Market Overview

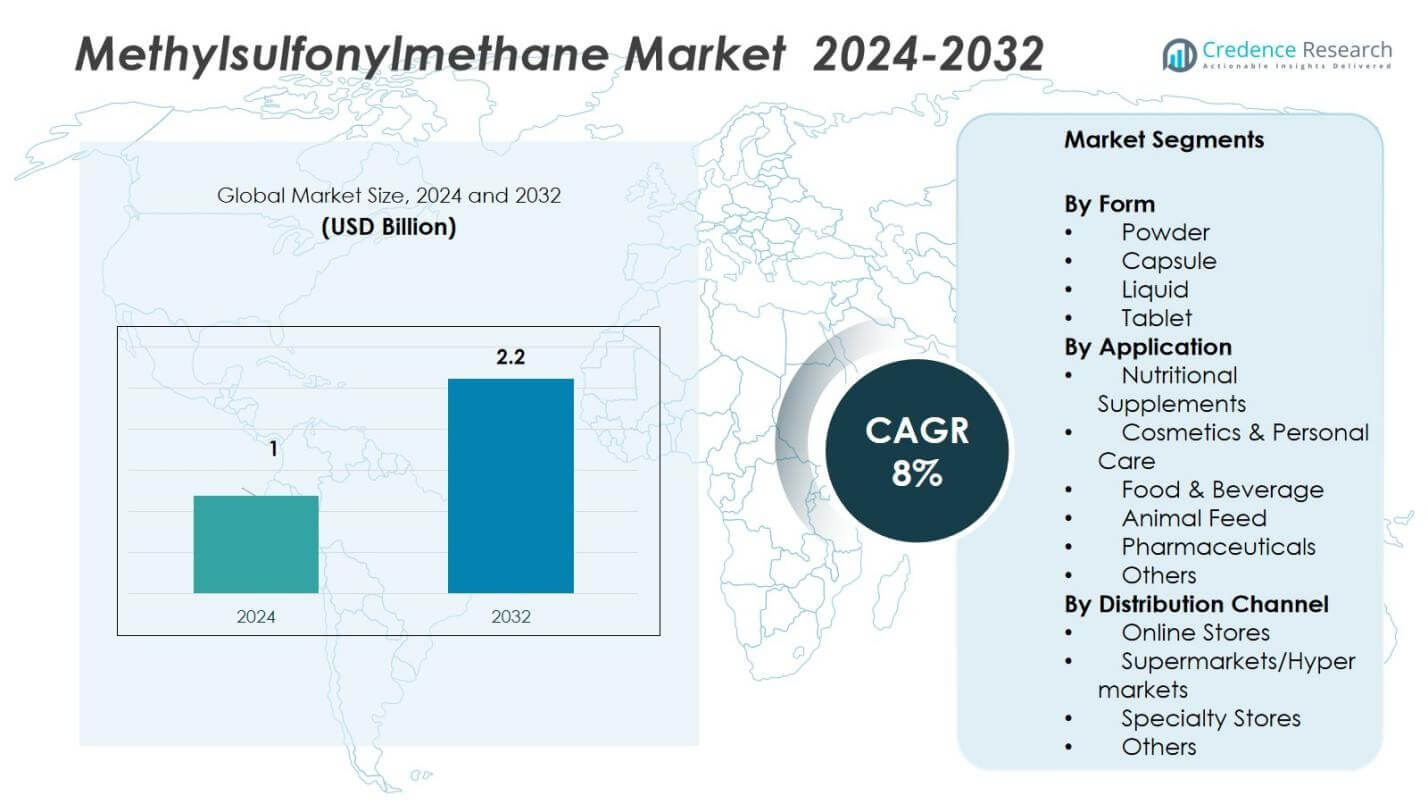

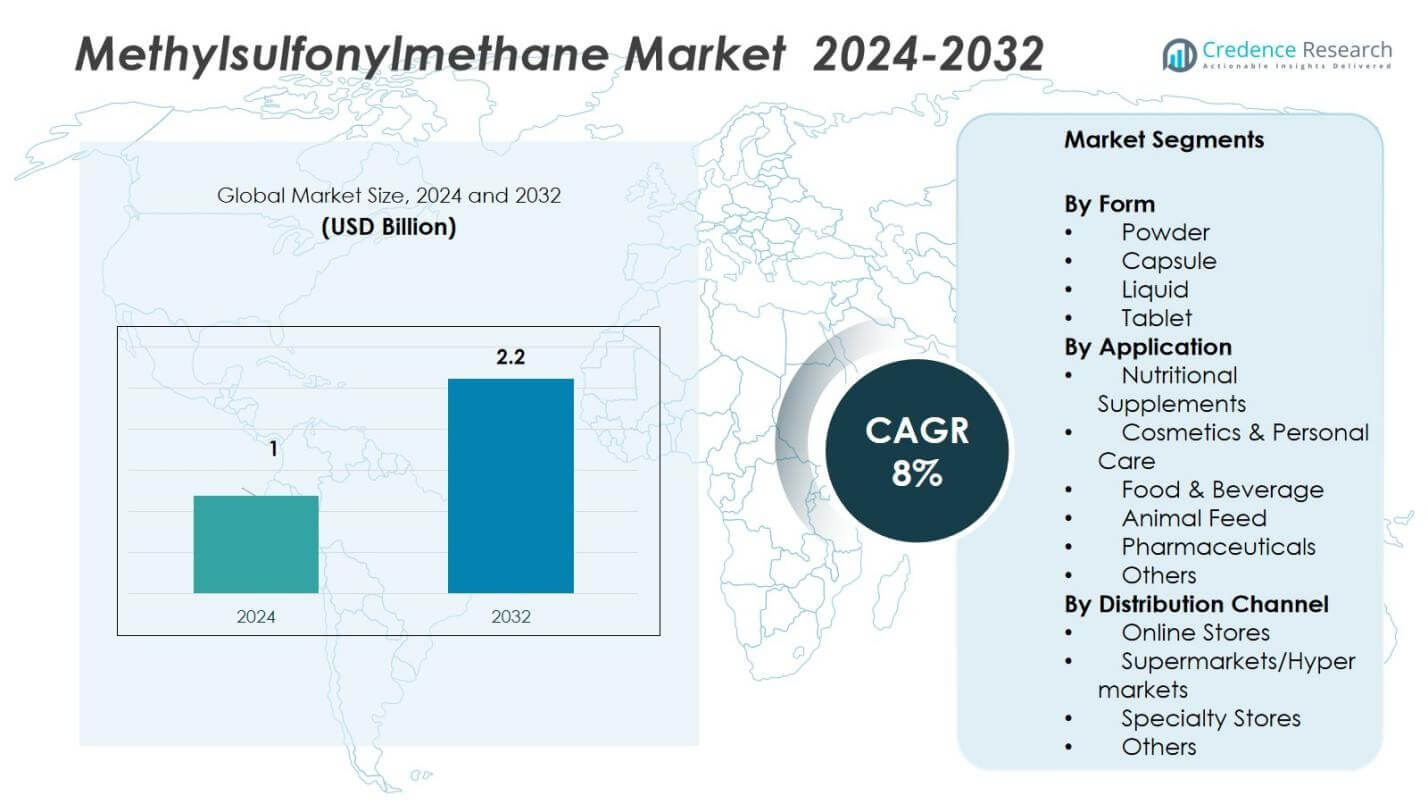

The Methylsulfonylmethane (MSM) Market was valued at USD 1 billion in 2024 and is projected to reach USD 2.22 billion by 2032, growing at a CAGR of 8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Methylsulfonylmethane (MSM) Market Size 2024 |

USD 1 Billion |

| Methylsulfonylmethane (MSM) Market, CAGR |

8% |

| Methylsulfonylmethane (MSM) Market Size 2032 |

USD 2.22 Billion |

The Methylsulfonylmethane (MSM) Market is driven by key players such as Bergstrom Nutrition, Hubei Xingfa Chemicals Group Co., Ltd., ZhuZhou Hansen Chemical Co., Ltd., Panvo Organics Pvt. Ltd., Chaitanya Biologicals Pvt. Ltd., Makana Produktion und Vertrieb GmbH, Yueyang Xiangmao Medicines & Chemicals Co., Ltd., Hangzhou Dakang New Materials Co., Ltd., Vita Flex Nutrition, and Jiangxi Hengxingyuan Technology Co., Ltd. These companies focus on enhancing product purity, expanding production capacity, and developing bio-based MSM formulations to meet global demand across nutraceutical and cosmetic applications. North America leads the global market with 38% share, supported by a mature nutraceutical industry and rising demand for joint health supplements, while Asia-Pacific, holding 22% share, is the fastest-growing region due to increasing consumer awareness and expanding wellness sectors in China, Japan, and India.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Methylsulfonylmethane Market was valued at USD 1 billion in 2024 and is expected to reach USD 2.22 billion by 2032, growing at a CAGR of 8%.

- Growing use of MSM in nutritional supplements drives market growth, supported by its anti-inflammatory and antioxidant benefits that promote joint and muscle health.

- Rising trends in bio-based production and inclusion of MSM in cosmetic formulations for skin repair and anti-aging are boosting global adoption.

- The market is moderately consolidated, with major players such as Bergstrom Nutrition and Hubei Xingfa Chemicals Group Co., Ltd. expanding production capacities to strengthen competitiveness.

- North America leads with 38% share due to a strong nutraceutical base, while Asia-Pacific holds 22% share and records the fastest growth; the powder form dominates with 48% share, followed by nutritional supplements at 52%, reflecting high consumer preference for health-focused MSM applications.

Market Segmentation Analysis:

By Form:

The powder form dominates the Methylsulfonylmethane Market with nearly 48% share in 2024. It is widely preferred for its high solubility, stability, and ease of formulation in dietary supplements and beverages. Powder MSM supports enhanced absorption and versatility in blending with other nutrients. It is also favored in sports nutrition and joint health products for its convenience in dosage customization. Capsules and tablets follow due to consumer preference for ready-to-use formats, while the liquid segment gains steady traction in cosmetic and topical applications for improved skin absorption.

- For instance, NOW Foods offers an MSM powder supplement providing 1,800 mg of pure MSM per half teaspoon serving, allowing flexible dosing for joint health and wellness formulations.

By Application:

The nutritional supplements segment leads the market with approximately 52% share, driven by the growing adoption of MSM in joint health and anti-inflammatory formulations. Increasing consumer focus on natural wellness solutions and aging-related joint disorders boosts demand. The cosmetics and personal care segment is also expanding rapidly due to MSM’s ability to enhance collagen production and skin elasticity. Meanwhile, the food and beverage industry integrates MSM into functional foods, while animal feed and pharmaceutical applications continue to rise due to its proven bioactivity and biocompatibility.

- For instance, Balchem’s OptiMSM® ingredient, approved in Japan for joint health claims, demonstrated that a daily dose of 2,000 mg over 12 weeks improved joint comfort and mobility in individuals with mild knee pain.

By Distribution Channel:

Supermarkets and hypermarkets hold the dominant position with around 40% market share in 2024, owing to their broad product availability and consumer trust in established retail networks. These outlets offer varied MSM-based health supplements and cosmetic formulations under one roof, enhancing accessibility. Online stores are the fastest-growing channel, fueled by e-commerce expansion and preference for doorstep delivery of nutraceutical products. Specialty stores also maintain strong sales, catering to fitness enthusiasts and targeted consumer segments seeking certified organic or premium-grade MSM formulations.

Key Growth Drivers

Rising Demand for Nutraceutical Supplements

The growing use of MSM in nutraceutical products drives market expansion globally. Consumers increasingly seek natural compounds that support joint health, muscle recovery, and overall wellness. MSM’s anti-inflammatory and antioxidant properties make it a preferred ingredient in dietary supplements. Expanding geriatric populations and higher fitness awareness also strengthen its adoption. For instance, many supplement brands now include MSM alongside glucosamine and chondroitin, reinforcing its role in preventive healthcare and performance enhancement.

- For instance ,OptiMSM®, a premium MSM form, in Chosen TOR Bright Low Sugar OptiMSM Powder, designed to reduce inflammation and support joint flexibility and recovery in active individuals.

Expansion in Cosmetics and Personal Care Applications

MSM’s ability to improve skin elasticity and reduce oxidative stress has elevated its use in skincare and cosmetic formulations. The compound enhances collagen production, promoting anti-aging and skin-repair benefits. Major cosmetic manufacturers are introducing MSM-infused creams, serums, and hair products to cater to clean beauty trends. The growing consumer shift toward natural and bio-based ingredients continues to propel this segment, positioning MSM as a high-value additive in premium skincare and personal care solutions.

- For instance, Bellajade Botanicals recently launched a Setting Spray infused with MSM, specifically designed to strengthen skin and hair, aligning with clean beauty principles and consumer demand for natural ingredient formulations.

Increasing Use in Veterinary and Animal Nutrition

The animal feed industry increasingly integrates MSM for its role in improving mobility, immune strength, and recovery in livestock and pets. MSM’s bioactive sulfur content supports healthy joint cartilage and reduces inflammation in performance animals. Rising pet ownership and greater attention to animal wellness further contribute to its growing use. Manufacturers are also developing specialized formulations targeting horses and aging pets, reflecting a broader shift toward natural, safe, and nutritionally efficient feed additives.

Key Trends & Opportunities

Adoption of Sustainable and Bio-Based Production Processes

Manufacturers are focusing on sustainable MSM synthesis methods using green chemistry and renewable raw materials. The shift from petrochemical-based to bio-based production reduces environmental impact and appeals to eco-conscious consumers. Companies investing in clean extraction technologies also benefit from regulatory support favoring sustainable manufacturing. This trend offers an opportunity for market players to differentiate through environmental stewardship and supply chain transparency, aligning with global sustainability commitments in health and wellness industries.

- For instance, Arkema has developed bio-based polymers and renewable materials using green chemistry principles, integrating resource efficiency and waste reduction across its supply chain.

Integration into Functional Food and Beverage Products

MSM is increasingly incorporated into fortified beverages, protein powders, and functional foods targeting joint and muscle recovery. This trend reflects the convergence of nutrition and wellness, where consumers prefer ingestible formats for daily health benefits. Food manufacturers are exploring innovative delivery systems to enhance MSM’s stability and bioavailability. The growing popularity of health drinks and fortified snacks presents a strong growth opportunity for MSM producers to tap into expanding functional nutrition markets.

- For instance, Balchem Corporation introduced MSM formulations specifically designed for sports nutrition products to support joint mobility and promote muscle recovery, emphasizing MSM’s role in athletic performance supplements.

Key Challenges

Quality and Purity Standardization Issues

Variations in MSM quality across suppliers pose challenges to product consistency and efficacy. The absence of uniform global standards leads to discrepancies in purity levels and contaminant presence. This affects consumer trust and brand reliability, particularly in the supplement and cosmetic sectors. Regulatory bodies are increasingly emphasizing testing and certification to address this issue. Manufacturers must invest in advanced purification technologies and transparent quality assurance processes to maintain competitiveness in regulated markets.

Limited Consumer Awareness in Emerging Economies

Despite rising health trends, MSM awareness remains low in developing regions. Many consumers lack understanding of its benefits in joint health, skincare, and dietary support. Limited marketing and education campaigns further restrict its penetration in Asia-Pacific, Latin America, and Africa. This lack of awareness slows adoption rates outside mature markets. To overcome this barrier, companies must invest in targeted outreach, collaborations with healthcare professionals, and localized product strategies to build consumer trust and demand.

Regional Analysis

North America

North America leads the Methylsulfonylmethane Market with 38% share in 2024, driven by the strong presence of dietary supplement manufacturers and high consumer preference for natural health products. The U.S. dominates regional demand due to its advanced nutraceutical sector and widespread awareness of joint and skin health benefits. Continuous product innovation and inclusion of MSM in sports nutrition and anti-aging formulations further support growth. Strategic collaborations among leading brands and a mature distribution network through pharmacies and online channels sustain the region’s leadership position.

Europe

Europe accounts for 27% share of the Methylsulfonylmethane Market, supported by rising adoption of clean-label supplements and eco-friendly cosmetics. Countries such as Germany, the U.K., and France lead the region’s demand due to strong consumer focus on natural ingredients and sustainable formulations. Regulatory compliance with REACH and EFSA guidelines ensures high-quality MSM supply. Increased investment in research and development, especially in pharmaceutical and personal care applications, enhances product penetration. Growing interest in vegan and organic dietary supplements also strengthens regional market growth.

Asia-Pacific

Asia-Pacific holds 22% market share and is the fastest-growing region, propelled by expanding health and wellness industries in China, Japan, and India. Rising disposable incomes, growing aging populations, and a shift toward preventive healthcare drive market expansion. Local producers increasingly focus on affordable MSM formulations for dietary and cosmetic use. Japan’s advanced beauty market and China’s large nutraceutical base contribute significantly to demand. Expanding e-commerce platforms, coupled with growing awareness about MSM’s benefits in joint mobility and skin health, reinforce regional growth momentum.

Latin America

Latin America captures 8% share of the global Methylsulfonylmethane Market, with Brazil and Mexico serving as major consumption hubs. The growing nutraceutical and animal feed sectors contribute to steady demand. Increasing adoption of MSM-based supplements among fitness enthusiasts and aging populations supports market penetration. However, limited consumer awareness and price sensitivity restrain faster adoption. Strategic marketing campaigns and partnerships with local distributors are improving accessibility, while the shift toward natural health solutions positions the region for moderate long-term growth.

Middle East & Africa

The Middle East & Africa region accounts for 5% market share, supported by rising interest in health and wellness products across the UAE, Saudi Arabia, and South Africa. Expanding retail networks and the introduction of MSM-based nutraceuticals are driving gradual adoption. Increased urbanization and a growing middle-class population fuel demand for functional supplements and personal care products. However, limited local manufacturing capacity and import dependence pose challenges. International players entering through partnerships and online platforms are expected to enhance MSM availability and market growth in coming years.

Market Segmentations:

By Form

- Powder

- Capsule

- Liquid

- Tablet

By Application

- Nutritional Supplements

- Cosmetics & Personal Care

- Food & Beverage

- Animal Feed

- Pharmaceuticals

- Others

By Distribution Channel

- Online Stores

- Supermarkets/Hypermarkets

- Specialty Stores

- Others

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Methylsulfonylmethane Market includes major players such as Bergstrom Nutrition, Hubei Xingfa Chemicals Group Co., Ltd., Vita Flex Nutrition, ZhuZhou Hansen Chemical Co., Ltd., Chaitanya Biologicals Pvt. Ltd., Makana Produktion und Vertrieb GmbH, Yueyang Xiangmao Medicines & Chemicals Co., Ltd., Panvo Organics Pvt. Ltd., Hangzhou Dakang New Materials Co., Ltd., and Jiangxi Hengxingyuan Technology Co., Ltd. The market is moderately consolidated, with leading companies focusing on expanding production capacities and enhancing purity standards to maintain their competitive edge. Strategic collaborations with nutraceutical and cosmetic brands are common to strengthen supply networks and product visibility. Continuous innovation in bio-based manufacturing and formulation technology drives differentiation. Companies are also emphasizing sustainable practices and certifications such as ISO and GMP to appeal to health-conscious consumers. Emerging players in Asia-Pacific are gaining traction by offering cost-effective MSM solutions, fostering competition across global markets.

Key Player Analysis

- ZhuZhou Hansen Chemical Co., Ltd.

- Panvo Organics Pvt. Ltd.

- Hubei Xingfa Chemicals Group Co., Ltd.

- Yueyang Xiangmao Medicines & Chemicals Co., Ltd.

- Chaitanya Biologicals Pvt. Ltd.

- Makana Produktion und Vertrieb GmbH

- Bergstrom Nutrition

- Hangzhou Dakang New Materials Co., Ltd.

- Vita Flex Nutrition

- Jiangxi Hengxingyuan Technology Co., Ltd.

Recent Developments

- In June 2025, Balchem Corporation’s branded MSM, OptiMSM®, received approval from Japan’s Consumer Affairs Agency as a Food with Functional Claims (FFC).

- In September 2025, Balchem announced a clinical study with University of North Texas showing that MSM at 1 g/day supported post‑exercise recovery and immune response, signaling expanded use in sports nutrition applications.

- In August 2025, Foodcom S.A. (Poland) launched a new MSM supplement for joints, immunity, skin, hair and nails, manufactured from certified raw materials in‑house.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Form, Application, Distribution Channel and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for MSM-based nutraceuticals will continue rising due to increasing focus on preventive healthcare.

- Growth in cosmetic formulations with MSM will strengthen as natural and anti-aging products gain popularity.

- Adoption of bio-based and sustainable MSM production methods will expand across manufacturing facilities.

- Partnerships between supplement brands and MSM producers will enhance product diversification and global reach.

- Online retail channels will play a larger role in distribution, improving accessibility and consumer awareness.

- Pharmaceutical applications of MSM will grow, supported by clinical research on anti-inflammatory benefits.

- Rising pet health awareness will drive higher use of MSM in veterinary nutrition and feed additives.

- Asia-Pacific will emerge as the fastest-growing market due to expanding wellness and beauty sectors.

- Continuous product innovation will lead to new MSM blends targeting joint, skin, and immune health.

- Regulatory standardization and quality certifications will shape market competitiveness and consumer trust globally.