Market Overview:

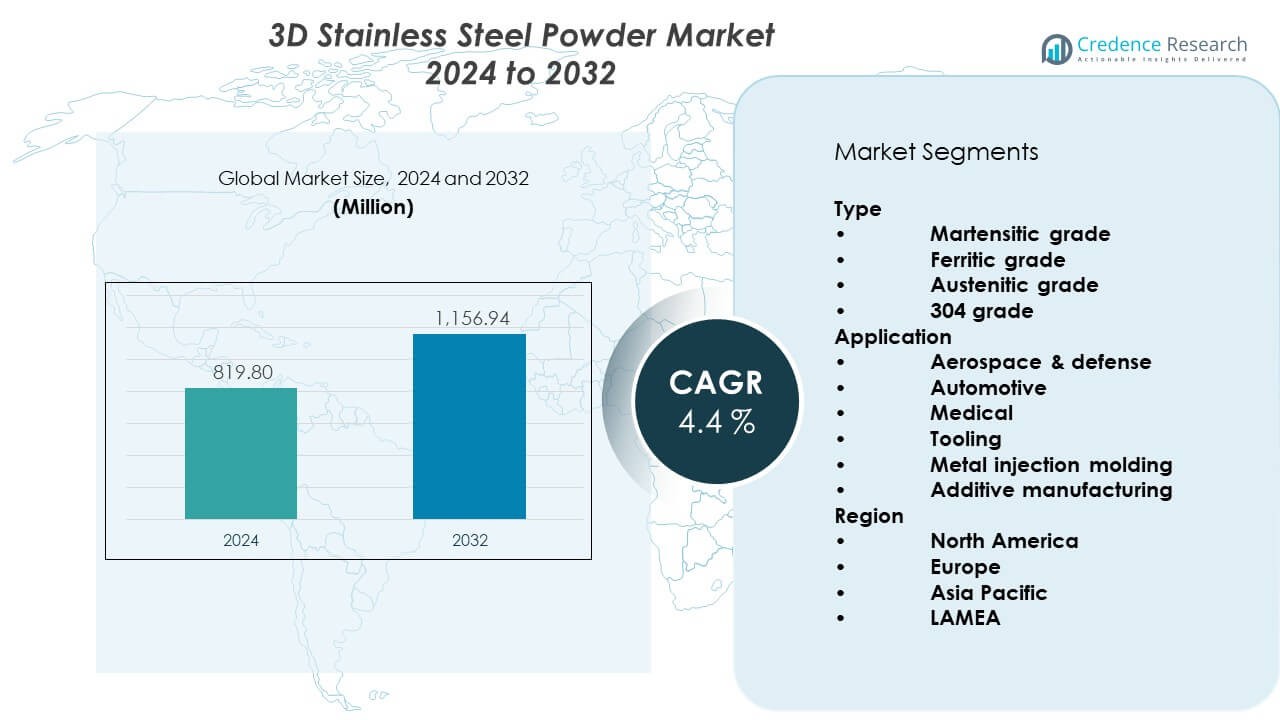

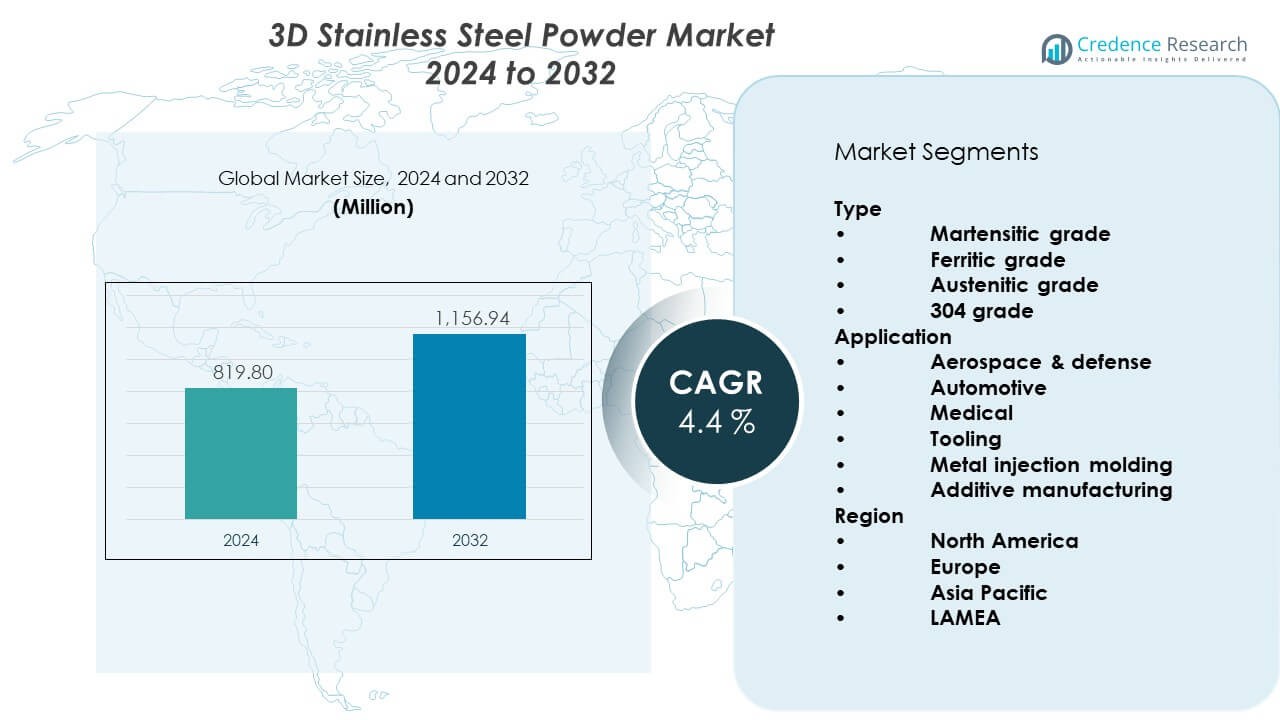

The 3D Stainless Steel Powder Market is projected to grow from USD 819.8 million in 2024 to an estimated USD 1,156.94 million by 2032, with a CAGR of 4.4% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| 3D Stainless Steel Powder Market Size 2024 |

USD 819.8 Million |

| 3D Stainless Steel Powder Market, CAGR |

4.4% |

| 3D Stainless Steel Powder Market Size 2032 |

USD 1,156.94 Million |

Growing demand for lightweight designs fuels higher use of stainless steel powders in industrial printing systems. Aerospace firms adopt these powders to achieve complex shapes and reduce assembly steps. Medical device makers favor the material for biocompatibility and reliable surface quality. Automotive teams use additive tools to cut development time and raise flexibility in prototype building. Powder suppliers refine particle size control to support better flow and higher print stability. Broader industry automation also lifts adoption across factories.

North America leads due to strong industrial 3D printing use and early technology uptake. Europe follows with strong aerospace, automotive, and medical manufacturing bases that prefer stainless steel powders for high-precision builds. Asia Pacific emerges as a fast-growing region due to rising metal printing investments in China, Japan, and South Korea. These markets expand due to stronger factory upgrades and wider interest in industrial automation. The Middle East shows steady growth through energy and manufacturing diversification. Latin America gains traction as local industries adopt additive tools to shorten production cycles.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The 3D Stainless Steel Powder Market reached USD 819.8 million in 2024 and is projected to hit USD 1,156.94 million by 2032, growing at a 4% CAGR driven by rising adoption in aerospace, medical, and industrial additive manufacturing.

- North America (38%), Europe (32%), and Asia Pacific (25%) held the largest shares due to strong aerospace clusters, advanced automotive manufacturing, and robust medical device production that rely heavily on stainless steel powder–based 3D printing.

- Asia Pacific, holding 25%, is the fastest-growing region supported by large-scale industrialization, expanding 3D printer installations, and national programs promoting digital manufacturing.

- Austenitic and 304 grades accounted for over 45% of the type segment due to high corrosion resistance and strong printability across engineering applications.

- Additive manufacturing and aerospace & defense together represented over 50% of total application share, supported by rising demand for complex, lightweight, and high-strength metal components.

Market Drivers:

Strong Rise in Industrial Additive Manufacturing Adoption Across High-Precision Applications

Demand grows as aerospace, automotive, and medical sectors expand metal 3D printing use. Firms rely on stainless steel powders to support durable parts with complex shapes. The 3D Stainless Steel Powder Market gains momentum due to rising interest in lightweight and corrosion-resistant builds. Many production units adopt powders for rapid prototyping and low-volume runs. Engineers choose the material for stable print quality across multiple geometries. Manufacturers refine powder grades to support better flow and stronger fusion. New industrial printers lift output quality across many plants. Broader digital manufacturing trends help the market strengthen each year.

- For instance, GE Aerospace has produced over 100,000 3D-printed fuel nozzle tips for commercial jet engines, demonstrating high-strength stainless applications. Firms rely on stainless steel powders to support durable parts with complex shapes.

Increasing Use of Stainless Steel Powders in Custom and On-Demand Component Fabrication

Demand increases due to higher need for custom parts across fast-moving industries. Many companies replace traditional machining for faster output cycles. Stainless steel powders support efficient bridge production and controlled material use. The 3D Stainless Steel Powder Market benefits from this shift toward flexible part development. Medical teams rely on the material for implants and tools with tight tolerances. Automotive units apply additive designs to shorten testing cycles and redesign complex assemblies. Powder makers enhance consistency to support smoother machine operations. Growth in short-run manufacturing helps sustain broader market use.

For instance, BMW Group produces over 300,000 metal and polymer 3D-printed components annually, supporting rapid part development. Many companies replace traditional machining for faster output cycles.

Shift Toward Lightweight Structures and Reduced Assembly Steps in Core Manufacturing Segments

Aerospace firms invest in additive tools to meet strict performance needs. Stainless steel powders help reduce weld points and support integrated part construction. Demand rises as companies seek stronger fatigue resistance across mission-critical parts. The 3D Stainless Steel Powder Market advances with wider use of topology-optimized designs. Many developers cut part counts to raise durability and simplify maintenance. Supply chains value powders for stable lead times and predictable output. New printers raise dimensional accuracy and support stronger mechanical traits. This shift pushes more firms toward powder-based additive routes.

Rapid Improvements in Powder Quality, Particle Uniformity, and Printing Efficiency Across Production Lines

Producers enhance particle size control to lift print precision across sectors. Better flow traits reduce machine downtime and boost final part quality. The 3D Stainless Steel Powder Market gains support from steady improvements in laser fusion and binder-jet processes. Many plants deploy automated handling tools to lower contamination risk. Industries value powders with stable chemical balance for stronger part life. New melting strategies help firms meet advanced surface-finish standards. Adoption rises as process reliability improves across many units. Manufacturers keep upgrading to meet strict quality protocols.

Market Trends:

Growing Shift Toward Binder Jetting and High-Speed Metal Printing Technologies Across Production Units

Companies invest in faster printing systems to meet rising output targets. Binder jetting gains attention due to lower cost per part and high throughput. The 3D Stainless Steel Powder Market benefits from this shift toward scalable metal builds. Many users adopt systems that support rapid sintering and higher design freedom. Industries value the method for reduced production bottlenecks. Powder firms create grades tailored for faster deposition rates. Factories upgrade machines to manage larger batch volumes. These upgrades expand adoption across multiple manufacturing hubs.

- For instance, Desktop Metal’s P-50 system is publicly documented to deliver up to 100× the throughput of legacy laser-based metal printers. Binder jetting gains attention due to lower cost per part and high throughput.

Expansion of Stainless Steel Powder Use in Tooling, Fixtures, and Production Support Equipment

Many factories integrate metal printing to build jigs, molds, and durable fixtures. Demand rises due to higher need for fast replacement tools. The 3D Stainless Steel Powder Market grows as plants adopt digital production strategies. Tooling units prefer stainless steel for predictable strength and wear resistance. New design software improves support-free structures and shortens print cycles. Production teams rely on printed tools to reduce downtime. Better thermal traits support stable use in high-stress environments. This trend strengthens metal printing use across industrial floors.

- For instance, Ford Motor Company documented production of over 500 custom 3D-printed tools and fixtures per year across several plants to improve assembly efficiency. Demand rises due to higher need for fast replacement tools.

Rising Focus on Sustainability, Material Reuse, and Closed-Loop Powder Handling Systems

Manufacturers prioritize recycling methods to reduce waste generation. Many firms adopt closed-loop feeders to preserve powder purity. The 3D Stainless Steel Powder Market aligns with sustainability goals across large industries. Producers refine sieving tools to maintain stable powder characteristics. Plants track powder aging to avoid quality loss. Cleaner handling systems support safer production floors. Several vendors invest in low-energy atomization methods. This movement strengthens responsible production practices across the value chain.

Growing Integration of AI-Driven Process Optimization, Monitoring, and Quality Control Across Metal Printing Lines

AI tools help firms manage laser settings and print stability. Many plants deploy sensors to monitor melt pools in real time. The 3D Stainless Steel Powder Market gains support from advanced predictive quality tools. Engineers use data models to correct defects before final prints complete. Automated controls lift consistency across serial builds. Powder firms create blends suited for tighter machine tuning. Users gain higher reliability, which raises market confidence. These tools improve long-term production outcomes across many sectors.

Market Challenges Analysis:

High Production Costs, Quality Variations, and Complex Powder Handling Issues Across Industrial Printing Lines

Producers face high atomization costs that limit broad adoption. Many plants struggle with stable powder flow during large builds. The 3D Stainless Steel Powder Market encounters challenges linked to recycling limits and contamination risks. Variations in particle shape can reduce print accuracy. Firms invest more time in screening steps to protect machine performance. Supply chains face price pressure during raw-material shifts. Users need skilled operators to manage advanced printing tools. These factors add friction across many production cycles.

Limited Standardization, Certification Barriers, and Slow Qualification Cycles Across Mission-Critical Industries

Aerospace and medical sectors require long approval timelines for printed parts. The 3D Stainless Steel Powder Market faces constraints due to strict testing needs and material validation rules. Many firms struggle with inconsistent global certification paths. Complex qualification protocols slow adoption across high-risk segments. Users spend significant resources to validate powder lots. Variability in machine conditions creates repeatability concerns. These delays reduce momentum across regulated markets. Firms push for unified standards to ease future expansion.

Market Opportunities:

Expansion of Metal Printing in Automotive, Medical, and Energy Applications with Higher Need for Complex Geometries

Many sectors adopt advanced printers to reduce fabrication time. The 3D Stainless Steel Powder Market gains opportunities through rising use in design-dense parts. Energy firms explore stainless powder for heat exchangers and turbine elements. Automotive developers benefit from lighter and stronger prototypes. Medical units expand implant production with custom geometries. Powder suppliers launch new blends for specific end-use needs. These applications widen future market scope across global industries.

Growing Use of Stainless Steel Powders in Mid-Volume Production, Replacement Parts, and Localized Manufacturing Networks

Demand rises due to rapid part replacement needs across factories. The 3D Stainless Steel Powder Market benefits from decentralized production hubs. Local printing reduces lead times and lifts supply-chain flexibility. Many plants adopt additive routes for bridge manufacturing. Service bureaus expand capacity to support regional demand. Powder makers supply optimized grades for smoother print execution. These elements create strong opportunities across emerging industrial zones.

Market Segmentation Analysis:

Type

The 3D Stainless Steel Powder Market includes martensitic, ferritic, austenitic, and 304 grades, each serving distinct performance needs. Martensitic grades support high-strength parts for structural use. Ferritic grades meet thermal and corrosion demands in industrial environments. Austenitic grades remain the most preferred due to stable printability and strong mechanical traits. The 304 grade maintains wide adoption across general engineering, tooling, and prototypes. Many industries select specific grades to match durability, weldability, or corrosion needs. Growing refinement in particle control strengthens demand across all types.

- For instance, Sandvik confirmed production of alloy powder variants, including austenitic and martensitic stainless grades tailored for AM. Martensitic grades support high-strength parts for structural use.

Application

Key applications include aerospace and defense, automotive, medical, tooling, metal injection molding, and additive manufacturing. Aerospace teams adopt stainless powders for heat-resistant, lightweight components. Automotive firms use the material for prototyping and low-volume structural parts. Medical units rely on stainless powders for biocompatible implants and surgical tools. Tooling segments deploy printed parts to shorten development cycles and boost durability. Metal injection molding units value stainless powders for tight-tolerance production. Additive manufacturing remains the fastest-expanding area due to higher design flexibility and rising industrial automation.

- For instance, Stryker operates one of the world’s largest orthopedic AM facilities, producing thousands of 3D-printed medical implants annually using titanium alloys(specifically their proprietary Tritanium material) designed for bone fusion. Aerospace teams also adopt various metal powders, including titanium and heat-resistant superalloys, for critical, lightweight components.

Segmentation:

Type

- Martensitic grade

- Ferritic grade

- Austenitic grade

- 304 grade

Application

- Aerospace & defense

- Automotive

- Medical

- Tooling

- Metal injection molding

- Additive manufacturing

Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

North America holds the largest market share in the 3D Stainless Steel Powder Market, supported by strong aerospace, defense, and medical manufacturing activity. The region benefits from early adoption of metal 3D printing technologies across major production hubs. Leading companies invest in advanced powder grades that meet strict quality and certification needs. Many defense programs rely on stainless steel powders for complex, high-performance components. Medical device makers use additive tools to expand implant and instrument production. The region maintains steady growth due to strong R&D spending and well-developed supply networks. Its leadership position remains stable due to continuous innovation.

Europe

Europe captures the second-largest share driven by a robust automotive base and mature aerospace ecosystem. Many engineering firms across Germany, France, and the UK adopt stainless steel powders for prototype and production-scale parts. The 3D Stainless Steel Powder Market in Europe benefits from strong manufacturing standards and supportive industrial policies. Tooling and metal injection molding applications remain widely adopted across mid-sized factories. Medical manufacturers deploy stainless steel powders for high-precision surgical tools. Many powder producers in the region invest in sustainable atomization methods. Europe maintains solid growth through its strong technical expertise and broad industrial footprint.

Asia Pacific

Asia Pacific holds a rapidly expanding market share supported by heavy industrialization and rising adoption of additive manufacturing. China, Japan, and South Korea lead regional demand through investments in high-volume 3D printing capacity. The region strengthens its position due to active machine-building industries and growing supply of stainless steel powder. The 3D Stainless Steel Powder Market gains traction in medical, automotive, and tooling segments across major economies. Local manufacturers focus on cost-effective powder production and competitive material portfolios. Many governments support digital manufacturing programs to boost industrial efficiency. Asia Pacific remains the fastest-growing region driven by scale and technology upgrades.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Sandvik AB

- GKN Powder Metallurgy (Höganäs AB)

- Carpenter Technology Corporation

- Daido Steel Co., Ltd.

- Toray Precision Co., Ltd.

- Fushun Special Steel Co., Ltd.

- US Research Nanomaterials, Inc.

- Luoyang Tongrun Nano Technology Co., Ltd.

- CNPC Powder

- American Elements Corporation

- EOS GmbH

- Markforged

Competitive Analysis:

The 3D Stainless Steel Powder Market features strong competition driven by advanced material development and rising industrial adoption. Leading players focus on consistent powder quality, tighter particle control, and stable print performance. Many companies expand production capacity to meet growing demand from aerospace, medical, and automotive sectors. Global suppliers invest in atomization upgrades to support higher throughput and cleaner powder batches. It benefits from continuous innovation in alloy design and process optimization. Firms strengthen distribution networks to reach fast-growing Asian and European hubs. Partnerships with printer manufacturers help secure long-term supply links. Competitive intensity remains high due to rapid technology upgrades.

Recent Developments:

- In October 2025, EOS GmbH announced a significant material expansion with the addition of four new metal additive manufacturing materials to its portfolio: EOS FeNi36, EOS NickelAlloy C22, EOS Steel 42CrMo4, and EOS StainlessSteel 316L-4404, each specifically optimized for EOS Laser Powder Bed Fusion (LPBF) systems. The EOS StainlessSteel 316L-4404 represents a notable industry-standard variant combining high ductility, toughness, strength, and corrosion resistance, tailored for industries including chemical processing, food production, water handling, and marine applications. EOS FeNi36 was engineered for aerospace, space, defense, and energy applications with an exceptionally low coefficient of thermal expansion (less than 2 ppm/K between 30–150°C), providing up to 10 times lower thermal expansion than conventional alloys like 316L. All materials were showcased at Formnext 2025 and made commercially available immediately.

- In August 2025, Sandvik announced the launch of Osprey® MAR 55, a highly versatile tool steel powder that bridges the gap between maraging steels and carbon-bearing tool steels, representing a significant breakthrough in additive manufacturing materials. This new alloy delivery eliminates the traditional industry dilemma where manufacturers had to choose between superior weldability of carbon-free maraging steels and the performance characteristics of carbon-bearing steels. Prior to this, in September 2024, Sandvik introduced Osprey® HWTS 50, a lean hot-work tool steel powder engineered for enhanced printability, specifically developed for laser-based additive manufacturing while also accommodating Hot Isostatic Pressing (HIP) and Metal Injection Molding (MIM) processes. Additionally, the company made pioneering strides in 2021 when it became the first to successfully 3D-print components in super-duplex stainless steel (Osprey® 2507), an alloy combining mechanical strength with exceptional corrosion resistance, particularly valuable for harsh offshore environments.

- In July 2025, CNPC Powder announced a strategic cooperation agreement with Japan’s SHOWA KDE to jointly develop and build a supply chain system for metal powder materials specifically designed for additive manufacturing in East Asia. Additionally, in June 2025, CNPC Powder launched a highly significant material breakthrough with CNPC-Al0407, a highly thermally and electrically conductive 3D-printable aluminum alloy powder representing an advancement in specialized material science. CNPC Powder’s 3D printing metal powder portfolio encompasses iron-based, aluminum-based, nickel-based, copper-based, and titanium-based alloys, with manufacturing certifications including ISO 9001, ISO 41001, ISO 45001, IATF16949, and ISO 13485.

Report Coverage:

The research report offers an in-depth analysis based on Type and Application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand will grow in aerospace and defense due to rising adoption of printed metal components.

- Automotive applications will expand with higher use of stainless powders in prototype and tooling programs.

- Medical manufacturers will increase reliance on stainless powders for biocompatible implants and instruments.

- Powder producers will invest in improved atomization lines to ensure tighter particle uniformity.

- Binder jetting and high-speed metal printing will accelerate broader industrial usage.

- Regional supply chains will strengthen through local powder production facilities.

- Sustainability goals will push companies toward recyclable and low-waste powder systems.

- AI-based process monitoring will enhance powder performance and print repeatability.

- Strategic partnerships between powder suppliers and printer OEMs will increase.

- Emerging markets will drive fresh demand as industrial automation gains momentum.