Market Overview

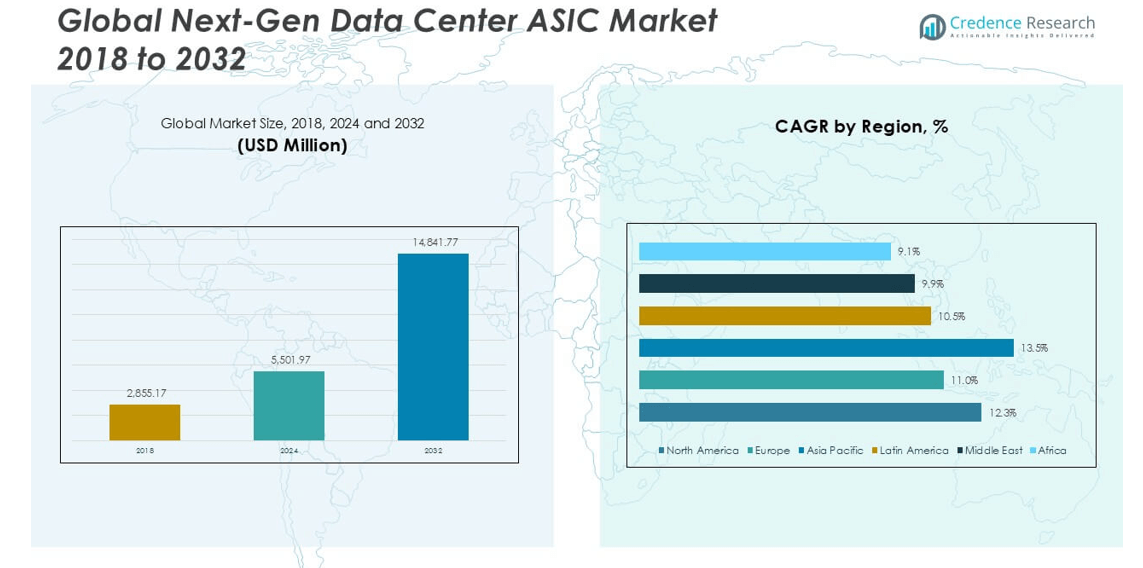

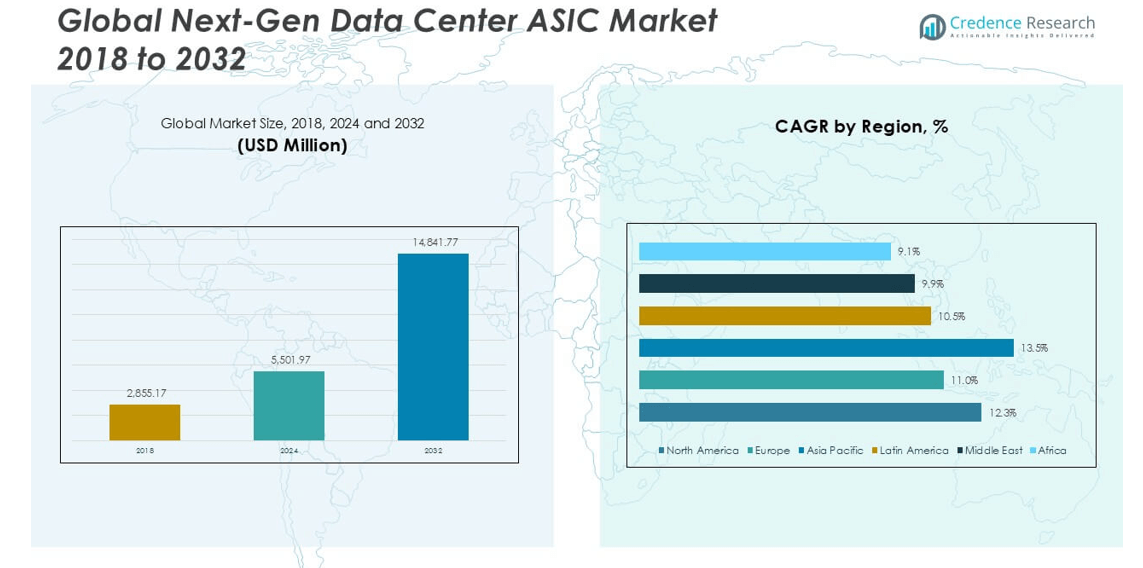

The Next-Gen Data Center ASIC market size was valued at USD 2,855.17 million in 2018, grew to USD 5,501.97 million in 2024, and is anticipated to reach USD 14,841.77 million by 2032, at a CAGR of 12.31% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Next-Gen Data Center ASIC Market Size 2024 |

USD 5,501.97 million |

| Next-Gen Data Center ASIC Market, CAGR |

12.31% |

| Next-Gen Data Center ASIC Market Size 2032 |

USD 14,841.77 million |

The Next-Gen Data Center ASIC market is led by top players such as Nvidia, Intel Corporation, Qualcomm, Advanced Micro Devices (AMD), and Marvell Technology, all of which offer advanced ASIC solutions tailored for AI acceleration, network optimization, and cloud infrastructure. These companies maintain a competitive edge through continuous innovation, strategic partnerships, and large-scale deployment in hyperscale data centers. Regionally, North America dominates the market with a 42.7% share in 2024, driven by a strong presence of cloud service providers, extensive AI adoption, and established data center infrastructure. Asia Pacific follows closely, exhibiting the highest growth rate due to rapid digital transformation and investments in regional data centers. As demand for efficient, high-performance computing solutions accelerates globally, leading vendors are focused on expanding their regional footprints and enhancing chip performance to meet evolving enterprise and cloud-native workload requirements.

Market Insights

- The Next-Gen Data Center ASIC market was valued at USD 5,501.97 million in 2024 and is projected to reach USD 14,841.77 million by 2032, growing at a CAGR of 12.31% during the forecast period.

- Market growth is driven by the rising demand for AI and machine learning workloads, increasing cloud infrastructure deployment, and the need for energy-efficient, high-performance computing across hyperscale data centers.

- A key trend includes the integration of ASICs in heterogeneous architectures combining CPUs, GPUs, and ASICs for optimized data center performance, along with a strong push toward sustainability and low-power chip solutions.

- North America leads the market with a 42.7% share in 2024, followed by Asia Pacific with 30.9%, while Hyperscale Data Centers dominate the deployment segment with over 45% share.

- High development costs, limited flexibility of ASICs, and supply chain disruptions act as primary restraints, particularly for smaller vendors in emerging regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

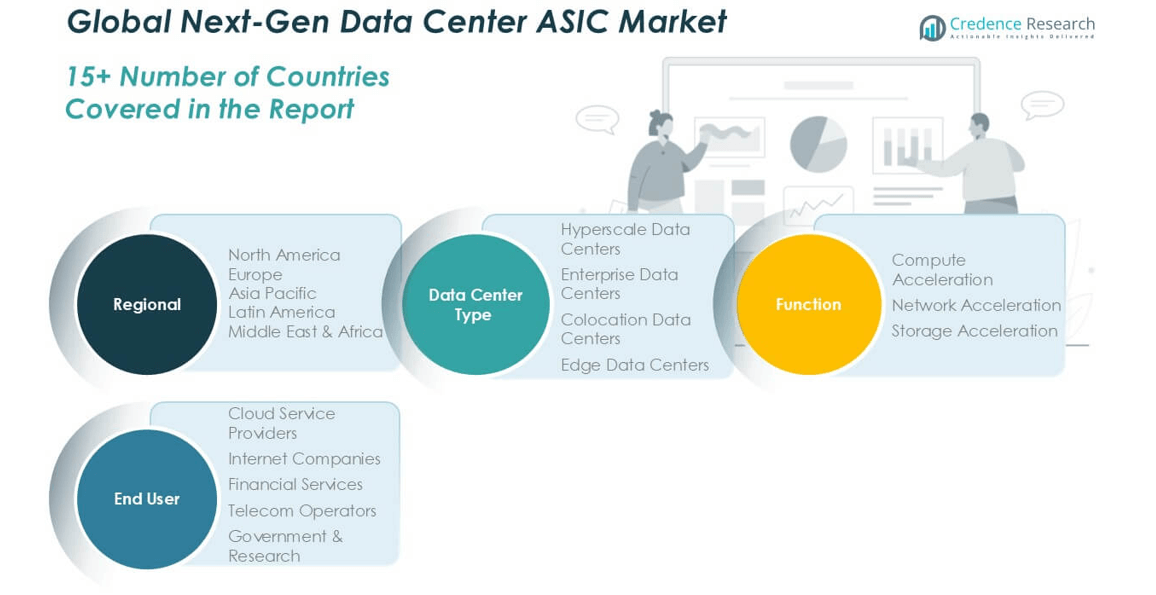

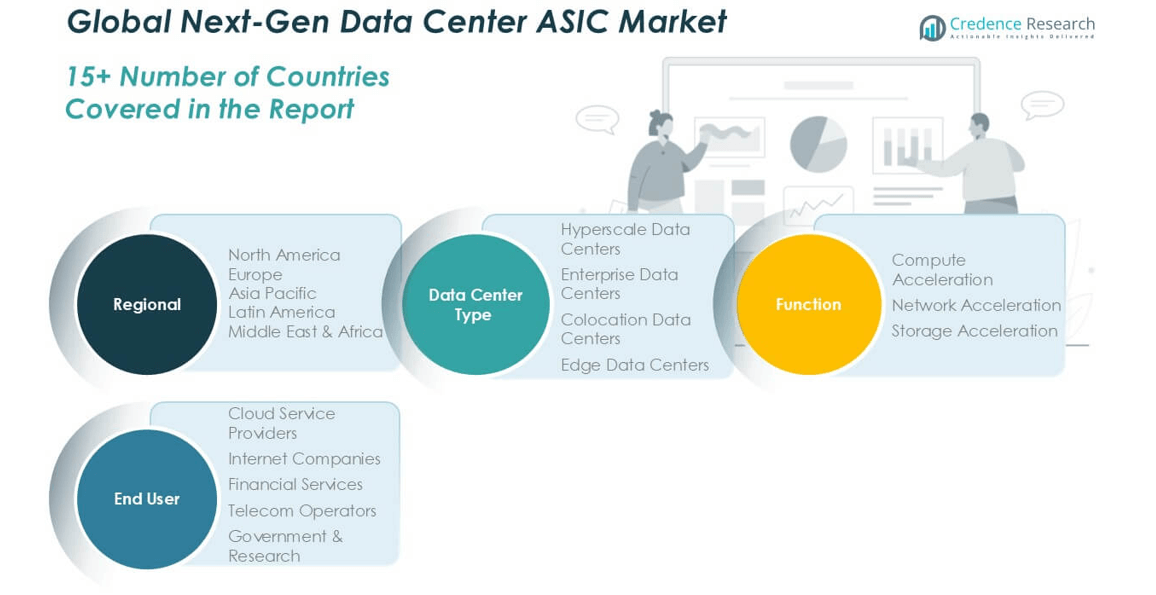

By Type

In the Next-Gen Data Center ASIC market, Hyperscale Data Centers emerged as the dominant sub-segment, accounting for over 45% of the market share in 2024. The rapid expansion of global cloud infrastructure and rising demand for high-throughput computing are key drivers of this segment’s growth. Hyperscale operators prioritize energy efficiency, scalability, and specialized ASICs for AI workloads, which propel adoption. Meanwhile, Edge Data Centers are gaining traction due to increased IoT and real-time data processing needs, though they still represent a smaller portion of the market compared to hyperscale deployments.

- For instance, Google’s TPU v4 ASIC, used in its hyperscale data centers, delivers 275 teraflops of peak performance per chip and is deployed in pods of up to 4,096 TPUs, enabling exascale computing across large-scale AI models.

By Function:

Compute Acceleration leads the functional segmentation of the market, contributing nearly 50% of total revenue in 2024. The surge in AI/ML model training, deep learning applications, and real-time data analytics has intensified the demand for compute-specific ASICs. These chips offer superior performance-per-watt compared to general-purpose processors, making them ideal for power-intensive tasks. Network Acceleration is the next significant segment, driven by increasing data traffic and the need for faster packet processing, especially in cloud-native architectures. Storage Acceleration remains niche but is expanding as data-intensive industries prioritize high-speed data retrieval and management.

- For instance, Nvidia’s Grace Hopper Superchip, which integrates a GPU and CPU with embedded ASIC components, delivers 900 GB/s of memory bandwidth via NVLink-C2C and supports up to 600 W of TDP, enhancing compute acceleration for large-scale AI training workloads.

By End User:

Cloud Service Providers dominate the end-user landscape, capturing more than 48% market share in 2024, fueled by ongoing investments in data center infrastructure and cloud-native services. Their reliance on custom ASICs to optimize computing, networking, and storage functions supports cost efficiency and service scalability. Internet Companies, including major content and service platforms, also represent a significant user group, leveraging ASICs to enhance user experience through low-latency processing. Other end-users such as Telecom Operators and Financial Services are adopting ASICs to meet latency-sensitive requirements, while Government & Research institutions use them for advanced simulations and high-performance computing needs.

Market Overview

Rising Demand for AI and Machine Learning Workloads

The exponential growth of AI and machine learning applications is a primary driver for the Next-Gen Data Center ASIC market. These workloads require accelerated computing performance and lower latency, which traditional CPUs cannot efficiently deliver. Custom ASICs, optimized for specific AI tasks such as deep learning inference and model training, offer significant advantages in terms of power efficiency and throughput. Enterprises and cloud service providers are increasingly investing in ASIC-powered infrastructures to meet the computing demands of real-time AI analytics and automation across industries.

- For instance, Amazon Web Services’ Inferentia2 ASIC, designed for AI inference, delivers up to 2.3 petaflops of performance, and powers large language models with over 100 billion parameters, drastically reducing inference costs and latency for its cloud clients.

Expansion of Hyperscale Data Centers

The proliferation of hyperscale data centers globally is accelerating demand for next-gen ASIC solutions. These facilities require highly specialized, power-efficient hardware to handle massive workloads while minimizing operational costs. ASICs play a vital role in optimizing compute, storage, and network functions to support cloud-native applications, virtualization, and dynamic workloads. Major cloud providers are developing proprietary ASICs or integrating third-party chipsets to gain performance advantages, driving strong market uptake. This trend is further supported by growing data traffic and digital transformation across various sectors.

- For instance, Microsoft Azure’s Project Brainwave, built on FPGA-accelerated ASICs, provides sub-millisecond latency inference and processes over 1 million requests per second, supporting hyperscale AI deployment in real-time applications such as speech recognition and image classification.

Growing Shift Toward Edge Computing

The increasing adoption of edge computing is fueling demand for ASICs capable of delivering localized processing with minimal latency. As enterprises deploy applications closer to end-users—ranging from smart cities to autonomous systems—there is a need for compact, energy-efficient chips that can operate independently of centralized data centers. ASICs offer the ideal balance of computational efficiency and task-specific optimization at the edge. This shift enhances responsiveness, reduces bandwidth use, and supports the real-time processing needs of IoT devices, thereby creating substantial growth potential for the market.

Key Trends & Opportunities

Integration of ASICs in Heterogeneous Architectures

One of the most significant trends is the integration of ASICs into heterogeneous computing environments. Organizations are combining CPUs, GPUs, and ASICs to handle diverse workloads more effectively. This trend reflects a broader shift toward workload-specific hardware optimization, where ASICs provide specialized acceleration for functions such as cryptographic processing, AI inference, or video transcoding. As software ecosystems and development tools evolve, deploying ASICs within multi-chip architectures becomes more feasible, presenting opportunities for vendors to offer customized, scalable solutions tailored to varied industry needs.

- For instance, Intel’s Gaudi2 AI processor, featuring 24 Tensor Processor Cores, integrates seamlessly with CPUs and GPUs and supports 96 GB of HBM2E memory, achieving up to 1.2 TB/s of memory bandwidth, enabling efficient mixed-architecture deployment for AI inference and training.

Sustainability and Energy-Efficiency Focus

Energy efficiency is becoming a top priority for data center operators, driven by both environmental regulations and the high cost of power consumption. ASICs, by design, consume less energy per operation compared to general-purpose processors, making them attractive for sustainable computing initiatives. This is especially important in hyperscale and edge environments where power density and thermal management are critical. Vendors that can offer low-power, high-performance ASICs aligned with green computing standards will gain a competitive advantage, opening new growth avenues in energy-conscious markets.

- For instance, Marvell’s OCTEON 10 ASIC, built on a 5nm process node, delivers up to 50% lower power consumption compared to its predecessor, while achieving over 200 Gbps of throughput, making it highly suitable for energy-efficient cloud and carrier-grade data centers.

Key Challenges

High Development Costs and Time-to-Market Pressure

Developing custom ASICs involves significant upfront investment, long design cycles, and specialized expertise, making it a high-risk venture for smaller players. The time-to-market for ASICs is often extended due to the complexity of verification, testing, and fabrication. In a rapidly evolving technological landscape, delays can render chip designs obsolete before deployment. This barrier limits market entry and innovation, concentrating power among a few large companies with sufficient capital and R&D capabilities to absorb the risk and bring competitive ASICs to market swiftly.

Limited Flexibility Compared to General-Purpose Processors

While ASICs excel in performance and efficiency for specific tasks, they lack the programmability and adaptability of general-purpose processors such as CPUs or FPGAs. This rigidness can be a disadvantage in environments where workload requirements evolve rapidly or vary significantly. Organizations may hesitate to invest heavily in ASIC-based infrastructure without assurance of long-term application compatibility. As workloads become increasingly dynamic, this limitation could hinder broader adoption unless vendors address it through modular or semi-programmable ASIC architectures.

Supply Chain Disruptions and Geopolitical Risks

The semiconductor supply chain remains vulnerable to geopolitical tensions, trade restrictions, and manufacturing disruptions. ASIC production, often reliant on advanced fabrication facilities in specific countries, can be delayed due to export controls or component shortages. These vulnerabilities can impact the timely availability of critical ASICs for data centers, especially amid growing global demand. Companies must navigate a complex web of regulatory compliance and sourcing challenges, which may increase operational costs and limit the scalability of deployment plans.

Regional Analysis

North America:

North America held the largest share in the Next-Gen Data Center ASIC market, accounting for approximately 42.7% of global revenue in 2024, with a market size of USD 2,347.66 million, up from USD 1,231.24 million in 2018. The region is projected to reach USD 6,350.72 million by 2032, growing at a CAGR of 12.3%. This growth is driven by the strong presence of hyperscale cloud providers, extensive data center investments, and early adoption of AI/ML technologies. The U.S. leads regional demand due to its technological maturity and concentration of data center infrastructure innovators.

Europe:

Europe captured around 17.7% of the global market share in 2024, with a market value of USD 975.07 million, increasing from USD 535.20 million in 2018. The market is expected to expand to USD 2,392.83 million by 2032, registering a CAGR of 11.0%. Key growth drivers include rising investments in green and modular data centers, increasing emphasis on energy-efficient hardware, and a robust cloud services sector. Countries like Germany, the UK, and the Netherlands are leading adoption, supported by regulatory frameworks encouraging high-performance computing infrastructure.

Asia Pacific:

Asia Pacific emerged as the fastest-growing regional market, with a CAGR of 13.5%, and held approximately 30.9% market share in 2024. The market grew from USD 835.31 million in 2018 to USD 1,698.43 million in 2024, and is forecasted to reach USD 4,991.81 million by 2032. Rapid digital transformation, strong government support for AI and 5G deployment, and the expansion of regional cloud providers are key drivers. China, India, and Japan are among the leading countries accelerating demand for custom ASIC solutions in data centers for compute-intensive and low-latency applications.

Latin America:

Latin America accounted for around 4.5% of the global market share in 2024, with a market size of USD 245.62 million, rising from USD 129.14 million in 2018. The market is projected to reach USD 583.03 million by 2032, registering a CAGR of 10.5%. Regional growth is fueled by increasing cloud adoption, digital infrastructure investments, and the emergence of regional data centers. Countries like Brazil and Mexico are witnessing growing interest from international cloud service providers, which is accelerating demand for power-efficient and high-performance ASIC components in local data center environments.

Middle East:

The Middle East held a 2.6% market share in 2024, with the market valued at USD 142.10 million, up from USD 80.61 million in 2018, and is projected to reach USD 323.96 million by 2032, growing at a CAGR of 9.9%. Expansion of smart city projects, digital transformation initiatives, and increasing deployment of AI-based services in the UAE and Saudi Arabia are fueling the adoption of Next-Gen Data Center ASICs. While the market remains in its nascent phase, regional ambitions to become digital hubs are expected to drive steady demand for custom acceleration technologies.

Africa:

Africa contributed approximately 1.7% of global revenue in 2024, with a market size of USD 93.08 million, growing from USD 43.67 million in 2018. It is expected to reach USD 199.43 million by 2032, at a CAGR of 9.1%. The market is gradually evolving with rising interest in regional data centers, enhanced internet penetration, and digitization of public services. South Africa, Nigeria, and Kenya are leading data center developments, though infrastructure constraints and high capital investment requirements pose challenges. Continued investments from global tech firms are expected to support long-term growth in the region.

Market Segmentations:

By Type:

- Hyperscale Data Centers

- Enterprise Data Centers

- Colocation Data Centers

- Edge Data Centers

By Function:

- Compute Acceleration

- Network Acceleration

- Storage Acceleration

By End User:

- Cloud Service Providers

- Internet Companies

- Financial Services

- Telecom Operators

- Government & Research

By Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Next-Gen Data Center ASIC market is characterized by the strong presence of global technology leaders and specialized semiconductor firms focusing on high-performance computing solutions. Key players such as Nvidia, Intel Corporation, Qualcomm, and AMD dominate the market with robust ASIC portfolios designed for AI, ML, and cloud computing workloads. These companies continuously invest in R&D to enhance chip performance, energy efficiency, and integration capabilities, maintaining a competitive edge. Emerging players like Marvell Technology, Synopsys, and Lattice Semiconductor are gaining traction through innovations in network and storage acceleration. Additionally, major system integrators like IBM, Dell Inc., and Lenovo contribute by embedding custom ASICs into data center architectures, offering complete hardware-software ecosystems. Strategic collaborations, acquisitions, and proprietary chip developments are prevalent, with companies aiming to secure long-term contracts with hyperscale data center operators and cloud providers. The market remains dynamic, driven by rapid technology shifts and the growing demand for specialized, scalable computing infrastructure.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Nvidia

- Intel Corporation

- Qualcomm Incorporated

- Advanced Micro Devices (AMD)

- Marvell Technology

- Synopsys

- IBM Corporation

- Dell Inc.

- Lattice Semiconductor

- Lenovo

Recent Developments

- In May 2025, NVIDIA introduced NVIDIA NVLink Fusion, new ASIC silicon for building semi-custom AI infrastructure. NVLink Fusion enables large-scale GPU interconnects, up to millions in a single AI “factory,” and is supported by a partner ecosystem including Marvell, Synopsys, MediaTek, and others.

- In May 2025, Intel Corporation announced Gaudi 3 PCIe cards at Computex 2025, supporting scalable AI inferencing across data center deployments, complementing their AI-centric Xeon line and offering an expansion in their GPU and accelerator portfolio.

- In May 2025, Qualcomm announced plans to introduce custom data center CPUs designed for seamless integration with Nvidia’s AI chips. This initiative represents a strategic return to the data center CPU market for Qualcomm, with a focus on high-performance, low-power AI workloads. The new CPUs will leverage Nvidia’s rack-scale architecture and NVLink Fusion technology to enhance connectivity and performance.

- In May 2025, Marvell Technology adopted NVIDIA NVLink Fusion for next-gen AI data center ASICs. This partnership allows Marvell to deliver semi-custom AI infrastructure solutions compatible with NVIDIA GPUs and high-speed interconnects, positioning Marvell as a critical ASIC provider for hyperscale and cloud AI workloads.

- In May 2025, Synopsys joined NVIDIA’s NVLink Fusion partner ecosystem, providing silicon design services to enable large-scale, semi-custom AI data center ASICs that interface directly with NVIDIA’s GPU fabric. This collaboration enhances the flexibility and scale of AI data center infrastructure.

Market Concentration & Characteristics

The Next-Gen Data Center ASIC market demonstrates a moderately concentrated structure, with a few dominant players such as Nvidia, Intel, Qualcomm, AMD, and Marvell Technology holding substantial market shares due to their technological leadership and deep integration with hyperscale infrastructure. It features high entry barriers driven by significant R&D investment requirements, complex manufacturing processes, and the need for strategic partnerships with cloud service providers. The market is characterized by rapid innovation cycles, with a strong focus on performance optimization, energy efficiency, and customization for AI, ML, and data-intensive workloads. Vendors compete based on chip efficiency, cost-performance ratios, and alignment with evolving cloud-native architectures. Demand remains concentrated in developed economies with advanced data center ecosystems, including North America and parts of Asia Pacific. The market supports long-term supplier relationships due to the high switching costs and integration complexity of ASICs within data center frameworks. It continues to evolve toward application-specific performance improvements across compute, network, and storage functions.

Report Coverage

The research report offers an in-depth analysis based on Type, Function, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will witness strong growth driven by increasing AI and machine learning workloads across industries.

- Hyperscale cloud providers will continue to lead demand for custom ASICs tailored to specific compute and networking needs.

- Energy-efficient ASIC designs will gain priority as data centers aim to reduce power consumption and carbon footprint.

- Edge computing will open new opportunities for compact, high-performance ASICs supporting real-time data processing.

- Integration of ASICs in heterogeneous computing environments will become more common to enhance workload optimization.

- Investment in R&D for advanced node technologies will increase to improve performance and scalability of ASICs.

- The Asia Pacific region is expected to become a major growth hub due to rising cloud adoption and digital transformation.

- Collaboration between semiconductor firms and cloud service providers will drive innovation and customized chip development.

- Supply chain resilience and localization strategies will become critical for sustained production and delivery.

- Market consolidation may increase as leading players acquire smaller firms to expand capabilities and market share.