Market Overview

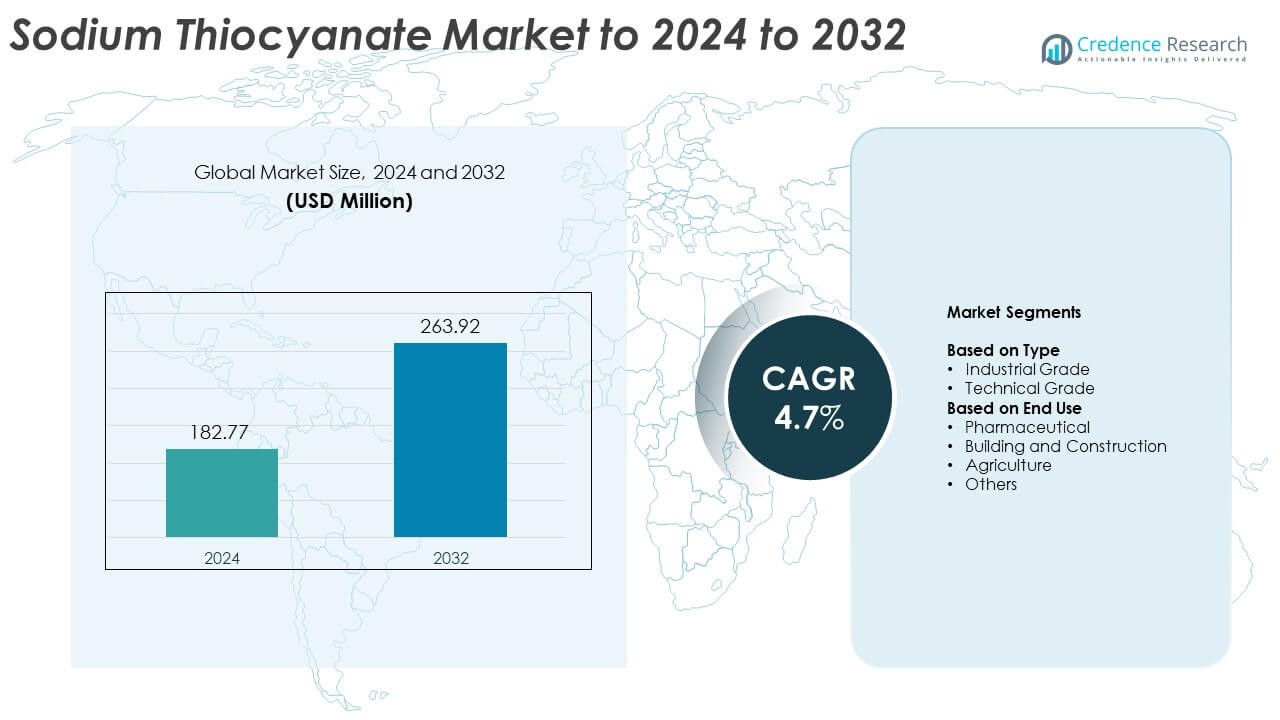

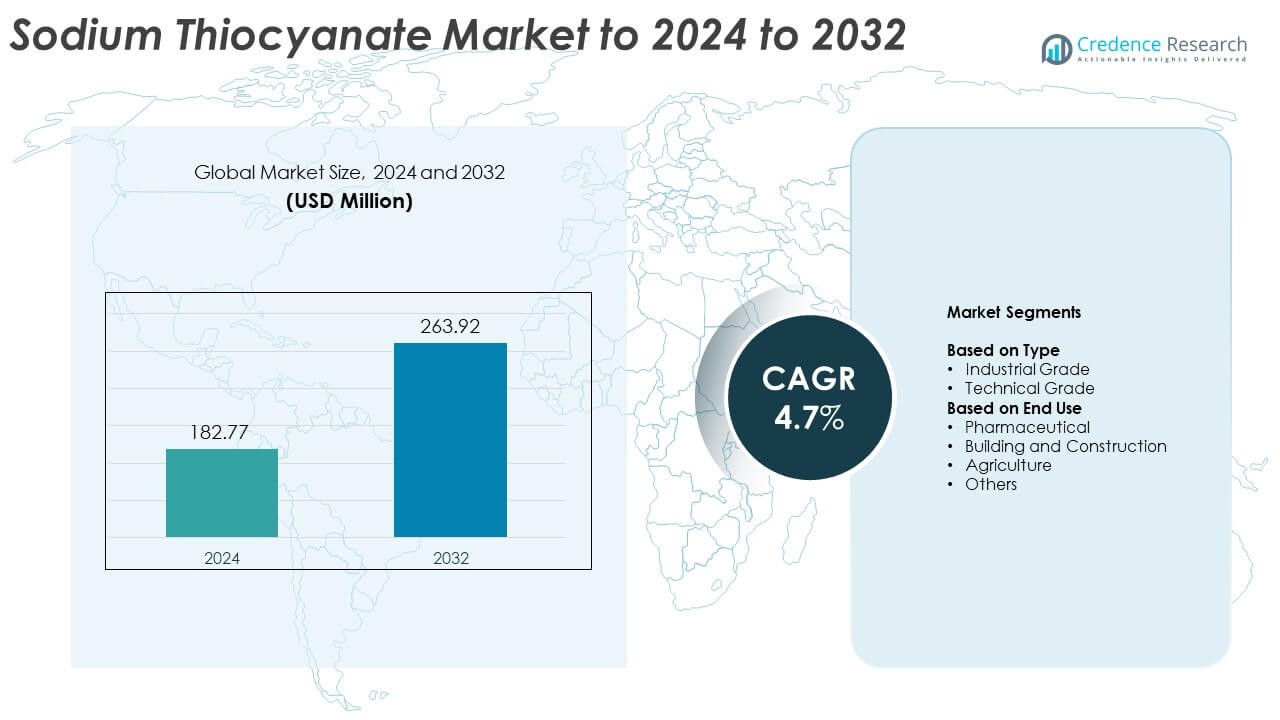

Sodium Thiocyanate Market size was valued at USD 182.77 million in 2024 and is anticipated to reach USD 263.92 million by 2032, at a CAGR of 4.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Sodium Thiocyanate Market Size 2024 |

USD 182.77 Million |

| Sodium Thiocyanate Market , CAGR |

4.7% |

| Sodium Thiocyanate Market Size 2032 |

USD 263.92 Million |

The Sodium Thiocyanate Market is shaped by several established manufacturers that focus on high-purity production, stable supply, and strong integration with pharmaceutical, textile, and construction industries. These companies compete through expanded capacities, improved refining systems, and long-term contracts with major end-use sectors. Asia Pacific leads the global market with about 34% share in 2024, supported by large-scale chemical manufacturing and strong textile and polymer production. North America follows with nearly 32% share due to advanced pharmaceutical operations and consistent demand for reagent-grade material. Europe holds around 28% share, driven by regulated chemical processing and steady industrial use.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Sodium Thiocyanate Market reached USD 182.77 million in 2024 and is projected to hit USD 263.92 million by 2032 at a CAGR of 4.7%.

- Growth is driven by rising demand from pharmaceuticals, which hold 39% share due to strong use in reagents and formulations.

- Trends include increasing adoption of high-purity grades and modernization of chemical processing across major producing countries.

- Competition intensifies as global and regional suppliers expand capacity and upgrade purification technology to meet stricter quality requirements.

- Asia Pacific leads with 34% share, followed by North America at 32% and Europe at 28%, while industrial grade dominates the type segment with 71% share.

Market Segmentation Analysis:

By Type

Industrial grade leads this segment with about 71% share in 2024 due to its wide use across chemical processing, textile dyeing, and metal treatment activities. Demand remains steady because industrial users rely on high-purity sodium thiocyanate for polymer production, plating solutions, and specialty chemicals. Technical grade grows at a moderate pace as smaller manufacturers adopt it for low-intensity applications. Growth across both grades is supported by rising synthetic fiber production and expansion of industrial operations in developing economies.

- For instance, Sinopec’s Baling Chemical Fiber Plant has a significant caprolactam production capacity, which is the raw material for nylon-6 production. The plant has developed process technologies for 200,000 tons per year of caprolactam and a total caprolactam production scale for Sinopec was 900,000 tons annually as of the end of 2019

By End Use

The pharmaceutical sector dominates this segment with nearly 39% share in 2024, driven by rising demand for sodium thiocyanate in drug formulation, diagnostic reagents, and therapeutic research. Building and construction follows as the compound is used in accelerating admixtures for concrete. Agriculture records steady use in pest control and soil treatment, while other industries adopt it for laboratory reagents and specialty applications. Growth accelerates due to expanding pharmaceutical manufacturing capacity and ongoing material innovation across end-use sectors.

- For instance, Thermo Fisher Scientific operates through a global network that includes more than 60 main pharma services sites across over 25 countries.

Key Growth Drivers

Rising Demand from Pharmaceutical Manufacturing

Pharmaceutical companies drive strong consumption of sodium thiocyanate because the compound supports active ingredient synthesis, diagnostic reagent production, and formulation research. Expansion of drug manufacturing facilities in Asia and Europe strengthens industrial uptake. The shift toward advanced analytical testing also boosts demand for high-purity grades. Growing investment in biotechnology and broader adoption of reagent-based diagnostic workflows further lift consumption, making pharmaceuticals the most influential growth driver in the market.

- For instance, Novartis operates in more than 30 production sites worldwide and manufactured over 20 billion treatments in 2024.

Expansion of Textile and Polymer Production

The textile and polymer industries rely on sodium thiocyanate for fiber processing, dye stabilization, and specialty polymer synthesis. Rapid growth in synthetic fiber production across emerging economies increases the need for consistent chemical supply. Manufacturers expand capacity to serve rising apparel exports and industrial textile applications. Improved processing efficiencies and adoption of modern spinning technologies also support steady consumption. This sector’s scale and stable usage patterns make it a major driver of market growth.

- For instance, Indorama Ventures produced 14.04 million tons of polyester, PET, and related synthetic fibers in its latest reporting year (2024).

Growing Use in Construction Chemicals

Demand rises in construction due to the compound’s role in accelerating admixtures and performance-enhancing formulations. Infrastructure development in developing regions lifts consumption as builders seek faster setting times and improved concrete durability. Chemical suppliers integrate sodium thiocyanate into advanced construction blends to enhance productivity on large projects. Rising investments in transportation, housing, and commercial infrastructure keep this segment growing, positioning construction as a key driver of long-term market expansion.

Key Trends and Opportunities

Shift Toward Higher-Purity and Specialty Grades

Manufacturers focus on producing higher-purity sodium thiocyanate to meet stricter quality needs in pharmaceuticals, polymers, and laboratory applications. This trend opens opportunities for suppliers capable of offering premium grades. Companies strengthen purification processes and expand their analytical capabilities to secure contracts in regulated industries. Growing demand for cleaner chemical inputs and trace-level control creates room for specialized products with enhanced performance and reduced impurities.

- For instance, the Honeywell Research Chemicals brand, which includes sub-brands like Fluka, Riedel-de Haën, and Burdick & Jackson, offers over 10,000 different high-purity research chemicals and reagents through its extensive global catalog and distributor networks

Adoption of Sustainable and Energy-Efficient Production Methods

Producers explore cleaner manufacturing pathways to reduce emissions and cut waste generation. Adoption of energy-efficient reactors, improved heat-recovery systems, and optimized reagent use creates opportunities for cost advantages and regulatory compliance. Sustainability goals in end-use industries encourage uptake of responsibly produced chemicals. This trend supports long-term investments in modernized facilities and opens new avenues for suppliers with strong environmental performance.

- For instance, Clariant achieved a 29% reduction in its total scope 1 & 2 greenhouse gas emissions from a 2019 baseline by the end of 2023 through various initiatives including using green electricity and replacing coal with natural gas and sustainable biomass at various sites.

Key Challenges

Volatility in Raw Material Availability

Fluctuations in raw material supply disrupt production consistency and pricing stability. Producers depend on reliable access to ammonia, sulfur compounds, and related inputs, making the market sensitive to industrial outages and trade restrictions. Interruptions in global supply chains raise procurement costs and reduce profit margins. These challenges force manufacturers to diversify sourcing strategies and maintain larger inventory buffers, increasing operational complexity.

Stringent Environmental and Safety Regulations

Regulatory pressure increases as authorities tighten standards on chemical handling, emissions, and waste disposal. Compliance requires costly upgrades to treatment systems, monitoring tools, and safety protocols. Smaller manufacturers face difficulties in meeting evolving regulatory expectations, limiting their competitiveness. As environmental enforcement strengthens worldwide, operational costs rise and plant expansions require longer approval timelines, posing a persistent challenge for the market.

Regional Analysis

North America

North America holds about 32% share of the Sodium Thiocyanate Market in 2024, supported by strong pharmaceutical production and advanced chemical manufacturing. Growth remains steady as the region expands diagnostic reagent use and invests in high-purity chemical processing. The United States leads due to large-scale drug development, while Canada contributes through rising polymer and research-grade chemical demand. Regulatory focus on quality drives suppliers to improve refining processes and ensure consistent purity. Expanding life sciences research and stable industrial applications keep North America a dominant and resilient regional market.

Europe

Europe accounts for nearly 28% share of the Sodium Thiocyanate Market in 2024, driven by robust textile processing, pharmaceutical formulation, and specialty chemical production. Germany, France, and the United Kingdom lead consumption due to strong industrial activity and regulated chemical standards. Demand stays stable as manufacturers adopt high-grade sodium thiocyanate for fibers, polymers, and concrete additives. Sustainability goals push producers to upgrade plants and reduce waste. Continued infrastructure renovation and expansion of advanced material research strengthen Europe’s position as a key regional market.

Asia Pacific

Asia Pacific holds the largest share at about 34% in 2024, driven by expanding textile manufacturing, high-volume polymer production, and growing pharmaceutical capacity. China and India lead due to large-scale industrial operations and rising investments in chemical intermediates. Rapid construction growth also boosts demand for admixture components. Lower manufacturing costs and expanding export activity make the region a global supply hub. Improvements in chemical purification and adoption of automation increase production efficiency, reinforcing Asia Pacific’s dominance in the global Sodium Thiocyanate Market.

Latin America

Latin America captures around 4% share of the Sodium Thiocyanate Market in 2024, supported by moderate demand from agriculture, construction, and chemical processing. Brazil and Mexico drive consumption as industrialization expands and regional manufacturers adopt sodium thiocyanate for concrete additives, crop applications, and laboratory reagents. Growth remains gradual due to limited high-purity production facilities. However, rising investment in pharmaceutical packaging and agrochemical formulations offers new opportunities. Strengthening regional trade networks helps improve product availability and reduce procurement delays, supporting steady market development.

Middle East and Africa

Middle East and Africa represent nearly 2% share of the Sodium Thiocyanate Market in 2024, with demand driven by construction projects, mining chemicals, and emerging pharmaceutical activities. Gulf countries support consumption through infrastructure expansion, while South Africa contributes through industrial chemical applications. Growth remains modest because of limited regional manufacturing capacity and heavy reliance on imports. However, rising investment in concrete admixtures and growing interest in localized chemical production create future opportunities. Improved logistics and industrial diversification efforts gradually strengthen the region’s market footprint.

Market Segmentations:

By Type

- Industrial Grade

- Technical Grade

By End Use

- Pharmaceutical

- Building and Construction

- Agriculture

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Sodium Thiocyanate Market includes Honeywell, Ronas Chemical, Hebei Chengxin, Dongsheng Chemical, Jiaozuo Henghua Chemical, Triveni Chemicals, Shandong Tiancheng Chemical, Anhui Shuguang Chemical, and Henan Province Tianshui Chemical in the first line. The market features a mix of global producers and regional suppliers that focus on capacity expansion, cost optimization, and product purity enhancement. Most companies invest in improved chemical processing technologies to meet rising demand from pharmaceuticals, textiles, and construction applications. Producers emphasize reliable raw material sourcing and upgraded purification systems to strengthen consistency and compliance. Strategic partnerships with downstream industries help stabilize long-term supply contracts and support market penetration. Growing interest in high-purity and specialty-grade sodium thiocyanate encourages firms to modernize facilities and adopt advanced quality-control systems. Competitive strength increasingly depends on production efficiency, environmental compliance, and the ability to serve diverse industrial requirements across global markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In 2025, Ronas Chemical continued its operations as a significant manufacturer, supporting the expanding use of sodium thiocyanate in various chemical formulations and laboratory reagents.

- In 2024, Honeywell announced it will spin off its Advanced Materials business, which includes specialty and research-grade chemicals like sodium thiocyanate, into a separate U.S.-listed company by late 2025/early 2026 to streamline focus and sharpen investment for lab reagents.

- In 2023, Triveni Chemicals continued to be an active supplier of various industrial chemicals, including sodium thiocyanate, within the Indian market.

Report Coverage

- The research report offers an in-depth analysis based on Type, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

- Future Outlook

- The market will grow steadily as pharmaceutical manufacturing expands worldwide.

- Demand will rise in textile and polymer production due to higher synthetic fiber output.

- Construction chemicals will use more sodium thiocyanate for faster-setting admixtures.

- Producers will upgrade plants to deliver higher-purity and specialty-grade material.

- Sustainability goals will push manufacturers toward cleaner and energy-efficient processes.

- Asia Pacific will strengthen its role as the leading production and consumption hub.

- Supply chains will become more localized to reduce raw material and import risks.

- Research applications will expand as labs adopt advanced reagent-based testing.

- Regulatory compliance will shape investments in safety, waste treatment, and monitoring.

- New opportunities will emerge in niche sectors such as electronics chemicals and performance materials.