Market Overview:

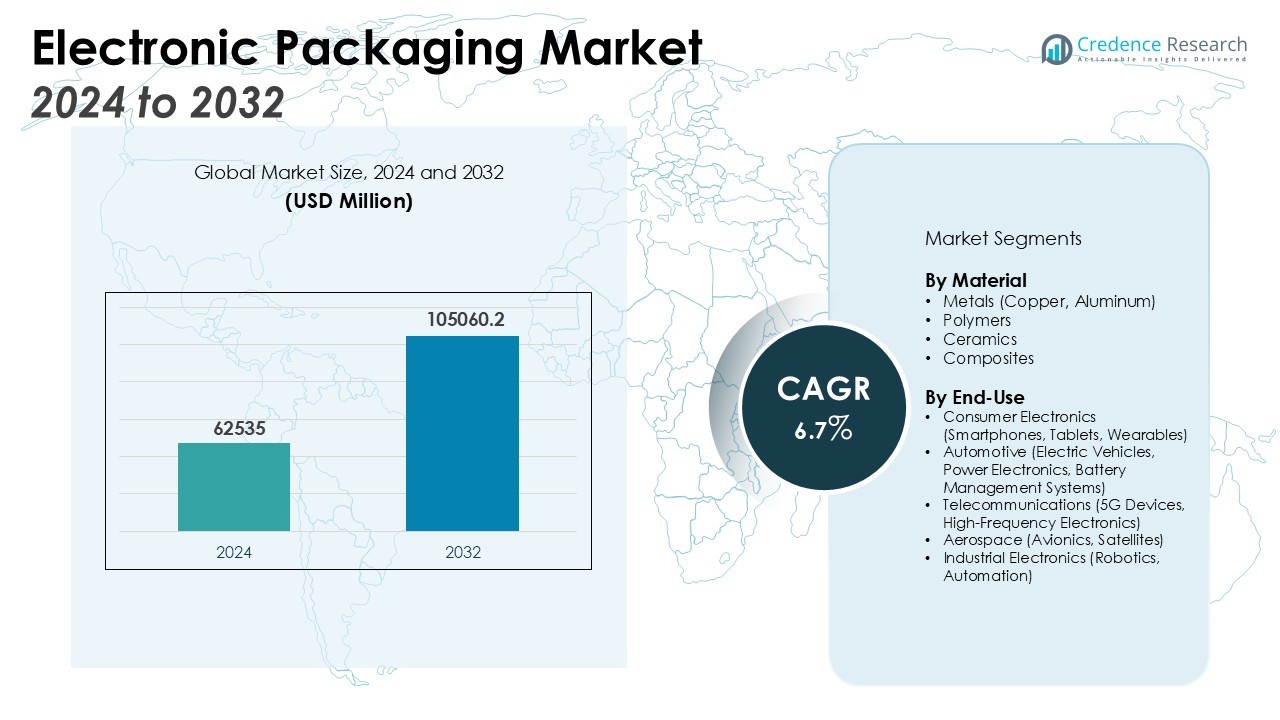

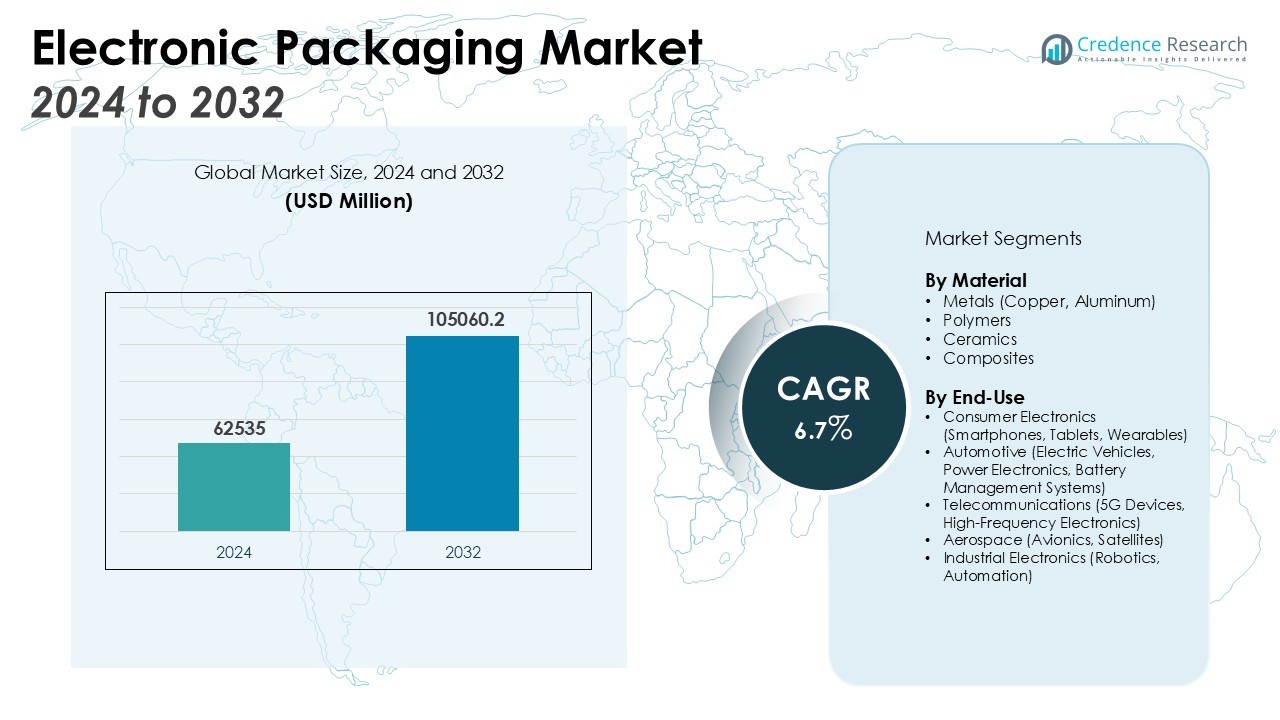

The Electronic Packaging Market size was valued at USD 62535 million in 2024 and is anticipated to reach USD 105060.2 million by 2032, at a CAGR of 6.7% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Electronic Packaging Market Size 2024 |

USD 62535 Million |

| Electronic Packaging Market, CAGR |

6.7% |

| Electronic Packaging Market Size 2032 |

USD 105060.2 Million |

Key drivers of market growth include the rise in electronic device miniaturization, which necessitates the development of compact and efficient packaging solutions. Additionally, the growing need for thermal management, enhanced signal integrity, and power efficiency in electronics is propelling the adoption of advanced packaging technologies. The expansion of the electric vehicle market, coupled with the demand for wearable devices, further fuels the demand for electronic packaging solutions. The increasing integration of 5G technology and IoT devices is also accelerating the need for innovative packaging solutions.

Regionally, North America holds the largest market share due to the presence of major electronics manufacturers and significant R&D investments in innovative packaging solutions. The Asia Pacific region is anticipated to witness the highest growth rate, driven by rapid industrialization, increasing production of consumer electronics, and the presence of key semiconductor manufacturers in countries like China, Japan, and South Korea. Europe also maintains a substantial market share, supported by its automotive and industrial electronics sectors. Additionally, government initiatives in emerging economies are creating opportunities for market expansion.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Electronic Packaging Market is valued at USD 62,535 million in 2024 and is projected to reach USD 105,060.2 million by 2032, growing at a CAGR of 6.7%.

- Miniaturization in electronic devices drives the need for compact and efficient packaging solutions to meet performance demands in consumer electronics and wearables.

- Enhanced thermal management and power efficiency are crucial for high-performance devices, particularly in automotive and consumer electronics.

- Advancements in semiconductor manufacturing, such as 3D packaging and system-in-package (SiP), enable higher-density chip designs, fueling market growth.

- The expansion of the EV market and the growing demand for wearable devices are boosting the need for specialized electronic packaging solutions.

- North America holds a 38% market share, with Asia Pacific at 33%, and both regions are driving growth through industrialization and electronics production.

- Design complexity and supply chain disruptions pose challenges to the timely production and performance of advanced packaging solutions.

Market Drivers:

Miniaturization of Electronic Devices Driving Market Growth

The rise in electronic device miniaturization is a key driver of the Electronic Packaging Market. As consumer electronics, wearables, and automotive devices become smaller, the demand for compact and efficient packaging solutions increases. These advancements require packaging technologies that can manage reduced spaces while maintaining high-performance standards. Smaller form factors also demand more advanced materials and designs to ensure functionality without compromising reliability. This trend has led to the development of high-density interconnects and microelectronic packaging solutions that enable miniaturized devices to perform at optimal levels.

Thermal Management and Power Efficiency Demand

The increasing need for effective thermal management and power efficiency in electronics is another significant driver. Electronic components generate heat that can impact performance and longevity. Packaging solutions that manage heat dissipation are critical to maintaining the reliability of high-performance devices, particularly in sectors like consumer electronics and automotive. With the proliferation of high-powered devices, including processors, power modules, and electric vehicle components, there is a greater demand for packaging solutions that balance power efficiency and thermal control. This has led to innovations in heat spreaders, heat sinks, and advanced substrates that provide superior heat dissipation.

- For instance, imec has developed a silicon-based microchannel heat sink that dissipates more than 600W/cm² of heat while maintaining the device temperature below 100°C and achieving a total thermal resistance as low as 0.28K/W at less than 2-W pump power.

Advancements in Semiconductor Technology

Technological advancements in semiconductor manufacturing are pushing the demand for innovative packaging solutions. The transition to smaller process nodes and complex chip designs requires packaging technologies that can accommodate multiple layers of chips, fine pitch connections, and intricate geometries. The development of 3D packaging and system-in-package (SiP) technologies has gained traction, allowing for better performance in smaller footprints. These innovations are expected to continue fueling the growth of the Electronic Packaging Market, as they support the increasing complexity of modern semiconductor devices used in a wide range of applications.

- For instance, Siemens Digital Industries Software’s Innovator3D IC platform, introduced in September 2024, integrates system-centric planning and predictive modeling for IC package design and was recognized with the 3D InCites Technology Enablement Award in 2025 for enabling digital twin creation of entire semiconductor package assemblies.

Growth in Electric Vehicles and Wearables

The expansion of the electric vehicle (EV) market and the demand for wearable devices are also contributing to the increased demand for electronic packaging solutions. EVs require specialized electronic components such as power electronics and battery management systems, which need advanced packaging to ensure durability, safety, and thermal management. Wearable devices, on the other hand, require packaging solutions that combine miniaturization with high performance. Both sectors are pushing the boundaries of electronic packaging technology, thereby creating new growth opportunities for the market. The integration of these technologies into daily life will further drive innovation and adoption of advanced electronic packaging solutions.

Market Trends:

Integration of Advanced Materials in Packaging Solutions

One of the key trends shaping the Electronic Packaging Market is the integration of advanced materials to improve performance and reliability. The demand for lightweight, high-performance materials such as ceramics, composites, and advanced polymers is rising. These materials offer better thermal management, durability, and electrical performance, essential for modern electronic devices. Packaging solutions are increasingly using these materials to achieve higher functionality in smaller spaces. The adoption of new materials helps meet the growing performance demands of consumer electronics, automotive, and telecommunications sectors. Furthermore, these materials contribute to the miniaturization of electronic components without compromising quality or reliability. As the market continues to demand more efficient and compact designs, material innovation remains crucial for supporting technological advancements in electronics.

- For instance, SABIC engineered a 1-millimeter-thick notebook cover using a carbon fiber-reinforced polycarbonate laminate overmolded with a 40% glass-fiber/polycarbonate compound, achieving all required industry specifications for thin, lightweight consumer electronics.

Rise of System-in-Package (SiP) and 3D Packaging Technologies

Another significant trend in the Electronic Packaging Market is the growing adoption of system-in-package (SiP) and 3D packaging technologies. These packaging solutions integrate multiple chips and components into a single package, allowing for greater functionality and performance in compact devices. The move toward SiP and 3D packaging addresses the need for higher processing power, better thermal management, and reduced size in a wide range of applications, from mobile devices to automotive electronics. By stacking chips and integrating them within a single package, these technologies provide space savings while optimizing signal integrity and power efficiency. With the increasing demand for advanced electronics, particularly in the smartphone, wearable, and electric vehicle markets, SiP and 3D packaging solutions will continue to play a pivotal role in the growth of the Electronic Packaging Market.

- For instance, Apple’s Watch Series 4 used a custom SiP with advanced packaging technology, featuring all core components (including the application processor, PMIC, and RF modules) integrated into a single package of less than 700mm² area, forming the most compact and integrated device of its category at release.

Market Challenges Analysis:

Complexity in Design and Manufacturing Processes

The complexity of design and manufacturing processes presents a significant challenge in the Electronic Packaging Market. As the demand for smaller, more powerful devices increases, packaging solutions must meet higher performance and reliability standards. Designing efficient packaging that can manage power, heat, and signal integrity while minimizing space is a difficult task. The advanced technologies required for these solutions, such as 3D packaging and system-in-package (SiP), involve intricate processes that require specialized equipment and expertise. This complexity raises production costs and increases the risk of defects, which can delay time-to-market for new products and affect the overall competitiveness of manufacturers.

Supply Chain and Material Availability Constraints

Supply chain disruptions and material availability also pose challenges for the Electronic Packaging Market. The increasing demand for advanced materials, such as high-performance polymers, ceramics, and semiconductors, places pressure on suppliers to meet production requirements. Shortages of critical materials can lead to delays in the production of packaging solutions, affecting the timely release of electronic devices. These supply chain constraints are further exacerbated by geopolitical factors and fluctuations in global demand. Manufacturers face the challenge of ensuring a steady supply of high-quality materials while managing cost increases and minimizing production bottlenecks.

Market Opportunities:

Growth of Emerging Technologies and Consumer Electronics

The growing adoption of emerging technologies, such as 5G, Internet of Things (IoT), and artificial intelligence (AI), presents significant opportunities for the Electronic Packaging Market. These technologies require advanced packaging solutions that can handle high processing power, efficient heat dissipation, and compact designs. As demand for devices such as smartphones, wearables, and connected appliances continues to rise, the need for high-performance packaging solutions will grow. Manufacturers can capitalize on these opportunities by developing packaging technologies that cater to the evolving needs of these industries. Innovations in packaging materials and design will be critical in enabling the seamless integration of emerging technologies into consumer electronics.

Expansion in Electric Vehicles and Automotive Electronics

The expansion of electric vehicles (EVs) and the increasing complexity of automotive electronics present substantial growth opportunities for the Electronic Packaging Market. As the automotive sector shifts toward electrification, advanced packaging solutions are required to ensure the performance, durability, and safety of critical components such as power electronics, battery management systems, and sensors. With the automotive industry’s focus on energy efficiency and sustainability, packaging solutions that offer thermal management, power efficiency, and miniaturization will play a vital role. This growing demand for high-quality packaging in automotive electronics offers significant opportunities for manufacturers to develop innovative solutions tailored to the evolving needs of the EV market.

Market Segmentation Analysis:

By Material

The Electronic Packaging Market is segmented by material into metals, polymers, ceramics, and composites. Metals such as copper and aluminum are extensively used for their excellent conductivity and thermal management properties, making them ideal for high-performance electronics. Polymers and composites are favored for their lightweight and flexible nature, making them suitable for portable devices and wearables. Ceramics, known for their high thermal stability, are used in high-power electronics where heat dissipation is crucial. The growing demand for lightweight, durable, and thermally efficient materials is driving innovation in this segment, as manufacturers aim to improve device performance while maintaining reliability.

- For instance, Georgia Tech developed a silicone-based LED encapsulant with a refractive index of 1.7 and relative transmittance of 90 for improved optical performance in electronic packaging.

By End-Use

The end-use segment of the Electronic Packaging Market includes consumer electronics, automotive, telecommunications, aerospace, and industrial electronics. Consumer electronics, such as smartphones, tablets, and wearables, dominate this segment due to the need for compact, high-performance packaging solutions. The automotive industry, particularly with the rise of electric vehicles (EVs), requires specialized packaging for power electronics and battery management systems. Telecommunications, driven by the growth of 5G technology, demands packaging solutions capable of handling high-frequency signals. Aerospace and industrial electronics also represent growing segments, with increasing demand for reliable, high-performance packaging for mission-critical applications. The diversity across end-use sectors underscores the vital role electronic packaging plays in modern electronics.

- For instance, Tesla’s Model 3 uses a semi-custom power module design that combines the benefits of industrial modules — such as improved thermal performance and higher current ratings per device — optimized specifically for EV applications, leading to enhanced reliability in its powertrains.

Segmentations:

By Material:

- Metals (Copper, Aluminum)

- Polymers

- Ceramics

- Composites

By End-Use:

- Consumer Electronics (Smartphones, Tablets, Wearables)

- Automotive (Electric Vehicles, Power Electronics, Battery Management Systems)

- Telecommunications (5G Devices, High-Frequency Electronics)

- Aerospace (Avionics, Satellites)

- Industrial Electronics (Robotics, Automation)

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America: Dominating the Electronic Packaging Market

North America holds a market share of 38% in the Electronic Packaging Market, driven by its advanced technological infrastructure and strong presence of major electronics manufacturers. The region benefits from a robust R&D ecosystem that accelerates the adoption of innovative packaging solutions across various industries, including consumer electronics, telecommunications, and automotive. Companies in the U.S. and Canada lead advancements in packaging technologies such as 3D packaging and system-in-package (SiP) solutions. The demand for high-performance, energy-efficient electronic devices in sectors like aerospace and automotive continues to fuel growth. With continued investments in R&D, North America will maintain its leadership position in the electronic packaging sector.

Asia Pacific: Rapid Expansion Fueled by Manufacturing Growth

The Asia Pacific region commands a 33% market share in the Electronic Packaging Market and is expected to see the highest growth rate during the forecast period. Rapid industrialization in countries like China, India, and South Korea has positioned the region as a global hub for electronics manufacturing. Major semiconductor manufacturers and consumer electronics companies in the region are at the forefront of innovation, driving demand for advanced packaging solutions. The region’s growing middle class and rising demand for smartphones, wearables, and electric vehicles further increase the need for miniaturized, power-efficient, and thermally managed electronic packaging. The availability of cost-effective manufacturing in the region supports continued market growth.

Europe: Steady Growth Driven by Automotive and Industrial Sectors

Europe holds a 21% market share in the Electronic Packaging Market, with significant contributions from its automotive, industrial, and consumer electronics sectors. The automotive industry, particularly in Germany, is investing heavily in electric vehicles and autonomous driving technologies, which demand advanced packaging solutions for components like sensors, power modules, and battery management systems. The industrial sector’s growing demand for high-performance, energy-efficient components in applications such as robotics and automation is also a key driver. Europe’s focus on sustainability and green technologies encourages the development of eco-friendly packaging materials, supporting steady growth in the market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- ASE Group

- Jabil

- UFP Technologies, Inc

- SCHOTT AG

- Sonoco Products Company

- Sealed Air Corporation

- Mondi plc

- DS Smith plc

- DuPont de Nemours, Inc.

- Amkor Technology

Competitive Analysis:

The Electronic Packaging Market is highly competitive, with key players focusing on technological advancements and material innovations to strengthen their market position. Leading companies such as Amkor Technology, Intel Corporation, TSMC, and ASE Group are investing heavily in research and development to enhance packaging technologies like 3D packaging and system-in-package (SiP). These companies aim to address the growing demand for compact, high-performance packaging solutions in consumer electronics, automotive, and telecommunications sectors. Manufacturers are also leveraging strategic partnerships and acquisitions to expand their capabilities and market reach. The competition in the market is further driven by the continuous need for thermal management, power efficiency, and miniaturization, which pushes companies to innovate. Smaller players are also emerging, focusing on niche markets and offering specialized packaging solutions to meet specific industry needs. This dynamic competitive environment encourages continuous improvement in packaging designs and performance.

Recent Developments:

- In July 2025, UFP Technologies announced the acquisition of Universal Plastics & Engineering Company, Inc. (UNIPEC) and Techno Plastics Industries, Inc. (TPI).

- In March 2025, SCHOTT started serial production of matte glass-ceramic cooktops (SCHOTT CERAN® matte line), which are now being launched by leading appliance brands to align with current kitchen design trends.

- In June 2024, Sonoco announced an agreement to acquire Eviosys, Europe’s leading food cans, ends, and closures manufacturer, from KPS Capital Partners for approximately $3.9 billion.

Market Concentration & Characteristics:

The Electronic Packaging Market exhibits moderate concentration, with a few large players holding significant market shares while smaller companies cater to niche applications. Major companies, such as Amkor Technology, ASE Group, and TSMC, dominate the market due to their strong research and development capabilities, broad product portfolios, and strategic partnerships. These leaders focus on advancing packaging technologies like 3D packaging and system-in-package (SiP) to meet the rising demand for miniaturized, high-performance electronics. Smaller players, however, contribute to market dynamics by offering specialized solutions for industries like aerospace and automotive. The market is characterized by rapid technological innovation, with an emphasis on thermal management, power efficiency, and miniaturization to meet the evolving demands of consumer electronics, electric vehicles, and telecommunications. Competitive dynamics continue to evolve as companies focus on expanding their offerings and geographical presence to maintain market leadership.

Report Coverage:

The research report offers an in-depth analysis based on Material, End-Use and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The demand for smaller, more powerful electronic devices drives the adoption of advanced packaging solutions like 3D packaging and system-in-package (SiP).

- Advancements in materials and design techniques enhance heat dissipation, crucial for maintaining the performance and reliability of high-powered electronic components.

- The industry is focusing on developing eco-friendly packaging materials and recycling processes to reduce electronic waste and meet environmental regulations.

- The proliferation of artificial intelligence and Internet of Things devices increases the need for packaging solutions that support high-speed data processing and connectivity.

- The rise of electric vehicles and autonomous driving technologies necessitates advanced packaging for power electronics and battery management systems.

- The growth of flexible and wearable electronics requires packaging solutions that are lightweight, durable, and capable of conforming to various shapes.

- Techniques like fan-out wafer-level packaging (FO-WLP) and embedded die packaging are gaining traction for their ability to integrate multiple components into a single package.

- Asia Pacific leads in market share, driven by manufacturing hubs in China, Japan, and South Korea, while North America and Europe focus on innovation and high-end applications.

- Geopolitical tensions and material shortages impact the availability and cost of essential components, affecting production timelines and costs.

- Companies are increasing investments in research and development to stay competitive, focusing on next-generation packaging solutions and materials.