Market Overview

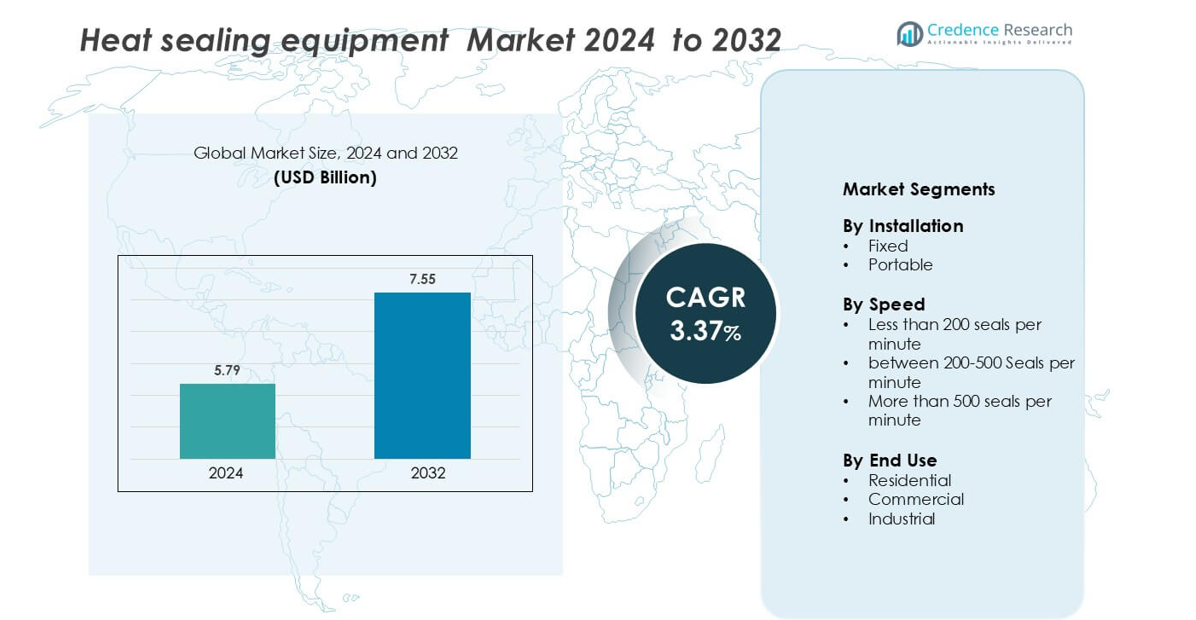

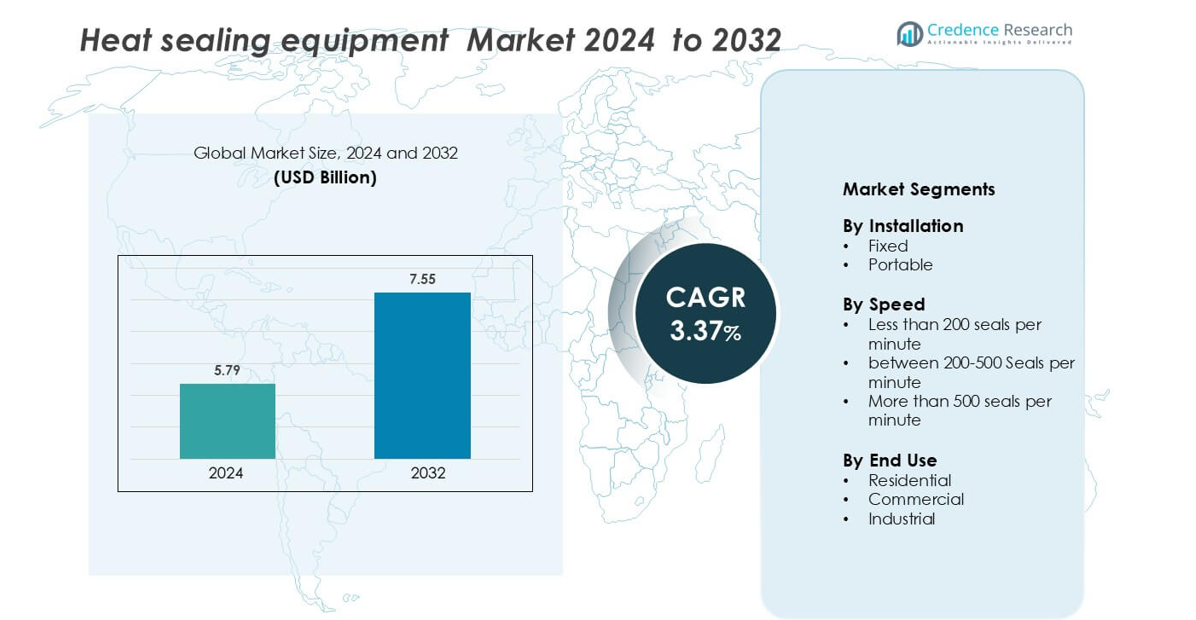

Heat sealing equipment Market size was valued USD 5.79 billion in 2024 and is anticipated to reach USD 7.55 billion by 2032, at a CAGR of 3.37% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Heat Sealing Equipment Market Size 2024 |

USD 5.79 billion |

| Heat Sealing Equipment Market, CAGR |

3.37% |

| Heat Sealing Equipment Market Size 2032 |

USD 7.55 billion |

The heat sealing equipment market is dominated by key players such as GEA Group, PAC Machinery Group, Omron Corporation, Barry-Wehmiller Companies, Packrite, Bosch Packaging Technology, Krones AG, Illinois Tool Works Inc., Hayssen Flexible Systems, and Audion Elektro. These companies focus on automation, energy-efficient technologies, and precision sealing to improve performance across food, pharmaceutical, and industrial packaging sectors. Continuous R&D investments and strategic partnerships enhance their product portfolios and global reach. Asia-Pacific leads the market with a 34% share, driven by rapid industrialization, expanding manufacturing bases, and rising demand for flexible packaging solutions, followed by North America with 32%, supported by advanced automation and high production capacities.

Market Insights

- The global heat sealing equipment market was valued at USD 5.79 billion in 2024 and is projected to reach USD 7.55 billion by 2032, growing at a CAGR of 3.37% during the forecast period.

- Rising demand from the food and pharmaceutical industries drives growth as manufacturers prioritize secure, contamination-free, and tamper-proof packaging solutions.

- Key market trends include the adoption of automation, IoT-based monitoring systems, and sustainable sealing solutions compatible with recyclable packaging materials.

- The market is highly competitive, with major players such as GEA Group, Bosch Packaging Technology, PAC Machinery Group, Omron Corporation, and Barry-Wehmiller Companies focusing on product innovation and global expansion.

- Asia-Pacific dominates with a 34% share, followed by North America at 32%, while the industrial segment leads application-wise due to its extensive use in high-volume packaging operations.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Installation

Fixed heat sealing equipment holds the dominant market share, driven by its reliability and integration in large-scale production lines. These machines are widely used in industrial packaging facilities that require consistent sealing quality and long operational cycles. Fixed systems offer higher precision, automation compatibility, and lower maintenance compared to portable variants. Portable sealers, though gaining popularity in small-scale and on-site applications, remain secondary due to lower throughput. The demand for fixed installations continues to rise with the expansion of food, pharmaceutical, and electronics manufacturing units emphasizing continuous sealing operations.

- For instance, the Contiroll HS can achieve significantly higher output than 600 units per minute. Some models can reach up to 66,000 containers per hour, which is over 1,100 containers per minute.

By Speed

Equipment operating between 200–500 seals per minute dominates the heat-sealing equipment market, offering the ideal balance between speed, accuracy, and energy efficiency. This segment supports medium to high-volume production needs across sectors like packaged food and healthcare. Machines in this category are preferred for their reduced downtime, enhanced process control, and adaptability to multiple packaging materials. High-speed models exceeding 500 seals per minute serve large automated facilities, while lower-speed units cater to small operations. The 200–500 seal range remains the most adopted due to optimized productivity and cost-efficiency.

- For instance, Syntegon Technology’s SVE 2520 DZ machine achieves up to 200 bags per minute for pillow bags and up to 100 bags per minute for Doy-Zip bags with servo-driven precision control.

By End Use

The industrial segment leads the heat-sealing equipment market, accounting for the largest market share due to extensive use in manufacturing and bulk packaging. Industries such as pharmaceuticals, food processing, and chemicals rely on high-capacity sealers for product integrity and contamination prevention. Commercial users follow, utilizing sealing equipment for retail and logistics packaging applications. Residential use, though limited, is growing due to small-scale sealing devices for household and e-commerce packaging. Industrial adoption continues to expand with rising automation levels and strict quality compliance standards in production environments.

Key Growth Drivers

Technological Advancements and Automation Integration

The integration of automation and digital control systems in heat sealing machines enhances precision, speed, and repeatability, driving market growth. Advanced PLC systems, temperature sensors, and servo-driven mechanisms allow accurate sealing under varying material conditions. Automated solutions reduce human intervention, minimize waste, and increase throughput. Industries are shifting toward smart sealers equipped with IoT and data analytics for predictive maintenance and energy optimization. This automation trend aligns with Industry 4.0 initiatives, enabling manufacturers to achieve consistent quality and reduce operational downtime while improving sustainability and efficiency.

- For instance, Omron Corporation’s sealing-module platform uses a “2-PID” temperature-control algorithm combined with direct-power control to maintain seal-jaw temperature within ±0.5 °C during machine transients, reducing first-pack defects and enabling continuous output of up to 140 bags per minute with ultrasonic sealing.

Expansion of E-commerce and Flexible Packaging Applications

The rise in e-commerce and online retailing has created strong demand for flexible packaging solutions that ensure secure product delivery. Heat sealing equipment plays a vital role in sealing poly mailers, bubble wraps, and protective films used in logistics. The flexibility of heat sealers to work with diverse packaging materials such as polyethylene, polypropylene, and laminated films drives their adoption. E-commerce fulfillment centers increasingly rely on high-speed automated sealers for efficient order processing. This growing digital retail ecosystem is boosting the need for durable, portable, and energy-efficient sealing technologies worldwide.

- For instance, PackRite’s BandRite 6000 series runs up to 750 inches per minute and seals bags up to 12 mil single thickness.

Rising Demand from Food and Pharmaceutical Packaging Industries

The growing need for secure and hygienic packaging in the food and pharmaceutical sectors is a major driver for the heat-sealing equipment market. Manufacturers are adopting advanced sealers to ensure product safety, tamper resistance, and extended shelf life. Heat sealing provides an airtight and contamination-free seal, meeting strict regulatory standards such as FDA and ISO 11607. In pharmaceuticals, it supports sterile barrier packaging for medical devices and blister packs. The surge in packaged food consumption, ready-to-eat products, and sterile medical supplies continues to accelerate equipment adoption across high-speed production lines.

Key Trends & Opportunities

Increased Customization and Modular Equipment Design

he growing preference for modular sealing systems capable of handling multiple packaging formats is driving innovation. Customizable equipment allows manufacturers to adapt quickly to different package sizes, materials, and production volumes. Modular heat sealers also simplify maintenance and reduce downtime, increasing plant productivity. The demand for compact and portable sealers is also rising in small-scale and contract packaging operations. This flexibility trend opens opportunities for manufacturers to develop scalable solutions for diverse end-use industries such as healthcare, FMCG, and consumer goods.

- For instance, Barry-Wehmiller Companies introduced the Synerlink Versatech platform, which enables modular sealing line reconfiguration within 20 minutes using interchangeable tooling units.

Adoption of Sustainable and Eco-friendly Packaging Solutions

Sustainability is shaping product development in the heat sealing equipment market. Manufacturers are designing machines compatible with biodegradable, recyclable, and compostable materials. Heat sealers with precise temperature control help reduce energy consumption and material waste. For instance, bio-based films made from polylactic acid and paper laminates require advanced sealing technologies to maintain packaging integrity. Companies investing in energy-efficient models are attracting environmentally conscious clients, especially in the food and personal care industries. The shift toward circular packaging solutions creates long-term opportunities for eco-compliant sealing innovations.

Key Challenges

High Initial Investment and Maintenance Costs

The installation of advanced heat sealing equipment involves substantial capital expenditure, particularly for automated and high-speed systems. Small and medium enterprises often face barriers to adoption due to limited budgets. Maintenance costs, including sensor calibration and periodic part replacement, add to operational expenses. Furthermore, ensuring compliance with global safety and environmental standards increases costs for certification and quality assurance. These financial challenges may restrain market penetration among emerging manufacturers and drive demand for cost-effective yet reliable sealing solutions.

- For instance, Illinois Tool Works Inc. (ITW) is a legitimate, American Fortune 500 company that produces a wide range of engineered fasteners, components, equipment, and consumable systems.

Material Compatibility and Process Optimization Issues

The wide variety of packaging materials, including multilayer films and composites, poses challenges in achieving consistent seal quality. Differences in melting points, film thickness, and thermal properties require precise temperature and pressure control. Inconsistent sealing can lead to product leakage, contamination, and regulatory non-compliance. Manufacturers must invest in R&D to improve heat distribution and sealing uniformity across diverse materials. The complexity of balancing production speed with sealing integrity remains a persistent challenge, especially in high-output industrial applications.

Regional Analysis

North America

North America holds 32% market share in the heat sealing equipment market, supported by advanced automation technologies and strong regulatory compliance. The United States leads the region’s demand due to well-established food, pharmaceutical, and healthcare packaging industries. Companies such as PAC Machinery Group and Barry-Wehmiller Companies dominate through innovation in high-speed sealing lines and smart control systems. The focus on tamper-proof and recyclable packaging materials continues to drive equipment modernization. Widespread use of automated sealing systems in large manufacturing facilities further reinforces North America’s position as a key revenue contributor in the global market.

Europe

Europe accounts for 28% market share, driven by sustainable packaging initiatives and strict compliance with EU standards. Countries including Germany, Italy, and the U.K. lead adoption due to advanced industrial automation and eco-efficient sealing technologies. Companies such as Bosch Packaging Technology and GEA Group are at the forefront of developing precision-controlled, low-energy sealing machines. Rising demand from the pharmaceutical, cosmetics, and dairy sectors boosts market growth. The region’s transition toward recyclable packaging materials continues to influence technological upgrades, making Europe a vital hub for high-performance sealing equipment manufacturing.

Asia-Pacific

Asia-Pacific dominates the heat sealing equipment market with a 34% market share, owing to rapid industrialization and manufacturing expansion in China, India, and Japan. The region benefits from strong demand in food processing, e-commerce packaging, and healthcare applications. Key players such as Omron Corporation and Packrite are expanding localized production to cater to regional requirements. Government initiatives promoting automation and industrial development support equipment adoption. The growing consumer base and rise in flexible packaging production position Asia-Pacific as the fastest-growing and most influential region in global heat sealing equipment demand.

Latin America

Latin America represents 4% market share in the heat sealing equipment market, with growth driven by the modernization of food and beverage packaging sectors. Brazil and Mexico lead adoption due to expanding manufacturing bases and export-oriented industries. Companies are introducing cost-effective sealing equipment tailored for small to medium enterprises to meet the region’s price-sensitive market. Rising awareness of product safety and shelf-life enhancement supports technological upgrades. Strengthening supply chains and regional investments in packaging automation continue to create long-term opportunities for sealing equipment suppliers.

Middle East & Africa

The Middle East & Africa hold 2% market share, reflecting steady growth driven by industrial development and increasing packaged goods demand. The UAE, Saudi Arabia, and South Africa are key contributors, investing in automated packaging systems to support food, beverage, and logistics industries. Manufacturers are focusing on providing durable, energy-efficient sealers suited to regional environmental conditions. Growing awareness of international packaging standards and government support for local production foster gradual market expansion. Though smaller in size, the region shows strong potential for future heat sealing equipment adoption.

Market Segmentations:

By Installation

By Speed

- Less than 200 seals per minute

- between 200-500 Seals per minute

- More than 500 seals per minute

By End Use

- Residential

- Commercial

- Industrial

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The heat sealing equipment market is characterized by strong competition among leading global and regional manufacturers. Key players include GEA Group, PAC Machinery Group, Omron Corporation, Barry-Wehmiller Companies, Packrite, Bosch Packaging Technology, Krones AG, Illinois Tool Works Inc., Hayssen Flexible Systems, and Audion Elektro. These companies focus on technological advancements such as precision temperature control, automation integration, and energy-efficient sealing mechanisms to enhance productivity and reliability. Strategic partnerships and product innovations support their dominance across industrial, food, and healthcare sectors. Asia-Pacific leads the market with a 34% share, driven by expanding manufacturing capacity and automation adoption, followed by North America with 32%, supported by established industrial infrastructure and strong demand for high-speed, sustainable sealing solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- GEA Group

- PAC Machinery Group

- Omron Corporation

- Barry-Wehmiller Companies

- Packrite

- Bosch Packaging Technology

- Krones AG

- Illinois Tool Works Inc.

- Hayssen Flexible Systems

- Audion Elektro

Recent Developments

- In 2023, PAC Machinery introduced a new range of heat-sealing machines targeted at broadening the scope and efficiency in packaging services. The new models equipped with faster, and more energy efficient sealing technology are set to expand the growing markets in food and medical packaging, further reinforcing PAC’s position as an expert in the heat-sealing market.

- In 2023, Bosch showcased the next generation of heat-sealing machines during the Interpack trade fair, placing focus on greater energy efficiency and reduced cycle times. The recent machinery is directed towards the food and the pharmaceutical industry, suggesting Bosch’s drive towards inventions in the packaging arena.

Report Coverage

The research report offers an in-depth analysis based on Installation, Speed, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Automation and robotics will continue to transform heat sealing operations for higher precision.

- Demand for energy-efficient and low-maintenance sealing equipment will grow across industries.

- Integration of IoT and smart sensors will enable real-time monitoring and predictive maintenance.

- Adoption of eco-friendly and recyclable packaging materials will drive equipment innovation.

- Manufacturers will focus on modular and compact sealing systems for flexible production setups.

- Asia-Pacific will remain the key manufacturing hub and fastest-growing regional market.

- The pharmaceutical and healthcare sectors will expand their use of sterile sealing technologies.

- E-commerce and logistics growth will boost the need for high-speed flexible sealing solutions.

- Advancements in temperature control and sealing uniformity will enhance product safety.

- Strategic collaborations and regional expansions will strengthen global market competitiveness.