Market overview

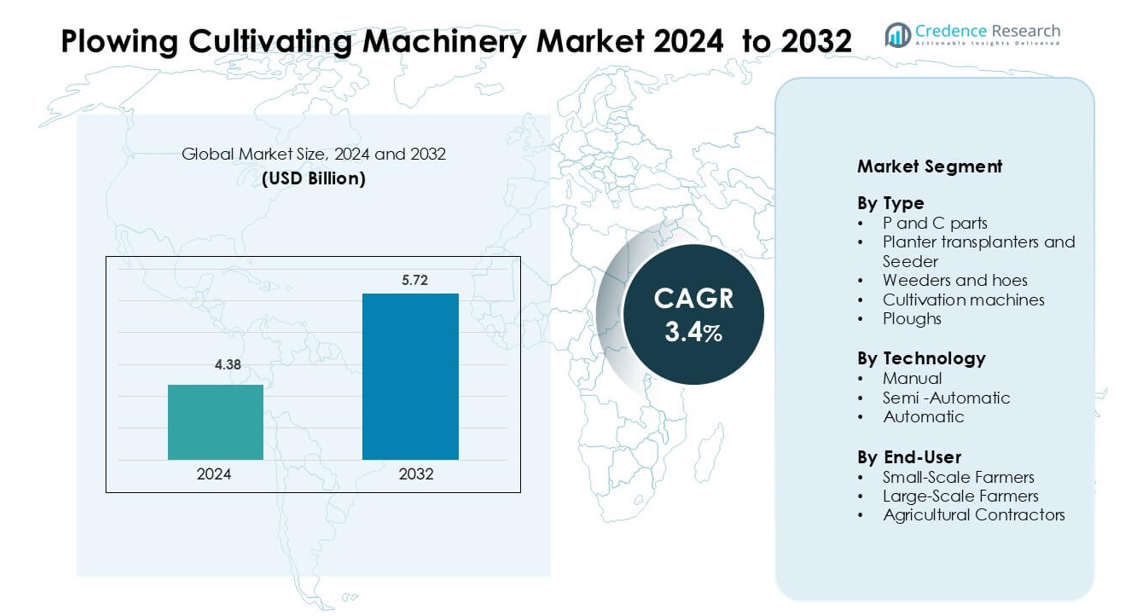

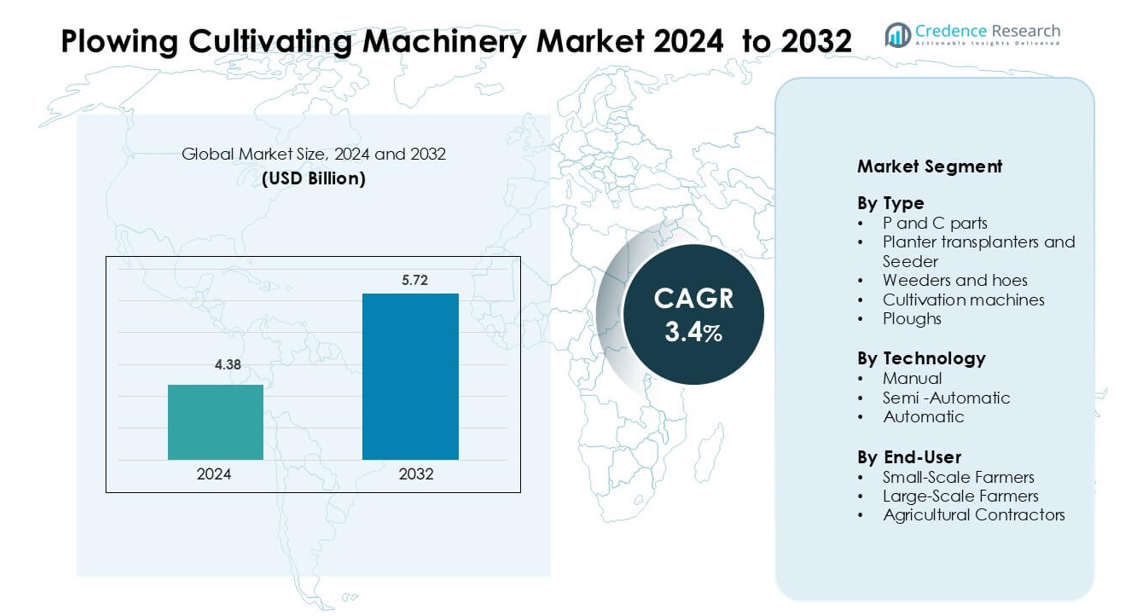

Plowing Cultivating Machinery Market was valued at USD 4.38 billion in 2024 and is anticipated to reach USD 5.72 billion by 2032, growing at a CAGR of 3.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Plowing Cultivating Machinery Market Size 2024 |

USD 4.38 billion |

| Plowing Cultivating Machinery Market, CAGR |

3.4% |

| Plowing Cultivating Machinery Market Size 2032 |

USD 5.72 billion |

The Plowing and Cultivating Machinery Market is led by major players including CNH Industrial NV, AGCO Corp., Deere & Company, CLAAS KGaA mbH, BEDNAR FMT s.r.o., Bucher Industries AG, Dewulf, Great Plains Manufacturing Inc., Gregoire Besson SAS, and Alamo Group Inc. These companies focus on expanding precision agriculture solutions, integrating GPS and IoT technologies to enhance soil preparation and crop yield efficiency. Continuous innovation in autonomous ploughs, sustainable cultivation systems, and smart farm machinery strengthens their competitive edge. Asia-Pacific leads the global market with a 34% share, driven by large-scale mechanization programs, government subsidies, and rapid adoption of advanced agricultural technologies across China, India, and Japan.

Market Insights

- The Plowing and Cultivating Machinery Market was valued at USD 4.38 billion in 2024 and is projected to grow at a CAGR of 3.4 % from 2025 to 2032.

- Rising mechanization and technological upgrades in precision farming drive market expansion, supported by increasing demand for efficient soil preparation equipment.

- Smart and automated cultivation machinery featuring GPS and IoT integration is a key trend, improving field productivity and reducing labor dependency.

- Leading companies such as CNH Industrial NV, Deere & Company, and AGCO Corp. focus on automation, sustainability, and expanding global distribution networks to strengthen competitiveness.

- Asia-Pacific dominates the market with a 34% share, followed by North America at 27%, while the ploughs segment leads with the largest contribution due to high demand for advanced soil-turning machinery

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis

By Type

The ploughs segment dominates the Plowing and Cultivating Machinery Market with the largest share due to its essential role in soil preparation and crop yield improvement. Modern ploughs feature hydraulic systems and adjustable blades, allowing farmers to operate efficiently across various soil types. Their high durability and precision reduce fuel use and operating time, increasing productivity for large farms. Growing mechanization in emerging economies further drives plough adoption, supported by favorable government subsidies and rural equipment modernization initiatives.

- For instance, John Deere introduced the 995 Reversible Plough equipped with a hydraulic automatic reset system and working width of up to 3.7 m, enabling consistent soil inversion across 8 bottoms.

By Technology

The semi-automatic segment holds the largest share in the market, driven by its balance between efficiency and affordability. These machines reduce manual labor while maintaining user control, making them suitable for small and medium farms. Semi-automatic cultivators integrate power steering, depth control sensors, and low-maintenance engines, enhancing field performance and reducing downtime. Farmers prefer these systems for their operational flexibility and easy maintenance. The rising demand for precision farming and mechanized seeding continues to accelerate the segment’s growth.

- For instance, The Kubota PEM140DI is widely marketed as a 14 HP or 13 HP compatible power tiller. Its engine (Kubota RT140DI-EM) has a rated maximum output of 9.56 kW, which converts to approximately 12.8 HP, often rounded to 13 or 14 HP in product listings.

By End-User

Large-scale farmers represent the dominant end-user segment, accounting for the highest market share due to large landholdings and greater investment capacity. These farmers adopt advanced, automated plowing and cultivating systems to achieve consistent soil aeration, reduced turnaround time, and enhanced crop output. Integrated GPS and telemetry-enabled machinery allow remote monitoring and data-driven cultivation planning. Additionally, government schemes promoting agricultural mechanization and farm consolidation strengthen equipment adoption among large-scale agricultural enterprises worldwide.

Key Growth Drivers

Rising Farm Mechanization and Productivity Needs

The growing demand for farm mechanization is a major driver of the Plowing and Cultivating Machinery Market. Increasing labor shortages and the need for higher productivity push farmers toward advanced machinery solutions. Governments across regions such as India, China, and Brazil are offering subsidies and financial aid to promote modern agricultural practices. Technological improvements in hydraulic ploughs and precision cultivators enhance soil turnover and reduce energy use, leading to improved yield. These developments allow faster land preparation, minimize manual dependency, and optimize operational efficiency, fueling market growth globally.

- For instance, Sonalika s Tiger Electric tractor the tractor has an 8-hour battery backup specifically when operating with a 2-tonne trolley for haulage operations, achieving consistent soil depth control through electronic draft sensing technology.

Expansion of Large-Scale Farming Operations

The consolidation of agricultural land and the rise of commercial farming drive the adoption of high-capacity plowing and cultivating equipment. Large-scale farmers prefer automated ploughs, cultivators, and seeders that provide consistent performance across extensive fields. Integration of GPS-guided control systems and telematics improves accuracy and reduces overlaps during cultivation. Companies are focusing on developing wide-width and multi-row implements that minimize operation time. This scalability enables large farms to achieve higher productivity and operational cost savings, propelling the demand for advanced cultivating machinery.

- For instance, AGCO Corporation’s Fendt 1000 Vario series integrates the Fuse® precision farming platform with GPS steering accuracy of up to 2.5 cm and supports 12-row cultivator attachments for large-acre operations.

Technological Advancements in Smart Agricultural Equipment

Continuous innovation in agricultural technology strongly supports market expansion. Smart plowing and cultivating machines equipped with IoT sensors, variable depth control, and AI-based diagnostics enhance precision and reliability. These systems allow remote monitoring, real-time soil analysis, and predictive maintenance, ensuring consistent field performance. Manufacturers such as John Deere and CNH Industrial are introducing autonomous tractors and precision cultivators to optimize efficiency. The adoption of automation and data-driven cultivation significantly reduces input costs and boosts output quality, encouraging widespread acceptance among both developed and emerging economies.

Key Trends and Opportunities

Integration of Sustainable and Energy-Efficient Solutions

The growing emphasis on sustainability presents a key opportunity in the Plowing and Cultivating Machinery Market. Manufacturers are investing in electric and hybrid-powered machinery that minimizes fuel use and greenhouse emissions. Lightweight materials, such as reinforced composites, reduce soil compaction and improve operational efficiency. Governments and organizations promoting green agriculture are supporting eco-friendly solutions through tax incentives and research funding. This shift toward sustainable technologies aligns with global climate goals and offers equipment makers a competitive advantage through energy-efficient innovations and compliance with environmental standards.

- For instance, The Monarch MK-V tractor uses a high-capacity lithium-ion battery system. The battery system provides an industry-leading runtime of up to 14 hours and can be fully charged in 5-6 hours with an 80A charger.

Growth of Precision and Digital Agriculture

Digitalization and precision farming continue to shape the industry’s growth path. The integration of GPS, GIS, and real-time monitoring systems enhances the accuracy of plowing and cultivation. Data analytics and automated depth adjustments ensure optimal soil conditions, reducing wastage and improving crop performance. Companies are leveraging smart farming platforms to connect machinery to cloud-based systems for continuous data exchange. This trend creates new opportunities for manufacturers to develop intelligent implements capable of syncing with farm management software, driving modernization in agricultural operations.

- For instance, Deere & Company’s AutoTrac™ guidance system provides sub-inch accuracy through RTK GPS and integrates with the John Deere Operations Center, enabling seamless data synchronization across fleets.

Emerging Markets Adoption and Government Support

Developing economies present strong growth opportunities as rural modernization accelerates. Countries in Asia-Pacific and Africa are adopting mechanized agriculture to increase crop yields and reduce manual labor dependency. Government programs, such as farm mechanization schemes and low-interest loans, are making machinery more accessible to small and medium-scale farmers. Global players are expanding dealer networks and after-sales support in these regions to strengthen market penetration. These initiatives enhance affordability, encourage innovation, and promote the widespread use of plowing and cultivating equipment in emerging markets.

Key Challenges

High Equipment and Maintenance Costs

The high cost of advanced plowing and cultivating machinery remains a key restraint, especially for small and medium farmers. Initial investment, coupled with ongoing maintenance expenses, limits adoption in low-income regions. Spare parts availability and servicing challenges further increase operational costs. Many farmers continue relying on traditional methods due to limited financing options. Addressing this issue requires flexible leasing models, cooperative ownership programs, and affordable credit systems that can make advanced machinery more attainable and sustainable for all farming segments.

Limited Skilled Labor and Technical Knowledge

The lack of skilled operators and insufficient technical training pose another significant challenge to market growth. Advanced cultivating machines require knowledge of hydraulic controls, digital interfaces, and precision settings, which many rural farmers lack. Improper use can reduce machinery lifespan and productivity. To bridge this gap, industry players and governments must collaborate to provide structured training programs, field demonstrations, and digital learning tools. Building awareness and technical competency among farmers is essential to ensure the effective and safe adoption of modern agricultural equipment.

Regional Analysis

North America

North America holds a 27% share of the Plowing and Cultivating Machinery Market, driven by advanced mechanization and strong adoption of precision agriculture. The United States leads regional demand due to large-scale commercial farming and high labor costs, encouraging investment in autonomous and GPS-enabled machinery. Major manufacturers such as John Deere and AGCO Corporation drive innovation through smart ploughs and cultivators with IoT integration. Government incentives for sustainable agriculture and replacement of aging equipment further strengthen the regional market, enhancing efficiency and crop productivity across vast agricultural landscapes.

Europe

Europe accounts for a 25% share of the global Plowing and Cultivating Machinery Market, supported by strong technological advancement and environmental compliance. Germany, France, and Italy lead adoption due to well-established farming infrastructure and emphasis on soil conservation. The European Union’s Common Agricultural Policy promotes sustainable mechanization, driving demand for energy-efficient ploughs and cultivators. Leading players such as Lemken GmbH and Kverneland Group innovate precision machinery to optimize tillage and fuel efficiency. Rising adoption of autonomous systems and low-emission farming technologies continues to sustain the region’s strong market presence.

Asia-Pacific

Asia-Pacific dominates the market with a 34% share, fueled by large agricultural bases and expanding mechanization in India, China, and Japan. Government-backed subsidy programs and rural modernization initiatives are major growth enablers. Increasing small-scale farmer adoption of semi-automatic and compact machinery supports regional expansion. Companies like Kubota and Mahindra & Mahindra focus on low-cost, efficient equipment designed for local soil conditions. Rapid urbanization and the shift toward commercial farming drive continuous upgrades in plowing and cultivating technology, reinforcing Asia-Pacific’s leadership in global production and equipment deployment.

Latin America

Latin America captures a 9% share of the Plowing and Cultivating Machinery Market, with Brazil and Argentina as leading contributors. Expanding soybean and corn cultivation areas increase demand for high-performance cultivators and ploughs. Mechanization in the region is gaining pace as farmers adopt GPS-based and energy-efficient solutions to improve yield and reduce field time. Government programs promoting agricultural exports and financing options for modern equipment are accelerating growth. Manufacturers are expanding distribution networks to improve accessibility, particularly in developing economies with large untapped agricultural potential.

Middle East & Africa

The Middle East and Africa region holds a 5% share of the Plowing and Cultivating Machinery Market, supported by increasing adoption of mechanized farming in countries like South Africa, Egypt, and Saudi Arabia. Growing government investments in irrigation and sustainable agriculture drive equipment demand. Compact and durable ploughs are gaining traction due to suitability for arid and semi-arid soils. International manufacturers are forming partnerships with local distributors to enhance market reach. Although adoption rates remain lower than other regions, increasing food security initiatives are gradually expanding the mechanization base.

Market Segmentations

By Type

- P and C parts

- Planter transplanters and seeders

- Weeders and hoes

- Cultivation machines

- Ploughs

By Technology

- Manual

- Semi -Automatic

- Automatic

By End-User

- Small-Scale Farmers

- Large-Scale Farmers

- Agricultural Contractors

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Plowing and Cultivating Machinery Market is highly competitive, characterized by global and regional players focusing on innovation, strategic expansion, and technology integration. Leading companies such as CNH Industrial NV, AGCO Corp., Deere & Company, CLAAS KGaA mbH, and Bucher Industries AG emphasize product development through automation, GPS-guided precision systems, and sustainability-driven machinery. Mid-tier firms like BEDNAR FMT s.r.o., Dewulf, and Gregoire Besson SAS strengthen market presence through niche specialization and cost-effective product lines. Strategic mergers, distribution network expansion, and investment in R&D enable these companies to improve soil management efficiency and operational reliability. Partnerships with government programs promoting farm mechanization further enhance their market reach.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- CNH Industrial NV

- BEDNAR FMT s.r.o.

- AGCO Corp.

- CLAAS KGaA mbH

- Dewulf

- Great Plains Manufacturing Inc.

- Gregoire Besson SAS

- Alamo Group Inc.

- Bucher Industries AG

- Deere and Co.

Recent Developments

- In September 2025, AGCO at its Tech Day showcased AI, autonomy and mixed‑fleet solutions aimed at boosting productivity for soil preparation, seeding & tillage operations.

- In August 2025, AGCO Corp. announced that at the 2025 Farm Progress Show (Aug 26‑28) it would display new tractors, planters and retrofit/autonomous solutions via its brands (Fendt®, Massey Ferguson®, PTx™).

Report Coverage

The research report offers an in-depth analysis based on Type, Technology, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience steady growth driven by increased adoption of precision agriculture.

- Automation and smart control systems will become standard in plowing and cultivating equipment.

- Manufacturers will invest more in electric and hybrid-powered machinery to reduce emissions.

- Demand from developing regions will rise as governments promote farm mechanization programs.

- Integration of IoT and GPS will enhance real-time monitoring and improve operational efficiency.

- Compact and multi-functional machinery will gain traction among small and medium-scale farmers.

- Companies will expand after-sales service networks to strengthen customer retention.

- Sustainable materials and energy-efficient technologies will influence future product designs.

- Data-driven analytics will support predictive maintenance and reduce machinery downtime.

- Strategic collaborations between equipment manufacturers and digital solution providers will drive long-term industry innovation.1