Market Overview

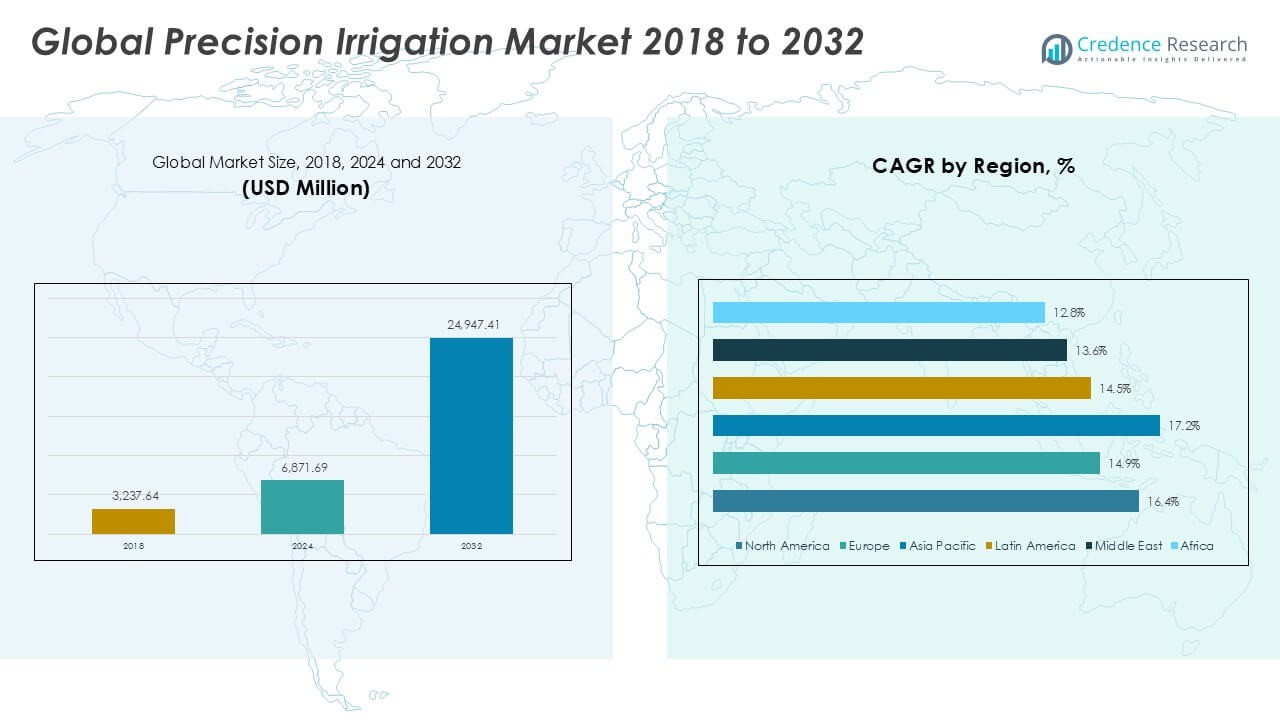

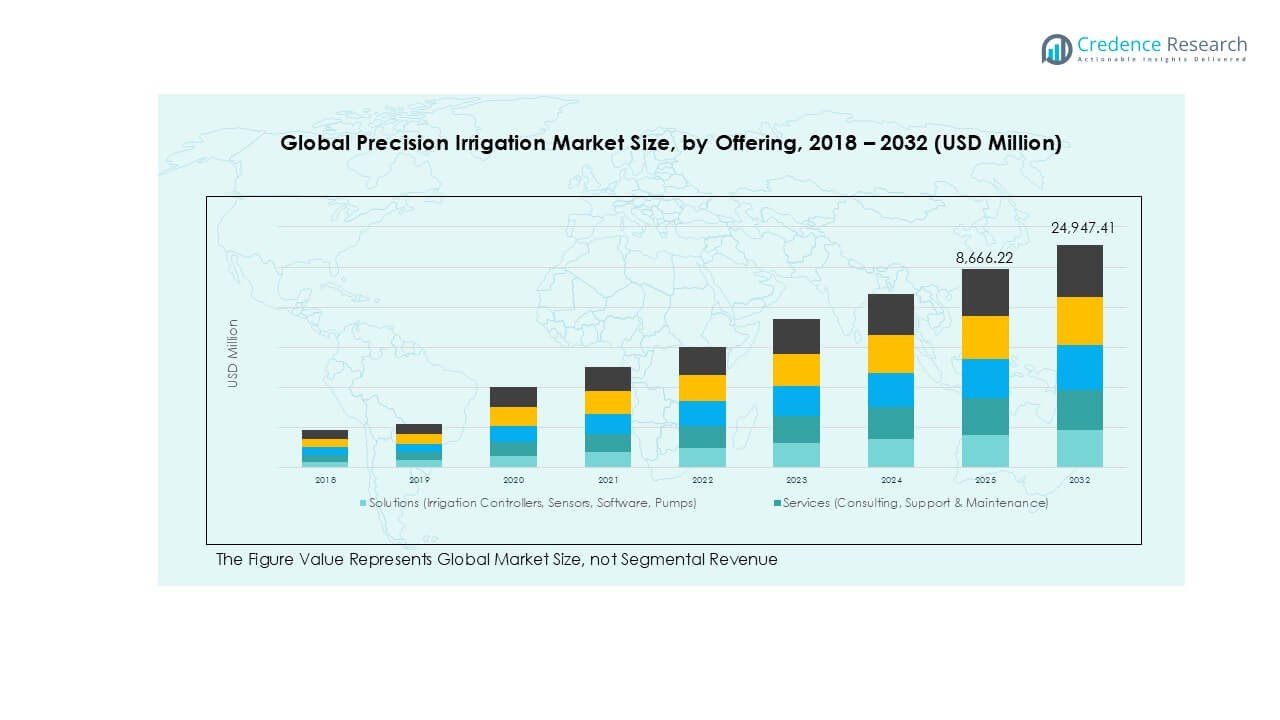

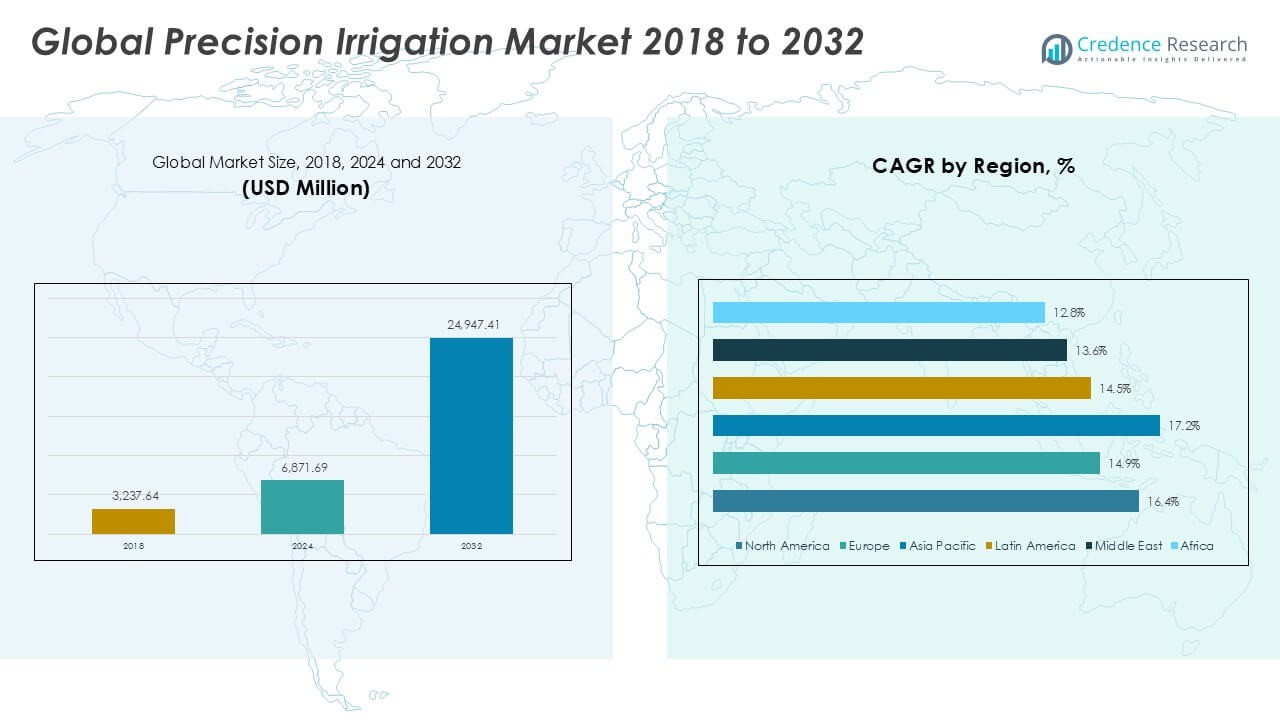

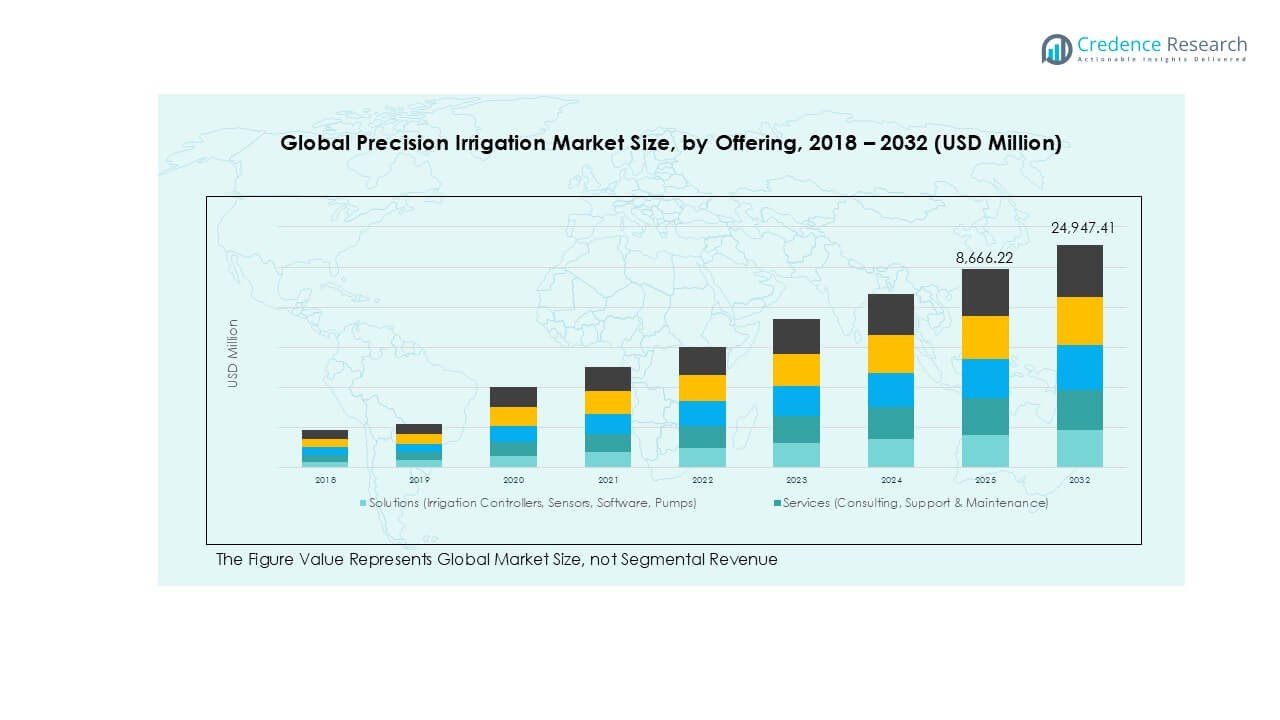

Global Precision Irrigation Market size was valued at USD 3,237.64 million in 2018 to USD 6,871.69 million in 2024 and is anticipated to reach USD 24,947.41 million by 2032, at a CAGR of 16.31% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Precision Irrigation Market Size 2024 |

USD 6,871.69 Million |

| Precision Irrigation Market, CAGR |

16.31% |

| Precision Irrigation Market Size 2032 |

USD 24,947.41 Million |

The global precision irrigation market is shaped by key players such as Netafim Limited, Deere & Company, Jain Irrigation Systems Ltd., Lindsay Corporation, Nelson Irrigation Corporation, The Toro Company, Valmont Industries, T-L Irrigation Co., Saturas Ltd., and Viridix Ltd. These companies lead through advanced drip systems, smart controllers, and IoT-enabled platforms that enhance water efficiency and crop yields. Asia Pacific holds the largest share, accounting for 38.7% of the global market in 2024, driven by extensive agricultural activity and government-backed micro-irrigation programs. North America follows with 28.7% share, supported by strong adoption of automation and sustainability initiatives, while Europe contributes 19.3%, emphasizing compliance with strict water-use regulations.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Global Precision Irrigation Market was valued at USD 6,871.69 million in 2024 and is projected to reach USD 24,947.41 million by 2032, growing at a CAGR of 16.31%.

- Rising need for water conservation and food security drives adoption of advanced drip and sprinkler systems, with solutions such as controllers and sensors holding the largest segment share.

- Integration of IoT, AI, and automation in irrigation systems is a key trend, enabling real-time monitoring, predictive analytics, and improved crop yield management.

- The market is competitive with leading players including Netafim, Deere & Company, Jain Irrigation Systems, Lindsay Corporation, Toro, and Valmont Industries focusing on innovation, partnerships, and smart farm solutions.

- Asia Pacific leads with 38.7% share, followed by North America at 28.7% and Europe at 19.3%, while drip irrigation dominates irrigation type, supported by government subsidies and efficiency-focused farming practices.

Market Segmentation Analysis:

By Offering

The global precision irrigation market by offering is divided into solutions and services. Solutions dominate the segment, holding the largest market share due to widespread adoption of irrigation controllers, sensors, software, and pumps. Farmers rely on these technologies to automate water distribution, reduce resource waste, and improve crop yields. The adoption of smart sensors and advanced software platforms enables real-time monitoring and precise decision-making. Services such as consulting and maintenance support market growth, but solutions remain the dominant category driven by rising demand for digital agriculture tools.

- For instance, Valmont Industries’ Valley 365 platform integrates data from more than 90,000 connected irrigation machines worldwide, enabling field-level insights and automated water scheduling.

By Application

Agricultural fields represent the leading application segment in the precision irrigation market, accounting for the largest share. Large-scale adoption stems from the growing need to optimize water use in crop cultivation and meet food security demands. Precision irrigation in agricultural fields helps reduce water wastage while improving soil moisture management. Landscape and turf irrigation, greenhouse irrigation, and residential lawns follow, but their adoption is relatively smaller. Strong government support for efficient irrigation in farming and the push toward sustainable agricultural practices drive the dominance of agricultural fields.

- For instance, Netafim has deployed over 10 million hectares of precision irrigation systems globally, with projects saving up to 1.4 billion cubic meters of water annually in agricultural fields.

By Irrigation Type

Drip irrigation dominates the market by irrigation type, capturing the largest share due to its efficiency in water delivery directly to plant roots. This method significantly reduces evaporation losses and enhances nutrient absorption, making it highly suitable for field crops, orchards, and vineyards. Sprinkler irrigation remains popular for large-scale farming, while surface irrigation has a declining share due to inefficiencies. Increasing awareness of water conservation, coupled with government incentives for drip systems, drives strong adoption. Farmers recognize drip irrigation as the most effective solution to maximize yields with minimal water usage.

Key Growth Drivers

Rising Need for Water Conservation

Water scarcity is a growing global concern, driving adoption of precision irrigation systems. Farmers and growers turn to smart irrigation tools to reduce water waste and ensure sustainability. Precision technologies like drip and sensor-based irrigation help deliver water directly to plant roots, minimizing losses. Governments worldwide support efficient irrigation through subsidies and regulations promoting water management. This demand for resource-efficient farming practices positions precision irrigation as a critical solution to meet future agricultural productivity and sustainability goals while addressing pressing environmental challenges.

- For instance, Netafim’s drip irrigation solutions have saved more than 40% of water usage across 17 million hectares of farmland worldwide, covering over 110 countries.

Technological Advancements in Smart Farming

Advances in IoT, AI, and automation strongly support growth in the precision irrigation market. Smart sensors, wireless controllers, and advanced software platforms enable real-time monitoring of soil moisture and weather conditions. These innovations improve irrigation scheduling and reduce manual intervention. Integration with data analytics platforms allows predictive decision-making, enhancing crop yield and resource efficiency. As digital agriculture continues expanding, precision irrigation technologies gain stronger adoption. Farmers increasingly view these tools as vital to achieving higher profitability, sustainability, and operational efficiency in modern farming.

- For instance, Lindsay Corporation’s FieldNET platform provides remote monitoring and control of irrigation systems in over 90 countries. Together with its Zimmatic irrigation systems, Lindsay’s products irrigate approximately 4.8 million hectares (12 million acres) globally.

Expanding Demand for High-Value Crops

The shift toward cultivating fruits, vegetables, orchards, and vineyards supports market growth. High-value crops require consistent water supply and careful monitoring, which precision irrigation systems efficiently provide. Farmers adopt drip and micro-irrigation methods to improve quality, reduce water stress, and enhance profitability of these crops. Export demand for fresh produce adds further pressure to maintain high standards. Precision irrigation enables consistent quality across large-scale plantations. The increasing focus on cash crops and sustainable cultivation methods drives stronger investment in modern irrigation solutions globally.

Key Trends & Opportunities

Integration of IoT and AI in Irrigation Systems

Smart irrigation systems are evolving with IoT-enabled devices and AI-based platforms. These technologies allow farmers to remotely monitor soil health, moisture, and crop growth patterns. Predictive analytics helps optimize water scheduling, improving crop yields while conserving resources. Integration with cloud platforms and mobile apps boosts accessibility for large and small-scale farmers. The trend toward digital farming creates strong opportunities for technology providers to expand their solutions. Growing adoption of connected devices positions smart irrigation as a key pillar of precision agriculture globally.

- For instance, Trimble’s Irrigate-IQ solution enables variable rate irrigation across more than 4,000 pivot systems worldwide, using IoT and AI to analyze soil and crop data in real time.

Government Support and Subsidy Programs

Government initiatives aimed at promoting sustainable farming practices present significant opportunities for precision irrigation adoption. Subsidies and financial incentives for drip and sprinkler systems encourage farmers to modernize their irrigation infrastructure. Policies targeting water-use efficiency and climate resilience further expand adoption. Emerging economies, especially in Asia-Pacific and Africa, benefit from government-backed schemes that address agricultural modernization. These programs support both large-scale commercial farms and smallholders, ensuring wider penetration of advanced irrigation systems. Strong regulatory backing continues to act as a growth catalyst.

- For instance, India’s Pradhan Mantri Krishi Sinchayee Yojana (PMKSY) covered over 9.6 million hectares with micro-irrigation systems by 2023, directly supporting farmers with subsidies on drip and sprinkler installations.

Growing Urban Landscaping and Greenhouse Cultivation

Urbanization and expansion of greenhouse farming open new opportunities for precision irrigation solutions. Cities increasingly invest in smart landscape irrigation to maintain turf, parks, and residential green spaces with minimal water consumption. Greenhouse operators adopt precision systems to control microclimates, maximize productivity, and reduce manual intervention. Rising demand for fresh produce and ornamental plants in urban areas fuels this growth. Precision irrigation ensures efficient use of resources in controlled environments. This segment presents a promising avenue for technology providers targeting non-traditional applications.

Key Challenges

High Initial Investment Costs

The cost of installing advanced irrigation systems remains a major barrier to adoption. Farmers, especially in developing regions, face difficulties affording controllers, sensors, and drip lines. Smallholders often rely on traditional irrigation due to limited budgets. Although long-term savings in water and energy justify investments, upfront costs discourage many from transitioning. Limited access to financing and lack of awareness further compound the challenge. Vendors must offer affordable solutions and flexible models to overcome cost concerns and ensure wider adoption of precision irrigation.

- For instance, a Netafim drip irrigation system installation can cost between USD 1,500 and USD 2,000 per hectare, making it difficult for small-scale farmers without subsidy or credit access.

Technical Complexity and Limited Awareness

Precision irrigation systems require technical expertise for installation, operation, and maintenance. Farmers lacking training or exposure to digital farming often find these solutions complex to manage. In many regions, awareness about long-term benefits remains low, leading to slower adoption rates. Insufficient technical support and inadequate after-sales services also pose hurdles. Bridging this gap requires capacity-building programs, training initiatives, and partnerships with agricultural cooperatives. Addressing technical challenges and enhancing user awareness are critical to ensuring sustained growth in the global precision irrigation market.

Regional Analysis

North America

North America leads the global precision irrigation market with a significant share, valued at USD 942.91 million in 2018 and reaching USD 1,970.11 million in 2024. The region is projected to attain USD 7,182.33 million by 2032, expanding at a CAGR of 16.4%. Strong adoption of advanced irrigation technologies in the U.S. and Canada supports its dominance, accounting for a leading market share. Government programs promoting water-efficient farming and widespread use of IoT-based solutions in agriculture drive steady growth, making North America a central hub for precision irrigation adoption.

Europe

Europe holds a robust share in the precision irrigation market, valued at USD 590.71 million in 2018 and increasing to USD 1,183.46 million in 2024. By 2032, the region is expected to reach USD 3,897.35 million at a CAGR of 14.9%. European farmers adopt smart irrigation systems to comply with strict water conservation policies and sustainability regulations. Countries such as Spain, Italy, and France lead adoption due to their extensive vineyards and orchards. Europe maintains a notable share of the global market, supported by EU incentives for sustainable agriculture and high-value crop cultivation.

Asia Pacific

Asia Pacific dominates the precision irrigation market, valued at USD 1,419.20 million in 2018 and surging to USD 3,123.05 million in 2024. It is projected to achieve USD 12,027.64 million by 2032, growing at the highest CAGR of 17.2%. The region accounts for the largest market share, driven by vast agricultural activities in China, India, and Australia. Rapid urbanization and government subsidies for micro-irrigation systems strengthen adoption. Rising demand for food security and water conservation fuels strong investment in digital farming, positioning Asia Pacific as the fastest-growing and most influential regional market globally.

Latin America

Latin America contributes a growing share to the precision irrigation market, valued at USD 153.29 million in 2018 and projected to reach USD 321.31 million in 2024. By 2032, the market is forecasted at USD 1,032.77 million, recording a CAGR of 14.5%. Countries like Brazil, Mexico, and Argentina are key adopters, focusing on high-value crops such as coffee, soybeans, and sugarcane. Expanding agricultural exports and government-backed irrigation programs promote adoption. Though its share remains moderate compared to larger markets, Latin America’s demand for resource-efficient irrigation positions it as a promising growth region.

Middle East

The Middle East precision irrigation market was valued at USD 84.58 million in 2018 and reached USD 162.97 million in 2024. It is anticipated to grow to USD 491.88 million by 2032 at a CAGR of 13.6%. The region accounts for a smaller share globally but shows steady demand due to arid climates and water scarcity challenges. Countries such as Israel, Saudi Arabia, and the UAE adopt advanced drip and sprinkler systems to support food security initiatives. Investments in greenhouse farming and desert agriculture further contribute to the region’s rising precision irrigation adoption.

Africa

Africa’s precision irrigation market was valued at USD 46.96 million in 2018 and expanded to USD 110.80 million in 2024. It is expected to reach USD 315.44 million by 2032, growing at a CAGR of 12.8%. The region holds the smallest share in the global market but demonstrates strong long-term potential. Adoption is concentrated in South Africa, Kenya, and Egypt, supported by projects targeting food security and efficient water use. Limited awareness and high costs hinder rapid penetration, but international investments and government-led agricultural modernization programs foster gradual adoption across African nations.

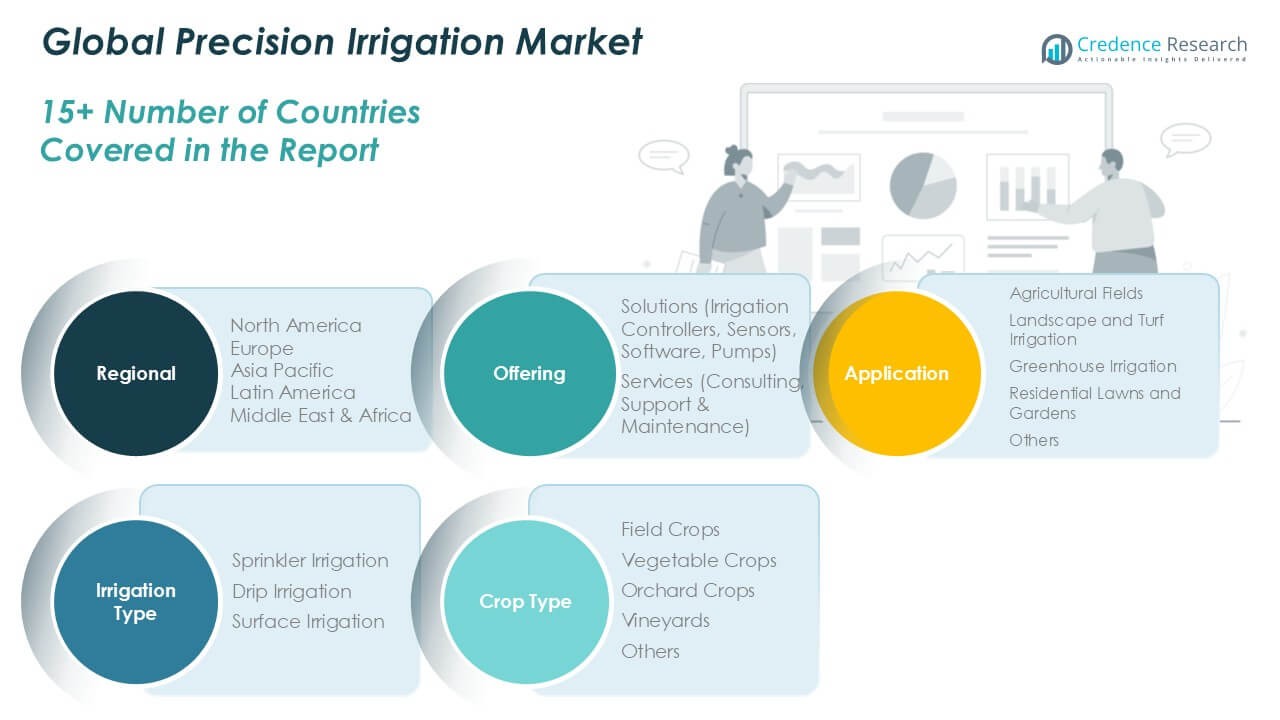

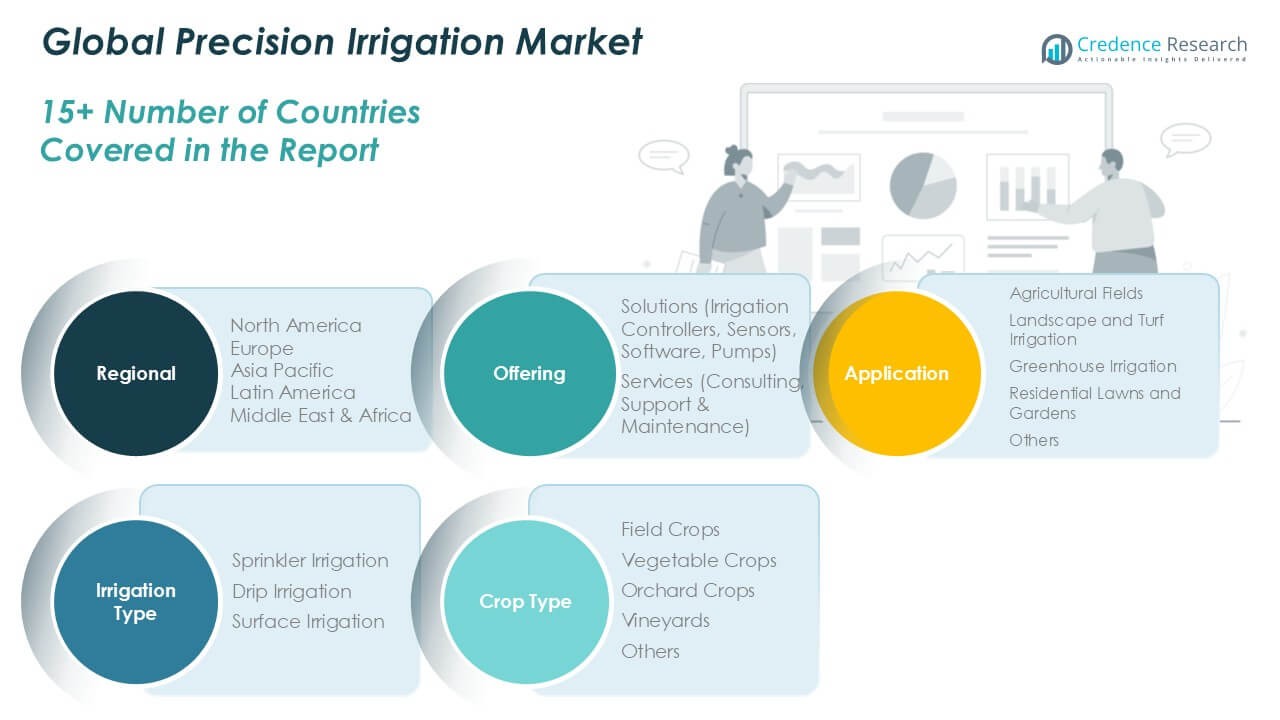

Market Segmentations:

By Offering

- Solutions (Irrigation Controllers, Sensors, Software, Pumps)

- Services (Consulting, Support & Maintenance)

By Application

- Agricultural Fields

- Landscape and Turf Irrigation

- Greenhouse Irrigation

- Residential Lawns and Gardens

- Others

By Irrigation Type

- Sprinkler Irrigation

- Drip Irrigation

- Surface Irrigation

By Crop Type

- Field Crops

- Vegetable Crops

- Orchard Crops

- Vineyards

- Others

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East

- Africa

Competitive Landscape

The global precision irrigation market is highly competitive, with leading players focusing on technological innovation, product diversification, and strategic partnerships to strengthen their market positions. Companies such as Netafim Limited, Deere & Company, Jain Irrigation Systems Ltd., Lindsay Corporation, Nelson Irrigation Corporation, Saturas Ltd., The Toro Company, Valmont Industries, T-L Irrigation Co., and Viridix Ltd. play a pivotal role in driving advancements. These firms emphasize IoT-enabled irrigation systems, advanced drip technologies, and integrated farm management platforms to enhance efficiency and sustainability. Mergers, acquisitions, and collaborations with agri-tech providers expand their geographical presence and service capabilities. Continuous investment in R&D supports the launch of smart sensors, cloud-based solutions, and automation tools tailored to large and small-scale farmers. Market players also prioritize sustainability, targeting water conservation and crop productivity. Intense competition encourages innovation, while government support and rising demand for high-value crops create strong opportunities for both global leaders and emerging regional companies.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In November 2024, Netafim Italia, a subsidiary of Orbia’s Precision Agriculture business, has acquired Tecnir S.r.l., a Faenza-based leader in irrigation system design and installation, to strengthen its position in precision irrigation for Italian agribusiness. The acquisition enhances Netafim Italia’s offerings with Tecnir’s expertise in innovative and sustainable irrigation solutions, aligning with its strategy to support efficient water use and address the needs of Italian farmers and Green Economy professionals.

- In September 2024, Rivulis (Israel) announced the opening of its largest micro-irrigation manufacturing facility in North America. This 160,000-square-foot facility in Tijuana, Mexico, will manufacture T-Tape goods. With its advanced technology, the new facility has produced about 200 jobs locally, is built for future growth, and maximizes recycled materials and product quality.

- In August 2024, Rain Bird Corporation (US) announced the acquisition of Adritec Group International’s Jordanian and Mexican assets. This acquisition is expected to enhance Rain Bird’s agricultural irrigation capabilities in the Middle East, Africa, and Latin America. It enables the business to take advantage of Adritec’s experience and broaden its product line, particularly in drip irrigation.

- In April 2024, Mahindra Irrigation (India) announced that it had received contracts to supply micro-irrigation systems for about 2,700 hectares of land. The contract is worth USD 1.59 million and will be completed within a year.

- In January 2024, Lindsay Corporation (US) introduced FieldNET NextGen, a new user interface for its FieldNET platform that makes managing precision irrigation easier. The new interface offered farmers clear and intuitive maps, graphics, and real-time analytics for efficient irrigation control and monitoring. It features better mapping, intelligent reporting, and remote control, giving farmers a complete view of their fields.

Report Coverage

The research report offers an in-depth analysis based on Offering, Application, Irrigation Type, Crop Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand rapidly with increasing focus on water-use efficiency in agriculture.

- Adoption of IoT, AI, and automation will transform irrigation practices across all farm sizes.

- Drip irrigation will remain the most dominant method due to its high efficiency and crop suitability.

- Demand for precision irrigation will rise with growing cultivation of high-value crops worldwide.

- Government subsidies and sustainability programs will continue to drive system adoption in emerging markets.

- Smart sensors and cloud-based platforms will play a greater role in irrigation management.

- Service models like consulting and maintenance will grow alongside solution-based offerings.

- Asia Pacific will strengthen its leadership while North America and Europe show steady growth.

- Rising greenhouse farming and urban landscaping will open new market opportunities.

- Competition among global and regional players will intensify, driving innovation and cost-effective solutions.