Market Overview

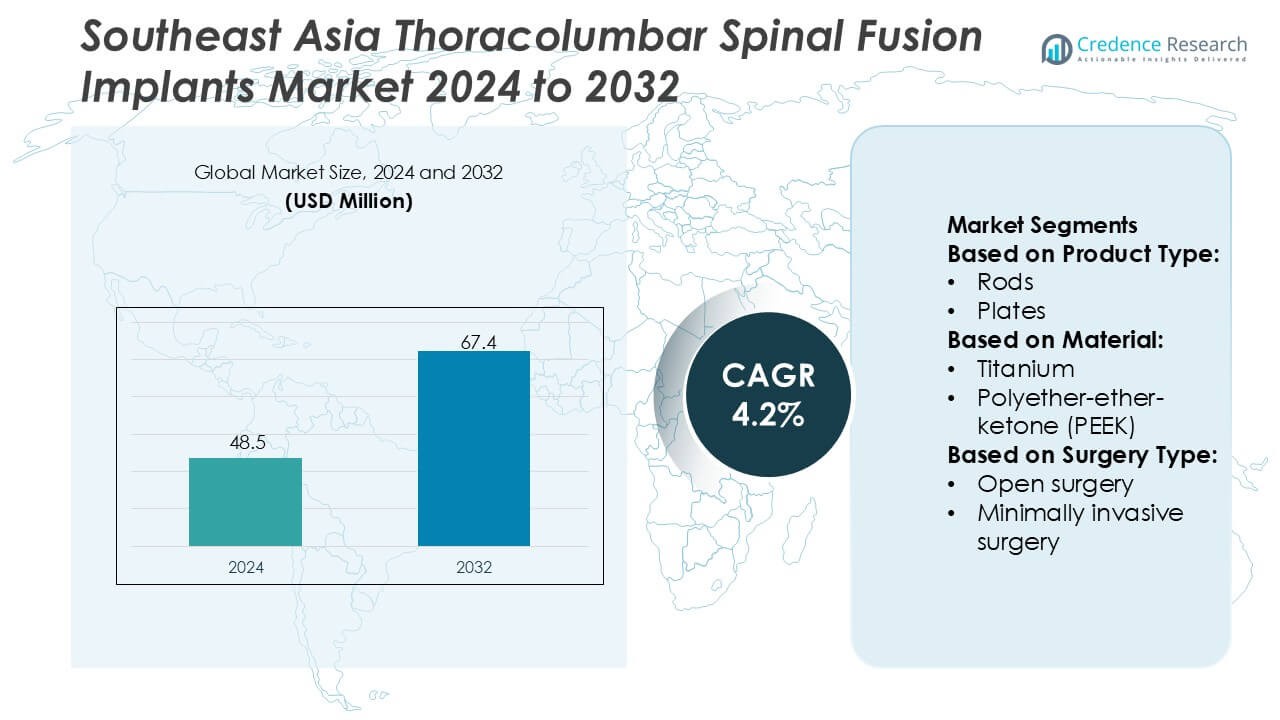

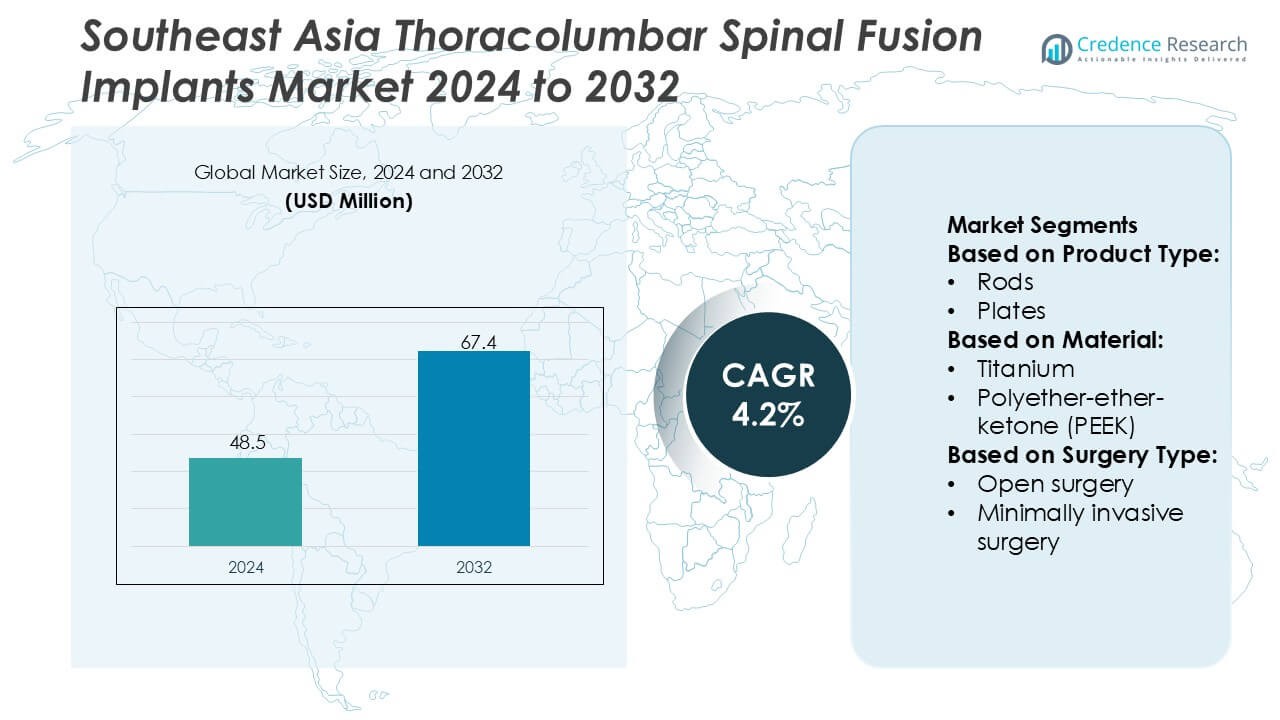

Southeast Asia Thoracolumbar Spinal Fusion Implants Market size was valued USD 48.5 million in 2024 and is anticipated to reach USD 67.4 million by 2032, at a CAGR of 4.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Southeast Asia Thoracolumbar Spinal Fusion Implants Market Size 2024 |

USD 48.5 Million |

| Southeast Asia Thoracolumbar Spinal Fusion Implants Market, CAGR |

4.2% |

| Southeast Asia Thoracolumbar Spinal Fusion Implants Market Size 2032 |

USD 67.4 Million |

The Southeast Asia Thoracolumbar Spinal Fusion Implants Market features a mix of multinational spine technology companies and regional suppliers that strengthen clinical adoption through advanced fixation systems, minimally invasive solutions, and surgeon-centric design improvements. Competition centers on expanding procedural support, improving implant biomechanics, and enhancing compatibility with navigation and robotic platforms. Indonesia emerges as the leading regional market with an exact 38% share, supported by its large patient population, expanding hospital networks, and rising investment in complex spinal surgery capabilities. Growing procurement programs and wider access to specialty care reinforce the dominance of high-performance fusion systems across the region.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The market reached USD 48.5 million in 2024 and is projected to hit USD 67.4 million by 2032, registering a 4.2% CAGR, supported by steady procedural growth across spine centers.

- Demand strengthens as hospitals prioritize advanced fixation systems, MIS-compatible thoracolumbar implants, and surgeon-centric design upgrades that improve stability and reduce OR time.

- Trends shift toward robotic-compatible hardware, navigation-integrated pedicle screws, and enhanced biomechanics, while competition intensifies among global and regional players offering differentiated fusion portfolios.

- Market restraints include high implant costs, uneven reimbursement structures, and limited availability of specialized spine surgeons in emerging provinces, which slows uniform adoption across Southeast Asia.

- Indonesia leads with an exact 38% regional share, while premium fixation systems dominate the segment with an estimated 55–57% share due to strong demand in complex fusion procedures; broader procurement programs and expanding tertiary care capacity continue to strengthen regional uptake.

Market Segmentation Analysis:

By Product Type

Pedicle screws dominate the Southeast Asia thoracolumbar spinal fusion implants market with an estimated 42–44% share, supported by their high fixation strength, intraoperative versatility, and broad compatibility with rods and plates across degenerative, traumatic, and deformity cases. Intervertebral body fusion devices (IBFDs) show rapid adoption due to rising demand for height restoration and improved load sharing in multilevel pathologies. Rods, plates, and other product types maintain stable use in complex reconstructions, though shifting surgeon preference toward modular and biomechanically optimized screw-rod systems strengthens the leadership of pedicle screw constructs.

- For instance, Globus Medical’s CREO® pedicle screw platform features a robust design capable of complex spinal correction. The system utilizes a specialized, powerful rod reduction instrument that enables controlled manipulation and correction of spinal deformities of up to 30 mm (as featured in the CREO MIS and CREO Side-Loading systems).

By Material

Titanium remains the dominant material with an estimated 48–50% share, driven by its favorable strength-to-weight ratio, excellent biocompatibility, and superior osseointegration outcomes, which align with surgeon preference for long-term stability in fusion procedures. Polyether-ether-ketone (PEEK) expands steadily due to its radiolucency and modulus of elasticity that mimics natural bone, supporting better postoperative assessment. Cobalt chrome and stainless steel continue serving high-load or corrective procedures, while other materials gain niche traction. The combination of durability, clinical familiarity, and strong fusion success rates reinforces titanium’s sustained leadership in the region.

- For instance, NuVasive’s Modulus® titanium interbody system features a 3D-printed pore architecture averaging 500–700 microns, engineered to achieve up to 75% porosity for enhanced bone ingrowth, while maintaining structural stiffness within 10% of native cancellous bone, as validated in company technical performance data.

By Surgery Type

Open surgery holds the dominant position with an estimated 55–57% share, supported by its widespread availability, lower equipment dependency, and strong surgeon familiarity across public and private hospitals in Southeast Asia. It remains crucial for complex deformities, trauma cases, and multilevel reconstructions requiring extensive visualization. Minimally invasive surgery (MIS) accelerates adoption due to shorter recovery time, reduced blood loss, and enhanced postoperative mobility, particularly in urban centers with advanced surgical infrastructure. However, limited access to advanced navigation systems and specialized training in smaller markets preserves the dominance of open thoracolumbar fusion techniques.

Key Growth Drivers

Rising Burden of Degenerative Spine Disorders

Increasing prevalence of lumbar spondylosis, spinal stenosis, and vertebral instability accelerates demand for thoracolumbar fusion procedures across Southeast Asia. Aging populations in Thailand, Singapore, Malaysia, and Vietnam elevate surgical volumes as clinicians confront more complex degeneration requiring stable fixation. Hospitals expand spine surgery capacity, while government health programs strengthen access to advanced orthopedic care. Broader diagnostic adoption, alongside growing preference for long-term corrective procedures, reinforces steady uptake of screw-rod constructs and interbody fusion devices that deliver structural integrity and postoperative stability.

- For instance, B. Braun SE’s S4® Spinal System (specifically its thoracolumbar polyaxial screw components) integrates polyaxial screws typically capable of approximately 40° to 50° multidirectional angulation.

Rapid Expansion of Surgical Infrastructure and Trained Spine Specialists

Regional investments in tertiary-care hospitals, neurosurgical centers, and orthopedic institutes strongly support growth in thoracolumbar fusion adoption. Countries such as Indonesia and the Philippines increase training programs for spinal surgeons, promoting safer and more standardized fusion techniques. Hospitals integrate navigation systems, intraoperative imaging, and advanced surgical instruments that enhance accuracy and reduce complication risks. This infrastructure uplift enables higher procedural throughput and wider adoption of modern implant systems. Improved reimbursement clarity further motivates providers to expand elective and trauma-related spinal fusion services.

- For instance, Stryker’s Q Guidance™ System, paired with the Spine Guidance Software, delivers real-time navigation and optical tracking to enhance surgical accuracy. The system is validated by the FDA as having positional displacement accuracy with a mean of 2 mm and angular accuracy with a mean of 2 degrees during procedures.

Increasing Preference for Biocompatible and Advanced Implant Materials

Demand intensifies for implants that offer stronger osseointegration, reduced wear, and better fusion outcomes, driving adoption of titanium and radiolucent biomaterials. Surgeons increasingly favor systems that simplify postoperative assessment and minimize imaging artifacts, supporting the shift toward PEEK and hybrid cages. As patient expectations for long-term mobility rise, hospitals adopt product platforms with improved fatigue strength, corrosion resistance, and load-sharing characteristics. Continuous advancements in material science, combined with broader availability of premium implant systems, strengthen the region’s transition toward high-performance fusion technologies.

Key Trends & Opportunities

Accelerating Shift Toward Minimally Invasive Thoracolumbar Fusion

Minimally invasive procedures gain traction due to reduced muscle disruption, faster rehabilitation, and lower postoperative pain. Surgeons increasingly utilize tubular retractors, percutaneous pedicle screw systems, and navigation-guided instrumentation, enabling precise fixation through smaller incisions. Rising investment in robotics, 3D navigation, and intraoperative CT supports expanded MIS capabilities across leading hospitals. This trend creates strong opportunities for implant manufacturers offering low-profile screws, MIS-specific rods, and expandable interbody cages designed for narrow surgical corridors.

- For instance, Zimmer Biomet’s ROSA® Spine robotic platform assists surgeons in trajectory planning and pedicle screw placement for minimally invasive procedures. Clinical studies have shown that the system provides high accuracy rates for screw placement (often exceeding 93% for clinically acceptable Grade A and B screws), with mean positional deviations typically ranging between 0.89 mm and 2.05 mm depending on the specific study and screw location.

Growing Adoption of Navigation, Robotics, and Digital Surgical Technologies

Technological innovation reshapes surgical workflows, with hospitals integrating robotic-assisted systems, real-time navigation, and AI-enabled preoperative planning tools that enhance accuracy in screw placement and alignment correction. These platforms reduce revision risks, particularly in complex deformity and trauma cases. Digital integration also strengthens training, allowing surgeons to simulate procedures and refine trajectories. Manufacturers gain opportunities to supply compatible implants, instrument kits, and software-driven planning systems that align with precision-driven spine care models across Southeast Asia.

- For instance, FORZA® XP Expandable Interbody System is a titanium alloy spacer for PLIF and TLIF procedures that offers up to 3 mm of continuous expansion to restore disc height and provide stabilization during lumbar fusion.

Opportunity for Customized and Patient-Specific Implant Solutions

Demand rises for implants tailored to anatomical variations, especially among younger patients and individuals with congenital or traumatic abnormalities. Adoption of 3D-printed cages and anatomically contoured rods supports improved fusion integrity and reduced intraoperative adjustments. Hospitals increasingly explore personalized planning tools that optimize cage sizing and screw trajectories. This trend creates opportunities for manufacturers offering additive-manufactured spinal implants, modular constructs, and patient-matched solutions that enhance surgeon workflow efficiency and postoperative stability.

Key Challenges

High Cost of Advanced Implants and Limited Reimbursement Coverage

Premium thoracolumbar implant systems, navigation platforms, and MIS-compatible instruments remain expensive for many Southeast Asian healthcare providers. Out-of-pocket patient expenses are high, particularly in Indonesia, Vietnam, and the Philippines, where reimbursement for spine procedures is limited. These financial barriers hinder adoption of advanced material implants and digital surgical technologies. Hospitals often restrict procurement to cost-efficient or legacy systems, creating disparities in access to high-end fusion solutions and slowing market penetration of next-generation devices.

Shortage of Specialized Spine Surgeons in Emerging Markets

Although spine care infrastructure improves, many countries still face insufficient numbers of trained spinal surgeons capable of performing complex thoracolumbar fusion procedures. Rural and secondary cities experience significant gaps in expertise, delaying diagnosis and limiting patient referral pathways. Training requirements for MIS, navigation-assisted surgery, and deformity correction further widen the skill gap. This shortage restricts procedural volumes, reduces adoption of technologically advanced implant systems, and prolongs patient waiting times across several developing Southeast Asian markets.

Regional Analysis

North America

North America holds a 32% share of the Southeast Asia thoracolumbar spinal fusion implants market due to strong clinical adoption of minimally invasive fusion techniques and a high concentration of advanced spine centers. Hospitals emphasize precision-driven procedures supported by 3D-navigation and robotic assistance, enabling higher procedural accuracy and reduced revision rates. Surgeons increasingly rely on next-generation pedicle screws, expandable cages, and titanium alloy constructs optimized for load-bearing stability. Strong regulatory oversight and reimbursement frameworks accelerate technology diffusion across regional training programs, influencing surgical preferences and driving technology transfer partnerships with Southeast Asian spine care providers.

Europe

Europe accounts for 27% of the regional influence on the Southeast Asia thoracolumbar spinal fusion implants landscape, supported by established orthopedic research networks and widespread adoption of evidence-based surgical protocols. The region’s focus on biocompatible materials, including advanced PEEK and porous titanium implants, enhances osseointegration outcomes and postoperative mobility. European clinics prioritize low-profile instrumentation that reduces soft-tissue disruption and improves patient recovery cycles. Cross-border collaborations among clinical institutions, implant manufacturers, and regulatory bodies promote technology standardization and knowledge exchange, strengthening clinical decision-making across Southeast Asian health systems seeking high-reliability implant solutions.

Asia-Pacific

Asia-Pacific dominates with a 34% market share, driven by rapid expansion of tertiary care hospitals, higher spinal disorder prevalence, and increasing availability of specialized spine surgeons. Southeast Asian nations actively integrate advanced thoracolumbar fusion systems featuring modular pedicle screws, interbody cages, and hybrid fixation devices tailored for diverse anatomical requirements. Growing investments in surgical robotics and intraoperative imaging modernize operating environments, improving procedural precision and patient outcomes. The region’s cost-effective manufacturing capabilities and localized production partnerships reduce implant procurement costs, supporting broader adoption across both public and private healthcare facilities.

Latin America

Latin America contributes a modest 4% share due to slower healthcare modernization but gradually strengthens its influence through expanding orthopedic training programs and rising adoption of minimally invasive spinal fusion systems. Hospitals integrate streamlined implant kits and standardized fixation systems to improve intraoperative efficiency and reduce inventory constraints. Demand heightens for implants with enhanced biomechanical stability suitable for trauma-related thoracolumbar injuries. Collaborative academic exchanges and surgeon fellowship programs accelerate exposure to advanced fusion technologies, enabling clinical practices that indirectly support Southeast Asian markets through shared research insights and evolving surgical preferences.

Middle East & Africa

The Middle East & Africa region accounts for 3% of the market’s global interaction footprint, shaped by selective adoption of premium thoracolumbar fusion implants in urban medical hubs. Spine centers increasingly utilize titanium and PEEK constructs for deformity correction and degenerative spine management, supported by government-driven investments in specialty surgical care. Capacity-building initiatives advance surgeon training in minimally invasive fusion techniques, although broader adoption remains constrained by cost and infrastructure limitations. Regional procurement collaborations and technology-transfer initiatives strengthen knowledge dissemination across Southeast Asia, particularly in areas involving high-precision imaging and fixation optimization.

Market Segmentations:

By Product Type:

By Material:

- Titanium

- Polyether-ether-ketone (PEEK)

By Surgery Type:

- Open surgery

- Minimally invasive surgery

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East

- Africa

Competitive Landscape

The competitive landscape of the Southeast Asia thoracolumbar spinal fusion implants market players such as SeaSpine, Globus Medical, NuVasive, Inc., B. Braun SE, Stryker, Zimmer Biomet, Orthofix Medical Inc., Medtronic, RTI Surgical, and Medical Device Business Services, Inc. the Southeast Asia thoracolumbar spinal fusion implants market is characterized by rapid technological advancement, strong clinical training initiatives, and expanding adoption of minimally invasive fusion systems. Manufacturers focus on developing high-precision pedicle screw platforms, expandable interbody cages, and porous titanium constructs that deliver improved biomechanical performance and reduced postoperative complications. Hospitals increasingly integrate navigation, robotic assistance, and intraoperative imaging to enhance procedural accuracy and strengthen implant outcomes. Regional distributors support market penetration through specialized logistics, cost-efficient procurement, and technical assistance programs. As clinical standards rise, competition intensifies around innovation, material science, and surgeon-centric support systems that elevate long-term fusion success and patient recovery.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- SeaSpine

- Globus Medical

- NuVasive, Inc.

- Braun SE

- Stryker

- Zimmer Biomet

- Orthofix Medical Inc.

- Medtronic

- RTI Surgical

- Medical Device Business Services, Inc.

Recent Developments

- In November 2025, Eminent Spine announced that the FDA had approved the 3D Printed Titanium Posterior SI System. This implant is designed to ensure safety, reliability, and superior clinical outcomes.

- In October 2025, Aurora Spine Corporation launched Aurora Biologics. Aurora Biologics is a new division dedicated to spinal fusion success through best-in-class biologic innovation across the world.

- In May 2025, Nexxt Spine announced the launch of its NEXXT MATRIXX SI System for sacroiliac (SI) joint fusion in utilizing 3D printing (additive manufacturing) to create porous titanium implants that promote bone growth for stabilization in SI joint dysfunction, fracture fixation, and spinal fusion augmentation.

- In February 2025, Globus Medical introduced the HILINE Fixation System, an advanced posterior band fixation solution tailored for cervical and thoracolumbar spine applications. Engineered with robust implants and streamlined instrumentation, HILINE enhances deformity correction, stabilization in compromised anatomy, and ligament augmentation.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Material, Surgery Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for thoracolumbar spinal fusion implants rises as regional surgical volumes increase and early diagnosis improves.

- Hospitals and specialty centers expand adoption of advanced fusion systems to enhance clinical outcomes and reduce postoperative complications.

- Surgeons increasingly shift toward minimally invasive thoracolumbar procedures to reduce blood loss, shorten hospitalization, and accelerate recovery.

- Hybrid fixation systems gain stronger traction as clinicians prefer versatile constructs for complex deformity and trauma cases.

- Adoption of patient-specific implants accelerates as imaging integration and digital planning tools improve surgical precision.

- Robotic-assisted spine surgery expands across major urban centers, driven by investments in navigation and automation platforms.

- Greater penetration of bioactive and osteoinductive materials strengthens fusion reliability in high-risk or elderly patient groups.

- Training programs and surgeon education partnerships intensify to standardize procedural accuracy and improve implant selection.

- Regional manufacturing capabilities grow as governments promote medical device localization and regulatory streamlining.

- Cross-border medical tourism increases demand for advanced thoracolumbar spinal fusion procedures due to competitive treatment quality and cost advantages.