| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Aluminum Silicon Alloy Market Size 2024 |

USD 2,680.26 million |

| Aluminum Silicon Alloy Market, CAGR |

5.51% |

| Aluminum Silicon Alloy Market Size 2032 |

USD 4,245.12 million |

Market Overview:

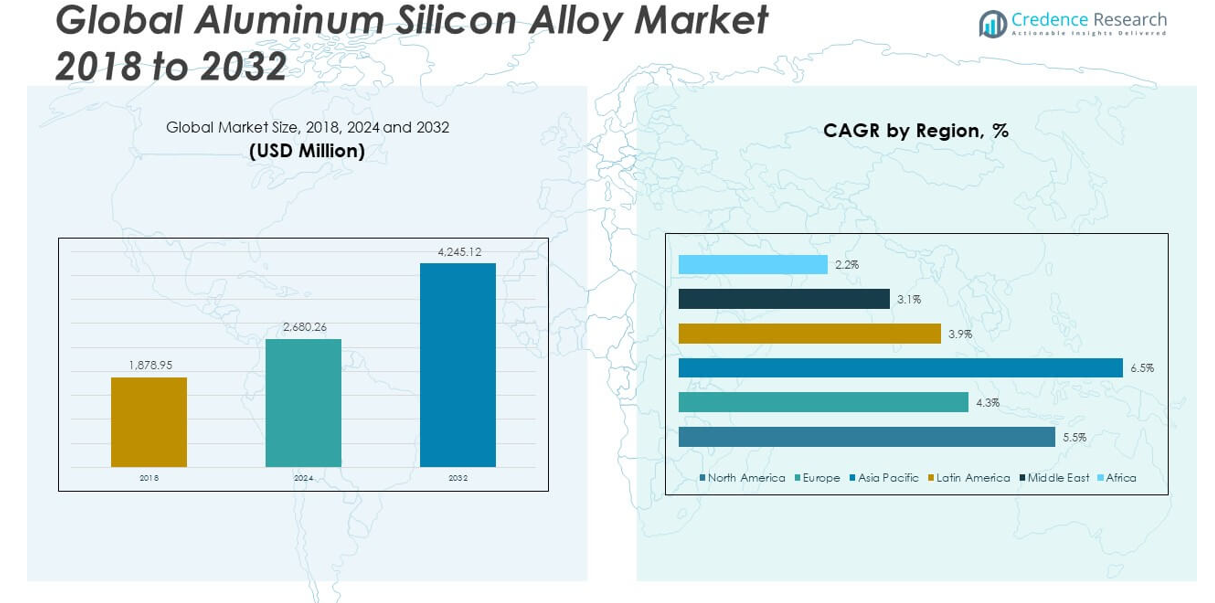

The Global Aluminum Silicon Alloy Market size was valued at USD 1,878.95 million in 2018 to USD 2,680.26 million in 2024 and is anticipated to reach USD 4,245.12 million by 2032, at a CAGR of 5.51% during the forecast period.

Key drivers contributing to the market’s expansion include the growing use of aluminum silicon alloys in the automotive and aerospace sectors, where they are valued for their lightweight properties, high thermal conductivity, and corrosion resistance. These alloys are widely used in engine components, wheels, brake systems, transmission housings, and structural parts, particularly in electric vehicles that demand efficient powertrain systems and extended battery performance. Technological advancements in casting, forging, and additive manufacturing have further improved alloy strength, consistency, and cost-efficiency, encouraging their broader adoption. Additionally, regulatory initiatives focused on lowering emissions and increasing fuel economy are pushing OEMs to integrate aluminum-based alloys into their manufacturing processes. The demand for heat-resistant and durable materials in electronics and thermal management applications is also growing, reinforcing the role of aluminum silicon alloys in meeting next-generation industrial requirements.

Regionally, Asia-Pacific dominates the global market. The region’s growth is underpinned by strong demand from automotive production hubs, industrial manufacturing, and infrastructure projects in countries like China, India, Japan, and South Korea. China remains the largest contributor due to its extensive industrial base and aggressive electric vehicle production targets. North America follows, supported by innovations in aerospace engineering, EV manufacturing, and high-end electronics in the U.S. and Canada. Europe maintains a mature market presence, bolstered by environmental regulations, high-quality engineering standards, and ongoing modernization of transportation and industrial systems in countries such as Germany, France, and the United Kingdom. Meanwhile, emerging markets in Latin America and the Middle East & Africa are witnessing moderate growth, driven by infrastructure development, industrial diversification, and increasing automotive assembly operations. These regions are expected to play a more significant role in the long term as global supply chains diversify and regional manufacturing capabilities expand.

Market Insights:

- The Global Aluminum Silicon Alloy Market reached USD 2,680.26 million in 2024 and is projected to reach USD 4,245.12 million by 2032, growing at a CAGR of 5.51%.

- Aluminum silicon alloys are widely used in engine blocks, transmission systems, wheels, and structural parts due to their lightweight, heat-resistant, and corrosion-resistant properties, especially in electric vehicles and aerospace components.

- Advancements in casting, powder metallurgy, and additive manufacturing are improving alloy strength, consistency, and cost-efficiency, allowing broader adoption across industries.

- Stricter emission regulations and environmental policies are encouraging manufacturers to replace heavier materials with aluminum-based alloys that support sustainability goals.

- The electronics sector is increasing the use of aluminum silicon alloys in heat sinks, power supply systems, and structural supports due to rising demand for efficient thermal management.

- Raw material price volatility and supply chain disruptions are impacting profit margins and production stability, pushing companies to build resilient sourcing networks.

- Asia-Pacific leads the global market, supported by strong industrial activity in China, India, Japan, and South Korea, while North America and Europe follow with steady growth in regulated, high-performance sectors.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for Lightweight Materials in Automotive and Aerospace Applications

The automotive and aerospace industries are driving the demand for aluminum silicon alloys due to their excellent strength-to-weight ratio and corrosion resistance. Automakers use these alloys to manufacture engine components, transmission systems, wheels, and structural parts to improve fuel efficiency and reduce emissions. Aerospace manufacturers rely on aluminum silicon alloys for critical applications such as aircraft frames, landing gear, and heat-resistant components. These materials contribute to reducing vehicle weight while maintaining structural integrity. The Global Aluminum Silicon Alloy Market benefits significantly from the shift toward fuel-efficient and lightweight mobility solutions. It continues to gain traction with electric vehicle manufacturers that prioritize performance, range, and weight reduction.

Technological Advancements Enhancing Alloy Performance and Processing Efficiency

Continuous innovation in alloy processing methods is strengthening the market. Advancements in casting techniques, powder metallurgy, and additive manufacturing are improving product uniformity, thermal conductivity, and mechanical strength. These technologies reduce production costs and waste while enabling complex geometries and customized applications. Enhanced process control systems ensure tighter tolerances and superior quality in finished components. It is supporting manufacturers in meeting high-performance specifications across industrial sectors. The Global Aluminum Silicon Alloy Market is expanding through increased investments in research and development by both alloy producers and end-users.

- For example, tensile strength increased from 154.69 MPa at 2% SiC to 206.95 MPa at 8% SiC; compressive strength rose to 543.7 MPa at 8% SiC; and Brinell hardness reached 92.8 HB, confirming enhanced strength, hardness, and wear resistance suitable for aerospace and automotive applications.

Stringent Emission Norms and Environmental Regulations Promoting Material Shift

Governments across major economies are enforcing stricter emission norms and fuel efficiency standards, accelerating the shift toward sustainable materials. Aluminum silicon alloys offer recyclability, lower carbon footprints, and compliance with environmental directives. Industries are replacing heavier and less eco-friendly materials with aluminum-based alloys to align with policy requirements. The market is experiencing a strong push from regulatory bodies encouraging cleaner production and greener supply chains. It is well-positioned to serve manufacturers seeking materials that meet both functional and sustainability goals. The Global Aluminum Silicon Alloy Market is aligned with long-term environmental strategies adopted by automotive, aerospace, and electronics sectors.

Growth in Electronics and Thermal Management Applications Driving Broader Adoption

Electronics manufacturers are increasing their reliance on aluminum silicon alloys due to their excellent thermal conductivity and durability. These alloys play a key role in producing heat sinks, casings, and structural supports for devices requiring reliable heat dissipation. Consumer electronics, power supply systems, and data centers are contributing to this trend. The demand for efficient thermal management solutions is expanding in parallel with the miniaturization and performance requirements of modern devices. It continues to meet industry needs for lightweight, corrosion-resistant, and high-heat tolerance materials. The Global Aluminum Silicon Alloy Market is gaining relevance in sectors where thermal control and material longevity are critical.

- For example, AyontEX 13 matches nickel’s CTE, suitable for reflective optics substrates, while AyontEX 17 matches copper’s CTE, ideal for structural heat sinks requiring robustness and weight savings.

Market Trends:

Growing Adoption of High-Performance Alloys for Additive Manufacturing Applications

The increasing integration of additive manufacturing technologies is influencing alloy selection across industries. Aluminum silicon alloys are being tailored for use in 3D printing to produce lightweight, durable, and complex parts in low-volume, high-value applications. This trend is particularly prominent in prototyping and specialized components for aerospace and defense sectors. Manufacturers are optimizing alloy compositions to improve printability, surface finish, and post-processing compatibility. The Global Aluminum Silicon Alloy Market is witnessing product development initiatives focused on powders specifically designed for additive manufacturing. It is responding to evolving production needs where flexibility, precision, and material efficiency are critical.

Expansion of Customized Alloy Solutions to Meet Niche Industry Requirements

End-use industries are demanding application-specific alloy grades that offer improved wear resistance, thermal stability, or machinability. Alloy producers are collaborating with manufacturers to co-develop custom compositions tailored to precise mechanical and thermal performance benchmarks. This demand is expanding in sectors such as marine, renewable energy, and high-speed rail, where standard alloys may not deliver optimal results. Product differentiation is emerging as a key strategy to enhance market share and customer retention. The Global Aluminum Silicon Alloy Market is increasingly characterized by flexible production capabilities and shorter innovation cycles. It is evolving into a more segmented and application-focused space.

Digitalization and Process Automation Transforming Foundry and Casting Operations

The adoption of digital technologies in metal casting operations is streamlining production and quality control. Smart foundry systems equipped with sensors and real-time monitoring tools are improving process accuracy, reducing scrap rates, and minimizing downtime. Manufacturers are investing in automation to enhance throughput and consistency, especially in large-scale production of alloy parts. These advancements are lowering operational costs and supporting mass customization efforts. The Global Aluminum Silicon Alloy Market is benefiting from the transition to Industry 4.0 standards within metal fabrication industries. It is becoming more efficient and data-driven in response to changing customer expectations.

- For instance, Sinto America’s Sinto Smart Foundry system integrates Industry 4.0 technologies for metal casting, using existing PLC data to provide real-time monitoring without additional sensors. Their ePVS software enables foundries to visualize machine health, optimize throughput, reduce scrap, and predict maintenance needs.

Shift Toward Circular Economy Driving Recycling and Secondary Alloy Use

Sustainability initiatives are reshaping material sourcing and life cycle management in metal industries. There is a growing emphasis on using secondary aluminum and recycled silicon alloys to reduce environmental impact and resource consumption. Industries are setting internal recycling targets and establishing closed-loop systems to recover and reuse alloy scrap. This shift is creating demand for alloys with consistent properties even when sourced from recycled inputs. The Global Aluminum Silicon Alloy Market is aligning with circular economy models across automotive, consumer goods, and infrastructure segments. It is adapting to support eco-conscious production goals and meet regulatory compliance standards.

- For example, according to Shapiro Metals and Master Alloys, recycling aluminum requires only about 5% of the energy and produces approximately 0.6 tCO2eq per ton of recycled aluminum, compared to 12–16.5 tCO2eq per ton for primary aluminum.

Market Challenges Analysis:

Fluctuating Raw Material Prices and Supply Chain Disruptions Impacting Profitability

Volatility in the prices of aluminum and silicon, the core inputs for alloy production, poses a major challenge for manufacturers. Commodity price fluctuations driven by geopolitical instability, energy costs, and mining restrictions can significantly affect operating margins. Supply chain disruptions, particularly in Asia-Pacific and Europe, have strained access to raw materials and delayed delivery timelines. Manufacturers are forced to manage higher inventory levels or pay premium prices to secure timely supplies. The Global Aluminum Silicon Alloy Market faces pressure to maintain pricing stability and production efficiency amid unpredictable sourcing environments. It must build resilient procurement networks and adopt long-term supplier agreements to reduce cost volatility.

Limited Standardization and Technical Barriers Restricting Broader Adoption

Despite the alloy’s favorable properties, the lack of global standardization for aluminum silicon alloy grades hinders widespread industrial acceptance. Industries with highly specific performance needs often struggle with inconsistent quality or limited data on long-term durability and reliability. Variability in manufacturing techniques across regions further complicates quality assurance, especially in mission-critical applications such as aerospace or medical devices. Smaller manufacturers may face technological limitations or lack testing infrastructure to validate alloy performance. The Global Aluminum Silicon Alloy Market must address these inconsistencies to scale adoption across new industries and geographies. It needs coordinated efforts to harmonize standards, improve material certification, and support R&D collaborations.

Market Opportunities:

Expanding Electric Vehicle and Renewable Energy Sectors Offering New Avenues for Growth

The rapid expansion of electric vehicles (EVs) and renewable energy systems is creating strong demand for high-performance, lightweight, and thermally conductive materials. Aluminum silicon alloys meet these requirements by enabling efficient battery housing, inverter components, and structural reinforcements. EV manufacturers are integrating these alloys into drive systems and battery enclosures to improve energy efficiency and reduce vehicle weight. In renewable energy, alloy components are used in solar panel frames, wind turbine housings, and thermal exchange systems. The Global Aluminum Silicon Alloy Market stands to benefit from this shift toward sustainable technologies. It is positioned to grow alongside the accelerating transition to low-emission energy solutions.

Emerging Markets and Infrastructure Development Creating Long-Term Demand

Rapid urbanization and infrastructure investment in emerging economies are driving new applications for aluminum silicon alloys. Construction, transportation, and industrial equipment sectors require corrosion-resistant and lightweight materials for enhanced durability and performance. Governments in Asia-Pacific, Latin America, and Africa are prioritizing infrastructure development, which supports the long-term consumption of advanced alloys. The Global Aluminum Silicon Alloy Market has opportunities to scale through localized production, strategic partnerships, and expanded distribution networks. It can also gain traction by addressing region-specific design and performance needs. This regional growth potential is expected to play a pivotal role in sustaining future market expansion.

Market Segmentation Analysis:

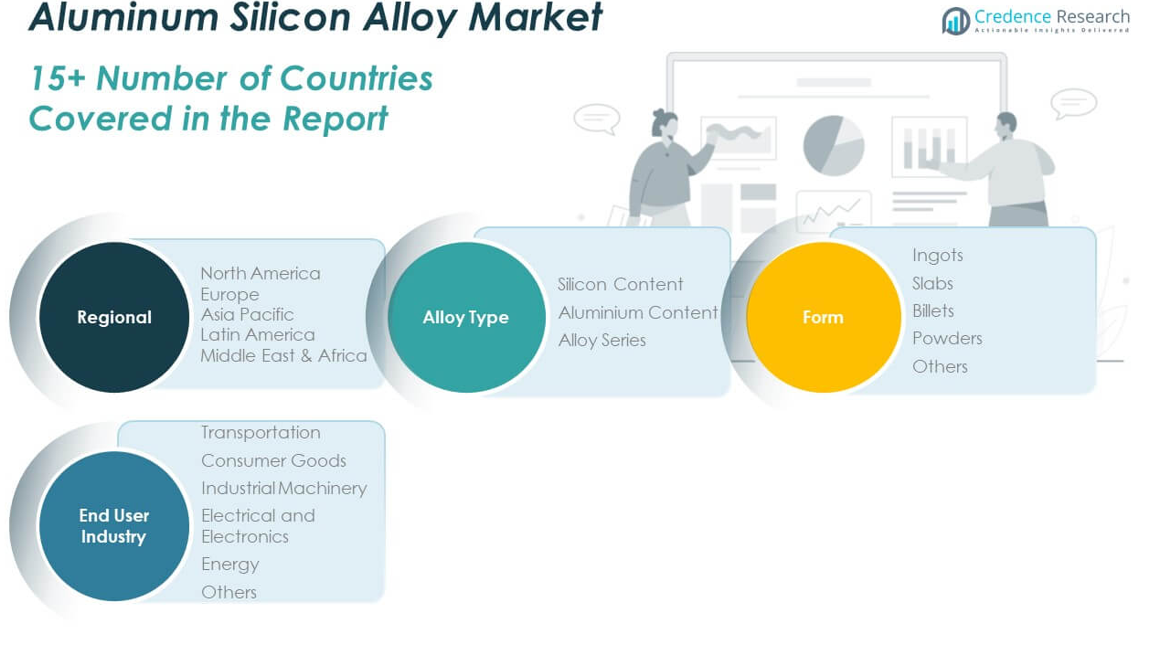

The Global Aluminum Silicon Alloy Market is segmented by alloy type, form, and end-user industry.

By alloy type, the market is categorized into silicon content, aluminum content, and alloy series. Variations in silicon and aluminum ratios determine thermal conductivity, strength, and corrosion resistance, making these alloys suitable for specialized applications in automotive, aerospace, and electronics.

- For example, Alloys with higher silicon (e.g., AlSi10Mg) exhibit thermal conductivities of 150–170 W/m·K, making them suitable for heat sinks and automotive engine parts.

By form, the market includes ingots, slabs, billets, powders, and others. Ingots and billets are widely used in casting and forging operations across heavy machinery and automotive sectors. Powders are gaining prominence in additive manufacturing and precision component production due to their adaptability in complex geometries.

By end-user industry, the market serves transportation, consumer goods, industrial machinery, electrical and electronics, energy, and others. The transportation segment leads due to the demand for lightweight and durable components in electric and conventional vehicles. It also sees growing usage in industrial machinery and electronics, where thermal stability and strength are critical. The Global Aluminum Silicon Alloy Market remains dynamic, with each segment contributing uniquely to its expansion and diversification.

- For instance, Materion documents that their AyontEX® alloys are used in heat sinks and housings for power electronics, leveraging high thermal conductivity (up to 170 W/m·K) and tailored coefficients of thermal expansion.

Segmentation:

By Alloy Type

- Silicon Content

- Aluminium Content

- Alloy Series

By Form

- Ingots

- Slabs

- Billets

- Powders

- Others

By End-User Industry

- Transportation

- Consumer Goods

- Industrial Machinery

- Electrical and Electronics

- Energy

- Others

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

The North America Aluminum Silicon Alloy Market size was valued at USD 748.67 million in 2018 to USD 1,055.79 million in 2024 and is anticipated to reach USD 1,677.31 million by 2032, at a CAGR of 5.5% during the forecast period. North America accounts for 22% of the global market share, driven by strong demand from the automotive, aerospace, and electronics industries. The region benefits from advanced manufacturing infrastructure and a high concentration of OEMs across the United States and Canada. The market is supported by stringent emission regulations that encourage lightweighting in vehicles and aircraft. Ongoing investments in electric vehicles and renewable energy systems are fueling the demand for high-performance aluminum silicon alloys. The Global Aluminum Silicon Alloy Market in North America is also benefiting from technology-driven enhancements in casting and processing methods. It continues to see steady growth through strategic collaborations and the adoption of next-generation alloys in defense and transportation sectors.

The Europe Aluminum Silicon Alloy Market size was valued at USD 354.09 million in 2018 to USD 477.68 million in 2024 and is anticipated to reach USD 688.66 million by 2032, at a CAGR of 4.3% during the forecast period. Europe represents 10% of the global market share and maintains a stable growth outlook due to the region’s established automotive and industrial base. Countries like Germany, France, and the UK are major consumers, with demand centered around vehicle electrification and sustainable infrastructure development. Environmental regulations and carbon neutrality goals are promoting material innovation and wider alloy adoption. The region also exhibits a high level of standardization and quality certification, making it a preferred hub for precision-engineered alloy applications. The Global Aluminum Silicon Alloy Market in Europe is supported by growing use in aerospace components and energy-efficient building systems. It remains consistent in performance despite economic uncertainties across certain markets.

The Asia Pacific Aluminum Silicon Alloy Market size was valued at USD 613.18 million in 2018 to USD 917.92 million in 2024 and is anticipated to reach USD 1,571.18 million by 2032, at a CAGR of 6.5% during the forecast period. Asia Pacific dominates the global landscape with a 47% market share, driven by robust industrialization and infrastructure development in China, India, Japan, and South Korea. The region leads in automotive production and electronics manufacturing, both key consumers of aluminum silicon alloys. Government initiatives supporting electric vehicle deployment and clean energy transitions are accelerating market adoption. It is also benefitting from localized manufacturing, low-cost labor, and access to raw materials. The Global Aluminum Silicon Alloy Market in Asia Pacific continues to grow at the fastest rate, supported by foreign investments, rising exports, and expanding end-user industries. It is positioned to remain the primary revenue generator over the forecast period.

The Latin America Aluminum Silicon Alloy Market size was valued at USD 87.07 million in 2018 to USD 122.63 million in 2024 and is anticipated to reach USD 171.47 million by 2032, at a CAGR of 3.9% during the forecast period. Latin America holds a 3% share of the global market and shows gradual growth, led by Brazil and Mexico. Increasing investments in automotive assembly plants and infrastructure modernization are expanding regional demand. The region is focusing on lightweight materials to support fuel efficiency and cost reduction in transportation systems. Demand from industrial machinery and consumer electronics segments is also rising steadily. The Global Aluminum Silicon Alloy Market in Latin America is gaining traction through trade agreements and regional manufacturing capacity expansion. It is expected to capture additional demand with improved supply chain integration and product standardization.

The Middle East Aluminum Silicon Alloy Market size was valued at USD 49.60 million in 2018 to USD 64.31 million in 2024 and is anticipated to reach USD 84.87 million by 2032, at a CAGR of 3.1% during the forecast period. The Middle East represents 2% of the global market and is supported by infrastructure growth and diversification in industrial sectors. Countries like the UAE and Saudi Arabia are adopting aluminum silicon alloys in energy, defense, and construction projects. The region is seeing a gradual shift toward advanced materials in high-temperature and corrosive environments. It is also investing in domestic manufacturing to reduce reliance on imports. The Global Aluminum Silicon Alloy Market in the Middle East benefits from government-backed industrialization programs and renewable energy goals. It has long-term growth potential through broader application of alloys in public infrastructure and transport systems.

The Africa Aluminum Silicon Alloy Market size was valued at USD 26.34 million in 2018 to USD 41.92 million in 2024 and is anticipated to reach USD 51.63 million by 2032, at a CAGR of 2.2% during the forecast period. Africa accounts for 1% of the global market share and is in an early phase of adoption. Demand is driven by construction, mining equipment, and growing industrial activities in countries such as South Africa, Nigeria, and Egypt. Infrastructure initiatives supported by public and private investment are opening new opportunities. However, limited local production and fragmented supply chains continue to challenge growth. The Global Aluminum Silicon Alloy Market in Africa is slowly gaining momentum with support from international partnerships and import-driven demand. It is expected to expand further as economic development improves material accessibility and technical capabilities.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Alcoa Corporation

- BASF SE

- China Zhongtai International

- Constellium

- Hindalco Industries

- Kaiser Aluminum

- Norsk Hydro

- Rio Tinto

- Osprey

- TTC

Competitive Analysis:

The Global Aluminum Silicon Alloy Market features a moderately fragmented landscape, with a mix of global and regional players competing across end-use industries. Key companies focus on product innovation, quality consistency, and strategic partnerships to strengthen their market presence. It is characterized by continuous investment in advanced casting technologies and alloy customization to meet evolving performance standards. Leading manufacturers are expanding production capacities and targeting emerging markets to capture new demand. Competitive intensity remains high due to pricing pressures and the need for compliance with international quality certifications. The Global Aluminum Silicon Alloy Market is seeing consolidation through mergers, acquisitions, and long-term supply agreements aimed at securing raw materials and enhancing distribution networks. It continues to evolve through collaboration between alloy producers and OEMs to develop application-specific solutions in automotive, aerospace, electronics, and energy sectors.

Recent Developments:

- In July 2025, Alcoa completed the closing of its transaction with Ma’aden, receiving approximately 86 million shares of Ma’aden, valued at about $1.2 billion, and $150 million in cash, marking a strategic financial move for the company.

- In June 2025, BASF announced its intention to acquire DOMO Chemicals’ 49% share in the Alsachimie joint venture, moving towards full ownership. This acquisition will enhance BASF’s position in the polyamide 6.6 value chain, supporting its European production footprint and backward integration into key raw materials.

- In May 2024, JSW Steel launched a new product named JSW Magsure, which is India’s first Zinc-Magnesium-Aluminium alloy coated steel product. This launch aims to reduce dependence on imported coated steel and meet the growing domestic demand, especially driven by the renewable energy sector.

Market Concentration & Characteristics:

The Global Aluminum Silicon Alloy Market exhibits moderate concentration, with several key players holding significant market share while numerous regional manufacturers serve localized demand. It operates within a competitive environment shaped by technological advancements, material innovation, and regulatory compliance. The market favors companies with integrated production capabilities, strong R&D infrastructure, and established distribution channels. It supports a wide range of end-use applications, from high-performance automotive parts to precision electronics and energy systems. Demand for customized alloy grades and application-specific solutions defines its dynamic nature. The market values consistency, corrosion resistance, thermal performance, and recyclability, driving innovation across alloy formulations. It continues to evolve with emphasis on lightweight materials, sustainability, and digital manufacturing integration.

Report Coverage:

The research report offers an in-depth analysis based on alloy type, form, and end-user industry. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising electric vehicle production will accelerate the demand for lightweight and thermally efficient alloys.

- Ongoing innovations in additive manufacturing will expand alloy applications in aerospace and defense.

- Growth in renewable energy systems will drive the use of aluminum silicon components in structural and thermal systems.

- Increasing demand for high-strength, corrosion-resistant materials will support new alloy formulations.

- Asia Pacific will remain the leading regional market due to industrial expansion and export-driven manufacturing.

- Automation and digitalization in foundries will improve quality control and reduce production costs.

- Sustainability initiatives will promote recycled aluminum silicon alloys and closed-loop manufacturing.

- Customized alloy solutions will gain traction across marine, construction, and industrial machinery sectors.

- Strategic partnerships between OEMs and alloy producers will support long-term supply and innovation pipelines.

- Regulatory support for lightweight materials will continue to shape product development and market positioning.