Market Overview:

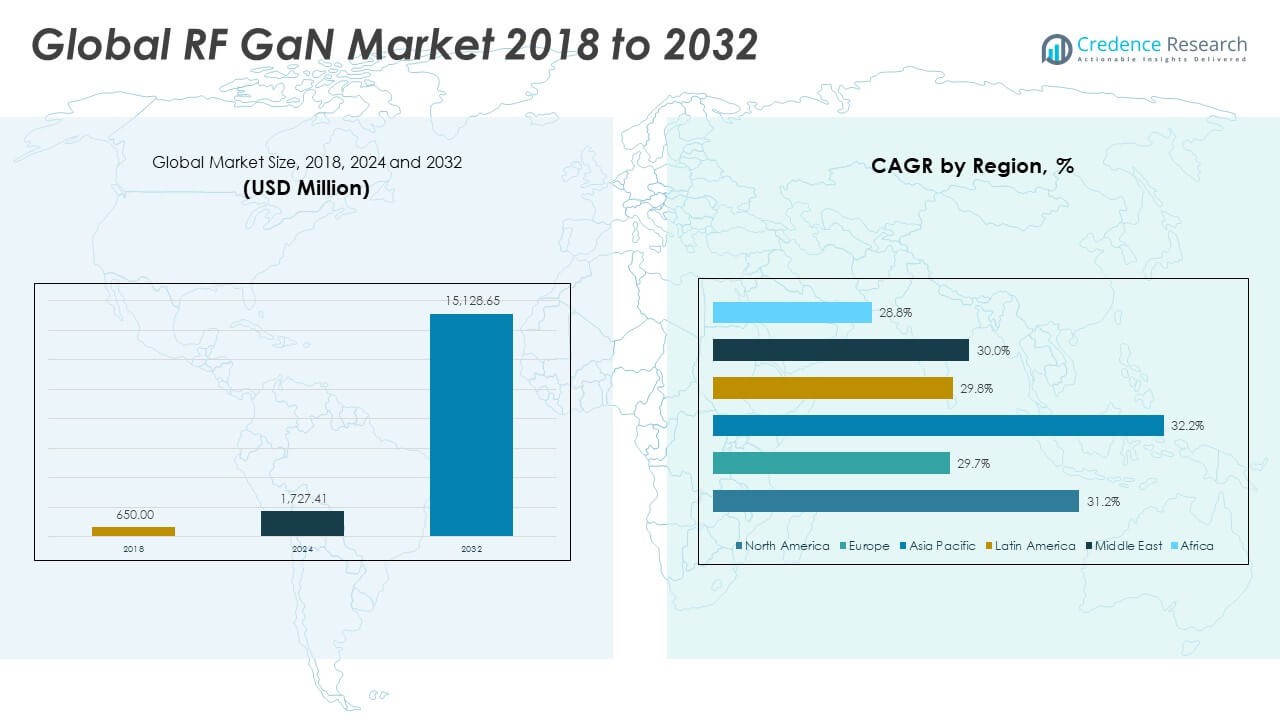

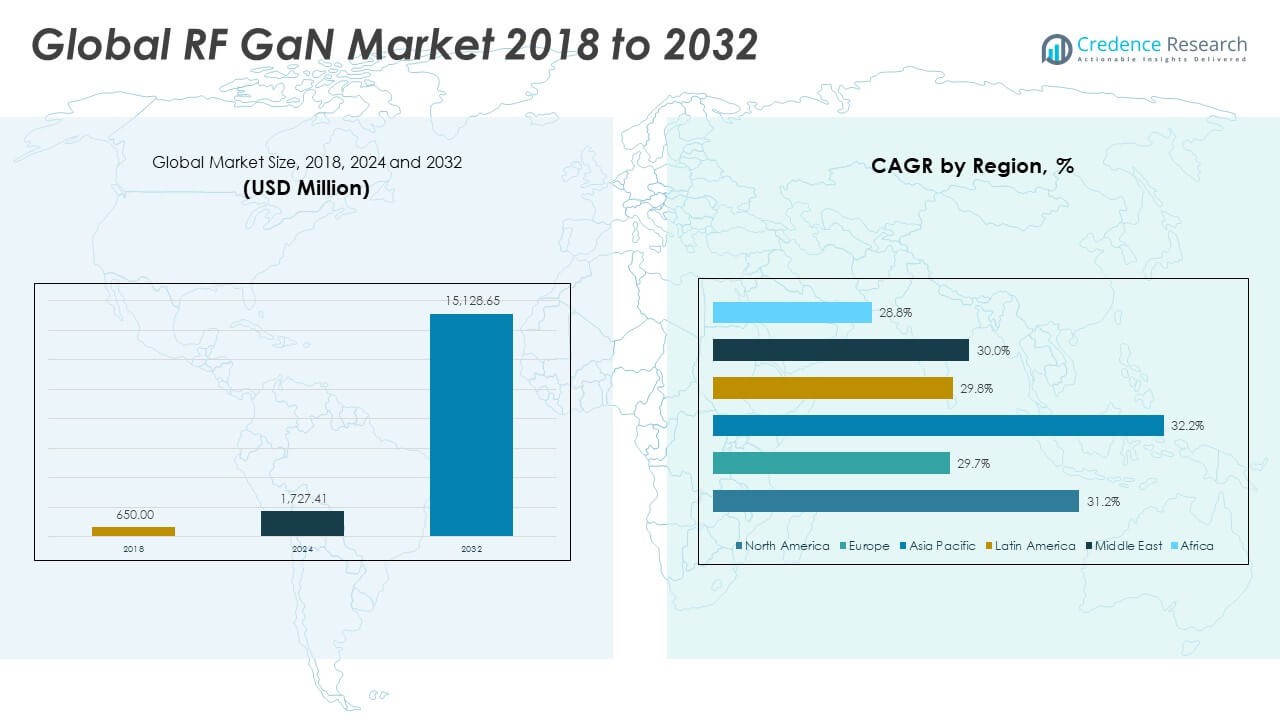

The RF GaN Market size was valued at USD 650.00 million in 2018 to USD 1,727.41 RF GaN Market million in 2024 and is anticipated to reach USD 15,128.65 million by 2032, at a CAGR of 31.22% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| RF GaN Market Size 2024 |

USD 1,727.41 million |

| RF GaN Market, CAGR |

6.1% |

| RF GaN Market Size 2032 |

USD 15,128.65 million |

The growth of the RF GaN market is primarily driven by the rising adoption of GaN-based RF devices in 5G infrastructure, defense radar systems, and satellite communications. GaN offers superior efficiency, high power density, and wider frequency capabilities compared to traditional semiconductors, enabling advanced performance in high-frequency applications. Increasing investments in aerospace and defense sectors and the growing demand for compact, high-power RF components are accelerating the market expansion. Additionally, the proliferation of wireless communication technologies and the shift toward energy-efficient systems are propelling further growth.

North America currently leads the RF GaN market due to its strong defense spending, robust aerospace infrastructure, and early deployment of 5G networks. The region benefits from significant R&D activity and the presence of leading semiconductor manufacturers. Meanwhile, the Asia Pacific region is emerging rapidly, driven by expanding telecom infrastructure, increased government defense budgets, and growing adoption of advanced electronics in countries such as China, Japan, and South Korea. Europe also plays a vital role in the market, supported by its aerospace industry and strategic initiatives to advance semiconductor capabilities across the region.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The RF GaN Market was valued at USD 1,727.41 million in 2024 and is projected to reach USD 15,128.65 million by 2032, growing at a CAGR of 31.22%.

- Rising demand for 5G infrastructure and defense radar systems is accelerating the adoption of GaN-based RF components.

- GaN-on-SiC continues to lead the material segment due to its superior thermal and power-handling capabilities.

- High production costs and limited substrate availability challenge broader commercial adoption across cost-sensitive sectors.

- North America leads the market due to strong defense investments and early 5G deployment, while Asia Pacific records the fastest growth rate.

- Telecom infrastructure, including remote radio heads and massive MIMO systems, represents the largest application segment.

- Emerging regions such as Latin America and the Middle East show long-term potential driven by telecom modernization and satellite communication initiatives.

Market Drivers:

Proliferation of 5G Infrastructure Demands High-Frequency and High-Efficiency RF Solutions

The RF GaN Market benefits from the global shift toward 5G infrastructure. Network operators require RF devices that support higher frequency ranges and maintain thermal stability. GaN-based transistors offer higher power density, enabling efficient signal transmission. It supports the reduction of system size and energy consumption in base stations. Telecom providers prefer RF GaN to meet the performance expectations of 5G. The need for fast and reliable connectivity across urban and remote areas drives deployment. RF GaN devices align with the miniaturization trend of RF systems. Telecom expansion in emerging economies further boosts its relevance. The market aligns with industry needs for next-generation connectivity.

- For example, NXP Semiconductorshighlights their MRFX1K80H device, a 8 kW peak RF power GaN transistor tailored for base stations, delivering 65% power-added efficiency at 2.5–3.7 GHz, directly addressing the thermal and size reduction requirements of 5G infrastructure.

Growing Defense Sector Adoption Driven by Radar and Electronic Warfare Demands

The defense industry significantly contributes to the RF GaN Market through radar, satellite, and electronic warfare programs. Military organizations demand reliable RF components that perform under extreme conditions. GaN-based amplifiers operate at high temperatures and frequencies, ideal for advanced radar systems. It supports enhanced signal detection and electronic countermeasures. Countries continue to increase defense spending on high-performance communication and surveillance. Governments fund R&D initiatives to replace legacy RF components. GaN’s durability and performance justify its cost in defense applications. Integration in naval, airborne, and ground systems continues to grow. The market expands as armed forces modernize communication infrastructure.

Satellite Communication and Aerospace Systems Require Efficient High-Power RF Devices

The RF GaN Market gains traction from satellite communication and aerospace developments. These sectors prioritize components with compact size, thermal efficiency, and high power output. GaN-based RF devices support continuous-wave and pulsed operations required in satellite links. It enables broader bandwidth and consistent performance at high altitudes. Satellite service providers invest in advanced RF technologies for coverage expansion. The need for long-range, interference-free communication strengthens RF GaN adoption. Aerospace applications also benefit from reduced system weight and improved thermal conductivity. RF GaN modules help ensure mission-critical reliability in both civilian and military programs. It fulfills strict design and operational standards in aerospace systems.

- For example, Hughes Network Systems’ Jupiter 3 Ultra (Jupiter 3 / EchoStar XXIV) high-throughput satellite (HTS) employs GaN-based transponders delivering 8 Gbps per transponder at Ka-band frequencies, enabling a maximum system throughput of 500 Gbps—the industry’s highest for a single satellite, thanks to GaN’s superior efficiency at high DC-to-RF conversion.

Increased Demand for High-Frequency Components in Test and Measurement Equipment

The test and measurement segment presents consistent demand for high-performance RF components. Engineers and technicians require RF sources and detectors with fast switching speeds and accuracy. The RF GaN Market meets these demands with devices that offer low noise, high efficiency, and wide frequency range. It supports applications in spectrum analysis, network testing, and device characterization. High-frequency components are essential for validating 5G, radar, and satellite systems. GaN amplifiers offer linearity and output stability critical for precise testing. Manufacturers incorporate RF GaN in compact equipment for lab and field operations. Rising R&D in telecom and defense technologies increases testing requirements. The market aligns with stringent technical specifications of the segment.

Market Trends

Transition Toward GaN-on-SiC Substrates to Optimize Power and Thermal Management

The RF GaN Market experiences a steady shift toward GaN-on-SiC (silicon carbide) substrates. GaN-on-SiC provides superior thermal conductivity, enabling higher power output with stable performance. It offers better device reliability in harsh environments such as defense and aerospace. Manufacturers invest in refining SiC wafer production to enhance cost-efficiency. It supports prolonged device life cycles and compact form factor designs. Commercial RF applications benefit from its heat dissipation and electrical strength. GaN-on-SiC remains the preferred material for high-performance systems. Fabrication process improvements reduce production complexity. It maintains its relevance in high-voltage and high-frequency RF architectures.

- For instance, Macom highlights that their GaN-on-SiC RF power transistors (e.g., MAGx-000185-00) support >65% efficiency at 2.7–3.8 GHz and >200 W saturated output power in a compact air-cavity package—critical for 5G macro base stations and phased array radars.

Adoption of MMICs and Integrated Designs to Improve Performance and Reduce Footprint

Monolithic Microwave Integrated Circuits (MMICs) gain momentum across RF front-end applications. The RF GaN Market aligns with this trend by enabling compact, high-efficiency MMICs. Designers consolidate multiple components into a single GaN-based module. It helps reduce interconnect losses and improves signal integrity. MMICs support high-gain and broadband performance in wireless infrastructure. Manufacturers integrate RF switches, amplifiers, and mixers on one chip. System-level integration simplifies design and enhances scalability. GaN-based MMICs offer robustness under varying load conditions. The market continues to see innovation in GaN-based monolithic packaging.

Rise of Software-Defined and Reconfigurable RF Systems Fuels GaN Demand

Software-defined RF platforms demand flexible hardware capable of handling diverse waveforms. The RF GaN Market meets this need through wideband power amplifiers and tunable RF chains. It supports software upgrades without physical redesigns. Defense and commercial users adopt reconfigurable platforms for multi-band operation. GaN devices operate efficiently across wide frequency ranges. The trend promotes multi-functionality in a single RF module. It reduces overall system cost and complexity. GaN’s efficiency allows faster modulation techniques and reduced latency. The trend boosts the adoption of programmable RF hardware in dynamic environments.

- For example, NXP Semiconductors’ AFSC-xxxx reconfigurable GaN front-end modules achieve >60% efficiency at 2–6 GHz with <100 ns switching times, supporting 256-QAM and 1024-QAM modulation for 5G densification.

Expansion of IoT and Smart Infrastructure Requires Scalable RF Architectures

Urban development and smart infrastructure projects increase the need for scalable RF connectivity. The RF GaN Market contributes by delivering compact RF amplifiers suited for distributed systems. GaN devices support low-latency, high-speed data transmission over long ranges. Smart transportation, metering, and public safety systems rely on uninterrupted connectivity. GaN-based components meet the operational demands of dense IoT networks. They withstand thermal stress and fluctuating signal loads. It supports real-time control in energy, logistics, and public utilities. OEMs design GaN-based RF modules for scalable and decentralized architectures. The trend reflects increasing digitization of physical infrastructure.

Market Challenges Analysis

High Manufacturing Cost and Material Complexities Limit Wide-Scale Adoption

The RF GaN Market faces challenges related to high production costs and fabrication complexities. GaN materials, especially when fabricated on SiC substrates, are expensive compared to traditional silicon. It requires specialized equipment and cleanroom environments, increasing capital expenditure. The complexity of processing GaN materials leads to lower initial yields. Limited availability of high-quality wafers adds supply-side pressure. Manufacturers must optimize processes to meet commercial demand and reduce cost per unit. Design engineers also face steep learning curves when shifting from silicon-based RF systems. These barriers affect adoption in cost-sensitive consumer segments. Price competitiveness remains a key hurdle for broader penetration.

Thermal Management and Device Reliability Pose Technical Limitations

Thermal management remains a critical issue in high-power RF GaN applications. Despite its thermal conductivity, GaN generates significant heat during extended operation. It requires advanced cooling mechanisms and thermal interface materials. Inadequate dissipation can degrade device performance and reliability over time. Designers must invest in robust packaging and system-level heat control. The RF GaN Market must address concerns about long-term device stability in mission-critical systems. Material stress, junction degradation, and environmental exposure can impact lifespan. These technical challenges demand continuous innovation in device design and packaging. Resolving reliability concerns is essential for defense and aerospace certifications.

Market Opportunities

Growth of 6G Research and Deployment to Open New Frontiers for GaN-Based RF Systems

The RF GaN Market stands to benefit from emerging 6G research and future deployment. It enables ultra-high-frequency and low-latency communication for advanced wireless systems. GaN’s wide bandwidth and power handling capabilities align with the goals of next-generation networks. Government and private sector investment in 6G prototypes supports innovation. GaN components play a key role in realizing terahertz communication. It creates opportunities in autonomous systems, immersive media, and industrial automation. The demand for energy-efficient and miniaturized RF solutions further enhances its potential. The market anticipates strong growth as 6G transitions from concept to early-stage implementation.

Expansion of Electric Mobility and Connected Automotive Systems Boosts RF Component Demand

The increasing integration of RF systems in electric and autonomous vehicles opens a promising opportunity. The RF GaN Market supports vehicle-to-everything (V2X) communication, radar, and connectivity modules. Automotive platforms require compact, efficient, and durable RF devices. GaN technology meets these demands through high-frequency performance and thermal resilience. It helps reduce weight and space in EV architectures. Growth in connected infrastructure fuels demand for reliable RF links. Automakers invest in GaN-based solutions for safety and efficiency. The market will grow with smart mobility and EV expansion across global markets.

Market Segmentation Analysis:

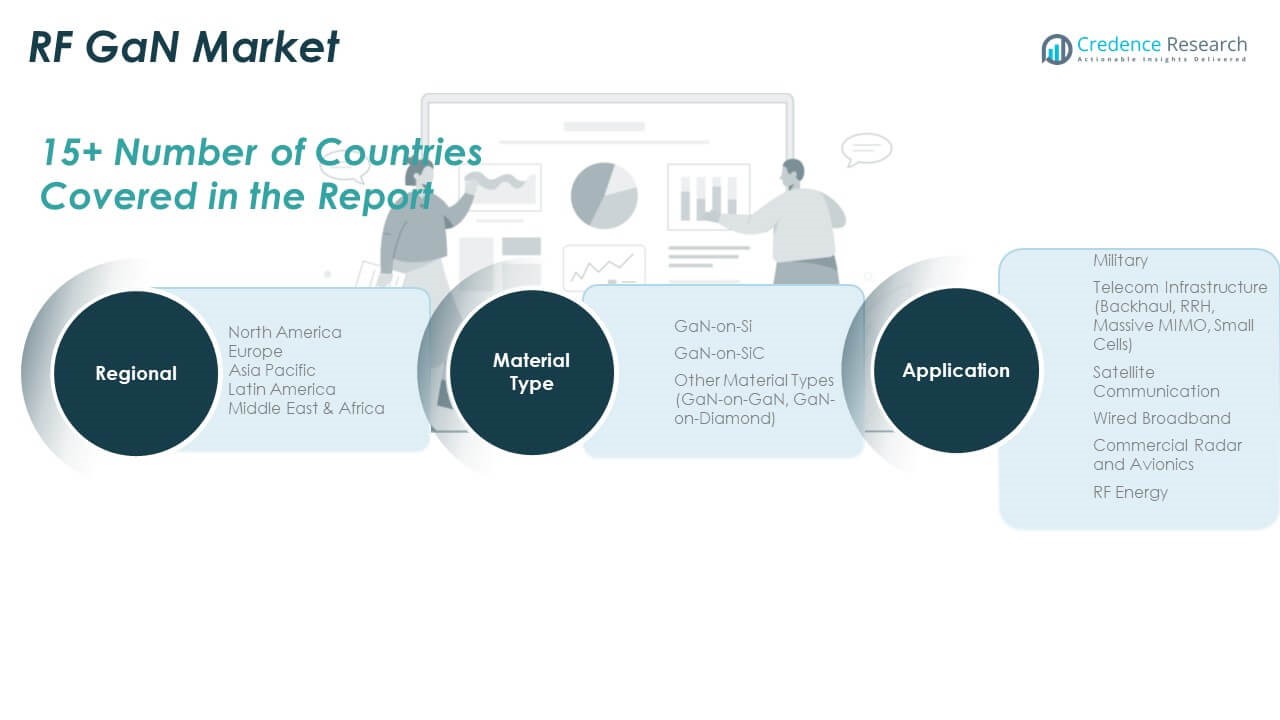

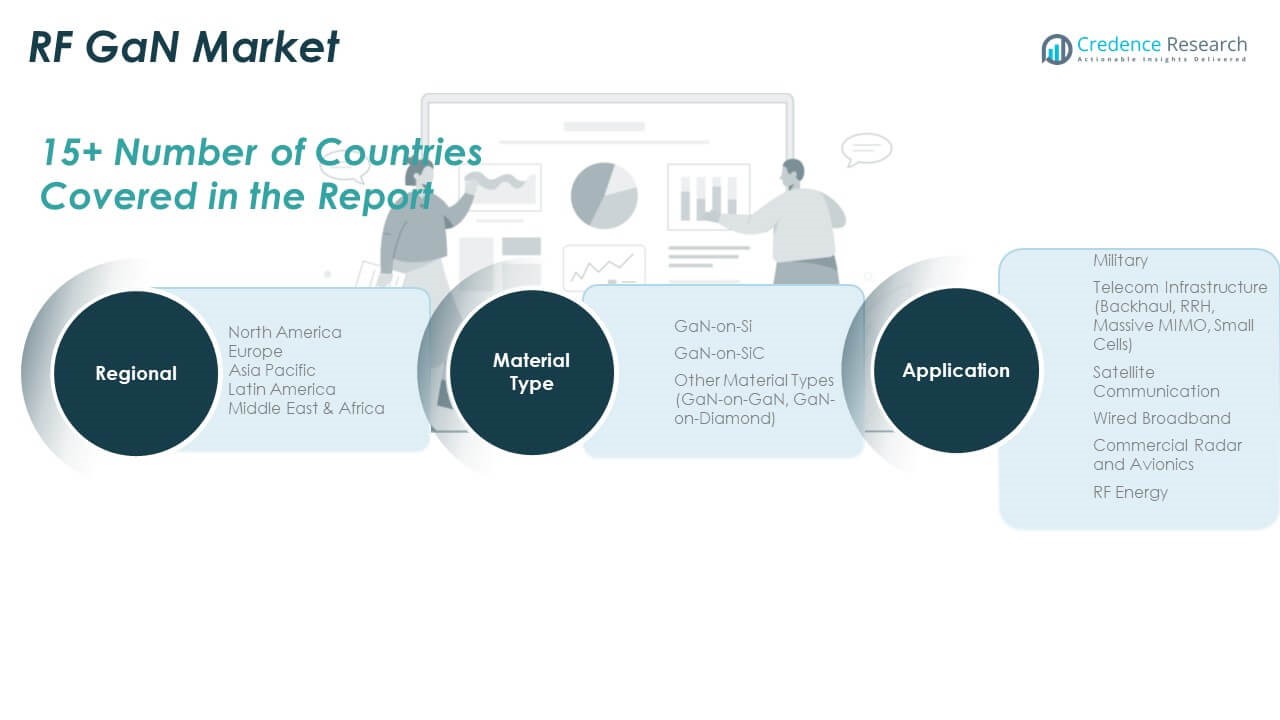

The RF GaN Market is segmented by material type and application, each playing a critical role in shaping demand and innovation.

By material type, GaN-on-Silicon Carbide (GaN-on-SiC) holds a dominant share due to its superior thermal conductivity, power density, and reliability. It supports high-frequency, high-power applications in defense and telecom. GaN-on-Silicon (GaN-on-Si) provides a cost-effective alternative for commercial RF systems where performance requirements are moderate. Other material types, including GaN-on-GaN and GaN-on-Diamond, offer next-generation performance benefits and are under active development for advanced military and aerospace systems.

- For example, Raytheon SPY-6(V)1 Radar: Uses GaN-on-SiC T/R modules for X-band radar(8–12 GHz), enabling >35x sensitivity and tracking of over 1,000 targets simultaneously made possible by the thermal and power-density advantages of SiC substrates.

By application, the RF GaN Market serves a broad range of end uses. Military remains a core segment, driving adoption through radar, electronic warfare, and secure communication systems. Telecom infrastructure uses RF GaN in base stations, backhaul, remote radio heads, massive MIMO, and small cell networks to support 5G deployment. Satellite communication requires compact, high-power devices for uplink and downlink systems. Wired broadband, commercial radar, avionics, and RF energy segments also contribute to growing market diversification.

- For example, Boeing EA-18G Growler: Uses GaN-based EW pods for 50% greater output powerand 60% reduced maintenance intervals

Segmentation:

By Material Type:

- GaN-on-Silicon (GaN-on-Si)

- GaN-on-Silicon Carbide (GaN-on-SiC)

- Other Material Types (including GaN-on-GaN, GaN-on-Diamond)

By Application:

- Military

- Telecom Infrastructure

- Backhaul

- Remote Radio Heads (RRH)

- Massive MIMO

- Small Cells

- Satellite Communication

- Wired Broadband

- Commercial Radar and Avionics

- RF Energy

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

The North America RF GaN Market size was valued at USD 186.55 million in 2018 to USD 488.16 million in 2024 and is anticipated to reach USD 4,267.82 million by 2032, at a CAGR of 31.2% during the forecast period. North America accounts for 28.2% of the global RF GaN Market share in 2024. The region leads in the deployment of RF GaN technology across defense, aerospace, and 5G infrastructure. It benefits from robust government investment in military modernization and radar systems. The presence of major semiconductor manufacturers and defense contractors drives consistent demand. The U.S. Department of Defense actively supports GaN integration for electronic warfare and satellite communication. Telecom operators in the U.S. accelerate 5G rollout using GaN-based amplifiers for high-band spectrum. Research institutes and private firms collaborate on GaN innovation, ensuring technological advancement. The region remains a key contributor to high-reliability, mission-critical RF applications.

Europe

The Europe RF GaN Market size was valued at USD 109.79 million in 2018 to USD 274.09 million in 2024 and is anticipated to reach USD 2,188.40 million by 2032, at a CAGR of 29.7% during the forecast period. Europe holds 15.9% of the global RF GaN Market share in 2024. It experiences steady adoption of RF GaN devices in satellite programs, automotive radar, and industrial RF applications. Countries such as Germany, France, and the UK invest in defense technologies incorporating GaN-based radar and electronic support systems. Telecom operators in Western Europe expand 5G coverage, creating opportunities for RF GaN infrastructure components. The European Space Agency supports satellite initiatives requiring high-frequency RF modules. It sees growing demand in smart transportation and connected mobility sectors. Local manufacturers collaborate with global players to strengthen supply chains. The EU’s focus on semiconductor sovereignty also enhances regional production capabilities.

Asia Pacific

The Asia Pacific RF GaN Market size was valued at USD 269.75 million in 2018 to USD 735.61 million in 2024 and is anticipated to reach USD 6,842.70 million by 2032, at a CAGR of 32.2% during the forecast period. Asia Pacific dominates the global RF GaN Market with 42.6% market share in 2024. The region’s leadership stems from aggressive 5G infrastructure expansion and growing defense expenditure in China, Japan, South Korea, and India. Local OEMs invest in GaN devices to meet demands in base stations, satellite communication, and radar. Consumer electronics and telecom sectors fuel mass adoption of high-frequency components. Governments promote semiconductor innovation through favorable policies and funding. It benefits from strong domestic manufacturing ecosystems and technology transfer from global players. Asia Pacific’s rising industrial automation also contributes to RF component demand. The region will continue to drive volume growth across both commercial and military domains.

Latin America

The Latin America RF GaN Market size was valued at USD 34.19 million in 2018 to USD 89.81 million in 2024 and is anticipated to reach USD 718.16 million by 2032, at a CAGR of 29.8% during the forecast period. Latin America represents 5.2% of the global RF GaN Market share in 2024. It remains an emerging market, supported by increasing telecom investments and digital connectivity initiatives. Countries like Brazil and Mexico begin deploying RF GaN-based components in next-generation networks. Public and private sectors focus on improving broadband and mobile communication infrastructure. It shows potential in satellite ground systems and civil aviation RF applications. Limited local production capacity leads to dependency on international suppliers. Rising demand for data-intensive applications influences the adoption of efficient RF amplifiers. Infrastructure challenges exist, but the pace of adoption is gradually improving. Latin America offers long-term potential for RF GaN technology expansion.

Middle East

The Middle East RF GaN Market size was valued at USD 31.53 million in 2018 to USD 79.62 million in 2024 and is anticipated to reach USD 644.56 million by 2032, at a CAGR of 30.0% during the forecast period. The region contributes 4.6% to the global RF GaN Market share in 2024. Demand stems from national defense upgrades and satellite communication initiatives across countries like UAE, Saudi Arabia, and Israel. Governments invest in RF technologies to strengthen radar surveillance and secure communication networks. It supports civil aviation modernization and airport infrastructure through GaN-based systems. The telecom sector explores RF GaN for enhancing wireless connectivity in high-density urban areas. Universities and research institutes partner with defense bodies on advanced RF programs. Import reliance remains high, yet strategic alliances with global manufacturers are growing. The Middle East steadily integrates RF GaN into critical national systems. It shows promise in secure, long-range communication applications.

Africa

The Africa RF GaN Market size was valued at USD 18.20 million in 2018 to USD 60.12 million in 2024 and is anticipated to reach USD 467.01 million by 2032, at a CAGR of 28.8% during the forecast period. Africa comprises 3.5% of the global RF GaN Market share in 2024. It remains in the early stages of adoption, with limited deployment of RF GaN components. Telecom expansion in Sub-Saharan Africa creates need for efficient RF infrastructure, particularly in rural broadband. Satellite connectivity for remote areas boosts demand for high-frequency RF systems. Defense modernization in a few North African countries includes radar upgrades utilizing GaN technology. Import-heavy supply chains limit access to advanced components. Efforts by international aid and technology organizations aim to improve digital infrastructure. Growth prospects depend on foreign investments and policy support. Africa offers long-term opportunities for RF GaN in communication and security sectors.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Fujitsu

- Macom

- United Monolithic Semiconductors (UMS)

- Microchip Technology Inc.

- Wolfspeed

- NXP Semiconductors

- Qorvo, Inc.

- Analog Devices Inc.

- ROHM Semiconductors

- STMicroelectronics NV

- Infineon Technologies

Competitive Analysis:

Key players in the RF GaN Market include Qorvo, Wolfspeed, Analog Devices, STMicroelectronics, and Mitsubishi Electric. These companies focus on performance innovation and broad application coverage in wireless infrastructure, defense, aerospace, and satellite communications. Qorvo and Analog Devices emphasize integrated solutions and mixed-signal capabilities. Wolfspeed leads in GaN-on-SiC technology with high-power and high-frequency applications. STMicroelectronics targets cost-effective GaN-on-Si offerings for commercial use. Mitsubishi Electric leverages its legacy in radar systems and RF modules. It invests in strategic alliances with telecom operators and defense contractors. Companies differentiate through proprietary material technologies, production capacity, and global footprint. They compete on performance metrics such as power density, thermal management, and frequency range. Market players pursue vertical integration, from substrate fabrication to module assembly. They pursue geographic expansion in Asia and the Middle East to capitalize on growing demand. Competition remains fierce around efficiency gains, cost reduction, and product reliability.

Recent Developments:

- In June 2025, Wolfspeed entered into a restructuring support agreement with key lenders as it focused on its core business following the sale of its RF business to Macom. With Macom now owning Wolfspeed’s former RF business, Wolfspeed continues as a leading supplier of silicon carbide wafers and GaN-on-SiC epiwafers

- In April 2025, Fujitsu announced a breakthrough with its gallium nitride (GaN) high-electron-mobility transistors (HEMTs), achieving a record 85.2% power-added efficiency at 2.45GHz. This advancement, accomplished on free-standing GaN substrates, represents the highest efficiency reported for discrete GaN HEMTs.

- In August 2023, Macom announced the acquisition of Wolfspeed’s RF business for $125 million, marking a strategic expansion within the RF GaN sector. This acquisition includes a 100mm GaN wafer fabrication facility and solidifies Macom’s portfolio and capabilities in RF power and MMIC technologies for communications, industrial, and defense markets

Market Concentration & Characteristics

The RF GaN Market demonstrates moderate concentration with a few leading semiconductor companies controlling a significant share. It features vertical integration from substrate sourcing to component assembly and end-user systems. Manufacturers differentiate through GaN-on-SiC and GaN-on-Si substrate technology, targeting performance or cost-driven segments. It serves high-growth verticals including defense radar, 5G base stations, satellite communication, and test equipment. Market characteristics include high R&D intensity, long product development cycles, and stringent quality standards. Customer adoption depends on device reliability, thermal stability, and power efficiency. It operates under structured procurement processes from telecom and government agencies. Innovation remains central to maintaining competitive advantage and meeting evolving application requirements.

Report Coverage:

The research report offers an in-depth analysis based on material type and application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- RF GaN devices will become integral to advanced 6G communication systems and future wireless infrastructure.

- Adoption in electric and autonomous vehicles will expand with increasing demand for vehicle-to-everything (V2X) communication.

- Defense applications will continue to lead in innovation, with governments investing in radar and electronic warfare upgrades.

- Satellite and aerospace industries will demand higher power GaN modules for global coverage and compact avionics systems.

- Manufacturers will prioritize GaN-on-SiC technologies for high-power applications while scaling GaN-on-Si for commercial use.

- Integration of RF GaN in MMICs and hybrid modules will support compact, multi-functional systems across industries.

- Asia Pacific will remain the fastest-growing region, driven by telecom, defense, and manufacturing advancements.

- Market consolidation may increase as major players pursue vertical integration and strategic partnerships.

- Focus on reducing manufacturing costs will intensify to enable broader adoption in cost-sensitive applications.

- Environmental and energy efficiency regulations will accelerate the shift toward GaN-based RF technologies.