

Key Challenges

Volatility in Raw Material Prices

Fluctuating prices of petrochemical-based resins present a key challenge for injection molded plastic manufacturers. Cost instability affects production planning, profit margins, and pricing strategies, particularly for high-volume contracts with fixed pricing structures. Sudden material cost increases strain supplier relationships and reduce competitiveness. Manufacturers must balance inventory management, supplier diversification, and material substitution strategies to mitigate exposure while maintaining consistent product quality and performance standards.

Environmental Regulations and Waste Management Pressure

Increasing environmental regulations impose challenges related to plastic waste reduction, recycling compliance, and material traceability. Injection molded plastic producers face pressure to reduce single-use plastics, improve recyclability, and adopt sustainable practices across production cycles. Compliance often requires investment in new materials, tooling modifications, and process validation. Companies that fail to align with evolving regulatory frameworks risk market access limitations, reputational damage, and higher operational costs.

Regional Analysis

North America

North America holds an estimated 28% market share in the injection molded plastic market, supported by strong demand from automotive, healthcare, packaging, and consumer goods industries. The region benefits from advanced manufacturing infrastructure, high adoption of automation, and early integration of smart injection molding technologies. Automotive lightweighting initiatives and expanding medical device production continue to drive consistent demand. Regulatory emphasis on product quality and safety encourages the use of high-performance polymers. The presence of major resin producers, mold manufacturers, and OEMs strengthens supply chain efficiency and supports continuous innovation across injection molding applications.

Europe

Europe accounts for approximately 24% market share, driven by strong industrial manufacturing, automotive engineering, and sustainable packaging demand. The region emphasizes precision manufacturing, material efficiency, and regulatory compliance, encouraging adoption of advanced injection molding processes. Automotive component production, electrical enclosures, and industrial housings represent key application areas. Strict environmental regulations accelerate the use of recyclable and bio-based plastics, influencing material selection and design. Technological innovation, combined with strong demand from Germany, France, Italy, and the UK, positions Europe as a mature yet innovation-focused market.

Asia-Pacific

Asia-Pacific dominates the injection molded plastic market with an estimated 38% market share, supported by large-scale manufacturing activity, rapid urbanization, and expanding consumer markets. High demand from packaging, electronics, automotive, and household goods sectors drives significant production volumes. Countries such as China, India, Japan, and South Korea benefit from cost-efficient labor, expanding industrial capacity, and strong domestic consumption. Growth in electrical and electronics manufacturing further boosts demand for precision-molded components. Continuous investments in automation and capacity expansion reinforce Asia-Pacific’s position as the leading global production hub.

Latin America

Latin America holds around 6% market share, supported by growing demand from packaging, construction, automotive, and consumer goods industries. Expanding urban populations and rising disposable incomes drive consumption of molded plastic products. Countries such as Brazil and Mexico serve as regional manufacturing hubs, benefiting from proximity to North American supply chains. Injection molding supports cost-effective production of packaging containers, household items, and automotive parts. While infrastructure and technology adoption remain uneven, increasing foreign investment and industrial modernization create steady growth opportunities across the region.

Middle East & Africa

The Middle East & Africa region represents approximately 4% market share, supported by growth in construction, packaging, consumer goods, and industrial applications. Infrastructure development, urban expansion, and rising demand for packaged food and beverages stimulate injection molded plastic consumption. Gulf countries benefit from access to petrochemical feedstocks, supporting resin availability and cost efficiency. In Africa, growing manufacturing bases and improving industrial capabilities gradually expand market adoption. Although technological penetration remains moderate, ongoing investments in manufacturing capacity and diversification strategies support long-term market development.

Market Segmentations:

By Product:

- Polycarbonate (PC)

- Polybutylene terephthalate (PBT)

By Application:

- Injection Molding

- Extrusion

By End User:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the injection molded plastic market players such as LyondellBasell Industries Holdings B.V., BASF SE, Magna International, Inc., INEOS Group, Dow, Inc., SABIC, Eastman Chemical Company, ExxonMobil Corporation, Huntsman International LLC, DuPont de Nemours, Inc. the injection molded plastic market is characterized by intense competition among material suppliers, component manufacturers, and integrated solution providers focused on scale, efficiency, and technological capability. Market participants compete by expanding high-performance polymer offerings, improving material consistency, and supporting complex, high-volume molding applications across automotive, packaging, healthcare, and electronics sectors. Companies emphasize process optimization, automation, and tooling precision to enhance productivity and reduce cycle times. Strategic initiatives include capacity expansion, vertical integration, and long-term partnerships with OEMs to secure demand stability. Sustainability initiatives, such as recyclable materials and lightweight designs, increasingly influence competitive positioning. Differentiation depends on application expertise, global manufacturing reach, reliable supply chains, and the ability to meet strict regulatory and quality requirements while maintaining cost competitiveness.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In July 2025, SABIC launched the LNP™ Thermotuf™ WF0087N compound, the first PBT-based material for Nano Molding Technology (NMT) with flame retardancy (UL94 V0) and strong mechanicals, ideal for lightweight, durable smartphone frames and other electronics needing metal-plastic hybrid parts with superior signal performance and bonding strength (60% stronger than standard FR PBTs).

- In May 2025, HTI will be exhibiting its proprietary line of feminine hygiene applicators and its advanced custom pharmaceutical molding capabilities. HTI Plastics will showcase its pharmaceutical injection molding expertise at CPHI North America. The company specializes in high-precision, quality components for pharmaceutical applications.

- In April 2025, C&J Industries completed a significant $6 million expansion of its facility in Meadville, Pennsylvania, in response to increased demand for medical-grade plastic components. The expansion added a 12,000-square-foot ISO Class 8 cleanroom specifically for injection molding.

- In February 2025, PSI Molded Plastics to expand its Marion, South Carolina, facility, an initiative that involved consolidating its local operations and acquiring advanced molding presses to enhance capacity and service offerings.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Injection molded plastics will continue to benefit from rising demand for lightweight, durable, and cost-efficient components across multiple industries.

- Automotive manufacturers will increasingly rely on injection molding to support vehicle electrification, safety enhancements, and interior design flexibility.

- Packaging applications will expand further as brands prioritize high-volume production, consistent quality, and improved product differentiation.

- Healthcare demand will strengthen with continued growth in disposable medical devices and precision-molded diagnostic components.

- Adoption of advanced automation and digital monitoring will improve process efficiency, repeatability, and production scalability.

- Sustainable material development will gain momentum, with greater use of recyclable and bio-based polymers in molded products.

- Electrical and electronics manufacturing will drive demand for high-precision molded housings, connectors, and insulation components.

- Manufacturers will invest in tooling innovation and mold design optimization to reduce cycle times and material consumption.

- Global production capacity will expand in emerging economies to support growing consumer and industrial demand.

- Competitive advantage will increasingly depend on technical expertise, supply chain resilience, and compliance with evolving regulatory standards.