Market Overview

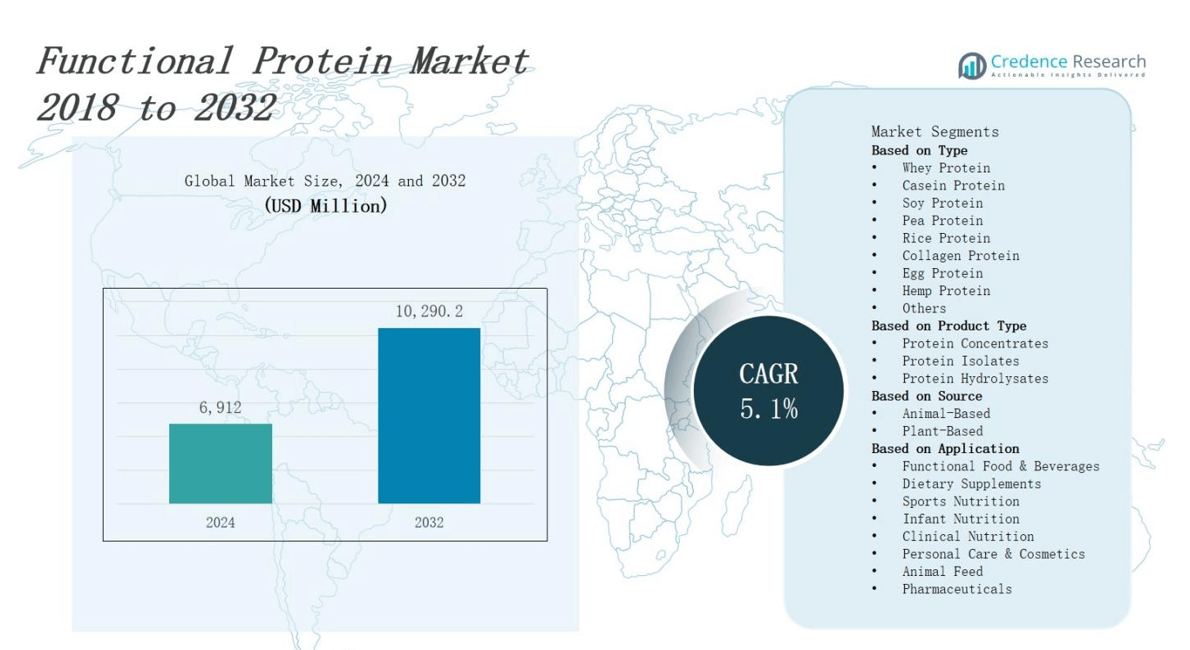

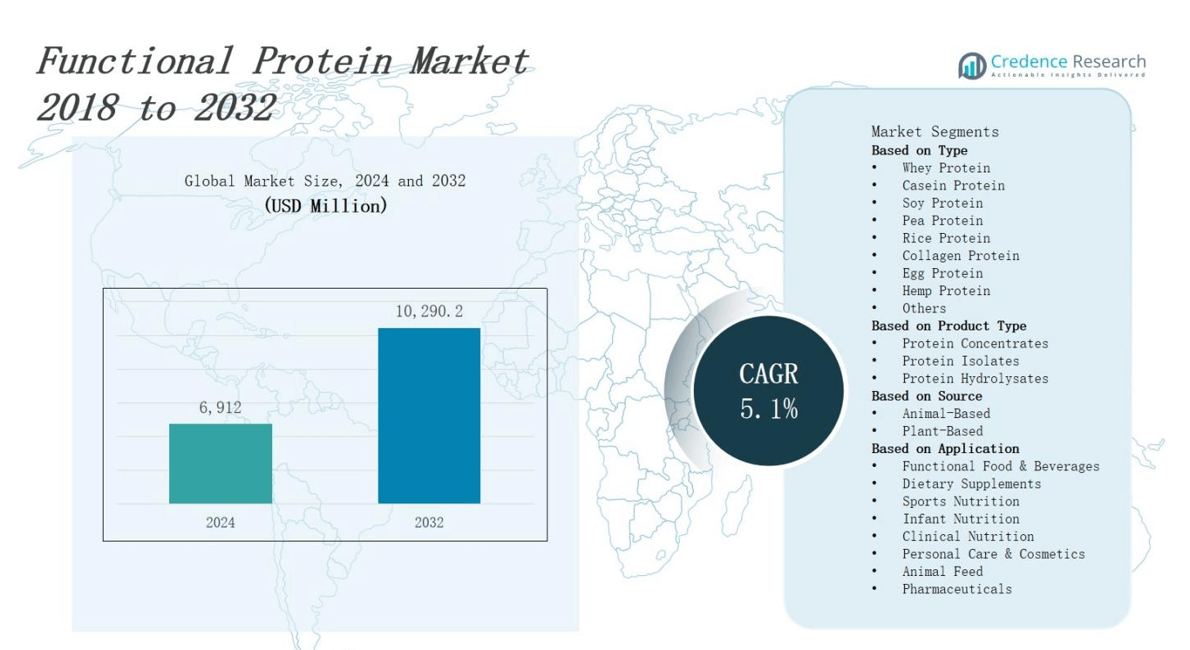

The functional protein market is projected to expand from USD 6,912 million in 2024 to USD 10,290.2 million by 2032, reflecting a CAGR of 5.1%.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Functional Protein Market Size 2024 |

USD 6,912 million |

| Functional Protein Market, CAGR |

5.1% |

| Functional Protein Market Size 2032 |

USD 10,290.2 million |

The functional protein market benefits from rising consumer focus on health and wellness, which drives demand for high‑protein, clean‑label ingredients in food and beverage applications. Manufacturers leverage advances in extraction technologies and fermentation processes to develop novel protein isolates and concentrates with improved solubility and sensory profiles. Growing interest in plant‑based and alternative proteins fuels diversification of product portfolios, while sports nutrition and weight‑management applications sustain steady uptake. Companies adopt sustainable sourcing practices and collaborate with nutrition research firms to validate functional benefits. Continued investment in personalized nutrition and on‑trend formats, such as protein‑fortified snacks and beverages, supports long‑term market growth.

In the functional protein market, North America leads with 35% share supported by global dairy and sports nutrition industries and key players such as Cargill and Archer Daniels Midland Company. Europe holds 25% share driven by stringent regulations and ingredient leaders including Roquette Frères and DuPont Nutrition & Biosciences. Asia Pacific commands 30% share with rapid uptake of plant‑based proteins led by Ingredion and Royal DSM. Latin America accounts for 6% and Middle East & Africa holds 4%, where Arla Foods Ingredients and Fonterra Co‑operative Group secure presence.

Market Insights

- The functional protein market will grow from USD 6,912 million in 2024 to USD 10,290.2 million by 2032 at a 5.1% CAGR.

- North America holds 35% market share, Asia Pacific 30%, Europe 25%, Latin America 6% and Middle East & Africa 4%.

- Rising health and wellness focus drives demand for high‑protein, clean‑label ingredients in foods and beverages.

- Advances in extraction, fermentation and membrane technologies improve yield, purity and sensory profiles of protein isolates.

- Plant‑based proteins (pea, soy, rice, algae) expand product portfolios and meet vegan consumer preferences.

- Clean‑label transparency and third‑party certifications reassure consumers on sourcing, allergen control and non‑GMO status.

- Personalized nutrition and sports applications fuel novel formats, digital customization platforms and direct‑to‑consumer subscription models.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Health and Wellness Focus Drives Demand

Consumer emphasis on health and well-being fuels growth of the functional protein market. It supports strong demand for high‑quality protein ingredients in beverages, nutrition bars, and dairy alternatives. Manufacturers develop isolates and concentrates that deliver targeted benefits such as muscle recovery and immune support. Partnerships with research institutions validate efficacy and boost consumer confidence. Regulatory approvals for novel protein sources encourage product innovation.

- For instance, Kerry Group, which invests heavily in R&D to develop novel plant-based protein isolates with enhanced digestibility and bioavailability, validated by research partnerships to boost consumer trust.

Advancements in Processing Technologies Propel Growth

Innovations in extraction and purification techniques transform the functional protein market. It enables producers obtain higher yields and purity from plant and animal sources. Ultrafiltration, enzymatic hydrolysis and membrane separation refine product profiles while reducing production costs. Equipment manufacturers supply scalable systems that meet industry demand. Collaboration with technology firms accelerates optimization. Increased automation improves consistency. Investment in pilot plants supports scale‑up and viability.

- For instance, GEA’s ultrafiltration systems are used widely in dairy processing to efficiently separate proteins while reducing energy consumption.

Sustainable Sourcing and Environmental Compliance

Growing regulatory pressure from governments and consumer demand for sustainability influence the functional protein market. It compels suppliers to adopt responsibly sourced raw materials from certified farms and fisheries to ensure traceability. Adoption of renewable energy and water conservation measures increases eco‑efficiency across operations. Suppliers implement waste minimization and recycling strategies. Brands report environmental metrics publicly and engage stakeholders. Continuous improvement programs foster circular economy principles and long‑term resource security globally.

Expansion of Personalized and Sports Nutrition Applications

Tailored nutrition trends drive innovation within the functional protein market. It integrates advanced formulations in sports supplements and meal replacements. Athletes seek high‑protein blends that support performance and recovery. Nutrigenomics research enhances formulation precision based on metabolism. Collaboration between supplement brands and biotech firms generates customized solutions. Trials demonstrate efficacy and encourage adoption by medical providers. Growth of direct‑to‑consumer channels accelerates market penetration.

Market Trends

Shift Toward Plant‑Based Protein Sources

The functional protein market reflects growing consumer preference for plant‑based proteins derived from peas, soy and algae. It prompts ingredient suppliers to source diverse crops and pursue novel pulse varieties to optimize amino acid profiles. Manufacturers collaborate with farmers to secure supply chains and implement sustainable agriculture practices. Research teams validate nutritional benefits to support product positioning. Retailers expand shelf space for plant‑based protein bars and beverages. Investors allocate capital toward alternative protein startups.

- For instance, tofu, a soy-based product, offers about 9 grams of protein per 3-ounce serving and contains all nine essential amino acids, making it a complete protein source widely utilized in meat substitute products.

Demand for Clean‑Label Credibility

The functional protein market sees rising demand for clean‑label formulations and transparent sourcing. It drives companies to publish origin details and regulatory compliance data. Brands adopt third‑party certifications to reassure consumers on allergen control and non‑GMO status. Suppliers streamline supply chain audits to meet retailer standards. Marketing teams emphasize minimal additives and ingredient traceability on packaging. Retailers test products for contaminants and promote certified labels. Analysts expect further emphasis on ingredient transparency.

- For instance, NutraBio exemplifies this trend by fully disclosing all ingredients on their protein supplement labels, avoiding proprietary blends, and rigorously testing every batch for contaminants through third-party labs to ensure compliance and consumer trust.

Expansion of Novel Delivery Formats

The functional protein market embraces novel delivery formats that cater to consumer convenience. It spurs development of ready‑to‑drink protein shots, shelf‑stable protein powders and snack bars embedded with microencapsulated proteins. Manufacturers test edible films and protein‑infused pastas to broaden applications. Equipment suppliers offer high‑shear mixing and spray‑drying technologies to refine texture. Retail rollout of instant protein mixes and single‑serve sachets meets on‑the‑go lifestyles. Investors fund startups exploring protein‑enriched baking ingredients.

Adoption of Digital Platforms for Personalization

The functional protein market leverages digital platforms to deliver personalized nutrition solutions. It integrates mobile apps and wearable data to tailor protein intake based on user activity and metabolism. Brands launch subscription models with algorithm‑driven product recommendations. Data analytics firms provide insights on consumption patterns to refine formulations. Virtual consultations with nutritionists support customized protein programs. E‑commerce channels integrate loyalty programs to track customer preferences and repeat purchases.

Market Challenges Analysis

High Production and Supply Chain Barriers Limit Growth

High production costs challenge the functional protein market. It reflects complex extraction and purification steps that require specialized equipment and skilled operators. Fluctuations in raw material prices lead to unpredictable margins and deter investment. Manufacturers face logistical hurdles in maintaining cold chains and preserving protein integrity across distributed facilities. Limited scalability of pilot processes delays large‑scale commercial rollout. Stakeholders commit significant capital expenditures to upgrade infrastructure and adopt advanced processing technologies. Persistent supply chain disruptions undermine supplier reliability and extend lead times.

Diverse Regulatory Demands and Quality Assurance Risks

Regulatory requirements create complexity for the functional protein market. It must satisfy varying safety, labeling and purity standards across multiple jurisdictions. Lengthy approval timelines for novel protein sources extend time to market and increase compliance costs. Quality control teams implement rigorous testing protocols to maintain functional performance and detect contaminants. Inconsistent definitions of acceptable ingredient specifications hinder supplier alignment. Consumer concerns about allergenicity and genetic modification demand transparent communication and third‑party certification. Intellectual property disputes over proprietary extraction methods add legal uncertainty.

Market Opportunities

Strategic Partnerships Drive Innovation and Access

Partnerships between ingredient suppliers and research institutes fuel growth in the functional protein market. It enables rapid development of next‑generation protein isolates with enhanced bioavailability. Collaborative ventures secure exclusive access to proprietary extraction technologies and scale‑up facilities. Joint investments reduce capital risk for manufacturers expanding production capacity. Licensing agreements grant brands rights to novel protein formulations under trademarked processes. Venture capital backing accelerates pilot projects and market entry for startups. Regulatory consulting partnerships streamline approval pathways and ensure compliance with global safety standards.

Expansion into Emerging Regional and Clinical Segments

Growing demand in Asia Pacific and Latin America presents new growth avenues for the functional protein market. It encourages local formulators to adapt blends for regional dietary habits and palates. Retailers integrate protein‑enriched staples into mainstream grocery assortments and online platforms. Clinical nutrition providers incorporate targeted protein blends into therapeutic diets for aging populations and chronic‑disease management. Public‑private partnerships support protein fortification programs in school feeding and maternal health initiatives. Medical trials validate clinical benefits and generate bulk procurement contracts. Distribution networks expand through specialty pharmacies and hospital supply chains.

Market Segmentation Analysis:

By Type

Whey protein leads the functional protein market with widespread use in sports supplements and nutrition bars. It offers complete amino acid profiles and rapid absorption. Casein protein holds steady demand in meal‑replacement products due to slow release properties. Plant‑derived segments such as soy, pea and rice protein gain traction among vegan consumers. Collagen protein supports beauty and joint health applications. Egg and hemp protein serve niche segments. Other specialty proteins satisfy emerging functional needs.

- For instance, Hilmar Ingredients produces a variety of whey protein products specializing in high-quality isolates and concentrates for application in food and beverage industries worldwide.

By Product Type

Protein concentrates represent the largest share of the functional protein market given cost‑effective production. It delivers balanced nutrition in food and beverage formulations. Protein isolates drive highest growth because of superior purity and minimal fats. Protein hydrolysates find strong uptake in clinical and sports nutrition where rapid digestion confers recovery benefits. Manufacturers tailor processing parameters to optimize solubility and taste. Investment in pilot‑scale facilities expands isolate and hydrolysate capacities to meet brand specifications.

- For instance, Archer Daniels Midland (ADM) produces soy protein concentrates widely used to enhance nutritional profiles in bakery products. Protein isolates drive the highest growth because of superior purity and minimal fats.

By Source

Animal‑based proteins dominate overall value due to established whey and casein supply chains. It ensures consistent quality and regulatory familiarity among formulators. Plant‑based proteins exhibit fastest growth as consumers seek sustainable, allergen‑friendly options. Suppliers explore novel pulses and algae to diversify offerings. Blended formulations combine animal and plant sources to balance functionality and consumer preferences. Traceability requirements drive certified sourcing for both categories. Regional producers tailor source portfolios to local dietary habits.

Segments:

Based on Type

- Whey Protein

- Casein Protein

- Soy Protein

- Pea Protein

- Rice Protein

- Collagen Protein

- Egg Protein

- Hemp Protein

- Others

Based on Product Type

- Protein Concentrates

- Protein Isolates

- Protein Hydrolysates

Based on Source

Based on Application

- Functional Food & Beverages

- Dietary Supplements

- Sports Nutrition

- Infant Nutrition

- Clinical Nutrition

- Personal Care & Cosmetics

- Animal Feed

- Pharmaceuticals

Based on Distribution Channel

- Supermarkets

- Online Retail

- Specialty Stores

- Convenience Stores

- Pharmacies

- Direct Sales

Based on End-User

- Athletes & Fitness Enthusiasts

- Lifestyle Users

- Geriatric Population

- Infants & Children

- Medical Patients

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America leads the functional protein market with a 35% share driven by established dairy and sports nutrition industries. It benefits from robust R&D infrastructure and strong collaboration between universities and ingredient suppliers. Manufacturers in the United States and Canada introduce novel whey and collagen variants to meet diverse consumer needs. Regulatory clarity and high disposable incomes support premium protein formats and personalized nutrition services. Retailers allocate prime shelf space to protein‑enriched products across mainstream and specialty channels. Market share in Europe stands at 25%, Asia Pacific at 30%, Latin America at 6%, and Middle East & Africa at 4%.

Europe

Europe commands a 25% share of the functional protein market thanks to well‑developed nutraceutical regulations and health‑conscious consumers. It leverages advanced fermentation and membrane technologies to refine plant‑based and animal‑derived proteins. Collaboration between ingredient firms and certification bodies ensures strict compliance with non‑GMO and allergen‑free standards. Retail chains across Germany, France and the UK feature protein‑fortified foods and beverages prominently. Investment in cold‑chain logistics preserves product integrity from production hubs to retail outlets. Market share in North America stands at 35%, Asia Pacific at 30%, Latin America at 6%, and Middle East & Africa at 4%.

Asia Pacific

Asia Pacific holds a 30% share of the functional protein market fueled by growing health awareness and expanding middle‑class populations. It sees rapid adoption of pea, soy and rice proteins tailored to local diets. Manufacturers partner with regional farmers to secure sustainable supply chains and optimize cost structures. Government initiatives in China, India and Southeast Asia promote protein fortification in school meals and eldercare programs. E‑commerce platforms accelerate product distribution and consumer engagement. Market share in North America stands at 35%, Europe at 25%, Latin America at 6%, and Middle East & Africa at 4%.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Roquette Frères

- Tate & Lyle PLC

- Royal DSM N.V.

- Fonterra Co‑operative Group Limited

- Cargill, Incorporated

- Kerry Group plc

- BASF SE

- DuPont Nutrition & Biosciences

- Archer Daniels Midland Company

- Glanbia plc

- Ingredion Incorporated

- Arla Foods Ingredients Group P/S

Competitive Analysis

Leading ingredient suppliers compete on technology, sustainability and product portfolios. Companies such as Roquette Frères and Tate & Lyle PLC invest heavily in enzyme‑based extraction platforms to differentiate protein isolates. Cargill, Incorporated and Archer Daniels Midland Company secure raw material access through strategic farming partnerships. Fonterra Co‑operative Group Limited and Arla Foods Ingredients Group P/S leverage established dairy supply chains to scale animal‑based proteins globally. DuPont Nutrition & Biosciences and Royal DSM N.V. develop tailored hydrolysate formulations for clinical nutrition segments. Glanbia plc collaborates with sports nutrition brands to position whey proteins in premium supplements. Ingredion Incorporated and BASF SE focus on plant‑based innovations to meet growing vegan demand. It highlights supply chain integration and regulatory compliance as key competitive drivers. Emerging alternative protein startups create niche competition, driving incumbent firms to enhance research pipelines and accelerate product launches to maintain market leadership in the functional protein market.

Recent Developments

- In March 12, 2025, Shiru and GreenLab formed a strategic partnership to commercialize sustainable food proteins using GreenLab’s proprietary corn expression system, enhancing Shiru’s AI‑driven ingredient discovery with scalable production capabilities

- In January 31, 2025, Burcon NutraScience Corporation announced that its alliance partner RE ProMan, LLC signed a purchase and sale agreement to acquire a North American protein production facility, paving the way for commercial‑scale plant‑based protein manufacturing

- In May 20, 2024, REBBL introduced Smoothie Starter™, an organic oat‑ and coconut‑milk base delivering 20 g of plant‑based protein plus zinc and postbiotics to support gut health

- In June 3, 2025, Meala FoodTech partnered with dsm‑firmenich to launch Vertis™ PB Pea, a patented texturizing pea protein now available in Europe for clean‑label meat alternatives

Market Concentration & Characteristics

The functional protein market features a moderate concentration among leading ingredient suppliers, with the top five companies commanding more than half of global revenues. It relies on large‑scale extraction facilities and proprietary purification platforms that raise entry barriers for new competitors. It demands robust quality control systems to meet stringent safety and labeling regulations across regions. It depends on diversified supply chains that secure both animal and plant protein sources under certified sustainability standards. It emphasizes continuous innovation in formulation, supported by R&D partnerships with academic institutions and technology providers. It benefits from strategic alliances and licensing agreements that grant access to novel protein isolates and hydrolysates. It attracts significant venture capital investment, particularly in alternative proteins and personalized nutrition. It maintains resilience through flexible production capacities and integrated distribution networks that serve food, beverage, clinical and sports nutrition segments worldwide.

Report Coverage

The research report offers an in-depth analysis based on Type, Product Type, Source, Application, Distribuion Channel, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Manufacturers will expand protein variants using diverse sources to satisfy consumer nutrition and wellness expectations.

- Companies will integrate precision fermentation to create novel protein sources with functionality and sustainability benefits.

- Brands will adopt blockchain to ensure transparent supply chains, traceability for functional protein ingredients globally.

- Suppliers will partner with biotech firms to accelerate development and launch protein formulations across markets.

- Retailers will personalize protein blends through subscription models, leverage consumer data for tailored nutrition solutions.

- Clinical nutrition will integrate functional proteins into therapeutic diets, improving patient outcomes and recovery support.

- Regulators will update guidelines to accommodate novel protein sources, balancing safety requirements with innovation incentives.

- Producers will scale sustainable farming practices, implement renewable energy strategies to secure raw materials responsibly.

- Technology developers will refine extraction techniques to reduce environmental impact, improve yields, optimize production costs.

- Startups will disrupt traditional markets, introducing alternative protein innovations that challenge incumbents and attract investment.