Market Overview

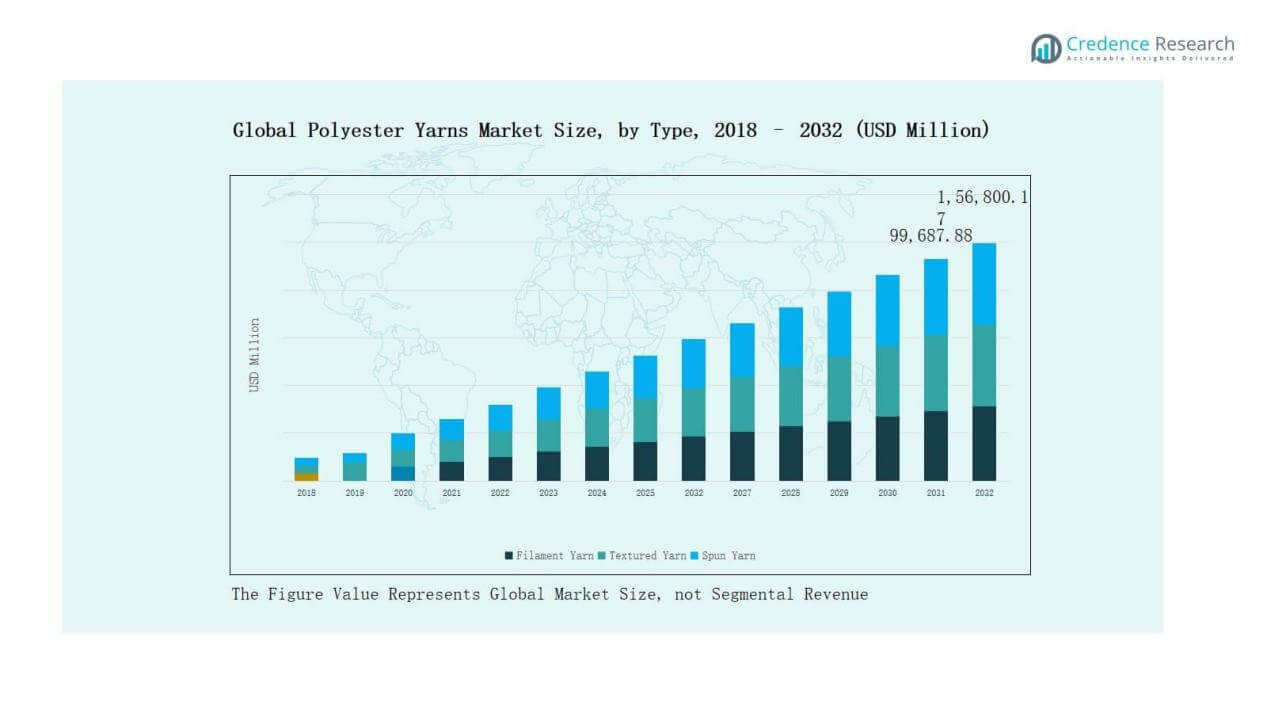

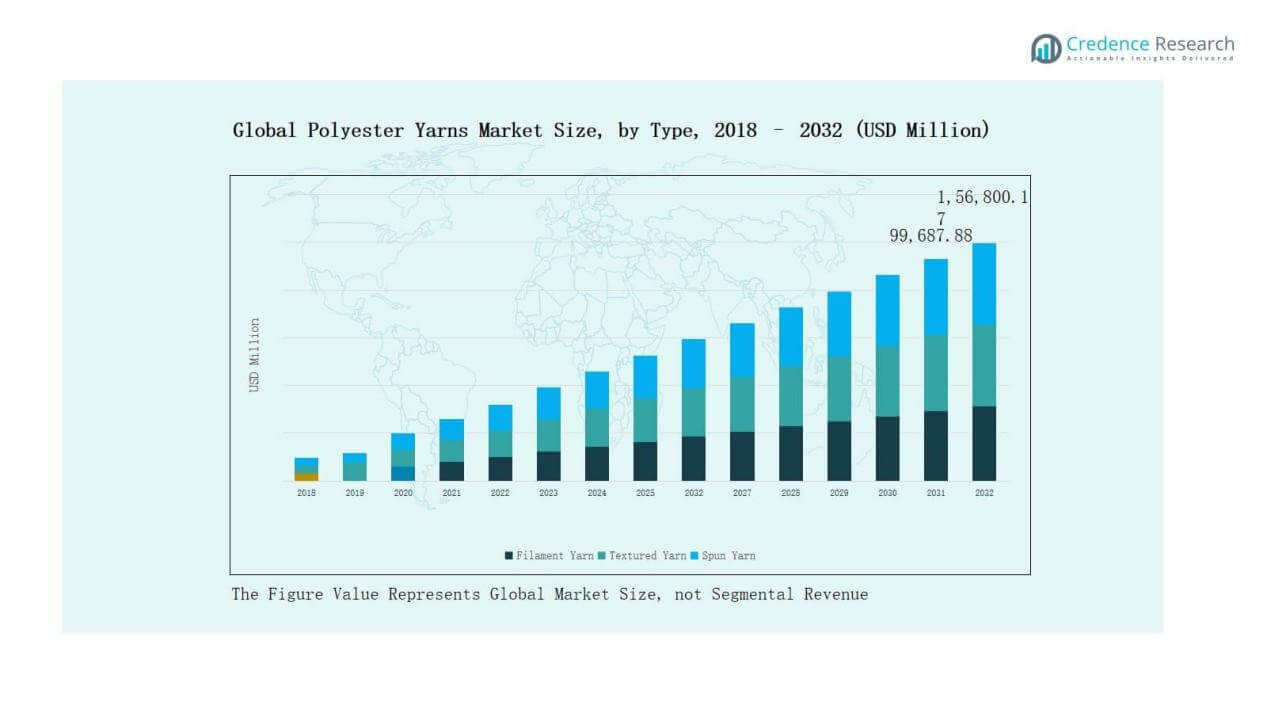

Global Polyester Yarns Market size was valued at USD 71,521.0 million in 2018 to USD 99,687.9 million in 2024 and is anticipated to reach USD 1,56,800.2 million by 2032, at a CAGR of 5.85% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Polyester Yarns Market Size 2024 |

USD 99,687.9 Million |

| Polyester Yarns Market, CAGR |

5.85% |

| Polyester Yarns Market Size 2032 |

USD 1,56,800.2 Million |

The Global Polyester Yarns Market is shaped by major players such as Reliance Industries Limited, Indorama Corporation, Toray Chemical Korea, Teijin Frontier, Alpek, Huvis Corporation, W. Barnet GmbH, Hubei Botao Synthetic Fiber, and Sateri International Co. Ltd. These companies leverage large-scale production, integrated supply chains, and sustainability-focused innovations to strengthen their market positions. Reliance and Indorama lead with extensive global operations and diversified product portfolios, while Toray and Teijin emphasize advanced textile applications. Regionally, Asia Pacific dominated the market in 2024 with a 31% share, driven by robust textile manufacturing capacity, rising domestic demand, and strong export competitiveness.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Global Polyester Yarns Market grew from USD 71,521.0 million in 2018 to USD 99,687.9 million in 2024 and is projected to reach USD 1,56,800.2 million by 2032, expanding at a CAGR of 5.85%.

- Filament yarn led with 46% share in 2024, followed by textured yarn at 34% and spun yarn at 20%, supported by growing use in apparel, sportswear, and blended fabrics.

- Clothing dominated with 41% share in 2024, followed by home furnishing at 21% and automotive fabrics at 14%, while industrial fabrics, packaging, and niche applications accounted for the remainder.

- Asia Pacific commanded 31% of the market in 2024, driven by large-scale textile manufacturing, strong domestic demand, and export competitiveness, while Europe held 25% and North America 19%.

- Key players such as Reliance Industries, Indorama, Toray, Teijin, Alpek, Huvis, and Sateri strengthened their positions through large-scale production, integrated supply chains, and sustainability-driven innovations.

Market Segment Insights

Market Segment Insights

By Type

Filament yarn accounted for the dominant share of around 46% in 2024, driven by its strength, smooth texture, and wide adoption in apparel and home textiles. Textured yarn followed with nearly 34% share, benefiting from high elasticity and versatility in sportswear and automotive fabrics. Spun yarn contributed about 20% share, supported by cost-effectiveness and strong uptake in blended fabrics. Demand across all types is further fueled by rising consumption in emerging economies and continuous textile innovation.

For instance, Reliance Industries introduced eco-friendly R|Elan™ GreenGold filament yarn, made from 100% post-consumer PET bottles, targeting apparel brands with sustainable solutions.

By Application

Clothing remained the leading application with about 41% market share in 2024, driven by fast fashion, rising disposable income, and demand for wrinkle-resistant fabrics. Home furnishing held nearly 21% share, supported by growth in upholstery, curtains, and decorative textiles. Automotive fabrics captured 14% share, benefiting from rising vehicle production and demand for durable, lightweight interior materials. Industrial fabrics contributed 9%, led by usage in conveyor belts, ropes, and filtration. Packaging followed with 6% share, supported by increasing demand for polyester-based flexible packaging. Electrical insulation and recording tapes together represented nearly 5%, while other niche applications held the remaining 4%, reflecting growing product diversification.

For instance, Trevira GmbH, a subsidiary of Indorama, introduced its flame-retardant polyester fibers for home textiles and upholstery, reflecting growing demand in the furnishing segment.

Key Growth Drivers

Rising Demand in Apparel and Fashion Industry

The apparel sector remains the largest consumer of polyester yarns, accounting for a significant share of global demand. Fast fashion trends, combined with rising disposable incomes in emerging markets, continue to drive consumption of cost-effective and durable fabrics. Polyester yarns are favored for wrinkle resistance, washability, and versatility, making them a staple in clothing production. Increasing penetration of e-commerce and affordable garment availability further amplify demand, positioning apparel as a primary driver of market expansion over the forecast period.

For instance, Hyosung offers sustainable, high-tenacity polyester yarns for activewear and fashion brands. This includes their regen™ recycled fiber and newer textile-to-textile recycled innovations.

Expansion in Home Furnishing and Interior Applications

The growing home furnishing industry is creating strong opportunities for polyester yarns in upholstery, carpets, curtains, and decorative fabrics. Rising urbanization and housing construction in Asia-Pacific and the Middle East have expanded consumption, as polyester provides durability and easy maintenance. Shifting consumer preferences toward stylish, affordable, and long-lasting home décor products reinforce this demand. Additionally, polyester’s ability to blend with other fibers enhances design flexibility, making it suitable for both premium and mass-market furnishing segments, boosting its long-term growth trajectory.

For instance, Devika Fibres, a leading polyester yarn manufacturer in India, supplies high-quality polyester yarn blends used extensively in curtains and upholstery that enhance durability and aesthetic appeal in home décor.

Automotive Sector Integration for Lightweight Materials

The automotive industry increasingly adopts polyester yarns for seat covers, headliners, airbags, and insulation, supporting lightweight design goals. Rising vehicle production and demand for durable, cost-efficient, and abrasion-resistant fabrics strengthen adoption. The shift toward electric vehicles further amplifies demand, as lightweight polyester-based fabrics contribute to energy efficiency and interior aesthetics. Automakers prefer polyester yarns for their recyclability and consistent quality, aligning with sustainability initiatives. This strong alignment with automotive innovation ensures polyester yarns remain vital in supporting mobility solutions and global automotive supply chains.

Key Trends & Opportunities

Shift Toward Sustainable and Recycled Polyester Yarns

Sustainability is shaping the polyester yarn market, with manufacturers increasing their focus on recycled yarns derived from PET bottles and textile waste. Consumer awareness of eco-friendly textiles and corporate commitments to reduce carbon footprints accelerate this trend. Brands across fashion and automotive sectors are integrating recycled polyester into product lines to meet regulatory and consumer expectations. This shift presents an opportunity for innovation in bio-based polyester blends and circular economy models, creating long-term market differentiation and competitive advantages for forward-looking players.

For instance, in April 2025, KS Spinning Mills highlighted that their recycled polyester yarn, sourced from post-consumer plastic bottles, offers durability comparable to traditional yarn while significantly reducing water and energy consumption during production.

Technological Advancements in Yarn Processing

Ongoing innovations in yarn spinning and texturizing technologies are enhancing product quality, strength, and design flexibility. Advanced processing methods enable improved moisture-wicking, softness, and color fastness, meeting the performance requirements of sportswear, industrial fabrics, and technical textiles. Automation and smart manufacturing solutions reduce costs while boosting efficiency, making polyester yarn production more competitive. These advancements also allow producers to meet rising customization demands across apparel, home furnishings, and industrial applications, unlocking opportunities for higher-margin segments and diversified end-use industries worldwide.

For instance, Trützschler introduced its new TC 30i carding machine featuring self-optimizing technologies, which enhance yarn evenness and reduce raw material consumption by up to 2%.

Key Challenges

Key Challenges

Fluctuating Raw Material Prices

Polyester yarn production is heavily dependent on petrochemical feedstocks such as purified terephthalic acid (PTA) and monoethylene glycol (MEG). Volatility in crude oil prices directly impacts production costs, creating uncertainty for manufacturers. Price fluctuations also pressure profit margins, especially for small- and medium-scale producers competing in highly price-sensitive markets. The inability to pass on increased costs to end consumers in competitive segments such as clothing and packaging remains a major challenge. Stable raw material supply and cost management strategies are critical for sustaining growth.

Environmental Concerns and Regulations

Despite its widespread usage, polyester faces scrutiny due to non-biodegradability and its role in microplastic pollution. Rising environmental concerns are driving stricter regulations on plastic-based materials, particularly in Europe and North America. Consumers increasingly demand sustainable alternatives, pressuring producers to shift toward recycled or bio-based yarns. Meeting regulatory requirements and investing in sustainable innovation increase operational costs, posing challenges for low-cost manufacturers. Balancing environmental responsibility with market competitiveness remains one of the toughest hurdles for polyester yarn producers globally.

Intense Market Competition

The polyester yarns market is highly fragmented, with global giants competing alongside regional and local players. Price wars are common, particularly in Asia-Pacific, where large-scale production capacities exert downward pressure on margins. Differentiating products in such a commoditized environment remains challenging, especially for producers lacking strong R&D or brand visibility. While demand continues to rise, the abundance of suppliers and limited product differentiation constrain profitability. Companies must adopt strategies such as vertical integration, product innovation, or sustainability branding to maintain competitiveness.

Regional Analysis

North America

North America generated USD 15,820.44 million in 2018, increasing to USD 21,572.46 million in 2024, and is projected to reach USD 32,928.04 million by 2032 at a CAGR of 5.5%. The region represented about 19% of the global share in 2024, supported by high consumption in clothing, home furnishing, and automotive fabrics. The U.S. dominates regional demand, fueled by strong apparel imports and growing adoption of technical textiles. Rising focus on sustainability and recycled polyester further drives market growth, while innovation in industrial fabrics enhances future opportunities.

Europe

Europe was valued at USD 20,054.49 million in 2018, rising to USD 28,687.32 million in 2024, with forecasts of USD 46,663.73 million by 2032 at a CAGR of 6.3%. Holding nearly 25% share of the global market in 2024, Europe benefits from a strong fashion industry, technical textiles, and home furnishing demand. Germany, Italy, and France lead consumption, while eco-regulations accelerate the transition toward recycled polyester. Continuous investments in sustainable innovations and automotive textile applications further strengthen Europe’s role as a key market for polyester yarns.

Asia Pacific

Asia Pacific recorded USD 24,467.33 million in 2018, expanding to USD 34,769.71 million in 2024, and is expected to reach USD 56,087.42 million by 2032, registering a CAGR of 6.2%. The region held the largest global share of about 31% in 2024, driven by China, India, and Southeast Asia. Strong textile production capacity, rising disposable incomes, and robust demand in apparel and home furnishings fuel dominance. Export competitiveness and government support for manufacturing further position Asia Pacific as the central hub for polyester yarn production and consumption globally.

Latin America

Latin America generated USD 5,643.01 million in 2018, reaching USD 7,677.39 million in 2024, and is projected to grow to USD 11,681.61 million by 2032 at a CAGR of 5.4%. The region accounted for about 7% share in 2024, led by Brazil and Argentina. Rising middle-class incomes, expansion of fast fashion, and growing home furnishing industries stimulate polyester yarn demand. Although production is limited, increasing imports and regional distribution partnerships are enhancing market access, making Latin America an attractive growth region for global players.

Middle East

The Middle East market was valued at USD 3,104.01 million in 2018, rising to USD 3,993.21 million in 2024, with projections of USD 5,582.09 million by 2032 at a CAGR of 4.3%. Holding about 3% of the global share in 2024, demand is concentrated in GCC countries. Growth is driven by rising construction, luxury home décor, and automotive textiles. Imports dominate the supply chain due to limited domestic production, though sustainability initiatives and demand for technical fabrics are creating new opportunities across the region.

Africa

Africa was valued at USD 2,431.71 million in 2018, reaching USD 2,987.79 million in 2024, and is expected to grow to USD 3,857.28 million by 2032 at a CAGR of 3.2%. With around 2.6% market share in 2024, Africa remains the smallest contributor to global polyester yarn demand. South Africa and Egypt dominate consumption, primarily in clothing and packaging applications. Reliance on imports and limited textile capacity restrict growth, though urbanization and population expansion create long-term potential. Global players are targeting the region as an emerging market for low-cost apparel and industrial fabrics.

Market Segmentations:

Market Segmentations:

By Type

- Filament Yarn

- Textured Yarn

- Spun Yarn

By Application

- Clothing

- Home Furnishing

- Automotive Fabrics

- Recording Tapes

- Industrial Fabrics

- Electrical Insulation

- Packaging

- Others

By Region

North America

Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

Latin America

- Brazil

- Argentina

- Rest of Latin America

Middle East

- GCC Countries

- Israel

- Turkey

- Rest of Middle East

Africa

- South Africa

- Egypt

- Rest of Africa

Competitive Landscape

The global polyester yarns market is highly competitive, characterized by the presence of multinational corporations and regional players that focus on large-scale production, product innovation, and sustainability initiatives. Leading companies such as Reliance Industries Limited, Indorama Corporation, Toray Chemical Korea, Teijin Frontier, and Alpek dominate the market with integrated supply chains, strong financial capabilities, and broad distribution networks. These players prioritize capacity expansion and vertical integration to secure raw material availability and cost competitiveness. Regional companies, including Huvis Corporation, W. Barnet GmbH, and Hubei Botao Synthetic Fiber, strengthen their positions by catering to local demand and offering customized products. Intense competition drives price pressure, especially in Asia-Pacific, where overcapacity is common. However, differentiation through recycled and bio-based yarns is emerging as a key strategy to align with sustainability goals and regulatory demands. Strategic collaborations, technological advancements in yarn processing, and mergers and acquisitions continue to shape the competitive dynamics of the market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Sateri International Co. Ltd.

- XINDA Corp.

- TEIJIN FRONTIER Co. Ltd.

- Hubei Botao Synthetic Fiber Co., Ltd.

- Barnet GmbH & Co. KG

- Toray Chemical Korea, Inc.

- Reliance Industries Limited

- Alpek, S.A.B. de C.V.

- Huvis Corporation

- Diuou Fibre (M) Sdn Bhd

- Indorama Corporation

- Others

Recent Developments

- In July 2025, Loop Industries introduced Twist™, a high-performance, fully traceable textile-to-textile polyester resin brand.

- In April 2025, Reju partnered with Utexa in Central America and Antex in Europe to validate REJU Polyester™ for multifilament yarn production.

- In early 2025, Jiwarajka partnered with CiCLO® to advance eco-conscious textiles by enabling synthetic fibers, including polyester yarns, to biodegrade naturally.

- In May 2025, HUGO BOSS launched NovaPoly, a recycled polyester yarn co-developed with chemical recycling suppliers.

Report Coverage

The research report offers an in-depth analysis based on Type, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for polyester yarns will expand with the growth of fast fashion worldwide.

- Recycled and bio-based yarns will gain wider acceptance across apparel and home textiles.

- Asia Pacific will continue to dominate as the primary hub for production and exports.

- Europe will lead adoption of sustainable yarns driven by strict environmental regulations.

- North America will see rising demand for technical textiles in automotive and industrial uses.

- Latin America will emerge as a growing consumer market due to middle-class expansion.

- The Middle East will experience steady uptake in home furnishings and construction-related fabrics.

- Africa will present long-term opportunities with increasing urbanization and population growth.

- Technological advances in yarn spinning and texturizing will improve product performance.

- Strategic partnerships and mergers will shape competitive positioning in the global market.

Market Segment Insights

Market Segment Insights Key Challenges

Key Challenges Market Segmentations:

Market Segmentations: