Market Overview:

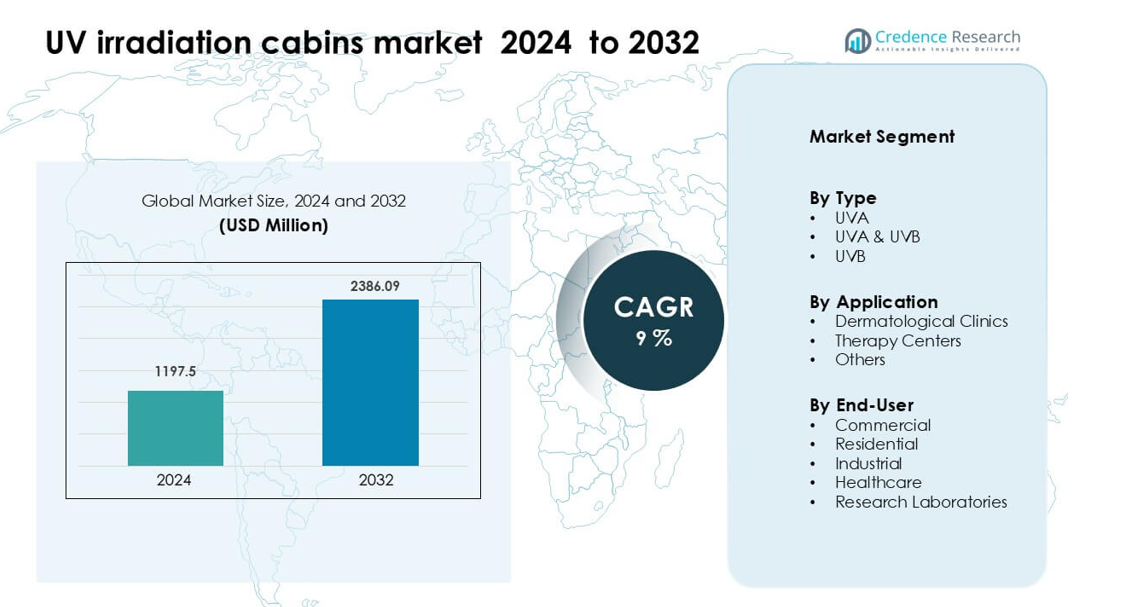

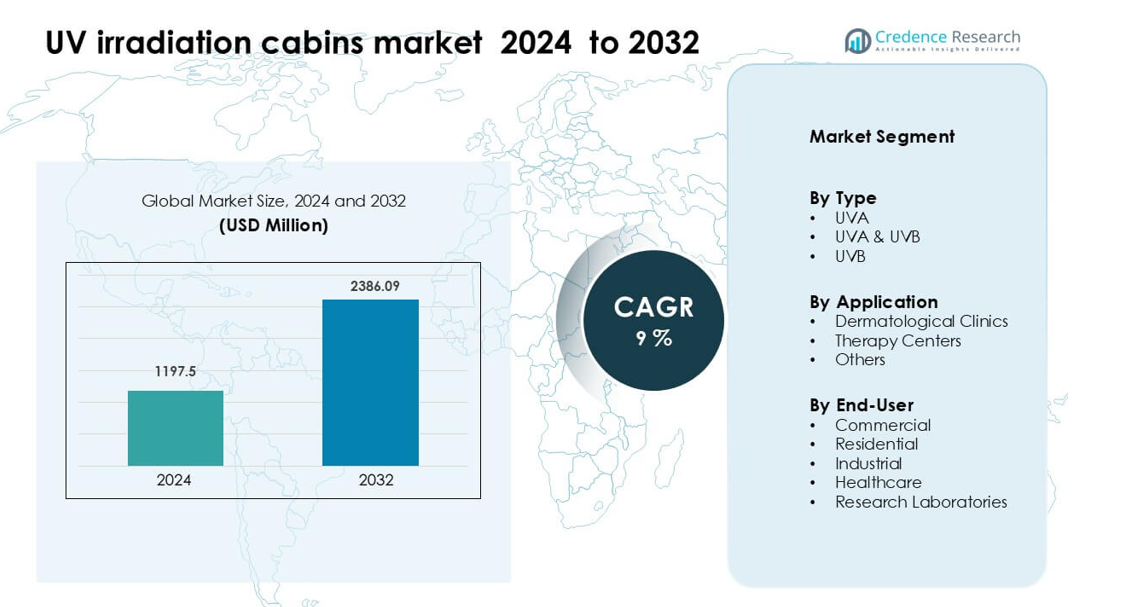

UV irradiation cabins market was valued at USD 1197.5 million in 2024 and is anticipated to reach USD 2386.09 million by 2032, growing at a CAGR of 9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| UV Irradiation Cabins Market Size 2024 |

USD 1197.5 million |

| UV Irradiation Cabins Market, CAGR |

9% |

| UV Irradiation Cabins Market Size 2032 |

USD 2386.09 million |

The UV irradiation cabins market is shaped by leading players such as Curative UV, Atlantic Ultraviolet Corporation, Osram, Honeywell International Inc., Xenex Disinfection Services, Philips Lighting, UV-C Technologies, Trojan Technologies, Steril-Aire, and Severn Trent Services. These companies compete by developing safer cabins with automated dosing, improved shielding, and digital controls that support precise phototherapy. Vendors strengthen market reach through wider distribution networks and upgrades in lamp efficiency and system durability. Europe leads the market with about 34 % share in 2024, supported by strong clinical adoption, strict safety standards, and high investment in dermatology infrastructure across hospitals and specialty clinics.

Market Insights

- The UV irradiation cabins market was valued at USD 1197.5 million in 2024 and is projected to reach USD 2386.09 in million by 2032, growing at a CAGR of 9 % during the forecast period.

- Growth is driven by rising dermatological cases such as psoriasis, vitiligo, and eczema, along with increased adoption of regulated UVB and combined UV therapy in hospitals and specialty clinics.

- Trends include wider adoption of digital dose-controlled cabins, LED-enhanced UV systems, and growing use of compact phototherapy units in wellness centers and cosmetic studios.

- The competitive landscape features strong participation from medical UV system manufacturers expanding safer cabin designs, automated controls, and service networks to maintain segment leadership; the dominant segment includes medical applications with about 62 % share.

- Europe leads the market with 34 % regional share, followed by North America at 28 %, driven by high clinical adoption, strict safety guidelines, and strong investment in dermatology infrastructure.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

UVA cabins dominate this segment with about 54% share in 2024. Demand rises as clinics use UVA systems for broad psoralen-based therapy and faster session cycles. Healthcare providers choose UVA cabins because these systems deliver deeper skin penetration and support large-area exposure with stable dose control. UVB cabins grow as hospitals treat chronic skin conditions with narrow-band wavelengths. Combined UV cabins gain traction in advanced centers that need flexible therapy modes for mixed dermatological needs. Overall growth strengthens as treatment accuracy becomes a major clinical priority.

- For instance, Daavlin’s ML24000 UVA-1 unit uses Philips medium-pressure lamps peaking at 365 nm and delivers full-body UVA illumination in a microprocessor-controlled design.

By Application

Medical applications lead this segment with nearly 62% share in 2024. Hospitals adopt UV cabins to manage psoriasis, vitiligo, and eczema with regulated phototherapy. Dermatologists prefer medical installations because these units support repeatable dosage, shorter treatment cycles, and lower risk of overexposure. Wellness centers expand use for skin rejuvenation programs with controlled cosmetic treatments. Research institutes upgrade cabins to study UV-based dermatological response under monitored lab settings. Market demand grows as patient volumes increase and phototherapy becomes a standard non-invasive option.

- For instance, the Medisun 2800 Innovation cabin allows dose input in J/cm² via its touch-PC control, with redundant real-time UVA or UVB sensors (two of each) for precision and safety.

By End User

Hospitals dominate this segment with about 48% share in 2024. Hospital units rely on UV cabins for consistent therapy and integrated patient monitoring features. Clinics prefer these systems because they offer precise wavelength control and steady throughput for daily sessions. Dermatology clinics increase adoption for targeted care and greater scheduling flexibility. Wellness studios add UV cabins for cosmetic routines and controlled exposure services. Growth stays strong as end users seek safer systems with improved shielding, automated calibration, and enhanced patient safety features.

Key Growth Drivers

Rising Prevalence of Dermatological Disorders

Growing cases of psoriasis, vitiligo, eczema, and chronic dermatitis drive strong demand for UV irradiation cabins across hospitals and dermatology clinics. Providers adopt these systems because they deliver controlled, repeatable phototherapy with fewer side effects than long-term steroid use. Clinics also rely on UV-based care to reduce flare frequency and improve symptom control in patients who do not respond well to topical drugs. The rising need for non-invasive therapy strengthens market penetration in both developed and emerging regions, where medical centers expand dermatology departments. Narrow-band UVB therapy becomes a preferred treatment mode due to targeted wavelength accuracy and shorter session duration. As global skin disease incidence increases, healthcare systems integrate these cabins into routine care pathways to reduce outpatient loads and enhance treatment outcomes. Growing patient awareness further boosts adoption as more individuals seek clinically guided light therapy with lower long-term complications.

- For instance, Daavlin’s DermaPal narrow-band UVB device uses a Philips TL-01 lamp operating at a peak wavelength of 311 nm, enabling precision treatment for patients requiring consistent spectral accuracy.

Technological Advancements in Phototherapy Systems

Advances in UV cabin engineering support stronger market growth through improved safety, precision, and energy efficiency. Modern cabins feature automated dosage calibration, real-time irradiation monitoring, and enhanced shielding that reduces accidental overexposure. Manufacturers introduce digital control interfaces, sensor-triggered shutoff mechanisms, and optimized reflector designs that increase uniform light distribution. These upgrades help dermatology clinics manage higher patient throughput without compromising treatment quality. LED-based UV modules also gain attention for lower heat output and longer lamp life, reducing operating costs and maintenance downtime for end users. Smart connectivity enables treatment tracking, remote adjustment, and documentation for clinical audits. Hospitals adopting advanced phototherapy cabins benefit from reduced treatment variability and improved patient comfort during sessions. As technology continues to improve, the market experiences faster replacement cycles, with providers shifting to next-generation solutions that enhance efficiency, reliability, and long-term performance.

- For instance, Waldmann’s UV 7002 full-body system uses 42 lamps (21 PUVA + 21 narrow-band TL-01), with high-gloss inner reflectors to improve uniformity, and a power draw of 6.24 kW under 400 V three-phase supply.

Growth of Wellness and Cosmetic Phototherapy Services

Wellness centers and cosmetic studios increasingly integrate UV irradiation cabins to meet rising consumer interest in skin rejuvenation, pigmentation correction, and controlled tanning solutions. The sector attracts customers seeking non-invasive procedures that offer visible improvements with shorter recovery time than chemical treatments. UV cabins support these programs by providing regulated exposure that promotes collagen stimulation and balanced skin tone. Growing adoption within premium wellness chains expands market visibility beyond medical settings. Improved safety protocols and preset cosmetic modes encourage more operators to offer UV-based services without advanced clinical staff. The trend is further driven by social media influence, where consumers pursue clearer skin and fast cosmetic enhancement options. As disposable income rises across major regions, wellness-focused phototherapy becomes a viable revenue stream for studios. This shift creates a secondary growth channel for manufacturers supplying compact, energy-efficient, and user-friendly UV cabin models designed for non-medical environments.

Key Trend & Opportunity

Expansion of Home-Use and Portable UV Devices

A growing trend toward home-based phototherapy presents strong opportunity for manufacturers to introduce compact UV cabins and portable panels. Patients with chronic skin diseases prefer home therapy options to reduce frequent clinic visits and lower long-term treatment costs. Advances in low-emission UVB lamps, improved shielding, and simplified interfaces make home systems safer and more user-friendly. Remote monitoring features allow dermatologists to track sessions, dosage, and adherence through connected apps. Companies offering medically approved personal-use devices gain an edge as insurance systems in some regions support partial reimbursement for at-home phototherapy. Rising tele-dermatology adoption enables combined clinical oversight and self-administered therapy, strengthening demand for portable solutions. This trend broadens the market reach beyond hospitals and clinics, creating long-term recurring revenue through lamp replacements and service contracts. Home solutions also open new distribution channels through e-commerce and direct-to-consumer sales.

- For instance, the Daavlin DermaPal home-use narrow-band UVB device uses a Philips TL-01 lamp operating at 311 nm and provides a treatment aperture of approximately 13 cm × 5 cm, enabling controlled small-area therapy suitable for home protocols.

Integration of Digital Health and AI-Based Treatment Optimization

Digital health integration becomes a powerful opportunity as UV cabins adopt AI-driven exposure control, automated patient profiling, and treatment optimization algorithms. Clinics seek systems capable of adjusting intensity, wavelength, and duration based on skin type, past response, and medical history. AI-enabled sensors analyze skin tone, lesion severity, and treatment progress, helping providers achieve consistent outcomes. Cloud connectivity supports session tracking, electronic record integration, and data-driven clinical decision-making. These technologies enhance safety by flagging high-risk skin photosensitivity patterns or incomplete shielding. Manufacturers that embed analytics and tele-dermatology functions gain a competitive edge among hospitals aiming to modernize dermatology workflows. Opportunities also emerge in creating subscription-based digital services for treatment monitoring and device calibration. As healthcare systems invest in digital transformation, UV cabin vendors benefit from growing interest in smart phototherapy platforms that combine precision, patient engagement, and operational efficiency.

- For instance, Daavlin’s ClearLink ecosystem logs every session parameter including irradiance in mW/cm², exposure duration in seconds, and cumulative dose in J/cm²—and transfers the data to clinicians for automated protocol review.

Expansion in Emerging Markets with Growing Dermatology Infrastructure

Emerging economies represent a major opportunity as hospitals upgrade dermatology units and expand access to phototherapy. Regions in Asia-Pacific, Latin America, and the Middle East witness rising awareness of phototherapy’s effectiveness and lower long-term treatment burden. Governments increase healthcare spending to manage chronic and infectious skin conditions, opening procurement channels for cost-effective UV cabins. Multinational manufacturers enter these markets through partnerships with local distributors, providing training and maintenance support to build long-term demand. As private clinics expand in urban areas, UV cabins become a common component of dermatology service packages. Lower manufacturing cost models and locally assembled units help increase affordability for mid-sized facilities. The growing presence of dermatology chains and wellness studios further widens market penetration. These conditions create a strong opportunity for vendors offering scalable, durable, and easy-maintenance cabins tailored to developing healthcare environments.

Key Challenge

Safety Concerns and Regulatory Compliance Requirements

Safety remains one of the biggest challenges in the UV irradiation cabins market. Incorrect dosage, prolonged exposure, and poor shielding can cause burns, skin damage, or heightened long-term cancer risk. Strict regulatory standards require manufacturers to implement multi-level safety protocols, automated dose limits, and certified lamp technologies. Facilities must train operators to manage phototherapy sessions with precision, which increases operational burden and costs for smaller clinics. Complex compliance procedures prolong market entry for new products and slow adoption in regions with limited regulatory clarity. Upgrading older cabins to meet modern safety expectations also demands capital investment. As public awareness of UV risks grows, cautious patient behavior may reduce adoption unless centers demonstrate strong safety records. Meeting regulatory demands while maintaining affordability remains a key constraint for manufacturers and end users across different regions.

High Installation, Maintenance, and Operational Costs

UV irradiation cabins require significant upfront investment, which limits adoption in smaller hospitals, rural clinics, and low-income markets. High-quality cabins include advanced shielding, digital controls, airflow systems, and medical-grade lamps, all of which raise production cost. Routine maintenance and lamp replacement also add recurring expenses, especially in high-volume dermatology units where lamps degrade faster due to frequent sessions. Clinics must allocate trained staff to monitor treatment cycles, increasing operational cost further. Limited reimbursement in many healthcare systems forces patients to pay out of pocket, reducing willingness to pursue long-term phototherapy. Competitive pressures from alternative treatments, such as biologics and topical immunomodulators, intensify the challenge by offering faster symptom relief despite higher drug cost. Manufacturers must find ways to reduce system price and ongoing service cost to improve affordability and expand global penetration.

Regional Analysis

North America

North America is estimated to hold around 28 % share in the UV irradiation cabins market in 2024. Demand grows as hospitals and dermatology clinics expand phototherapy units for psoriasis, vitiligo, and eczema. Strong reimbursement structures and high healthcare spending support faster technology upgrades. Vendors benefit from strict safety standards that favor certified, premium cabins. Wellness centers and medical spas add cosmetic phototherapy services, widening the installed base. Growth remains strong in the United States, while Canada shows steady adoption in specialized dermatology centers. Replacement of older units with digitally controlled cabins further supports regional revenues.

Europe

Europe leads the UV irradiation cabins market with about 34 % share in 2024. The region benefits from a dense network of dermatology clinics, university hospitals, and specialized phototherapy centers. Strong clinical guidelines support UVB and combined UV therapy for chronic skin diseases. Public healthcare systems in countries such as Germany, France, and the Nordics adopt cabins as standard treatment tools. Demand also rises in private clinics and wellness facilities offering cosmetic light-based services. Strict safety regulations encourage adoption of advanced, certified systems. Replacement demand and early technology adoption keep Europe a core revenue hub.

Asia-Pacific

Asia-Pacific accounts for roughly 25 % share in the UV irradiation cabins market in 2024 and shows the fastest growth. Rising incomes and urbanization drive awareness of dermatological care and cosmetic treatments. Hospitals in China, India, Japan, and South Korea expand dermatology departments and add phototherapy suites. Private skin clinics and aesthetic centers increasingly offer UV-based therapies for pigmentation and chronic conditions. Growing medical tourism in countries such as Thailand and India further supports demand. Local distributors partner with global manufacturers to provide installation, training, and maintenance services. This combination of new installations and upgrading facilities underpins strong regional expansion.

Latin America

Latin America holds close to 7 % share in the UV irradiation cabins market in 2024. Market growth concentrates in Brazil, Mexico, Argentina, and Chile, where urban hospitals and private dermatology clinics invest in phototherapy. Adoption focuses on treating chronic inflammatory skin diseases and some cosmetic applications in higher income groups. Limited reimbursement and budget constraints slow deployment in public hospitals. However, rising middle-class spending on aesthetic procedures supports incremental demand. Distributors play a key role in after-sales service and lamp replacement. Over time, better dermatology infrastructure and training programs are expected to support steadier regional growth.

Middle East and Africa

The Middle East and Africa region represents around 6 % share in the UV irradiation cabins market in 2024. Adoption primarily clusters in Gulf Cooperation Council countries and South Africa, where tertiary hospitals and private clinics invest in advanced dermatology equipment. Demand is driven by high rates of certain skin disorders, growing medical tourism, and increased focus on premium aesthetic services. In many African countries, limited budgets and infrastructure slow wider diffusion. International manufacturers often work through local partners to handle installation and maintenance. As specialized dermatology centers expand, the region offers gradual but long-term growth potential.

Market Segmentations:

By Type

By Application

- Dermatological Clinic

- Therapy Centre

- Others

By End-User

- Commercial

- Residential

- Industrial

- Healthcare

- Research Laboratories

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the UV irradiation cabins market features a mix of global manufacturers and specialized phototherapy equipment providers that focus on safety, energy efficiency, and treatment accuracy. Leading companies compete by developing cabins with advanced shielding, automated dose control, and digital monitoring systems that support clinical decision-making in dermatology. Vendors strengthen market position through partnerships with hospitals, wellness chains, and distributors to expand installation and maintenance coverage. Many players invest in R&D to integrate LED-based UV modules, AI-supported exposure management, and compact cabin designs that reduce operating costs. Growing demand from medical and cosmetic segments encourages companies to offer multi-mode UV cabins and customizable configurations. After-sales service, lamp replacement programs, and operator training have become key differentiators, especially in competitive regions with strong regulatory requirements. As clinics replace older units with modern systems, manufacturers focus on reliability, patient safety, and digital features to secure long-term market share.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Curative UV

- Atlantic Ultraviolet Corporation

- Osram

- Honeywell International Inc.

- Xenex Disinfection Services

- Philips Lighting

- UV-C Technologies

- Trojan Technologies

- Steril-Aire

- Severn Trent Services

Recent Developments

- In 2025, Atlantic Ultraviolet Corporation launched the SaniUV-Cube UV-C disinfection cabinet for commercial, industrial, and institutional facilities. The stainless-steel unit with quartz shelves and four high-output lamps is designed to neutralize microbes such as C. diff, Staph aureus, Candida auris, and SARS-CoV-2 on small items, strengthening the UV disinfection cabinet segment.

- In 2024, ams OSRAM announced a new high-power UV-C LED in its OSLON UV portfolio, the OSLON UV 3535, with an output of typically 115 mW at 265 nm

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will grow as phototherapy becomes a routine treatment for chronic skin disorders.

- Clinics will adopt more cabins with automated exposure control and enhanced safety systems.

- LED-based UV technologies will expand due to lower heat output and longer lamp life.

- Wellness centers will increase cosmetic UV services, widening non-medical usage.

- Smart cabins with digital tracking and AI-based treatment optimization will gain popularity.

- Home-use and portable UV units will emerge as a fast-growing category.

- Emerging regions will accelerate adoption as dermatology infrastructure improves.

- Replacement cycles will strengthen as older cabins are upgraded to digital models.

- Manufacturers will expand service networks to support higher installation volumes.

- Regulatory improvements will create a clearer path for safer and certified UV cabin deployment.