Market Overview:

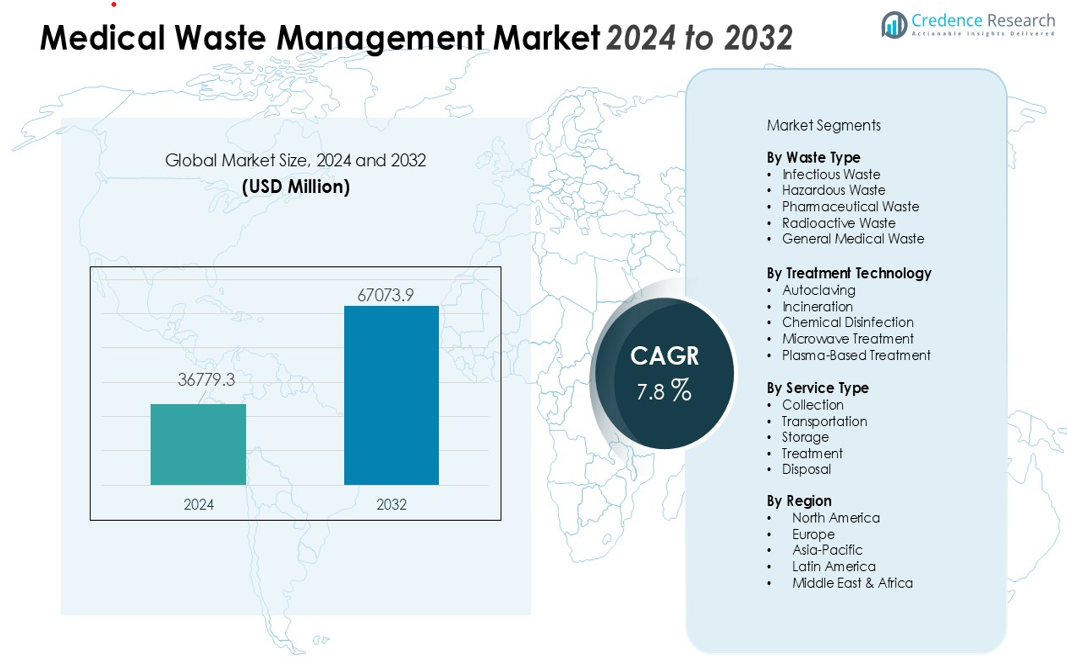

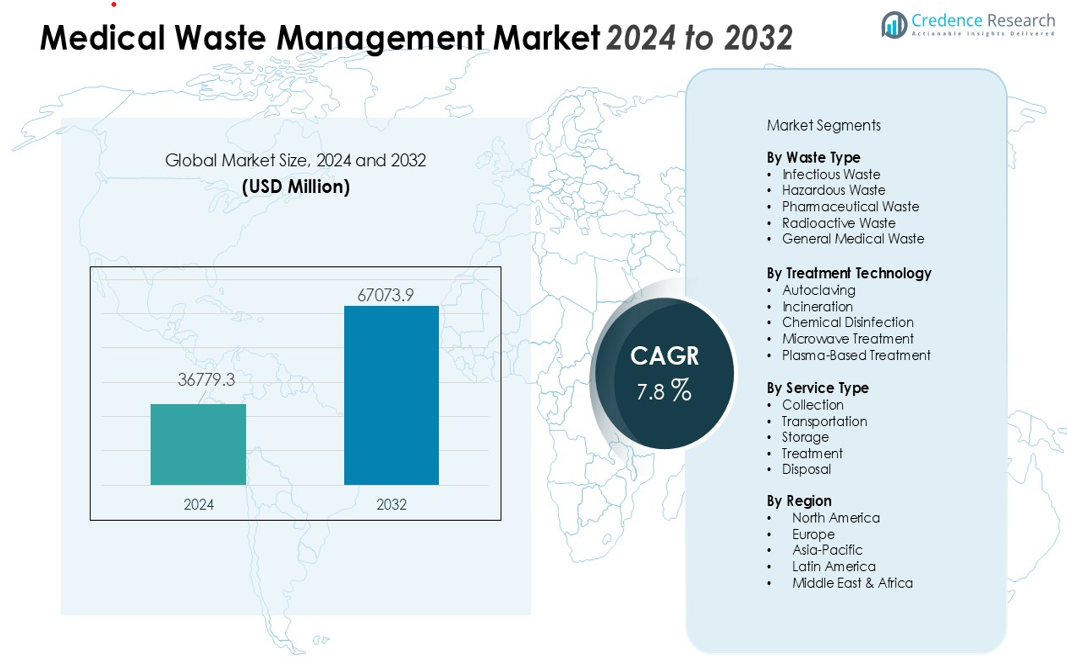

The medical waste management market size was valued at USD 36779.3 million in 2024 and is anticipated to reach USD 67073.9 million by 2032, at a CAGR of 7.8 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Medical Waste Management Market Size 2024 |

USD 36779.3 million |

| Medical Waste Management Market, CAGR |

7.8% |

| Medical Waste Management Market Size 2032 |

USD 67073.9 million |

Key market drivers include the surge in infectious and hazardous waste generation, stricter regulatory frameworks for waste segregation and disposal, and growing emphasis on environmental sustainability. Healthcare facilities adopt advanced technologies such as autoclaving, chemical disinfection, microwave treatment, and plasma gasification to ensure safe and compliant waste processing. Rising awareness of occupational safety and the need to reduce landfill burden also accelerate investments in modern waste-handling infrastructure.

Regionally, North America leads the market due to stringent environmental regulations, strong compliance systems, and high adoption of advanced treatment technologies. Europe follows closely with well-established waste segregation protocols and sustainability-focused initiatives. Asia-Pacific represents the fastest-growing region, supported by rapid healthcare expansion, higher waste generation rates, and increasing regulatory enforcement across China, India, and Southeast Asia. Emerging regions in Latin America and the Middle East & Africa show steady growth as healthcare modernization and regulatory frameworks continue to evolve.

Market Insights:

- The medical waste management market is set to grow from USD 36779.3 million in 2024 to USD 67073.9 million by 2032, reflecting a strong CAGR of 7.8%.

- Rising infectious and hazardous waste volumes, along with stricter regulatory enforcement, continue to boost demand for compliant treatment solutions.

- Adoption of advanced technologies such as autoclaving, microwave systems, and non-incineration methods strengthens safety and sustainability efforts.

- High operational costs, infrastructure gaps, and limited trained personnel remain key barriers to scalable and efficient waste handling.

- Regionally, North America leads the market, Asia-Pacific grows the fastest with expanding healthcare systems, and Europe maintains strong sustainability-focused progress.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Stringent Regulatory Frameworks and Enforcement Policies Stimulate Compliance and Drive Growth

Governments enforce strict protocols for the handling, segregation, and disposal of hazardous biomedical waste, which strengthens demand for compliant solutions in the medical waste management market. It compels healthcare facilities to upgrade legacy systems and adhere to standardized treatment practices. Rising inspections and penalties increase the urgency for hospitals and laboratories to adopt certified equipment and licensed service providers. Strong regulatory alignment across healthcare ecosystems ensures consistent investment in safe and sustainable waste processing infrastructure.

- For instance, Secure Waste, a leading provider in Maryland, Virginia, and Washington, D.C., uses advanced tracking systems to ensure full compliance with applicable federal and state guidelines (such as OSHA, EPA, and DOT), significantly improving regulatory adherence through automated digital tracking of every disposal event

Rising Healthcare Expenditure and Procedural Volumes Intensify Waste Generation Needs

Growing hospital admissions, diagnostic procedures, and pharmaceutical manufacturing activities generate higher volumes of infectious and chemical waste. It creates sustained pressure on service providers to expand treatment capacity and modernize operational models. The medical waste management market gains momentum as healthcare facilities integrate advanced equipment to maintain safety and regulatory compliance. Rising utilization of disposables in surgeries and outpatient care further reinforces demand for efficient waste-handling systems.

- For instance, at a major teaching hospital, pharmaceutical waste production reached approximately 153.82 kg per day, reflecting the scale of waste generated by expanding healthcare operations.

Increased Focus on Environmental Sustainability Strengthens Adoption of Advanced Treatment Technologies

Healthcare organizations prioritize eco-friendly waste handling to reduce emissions and landfill accumulation. It drives stronger adoption of technologies such as autoclaving, steam sterilization, microwave systems, and non-incineration methods. The medical waste management market benefits from initiatives aimed at lowering carbon footprints and improving resource recovery. Sustainability mandates encourage investments in energy-efficient equipment and closed-loop waste processes.

Growing Awareness of Occupational Safety Promotes Safer Waste Handling Practices

Workplace safety programs raise awareness of exposure risks linked to sharps, pathological waste, and chemical contaminants. It improves compliance with protective guidelines and strengthens demand for standardized handling tools. The medical waste management market expands as hospitals prioritize staff training and deploy automated systems to reduce manual contact. Rising emphasis on reducing needlestick injuries and contamination incidents accelerates adoption of secure storage and transportation solutions.

Market Trends:

Growing Integration of Non-Incineration and High-Efficiency Treatment Technologies Reshapes Operational Models

The medical waste management market sees an accelerated shift toward non-incineration technologies that reduce emissions and support sustainability mandates. It adopts systems such as autoclaves, microwave units, chemical disinfectors, and plasma-based treatment platforms to enhance sterilization efficiency while minimizing environmental impact. Healthcare facilities invest in compact, automated machines that improve waste throughput and reduce manual handling. Strong focus on operational safety encourages providers to deploy closed-loop systems that limit exposure risks. Demand for modular, mobile, and on-site treatment solutions increases due to rising waste volumes generated by specialty clinics and diagnostic centers. Adoption of energy-efficient equipment strengthens compliance with carbon-reduction strategies. Digital tracking tools gain traction as facilities seek real-time monitoring of waste movement, storage, and treatment cycles.

- For example, the mobile microwave treatment units offered by several vendors are capable of processing from approximately 1.2 to over 10 tons of medical waste per day, providing flexible, on-demand sterilization that supports healthcare facilities’ decentralization needs.

Rising Adoption of Smart Waste Management Solutions Strengthens Traceability and Data-Driven Operations

Healthcare institutions implement IoT-enabled collection containers and sensor-based monitoring platforms that alert staff when waste reaches defined thresholds. It supports predictive planning and reduces delays linked to manual oversight. The medical waste management market embraces cloud-based dashboards that streamline documentation, manifest tracking, and compliance reporting. Service providers deploy RFID tagging systems that improve chain-of-custody accuracy and reduce risks linked to misclassification. Growing interest in automation promotes the use of robotic arms and mechanized sorting units in high-volume facilities. Rising demand for transparent and auditable waste pathways strengthens investment in digital platforms that capture real-time operational metrics. Increasing partnerships between technology firms and waste processors drive stronger integration of analytics and workflow optimization tools.

- For instance, Stericycle employs autoclave systems that sterilize medical waste with high-pressure steam for 20–30 minutes, effectively neutralizing pathogens while reducing emissions from traditional incineration processes by over 90% in their facilities.

Market Challenges Analysis:

High Operational Costs and Infrastructure Gaps Limit Scalable Waste Handling Capacity

The medical waste management market faces persistent challenges linked to high treatment and disposal costs that strain budgets for hospitals and small clinics. It requires continuous investment in certified equipment, licensed transport fleets, and specialized storage systems, which increases financial pressure. Limited availability of advanced treatment facilities in developing regions restricts timely processing and forces long-distance transportation. Compliance with evolving regulations often demands costly upgrades that many providers struggle to implement. Shortages of trained personnel weaken operational efficiency and create inconsistencies in waste segregation. Rising maintenance expenses for high-tech equipment further increase operational complexity.

Regulatory Complexity and Waste Volume Variability Create Execution Barriers for Service Providers

Healthcare facilities operate under diverse national and regional regulations that create challenges in standardizing waste-handling practices. It becomes difficult for service providers to maintain uniform quality across multiple jurisdictions. The medical waste management market experiences pressure from fluctuating waste volumes generated by hospitals, research labs, and pharmaceutical units. Limited awareness of proper segregation practices continues to cause contamination of recyclable or nonhazardous waste streams. Risk of environmental violations increases when facilities lack reliable monitoring tools. Frequent updates to safety guidelines require continuous training and adjustment of operational workflows.

Market Opportunities:

Expansion of Sustainable and Advanced Treatment Technologies Creates Strong Growth Prospects

The medical waste management market benefits from rising demand for non-incineration systems that reduce emissions and improve sterilization performance. It enables providers to deploy autoclaves, microwave units, and plasma-based technologies that align with environmental standards. Hospitals seek energy-efficient and compact machines that support on-site processing and reduce transport costs. Adoption of closed-loop treatment systems increases due to the need for safer handling of infectious materials. Strong interest in sustainable waste solutions creates opportunities for manufacturers offering low-emission and recyclable technologies. Growing investment in green infrastructure supports large-scale upgrades across healthcare networks.

Digital Transformation and Smart Waste Handling Solutions Strengthen Future Market Potential

Healthcare facilities adopt IoT sensors, cloud-based dashboards, and automation tools to improve waste tracking and operational transparency. It enhances compliance reporting, chain-of-custody verification, and audit readiness. The medical waste management market gains momentum as providers integrate RFID tagging and real-time monitoring systems. Surge in telemedicine and remote clinics creates opportunities for decentralized and mobile treatment units. Technology partnerships open avenues for advanced analytics that optimize routing, storage capacity, and treatment schedules. Rising focus on quality assurance encourages investment in digital platforms that standardize workflows across hospitals, laboratories, and pharmaceutical units.

Market Segmentation Analysis:

By Waste Type

The medical waste management market classifies waste into infectious, hazardous, pharmaceutical, radioactive, and general waste streams. Infectious waste holds a dominant share due to rising hospital admissions and increased use of disposable medical supplies. It requires stringent segregation and specialized containment solutions to limit exposure risks. Hazardous and pharmaceutical waste segments grow steadily with expanding diagnostic services and drug production. Radioactive waste remains a specialized segment handled by certified facilities with strict regulatory oversight. Growing emphasis on proper classification improves treatment efficiency across healthcare environments.

- For instance, Bertin Medical Waste’s Sterilwave system inactivates infectious agents in under 30 minutes and reduces waste volume by up to 85% (weight by over 25%), significantly improving on-site infectious waste treatment efficiency.

By Treatment Technology

The market includes autoclaving, incineration, chemical disinfection, microwave treatment, and emerging plasma-based systems. Autoclaving secures widespread adoption because it offers reliable sterilization and cost efficiency. Incineration remains essential for pathological and pharmaceutical waste that requires high-temperature destruction. It faces stricter environmental controls, which encourage investments in cleaner combustion units. Microwave and chemical systems gain traction among smaller facilities seeking compact and automated technologies. Plasma-based methods expand through demand for low-emission, high-efficiency treatment solutions.

- For instance, Tuttnauer, a pioneer in autoclave technology, has developed models that achieve sterilization cycles as short as 28 minutes, enhancing throughput for healthcare facilities.

By Service Type

Service segmentation includes collection, transportation, storage, treatment, and disposal. Collection and transportation services hold a major share due to the high frequency of waste movement from hospitals and laboratories. Treatment and disposal services attract strong investment as facilities upgrade to advanced systems to meet regulatory standards. It supports adoption of on-site and off-site processing models tailored to facility size. Storage services gain importance in regions with limited access to certified treatment plants. Growing preference for end-to-end service providers strengthens market consolidation.

Segmentations:

By Waste Type

- Infectious Waste

- Hazardous Waste

- Pharmaceutical Waste

- Radioactive Waste

- General Medical Waste

By Treatment Technology

- Autoclaving

- Incineration

- Chemical Disinfection

- Microwave Treatment

- Plasma-Based Treatment

By Service Type

- Collection

- Transportation

- Storage

- Treatment

- Disposal

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Strong Regulatory Enforcement and Advanced Infrastructure Sustain North America’s Leadership Position

North America maintains a leading share in the medical waste management market due to strict regulatory oversight, well-established healthcare systems, and high adoption of certified treatment technologies. It benefits from strong compliance frameworks enforced by agencies such as the EPA, OSHA, and state-level authorities. Hospitals invest heavily in automated segregation tools, high-efficiency autoclaves, and low-emission incinerators to maintain operational standards. Rising procedural volumes and broader use of disposable medical supplies further increase waste generation across the region. Strong collaboration between healthcare facilities and licensed service providers improves consistency in collection, transport, and final disposal. Growing focus on sustainable waste solutions encourages rapid uptake of non-incineration technologies.

Stringent Environmental Standards Support Europe’s Steady Growth Momentum

Europe demonstrates robust market progression driven by comprehensive waste-handling regulations and high awareness of environmental protection. It benefits from harmonized guidelines implemented across EU member states, which strengthen standardization of segregation and sterilization practices. Healthcare facilities adopt energy-efficient equipment and digital tracking platforms to support compliance with sustainability mandates. Rising investments in hospital modernization increase demand for integrated waste-handling systems. Countries such as Germany, France, and the U.K. lead in advanced treatment adoption due to strong regulatory enforcement and established service networks. Growing preference for low-carbon waste solutions reinforces ongoing technological upgrades across the region.

Rapid Healthcare Expansion and Regulatory Improvements Accelerate Asia-Pacific’s Growth Potential

Asia-Pacific emerges as the fastest-growing region due to expanding healthcare infrastructure, rising patient volumes, and increasing clinical activity. It experiences significant growth in waste output from hospitals, diagnostic centers, and pharmaceutical manufacturing plants. The medical waste management market gains momentum as governments strengthen waste-handling regulations and invest in modern treatment facilities. Adoption of autoclaves, microwave systems, and chemical disinfectors rises across China, India, South Korea, and Southeast Asia. Rising awareness of occupational safety encourages training programs and standardized segregation protocols. Growing urban populations and expanding private healthcare networks drive sustained demand for efficient and scalable waste-management solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The medical waste management market features a competitive landscape dominated by global and regional service providers that invest in advanced treatment technologies and compliant infrastructure. Key companies include REMONDIS SE & Co. KG, Republic Services, Inc., Sharps Compliance, Inc., Stericycle, Inc., Suez Environment, and Veolia. These players strengthen their market positions through strategic partnerships, geographic expansion, and upgrades to energy-efficient and low-emission treatment systems. It supports safer waste handling and improves adherence to strict regulatory standards across healthcare facilities. Leading firms focus on developing integrated service models that cover collection, transport, treatment, and final disposal to deliver reliable end-to-end solutions. Adoption of digital monitoring tools, chain-of-custody platforms, and automated processing technologies enhances operational transparency. Competitive pressure encourages continuous innovation and drives investment in sustainable waste-management infrastructure.

Recent Developments:

- In January 2025, REMONDIS integrated Siemer into its operations as part of its broader expansion strategy in Germany and Europe, focusing on sustainable waste treatment and chemical recycling of waste plastics.

- In November 2025, Veolia announced the acquisition of Clean Earth, a leading U.S. hazardous waste company with 82 locations and over 700 permits, in a $3 billion deal expected to double Veolia’s U.S. footprint and advance its GreenUp strategic plan.

Report Coverage:

The research report offers an in-depth analysis based on Waste Type, Treatment Technology and Service Type. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- Demand for non-incineration and low-emission treatment technologies will strengthen due to rising sustainability mandates.

- Investment in automated segregation, sterilization, and handling systems will increase across hospitals and laboratories.

- Expansion of smart waste tracking platforms will improve transparency and compliance across waste-handling workflows.

- Stricter enforcement of biomedical waste regulations will accelerate upgrades to certified treatment infrastructure.

- Growth in diagnostic services, pharmaceutical production, and outpatient care will elevate medical waste volumes.

- Adoption of decentralized and on-site treatment units will rise in facilities seeking faster processing and lower transport risks.

- Technology partnerships between waste processors and digital solution providers will support data-driven operations.

- Rising focus on occupational safety will drive investment in safer storage, transport, and containment systems.

- Emergence of advanced plasma and microwave technologies will expand opportunities for energy-efficient treatment.

- Growing healthcare modernization in developing economies will strengthen demand for scalable and compliant waste-management solutions.