| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Automotive Assembly Market Size 2024 |

USD 52,806.49 Million |

| Automotive Assembly Market, CAGR |

6.22% |

| Automotive Assembly Market Size 2032 |

USD 85,352.80 Million |

Market Overview

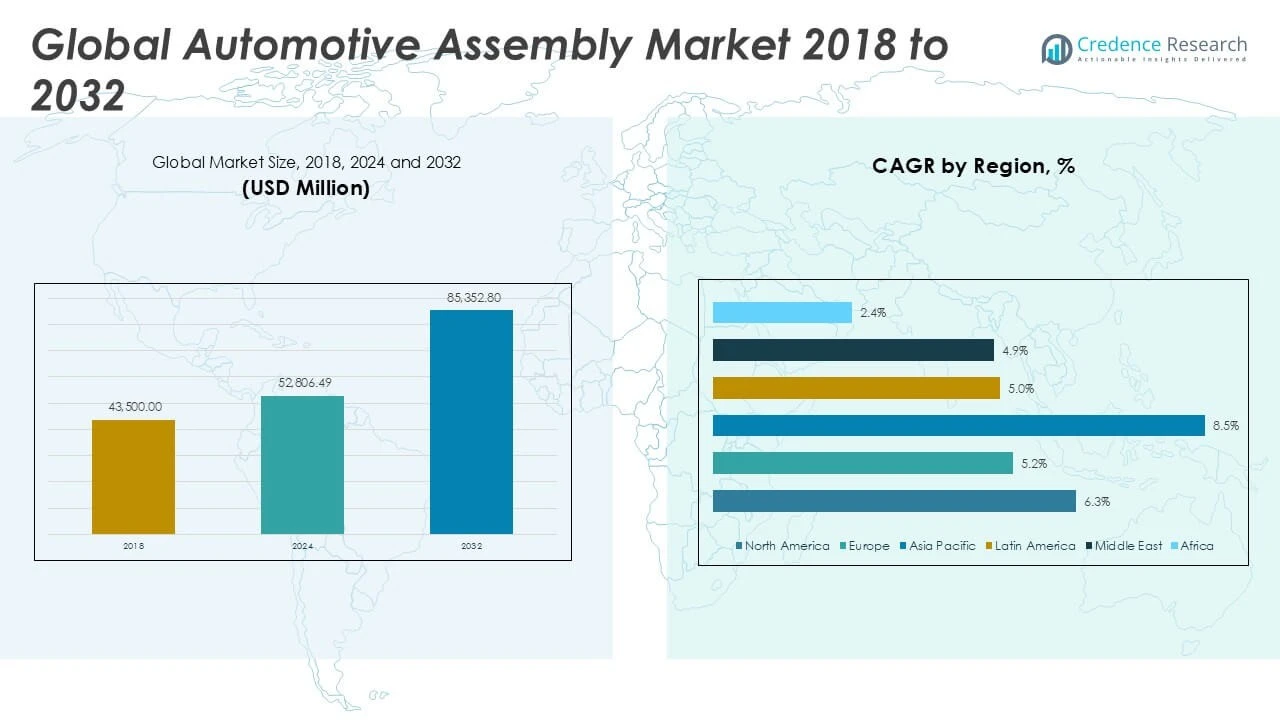

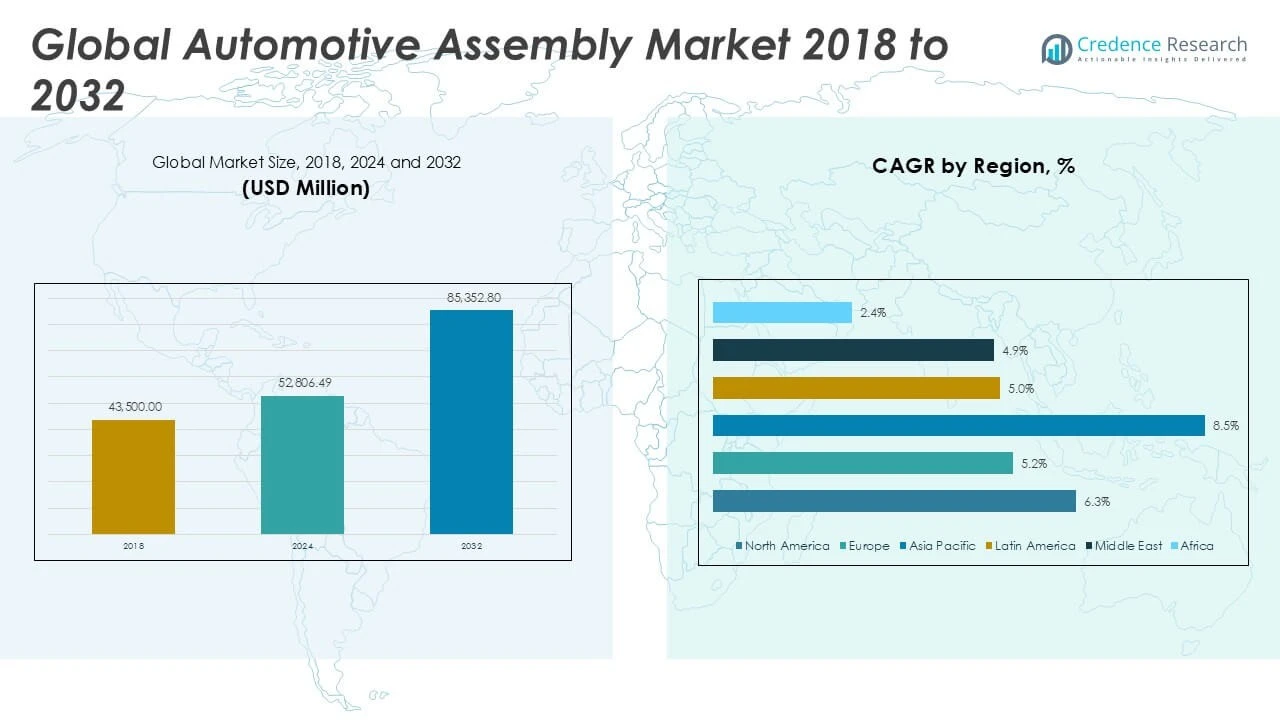

The Global Automotive Assembly Market is projected to grow from USD 52,806.49 million in 2024 to an estimated USD 85,352.80 million based on 2032, with a compound annual growth rate (CAGR) of 6.22% from 2025 to 2032.

Key drivers fueling the market include the surge in electric vehicle adoption, which requires advanced assembly systems tailored for battery packs and modular platforms. Trends such as lightweight vehicle construction, smart manufacturing, and Industry 4.0 adoption are reshaping the automotive assembly landscape. Automakers are increasingly investing in flexible and modular assembly lines to accommodate varied models and drivetrain configurations. Additionally, the need for sustainable manufacturing practices is promoting the use of energy-efficient machinery and recyclable materials throughout the assembly process.

Regionally, Asia-Pacific dominates the automotive assembly market due to the presence of major automotive manufacturing hubs in China, Japan, South Korea, and India. North America and Europe also hold significant market shares, supported by technological innovation and EV production. Prominent players in the market include Toyota Motor Corporation, General Motors, Volkswagen AG, Hyundai Motor Company, and Stellantis N.V., all of whom are investing heavily in next-generation assembly systems.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Global Automotive Assembly Market is projected to grow from USD 52,806.49 million in 2024 to USD 85,352.80 million by 2032, at a CAGR of 6.22% from 2025 to 2032.

- Increasing demand for electric vehicles is driving investment in advanced, modular, and battery-focused assembly systems.

- The adoption of Industry 4.0 technologies such as automation, robotics, and real-time analytics is enhancing production efficiency and quality.

- High capital investment requirements and integration challenges with legacy systems act as major restraints for small and mid-sized manufacturers.

- Supply chain disruptions and shortages of skilled labor further limit the pace of technological upgrades across production lines.

- Asia-Pacific leads the market with strong manufacturing capabilities in China, Japan, South Korea, and India, contributing to global vehicle output.

- North America and Europe hold substantial shares due to their focus on innovation, electric mobility, and high-end automotive production.

Market Drivers

Rising Demand for Electric Vehicles Driving Assembly Innovations

The Global Automotive Assembly Market is experiencing strong momentum due to the growing demand for electric vehicles (EVs). Governments worldwide are implementing stricter emission regulations and offering incentives to promote clean transportation. EV manufacturers require specialized assembly systems for battery packs, powertrains, and lightweight chassis. These new vehicle configurations have pushed automakers to redesign their assembly lines to support modular and scalable production. It has led to increased adoption of automated robotic systems to ensure efficiency and safety. The need for high throughput and minimal downtime continues to push assembly facilities toward advanced, EV-focused infrastructure.

For instance, over 57,000 automated assembly systems were deployed globally in 2024 to support the rising demand for EV production

Shift Toward Industry 4.0 and Smart Manufacturing Solutions

Smart manufacturing technologies are transforming the Global Automotive Assembly Market by enabling real-time data monitoring, predictive maintenance, and seamless integration of production systems. Industry 4.0 practices involve IoT-enabled equipment, digital twins, and AI-based analytics to enhance productivity and reduce human errors. It allows manufacturers to optimize energy usage, reduce defects, and accelerate production cycles. Automation and robotics have also contributed to consistent quality and operational flexibility. The ability to quickly switch between different vehicle models has become essential due to shifting consumer preferences. These capabilities improve competitiveness in a dynamic automotive landscape.

For instance, a survey of 600 manufacturing executives revealed that smart factories implementing Industry 4.0 technologies achieved a 10% to 15% increase in throughput

Expansion of Vehicle Production Across Emerging Markets

Emerging economies are contributing significantly to the growth of the Global Automotive Assembly Market. Countries like India, Brazil, and Indonesia are witnessing a surge in domestic vehicle demand, prompting automakers to establish or expand local assembly facilities. Government policies promoting local manufacturing and foreign direct investments support this trend. It enables global OEMs to reduce logistics costs and import duties while meeting region-specific standards. Localized production also shortens delivery timelines and improves market responsiveness. These developments strengthen the overall supply chain and manufacturing resilience.

Focus on Cost Optimization and Flexible Assembly Line Configurations

Manufacturers in the Global Automotive Assembly Market are focusing on cost control without compromising efficiency. The adoption of modular assembly lines enables simultaneous production of different vehicle models on the same platform. It reduces changeover times and lowers infrastructure costs. Automakers are investing in scalable systems that can adjust production volumes based on market conditions. Flexible tooling and intelligent automation allow facilities to operate with reduced labor and energy consumption. These practices support lean manufacturing goals and ensure profitability. The push for flexibility is becoming a core strategy for assembly operations worldwide.

Market Trends

Integration of Automation and Robotics for Precision and Efficiency

The Global Automotive Assembly Market is witnessing a widespread integration of automation and robotics to enhance operational accuracy and speed. Manufacturers are deploying advanced robotic arms, automated guided vehicles (AGVs), and collaborative robots to streamline assembly tasks. It improves precision, minimizes human error, and increases output per shift. These technologies enable better control over quality and reduce variability in production processes. Real-time monitoring systems connected to robotic units support predictive maintenance and continuous performance optimization. Automation is becoming central to modern assembly strategies across both developed and emerging markets.

For instance, automotive manufacturers globally deployed over 250,000 industrial robots in 2024 to enhance precision and efficiency in production.

Adoption of Modular Platforms for Versatile Vehicle Production

The use of modular vehicle platforms is shaping the structure of assembly operations across the Global Automotive Assembly Market. Original equipment manufacturers (OEMs) are building flexible assembly lines that accommodate various models and drivetrains on the same platform. It helps reduce complexity in production and accelerates time-to-market for new models. Modular design supports efficient resource allocation and consistent manufacturing quality. It allows manufacturers to respond quickly to changing consumer preferences and regional demands. This trend supports production agility and long-term cost efficiency.

For instance, Volkswagen’s MQB platform supported the production of over 40 million vehicles across various models since its introduction.

Digital Twin Technology Enhancing Operational Visibility

Digital twin technology is gaining traction in the Global Automotive Assembly Market, offering a virtual replica of physical assets to simulate, predict, and optimize production. It enables engineers to test changes, identify bottlenecks, and refine workflows before implementation on the actual floor. It also facilitates real-time diagnostics and remote process adjustments. Digital twins help reduce downtime and improve throughput by supporting informed decision-making. With increasing data availability, this technology is strengthening predictive maintenance and improving equipment lifecycle management. The trend is aligning assembly plants with smart manufacturing goals.

Sustainability Trends Driving Greener Assembly Processes

Sustainability initiatives are influencing operational strategies in the Global Automotive Assembly Market. Automakers are adopting energy-efficient machinery, recyclable materials, and cleaner production practices to meet environmental targets. It reflects growing regulatory pressure and consumer expectations for eco-friendly products. Facilities are shifting to renewable energy sources and implementing waste reduction measures. Environmental performance is becoming a key criterion for evaluating assembly technologies and suppliers. These trends are reshaping plant design, process planning, and supplier collaboration across the automotive industry.

Market Challenges

High Capital Investment and Complex Integration Hurdles

The Global Automotive Assembly Market faces significant challenges due to the high capital investment required for advanced assembly systems. Setting up automated and flexible production lines involves substantial costs related to robotics, control systems, and workforce training. Smaller manufacturers often struggle to keep pace with large OEMs in adopting new technologies. It creates a gap in operational efficiency and limits scalability. Integrating new technologies with legacy systems can lead to compatibility issues and process disruptions. Companies must balance innovation with financial sustainability to maintain competitiveness.

For instance, the global automotive industry produced approximately 81 million vehicles in 2021, highlighting the scale of assembly operations worldwide

Skilled Labor Shortage and Supply Chain Volatility

The increasing complexity of automotive assembly systems demands a skilled workforce capable of operating and maintaining high-tech equipment. The Global Automotive Assembly Market is affected by a growing shortage of technicians trained in robotics, AI, and digital tools. It restricts manufacturers from fully utilizing modern assembly technologies. Persistent supply chain disruptions also challenge production continuity, especially for critical components like semiconductors and specialized materials. It forces companies to adopt risk mitigation strategies and diversify suppliers. These labor and supply-related constraints slow down the pace of transformation in assembly operations.

Market Opportunities

Growing Electric Vehicle Demand Creating New Assembly Infrastructure Needs

The Global Automotive Assembly Market presents strong opportunities with the rising demand for electric vehicles (EVs) across all regions. Automakers are investing in dedicated EV platforms that require new assembly processes, particularly for battery integration and lightweight construction. It encourages the development of specialized assembly lines capable of handling diverse powertrain architectures. Countries offering EV incentives and regulatory support are attracting large-scale manufacturing facilities. This trend supports the adoption of flexible and scalable assembly technologies. Companies that offer EV-focused assembly solutions will gain a competitive edge in the evolving automotive landscape.

Technological Advancements Enabling Market Expansion Across Emerging Economies

Advancements in automation, robotics, and digital twin technologies offer significant growth potential in emerging markets. The Global Automotive Assembly Market can expand through localized production supported by cost-efficient, intelligent assembly systems. Governments in regions such as Southeast Asia, Latin America, and Africa are promoting industrial growth through favorable policies and infrastructure development. It opens opportunities for manufacturers to establish regional hubs that reduce logistics costs and serve local demand effectively. Investments in smart assembly solutions will enhance productivity and ensure consistent quality in cost-sensitive markets. These developments support long-term, sustainable market growth.

Market Segmentation Analysis

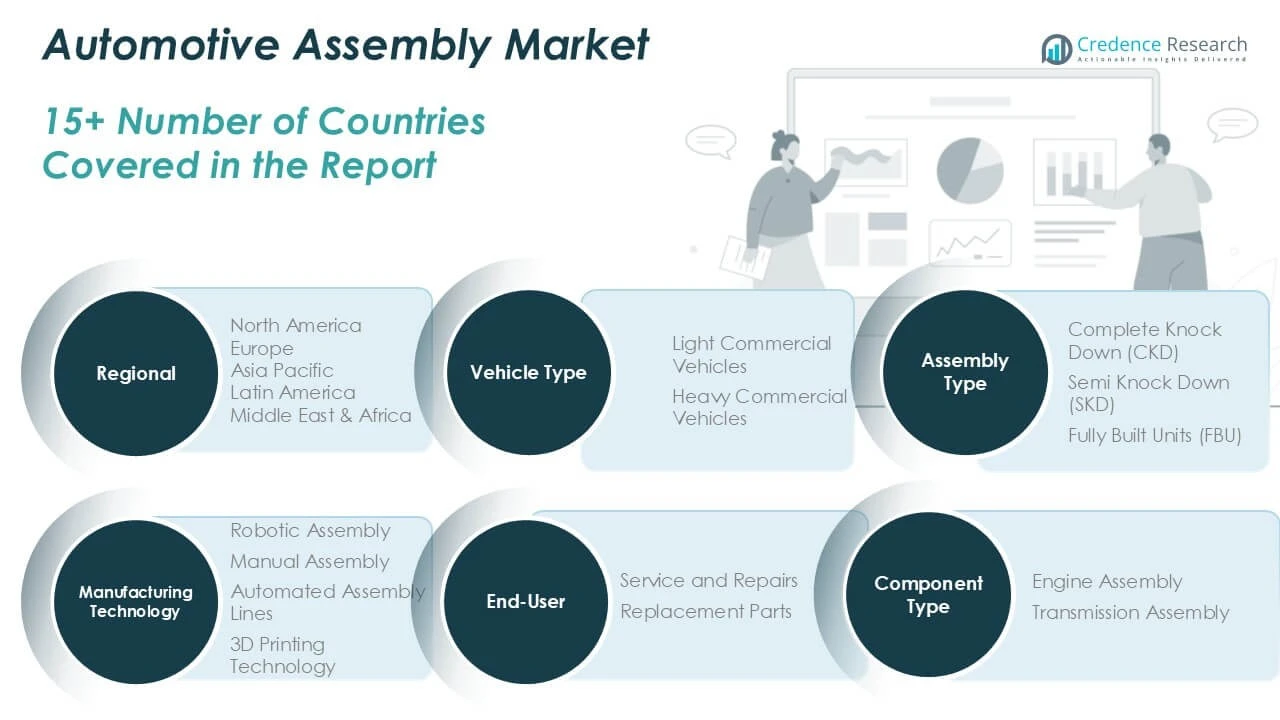

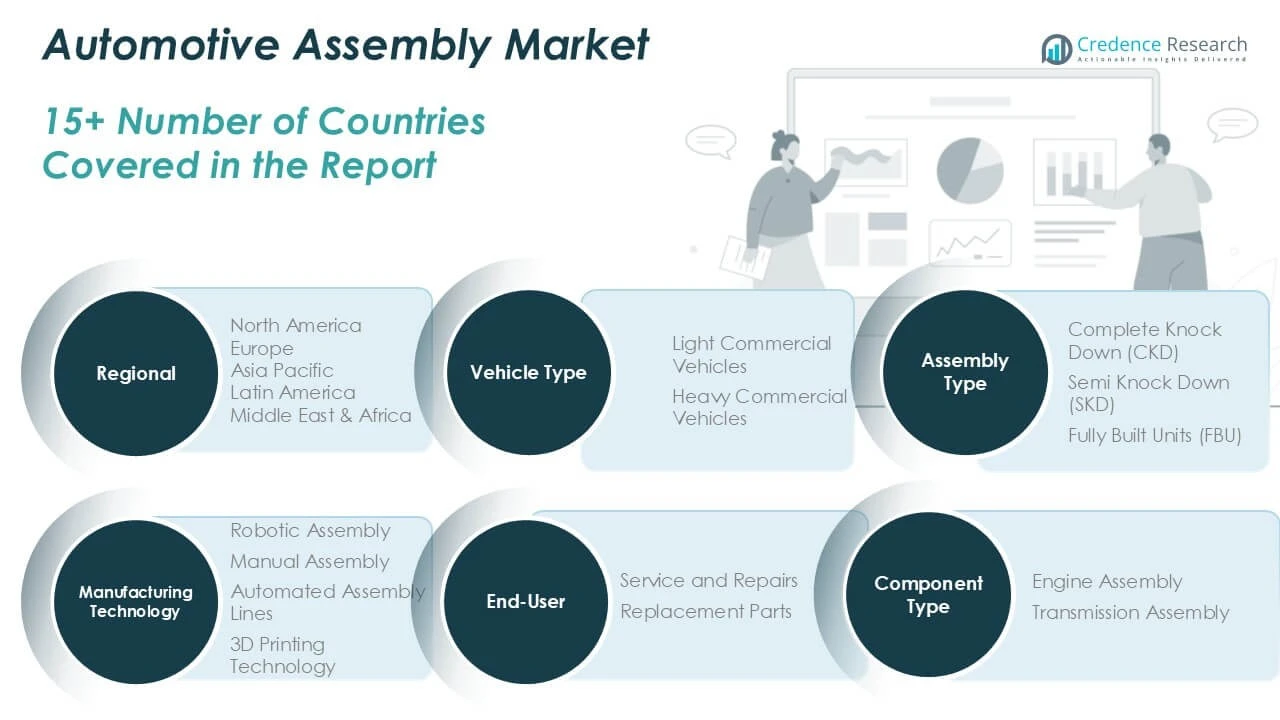

By Vehicle Type

The Global Automotive Assembly Market is segmented into light commercial vehicles and heavy commercial vehicles based on vehicle type. Light commercial vehicles hold a dominant share due to their widespread use in logistics, passenger transport, and urban delivery. These vehicles benefit from faster assembly processes and higher production volumes, driving segment growth. Heavy commercial vehicles, while lower in volume, contribute significantly to revenue through complex and high-value assembly operations. It requires precision and strength in engine and chassis integration, prompting manufacturers to adopt specialized equipment. The demand for both segments continues to rise with growing transportation needs worldwide.

By Component Type

The component type segment includes engine assembly and transmission assembly, both critical to vehicle performance and manufacturing complexity. Engine assembly remains the largest contributor due to its central role in powertrain functionality and its high precision requirements. It involves the integration of combustion chambers, pistons, crankshafts, and cooling systems. Transmission assembly follows closely, focusing on gear systems and drivetrain connections. The Global Automotive Assembly Market benefits from continuous innovation in these areas, with automation playing a key role in enhancing consistency and reducing manual labor. These components directly influence vehicle reliability and efficiency.

By End-user

OEMs represent the primary end-user segment in the Global Automotive Assembly Market, driven by their role in large-scale, standardized production. They demand integrated and scalable assembly lines that support volume and quality targets. The service and repairs segment is growing with increasing vehicle fleets and extended service life. It requires flexible assembly setups for diagnostics and component replacement. The replacement parts segment caters to aftermarket needs, focusing on modular assembly systems to handle varied part specifications. It supports supply chain responsiveness and ensures continuity in vehicle maintenance cycles.

By Manufacturing Technology

Manufacturing technologies include robotic assembly, manual assembly, automated assembly lines, and 3D printing technology. Robotic assembly dominates due to its efficiency and precision, especially in repetitive or hazardous tasks. Automated assembly lines integrate robotics, AI, and conveyors to optimize workflow and reduce errors. Manual assembly, although declining, remains essential for low-volume or specialized production. It offers flexibility in tasks requiring craftsmanship or human judgment. 3D printing technology is emerging as a transformative tool for prototyping and low-volume components. It supports innovation while reducing lead time and tooling costs.

By Assembly Type

The assembly type segment consists of Complete Knock Down (CKD), Semi Knock Down (SKD), and Fully Built Units (FBU). CKD is widely used in cost-sensitive regions where local assembly helps avoid import duties and meet regulatory norms. SKD involves partial disassembly and is preferred for intermediate manufacturing and cost control. FBU units cater to markets where local assembly infrastructure is limited or where high-end vehicles are imported intact. The Global Automotive Assembly Market utilizes each type strategically based on trade policies, logistics costs, and market access needs. It allows manufacturers to tailor operations for efficiency and compliance.

Segments

Based on Vehicle Type

- Light Commercial Vehicles

- Heavy Commercial Vehicles

Based on Component Type

- Engine Assembly

- Transmission Assembly

Based on End-user

- OEMs (Original Equipment Manufacturers)

- Service and Repairs

- Replacement Parts

Based on Manufacturing Technology

- Robotic Assembly

- Manual Assembly

- Automated Assembly Lines

- 3D Printing Technology

Based on Assembly Type

- Complete Knock Down (CKD)

- Semi Knock Down (SKD)

- Fully Built Units (FBU)

Based on Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America Automotive Assembly Market

North America holds the largest share in the global Automotive Assembly Market, accounting for 44.82% in 2024 with a market value of USD 23,663.86 million. By 2032, it is expected to reach USD 38,353.57 million, registering a CAGR of 6.3%. The United States plays a dominant role due to its mature automotive industry, robust infrastructure, and presence of leading OEMs. It supports advanced manufacturing facilities that integrate automation and robotics into large-scale assembly lines. Canada and Mexico also contribute significantly through cross-border manufacturing agreements and automotive clusters. It remains a region marked by innovation, skilled labor, and regulatory consistency.

Europe Automotive Assembly Market

Europe represents 21.27% of the Automotive Assembly Market in 2024 with a value of USD 11,235.78 million, projected to grow to USD 16,795.10 million by 2032, at a CAGR of 5.2%. Germany, France, and the UK are central to this growth, supported by strong engineering expertise and demand for high-performance vehicles. European automakers are investing in flexible and sustainable assembly processes to align with strict environmental standards. It benefits from strong governmental backing for electrification and digitalization of the automotive sector. Market players in this region emphasize precision and quality-driven assembly methodologies. Ongoing efforts in modular platform production strengthen its market position.

Asia Pacific Automotive Assembly Market

Asia Pacific holds a 19.29% share of the global market in 2024, valued at USD 10,188.45 million, and is expected to reach USD 19,358.73 million by 2032, growing at the highest CAGR of 8.5%. China, Japan, South Korea, and India are major contributors, driven by mass vehicle production and expanding domestic demand. It serves as a key hub for both global exports and local consumption. The region shows strong momentum in electric vehicle assembly and cost-efficient automation. Government initiatives in Make in India and China’s NEV policy support the expansion of assembly infrastructure. Rapid urbanization and rising middle-class income drive growth in this region.

Latin America Automotive Assembly Market

Latin America accounts for 5.91% of the Automotive Assembly Market in 2024, valued at USD 3,125.62 million, and forecasted to grow to USD 4,594.54 million by 2032 at a CAGR of 5.0%. Brazil and Mexico are the primary markets due to their industrial base and trade partnerships with North America. It shows resilience in supporting regional assembly to meet both export and domestic demand. Market growth is supported by strategic investments in modernizing legacy plants and improving supply chain efficiencies. OEMs view the region as a low-cost production base with long-term potential. Regional demand for affordable commercial and passenger vehicles remains steady.

Middle East Automotive Assembly Market

The Middle East comprises 4.08% of the market share in 2024, with a value of USD 2,154.16 million, projected to rise to USD 3,140.43 million by 2032, growing at a CAGR of 4.9%. The UAE and Saudi Arabia are focusing on diversifying their economies through industrial development, including automotive manufacturing. It offers logistical advantages due to its central location between Europe, Asia, and Africa. Regional assembly activity is supported by favorable tax policies and growing demand for luxury and utility vehicles. Manufacturers are targeting local assembly to reduce dependency on imports. Infrastructure developments and industrial zones promote sustained market expansion.

Africa Automotive Assembly Market

Africa holds a 4.62% share in the Automotive Assembly Market in 2024 with a size of USD 2,438.62 million, anticipated to reach USD 3,110.43 million by 2032 at a CAGR of 2.4%. South Africa dominates with its established automotive ecosystem and export-driven strategies. Nigeria, Kenya, and Egypt are emerging markets, aiming to strengthen local production through policy support. It faces challenges in infrastructure and skilled labor availability, which limits scalability. Investment is gradually increasing in localized assembly units to serve the regional demand. The market is at a nascent stage but presents long-term potential due to population growth and urbanization trends.

Key players

- Alpha Assembly Solutions

- Rockwell Automation

- Mondragon Assembly

- Fujitsu

- PMC Smart Solutions

- Deprag

- Araymond

- KUKA

- Thyssenkrupp

- Asteelflash

Competitive Analysis

The global Automotive Assembly Market features a competitive landscape shaped by technological innovation, strategic partnerships, and global expansion. Key players like KUKA, Rockwell Automation, and Thyssenkrupp lead in robotics integration, automated systems, and smart manufacturing solutions. It reflects a strong focus on increasing assembly speed, flexibility, and quality. Companies such as Alpha Assembly Solutions and Mondragon Assembly specialize in customized assembly systems tailored to evolving vehicle platforms, including EVs. New entrants and mid-sized firms contribute through niche solutions and regional expertise. Leading manufacturers invest in R\&D to stay ahead in automation, sustainability, and digital integration. Market consolidation and strategic collaborations are also increasing, aiming to strengthen capabilities and broaden geographic presence.

Recent Developments

- In April 2025, Rockwell Automation and Amazon Web Services (AWS) collaborated to enhance industrial automation solutions, aiming to improve productivity in the automotive sector. This partnership combined Rockwell’s automation expertise with AWS’s cloud capabilities to create more efficient and flexible cloud-based solutions for manufacturers.

- In April 2025, KUKA reported a 7.9% decline in 2024 revenue, citing geopolitical tensions and reduced customer investments in the automotive sector.

- In 2025, Alpha Assembly Solutions continued to supply the automotive electronics industry with conductive inks, adhesives, and low-temperature solder pastes.

- In 2025, Asteelflashmaintained its position in the automotive assembly market by offering electronic manufacturing services for vehicle systems and components, including high-volume manufacturing in automotive and industrial sectors. This involved delivering electronic assemblies and contributing to the overall production of vehicles.

Market Concentration and Characteristics

The global Automotive Assembly Market demonstrates moderate to high market concentration, with a few major players holding significant influence through technological leadership and extensive manufacturing footprints. It is characterized by rapid technological advancement, high capital intensity, and a growing emphasis on automation and digital integration. Market participants prioritize efficiency, flexibility, and sustainability in their assembly operations. Entry barriers remain high due to the need for substantial investment in infrastructure, skilled labor, and compliance with global standards. The market also reflects strong OEM influence, with a preference for long-term partnerships and integrated supply chains. Continuous innovation and regional expansion define the competitive dynamics.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Vehicle Type, Component Type, End-user, Manufacturing Technology, Assembly Type and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Smart factories will play a central role in future assembly operations, leveraging AI, IoT, and real-time analytics to optimize productivity and quality. This shift will reduce downtime and enable predictive maintenance strategies.

- The rise of electric vehicles will require reconfigured assembly lines focused on battery integration and lightweight chassis. Manufacturers will invest in modular systems to handle diverse EV platforms efficiently.

- Future assembly facilities will adopt highly flexible layouts to accommodate frequent model changes and varying production volumes. This approach will enhance responsiveness to market trends and customer preferences.

- Next-generation robotics will increase accuracy in critical assembly tasks and reduce human error. Collaborative robots (cobots) will support human workers in shared environments, improving safety and performance.

- Environmental regulations and ESG commitments will drive adoption of low-energy equipment, recyclable materials, and cleaner manufacturing processes. Companies will prioritize green certifications and carbon reduction targets.

- Automakers will expand regional supply chains and invest in local assembly plants to reduce dependency on single-source suppliers. This diversification will improve resilience against geopolitical and logistical disruptions.

- Wider deployment of digital twins will enable real-time simulation, design validation, and workflow optimization. These digital models will improve decision-making and accelerate product-to-market timelines.

- 3D printing will support low-volume production, rapid prototyping, and part customization within assembly environments. It will reduce tooling costs and allow on-demand manufacturing of complex components.

- The increasing reliance on technology will require continuous upskilling of the workforce. Companies will combine automation with targeted training programs to meet evolving operational demands.

- Growth in Asia Pacific, Latin America, and Africa will open new opportunities for localized assembly. Automakers will establish regional hubs to meet rising vehicle demand and regulatory requirements efficiently.