Market Overview:

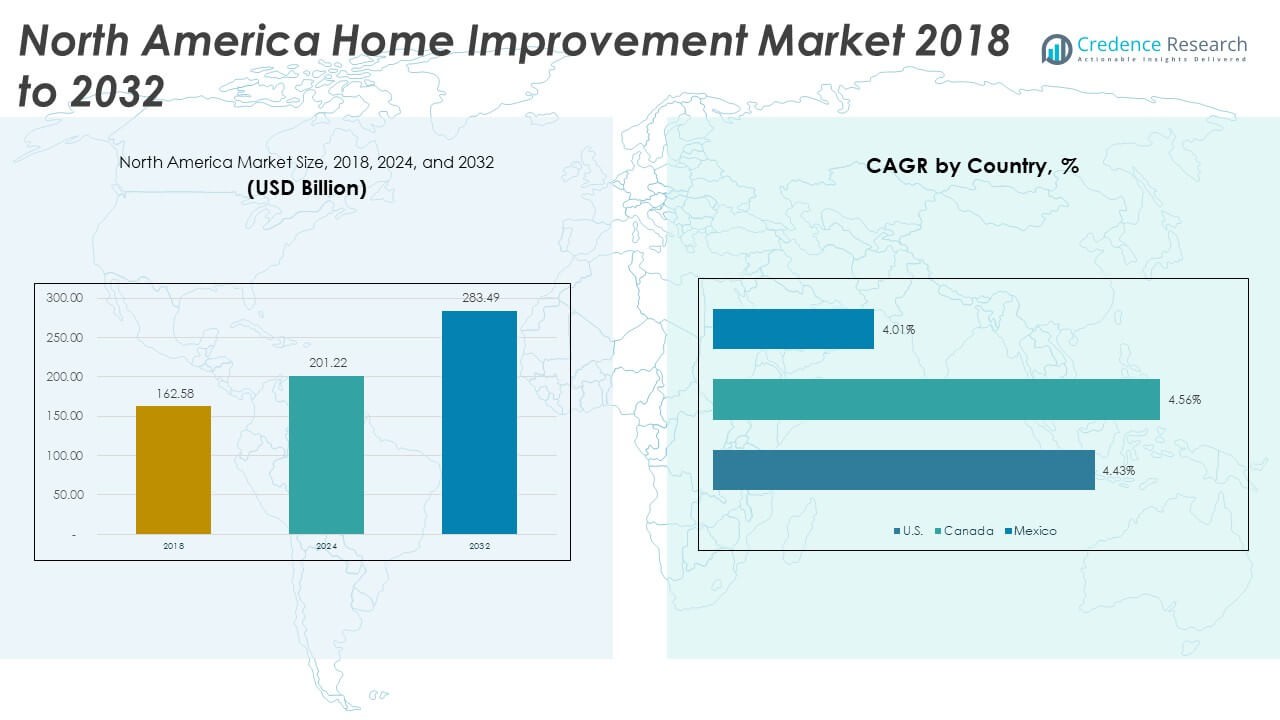

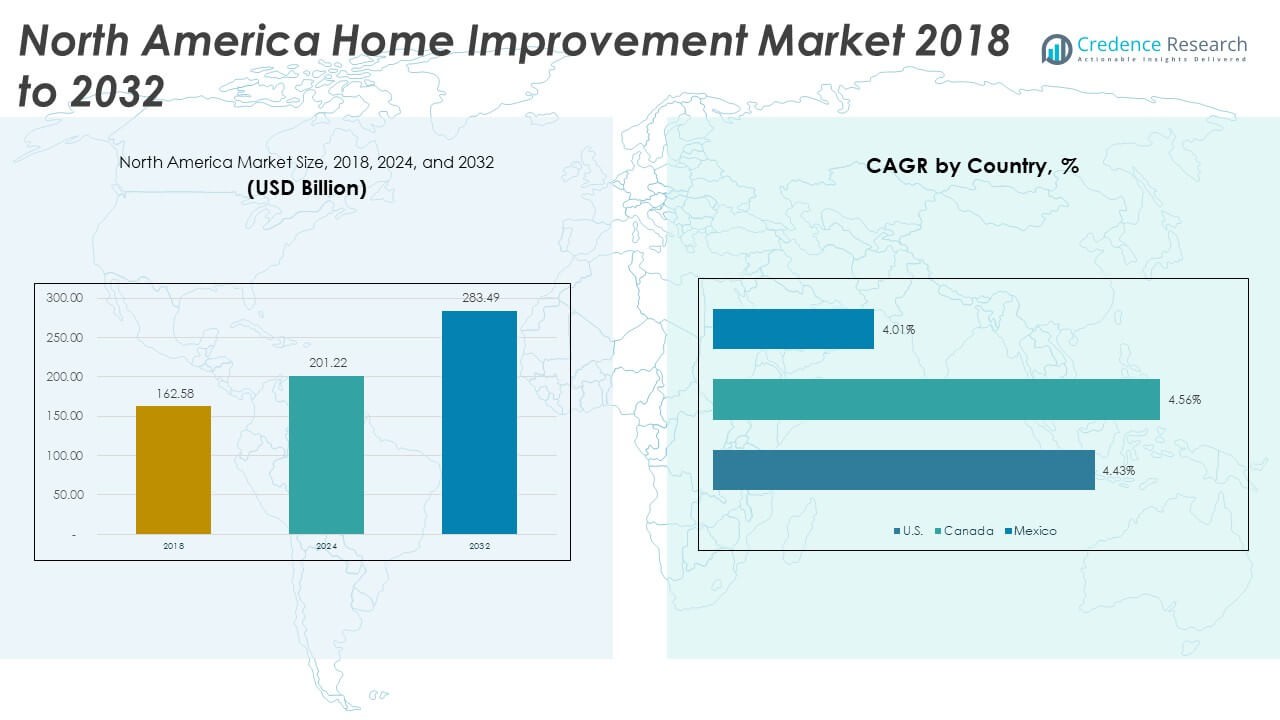

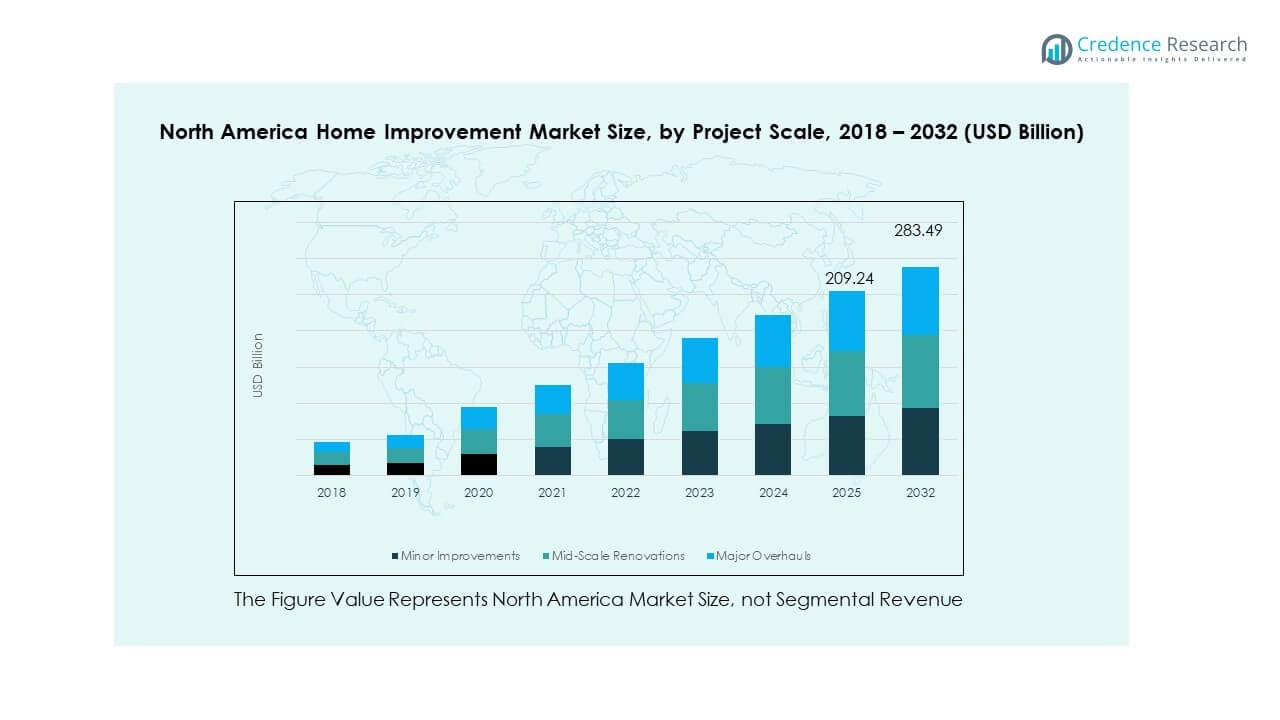

The North America Home Improvement Market size was valued at USD 162.58 billion in 2018 to USD 201.22 billion in 2024 and is anticipated to reach USD 283.49 billion by 2032, at a CAGR of 4.33% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| North America Home Improvement Market Size 2024 |

USD 201.22 Billion |

| North America Home Improvement Market , CAGR |

4.33% |

| North America Home Improvement Market Size 2032 |

USD 283.49 Billion |

The North American home improvement market is driven by increasing disposable incomes and a rising trend of home renovation projects. Homeowners are investing in renovations, remodeling, and upgrading their properties to enhance aesthetic appeal and functional value. Furthermore, the growing demand for smart home devices and energy-efficient solutions is propelling market growth. Additionally, the surge in DIY (Do-It-Yourself) projects, supported by easy access to information and tools, is fostering an optimistic outlook for the industry.

In North America, the U.S. dominates the home improvement market, owing to its large number of aging homes and the rising trend of homeownership. Canada also shows a steady growth trajectory, with an increasing interest in sustainable and energy-efficient home improvements. Emerging regions such as Mexico are witnessing a rise in home improvement activities driven by urbanization and an expanding middle class. The demand for home improvement products and services is supported by growing construction and real estate sectors across these regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The North America Home Improvement Market was valued at USD 162.58 billion in 2018, USD 201.22 billion in 2024, and is projected to reach USD 283.49 billion by 2032, growing at a CAGR of 4.33% from 2024 to 2032.

- The U.S. leads the North America Home Improvement Market with around 70% market share, supported by a large base of aging homes and a strong renovation culture. Canada holds 20%, driven by demand for energy-efficient improvements. Mexico captures 10%, with growth supported by urbanization and increasing middle-class demand.

- Mexico is the fastest-growing region in the North America Home Improvement Market, driven by rapid urbanization and an expanding middle class, offering significant growth opportunities for home improvement services.

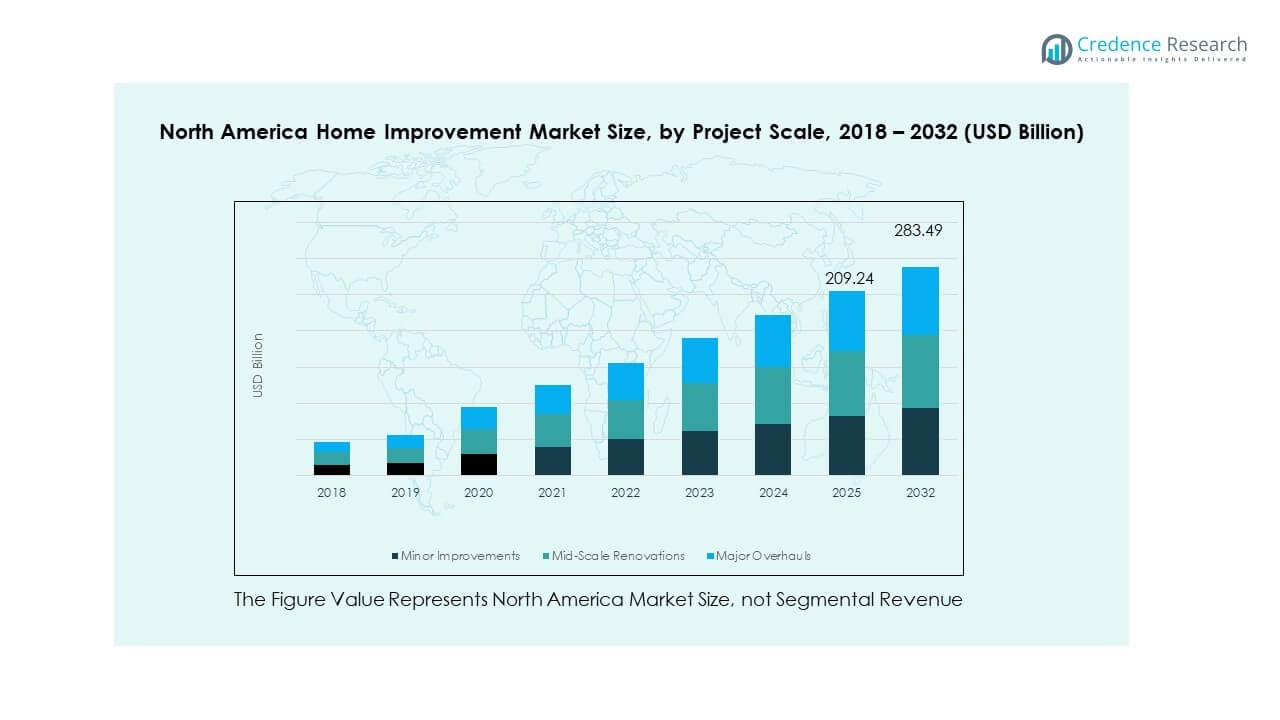

- The segment distribution shows Minor Improvements dominating the market share, followed by Mid-Scale Renovations and Major Overhauls, with each segment steadily increasing from 2020 to 2032.

- Segment-wise, Minor Improvements hold the largest share, while Major Overhauls contribute a significant portion of the market growth, reflecting the trend of larger and more complex home renovation projects.

Market Drivers:

Increasing Homeownership and Renovation Trends

The North America Home Improvement Market is heavily influenced by the growing trend of homeownership, particularly in the U.S. and Canada. Rising disposable incomes have allowed more homeowners to invest in renovating and upgrading their properties. Renovations, including kitchen and bathroom remodels, are considered valuable investments that increase a home’s value and appeal. Homeowners often prioritize home improvement projects to enhance comfort and functionality. These trends also reflect a shift towards maintaining homes longer, rather than moving to new ones, leading to consistent demand in the market.

- For instance, in 2024, Home Depot reported that consumers were postponing significant projects like kitchen and bathroom renovations due to high interest rates and broader economic uncertainty. The company’s sales growth was primarily driven by its business with professional contractors and acquisitions, rather than increased consumer spending on large do-it-yourself (DIY) projects.

Technological Advancements and Smart Home Integration

The integration of smart home devices and systems significantly contributes to the growth of the North America Home Improvement Market. Consumers increasingly seek energy-efficient and automated systems to enhance home functionality. Smart thermostats, lighting, and security systems are growing in popularity due to their ability to improve energy savings and provide convenience. Home improvement businesses are embracing smart technologies, offering innovative products that appeal to tech-savvy homeowners. This trend aligns with a larger consumer desire for connectivity and comfort in their homes.

- For instance, the global smart thermostat market is projected to reach approximately USD 6.0 billion in value in 2025, growing at a Compound Annual Growth Rate (CAGR) of around 17-20% from 2025 to 2030. This robust, double-digit expansion demonstrates how popular smart thermostats have become.

DIY Projects and Increased Consumer Empowerment

The rise of Do-It-Yourself (DIY) projects plays a crucial role in driving the North America Home Improvement Market. Consumers are increasingly empowered to take on home renovation tasks themselves, largely due to the vast availability of online resources and instructional content. The growth of DIY is fueled by a combination of factors such as cost savings and the sense of accomplishment it provides. Retailers and manufacturers have responded by offering more DIY-friendly products and tools. This shift is reflected in a market that is more focused on consumer autonomy and self-sufficiency.

Urbanization and Changing Lifestyles

Urbanization continues to shape the North America Home Improvement Market. As more individuals move into urban centers, there is an increased demand for home improvements that maximize smaller living spaces. This is especially true in cities with rising real estate prices, where homeowners are looking to optimize their available space. The trend toward more compact, multi-functional home designs is also prominent in new housing developments. Home improvements that enhance space efficiency, such as modular furniture and smart storage solutions, are becoming more sought after as a result of changing lifestyles in urban areas.

Market Trends:

Rise of Sustainable and Eco-Friendly Solutions

The North America Home Improvement Market is increasingly driven by sustainability and environmental concerns. Consumers are becoming more aware of the environmental impact of their homes and are seeking products that contribute to energy efficiency and waste reduction. Green building materials, such as recycled wood, eco-friendly insulation, and low-VOC paints, are gaining traction. Homeowners are prioritizing long-term environmental benefits over short-term savings. This trend is reflected in a growing demand for products that help create greener homes.

- For instance, green building materials, such as recycled wood, eco-friendly insulation (like some made from recycled paper or plastic bottles), and low-VOC paints, are gaining traction in the market due to growing demand for sustainable building solutions.

Rising Popularity of Home Automation and Connected Products

Automation and connected devices are revolutionizing the North America Home Improvement Market. Home automation systems that integrate lighting, security, heating, and cooling systems into one platform are becoming increasingly popular. Consumers are looking for ways to streamline their lives, making connected products an attractive option. In addition, the demand for smart appliances, such as refrigerators and washing machines, is also growing. These connected products provide enhanced convenience and energy savings, driving their adoption among homeowners who value both innovation and efficiency in their home improvement projects.

- For instance, the overall smart home market is experiencing significant growth, projected to grow at a Compound Annual Growth Rate (CAGR) of around 15-27%between 2025 and 2034, as consumers seek more control over their home environments. Consumers are looking for ways to streamline their lives and improve energy efficiency, making connected products an attractive option.

Focus on Wellness and Health-Oriented Spaces

There is a noticeable shift in the North America Home Improvement Market towards creating health-focused living spaces. Consumers are increasingly interested in making their homes places of wellness, investing in air purifiers, water filtration systems, and natural materials. Products that promote well-being, such as ergonomic furniture and sleep-enhancing mattresses, are also growing in popularity. Homeowners are focusing on creating spaces that foster physical and mental health, further pushing the demand for specialized home improvement products. This trend highlights how lifestyle changes are impacting the choices people make regarding home improvements.

Expansion of Online Shopping and E-commerce Platforms

The rise of e-commerce is playing a pivotal role in reshaping the North America Home Improvement Market. Online platforms have made it easier for consumers to access home improvement products, tools, and materials. Home improvement retailers are increasingly offering online shopping options and even virtual consultations, allowing customers to purchase everything from appliances to building materials. The convenience of shopping from home, combined with competitive pricing and home delivery services, is encouraging consumers to make purchases through online platforms rather than traditional brick-and-mortar stores.

Market Challenges Analysis:

Supply Chain Disruptions and Material Shortages

The North America Home Improvement Market faces significant challenges related to supply chain disruptions and material shortages. The COVID-19 pandemic exacerbated these issues, causing delays and driving up costs for home improvement products. The availability of key materials, such as lumber, steel, and other construction essentials, has fluctuated, making it difficult for businesses to meet consumer demand on time. These disruptions remain a challenge as manufacturers and suppliers work to stabilize the supply chain, and their resolution is crucial for sustaining market growth.

Labor Shortages and Skilled Workforce Gaps

Another challenge facing the North America Home Improvement Market is the shortage of skilled labor. Many homeowners rely on contractors and specialists to complete complex renovation and remodeling projects, but the industry is experiencing a lack of qualified professionals. This skills gap is particularly pronounced in specialized trades, such as plumbing, electrical work, and carpentry. The shortage of skilled labor leads to higher labor costs, delays in project timelines, and quality concerns. The issue remains a critical factor affecting the overall performance of the home improvement market.

Market Opportunities:

Growing Demand for Energy-Efficient Products

The North America Home Improvement Market presents significant opportunities driven by the growing demand for energy-efficient products. Homeowners are increasingly seeking products that lower energy consumption, reduce utility bills, and minimize environmental impact. Insulation materials, energy-efficient windows, and high-efficiency appliances are particularly in demand. This shift towards energy efficiency presents an opportunity for manufacturers to develop and market products that cater to this growing consumer concern. As energy efficiency continues to be a priority, innovations in home improvement products will play a key role in meeting these demands.

Opportunity for Smart Home Integration

The integration of smart home systems in the North America Home Improvement Market is a key opportunity for growth. Consumers are increasingly adopting smart technologies that improve home security, energy efficiency, and convenience. This presents an opportunity for companies to innovate and create new products that integrate seamlessly into connected homes. From smart lighting to home automation systems, the demand for these technologies is expected to rise, driving growth in the home improvement market. As consumers continue to embrace the benefits of smart homes, companies can expand their product offerings to meet this demand.

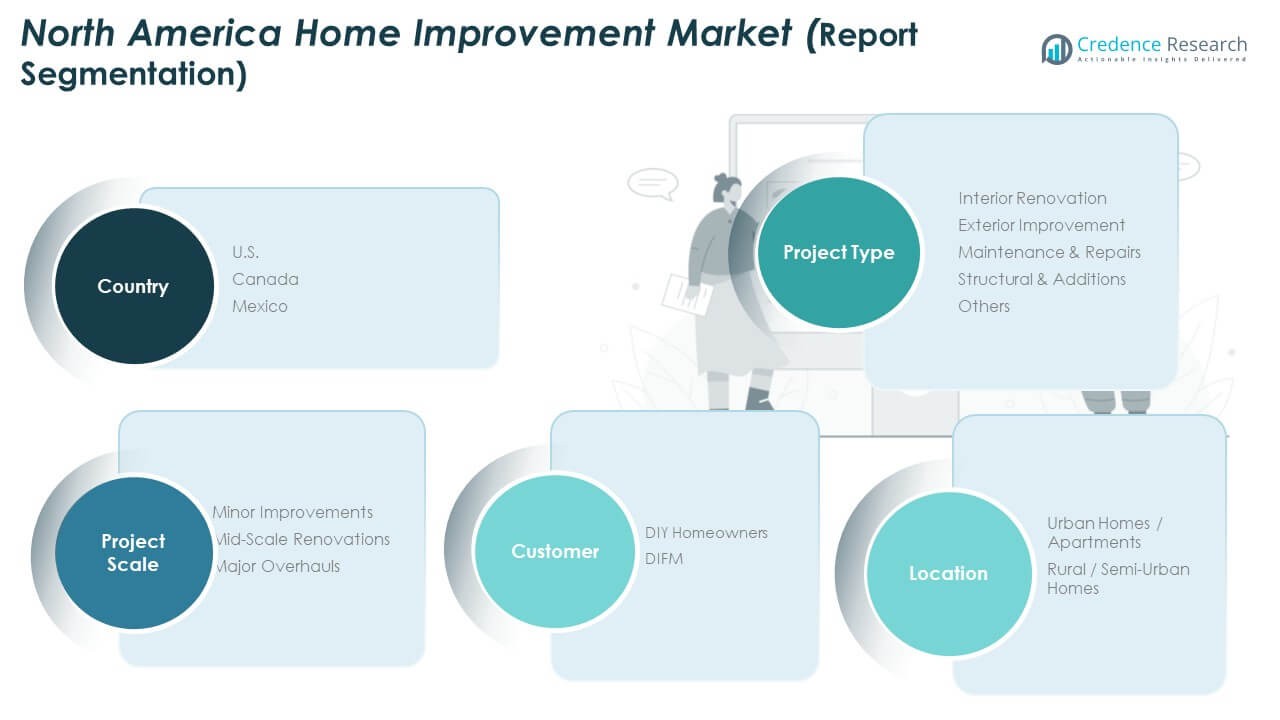

Market Segmentation Analysis:

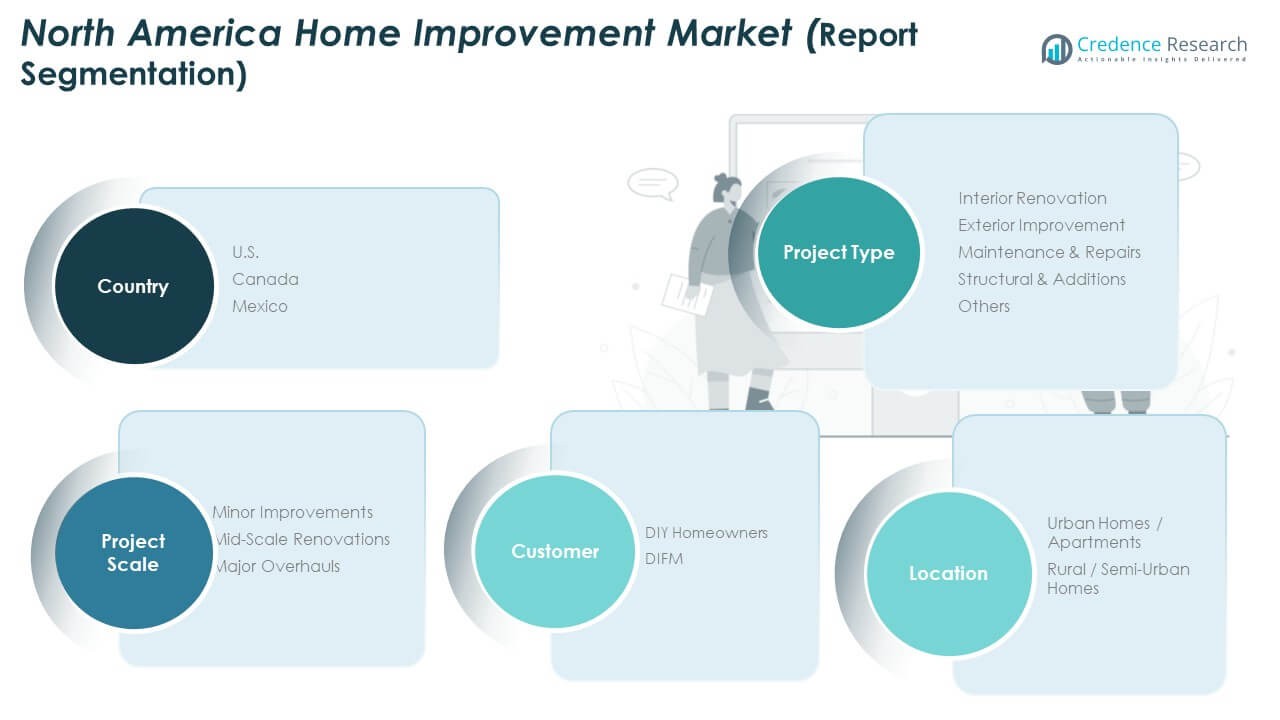

Project Type Segments

The North America Home Improvement Market is segmented into various project types, each catering to distinct needs. Interior renovation leads the market, driven by homeowners seeking to enhance living spaces through kitchen, bathroom, and living room updates. Exterior improvements are also significant, with homeowners investing in roofing, siding, and landscaping. Maintenance and repairs remain a consistent focus, particularly for aging homes. Structural and additions projects, such as home extensions or foundational work, are increasingly common as families grow. The “Others” category includes customized projects catering to niche needs.

- For example, in 2024, Texas saw a surge in new single-family home construction permits due to rapid population growth and efforts to improve housing affordability. To make homes more accessible, the median size of new construction homes in Texas actually decreased by over 5% compared to prior years, rather than increasing.

Project Scale Segments

Project scale plays a crucial role in the North America Home Improvement Market. Minor improvements dominate due to their low cost and quick turnaround, such as simple painting or fixture updates. Mid-scale renovations are increasingly popular, with homeowners opting for more comprehensive changes, including partial room remodels. Major overhauls, involving complete home redesigns or full-scale renovations, also see steady demand, especially in aging properties or luxury homes requiring extensive upgrades.

- For instance, in 2023, Sherwin-Williams reported a 4.1% increase in full-year consolidated sales, indicating a market where homeowners sought various updates. While minor home improvements like painting remained popular, a simultaneous trend saw homeowners increasingly opting for mid-scale renovations, including more comprehensive changes such as partial or full room remodels, often driven by a desire for personalization and increased property value.

Customer Type Segments

The North America Home Improvement Market serves both DIY homeowners and DIFM (Do-It-For-Me) customers. DIY homeowners continue to be a dominant segment, empowered by readily available tools and online resources. However, the DIFM segment is growing, with homeowners preferring to hire professionals for more complex or time-consuming projects. This shift reflects a demand for quality and convenience, driving growth in professional services across the market.

Location Segments

The location segments of the North America Home Improvement Market reflect diverse demands. Urban homes and apartments are witnessing a surge in space optimization projects, such as smart storage solutions. Meanwhile, rural and semi-urban homes see increased investment in both exterior and larger-scale structural improvements, as these areas often accommodate larger properties and more space for renovation projects.

Segmentation:

Project Type Segments

- Interior Renovation

- Exterior Improvement

- Maintenance & Repairs

- Structural & Additions

- Others

Project Scale Segments

- Minor Improvements

- Mid-Scale Renovations

- Major Overhauls

Customer Type Segments

- DIY Homeowners

- DIFM (Do-It-For-Me)

Location Segments

- Urban Homes / Apartments

- Rural / Semi-Urban Homes

Country Analysis

- North America

- U.S.

- Canada

- Mexico

Regional Analysis:

Dominance of the U.S. in the North America Home Improvement Market

The U.S. commands the largest share in the North America Home Improvement Market, estimated at approximately 70 % of the regional market value. It benefits from a large base of aging homes, a culture of renovation, and strong DIY activity. Homeowners in the U.S. allocate significant resources to remodeling, upgrades, and maintenance, which supports this dominant position. Contractors, specialty retailers, and mainstream home‑improvement chains converge to meet this demand. The mature nature of the U.S. market ensures stability but also intensifies competition among service providers and product suppliers. Given its scale, trends in the U.S. often set the tone for neighboring regions.

Stable Growth in Canada’s Market Share

Canada represents a steady contributor to the North America Home Improvement Market, holding around 20 % of the region’s share. It experiences demand driven by energy‑efficiency improvements, sustainable materials, and renovation of older housing stock in colder climates. Government incentives in certain provinces encourage upgrades in insulation, windows and mechanical systems, which enriches market opportunities. Urban centres such as Toronto and Vancouver drive higher‑end renovation work, while suburban and rural segments address broader home‑maintenance needs. The Canadian market’s moderate size offers room for international players to expand through partnerships or acquisitions focused on specialty services.

Emerging Potential in Mexico within the Regional Mix

Mexico captures the remaining roughly 10 % share of the North America Home Improvement Market and shows emerging growth potential. Urbanisation and a growing middle class fuel interest in home‑improvement projects, particularly in major metropolitan areas. While the market currently lags the U.S. and Canada in per‑home spend, its lower cost base and abundant labour create opportunities for cost‑effective renovation and add‑on services. Infrastructure development in housing and a shift toward modernisation of older homes are gaining momentum. Firms that establish efficient supply‑chains and local service models may realise significant gains in this evolving market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The North America Home Improvement Market is highly competitive, with a diverse range of players offering products and services across various segments. Major retailers, including The Home Depot, Lowe’s, and Menards, dominate the market, providing a wide selection of home improvement products. In addition to large retail chains, regional players and specialized service providers also contribute to market dynamics. The rise of e-commerce platforms, such as Amazon, has intensified competition by offering a broader selection and home delivery services. Companies are increasingly focusing on customer-centric solutions, including DIY tools, professional services, and smart home products. The competition is further enhanced by the trend toward sustainability, with businesses incorporating eco-friendly products and services. As the market grows, mergers, acquisitions, and partnerships will continue to shape its competitive landscape, with companies aiming to expand their offerings and reach.

Recent Developments:

- In October 2025, CR3 American Exteriors announced its official expansion to Cincinnati, Ohio, marking a significant milestone in the company’s rapid growth strategy across the North American home improvement sector. The company continues to focus on consolidation and franchise development as part of its broader strategy to become a nationwide leader in roofing and exterior remodeling.

- Hawkins HVAC Distributors, with locations in Charlotte, North Carolina and Columbia, South Carolina, acquired in April 2025 and Southern Ice Equipment Distributors, a Lafayette, Louisiana-based food-service and commercial refrigeration equipment distributor with seven locations across Sunbelt markets, acquired in May 2025.

- In 2025, Watsco, Inc. executed a strategic “buy and build” expansion across the heating, air conditioning, and refrigeration (HVAC/R) distribution market. The company completed three significant acquisitions during the first half of 2025: Lashley & Associates, a Houston, Texas-based distributor of commercial supplies and custom air movement products acquired in January 2025.

Report Coverage:

The research report offers an in-depth analysis based on project type, scale, customer type, and location. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Growth of e-commerce platforms and online sales for home improvement products will continue to shape the market.

- There will be an increasing demand for sustainable and energy-efficient home improvement solutions.

- Smart home technology integration will play a larger role in shaping consumer purchasing decisions.

- DIY projects will remain popular, but the DIFM segment is expected to grow due to demand for professional expertise.

- Urbanization will lead to a higher demand for home improvement projects focused on space optimization in cities.

- Innovations in eco-friendly building materials will increase as consumers seek more sustainable options.

- The aging housing stock in North America will fuel demand for renovations and repairs.

- Regional players will see growth as they capitalize on localized service offerings and specialized needs.

- Strategic partnerships and acquisitions will increase as companies seek to expand their product offerings and market presence.

- Increased focus on health and wellness in the home will lead to higher demand for products that promote better living environments.