Market Overview

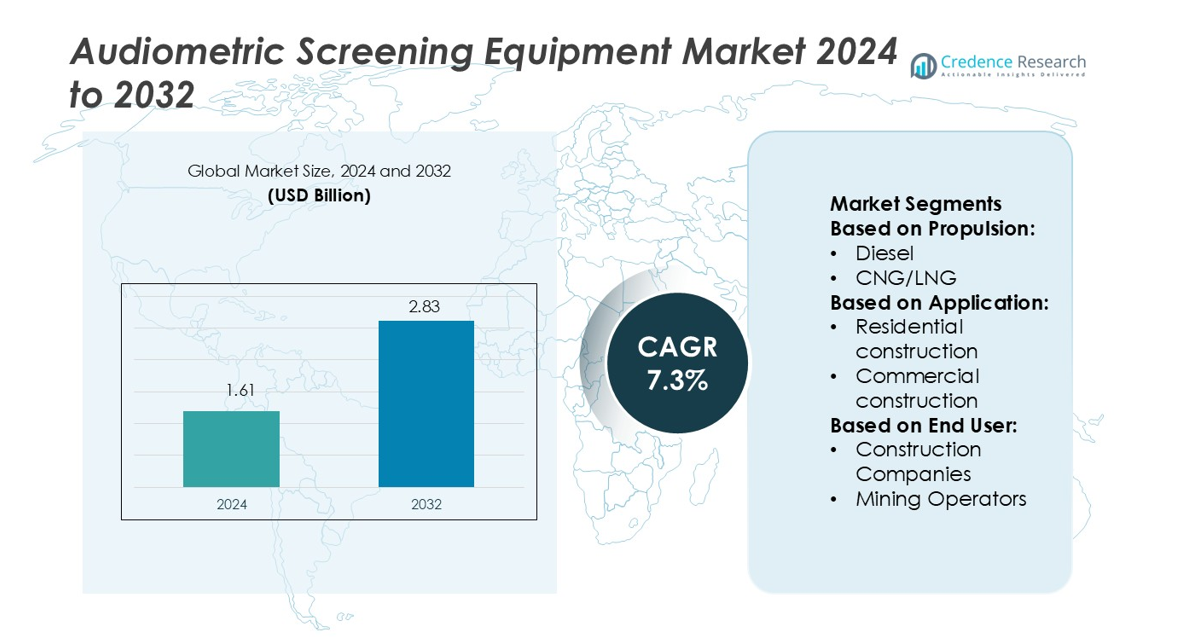

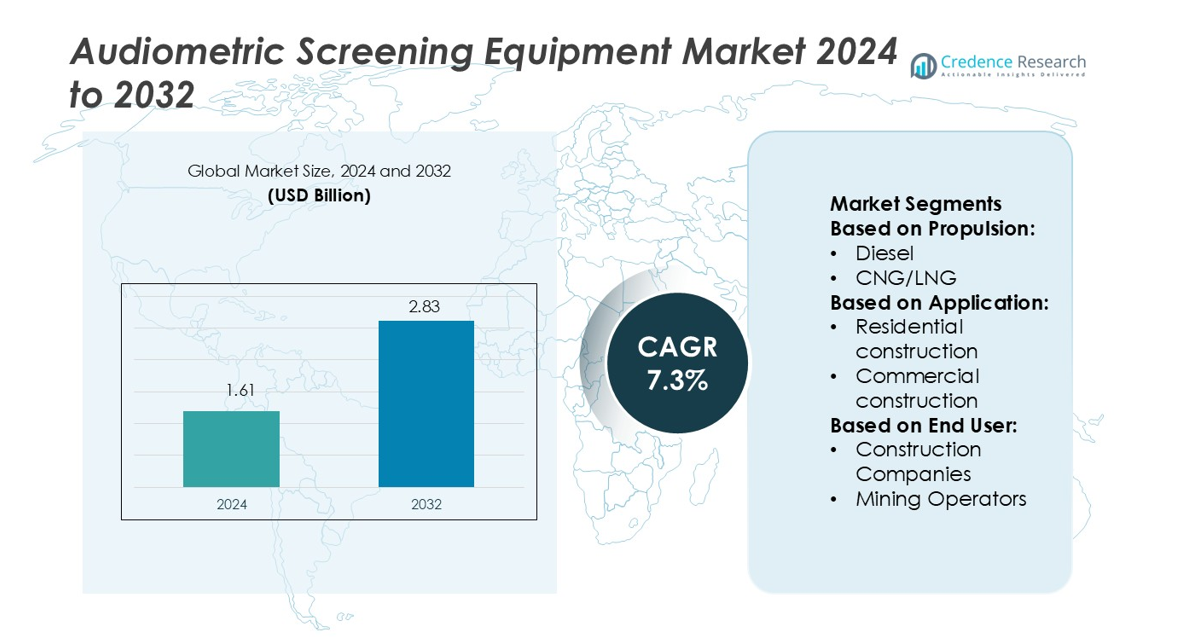

Audiometric Screening Equipment Market size was valued USD 1.61 billion in 2024 and is anticipated to reach USD 2.83 billion by 2032, at a CAGR of 7.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Audiometric Screening Equipment Market Size 2024 |

USD 1.61 billion |

| Audiometric Screening Equipment Market, CAGR |

7.3% |

| Audiometric Screening Equipment Market Size 2032 |

USD 2.83 billion |

The Audiometric Screening Equipment Market features prominent players such as Natus Medical Incorporated, MAICO Diagnostics, GN Otometrics, Interacoustics A/S, and Amplivox Ltd. These companies lead through continuous innovation, offering AI-assisted diagnostics, portable designs, and wireless connectivity to enhance usability and accuracy. Strategic partnerships with healthcare providers and expansion into emerging markets further strengthen their market positions. North America stands as the leading region, holding a 38.2% market share in 2024. This dominance is attributed to advanced healthcare infrastructure, strong government initiatives, and a high prevalence of hearing disorders, driving sustained demand for audiometric screening solutions.

Market Insights

- The Audiometric Screening Equipment Market size was valued at USD 1.61 billion in 2024 and is projected to reach USD 2.83 billion by 2032, growing at a CAGR of 7.3% during the forecast period.

- North America leads the market with a 38.2% share, supported by advanced healthcare infrastructure and government hearing screening programs. Europe and Asia-Pacific follow, with rising adoption in hospitals, schools, and occupational health settings.

- Key players such as Natus Medical, MAICO Diagnostics, GN Otometrics, Interacoustics A/S, and Amplivox focus on AI-assisted diagnostics, wireless devices, and portable audiometers to enhance accuracy and accessibility. Strategic collaborations with healthcare providers further strengthen market presence.

- Growth is driven by increasing prevalence of hearing disorders, rising awareness of hearing health, and expansion of tele-audiology solutions enabling remote screening. Portable and wearable devices offer additional convenience in rural and underserved areas.

- Market challenges include high equipment costs and limited availability of trained audiologists, while trends emphasize digital integration, AI-enabled diagnostics, and expansion into emerging markets with cost-effective solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Propulsion

The diesel segment dominates the Audiometric Screening Equipment Market, holding a 42.6% share in 2024. Diesel-powered units remain the preferred choice due to their high torque, durability, and cost efficiency in remote or heavy-duty construction projects. Their superior fuel economy and easy availability further sustain market leadership. Electric propulsion is gaining momentum driven by emission control policies and lower operating noise. Manufacturers are developing hybrid systems combining diesel and electric efficiency to meet sustainability goals, especially in urban environments focused on reducing carbon emissions.

- For instance, Hitachi Construction Machinery introduced its ZH210LC-5 hybrid excavator, featuring a hydraulic/electric swing motor and a 122 kW diesel engine. The system achieves up to 31% fuel savings compared to standard diesel models.

By Application

The commercial construction segment leads the market with a 36.8% share, driven by the expansion of healthcare facilities, educational institutions, and infrastructure modernization. Demand for reliable screening systems in large-scale projects enhances the adoption of heavy-duty, energy-efficient equipment. Industrial construction follows, fueled by manufacturing plant expansions and automation facilities requiring advanced noise-control assessments. Residential construction shows steady growth due to rising housing investments and government housing schemes, while mining and quarrying applications remain niche but vital for safety compliance and worker health programs.

- For instance, Liebherr launched its LR 12500-1.0 lattice boom crawler crane featuring a 2,500-tonne lifting capacity, supporting large-scale commercial and industrial infrastructure development.

By End User

Construction companies hold the largest market share of 39.4%, leading adoption due to their extensive use of screening systems in large-scale infrastructure projects. These firms prioritize durability, mobility, and integration with digital diagnostic tools to ensure accuracy in field testing. Rental companies are emerging as a fast-growing category, offering affordable access to modern audiometric equipment for short-term projects. Government and municipalities drive steady demand through public health initiatives, while mining operators and industrial users invest in advanced systems to comply with occupational noise regulations and worker safety standards.

Key Growth Drivers

Rising Prevalence of Hearing Disorders

Increasing cases of hearing impairment globally are a major growth driver for the audiometric screening equipment market. Factors such as aging populations, prolonged noise exposure, and genetic conditions are fueling demand for accurate diagnostic tools. Governments and healthcare organizations are emphasizing early detection through community-based screening programs. Hospitals and clinics are adopting portable audiometers for efficient testing in remote areas. Expanding awareness campaigns and school-based hearing initiatives continue to strengthen adoption across developed and developing economies.

- For instance, Terex Corporation integrated advanced telematics and IoT-based monitoring systems in its Genie® S-80 J telescopic boom lift, enabling data collection from over 250 machine parameters for predictive maintenance and operational efficiency.

Technological Advancements in Diagnostic Devices

Continuous innovation in audiometric technologies supports market expansion. Integration of wireless connectivity, AI-assisted diagnostics, and digital calibration systems improves precision and usability. Modern devices enable remote hearing assessments and cloud-based data storage, enhancing workflow efficiency for audiologists. The demand for handheld and mobile screening systems is rising, especially in tele-audiology programs. Manufacturers focus on developing user-friendly, battery-efficient, and multi-frequency devices to meet clinical and field-testing needs. These advancements ensure higher diagnostic accuracy and patient convenience.

- For instance, Komatsu NTC (part of the Komatsu group) developed the KOMTAS monitoring system, which can collect process data at a high-speed cycle of 1 millisecond (0.001 s).

Government Support and Preventive Healthcare Programs

Government-led initiatives promoting early hearing screening drive significant market growth. Public health departments and NGOs are implementing newborn and occupational hearing programs, especially in developing regions. Funding for school-based and industrial hearing checks enhances accessibility to screening tools. Policies supporting affordable healthcare infrastructure and medical equipment modernization further accelerate adoption. Collaborative efforts between health ministries and device manufacturers are expanding the reach of audiometric equipment in low-resource settings. Preventive care models continue to prioritize early diagnosis and intervention.

Key Trends & Opportunities

Integration of AI and Remote Screening Solutions

AI-driven audiometric systems are transforming diagnostic efficiency by automating hearing tests and interpreting results with greater accuracy. Remote screening via telehealth platforms enables large-scale assessments in rural and underserved regions. Mobile audiometry applications and Bluetooth-enabled devices allow real-time data transfer to specialists. These innovations improve accessibility, reduce costs, and ensure standardized testing. Companies investing in cloud-based software and machine learning algorithms are well-positioned to capitalize on this digital transformation trend.

- For instance, Caterpillar’s “VisionLink®” platform connects 1.4 million assets globally, feeding machine-sensor data into AI-based algorithms for condition monitoring.

Expansion of Portable and Wearable Audiometers

Rising demand for compact and portable audiometers presents strong market opportunities. Portable devices support field testing, occupational screening, and school health programs where traditional setups are impractical. Wearable hearing assessment tools equipped with wireless connectivity offer enhanced user comfort and data accuracy. Manufacturers are focusing on lightweight, battery-efficient designs that facilitate use in remote environments. The trend aligns with the growing preference for flexible, point-of-care diagnostics across healthcare sectors.

- For instance, Sany’s Beijing Piling Machinery Factory became certified as a “Lighthouse Factory” under the World Economic Forum framework in 2021, integrating digital twins and IoT sensors with over 3,500 connected devices on its production line.

Emerging Markets Driving Healthcare Infrastructure

Expanding healthcare infrastructure in Asia-Pacific, Latin America, and Africa presents new growth avenues. Investments in diagnostic facilities and hearing health awareness programs are creating favorable conditions for market entry. Manufacturers are targeting these regions with cost-effective, durable devices tailored to local needs. Government partnerships and international aid programs further enhance product accessibility. Rapid urbanization and increasing middle-class income levels strengthen demand for quality audiometric screening services across developing economies.

Key Challenges

High Cost of Advanced Audiometric Equipment

The high cost of advanced audiometric systems poses a significant challenge, especially for small clinics and community centers. Digital and AI-enabled devices require substantial investment in hardware, software, and maintenance. Budget constraints in developing nations limit widespread adoption, particularly in rural healthcare setups. Limited reimbursement policies for hearing screening add further strain. Manufacturers must focus on cost optimization and flexible pricing strategies to improve affordability while maintaining diagnostic reliability.

Shortage of Skilled Audiologists and Technicians

A global shortage of trained professionals capable of operating and interpreting audiometric tests hampers market efficiency. Many developing regions lack structured audiology training programs, leading to underutilization of available equipment. The complexity of modern systems demands technical expertise for calibration and data analysis. This skill gap restricts deployment in community health centers and mobile screening units. Expanding training programs and integrating user-friendly technologies are essential to address this workforce challenge.

Regional Analysis

North America

North America holds the largest share of 36.4% in the Audiometric Screening Equipment Market, driven by advanced healthcare infrastructure and high awareness of hearing health. The U.S. dominates the regional market due to strong adoption of digital and AI-based audiometers across hospitals, schools, and occupational health programs. Favorable reimbursement policies and government-led newborn hearing screening initiatives strengthen market penetration. Canada follows with growing tele-audiology programs and rural hearing outreach. Ongoing technological integration and strategic collaborations among manufacturers continue to support steady market expansion across the region.

Europe

Europe accounts for 29.6% of the global market, supported by early diagnosis initiatives and regulatory emphasis on occupational health safety. Countries such as Germany, the U.K., and France lead due to robust healthcare funding and advanced audiology networks. The EU’s focus on early childhood screening programs and workplace noise monitoring enhances product demand. Adoption of portable and wireless audiometers is increasing across clinics and industrial sectors. Manufacturers benefit from high device replacement rates and ongoing innovation in diagnostic precision and user comfort.

Asia-Pacific

Asia-Pacific holds a 23.8% market share and is the fastest-growing regional segment. Rising healthcare investments, urbanization, and large elderly populations are fueling demand for hearing assessment tools. China, Japan, and India are key contributors, driven by expanding ENT clinics and telemedicine programs. Government initiatives promoting early hearing detection and intervention further boost regional adoption. Increasing affordability of portable devices and growing awareness in rural communities present new growth avenues. Manufacturers are strengthening local partnerships to address regional cost sensitivities and service coverage gaps.

Latin America

Latin America represents 6.3% of the global market, driven by improving healthcare accessibility and growing awareness of hearing health. Brazil, Mexico, and Argentina lead adoption due to expanding hospital networks and public screening campaigns. Government initiatives for school hearing checks and industrial noise assessments support equipment deployment. However, uneven infrastructure and limited specialist availability challenge broader market penetration. Manufacturers are focusing on cost-effective and durable devices suited for mobile diagnostics and community health programs. Technological collaborations and regional distribution partnerships are enhancing supply chain efficiency.

Middle East & Africa

The Middle East & Africa hold a 3.9% market share, with gradual progress driven by investments in healthcare modernization. Gulf nations such as the UAE and Saudi Arabia are leading adoption through hospital expansions and occupational safety initiatives. African countries are experiencing increased hearing care awareness due to NGO-led screening programs and international funding. Limited access to trained audiologists and low affordability restrain growth, particularly in rural areas. Ongoing partnerships with global healthcare organizations aim to improve screening coverage and promote affordable diagnostic solutions across underserved communities.

Market Segmentations:

By Propulsion:

By Application:

- Residential construction

- Commercial construction

By End User:

- Construction Companies

- Mining Operators

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Audiometric Screening Equipment Market is dominated by key players including Hitachi Construction Machinery, Liebherr, Terex, Komatsu, Caterpillar, Sany, Volvo, CNH Industrial, Deere & Co., and Doosan. The Audiometric Screening Equipment Market is highly competitive, driven by continuous innovation and technological advancement. Companies focus on developing AI-assisted diagnostics, portable devices, and wireless connectivity to enhance usability and accuracy in both clinical and field settings. Strategic collaborations with hospitals, clinics, and telehealth providers expand market reach and adoption. Emphasis on product differentiation through user-friendly interfaces, seamless integration with electronic health records, and enhanced data security strengthens market positioning. Expansion into emerging regions with cost-effective, durable solutions addresses accessibility challenges. Comprehensive after-sales support, training programs for audiologists, and alignment with government health initiatives further reinforce competitiveness and promote sustainable growth across global markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In August 2025, JCB is about to transform the construction equipment scenario in India, when it will introduce a new generation of machines. It will be equipped with prototypes that are hydrogen-powered, fully electric, low-fuel consumption hybrid equipment, and enhanced diesel-powered machines that are approved to the CEV Stage-V norms.

- In July 2025, New Holland Construction introduces W100D Compact Wheel Loader with an all-new operator-centric cab and cab features. Constructed with landscapers, agricultural operators, snow removers and others in mind, the W100D is a dependable powerhouse with a deliberate design to provide productivity and performance in a small class size where there has been scarce choice.

- In January 2025, Volvo CE introduces New Generation Excavators in Southeast Asia to enhance efficiency, productivity and safety of the customers. The New Generation 5 models include: EC210, EC220, EC230, EC300 and EC360 and they will be sold throughout the region starting January 2025.

- In July 2024, Hitachi Construction Machinery Americas releases a super long front excavator, no compromises, dedicated to the North American market. The ZX210LC-7H Super Long Front (SLF) offers 50 ft, 4 in (15.35 m) of reach at ground level and a 39-ft, 2-in (11.94-m) dig depth with fewer trade-offs in that it was specifically designed for this purpose. The hydraulic system is proprietary and has been designed to operate smoothly and safely. It has a next level upgraded swing motor.

Report Coverage

The research report offers an in-depth analysis based on Propulsion, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Growing awareness of hearing health will drive widespread adoption of screening equipment.

- Integration of AI and machine learning will improve diagnostic accuracy and efficiency.

- Portable and wireless devices will expand testing capabilities in remote and rural areas.

- Tele-audiology solutions will enable large-scale, real-time hearing assessments.

- Government initiatives and public health programs will increase demand in schools and workplaces.

- Emerging markets will see rising adoption due to expanding healthcare infrastructure.

- Continuous technological innovation will enhance device usability and patient experience.

- Collaboration with hospitals and clinics will strengthen market penetration and distribution networks.

- Demand for eco-friendly and energy-efficient devices will grow in response to sustainability trends.

- Training programs for audiologists and technicians will support effective utilization of advanced equipment.