Market Overview

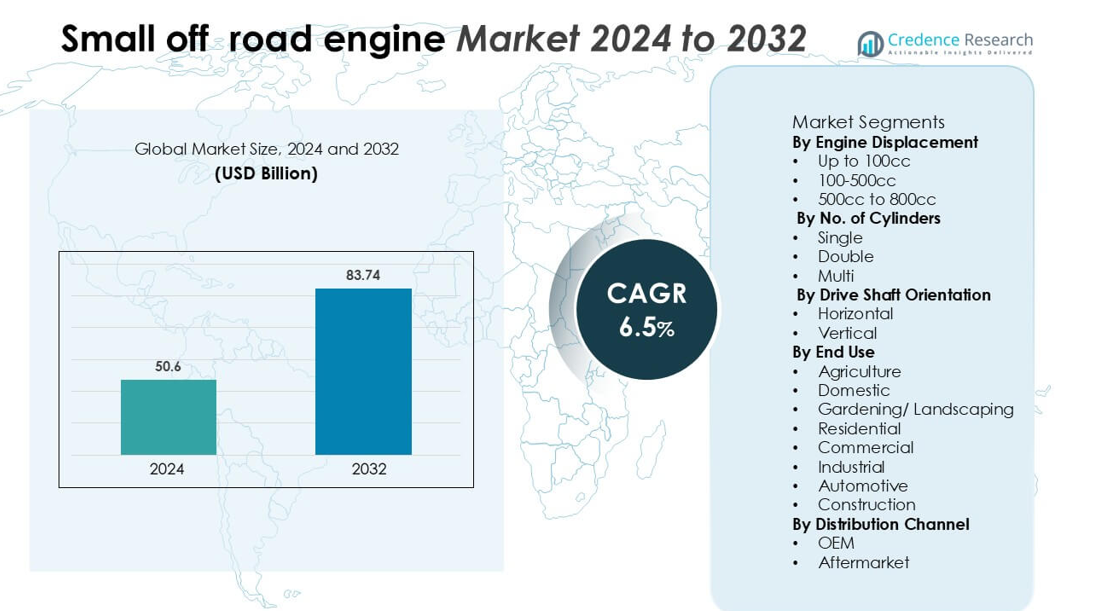

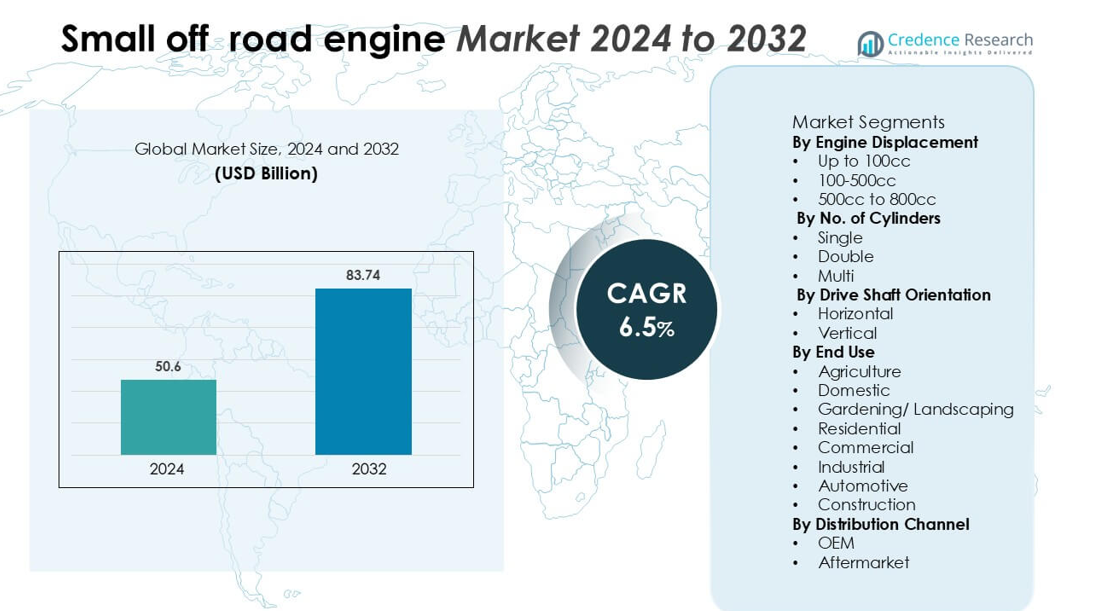

Small off-road engine market size was valued USD 50.6 billion in 2024 and is anticipated to reach USD 83.74 billion by 2032, at a CAGR of 6.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Small Off-Road Engine Market Size 2024 |

USD 50.6 billion |

| Small Off-Road Engine Market, CAGR |

6.5% |

| Small Off-Road Engine Market Size 2032 |

USD 83.74 billion |

The small off-road engine market is characterized by strong competition among leading players such as Honda Motor Co., Ltd., Briggs & Stratton, Kohler Co., Yamaha Motor Co., Ltd., Kubota Corporation, Kawasaki Heavy Industries, Ltd., Yanmar Co., Ltd., and Loncin Motor Co., Ltd. These companies dominate through advanced engine technologies, extensive OEM collaborations, and broad product portfolios serving diverse applications. Asia-Pacific leads the global market, accounting for approximately 35% of total market share, driven by rapid industrialization, agricultural mechanization, and large-scale manufacturing capabilities. The region’s cost-effective production base and growing demand for compact, energy-efficient engines further solidify its leadership in the global landscape.

Market Insights

- The small off-road engine market is valued at over USD 50.6 billion in 2024 and is projected to grow at a CAGR of around 6.5% during the forecast period, supported by rising demand for compact, high-performance engines.

- Increasing mechanization in agriculture, landscaping, and construction drives market growth, with 100–500cc engines holding the largest segment share due to their versatility and efficiency.

- Emerging trends include the adoption of hybrid and low-emission technologies, along with electronic fuel injection systems that enhance fuel efficiency and reduce maintenance costs.

- The market remains moderately consolidated, with key players such as Honda, Briggs & Stratton, Kohler, and Yamaha focusing on innovation, partnerships, and emission compliance to maintain competitiveness.

- Regionally, Asia–Pacific leads with approximately 35% market share, followed by North America and Europe, driven by rapid industrialization, expanding infrastructure, and rising equipment adoption across commercial and residential sectors.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis

By Engine Displacement

The 100–500cc segment dominates the small off-road engine market, accounting for the largest market share due to its balanced performance, fuel efficiency, and versatility across various applications. Engines in this range are widely used in lawn mowers, small tractors, generators, and utility vehicles, offering sufficient power for both domestic and light commercial tasks. Increasing adoption in compact agricultural machinery and recreational vehicles further drives demand. The segment’s growth is also supported by advancements in lightweight materials and emission-compliant designs that enhance efficiency and durability.

- For instance, Gaokin Industry Co., Ltd.’s 500 cm³ single-cylinder liquid-cooled 4-stroke engine delivers 38.8 hp (≈29 kW) at 6,750 rpm with 42 Nm of torque at 6,000 rpm, demonstrating how engines in the upper-end of this displacement band provide robust output while still being adapted for off-road use.

By No. of Cylinders and Drive Shaft Orientation

Single-cylinder engines hold the dominant market position, driven by their simplicity, cost-effectiveness, and ease of maintenance. These engines are commonly integrated into small equipment such as tillers, lawn mowers, and portable generators, making them ideal for domestic and light-duty industrial use. On the basis of drive shaft orientation, vertical shaft engines lead the market, primarily utilized in lawn and garden equipment. Their compact design, efficient power transmission, and compatibility with mower decks contribute to widespread adoption in residential and landscaping applications.

- For instance, Honda’s GCV160 vertical-shaft, air-cooled single-cylinder engine features a displacement of 160 cm³, delivers 4.4 hp (≈3.3 kW) at 3,600 rpm, and achieves a net torque of 9.4 Nm at 2,500 rpm.

By End Use and Distribution Channel

The commercial segment leads the market, capturing a major share due to extensive use of small off-road engines in landscaping, construction, and light industrial operations. The demand is reinforced by the growing need for reliable and fuel-efficient engines that reduce operational downtime. Within the distribution channel, OEMs dominate as they ensure product integration, performance consistency, and regulatory compliance. However, the aftermarket segment is gaining momentum with rising replacement needs and service-driven sales, supported by expanding equipment lifespans and increasing user preference for customization and upgrades.

Key Growth Drivers

Rising Demand from Agriculture and Landscaping Applications

The expansion of small-scale agriculture, gardening, and landscaping activities is a major growth driver for the small off-road engine market. Increasing mechanization across developing regions has accelerated the adoption of compact, fuel-efficient engines for power equipment such as tillers, mowers, and sprayers. Rising awareness about productivity enhancement and labor cost reduction is further boosting equipment demand. Additionally, governments and local organizations promoting small farm modernization are encouraging the use of low-emission, high-performance engines. The growing trend toward aesthetically maintained residential and commercial landscapes has also spurred the use of small off-road engines in turf management and lawn care tools, ensuring consistent market growth.

- For instance, Honda GX160 engine (air-cooled, single-cylinder) with a 163-cc displacement is used in compact tiller models, delivering 4.8 hp (3.6 kW) at 3,600 rpm.

Technological Advancements and Engine Efficiency Improvements

Advancements in engine design and fuel technologies have significantly influenced market expansion. Manufacturers are developing engines with improved combustion efficiency, reduced emissions, and longer operational life. The integration of electronic fuel injection (EFI) systems, hybrid power solutions, and lightweight components has enhanced engine reliability and performance across multiple end-use sectors. These innovations meet increasingly stringent emission regulations while maintaining cost-effectiveness for users. Additionally, research and development investments in noise reduction, thermal efficiency, and automation compatibility are increasing engine adoption in modernized equipment. The growing emphasis on cleaner, quieter, and more durable engines is expected to strengthen market competitiveness and support sustainable growth in the coming years.

- For instance, GEN EFI’s HK460E engine incorporates an electronic fuel-injection system on a single-cylinder 460 cc platform and supports gasoline blends up to E20, highlighting how fuel-system innovations are being deployed in small off-road engines.

Expansion of Commercial and Industrial Applications

Rising utilization of compact power equipment in commercial and industrial sectors is propelling market growth. Small off-road engines are increasingly deployed in construction tools, portable generators, and material-handling machinery due to their reliability and adaptability. Rapid urbanization and infrastructure development across emerging economies have heightened the demand for efficient, mobile power solutions. Furthermore, the expansion of rental and service-based equipment industries has increased engine replacement and maintenance needs, sustaining aftermarket revenue streams. Continuous innovation to improve torque output, reduce vibrations, and ensure operational safety further strengthens their role in heavy-duty yet portable machinery segments.

Key Trend & Opportunity

Shift Toward Eco-Friendly and Electric Hybrid Engines

Environmental regulations and consumer preferences for sustainable equipment are driving a market shift toward low-emission and hybrid small off-road engines. Manufacturers are increasingly focusing on integrating electric start systems, hybrid propulsion, and cleaner fuel alternatives to reduce carbon footprints. This transition offers opportunities for innovation in battery-assisted combustion engines and advanced control systems that optimize energy use. Governments offering subsidies and incentives for adopting eco-friendly technologies further accelerate this trend. As environmental compliance becomes a decisive purchasing factor, companies investing in green technologies are well-positioned to capture long-term growth opportunities in both OEM and aftermarket segments.

- For instance, Kubota’s Micro Hybrid engine architecture uses a 48-V motor generator to provide an instantaneous 10 kW electric boost in applications where high loads are needed only momentarily, enabling the selection of a smaller base engine.

Growth of Aftermarket Services and Customization

The rising demand for maintenance, repair, and customization services presents significant growth opportunities in the aftermarket segment. As small off-road engines age, end-users increasingly seek cost-effective replacement parts, upgrades, and performance tuning. Technological integration, such as telematics and predictive maintenance systems, enhances operational uptime and supports premium service offerings. The trend toward equipment personalization—tailoring engines for specific performance or environmental conditions—also drives aftermarket growth. Expanding online distribution channels and digital service platforms further streamline parts availability and technical support, positioning the aftermarket as a critical revenue stream within the industry’s evolving ecosystem.

- For instance, the part number 17210-Z0V-781is a genuine Honda air cleaner element for the GX160 engine, specifically for models that use the “cyclone” type air filter housing.

Key Challenge

Stringent Emission Regulations and Compliance Costs

The tightening of global emission norms poses a significant challenge to manufacturers in the small off-road engine market. Compliance with standards such as EPA, CARB, and EU Stage V requires continuous innovation, advanced filtration technologies, and investment in cleaner combustion systems. These modifications increase production costs and limit affordability for price-sensitive markets. Smaller manufacturers often struggle to allocate resources for research and development while maintaining competitive pricing. Moreover, transitioning to eco-friendly materials and components can disrupt supply chains. Balancing cost efficiency with regulatory compliance remains a central challenge that impacts profitability and product differentiation.

Volatility in Raw Material Prices and Supply Chain Disruptions

Fluctuating raw material prices, particularly for steel, aluminum, and rare earth elements used in engine components, pose operational and financial challenges. Supply chain disruptions caused by geopolitical instability, trade restrictions, and transportation delays further impact production timelines. Manufacturers face difficulties in maintaining inventory levels and managing cost pressures while ensuring consistent product quality. Dependence on global suppliers for critical components, such as electronic sensors and emission control systems, adds to market vulnerability. Companies are increasingly investing in local sourcing, digital supply chain monitoring, and strategic partnerships to mitigate these challenges and sustain operational resilience.

Regional Analysis

North America

North America holds a significant share of the small off-road engine market, accounting for over 30% of the global revenue. The region’s dominance is supported by high demand for lawn and garden equipment, recreational vehicles, and construction tools. Strong adoption of advanced emission-compliant engines and widespread use of power equipment in commercial landscaping drive growth. The United States leads the regional market, followed by Canada, where government incentives for cleaner technologies are encouraging manufacturers to develop eco-friendly, fuel-efficient engines. The well-established aftermarket network also supports consistent revenue generation across residential and commercial segments.

Europe

Europe represents approximately 25% of the global small off-road engine market, driven by stringent emission regulations and increasing adoption of sustainable technologies. Countries such as Germany, the UK, and France are key contributors, supported by high equipment utilization in agriculture, landscaping, and municipal services. European manufacturers focus heavily on innovation in low-emission and hybrid engine systems to comply with EU Stage V standards. Demand for compact and durable engines in construction and light industrial applications continues to rise. Additionally, the region’s focus on automation and energy efficiency sustains long-term market growth opportunities.

Asia-Pacific

Asia-Pacific dominates the global small off-road engine market, accounting for over 35% of total market share. Rapid industrialization, urbanization, and agricultural mechanization in China, India, and Japan are primary growth drivers. The region benefits from cost-effective manufacturing, expanding infrastructure projects, and rising demand for compact engines in agriculture and construction sectors. Local manufacturers’ focus on affordable and efficient engines supports widespread adoption. Government initiatives promoting rural development and modern farming further boost market expansion. Increasing exports from Asian countries to North America and Europe enhance regional competitiveness and strengthen the global supply network.

Latin America

Latin America accounts for around 5–7% of the global small off-road engine market, with steady growth driven by agricultural modernization and increasing use of power equipment in construction and landscaping. Brazil and Mexico are the key markets, supported by favorable government programs encouraging farm equipment adoption. The region is witnessing growing demand for fuel-efficient and low-maintenance engines suitable for small-scale operations. However, limited technological advancement and dependence on imports restrict faster growth. Expanding local assembly operations and the development of regional supply chains are expected to improve market accessibility and competitiveness.

Middle East & Africa

The Middle East & Africa region holds a smaller but emerging share of around 5% in the small off-road engine market. Growth is primarily driven by rising infrastructure development, expanding construction activities, and increasing agricultural mechanization in countries such as South Africa, the UAE, and Saudi Arabia. The demand for portable and durable engines for irrigation, light industrial machinery, and power generation is rising steadily. Although market penetration remains limited, improving economic conditions, government investments in agriculture, and gradual adoption of modern equipment are creating new opportunities for manufacturers and distributors.

Market Segmentations:

By Engine Displacement

- Up to 100cc

- 100-500cc

- 500cc to 800cc

By No. of Cylinders

By Drive Shaft Orientation

By End Use

- Agriculture

- Domestic

- Gardening/ Landscaping

- Residential

- Commercial

- Industrial

- Automotive

- Construction

By Distribution Channel

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The small off-road engine market is moderately consolidated, with a mix of global leaders and regional manufacturers competing on product performance, fuel efficiency, and emission compliance. Major players such as Honda Motor Co., Ltd., Briggs & Stratton Corporation, Kawasaki Heavy Industries, Kohler Co., and Yamaha Motor Corporation dominate the market with strong brand portfolios and extensive OEM partnerships. These companies focus on continuous innovation, integrating advanced fuel systems, lightweight materials, and hybrid technologies to enhance operational efficiency and meet regulatory standards. Regional participants, particularly in Asia-Pacific, compete through cost-effective manufacturing and tailored product offerings. Strategic collaborations, mergers, and distribution expansions are common as firms aim to strengthen market reach and supply chain resilience. The aftermarket segment also presents significant competitive intensity, with numerous local service providers and component suppliers offering customization, maintenance, and replacement parts, thereby contributing to sustained market growth and consumer retention.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Kohler Co.

- Yanmar Co., Ltd.

- Briggs & Stratton

- Kubota Corporation

- Chongqing Zongshen Power Machinery Co., Ltd.

- Yamaha Motor Co., Ltd.

- Loncin Motor Co., Ltd.

- Greaves Cotton Ltd.

- Mitsubishi Heavy Industries Engine & Turbocharger, Ltd.

- Lifan Industry (Group) Co., Ltd.

Recent Developments

- In January 2024, Bosch Rexroth partnered with Modine, a thermal management manufacturer. The partnership aimed to develop Modine EVantage thermal management systems to be added to the Bosch Rexroth portfolio of eLION products for electrified off-highway machinery globally.

- In June 2023, Zero Nox Inc., which specializes in sustainable, off-highway vehicle electrification, signed a product development agreement with Kubota Corporation. The agreement is based on electrifying products for off-highway applications.

- In June 2023, Forsee Power signed a partnership with Vensys Group to convert thermal off-highway vehicles into electric vehicles. Forsee Power is a smart battery systems provider, whereas Vensys Group specializes in electrohydraulic solutions for agriculture and construction

Report Coverage

The research report offers an in-depth analysis based on Engine Displacement, No. of cylinders, Drive shaft orientation, End use, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The small off-road engine market is expected to grow steadily, driven by increasing demand for compact and fuel-efficient equipment across multiple industries.

- Manufacturers will focus on developing low-emission and hybrid engine technologies to meet stricter environmental regulations.

- The adoption of electronic fuel injection and digital control systems will enhance engine performance and operational reliability.

- Asia-Pacific will continue to dominate global production and consumption, supported by rapid industrialization and agricultural mechanization.

- The aftermarket segment will expand as equipment owners seek cost-effective maintenance and performance upgrades.

- Collaboration between OEMs and component suppliers will strengthen innovation and improve supply chain resilience.

- The commercial landscaping and construction sectors will remain major growth contributors due to rising infrastructure and urban development projects.

- Technological integration such as IoT-based monitoring will increase engine efficiency and predictive maintenance capabilities.

- Manufacturers will prioritize lightweight designs and noise-reduction features to improve user experience.

- Growing preference for sustainable power solutions will accelerate the transition toward electric and hybrid off-road engines.