Market Overview

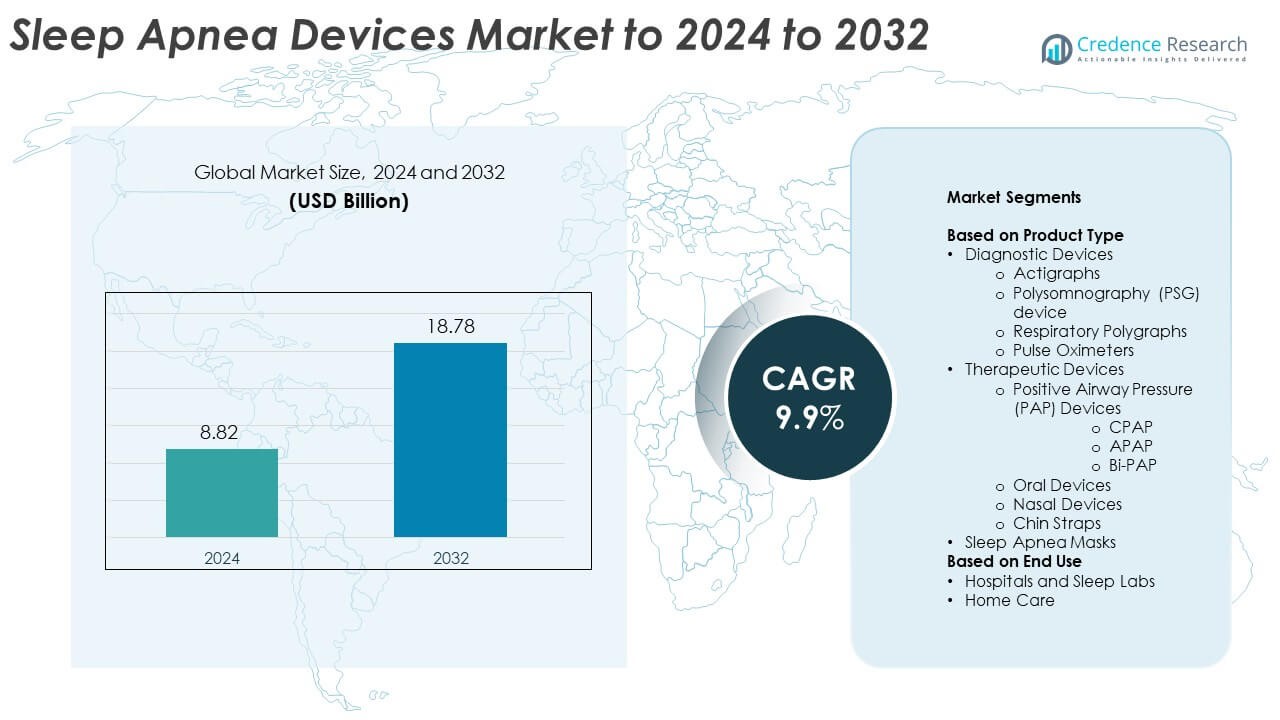

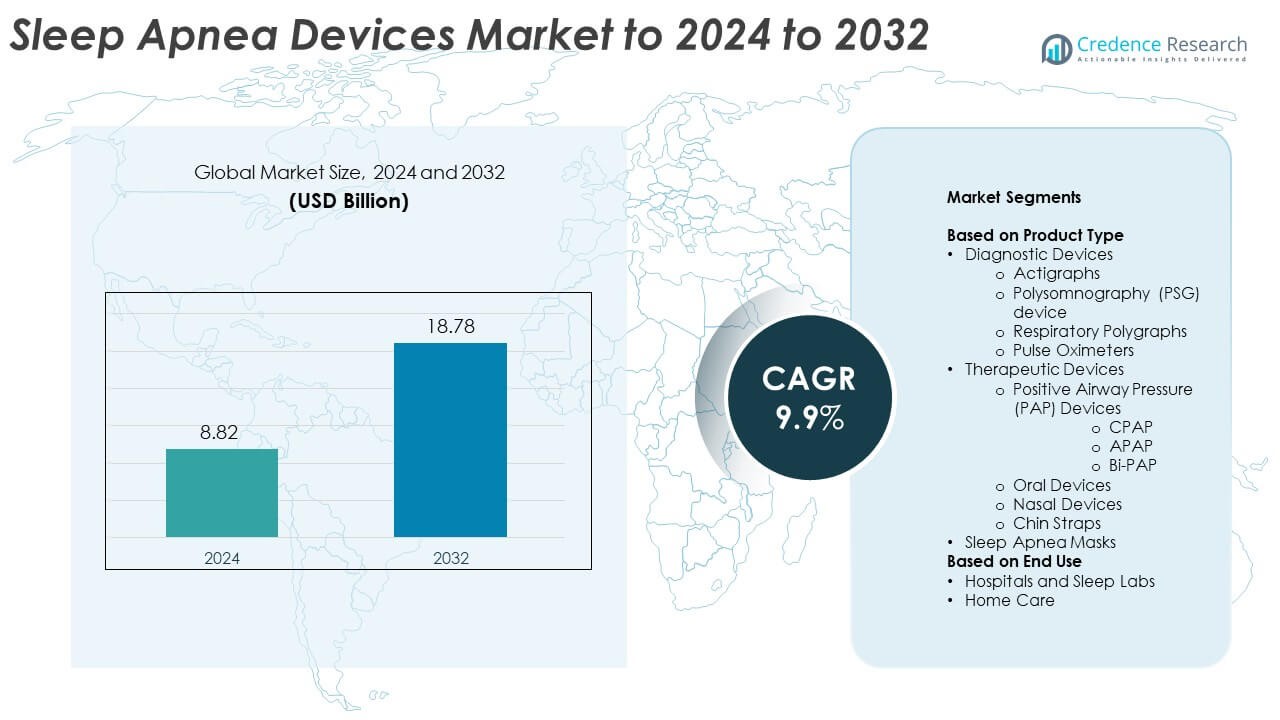

The Sleep Apnea Devices Market size was valued at USD 8.82 billion in 2024 and is anticipated to reach USD 18.78 billion by 2032, at a CAGR of 9.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Sleep Apnea Devices Market Size 2024 |

USD 8.82 Billion |

| Sleep Apnea Devices Market, CAGR |

9.9% |

| Sleep Apnea Devices Market Size 2032 |

USD 18.78 Billion |

The sleep apnea devices market is highly competitive, with leading companies such as ResMed, Fisher & Paykel Healthcare Limited, Philips Respironics, Compumedics, and SOMNOmedics GmbH driving innovation and technological progress. These players are focusing on improving comfort, connectivity, and user compliance through advanced PAP systems and smart diagnostic tools. Strategic collaborations, product diversification, and AI-based monitoring solutions are shaping competitive differentiation. North America remains the dominant region, holding a 43.2% market share in 2024, supported by robust healthcare infrastructure, high awareness levels, and widespread adoption of homecare treatment devices.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Sleep Apnea Devices Market was valued at USD 8.82 billion in 2024 and is projected to reach USD 18.78 billion by 2032, growing at a CAGR of 9.9%.

- Rising prevalence of sleep apnea and increasing awareness about sleep health are major growth drivers, supported by the adoption of non-invasive and home-based therapeutic solutions.

- Integration of wireless connectivity, AI-enabled diagnostics, and telemonitoring features is shaping emerging market trends, improving patient adherence and monitoring efficiency.

- The market remains competitive with companies focusing on innovation, strategic mergers, and enhanced product comfort, while challenges include high device costs and limited access in developing economies.

- Regionally, North America held a 43.2% share in 2024, followed by Europe at 28.5% and Asia Pacific at 20.6%; by segment, therapeutic devices dominated with a 61.4% share, driven by the widespread use of CPAP systems across homecare and clinical applications.

Market Segmentation Analysis:

By Product Type

The therapeutic devices segment dominated the sleep apnea devices market in 2024, accounting for a 61.4% share. Growth is driven by increasing adoption of Positive Airway Pressure (PAP) devices for effective management of obstructive sleep apnea. Continuous Positive Airway Pressure (CPAP) systems held the largest share within this category due to their proven efficacy in maintaining airway patency during sleep. Rising awareness of non-invasive treatments and technological upgrades such as auto-adjusting pressure systems and quiet operation features continue to boost product demand across both clinical and home care settings.

- For instance, ResMed’s AirSense 11 lists a 27 dBA sound pressure level, a 4–20 cmH₂O pressure range, and about 1.1 kg device weight.

By End Use

The home care segment led the market in 2024, capturing a 57.8% share. The dominance is attributed to the rising preference for portable and user-friendly therapeutic devices enabling self-treatment. Growing awareness of sleep-related disorders and improved reimbursement policies have accelerated the adoption of home-based CPAP and Bi-PAP systems. Manufacturers are focusing on compact designs and wireless connectivity for better monitoring and comfort. The shift toward remote care and telemonitoring solutions further strengthens the growth of home care as the preferred end-use segment globally.

- For instance, Philips’ DreamStation 2 weighs 2.3 lbs without the power supply, measures 10.11 × 6.24 × 3.34 in, and operates across 4–20 cmH₂O.

Key Growth Drivers

Rising Prevalence of Sleep Disorders

The growing incidence of obstructive sleep apnea (OSA) worldwide is a major growth driver. Increasing obesity rates and sedentary lifestyles contribute significantly to OSA prevalence. According to the American Academy of Sleep Medicine, over 25 million adults in the United States suffer from OSA. Rising awareness about the health risks linked to untreated sleep apnea, such as hypertension and cardiovascular diseases, is driving higher diagnosis rates and boosting the demand for both diagnostic and therapeutic devices across hospitals and home care settings.

- For instance, Inspire Medical Systems reported treating over 85,000 patients with its OSA implant therapy by Q3 2024.

Technological Advancements in Therapeutic Devices

Continuous innovations in Positive Airway Pressure (PAP) systems are fueling market expansion. Newer models feature auto-adjusting air pressure, smart connectivity, and noise-reduction technologies that improve patient comfort and adherence. Companies are also integrating cloud-based data platforms for real-time therapy monitoring. The introduction of portable, battery-operated CPAP devices has enhanced mobility for patients, promoting adoption among frequent travelers. These advancements enhance treatment outcomes and support broader use in both clinical and home-based care.

- For instance, Löwenstein Medical’s prisma SMART plus CPAP machine operates at a mean sound pressure level of approximately 26.5 dBA.

Growing Home Healthcare Adoption

Increasing demand for personalized and cost-effective home-based sleep apnea therapy is accelerating market growth. Rising healthcare costs and improved insurance coverage for home treatment are key supporting factors. Compact and user-friendly CPAP and BiPAP devices are increasingly replacing traditional in-lab treatments. Patients prefer at-home monitoring solutions that allow continuous data sharing with healthcare providers. The shift toward home healthcare not only enhances patient convenience but also reduces hospital burdens, making it a strong growth catalyst for device manufacturers.

Key Trends & Opportunities

Integration of Digital Health Technologies

The growing integration of artificial intelligence and Internet of Things (IoT) in sleep apnea devices is transforming patient management. Smart CPAP systems can track sleep patterns, detect anomalies, and automatically adjust airflow based on user needs. Bluetooth-enabled connectivity allows seamless data transfer to mobile applications for physician review. This integration supports personalized therapy, early diagnosis, and improved treatment adherence, creating opportunities for companies offering AI-driven monitoring platforms and telehealth-supported sleep therapy solutions.

- For instance, Fisher & Paykel’s SleepStyle pairs via Bluetooth with the SleepStyle App, while the device lists a 28.0 ± 1.5 dBA noise level, 4–20 cmH₂O range, and a 380 ml water chamber.

Expansion in Emerging Economies

Emerging markets across Asia-Pacific and Latin America present major opportunities for sleep apnea device manufacturers. Increasing urbanization, healthcare awareness, and expanding access to diagnostic services drive regional growth. Governments are promoting public health campaigns and funding sleep disorder screening programs. Local partnerships and affordable device introductions are enabling companies to penetrate underserved markets. As disposable incomes rise, demand for both diagnostic and therapeutic sleep solutions is expected to surge in these fast-developing regions.

- For instance, BMC Medical states its respiratory-sleep products support users in more than 100 countries and regions worldwide.

Key Challenges

High Device Costs and Limited Reimbursement

The high cost of advanced CPAP and BiPAP devices remains a major barrier to adoption, especially in low-income regions. Many patients struggle to afford long-term treatment due to limited or inconsistent insurance reimbursement policies. This cost burden often leads to low adherence rates and delayed diagnosis. Manufacturers face pressure to design affordable yet efficient alternatives, while healthcare policymakers continue to explore strategies to expand reimbursement coverage and improve accessibility for patients worldwide.

Low Patient Compliance and Device Discomfort

Despite proven clinical benefits, adherence to sleep apnea therapy remains low due to discomfort and device inconvenience. Issues such as mask leakage, skin irritation, and noise discourage consistent use among patients. Studies indicate that over 30% of CPAP users discontinue treatment within the first year. Manufacturers are working on ergonomic designs, softer materials, and adaptive pressure technologies to enhance user comfort. Addressing compliance challenges is crucial for improving long-term treatment outcomes and sustaining market growth.

Regional Analysis

North America

North America dominated the sleep apnea devices market in 2024, accounting for a 43.2% share. The region’s leadership stems from the high prevalence of sleep apnea, strong healthcare infrastructure, and increasing awareness of sleep-related disorders. The U.S. remains the primary contributor due to widespread access to diagnostic facilities and favorable reimbursement frameworks. Technological advancements in Positive Airway Pressure devices and growing demand for home-based treatment solutions further strengthen market growth. Continuous innovation and the presence of key manufacturers ensure the region maintains its dominant position during the forecast period.

Europe

Europe held a 28.5% share of the sleep apnea devices market in 2024. The region benefits from strong regulatory support and a rising number of certified sleep centers. Countries such as Germany, the U.K., and France are key contributors due to their emphasis on early diagnosis and effective treatment pathways. Increasing healthcare expenditure and growing adoption of non-invasive PAP devices are fueling market expansion. Government-backed awareness initiatives about sleep health and supportive reimbursement policies are expected to sustain steady growth across European countries.

Asia Pacific

Asia Pacific accounted for a 20.6% share of the global market in 2024, emerging as the fastest-growing region. Rapid urbanization, lifestyle-related health issues, and rising disposable incomes are driving higher demand for sleep apnea treatment devices. Countries like China, Japan, and India are witnessing increased adoption of portable CPAP systems due to growing awareness and affordability. Expanding healthcare infrastructure and local manufacturing investments are further enhancing product availability. Supportive government programs and telemedicine integration are expected to accelerate regional market growth in the coming years.

Latin America

Latin America captured a 4.2% share of the sleep apnea devices market in 2024. Market growth is driven by expanding healthcare access and increasing diagnosis rates across Brazil, Mexico, and Argentina. The demand for affordable and compact CPAP and Bi-PAP systems is growing due to rising awareness of untreated sleep apnea complications. Public health initiatives focusing on chronic respiratory disorders are supporting adoption. However, limited insurance coverage and high device costs remain barriers. Ongoing collaborations between healthcare providers and device manufacturers are improving treatment accessibility across the region.

Middle East & Africa

The Middle East & Africa region held a 3.5% share in 2024, showing gradual but consistent growth. Rising prevalence of obesity-related sleep apnea and improved healthcare infrastructure are key drivers. The United Arab Emirates and Saudi Arabia lead regional adoption due to growing investment in advanced diagnostic facilities. Awareness campaigns led by sleep research organizations are boosting patient screening and early intervention. Despite infrastructure challenges in some African nations, increasing government focus on sleep health and private sector engagement are expected to strengthen the regional market outlook.

Market Segmentations:

By Product Type

-

- Actigraphs

- Polysomnography (PSG) device

- Respiratory Polygraphs

- Pulse Oximeters

-

- Positive Airway Pressure (PAP) Devices

-

- Oral Devices

- Nasal Devices

- Chin Straps

By End Use

- Hospitals and Sleep Labs

- Home Care

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the sleep apnea devices market is characterized by strong technological innovation and strategic expansion led by key players such as Fisher & Paykel Healthcare Limited, ResMed, Curative Medical, Inc., SOMNOmedics GmbH, Nihon Kohden Corporation, React Health, Compumedics, Itamar Medical Ltd., Vivos Therapeutics, Respironics, BMC Medical Co., Ltd., Natus Medical Incorporated, and Somnetics International, Inc. Companies are focusing on improving device comfort, portability, and digital connectivity to enhance patient adherence. Advanced data integration capabilities and telemonitoring features are becoming critical differentiators. Firms are also investing in research partnerships to develop AI-enabled diagnostics and compact homecare systems. Strategic mergers, acquisitions, and product launches are aimed at expanding global distribution networks. Increasing emphasis on patient-centric solutions and favorable reimbursement policies are further shaping competition. Collectively, these efforts are driving innovation, accessibility, and broader adoption of sleep apnea management technologies worldwide.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Fisher & Paykel Healthcare Limited

- ResMed

- Curative Medical, Inc.

- SOMNOmedics GmbH

- Nihon Kohden Corporation

- React Health (Respiratory Product Line from Invacare Corporation)

- Compumedics

- Itamar Medical Ltd.

- Vivos Therapeutics

- Respironics (a subsidiary of Koninklijke Philips N.V.)

- BMC Medical Co., Ltd.

- Natus Medical Incorporated

- Somnetics International, Inc.

Recent Developments

- In 2024, ResMed launched its new AirCurve™ 11 series devices, a bilevel device that provides personalized support to treat sleep apnea.

- In 2023, ResMed acquired Somnoware, a cloud-based software platform for sleep and respiratory diagnostic workflows, to enhance its digital health offerings.

- In 2023, Vivos Therapeutics obtained FDA 510(k) Clearance for its CARE (Complete Airway Repositioning and/or Expansion) oral devices tailored for adults with severe obstructive sleep apnea (OSA).

Report Coverage

The research report offers an in-depth analysis based on Product Type, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Increasing global awareness of sleep apnea will continue to drive device adoption.

- Demand for portable and user-friendly homecare devices will expand steadily.

- Integration of wireless connectivity and telemonitoring will enhance patient compliance.

- AI-powered diagnostics and personalized therapy solutions will gain more traction.

- Collaborations between hospitals and device makers will improve treatment accessibility.

- Emerging markets in Asia Pacific and Latin America will witness higher growth rates.

- Continuous innovations in PAP technology will improve comfort and efficiency.

- Growing preference for non-invasive devices will strengthen therapeutic adoption.

- Favorable reimbursement frameworks will boost device penetration in developed regions.

- Strategic mergers and product launches by key players will shape market competitiveness.