Market Overview

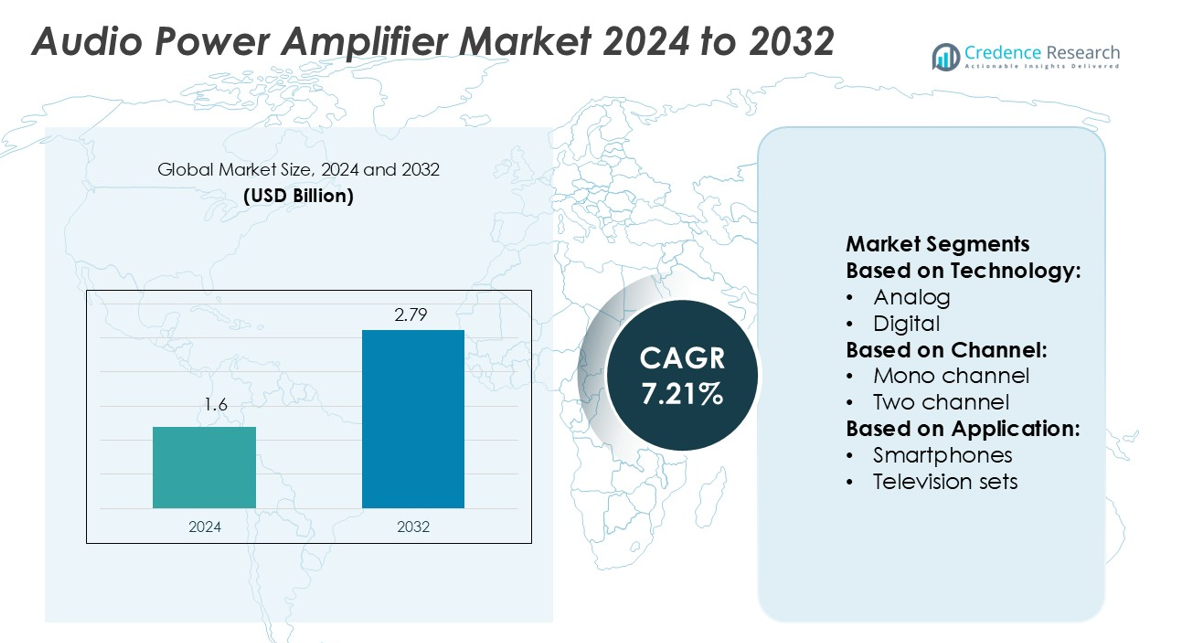

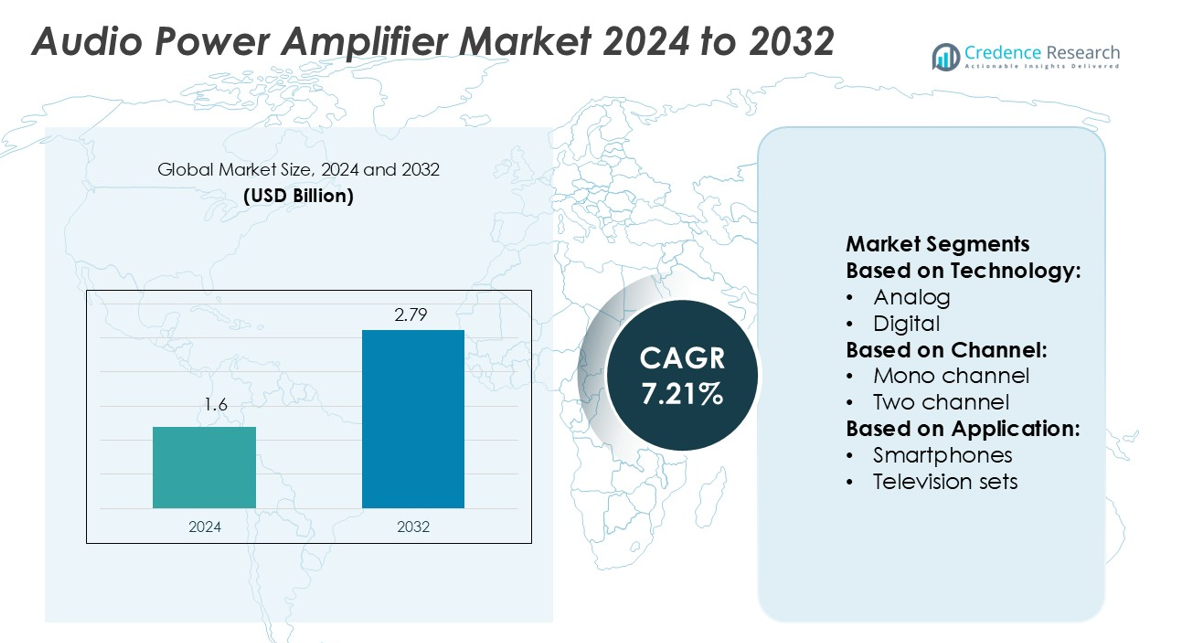

Audio Power Amplifier Market size was valued USD 1.6 billion in 2024 and is anticipated to reach USD 2.79 billion by 2032, at a CAGR of 7.21% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Audio Power Amplifier Market Size 2024 |

USD 1.6 billion |

| Audio Power Amplifier Market, CAGR |

7.21% |

| Audio Power Amplifier Market Size 2032 |

USD 2.79 billion |

The Audio Power Amplifier Market is shaped by key players such as Sony, Texas Instruments, Cirrus Logic, Qualcomm, Yamaha, Analog Devices, STMicroelectronics, NXP Semiconductors, Infineon Technologies, and On Semiconductor. These companies focus on high-efficiency amplifier architectures, integration with digital signal processors, and miniaturized designs for portable devices.Texas Instruments and Cirrus Logic lead in Class-D amplifier technology with advanced power management for smartphones and home audio systems. Meanwhile, Yamaha and Sony emphasize high-fidelity sound solutions for premium entertainment devices. Regionally, Asia Pacific dominates the global market, holding a 41.6% share in 2024 due to strong electronics manufacturing bases in China, Japan, and South Korea.

Market Insights

- The Audio Power Amplifier Market size was valued at USD 1.6 billion in 2024 and is projected to reach USD 2.79 billion by 2032, growing at a CAGR of 7.21% during the forecast period.

- Increasing demand for high-fidelity audio in smartphones, home audio systems, and automotive infotainment drives market growth, supported by advancements in Class-D amplifier technology.

- Key players such as Sony, Texas Instruments, Cirrus Logic, Qualcomm, Yamaha, Analog Devices, STMicroelectronics, NXP Semiconductors, Infineon Technologies, and On Semiconductor focus on power-efficient designs, DSP integration, and miniaturized solutions to strengthen their competitive positions.

- Asia Pacific leads with a 41.6% market share in 2024, driven by strong electronics manufacturing in China, Japan, and South Korea; North America and Europe follow with significant shares in consumer electronics and automotive segments.

- Analog amplifiers dominate the technology segment, while smartphones and home audio systems represent the largest application sub-segments, reflecting widespread consumer adoption and rising demand for premium audio experiences.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Technology

The digital segment dominates the audio power amplifier market, holding the largest market share in 2024. Its dominance stems from superior energy efficiency, compact size, and lower heat generation compared to analog systems. Digital amplifiers also provide better signal-to-noise ratios and integration with smart devices and wireless technologies. Their growing adoption in smartphones, automotive infotainment, and portable audio devices further strengthens demand. Advancements in Class D amplifiers enhance power efficiency and sound clarity, supporting growth in high-performance audio applications. Continuous innovation in chip miniaturization and digital signal processing contributes to this segment’s expansion.

- For instance, Sony’s digital amplifiers, such as the XM-GS6DSP, deliver 45 watts RMS per channel at 4 ohms. This model also provides 600 watts RMS for the subwoofer when bridged at 2 ohms.

By Channel

The two-channel segment leads the market, accounting for the highest share due to its wide use in home audio and television systems. It offers balanced stereo output and cost-effective configurations ideal for most consumer applications. Increasing demand for immersive audio experiences in entertainment systems fuels this segment’s expansion. Manufacturers integrate advanced features such as noise suppression and frequency control for better sound reproduction. The four-channel segment also shows strong growth potential in automotive and professional sound systems. However, the simplicity and versatility of two-channel designs continue to drive their market leadership.

- For instance, Texas Instruments’ TPA3121D2 is a Class-D audio amplifier delivering 15W per channel into a 4Ω load at 22V, operating within a supply voltage range of 10V to 26V. Its efficiency eliminates the need for external heat sinks during music playback.

By Application

Smartphones represent the dominant application segment, capturing the largest market share due to widespread global adoption. Rising demand for high-fidelity audio and compact amplifier integration drives innovation in smartphone design. Manufacturers focus on enhancing sound output while reducing power consumption to optimize battery life. Advancements in semiconductor technologies enable miniature, high-efficiency amplifiers that deliver superior sound in limited space. The growing trend of multimedia consumption and gaming further supports this segment’s growth. Additionally, the integration of AI-based audio enhancement features strengthens the role of amplifiers in premium smartphone models.

Key Growth Drivers

Rising Consumer Electronics Demand

The surge in consumer electronics, including smartphones, laptops, and home audio systems, drives demand for audio power amplifiers. Increased adoption of high-definition audio and immersive sound experiences in televisions, gaming consoles, and personal devices fuels market expansion. For instance, Apple’s latest devices integrate advanced amplifiers to deliver richer audio output, while Sony continues to enhance home audio systems with Class D amplifiers. Growing disposable income and preference for premium audio products, particularly in North America and Europe, further accelerate market growth, creating opportunities for innovative amplifier designs.

- For instance, CS42L43 audio codec offers a high dynamic range of 114 dB for stereo headphone output. It provides 33.7 mW output power into a 30 Ω load with less than 85 dB total harmonic distortion plus noise (THD+N).

Automotive Infotainment Expansion

The automotive industry’s shift toward connected cars and advanced infotainment systems boosts the need for high-performance audio power amplifiers. Consumers increasingly demand superior in-car audio quality, multi-channel setups, and integrated amplifier systems. Companies like Bose and Harman Kardon collaborate with car manufacturers to embed multi-channel digital amplifiers in vehicles, enhancing user experience. Electric and autonomous vehicles also require compact, energy-efficient amplifiers. Rising production of luxury and electric vehicles in APAC and Europe contributes to the increasing market adoption, supporting steady growth throughout the forecast period.

- For instance, Yamaha’s PX8 power amplifier delivers 800W per channel at 8Ω and 1050W at 4Ω, utilizing a newly developed Class-D amplifier engine with a custom LSI.

Technological Advancements in Amplifiers

Innovations in amplifier technologies, such as digital Class D amplifiers, hybrid designs, and energy-efficient modules, drive market expansion. These advancements improve sound clarity, reduce power consumption, and support compact form factors suitable for mobile and professional applications. For instance, Texas Instruments’ digital amplifiers offer high signal-to-noise ratios with minimal distortion. Continuous R&D by companies like Sony and Yamaha ensures integration with smart devices and wireless connectivity, enhancing user convenience. Adoption of these advanced amplifiers across consumer electronics, automotive, and professional audio segments significantly fuels the global market growth.

Key Trends & Opportunities

Integration with Smart Devices

Audio power amplifiers are increasingly integrated into smart home and IoT devices, offering wireless streaming and multi-room audio capabilities. Brands like Sonos and Bose leverage smart amplifiers to enable seamless connectivity with voice assistants and home automation systems. This trend presents opportunities for manufacturers to develop compact, energy-efficient amplifiers that support smart platforms. Growing adoption of AI-driven audio processing further enhances sound quality and personalization. The expanding smart home ecosystem in North America, Europe, and APAC regions provides a lucrative growth avenue, encouraging partnerships and innovation in amplifier technologies.

- For instance, Analog Devices’ MAX98357A is a compact, low-power Class D audio amplifier designed for integration into smart devices. It delivers 3.2W output power into a 4Ω load at 5V supply voltage, with a total harmonic distortion plus noise (THD+N) of 0.013% at 1kHz.

Professional Audio Market Expansion

The professional audio segment, including live events, recording studios, and broadcasting, offers significant growth potential for high-performance amplifiers. Rising demand for immersive concert experiences, larger venues, and digital broadcasting increases the need for multi-channel, high-wattage amplifiers. Companies such as QSC and Yamaha invest in scalable amplifier solutions to cater to professional audio requirements. Enhanced durability, low distortion, and precise audio reproduction drive adoption. Expansion of music festivals, studios, and content creation platforms globally further fuels opportunities, particularly in North America and Europe, strengthening the amplifier market’s growth trajectory.

- For instance, STMicroelectronics’ STA518 is a monolithic quad half-bridge audio amplifier capable of delivering 24W per channel at 10% total harmonic distortion (THD) into a 4Ω load with a 30V supply voltage in single-ended configuration.

Key Challenges

High Component Costs

Rising costs of electronic components, semiconductors, and rare materials pose challenges for amplifier manufacturers. Price-sensitive consumer segments may delay purchases or opt for low-cost alternatives, impacting revenue. Supply chain disruptions, particularly in semiconductors, can cause production delays, affecting market timelines. For example, fluctuations in high-purity silicon availability directly influence digital amplifier production. Companies must balance performance, cost, and energy efficiency to remain competitive. Strategies such as local sourcing, lean manufacturing, and design optimization are essential to mitigate cost pressures while maintaining product quality and market share.

Technical Complexity and Integration Issues

Advanced amplifiers require precise integration with devices and systems, presenting engineering and compatibility challenges. Multi-channel setups, wireless connectivity, and smart device integration increase design complexity and potential for performance issues. Companies must ensure compatibility across diverse devices, including smartphones, televisions, and automotive infotainment systems. For instance, improper integration may cause signal distortion or overheating. Continuous R&D, rigorous testing, and adherence to international standards are critical to overcome these technical barriers. Manufacturers must invest in skilled workforce and advanced design tools to deliver reliable, high-quality audio amplifiers.

Regional Analysis

North America

North America held a 28% share of the audio power amplifier market in 2024. Strong demand in consumer electronics, automotive, and smart home systems drives growth. The U.S. leads with rapid adoption of advanced audio technologies and premium amplifier systems. Continuous innovation and investments by key players strengthen the market, while integration in smartphones, TVs, and car audio systems sustains expansion.

Europe

Europe accounted for 22% of the market in 2024. Germany, France, and the U.K. drive growth through high demand for automotive and home audio systems. Consumers prefer amplifiers with high sound quality and energy efficiency. Expansion in smart home devices and automotive infotainment boosts adoption. Innovation in Class-D and Class-G&H amplifiers further strengthens the market in the region.

Asia-Pacific

Asia-Pacific leads with a 42% market share in 2024. China, Japan, and South Korea dominate due to large consumer electronics and automotive markets. Rapid urbanization, rising disposable incomes, and tech adoption fuel demand. Key players invest in advanced amplifier technologies for smartphones, TVs, and automotive systems. The region’s growth is supported by both OEM and aftermarket applications.

Latin America

Latin America held a 5% share of the market in 2024. Brazil and Mexico drive growth through increasing adoption of consumer electronics and car audio systems. Expanding middle-class populations and improving economies support demand. The market focuses on affordable, high-performance amplifiers for home and automotive use.

Middle East & Africa

The Middle East & Africa accounted for 3% of the market in 2024. UAE, Saudi Arabia, and South Africa lead adoption of premium audio systems. Rising infrastructure, growing consumer spending, and interest in smart homes drive growth. Market expansion focuses on advanced audio solutions for residential and commercial applications.

Market Segmentations:

By Technology:

By Channel:

By Application:

- Smartphones

- Television sets

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The audio power amplifier market players such as Sony, Texas Instruments, Cirrus Logic, Qualcomm, Yamaha, Analog Devices, STMicroelectronics, NXP Semiconductors, Infineon Technologies, and On Semiconductor. The audio power amplifier market is highly competitive, driven by continuous innovation and technological advancements. Companies focus on developing energy-efficient, high-performance amplifiers for consumer electronics, automotive systems, and professional audio applications. Strategic partnerships, mergers, and acquisitions enable rapid expansion into new regions, while investments in R&D enhance product quality, reduce power consumption, and improve sound clarity. The market emphasizes integration with smart devices, IoT-enabled systems, and compact designs to meet growing consumer demand. Regional expansions in North America, Europe, and Asia-Pacific further intensify competition, as players aim to capture emerging opportunities in automotive infotainment, home audio, and portable electronics, fostering a dynamic and evolving market environment.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Sony

- Texas Instruments

- Cirrus Logic

- Qualcomm

- Yamaha

- Analog Devices

- STMicroelectronics

- NXP Semiconductors

- Infineon Technologies

- On Semiconductor

Recent Developments

- In June 2025, Elite RF, a U.S.-based innovator in RF amplifier solutions, announces its entry into the C-band and S-band high-power RF amplifier market. The new systems are created to meet growing global demand in defense and weather radar applications, marking a strategic expansion of the company’s advanced amplifier portfolio.

- In March 2025, MACOM Technology Solutions displayed a High-Power Opto-Amp™ line delivering 10–50 W for satellite links and a linearized Q-band GaN MMIC PA at SATELLITE 2025.

- In January 2025, Guerrilla RF, Inc. announces the formal release of the GRF0020D and GRF0030D, the first in a new class of GaN on SiC HEMT power amplifiers being developed by the company.

- In June 2024, Qorvo released three monolithic microwave integrated circuit (MMIC) power amplifiers created especially for Ku-Band satellite communications (SATCOM) terminals.

Report Coverage

The research report offers an in-depth analysis based on Technology, Channel, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for high-fidelity audio in consumer electronics will continue to rise.

- Automotive infotainment systems will drive significant amplifier adoption globally.

- Integration of Class-D and energy-efficient amplifiers will expand across devices.

- Growth of smart home devices will boost demand for compact audio solutions.

- Wireless and Bluetooth-enabled amplifiers will gain wider market acceptance.

- Emerging markets in Asia-Pacific and Latin America will present new opportunities.

- Increased R&D will focus on reducing power consumption and improving sound quality.

- OEM and aftermarket applications will continue to support market expansion.

- Collaborations with technology companies will accelerate innovation and product development.

- Market competition will intensify, encouraging new features and advanced amplifier designs.