Market Overview

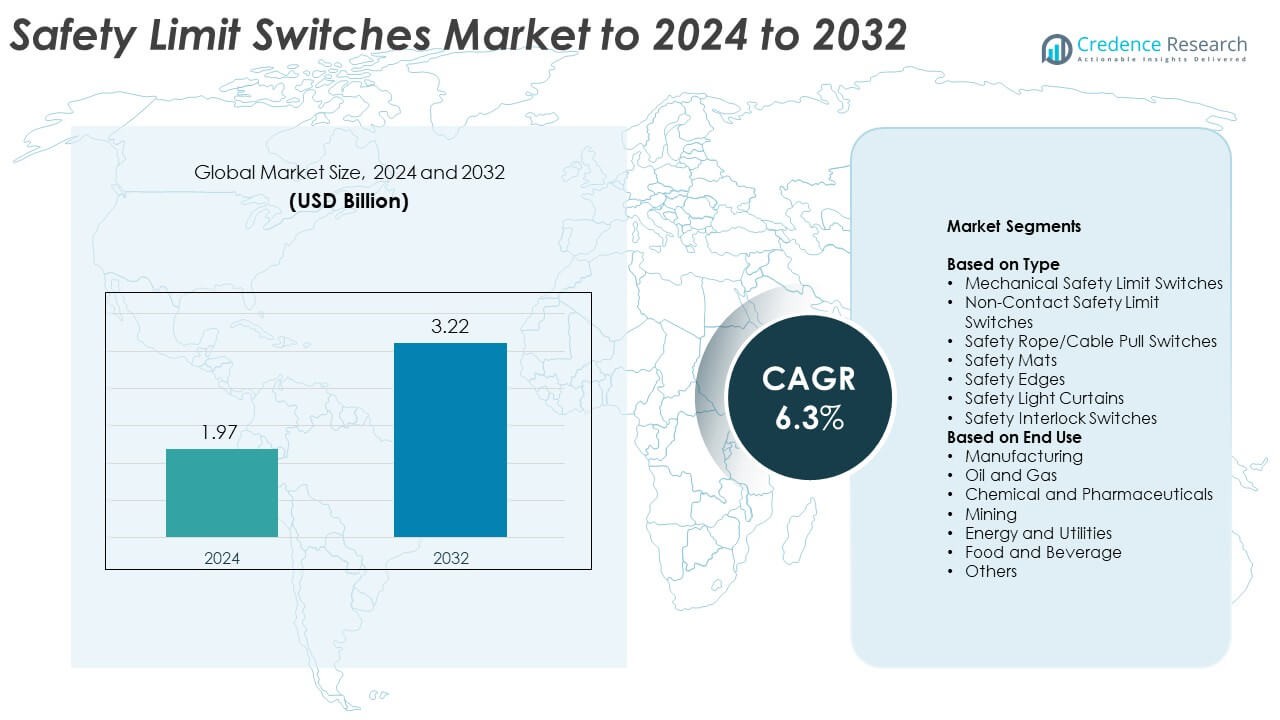

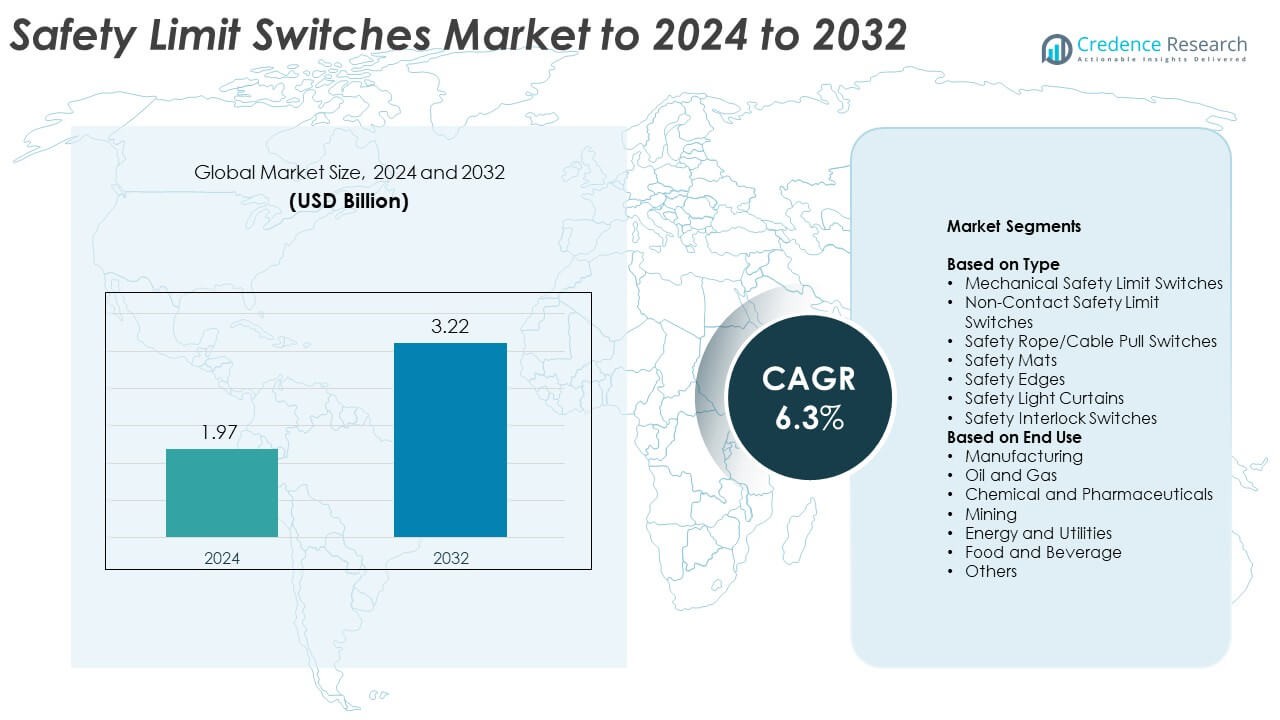

Safety Limit Switches Market size was valued at USD 1.97 Billion in 2024 and is anticipated to reach USD 3.22 Billion by 2032, at a CAGR of 6.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Safety Limit Switches Market Size 2024 |

USD 1.97 Billion |

| Safety Limit Switches Market, CAGR |

6.3% |

| Safety Limit Switches Market Size 2032 |

USD 3.22 Billion |

The Safety Limit Switches Market is dominated by key players such as Siemens AG, Schmersal, Omron Corporation, Rockwell Automation, ABB Ltd., Schneider Electric SE, Eaton Corporation plc, and Honeywell International Inc. These companies focus on advancing automation safety technologies and expanding their global reach through partnerships and digital integration. The market shows strong regional concentration, with North America leading at 35.6% share in 2024 due to high safety compliance and industrial automation adoption. Europe follows with 28.4% share, supported by advanced manufacturing standards and Industry 4.0 initiatives, while Asia-Pacific is rapidly expanding as the fastest-growing regional market.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Safety Limit Switches Market was valued at USD 1.97 Billion in 2024 and is projected to reach USD 3.22 Billion by 2032, growing at a CAGR of 6.3%.

- Market growth is driven by rising industrial automation, stricter safety regulations, and expanding use of machine safety systems across manufacturing and energy sectors.

- Key trends include the integration of IoT-enabled safety switches, adoption of non-contact technologies, and development of compact, durable designs.

- The market is competitive, with players focusing on R&D, strategic alliances, and smart factory integration to enhance reliability and compliance.

- Regionally, North America leads with 35.6% share, followed by Europe at 28.4% and Asia-Pacific at 25.7%, while the mechanical safety limit switches segment dominates with 36.8% share globally.

Market Segmentation Analysis:

By Type

The mechanical safety limit switches segment dominated the market in 2024 with a 36.8% share. These switches are widely used due to their high reliability, cost-effectiveness, and suitability for harsh industrial environments. They provide precise position detection and enable machine safety in automated systems. Increasing automation in manufacturing and processing industries supports their demand. Non-contact safety limit switches and safety interlock switches are also growing rapidly, driven by rising adoption in advanced assembly lines and robotic operations requiring enhanced operator safety and reduced downtime.

- For instance, Schmersal’s AZ16 switch lists a mechanical lifetime of 1,000,000 operations and IP67 protection on specific models, supporting rugged, high-duty use.

By End Use

The manufacturing segment held the largest share of 41.2% in 2024. The dominance is attributed to the growing focus on worker safety, process automation, and compliance with safety standards in production environments. Safety limit switches ensure emergency shutdown, machine guarding, and operational reliability in machinery and assembly equipment. The energy and utilities segment is also expanding due to increasing investment in smart grids and automated substations, while the food and beverage sector benefits from hygienic, corrosion-resistant switch designs ensuring safe operations in sanitary conditions.

- For instance, Rockwell Automation’s 440G-MZ guard-locking switch delivers 2,500 N holding force (Fzh) and tolerates ±5 mm misalignment on the locking bolt.

Key Growth Drivers

Rising Industrial Automation

Growing automation across manufacturing and process industries is driving the adoption of safety limit switches. Automated machinery requires reliable safety components to ensure controlled operations and prevent workplace hazards. The rise of Industry 4.0 and smart factory setups enhances the integration of advanced switches for monitoring and protection. Manufacturers are prioritizing safety solutions that meet global standards, further supporting market expansion.

- For instance, Banner Engineering’s SI-LS31R safety limit switch is rated for 1,000,000 operations mechanical life and 50 operations/min maximum switching speed.

Stringent Safety Regulations

Global safety standards, such as ISO 14119 and OSHA guidelines, are promoting the adoption of advanced safety switches. Industries must comply with strict safety protocols to prevent accidents and equipment damage. This regulatory push encourages the use of high-performance, fail-safe switches across sectors such as oil and gas, chemicals, and energy. As compliance becomes a top priority, investments in certified and durable safety components are rising.

- For instance, Pilz PSENmlock provides safe interlocking up to PL e / SIL 3 and a safe holding force up to 7,500 N, aligning with EN ISO 14119.

Expansion of Energy and Utility Infrastructure

Rapid growth in renewable energy and utility automation projects boosts the demand for safety switches. These systems are vital for ensuring safe equipment shutdown during maintenance and operational failures. Utilities and energy providers are increasingly deploying advanced safety interlock and rope pull switches in power plants and grid systems. This expansion strengthens market opportunities for safety component suppliers.

Key Trends & Opportunities

Integration of IoT and Smart Monitoring

IoT-enabled safety limit switches are emerging as a significant trend in industrial automation. These smart devices provide real-time condition monitoring and predictive maintenance capabilities. Manufacturers use data-driven insights to enhance system reliability and reduce downtime. As connected safety systems gain traction, demand for intelligent, network-compatible switches continues to increase.

- For instance, KEYENCE GS series allows cascading up to 10 units on non-contact models, with response time defined as 150 ms + 2 ms × (units–1) per IEC 60947-5-3.

Adoption of Non-Contact Safety Technologies

The market is witnessing a shift toward non-contact safety limit switches that use RFID or magnetic sensing. These switches offer longer lifespans and greater resistance to wear, making them ideal for high-speed operations. Industries favor them for hygienic environments and areas prone to mechanical stress. The shift toward contactless systems supports safer, maintenance-free operations across diverse industrial sectors.

- For instance, EUCHNER CES-AR non-contact switches enable series connection of up to 20 devices and achieve PL e / Cat. 4 with redundant OSSD outputs.

Key Challenges

High Installation and Maintenance Costs

Safety limit switches, especially advanced variants, involve significant installation and upkeep costs. Small and medium-sized enterprises often face budget constraints when integrating these systems into existing machinery. Regular testing and calibration are also required to maintain safety standards. These cost-related barriers can limit adoption, particularly in price-sensitive industries.

Limited Awareness in Developing Regions

In emerging economies, awareness of machine safety standards remains low. Many industries still rely on basic or outdated protective systems. Lack of training and understanding of advanced safety technologies slows market penetration. Expanding education programs and safety awareness initiatives are essential to drive adoption in these regions.

Regional Analysis

North America

North America held the largest share of 35.6% in the Safety Limit Switches Market in 2024. The region’s dominance is driven by strong industrial automation adoption and stringent occupational safety regulations. The United States leads with extensive use across manufacturing, oil and gas, and automotive sectors. Ongoing investments in industrial modernization and machine safety systems further boost market growth. The presence of leading manufacturers and high regulatory compliance standards ensure consistent demand for advanced, reliable safety limit switch technologies.

Europe

Europe accounted for 28.4% of the market share in 2024. The region benefits from strong enforcement of industrial safety norms and wide adoption of Industry 4.0 technologies. Germany, the United Kingdom, and France are major contributors, supported by automation in automotive and energy industries. The growing emphasis on sustainable manufacturing and worker protection standards continues to drive switch installations. Rising demand for contactless and smart monitoring systems is also accelerating market expansion across European industrial facilities.

Asia-Pacific

Asia-Pacific captured 25.7% of the global market in 2024, emerging as the fastest-growing region. Expanding manufacturing infrastructure in China, Japan, India, and South Korea fuels switch demand. Industrial automation initiatives and increased focus on workplace safety regulations are strengthening adoption rates. Local manufacturers are introducing cost-effective products with improved durability and performance. Rapid industrialization, growing exports, and government support for factory automation contribute to the region’s accelerating market growth in both primary and secondary industries.

Latin America

Latin America held a 6.1% share in 2024, supported by expanding industrial and energy infrastructure. Countries such as Brazil and Mexico are investing in modernizing production plants to enhance worker safety. The oil and gas and mining industries represent key application areas for safety limit switches. Although adoption rates remain moderate, increasing automation projects and safety awareness campaigns are expected to stimulate demand. Local government initiatives toward safer industrial operations are further supporting market penetration across key sectors.

Middle East and Africa

The Middle East and Africa accounted for 4.2% of the market in 2024. Growth in oil and gas, mining, and power generation sectors drives the use of safety limit switches. The Gulf Cooperation Council countries are witnessing increasing investment in industrial automation to ensure safe and reliable operations. Africa’s mining industry also presents emerging opportunities for switch manufacturers. While the market is still developing, rising safety compliance standards and infrastructure modernization projects are expected to improve regional adoption in coming years.

Market Segmentations:

By Type

- Mechanical Safety Limit Switches

- Non-Contact Safety Limit Switches

- Safety Rope/Cable Pull Switches

- Safety Mats

- Safety Edges

- Safety Light Curtains

- Safety Interlock Switches

By End Use

- Manufacturing

- Oil and Gas

- Chemical and Pharmaceuticals

- Mining

- Energy and Utilities

- Food and Beverage

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Safety Limit Switches Market is characterized by strong competition among leading global players such as Siemens AG, Schmersal, Omron Corporation, Rockwell Automation, ABB Ltd., Schneider Electric SE, Eaton Corporation plc, and Honeywell International Inc. The market features a mix of established automation providers and specialized safety system manufacturers offering broad product portfolios across mechanical and non-contact safety technologies. Companies are emphasizing product reliability, regulatory compliance, and integration with smart factory systems to strengthen their positions. Continuous investments in R&D are driving innovations in compact, wireless, and IoT-enabled switches for industrial automation. Strategic alliances with machinery manufacturers and distributors are helping expand global presence. In addition, players are focusing on sustainability, advanced diagnostics, and lifecycle management features to differentiate their offerings. The market’s competitive intensity remains high, driven by technology upgrades, regional expansion, and the increasing adoption of predictive safety systems in industrial applications.

Key Player Analysis

- Siemens AG

- Schmersal

- Omron Corporation

- Rockwell Automation, Inc.

- ABB Ltd.

- Schneider Electric SE

- Eaton Corporation plc

- Honeywell International Inc.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Recent Developments

- In 2024, Schmersal updated components of its safety system lines, such as introducing the SD-Gateway with PROFINET for fieldbus integration, and launched new mechanical products like the H series of command and signaling devices for the hygiene sector.

- In 2024, Schneider Electric continued to offer its established range of Harmony safety limit switches, which include IP67-rated options for use in industrial settings requiring resistance to dust and water ingress.

- In 2023, Siemens continued to offer and support its established SIRIUS 3SE5 mechanically actuated safety position switches, which are available in compact variants suitable for use in confined spaces within machinery and automation systems.

Report Coverage

The research report offers an in-depth analysis based on Type, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will witness strong growth due to rising automation across manufacturing industries.

- Integration of IoT and AI technologies will enhance real-time monitoring and predictive safety functions.

- Stringent global safety standards will continue to drive the adoption of advanced switch solutions.

- Demand for contactless and wireless safety limit switches will increase in hazardous environments.

- The manufacturing sector will remain the largest end user with expanding industrial safety investments.

- Asia-Pacific will experience the fastest growth due to rapid industrialization and infrastructure upgrades.

- Technological innovations will focus on compact, energy-efficient, and durable switch designs.

- Expansion of renewable energy and utilities will create new deployment opportunities.

- High installation costs may encourage the development of low-cost, modular safety switch systems.

- Partnerships between automation equipment manufacturers and safety solution providers will strengthen global supply networks.