Market Overview

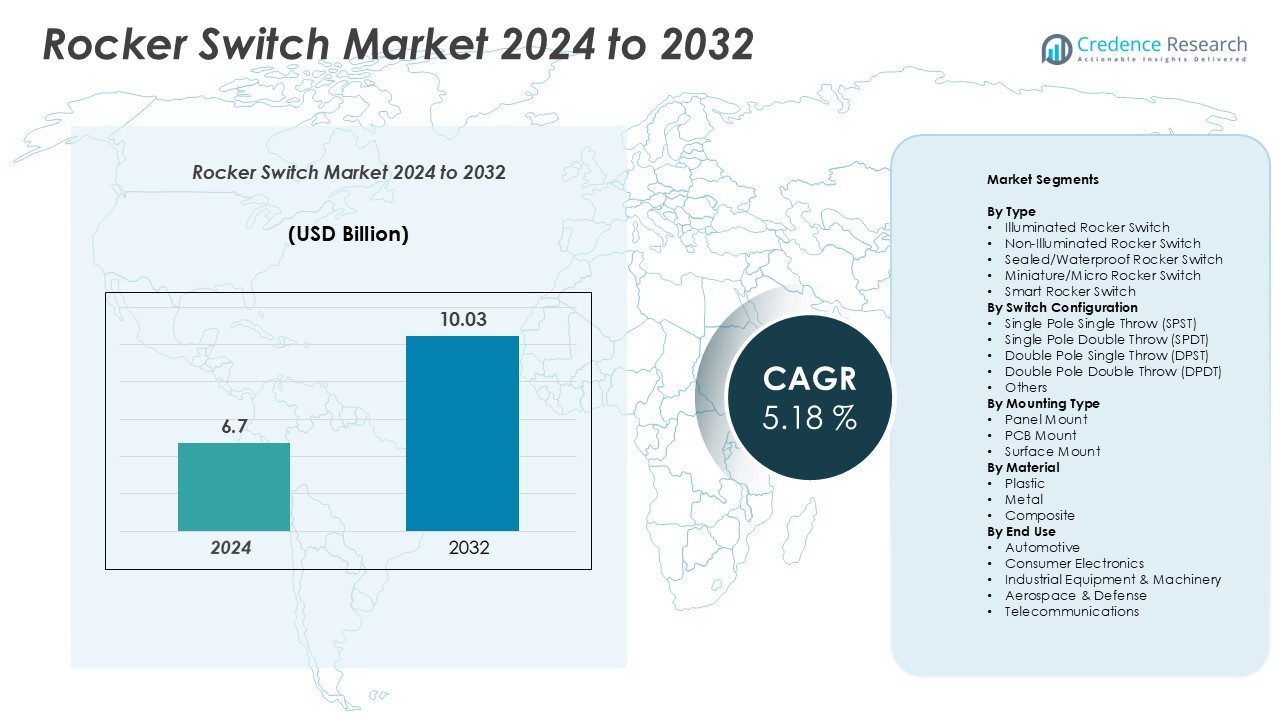

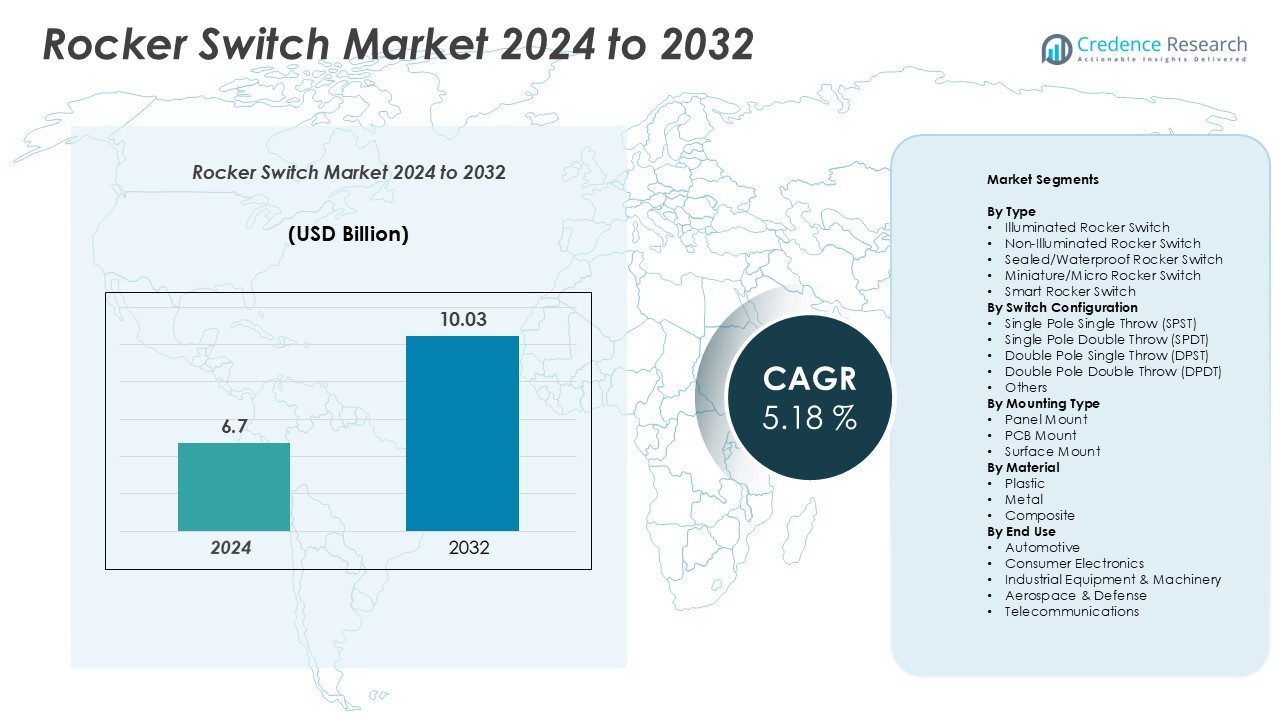

The Rocker Switch Market size was valued at USD 6.7 billion in 2024 and is anticipated to reach USD 10.03 billion by 2032, growing at a CAGR of 5.18% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Rocker Switch Market Size 2024 |

USD 6.7 Billion |

| Rocker Switch Market, CAGR |

5.18% |

| Rocker Switch Market Size 2032 |

USD 10.03 Billion |

The rocker switch market is led by prominent players such as Honeywell International Inc., ABB Ltd., Sensata Technologies, TE Connectivity, Eaton Corporation, Emerson Electric Co., Carling Technologies, Omron Corporation, Leviton Manufacturing Co. Inc., Everel Group S.p.A., and OTTO Engineering Inc. These companies focus on developing durable, energy-efficient, and smart switch solutions catering to automotive, industrial, and consumer electronics applications. North America leads the market with a 34% share, supported by strong industrial automation and advanced automotive sectors. Europe follows with 28%, driven by sustainability and electric vehicle adoption, while Asia Pacific, holding 27%, remains the fastest-growing region due to rapid industrialization and electronic manufacturing expansion.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The global rocker switch market was valued at USD 6.7 billion in 2024 and is projected to reach USD 10.03 billion by 2032, growing at a CAGR of 5.18%.

- Strong demand from automotive, industrial machinery, and consumer electronics sectors drives market growth due to their reliability, compactness, and low maintenance features.

- The market is witnessing a trend toward smart and energy-efficient rocker switches, with innovations in waterproofing, miniaturization, and IoT compatibility enhancing product appeal.

- Competition is intense, with major players like Honeywell, ABB, Sensata, TE Connectivity, and Eaton focusing on design efficiency, R&D, and global expansion strategies.

- North America leads with 34%, followed by Europe (28%) and Asia Pacific (27%), while illuminated rocker switches dominate the type segment due to widespread use in automotive and industrial applications.

Market Segmentation Analysis:

By Type

Illuminated rocker switches dominate the market with the largest share, driven by high demand in automotive dashboards, marine equipment, and industrial panels. Their built-in LED indicators enhance visibility and user safety in low-light conditions. Non-illuminated and sealed/waterproof variants follow due to rising use in outdoor and heavy-duty environments. The increasing trend toward miniaturization and smart integration supports growth for micro and smart rocker switches. Advancements in energy-efficient illumination and smart control technologies further strengthen the segment’s leadership in both industrial and consumer applications.

- For instance, Carling Technologies developed the V-Series Contura Rocker Switches with integrated 12V and 24V LED illumination, offering up to 100,000 electrical switching cycles depending on the circuit. The switches also feature an operating temperature range from -40°C to +85°C and a sealed construction certified to IP66/IP68, ensuring durability in harsh environments.

By Switch Configuration

Single Pole Single Throw (SPST) holds the dominant market share due to its simple design, cost-effectiveness, and wide usage across automotive and electronic devices. SPDT and DPDT switches also witness steady demand in applications requiring dual or multiple control circuits. The flexibility of SPST configurations supports easy integration into diverse electrical systems. Growth is supported by automation in household and industrial systems where quick operation and reliability are critical. The adoption of advanced contact materials and enhanced durability features further improves performance and longevity.

- For instance, NKK Switches offers M Series miniature SPST rocker switches. Specific models using silver alloy contacts are rated up to 15 amps at 125V AC, which ensures low resistance and high conductivity for power circuits. While the switches have a mechanical lifespan of at least 50,000 operations, the electrical life for silver-contact models is typically a minimum of 25,000 operations.

By Mounting Type and Material

Panel mount rocker switches lead the market with the highest share, owing to their extensive use in industrial machinery, vehicles, and marine applications. They offer durability, easy installation, and robust resistance to vibration and environmental stress. PCB and surface mount types are gaining traction in compact electronics and consumer devices. In terms of material, plastic-based rocker switches dominate due to low cost, lightweight nature, and design flexibility. Metal and composite switches follow in applications demanding higher strength, heat resistance, and longer operational life.

Key Growth Drivers

Expanding Demand from Automotive and Industrial Sectors

The growing use of rocker switches in automotive and industrial equipment drives market expansion. These switches provide high durability, quick actuation, and compact design suitable for harsh environments. In vehicles, they control lighting, HVAC, and infotainment systems, while in industries, they operate heavy machinery and control panels. The shift toward electric and hybrid vehicles further increases usage for advanced dashboard and auxiliary functions. Additionally, automation and process control systems in manufacturing enhance demand. The need for reliable, vibration-resistant switches continues to strengthen adoption across these key sectors.

- For instance, NKK Switches offers M Series miniature SPST rocker switches. Specific models that use silver alloy contacts are rated up to 6 amps at 125V AC. This specification provides low resistance and high conductivity for power circuits.

Rising Integration of Smart and Connected Switches

The emergence of smart home technologies and IoT-enabled systems fuels demand for intelligent rocker switches. These advanced switches allow remote operation, energy monitoring, and voice control integration with smart home ecosystems. Their compatibility with Wi-Fi and Bluetooth enhances user convenience and operational efficiency. Manufacturers are investing in smart switch designs that combine safety with automation features. Growing urbanization and consumer preference for energy-efficient solutions accelerate this trend. The focus on sustainable, connected systems continues to create new opportunities in residential and commercial segments.

- For instance, Leviton Manufacturing Co., Inc. offers the Decora Smart Wi-Fi 2nd Gen Switch (model D215S). This rocker switch supports 2.4GHz Wi-Fi networks and connects via the My Leviton app, requiring a neutral wire for installation. It provides on/off control for a variety of loads, including LED lighting up to 600W/5A, incandescent/halogen lighting up to 1500W, and motors up to 3/4 horsepower. The switch also supports voice control through Amazon Alexa, Google Assistant, and Apple Home/Siri. A firmware update is available to enable Matter connectivity.

Technological Advancements in Design and Material Efficiency

Continuous innovation in materials and design significantly boosts rocker switch performance. Manufacturers are developing switches with enhanced resistance to water, dust, and temperature fluctuations, improving reliability in industrial and outdoor applications. The adoption of lightweight thermoplastics and advanced composites reduces production costs while maintaining strength and safety. Miniaturized designs also support compact electronic devices and automotive interiors. These improvements enhance operational lifespan and performance consistency. The market benefits from R&D investments focusing on sustainable manufacturing and precision engineering to meet modern electrical and environmental standards.

Key Trends & Opportunities

Shift Toward Energy-Efficient and Sustainable Designs

Energy efficiency is becoming a major design focus in the rocker switch market. Manufacturers are adopting eco-friendly materials and production techniques to meet sustainability targets. Low-power illumination options, such as LED indicators, reduce energy usage while improving aesthetics and visibility. Companies are also using recyclable components to minimize environmental impact. Governments’ push for energy conservation in electronics and industrial systems enhances adoption. This trend creates opportunities for producers offering greener, longer-lasting, and compliant switch models that align with global environmental standards.

- For instance, Schneider Electric developed the Harmony series of illuminated switches, which includes rocker switches and other types like pushbuttons and selector switches. These products feature long-lasting LED indicators that consume very low power—typically well below 1 watt. The switches incorporate recyclable thermoplastic housings and are compliant with strict European environmental regulations, including the RoHS and REACH standards, as verified through Schneider Electric’s “Green Premium” eco-label.

Increasing Adoption of Miniature and Waterproof Switches

Miniaturization and waterproofing are shaping product innovation across sectors. Compact rocker switches are in high demand for portable electronics, medical devices, and modern vehicles where space optimization is crucial. Waterproof and sealed switches gain traction in marine, construction, and outdoor systems requiring high protection against dust and moisture. Advancements in sealing technology and IP-rated designs enhance product reliability. Manufacturers focusing on these specifications can capture niche markets and expand applications in rugged and high-performance environments, driving steady growth opportunities.

- For instance, APEM Inc. launched its IX Series miniature pushbutton switches, which are rated for harsh environments with an IP67 and IP69K sealing. The switches offer different contact materials with varying operational lifecycles and current ratings Gold-plated contacts have an operational life of 1,000,000 cycles with a current capacity of 100mA at 28V DC.Silver contacts have an operational life of 100,000 cycles with a current capacity of 2A at 28V DC.

Expansion in Smart Infrastructure and Automation Systems

The growing investment in smart infrastructure, automation, and industrial IoT creates vast opportunities for rocker switch manufacturers. These systems rely on durable, precise, and electronically integrated switches for monitoring and control functions. Smart buildings and connected factories demand advanced switches compatible with centralized control units. Integration with AI-based systems and sensors further enhances functionality. The increasing penetration of automation in developing regions positions rocker switch manufacturers to tap into expanding smart ecosystem markets, reinforcing long-term revenue potential.

Key Challenges

Intense Price Competition and Market Fragmentation

The rocker switch market faces strong price competition due to the presence of numerous regional and global players. Low-cost manufacturing in Asia-Pacific puts pressure on established brands to maintain competitive pricing while sustaining profit margins. Price-sensitive customers in industrial and consumer electronics sectors often favor cheaper alternatives, affecting premium product sales. Maintaining quality and performance standards amid shrinking margins poses a major challenge. This environment compels manufacturers to focus on innovation, automation, and value-added features to remain competitive.

Rising Material Costs and Supply Chain Constraints

Fluctuations in raw material prices, such as plastics, metals, and electronic components, challenge profitability. Supply chain disruptions from geopolitical tensions and logistical delays further impact production timelines. Shortages of semiconductor and contact materials increase lead times and operational costs. Manufacturers must secure reliable supplier networks and adopt flexible sourcing strategies to mitigate these issues. Additionally, the push toward sustainable and recyclable materials increases R&D and compliance costs. Effective supply management and cost optimization remain essential to sustain growth under volatile market conditions.

Regional Analysis

North America

North America holds the leading share of 34% in the global rocker switch market. The dominance is driven by advanced automotive production, industrial automation, and the strong presence of consumer electronics manufacturers. The United States leads due to high adoption of smart switches in residential and commercial buildings. The demand for durable, high-performance components in aerospace and defense further strengthens market growth. The region also benefits from rapid integration of IoT-enabled switches and energy-efficient systems, supported by favorable regulatory standards and continuous investment in modern infrastructure development.

Europe

Europe accounts for 28% of the global rocker switch market, supported by the region’s focus on sustainability and energy efficiency. Countries such as Germany, France, and the United Kingdom are at the forefront of adopting advanced switch technologies in automotive and industrial applications. The growth is further driven by smart home adoption and stringent environmental standards promoting eco-friendly materials. Manufacturers are investing in R&D to produce compact and efficient switches tailored for electric vehicles and automation systems. The region’s strong manufacturing base and innovation culture sustain its market position.

Asia Pacific

Asia Pacific captures 27% of the rocker switch market, emerging as the fastest-growing region. Expanding automotive production in China, Japan, and India, coupled with rapid industrialization, drives significant demand. The consumer electronics sector’s continuous growth further accelerates switch adoption. Increasing urbanization and government investments in smart cities promote the use of advanced electrical control components. Regional manufacturers benefit from low production costs and strong supply chain networks. The region’s focus on energy-efficient and miniaturized devices positions it as a key contributor to the market’s future expansion.

Latin America

Latin America holds a 6% market share, with growth driven by infrastructure modernization and rising automotive assembly activities. Countries such as Brazil and Mexico are witnessing increased demand for rocker switches in manufacturing and commercial building applications. The shift toward energy-efficient and durable electrical components is boosting adoption. Local production capabilities remain limited, leading to reliance on imports from global manufacturers. However, expanding construction projects and growing consumer electronics usage present steady opportunities for market players aiming to establish regional partnerships and distribution networks.

Middle East & Africa

The Middle East and Africa collectively account for 5% of the rocker switch market. The region’s growth is supported by infrastructure expansion, particularly in the Gulf Cooperation Council (GCC) countries. Rising demand for industrial automation and smart building technologies in commercial and residential sectors drives product penetration. South Africa and the UAE are key markets due to increasing adoption of durable switches in industrial and energy sectors. The availability of water-resistant and heat-tolerant rocker switches further supports their use in harsh environmental conditions, enhancing long-term market potential.

Market Segmentations:

By Type

- Illuminated Rocker Switch

- Non-Illuminated Rocker Switch

- Sealed/Waterproof Rocker Switch

- Miniature/Micro Rocker Switch

- Smart Rocker Switch

By Switch Configuration

- Single Pole Single Throw (SPST)

- Single Pole Double Throw (SPDT)

- Double Pole Single Throw (DPST)

- Double Pole Double Throw (DPDT)

- Others

By Mounting Type

- Panel Mount

- PCB Mount

- Surface Mount

By Material

By End Use

- Automotive

- Consumer Electronics

- Industrial Equipment & Machinery

- Aerospace & Defense

- Telecommunications

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The rocker switch market is highly competitive, with global and regional players focusing on innovation, quality, and technological integration. Key companies include Honeywell International Inc., Sensata Technologies, ABB Ltd., OTTO Engineering Inc., Carling Technologies, TE Connectivity, Everel Group S.p.A., Omron Corporation, Eaton Corporation, Leviton Manufacturing Co. Inc., and Emerson Electric Co. These firms compete on product reliability, customization, and compliance with international safety standards. Leading manufacturers invest in smart switch technology, waterproof designs, and miniaturized components to meet diverse industrial and consumer needs. Strategic partnerships, acquisitions, and regional expansions are common to enhance market reach and technological capability. Continuous R&D in materials, illumination efficiency, and automation-ready designs strengthens competitive advantage, while sustainability initiatives and cost optimization remain critical success factors for long-term growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In February 2024, SoundExtreme released rocker switches with built-in RF remote control, allowing users to manage audio and LED lighting systems wirelessly. These switches are designed for marine and off-road applications, offering enhanced convenience and durability.

- In September 2022, New Yorker Electronics announced the distribution of Adam-Tech’s full line of rocker switches, including sealed versions rated up to IP67. These switches cater to telecommunications, medical, and industrial equipment sectors, offering various termination options and actuator styles.

Report Coverage

The research report offers an in-depth analysis based on Type, Switch Configuration, Mounting Type, Material, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The rocker switch market will continue expanding with rising automation and smart device integration.

- Electric and hybrid vehicle adoption will boost demand for advanced automotive rocker switches.

- Smart home growth will increase the use of IoT-enabled and voice-controlled rocker switches.

- Manufacturers will focus on energy-efficient designs using recyclable and eco-friendly materials.

- Miniaturized and waterproof switches will gain traction in electronics and outdoor equipment.

- Technological advancements will enhance product durability, safety, and aesthetic appeal.

- Industrial modernization will drive demand for high-performance switches in machinery and control systems.

- Regional manufacturing hubs in Asia Pacific will strengthen global supply capabilities.

- Strategic partnerships and acquisitions will help companies expand their product portfolios.

- Sustainable manufacturing practices and compliance with environmental standards will shape future developments.