Market Overview

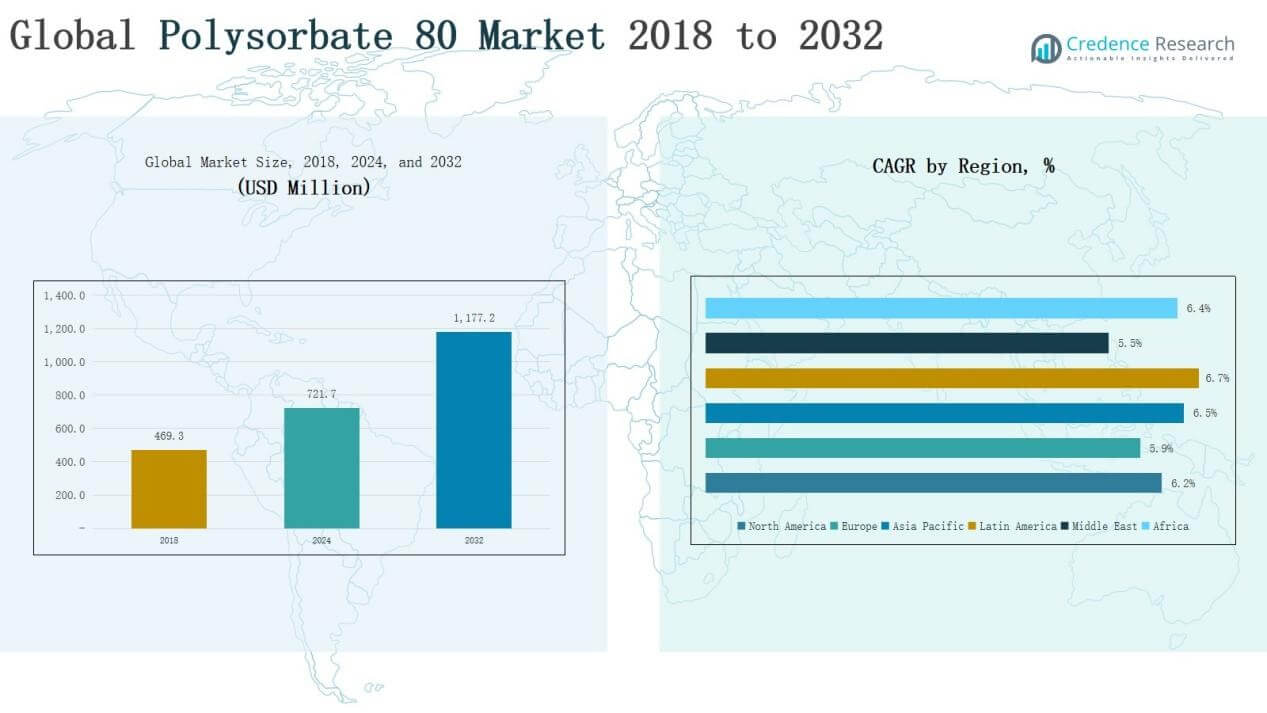

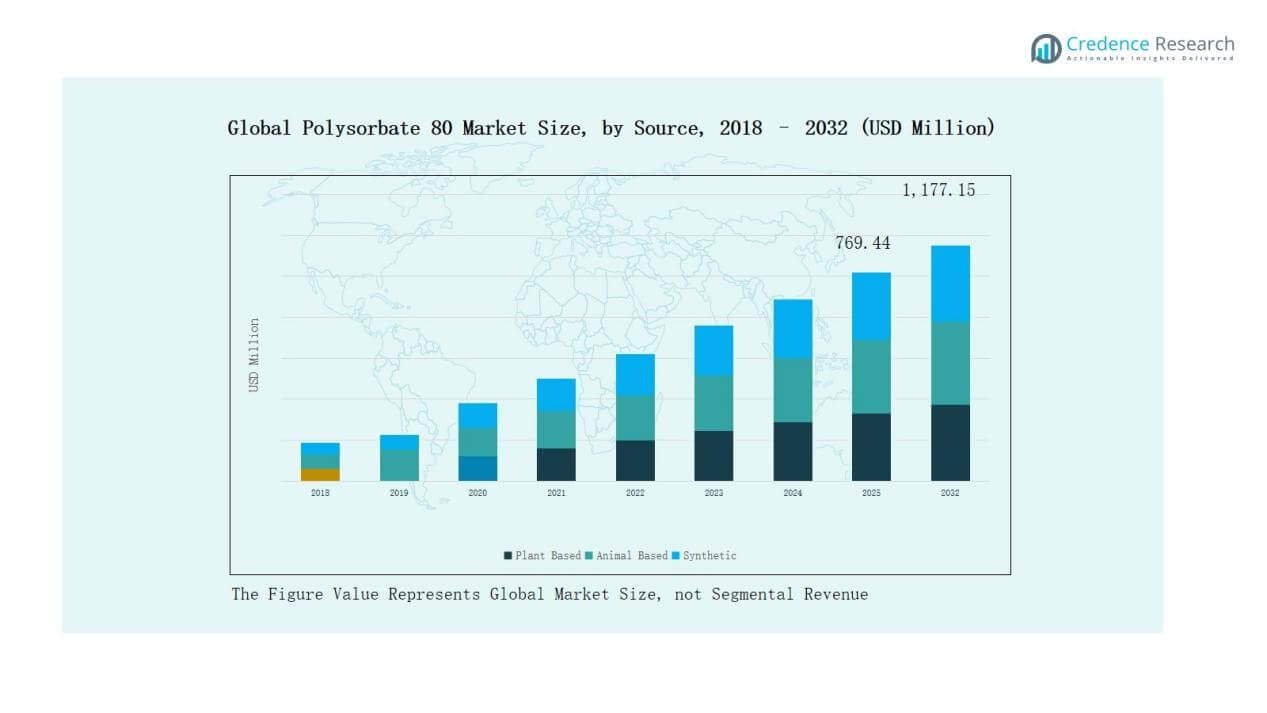

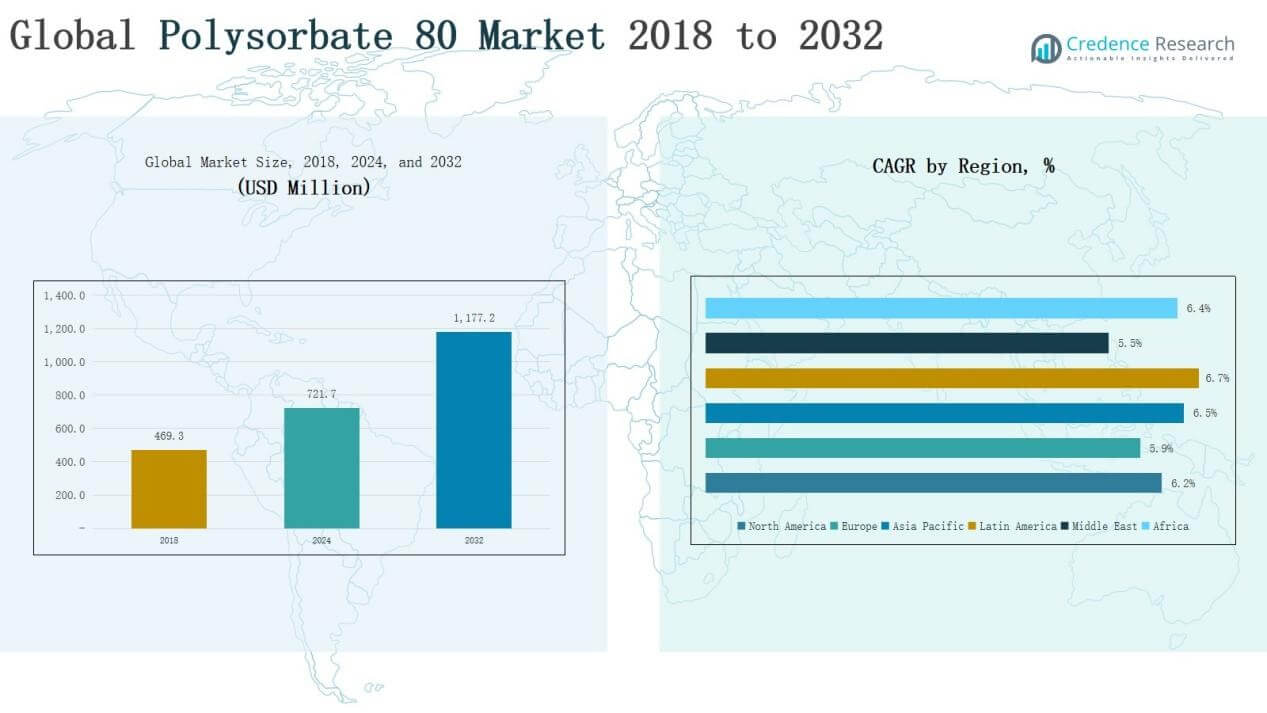

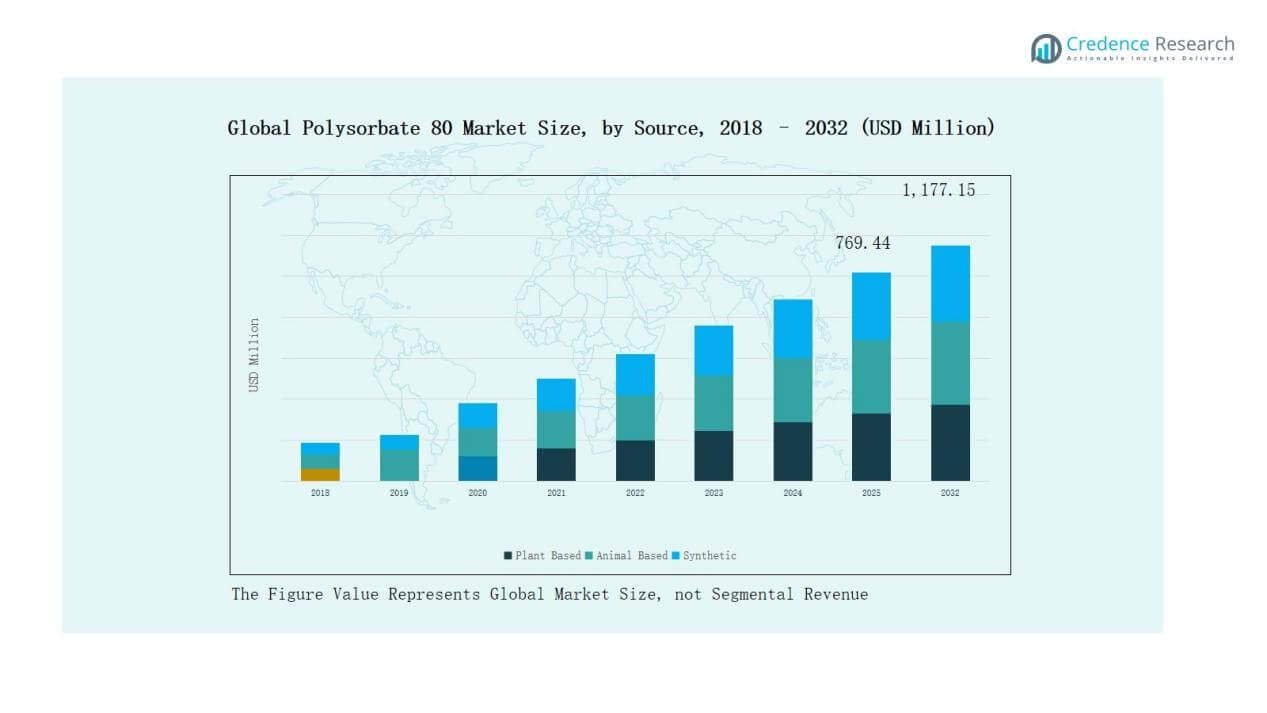

Global Polysorbate 80 Market size was valued at USD 469.3 million in 2018 to USD 721.7 million in 2024 and is anticipated to reach USD 1,177.2 million by 2032, at a CAGR of 6.26% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Polysorbate 80 Market Size 2024 |

USD 721.7 Million |

| Polysorbate 80 Market, CAGR |

6.26% |

| Polysorbate 80 Market Size 2032 |

USD 1,177.2 Million |

The Global Polysorbate 80 Market is shaped by the presence of leading companies such as Lonza Group Limited, BASF Corporation, Croda International plc, Solenis, Avril Group, Reachin Chemical Co., Ltd., Lotion Crafter LLC, ERACHEM Comilog, Inc., and Compania Minera Aultan. These players compete through extensive product portfolios, strong distribution networks, and continuous innovation in plant-based and sustainable formulations to meet rising clean-label demand. Strategic initiatives such as mergers, acquisitions, and regional expansions further strengthen their market position. Geographically, Asia Pacific emerged as the leading region in 2024 with a 6.5% share, supported by large-scale pharmaceutical production, rising cosmetics consumption, and expanding food and beverage industries.

Market Insights

- The Global Polysorbate 80 Market grew from USD 469.3 million in 2018 to USD 721.7 million in 2024, and is projected to reach USD 1,177.2 million by 2032.

- Plant-based sources dominated with a 52% share in 2024, driven by rising demand for sustainable, natural, and safer formulations across pharmaceuticals, food, and cosmetics.

- The emulsifier functionality led with 41% share, supported by its extensive use in stabilizing bakery, dairy, and beverage products across global food and beverage industries.

- Pharmaceuticals emerged as the top application segment with 37% share, fueled by polysorbate 80’s critical role in biologics, vaccines, and injectable formulations.

- Asia Pacific led the market with a 6.5% share in 2024, supported by large-scale pharmaceutical manufacturing, rising cosmetics demand, and expanding processed food consumption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segment Insights

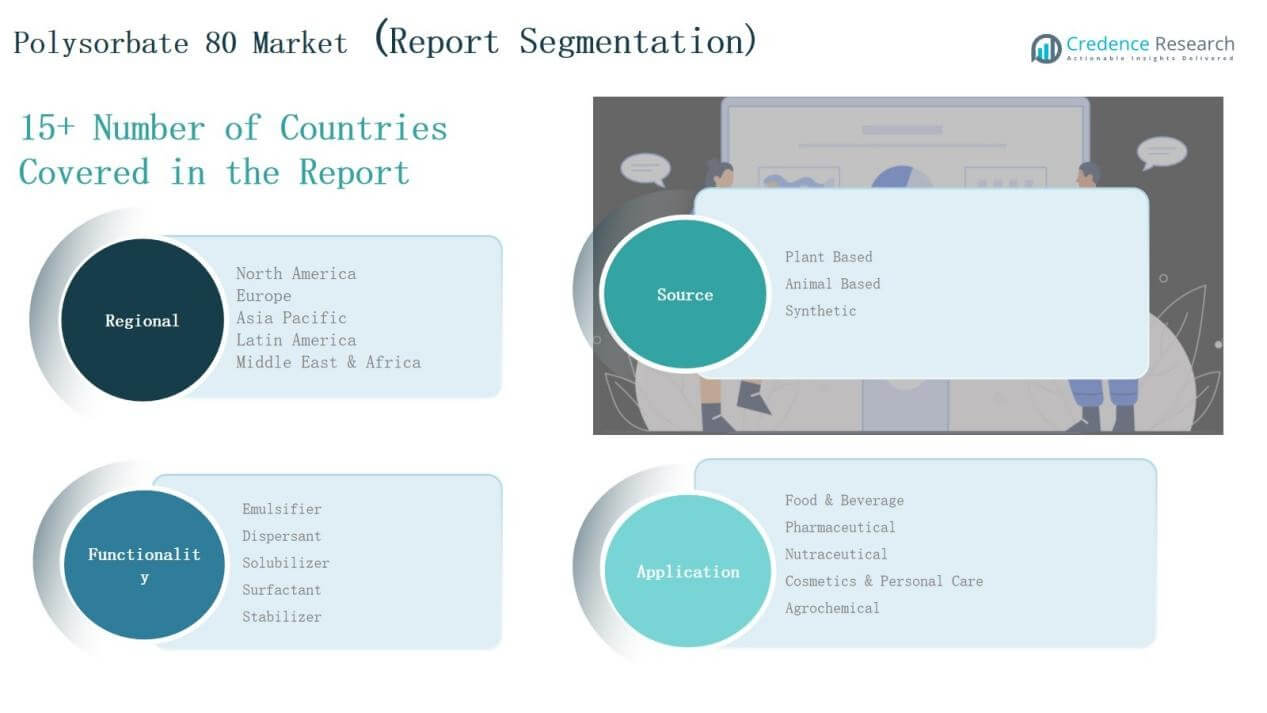

By Source

Plant-based polysorbate 80 dominated the market in 2024 with a 52% share, driven by rising demand for sustainable and natural ingredients in food, pharmaceuticals, and cosmetics. Consumers prefer plant-derived emulsifiers due to perceived safety and lower allergenic risks compared to animal-based sources. Animal-based polysorbate 80, holding 28% share, remains relevant in regions with established traditional processing, though it faces declining adoption amid ethical and regulatory concerns. Synthetic variants accounted for the remaining 20%, supported by cost efficiency and scalability in industrial applications, but they continue to face scrutiny due to increasing clean-label trends.

- For instance, Croda International launched its ECO Tween™ range in 2020, offering 100% bio-based polysorbates made from renewable plant feedstocks.

By Functionality

The emulsifier segment led the functionality category with a 41% share in 2024, reflecting polysorbate 80’s widespread use in stabilizing food and beverage formulations. Strong demand from bakery, dairy, and beverage industries underpins this dominance. The solubilizer function held 23% share, favored in pharmaceuticals and nutraceuticals to enhance bioavailability of active compounds. Surfactants contributed 15%, widely applied in cosmetics and personal care for effective cleansing and formulation stability. Dispersants and stabilizers captured 12% and 9% shares respectively, used in agrochemical suspensions and long-shelf-life formulations, ensuring broader but niche growth prospects.

- For insatcne, Mondelez International, a major chocolate and confectionery producer, uses other emulsifiers, such as polyglycerol polyricinoleate (PGPR) and lecithin, in its chocolate to maintain texture, reduce viscosity, and prevent fat bloom.

By Application

The pharmaceutical sector emerged as the leading application segment, capturing 37% share in 2024, driven by polysorbate 80’s critical role in injectable formulations, vaccines, and biologics. Food and beverage followed with 28% share, supported by its use as an emulsifier in processed foods, beverages, and confectionery. Cosmetics and personal care products held 19% share, leveraging polysorbate 80’s solubilizing and stabilizing properties in creams, lotions, and cleansers. Nutraceutical applications accounted for 10% share, boosted by growing demand for supplements with enhanced bioavailability. Agrochemicals represented 6% share, benefiting from polysorbate 80’s dispersing functions in pesticide and herbicide formulations.

Market Overview

Key Growth Drivers

Rising Pharmaceutical Demand

The pharmaceutical industry strongly drives polysorbate 80 demand, particularly in injectable formulations, biologics, and vaccines. Its role as a solubilizer and stabilizer makes it essential for enhancing drug delivery and maintaining product stability. Growing investments in biologics and monoclonal antibody therapies amplify its importance. The increasing prevalence of chronic diseases and rising vaccine demand globally further solidify polysorbate 80 as a critical excipient. Pharmaceutical firms increasingly depend on this emulsifier to meet regulatory standards and deliver effective, safe, and stable formulations.

- For instance, Amgen incorporates polysorbate 80 in formulations of biologics such as darbepoetin alfa (Aranesp®) and epoetin alfa (Epogen®, Procrit®), critical in treating anemia in cancer patients, enhancing stability and preventing protein aggregation.

Expansion in Food and Beverage Applications

Food and beverage manufacturers are increasingly adopting polysorbate 80 to improve product texture, stability, and shelf life. With consumer demand for processed and convenience foods rising, the need for reliable emulsifiers has expanded significantly. Its use in bakery, dairy, confectionery, and beverage applications ensures consistent product quality. Additionally, clean-label and natural product preferences boost demand for plant-based polysorbate 80. Global urbanization, lifestyle changes, and growing packaged food consumption continue to drive the segment, making polysorbate 80 integral to food innovation and formulation.

- For instance, in ice cream production, companies use polysorbate 80 at concentrations up to 0.5% to prevent ice crystal formation, resulting in a smoother texture and increased resistance to melting.

Growth in Cosmetics and Personal Care Industry

The cosmetics and personal care industry presents strong demand for polysorbate 80 as a solubilizer and surfactant. It enhances the formulation of creams, lotions, shampoos, and cleansers by improving texture, consistency, and stability. The rising consumer focus on skincare and grooming, especially in Asia-Pacific and Europe, supports the growth trajectory. Natural and plant-based variants are gaining traction among eco-conscious buyers, aligning with the shift toward sustainable personal care products. The rapid expansion of e-commerce channels further accelerates market penetration, increasing its global adoption across beauty and hygiene products.

Key Trends & Opportunities

Shift Toward Plant-Based and Sustainable Sources

One of the most notable trends is the growing preference for plant-based polysorbate 80, supported by clean-label initiatives and environmental sustainability goals. Consumers increasingly view plant-derived ingredients as safer and more ethical compared to animal-based sources. This trend opens opportunities for producers to innovate with natural alternatives that meet regulatory and consumer expectations. Companies adopting green chemistry processes and sustainable sourcing strategies are likely to gain a competitive advantage, as industries such as food, cosmetics, and nutraceuticals embrace environmentally conscious solutions.

- For instance, Vasudha Chemicals supplies high-quality, plant-derived polysorbate 80 meeting global safety standards such as FDA and EFSA, emphasizing sustainable sourcing for pharmaceuticals and cosmetics.

Rising Adoption in Biologics and Advanced Therapeutics

The global boom in biologics, monoclonal antibodies, and gene therapies provides new opportunities for polysorbate 80 in pharmaceutical applications. Its ability to stabilize complex molecules ensures longer shelf life and improved patient safety. As healthcare systems invest in advanced therapeutics, demand for high-purity excipients like polysorbate 80 grows. Expanding clinical trials and regulatory approvals further widen its scope. This trend positions polysorbate 80 as a strategic enabler of innovation in the pharmaceutical landscape, fueling steady growth in the long term.

- For instance, Sanofi-Aventis uses polysorbate 80 in its docetaxel injection (Taxotere®) to solubilize this chemotherapeutic agent, enhancing its stability and efficacy in cancer treatment.

Key Challenges

Regulatory Scrutiny and Safety Concerns

Polysorbate 80 faces growing regulatory scrutiny due to safety concerns associated with synthetic or animal-derived sources. Agencies in North America and Europe enforce strict compliance for pharmaceutical and food-grade use. Studies highlighting potential allergic reactions or toxicity risks create challenges for manufacturers. Meeting stringent safety and purity standards raises production costs and requires continuous monitoring. Regulatory delays or restrictions can affect product availability and market expansion, forcing companies to invest in compliance frameworks while balancing cost-effectiveness.

Price Volatility of Raw Materials

The production of polysorbate 80 depends on raw materials like sorbitol and oleic acid, which are subject to price fluctuations. Agricultural supply variations, geopolitical tensions, and energy costs directly influence availability and pricing. Manufacturers often face margin pressures due to rising input costs, making it challenging to sustain competitive pricing. Smaller producers are more vulnerable, as they have limited capacity to hedge against volatility. Long-term contracts and diversification of raw material sources are required to mitigate these cost-related challenges.

Competition from Alternative Ingredients

Alternative emulsifiers and solubilizers, including lecithin, mono- and diglycerides, and other bio-based surfactants, pose a competitive threat. These substitutes appeal to industries seeking clean-label, allergen-free, and cost-effective options. Continuous innovation in bio-based excipients may reduce dependency on polysorbate 80 in certain applications. Food, pharmaceutical, and cosmetic companies experimenting with alternative formulations create pressure on market share. To maintain relevance, polysorbate 80 suppliers must emphasize product performance, develop plant-based innovations, and differentiate through quality and regulatory compliance.

Regional Analysis

North America

North America held a 6.2% share of the global polysorbate 80 market in 2024, generating revenues of USD 197.21 million. Growth in this region is driven by the strong pharmaceutical industry, particularly the U.S., where polysorbate 80 is widely used in biologics, vaccines, and injectable formulations. Increasing demand from the food and beverage sector, supported by innovation in processed foods, also strengthens its presence. By 2032, revenues are projected to reach USD 320.19 million, with steady adoption across pharmaceuticals and nutraceuticals ensuring long-term growth.

Europe

Europe accounted for a 5.9% share in 2024, with revenues of USD 156.45 million. The market benefits from stringent regulatory frameworks that emphasize high-quality excipients in pharmaceuticals and clean-label ingredients in food and cosmetics. Countries such as Germany, France, and the UK remain major demand centers due to advanced healthcare systems and rising cosmetics consumption. By 2032, the European market is expected to generate USD 248.38 million, driven by growing biologics development, sustainable sourcing initiatives, and increasing consumer preference for natural-based ingredients.

Asia Pacific

Asia Pacific led the global polysorbate 80 market with a 6.5% share in 2024, valued at USD 254.45 million. Strong growth is driven by large-scale pharmaceutical production in China and India, coupled with rising cosmetics and personal care consumption across Southeast Asia, Japan, and South Korea. Expanding processed food demand also supports steady adoption. The region is projected to reach USD 422.48 million by 2032, maintaining its leadership position due to its cost-effective manufacturing base and rapidly growing end-use industries.

Latin America

Latin America represented a 6.7% share of the global market in 2024, generating revenues of USD 65.98 million. Brazil and Mexico are key contributors, driven by rising healthcare spending, growing pharmaceutical production, and expanding food processing industries. The cosmetics sector also plays a notable role, with increasing demand for affordable personal care solutions. By 2032, the regional market is forecasted to reach USD 111.24 million, supported by urbanization, rising disposable incomes, and investments in localized pharmaceutical and food manufacturing capabilities.

Middle East

The Middle East accounted for a 5.5% share in 2024, valued at USD 33.08 million. Growth is supported by increasing pharmaceutical imports, the expansion of local drug manufacturing, and demand for processed foods. GCC countries, particularly Saudi Arabia and the UAE, lead adoption due to their focus on healthcare modernization and food diversification. By 2032, revenues are projected to rise to USD 50.85 million, with opportunities emerging in cosmetics and personal care as consumer spending on premium beauty products grows across the region.

Africa

Africa captured a 6.4% share of the market in 2024, with revenues of USD 14.56 million. South Africa, Egypt, and Nigeria are the leading markets, driven by growing pharmaceutical demand and the expansion of consumer goods industries. Rising urbanization and an increasing population contribute to greater processed food consumption, fueling polysorbate 80 adoption. By 2032, the region is expected to achieve USD 24.01 million in revenues, supported by gradual healthcare improvements, expansion in nutraceuticals, and greater accessibility to global cosmetic and personal care brands.

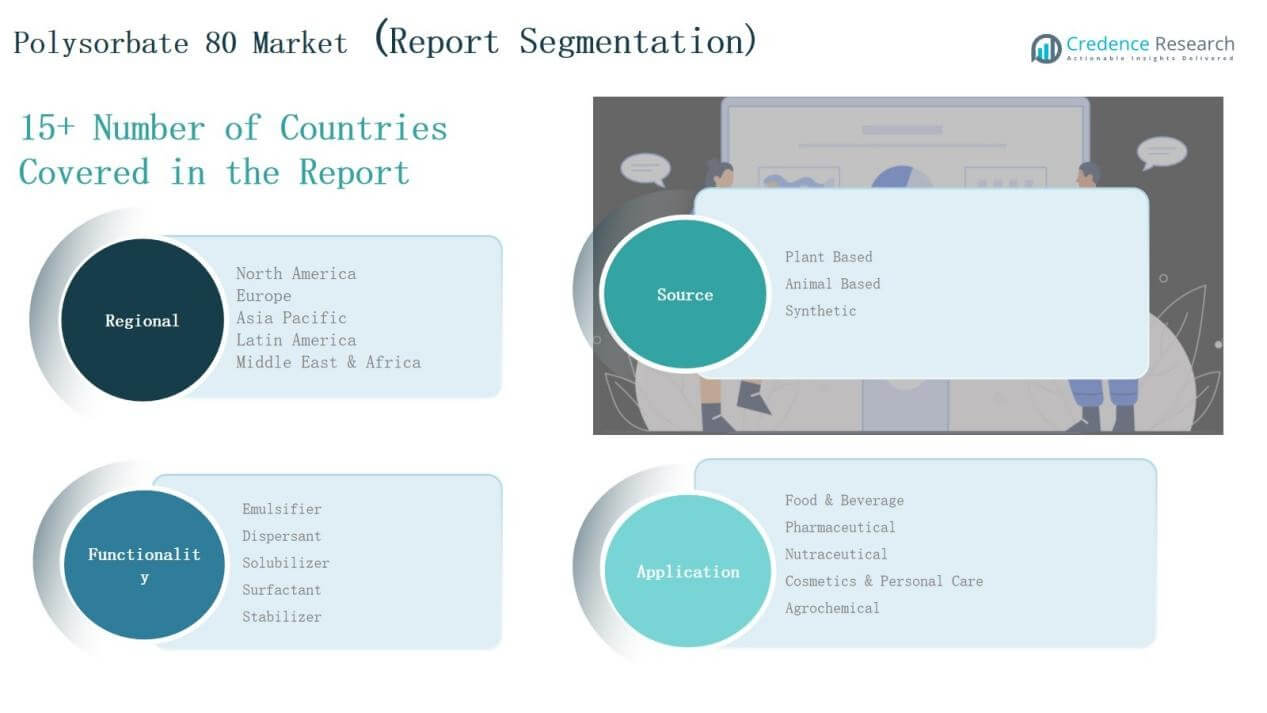

Market Segmentations:

By Source

- Plant Based

- Animal Based

- Synthetic

By Functionality

- Emulsifier

- Dispersant

- Solubilizer

- Surfactant

- Stabilizer

By Application

- Food & Beverage

- Pharmaceutical

- Nutraceutical

- Cosmetics & Personal Care

- Agrochemical

By Region

North America

Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

Latin America

- Brazil

- Argentina

- Rest of Latin America

Middle East

- GCC Countries

- Israel

- Turkey

- Rest of Middle East

Africa

- South Africa

- Egypt

- Rest of Africa

Competitive Landscape

The global polysorbate 80 market is moderately consolidated, with competition driven by established multinational corporations and regional players focusing on cost efficiency and innovation. Leading companies such as Lonza Group Limited, BASF Corporation, Croda International plc, Avril Group, and Solenis dominate through extensive product portfolios and strong global distribution networks. These players emphasize compliance with stringent regulatory standards, particularly for pharmaceutical and food-grade applications, which strengthens their competitive positioning. Strategic initiatives such as mergers, acquisitions, and partnerships are common, enabling firms to expand manufacturing capacities and penetrate high-growth regions, particularly Asia Pacific and Latin America. Smaller firms, including Reachin Chemical Co., Ltd. and Lotion Crafter LLC, compete by offering specialized solutions and flexible pricing to cater to niche applications in cosmetics and personal care. Continuous investment in plant-based sourcing, clean-label formulations, and sustainable manufacturing practices is emerging as a key differentiator, aligning with evolving consumer and industry preferences.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Lonza Group Limited

- Avril Group

- BASF Corporation

- Solenis

- Reachin Chemical Co., Ltd.

- Croda International plc

- Lotion Crafter LLC

- ERACHEM Comilog, Inc.

- Compania Minera Aultan

- A.B. De C.V.

- Other Key Players

Recent Developments

- In January 2024, Croda International launched a line of super-refined Polysorbate 80 and 20 variants aimed at biologics and gene therapies, offering ultra-low residual aldehydes and improved stability.

- In October 2024, Clariant launched its VitiPure Superior line including VitiPure O 80 Superior (Polysorbate 80) designed for colorless, ultra‑pure, parenteral formulations such as vaccines and biologics.

Report Coverage

The research report offers an in-depth analysis based on Source, Functionality, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand from pharmaceutical applications will continue to expand with rising biologics production.

- Food and beverage manufacturers will adopt plant-based variants to meet clean-label demand.

- Cosmetics and personal care products will drive growth with wider use in solubilizers.

- Asia Pacific will strengthen its position as the leading regional market.

- Europe will focus on sustainable sourcing and regulatory compliance in excipient use.

- North America will maintain steady growth through vaccine and injectable formulation demand.

- Latin America will benefit from urbanization and rising processed food consumption.

- Africa and the Middle East will gradually emerge as new growth frontiers.

- Companies will invest in innovation around bio-based and eco-friendly formulations.

- Strategic partnerships and acquisitions will shape competitive dynamics across key industries.