Market Overview:

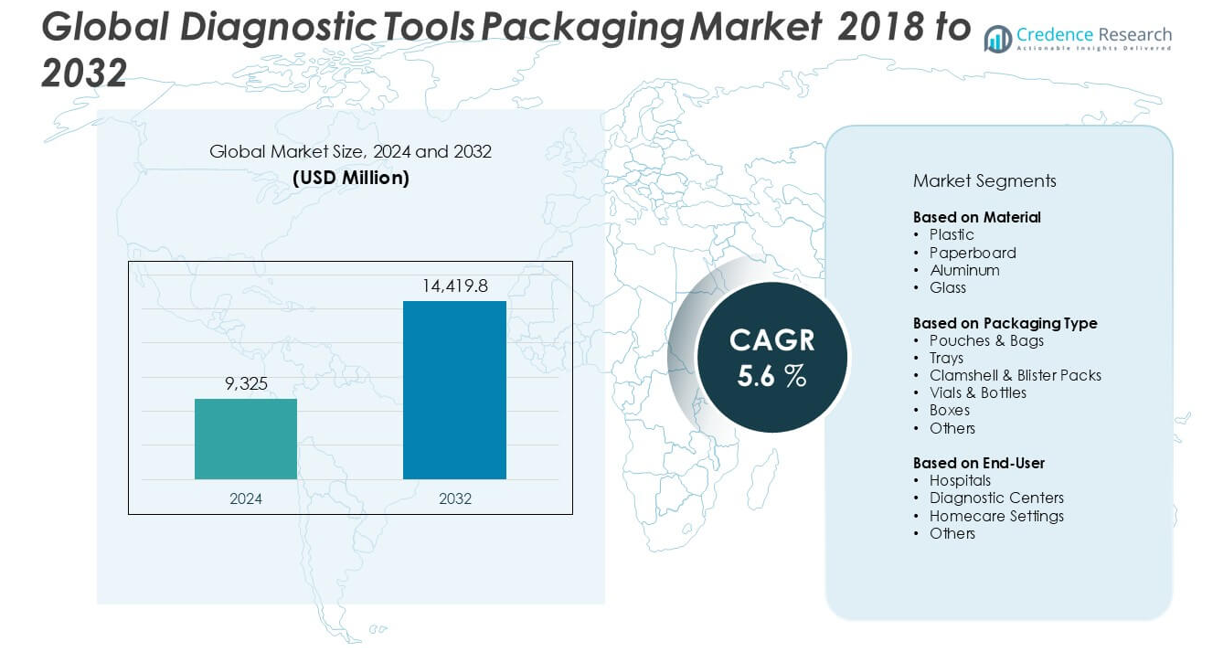

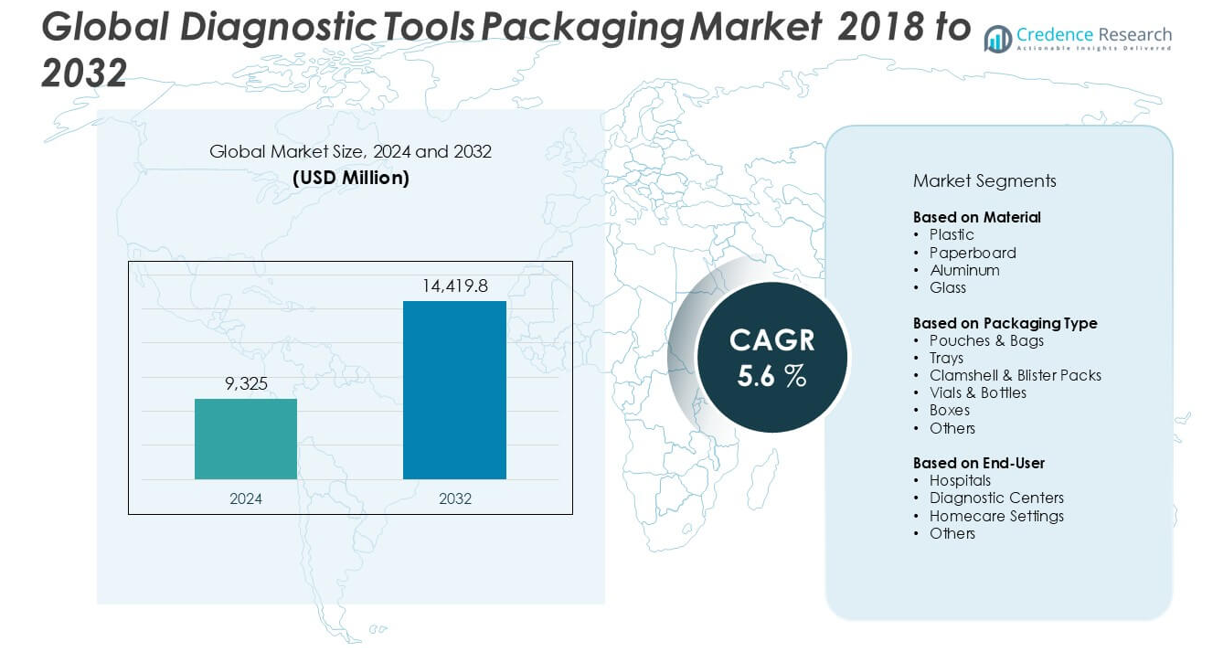

The Diagnostic Tools Packaging market size was valued at USD 9,325 million in 2024 and is anticipated to reach USD 14,419.8 million by 2032, at a CAGR of 5.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Diagnostic Tools Packaging Market Size 2024 |

USD 9,325 million |

| Diagnostic Tools Packaging Market, CAGR |

5.6% |

| Diagnostic Tools Packaging Market Size 2032 |

USD 14,419.8 million |

The Diagnostic Tools Packaging market is highly competitive, with key players including Thermo Fisher Scientific Incorporated, Amcor Plc, Gerresheimer AG, AptarGroup, Inc., and Berry Global Group, Inc. These companies lead through strong global distribution networks, advanced material innovation, and compliance with stringent healthcare packaging standards. Additional prominent participants such as Mondi Group, CCL Industries Inc., Nelipak Healthcare Packaging, Sonoco Products Company, and West Pharmaceutical Services, Inc. are expanding their presence through strategic collaborations and sustainability-focused packaging solutions. Regionally, North America dominates the global market, holding a 34.8% share in 2024, driven by its advanced diagnostic infrastructure, high healthcare expenditure, and increasing demand for home-based testing solutions.

Market Insights

- The Diagnostic Tools Packaging market was valued at USD 9,325 million in 2024 and is projected to reach USD 14,419.8 million by 2032, growing at a CAGR of 5.6% during the forecast period.

- Rising demand for point-of-care testing, home diagnostics, and personalized healthcare is driving the need for reliable, compact, and sterile packaging formats across hospitals and homecare settings.

- Pouches & bags led the packaging type segment due to their lightweight, resealable design, while plastic materials held the largest share owing to cost-effectiveness and durability.

- Thermo Fisher Scientific, Amcor Plc, Gerresheimer AG, and Berry Global Group, Inc. dominate the competitive landscape, focusing on smart, sustainable packaging and expanding global production capacities.

- North America held the largest regional share (34.8%), followed by Europe (28.5%) and Asia Pacific (23.7%); however, regulatory complexities and raw material price volatility continue to pose challenges for market players.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Material

Plastic emerged as the dominant material segment in the Diagnostic Tools Packaging market, accounting for the largest market share in 2024. Its widespread usage is attributed to its cost-effectiveness, lightweight nature, and excellent barrier properties that ensure product protection and extended shelf life. Plastics such as polyethylene and polypropylene are highly preferred for packaging diagnostic tools due to their durability and compatibility with sterilization methods. The increasing demand for flexible and tamper-evident packaging in diagnostic kits further propels plastic’s dominance. Moreover, its adaptability to various packaging formats supports its continued market leadership.

- For instance, Amcor has developed its AmSky™ blister system, which uses polyethylene-based plastic to eliminate PVC and aluminum, achieving a 70% reduction in carbon footprint compared to traditional multi-material packaging while maintaining product protection.

By Packaging Type:

Among the packaging types, Pouches & Bags held the largest market share in 2024, driven by their convenience, lightweight structure, and space efficiency. These packaging formats are widely used for single-use diagnostic devices and test kits, making them ideal for high-volume testing applications. Their resealable and moisture-resistant features enhance the shelf life of sensitive diagnostic tools. Additionally, the rise in at-home diagnostic testing and the need for hygienic, user-friendly packaging solutions continue to support the growth of pouches and bags. Manufacturers also favor these formats due to lower material usage and reduced production costs.

- For instance, Berry Global Group manufactures medical-grade pouches used in diagnostic kits, producing over 20 billion healthcare packaging units annually, with its Flexshield™ film technology offering enhanced puncture resistance and microbial barrier performance.

By End-User:

Hospitals represented the leading end-user segment in 2024, capturing the highest market share due to the significant volume of diagnostic procedures conducted in clinical settings. Hospitals demand a steady supply of diagnostic tools that are securely packaged to maintain sterility and avoid contamination. The increasing emphasis on early disease detection, infection control, and accurate diagnostic outcomes drives the need for reliable packaging solutions in these institutions. Additionally, rising investments in hospital infrastructure and the expansion of laboratory services globally are key contributors to the growth of this segment.

Market Overview

Rising Demand for Point-of-Care Testing (POCT):

The growing adoption of point-of-care testing is significantly boosting the demand for specialized diagnostic tools packaging. POCT allows rapid testing at or near the site of patient care, requiring compact, durable, and user-friendly packaging to ensure accuracy and ease of use. As healthcare providers shift towards decentralized diagnostics to enhance patient outcomes and reduce turnaround times, the packaging market is responding with innovative formats that support portability, sterility, and quick access. This trend is particularly pronounced in managing chronic diseases and infectious outbreaks.

- For instance, AptarGroup’s Active Packaging Solutions are embedded into over 300 million diagnostic test kits globally, supporting POCT applications with built-in desiccants that preserve reagent integrity under various temperature and humidity conditions.

Expansion of Diagnostic Infrastructure in Emerging Markets:

The rapid development of healthcare infrastructure in emerging economies is a major driver for the diagnostic tools packaging market. Countries in Asia-Pacific, Latin America, and the Middle East are investing heavily in diagnostic laboratories, mobile testing units, and hospital facilities. This expansion increases the need for secure and efficient packaging solutions that protect sensitive diagnostic kits during storage and transportation. Additionally, government initiatives to improve early disease detection and access to healthcare are amplifying demand for packaged diagnostic tools across public and private sectors.

- For instance, Gerresheimer AG expanded its manufacturing footprint in India by inaugurating a new production line in Kosamba dedicated to healthcare primary packaging, increasing its regional output capacity by 100 million units annually to meet growing diagnostic and pharmaceutical demand.

Growth in Home-Based and Self-Diagnostic Testing:

The increasing preference for home-based diagnostic solutions, especially post-COVID-19, is driving the demand for intuitive, tamper-proof, and compact packaging. Consumers require kits that are safe, easy to use, and provide instructions clearly through the packaging. This shift towards personal healthcare management fuels innovation in packaging design, with a focus on lightweight, resealable, and hygienic formats. The proliferation of over-the-counter diagnostic kits for conditions such as glucose monitoring, pregnancy, and infectious diseases is accelerating packaging volumes in the consumer diagnostics segment.

Key Trends & Opportunities

Sustainable Packaging Adoption:

Sustainability is becoming a critical trend in the diagnostic tools packaging market, as manufacturers and end-users seek eco-friendly solutions. Companies are exploring biodegradable, recyclable, and reusable packaging materials such as paper-based composites and bioplastics. Regulatory pressure, rising environmental awareness, and corporate responsibility goals are driving this shift. Sustainable packaging not only reduces environmental impact but also enhances brand value in the healthcare sector. This opens opportunities for innovation in green materials that meet sterility and durability requirements without compromising performance.

- For instance, Mondi Group launched its PerFORMing™ range of paper-based packaging for healthcare applications, which cuts plastic usage by up to 80 tons per year per production line, while maintaining compliance with sterility and strength standards.

Technological Integration in Packaging:

Advancements in smart packaging technologies, including RFID tags, QR codes, and tamper-evident seals, are enhancing product traceability and safety in diagnostic packaging. These technologies help in tracking expiration dates, verifying authenticity, and monitoring storage conditions, which is especially valuable for temperature-sensitive diagnostic tools. The growing integration of digital health with diagnostics encourages packaging solutions that contribute to real-time data capture and supply chain transparency, opening new avenues for technology-driven packaging manufacturers.

- For instance, West Pharmaceutical Services integrates RFID-enabled Flip-Off® seals into diagnostic vial packaging, enabling 100% unit-level traceability and supporting cold chain management for critical diagnostic reagents during global distribution.

Key Challenges

Strict Regulatory Compliance Requirements:

Meeting stringent regulatory standards for diagnostic packaging, especially related to sterility, labeling, and material safety, poses a significant challenge for manufacturers. Regulatory bodies such as the FDA and EMA enforce rigorous guidelines that packaging solutions must adhere to in order to ensure patient safety. The frequent updates to compliance standards increase the burden on companies to continuously adapt their materials, processes, and documentation, leading to higher operational costs and extended time-to-market for new products.

Fluctuating Raw Material Costs:

Volatile prices of raw materials such as plastics, aluminum, and specialty glass impact the profitability of diagnostic tools packaging manufacturers. These fluctuations, often driven by geopolitical factors, supply chain disruptions, and changing demand dynamics, make cost planning unpredictable. Manufacturers face the dual pressure of maintaining competitive pricing while ensuring quality and compliance, which can hinder long-term investment and innovation in packaging development.

Limited Recycling Infrastructure for Medical Packaging:

Despite the push for sustainable solutions, the limited infrastructure for recycling medical and diagnostic packaging remains a critical barrier. Most used diagnostic packaging contains biohazardous material, making recycling difficult under current waste management systems. This limits the practical implementation of circular economy initiatives in the sector. Companies are challenged to balance hygiene and safety standards with recyclability, often resulting in the continued use of single-use plastics and landfill accumulation.

Regional Analysis

North America:

North America held the largest market share of approximately 34.8% in 2024, with a market size valued at USD 3,245 million, up from USD 2,005 million in 2018. The market is projected to expand at a CAGR of 5.3% through 2032. The region benefits from a highly developed healthcare infrastructure, advanced diagnostic capabilities, and a strong presence of major packaging manufacturers. The rising adoption of at-home testing kits and increased focus on chronic disease management continue to fuel market growth. The U.S. remains the dominant contributor due to higher healthcare expenditure and ongoing technological advancements.

Europe:

Europe accounted for a significant share of the Diagnostic Tools Packaging market in 2024, representing 28.5% of the global market, with a valuation of USD 2,660 million, up from USD 1,720 million in 2018. The market is anticipated to grow at a CAGR of 5.1% through 2032. Growth is supported by strict regulatory frameworks, growing emphasis on patient safety, and the demand for sustainable packaging solutions. Countries such as Germany, the UK, and France are leading in diagnostic innovation and packaging efficiency. Additionally, Europe’s aging population is driving increased demand for diagnostic procedures and secure packaging formats.

Asia Pacific:

The Asia Pacific region held a market share of 23.7% in 2024, with the market valued at USD 2,210 million, rising from USD 1,340 million in 2018. It is projected to witness the fastest growth among all regions, registering a CAGR of 6.5% through 2032. Rapid urbanization, rising healthcare investments, and expanding diagnostic infrastructure across China, India, and Southeast Asia are key drivers. The growing prevalence of infectious diseases and increasing health awareness are boosting demand for diagnostic kits and corresponding packaging solutions. Regional governments’ support for local manufacturing and innovation also strengthens market potential.

Latin America:

Latin America captured a market share of 7.6% in 2024, valued at USD 710 million, growing from USD 455 million in 2018. The market is forecasted to expand at a CAGR of 5.4% over the forecast period. Growth in this region is driven by improvements in healthcare access, rising awareness of early disease detection, and increasing demand for cost-effective diagnostic packaging solutions. Brazil and Mexico dominate the regional market, supported by public and private investments in healthcare modernization. However, economic fluctuations and regulatory inconsistencies may pose moderate challenges to sustained market growth.

Middle East & Africa (MEA):

The Middle East & Africa held the smallest share of the global Diagnostic Tools Packaging market in 2024 at 5.4%, with a market size of USD 500 million, rising from USD 320 million in 2018. The region is expected to grow at a CAGR of 4.9% through 2032. Growth is primarily supported by increasing government initiatives to enhance diagnostic capabilities, particularly in the Gulf Cooperation Council (GCC) countries and South Africa. Rising demand for portable and safe diagnostic packaging, coupled with the development of mobile testing units, is contributing to market expansion despite infrastructural limitations in certain areas.

Market Segmentations:

By Material

- Plastic

- Paperboard

- Aluminum

- Glass

By Packaging Type

- Pouches & Bags

- Trays

- Clamshell & Blister Packs

- Vials & Bottles

- Boxes

- Others

By End-User

- Hospitals

- Diagnostic Centers

- Homecare Settings

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Diagnostic Tools Packaging market is characterized by the presence of several established players competing on the basis of innovation, product quality, regulatory compliance, and global reach. Key companies such as Thermo Fisher Scientific Incorporated, Amcor Plc, Gerresheimer AG, and AptarGroup, Inc. lead the market by offering advanced, sterile, and customizable packaging solutions tailored to evolving diagnostic needs. These firms are investing in sustainable materials, smart packaging technologies, and automation to enhance efficiency and reduce environmental impact. Strategic initiatives including mergers, acquisitions, and partnerships are prevalent, aimed at expanding product portfolios and entering new regional markets. For instance, collaborations between packaging companies and diagnostic kit manufacturers are increasingly shaping product development strategies. Mid-sized and emerging players such as Nelipak Healthcare Packaging and CCL Industries Inc. are also gaining ground by focusing on niche segments and flexible packaging innovations. Overall, the market reflects a dynamic and technology-driven competitive environment.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Thermo Fisher Scientific Incorporated

- Gerresheimer AG

- Amcor Plc

- AptarGroup, Inc.

- Mondi Group

- CCL Industries Inc.

- Nelipak Healthcare Packaging

- Berry Global Group, Inc.

- Sonoco Products Company

- West Pharmaceutical Services, Inc.

Recent Developments

- In September 2024, A Letter of Intent (LOI) was signed by CARBIOS and Selenis to manufacture Polyethylene Terephthalate Glycol (PETG). The cooperation intends to create an exceptional, ecological PETG material made from PET waste for the beauty and healthcare packaging industries in Europe and the United States by combining Selenis’ polymerization knowledge with CARBIOS’ advanced enzyme depolymerization technology. This deal, which comes after a two-year effort, is a major advancement for the plastic recycling sector.

- In May 2024, Coveris revealed an investment to improve its manufacturing capacity for medical equipment packaging at its plants located at Rohrdorf and Halle, Germany. In order to meet the growing demand for premium medical packaging solutions, the company is spending more than €8 million ($8.62 million) modernizing and expanding its medical equipment production lines. By late 2024, Coveris intends to add one header bag line and two new pouch lines. It is believed that the new bag and pouch lines will improve service and reflect the facility’s current technological capabilities.

- In November 2023, Amcor PLC launched the next generation of sustainable packaging for medical devices. The company’s latest innovation enables the development of all-fill packaging that can be recycled in the polyethylene stream. The new solution decreases the final package’s carbon footprint while maintaining the performance requirements of device applications. This helps medical companies achieve their sustainability goals without compromising patient safety.

Market Concentration & Characteristics

The Diagnostic Tools Packaging Market exhibits moderate to high market concentration, with a few dominant players holding a significant share of global revenues. Companies such as Thermo Fisher Scientific, Amcor Plc, Gerresheimer AG, and AptarGroup, Inc. lead the competitive landscape due to their established global supply chains, strong R&D capabilities, and regulatory compliance. It features a mix of large multinational corporations and mid-sized firms that specialize in healthcare and pharmaceutical packaging. Product differentiation focuses on material quality, sterility assurance, barrier protection, and compliance with healthcare standards. The market remains innovation-driven, influenced by the rising demand for point-of-care diagnostics and increasing emphasis on user-friendly and tamper-evident packaging. Sustainability trends are reshaping material choices, with players adopting recyclable plastics and paper-based alternatives to meet environmental goals. Price competitiveness and supply chain reliability continue to shape vendor selection among diagnostic tool manufacturers. The presence of regulatory scrutiny across major regions encourages continuous investment in quality control and packaging technologies.

Report Coverage

The research report offers an in-depth analysis based on Material, Packaging Type, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will witness sustained growth driven by the global expansion of diagnostic testing and early disease detection initiatives.

- Demand for compact, tamper-evident, and user-friendly packaging will increase with the rise in home-based and self-diagnostic kits.

- Manufacturers will invest in sustainable packaging materials to meet regulatory and environmental expectations.

- Smart packaging technologies, such as QR codes and RFID, will enhance product traceability and consumer engagement.

- Customized packaging solutions tailored for point-of-care diagnostics will gain traction across emerging economies.

- Automation and digitalization in packaging processes will improve efficiency and reduce operational costs.

- Strategic collaborations between packaging companies and diagnostic kit manufacturers will accelerate innovation.

- Regulatory compliance and sterility standards will continue to shape material selection and design.

- Asia Pacific will emerge as the fastest-growing region due to increased healthcare investment and diagnostic infrastructure.

- Growing competition will lead to pricing pressure, pushing companies to focus on value-added features and cost optimization.