Market Overview:

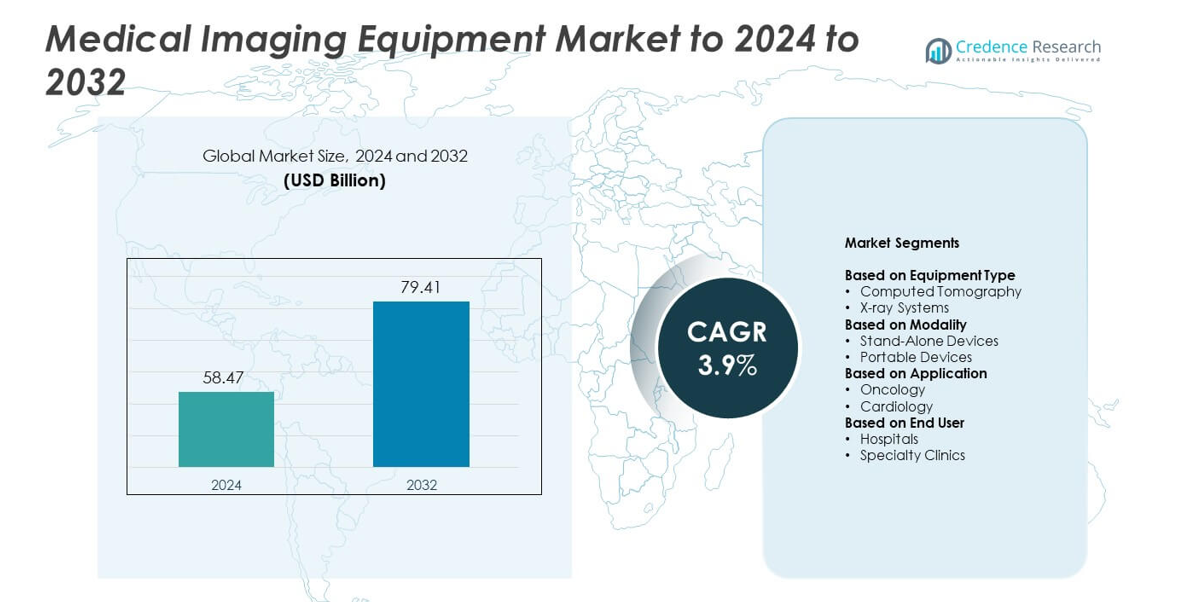

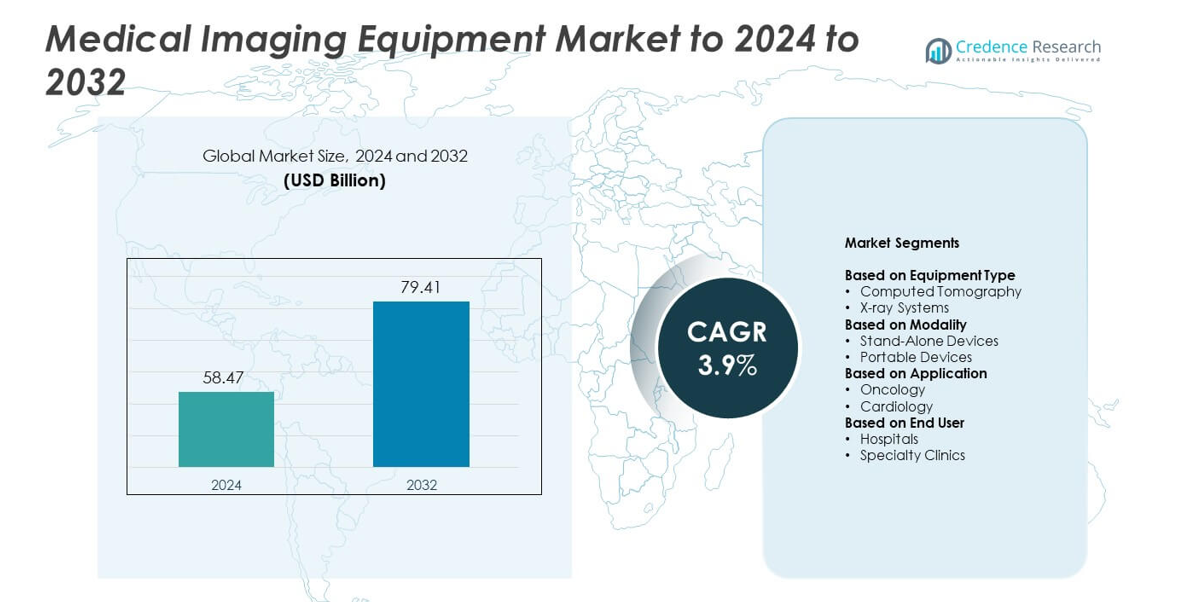

Medical Imaging Equipment Market size was valued USD 58.47 Billion in 2024 and is anticipated to reach USD 79.41 Billion by 2032, at a CAGR of 3.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Medical Imaging Equipment Market Size 2024 |

USD 58.47 Billion |

| Medical Imaging Equipment Market, CAGR |

3.9% |

| Medical Imaging Equipment Market Size 2032 |

USD 79.41 Billion |

The Medical Imaging Equipment Market is shaped by major players such as Siemens Healthineers, Samsung Medison Co. Ltd, Bio-Rad Laboratories Inc., Fujifilm Holdings Corporation, Hitachi, Ltd, Carestream Health, Inc., Koninklijke Philips N.V., Shimadzu Corporation, and Hologic, Inc. These companies compete through advanced imaging modalities, AI-supported diagnostics, and wider clinical integration across hospitals and diagnostic networks. North America leads the market with a 34% share due to strong technology adoption and high screening rates. Asia Pacific follows with a 29% share driven by rapid healthcare expansion, while Europe holds a 27% share supported by robust diagnostic infrastructure. Latin America and Middle East & Africa account for 6% and 4% respectively.

Market Insights

- The Medical Imaging Equipment Market reached USD 58.47 billion in 2024 and is projected to reach USD 79.41 billion by 2032, growing at a 3.9% CAGR.

- Strong demand for early diagnosis and rising chronic disease cases drive higher adoption of CT, MRI, and digital X-ray systems across hospitals and diagnostic centers.

- AI-enabled imaging, portable devices, and hybrid modalities such as PET-CT shape major trends as providers seek faster workflows and improved accuracy.

- The market remains competitive as global players expand product portfolios, invest in dose-reduction technology, and strengthen digital integration to retain market presence.

- North America leads with a 34% share, followed by Asia Pacific at 29% and Europe at 27%, while hospitals dominate end-use with a 61% segment share; Latin America holds 6% and Middle East & Africa account for 4%.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Equipment Type

Computed tomography leads the Medical Imaging Equipment Market with a 38% share due to strong demand for advanced diagnostic imaging across emergency care, oncology, and neurology. CT systems offer high-resolution cross-sectional views that help clinicians detect early lesions and guide treatment plans with greater accuracy. Growth strengthens as hospitals upgrade to multi-slice scanners for faster workflow and lower radiation dose. X-ray systems follow because many healthcare facilities rely on digital radiography for routine screening. Adoption also rises as low-cost units support wider access in developing regions.

- For instance, Carestream’s DRX-Revolution Nano mobile X-ray uses a 100-micron pixel detector that delivers high-resolution images for bedside diagnostic accuracy.

By Modality

Stand-alone devices dominate the Medical Imaging Equipment Market with a 72% share because hospitals prefer fixed systems for high-volume imaging, stable power supply, and broad modality integration. These units deliver consistent image quality and support complex scans across CT, MRI, and X-ray platforms. Demand grows as healthcare networks expand diagnostic centers with full-scale imaging rooms. Portable devices gain traction as providers use mobile X-ray and handheld ultrasound for bedside care, trauma units, and remote clinics. The shift toward point-of-care services continues to support portable modality adoption.

- For instance, Hologic’s SuperSonic MACH 30 ultrasound platform achieves imaging speeds up to 20,000 frames per second using UltraFast™ technology to support high-precision soft-tissue assessment.

By Application

Oncology holds the largest share at 47% in the Medical Imaging Equipment Market because cancer care requires precise imaging for early detection, staging, and treatment monitoring. CT, PET-CT, and MRI systems support tumor assessment with detailed anatomical and functional insights. Expanding cancer cases and rising screening programs accelerate imaging use across major hospitals. Cardiology follows as providers depend on advanced modalities to assess heart structure, blood flow, and vascular conditions. Growth is driven by the need for fast diagnosis of coronary artery disease and heart failure.

Key Growth Drivers

Rising Demand for Early and Accurate Diagnosis

The Medical Imaging Equipment Market grows due to strong demand for early disease detection across oncology, cardiology, and neurology. Providers depend on CT, MRI, and digital X-ray systems to identify conditions sooner and guide treatment with greater clarity. Rising screening rates and growing patient awareness support these upgrades. Governments also invest in diagnostic expansion to manage chronic diseases. This focus on timely diagnosis keeps advanced imaging systems in high demand across hospitals and diagnostic centers.

- For instance, general diagnostic ultrasound systems typically offer a spatial resolution in the range of 0.5 mm to 1 mm. Mindray’s Resona 7 system leverages its unique ZONE Sonography® Technology to maximize this resolution and enhance image quality.

Technological Advancements in Imaging Systems

Technology upgrades drive market expansion as manufacturers deliver higher resolution, lower radiation dose, and faster scan performance. AI-based imaging tools improve detection accuracy and optimize clinical workflow. New CT and MRI platforms support detailed visuals, helping doctors diagnose complex disorders. Providers adopt modern systems to replace ageing units and meet new clinical standards. These advancements push hospitals and clinics to upgrade equipment more frequently, strengthening overall market growth.

- For instance, Esaote’s Magnifico Open MRI is an FDA-approved system that uses a permanent 0.4 Tesla magnet, offering an open architecture that improves patient comfort and allows for dynamic (motion) imaging, which is important for orthopedic applications.

Expansion of Healthcare Infrastructure

Growing hospitals, diagnostic chains, and specialty centers increase demand for advanced imaging modalities. Many countries expand healthcare infrastructure to improve access to diagnostics in urban and rural locations. Providers invest in multi-modality rooms for CT, MRI, ultrasound, and digital X-ray to handle larger patient loads. Outpatient centers also rise due to strong demand for quick imaging services. This broad infrastructure growth drives continuous procurement of new imaging systems.

Key Trends and Opportunities

Growth of Portable and Point-of-Care Imaging

Portable imaging gains momentum as healthcare shifts toward flexible and patient-centric service models. Mobile X-ray, handheld ultrasound, and compact CT units allow clinicians to conduct scans at the bedside, in ICUs, and in emergency rooms. These systems speed up diagnosis and reduce patient movement. Adoption grows across rural clinics, ambulatory centers, and home-care programs. Rising need for fast diagnostics creates strong market opportunities for portable imaging devices.

- For instance, the Butterfly iQ+ and its predecessor, the original Butterfly iQ, use a proprietary “Ultrasound-on-Chip” technology with a 2D array of 9,000 micro-machined sensors (capacitive micromachined ultrasonic transducers, or CMUTs) integrated onto a single semiconductor chip.

Increasing Use of AI and Automation in Imaging

AI-based analysis tools reshape imaging workflows by improving accuracy and reducing reporting delays. Automated systems help radiologists detect abnormalities faster and reduce interpretation burden. Hospitals adopt AI-driven workflow software to streamline scan planning and lower error rates. This digital shift becomes more important as radiologist shortages rise. Growing investment in automation opens major opportunities for AI-enabled imaging platforms.

- For instance, Qure.ai’s AI model for chest imaging processes studies in under 20 seconds per scan and detects over 30 thoracic abnormalities with validated sensitivity benchmarks.

Rising Adoption of Hybrid Imaging Modalities

Hybrid modalities such as PET-CT and PET-MRI attract interest for their ability to combine structural and functional information. These systems improve diagnostic confidence in cancer, neurological disorders, and cardiovascular disease. Providers value hybrid imaging because it reduces the need for multiple scans. Manufacturers expand portfolios to meet the growing clinical demand. This preference for comprehensive imaging solutions creates long-term growth opportunities.

Key Challenges

High Cost of Advanced Imaging Systems

High equipment cost remains a major challenge for broader adoption. Advanced CT, MRI, and hybrid systems require significant capital investment and expensive maintenance contracts. Installation needs, such as shielding and room modifications, raise the cost further. Limited reimbursement in many regions slows upgrades. These financial barriers restrict access to advanced imaging in smaller facilities and developing markets.

Shortage of Skilled Radiology Professionals

A limited radiology workforce reduces the efficiency of imaging services. Many regions face rising scan volumes but have too few radiologists and technicians to operate advanced systems. Modalities like MRI and PET require strong technical training, slowing adoption in smaller centers. Workforce gaps cause longer wait times and higher workload pressure. This shortage limits effective use of modern imaging technologies across healthcare networks.

Regional Analysis

North America

North America holds a 34% share of the Medical Imaging Equipment Market due to strong adoption of advanced CT, MRI, and digital X-ray systems across hospitals and diagnostic networks. Providers invest heavily in technology upgrades, AI-based workflow tools, and hybrid imaging platforms to improve diagnostic accuracy. High screening rates for cancer and cardiovascular diseases also support equipment demand. The region benefits from strong reimbursement structures and a well-established healthcare ecosystem. Continuous expansion of outpatient imaging centers further strengthens growth across the United States and Canada.

Europe

Europe accounts for a 27% share of the Medical Imaging Equipment Market, supported by strong investments in diagnostic modernization across Germany, France, the U.K., and Nordic countries. Healthcare providers upgrade CT, MRI, and PET-CT systems to meet rising chronic disease cases and growing patient volumes. The region shows steady adoption of radiation-dose reduction technologies and portable imaging solutions. Government-funded screening programs also increase demand for early detection tools. Adoption of AI-supported imaging expands as hospitals seek workflow efficiency and standardized reporting across national health systems.

Asia Pacific

Asia Pacific leads with a 29% share, driven by rapid hospital expansion and rising diagnostic demand across China, India, Japan, and South Korea. Growing chronic disease burden and higher patient awareness boost imaging volumes in both public and private facilities. Governments invest heavily in modern radiology infrastructure to strengthen early diagnosis and rural access. Increased procurement of CT, MRI, and ultrasound units supports capacity building. The region also sees accelerating adoption of portable imaging systems due to large and diverse patient populations. Expanding medical tourism further contributes to strong market growth.

Latin America

Latin America holds a 6% share of the Medical Imaging Equipment Market, supported by rising investments in diagnostic services across Brazil, Mexico, Argentina, and Chile. Public and private hospitals upgrade imaging systems to improve detection of cancer, cardiac disorders, and trauma-related cases. Adoption of digital radiography and mid-range CT systems grows due to better affordability. Regional demand also increases as outpatient imaging centers expand in major cities. Although budget constraints affect equipment replacement cycles, steady improvement in healthcare infrastructure drives consistent market adoption.

Middle East and Africa

Middle East and Africa account for a 4% share of the Medical Imaging Equipment Market, driven by rising healthcare spending in the UAE, Saudi Arabia, and South Africa. Major hospitals invest in modern radiology departments featuring CT, MRI, and digital X-ray systems to support growing patient needs. Specialty centers focused on oncology, cardiology, and trauma care expand diagnostic capacity. Governments introduce healthcare modernization programs, improving access to imaging in urban regions. Despite financial and workforce limitations in some countries, slow but steady adoption continues across emerging markets.

Market Segmentations:

By Equipment Type

- Computed Tomography

- X-ray Systems

By Modality

- Stand-Alone Devices

- Portable Devices

By Application

By End User

- Hospitals

- Specialty Clinics

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Medical Imaging Equipment Market includes Siemens Healthineers, Samsung Medison Co. Ltd, Bio-Rad Laboratories Inc., Fujifilm Holdings Corporation, Hitachi, Ltd, Carestream Health, Inc., Koninklijke Philips N.V., Shimadzu Corporation, and Hologic, Inc. The market features strong competition as companies focus on advanced imaging technologies, improved workflow solutions, and broader clinical applications across hospitals and diagnostic centers. Manufacturers invest in high-resolution scanners, AI-based image analysis tools, and radiation-dose reduction innovations to strengthen product portfolios. Many players expand global reach by enhancing distribution networks and supporting clinical training programs to improve adoption. Continuous R&D efforts boost product reliability, speed, and diagnostic precision, helping companies meet rising demand for early detection and chronic disease management. Strategic partnerships with healthcare providers and digital health platforms further help companies improve integration across clinical workflows. Increasing emphasis on portable imaging, hybrid systems, and cloud-based imaging strengthens market competition and drives long-term growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In 2025, Siemens Healthineers unveiled advanced diagnostic imaging solutions at the Asian Oceanian Congress of Radiology (AOCR) 2025.

- In 2025, Shimadzu launched the inspeXio™ 7000 microfocus X-ray CT system, featuring a 225 kV tube and a 16-inch flat panel detector with a wide dynamic range.

- In 2024, Bio-Rad launched the ChemiDoc Go Imaging System for gels and western blots, adding a compact digital platform with multiplex imaging and automated exposure features.

Report Coverage

The research report offers an in-depth analysis based on Equipment Type, Modality, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand as hospitals upgrade to advanced multimodality imaging systems.

- AI-driven imaging software will reduce reporting time and improve diagnostic accuracy.

- Portable and point-of-care imaging devices will see strong adoption in emergency and remote care.

- Hybrid modalities like PET-CT and PET-MRI will gain wider clinical use.

- Low-dose imaging technologies will become a key focus for providers and manufacturers.

- Outpatient diagnostic centers will increase equipment procurement due to rising patient volumes.

- Radiology workflow automation will grow as facilities address staffing shortages.

- Emerging markets will expand imaging capacity through new hospital and clinic investments.

- Cloud-based imaging data management will strengthen interoperability across healthcare networks.

- Personalized and precision medicine will drive demand for more detailed and functional imaging tools.