Market Overview:

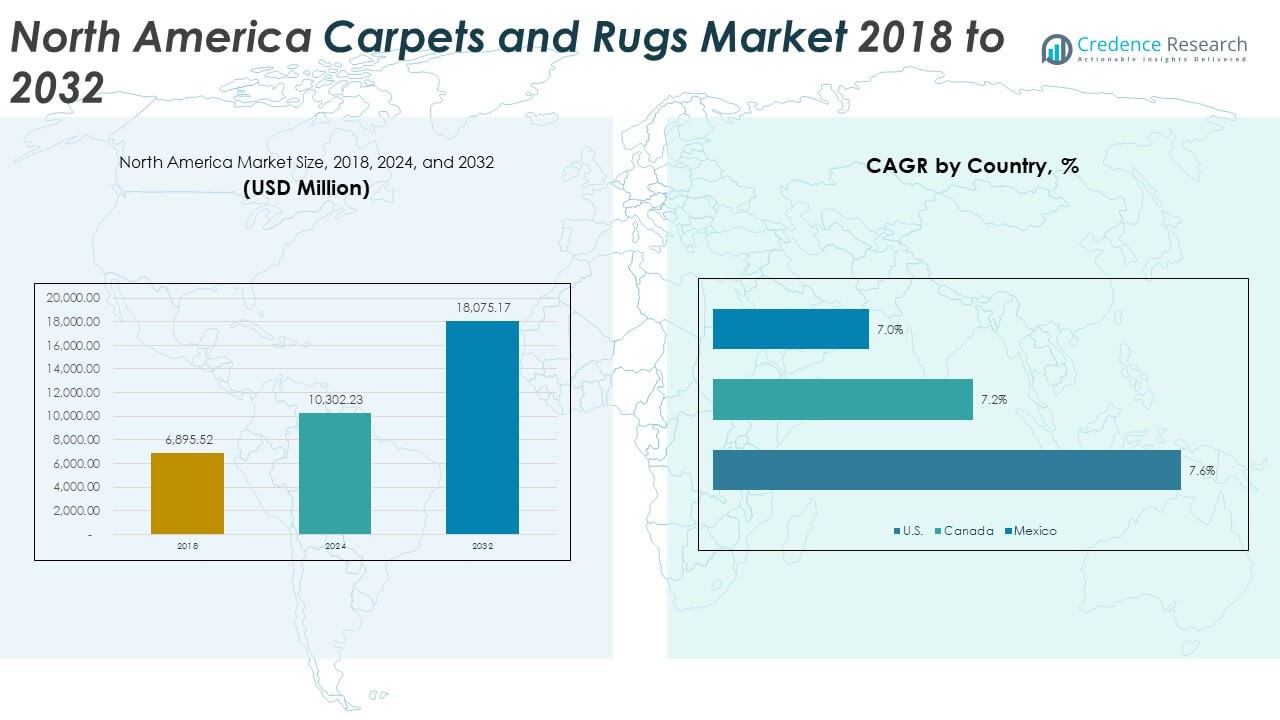

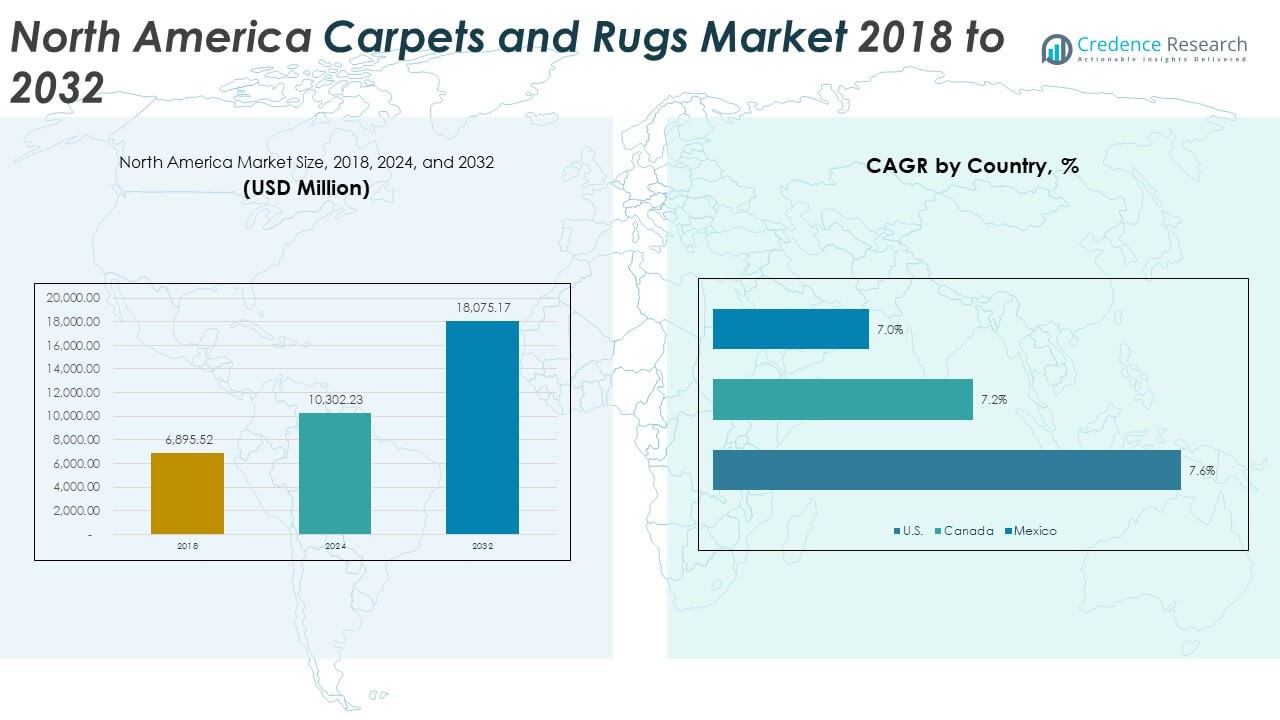

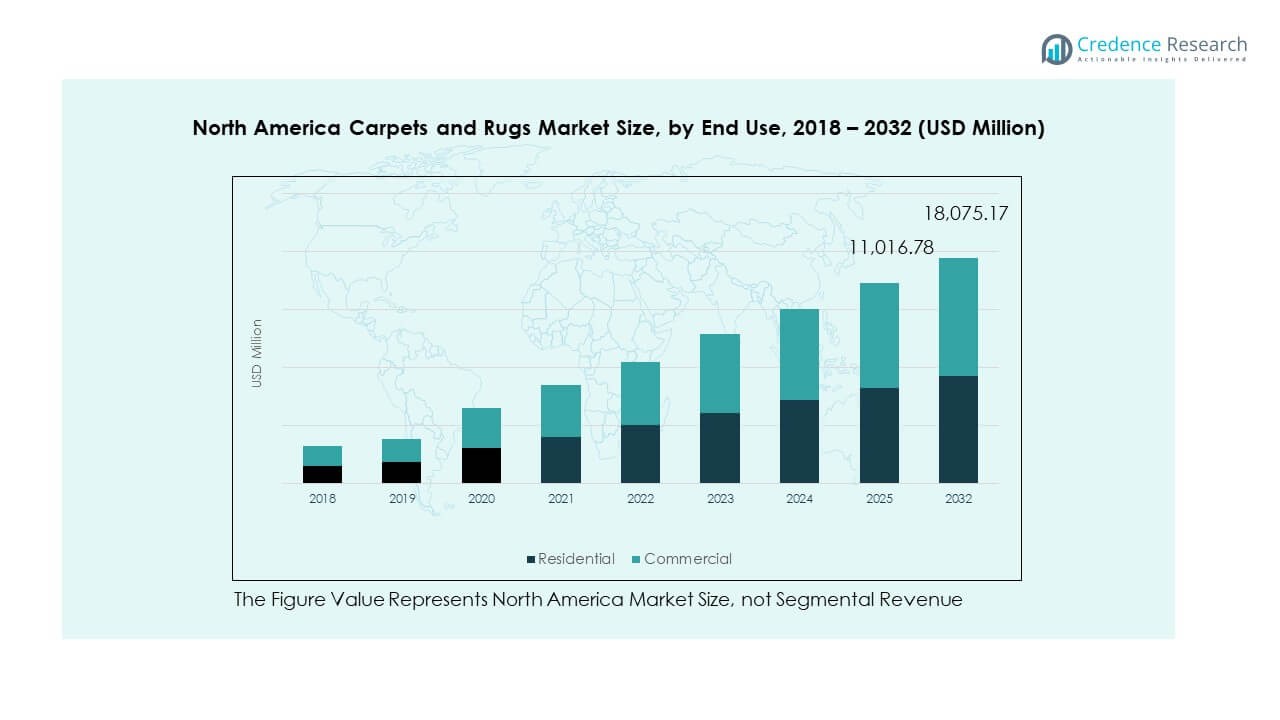

The North America Carpets and Rugs Market size was valued at USD 6,895.52 million in 2018 to USD 10,302.23 million in 2024 and is anticipated to reach USD 18,075.17 million by 2032, at a CAGR of 7.34% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| North America Carpets and Rugs Market Size 2024 |

USD 10,302.23 Million |

| North America Carpets and Rugs Market, CAGR |

7.34% |

| North America Carpets and Rugs Market Size 2032 |

USD 18,075.17 Million |

The market’s growth is driven by increasing demand for aesthetically pleasing, durable, and eco-friendly flooring solutions. Consumer preference for carpets that offer comfort, soundproofing, and insulation has intensified, along with a growing emphasis on sustainable products. The rise in renovation and remodeling activities, coupled with the expansion of the real estate sector, has significantly boosted demand. Additionally, innovations in manufacturing techniques, such as stain-resistant and easy-to-clean finishes, have contributed to increased consumer interest in carpets and rugs.

North America remains a dominant force in the carpets and rugs market, with the United States leading in both production and consumption. The increasing popularity of home renovations and commercial real estate projects in urban areas further drives demand for quality flooring solutions. Canada and Mexico also show growth potential, with rising investments in residential and commercial infrastructure. While the U.S. continues to hold a significant share, emerging regions like Canada are experiencing steady demand, particularly for eco-friendly and high-performance carpet options.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The North America Carpets and Rugs Market was valued at USD 6,895.52 million in 2018, growing to USD 10,302.23 million in 2024 and is expected to reach USD 18,075.17 million by 2032, at a CAGR of 7.34%.

- The United States holds the largest market share in North America, accounting for over 70%, driven by its extensive consumer base and high demand across both residential and commercial sectors. Canada follows with a 15% share, fueled by rising disposable incomes and urbanization, while Mexico captures around 10% due to growing urbanization and increasing middle-class demand.

- Canada is the fastest-growing region, with a significant increase in demand due to its expanding residential construction and commercial projects, along with a focus on sustainable product choices.

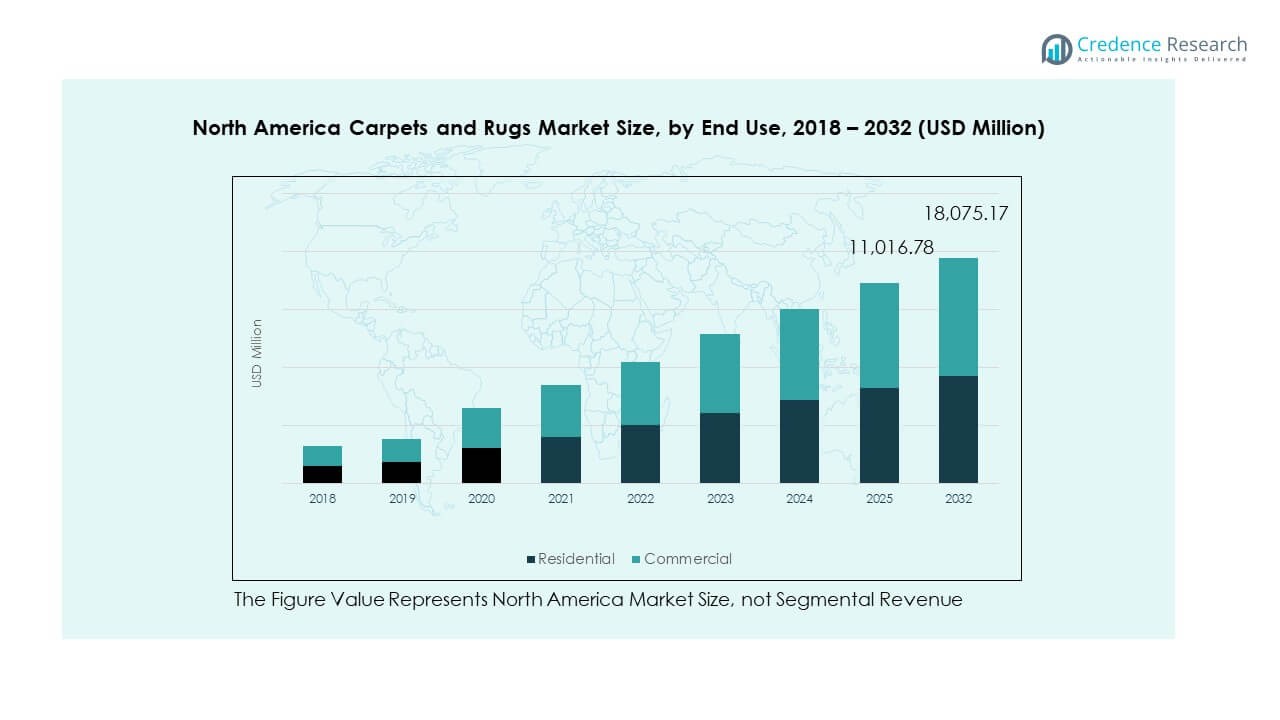

- The residential segment is the dominant share holder in the market, with over 60% of the revenue, driven by increasing homeownership and renovation trends. The commercial segment, although smaller, is growing steadily, contributing around 40% due to rising demand from offices, retail, and hospitality sectors.

- The North America Carpets and Rugs Market is largely driven by demand for durable and eco-friendly flooring solutions, with technological advancements and the growing trend for customization contributing to market expansion.

Market Drivers:

Increasing Demand for Sustainable Products

Sustainability plays a crucial role in driving the North America Carpets and Rugs Market. Consumers are becoming more environmentally conscious and demanding eco-friendly options. Manufacturers are responding to this trend by offering products made from sustainable materials, such as recycled fibers and organic cotton. The growing interest in green living and the desire to reduce environmental footprints are shaping purchasing decisions. Many companies now provide carpets with certifications that guarantee environmental compliance, which attracts a more eco-conscious consumer base. The demand for biodegradable and recyclable carpets continues to rise, further pushing this market segment.

- For instance, Mohawk Industries, a key player in the market, introduced its “SmartStrand” carpet, which is made in part from renewable, plant-based materials and is 100% recyclable when combined with its ReCover backing system. This aligns with the company’s commitment to sustainability, as it has reduced its greenhouse gas emissions intensity by 30% since 2010. The growing interest in green living and the desire to reduce environmental footprints are shaping purchasing decisions. Companies like Interface, Inc. have also committed to reducing their environmental impact by producing carbon-neutral carpets as part of their “Carbon Neutral Floors” program, which resonates well with eco-conscious consumers.

Expansion in Residential and Commercial Construction

The North America Carpets and Rugs Market benefits from the expansion in both residential and commercial construction. With urbanization and the increasing number of construction projects, the demand for quality flooring solutions has surged. Builders and developers prefer carpets and rugs for their ability to provide comfort, insulation, and aesthetics. This growth in residential housing and office spaces directly drives the demand for carpets. Many commercial spaces, including hotels, offices, and retail stores, are investing in carpets and rugs to improve the customer experience and ambiance. The expanding construction sector thus remains a significant factor fueling market growth.

- For instance, Shaw Industries, a leader in the market, has partnered with major real estate developers to supply eco-friendly carpets for commercial properties, including office buildings and hotels. This growth in residential housing and office spaces directly drives the demand for carpets.

Technological Advancements in Carpet Manufacturing

Technological advancements are revolutionizing the North America Carpets and Rugs Market by improving product quality and performance. Innovations in manufacturing processes have led to the development of more durable, stain-resistant, and easy-to-maintain carpets. These technologies offer added value, such as improved comfort, resistance to wear, and innovative designs. With advancements like 3D printing and digital printing, companies are now able to create highly customizable products that meet the specific needs of consumers. These developments make carpets more functional and appealing, contributing to increased market demand.

Changing Consumer Preferences for Versatile and Multifunctional Carpets

Consumer preferences are shifting towards carpets that serve multiple purposes, influencing the North America Carpets and Rugs Market. Homeowners and businesses are now looking for flooring solutions that not only provide comfort but also offer additional benefits, such as soundproofing, insulation, and allergy control. Carpets with enhanced functionality are in high demand, particularly in urban areas. Products that serve both aesthetic and practical needs, such as carpets that help maintain indoor air quality, are becoming increasingly popular. As lifestyle changes and consumer expectations evolve, the market for versatile carpets continues to expand.

Market Trends:

Customization and Personalization in Carpet Designs

The demand for personalized and customized carpets is a growing trend in the North America Carpets and Rugs Market. Consumers are increasingly seeking unique products that reflect their individual style and preferences. Many manufacturers now offer a wide range of customization options, including different colors, patterns, and sizes, to cater to these needs. This trend is particularly evident in high-end residential and commercial spaces where bespoke designs are highly valued. Custom-designed carpets provide added exclusivity and appeal, making them a preferred choice among discerning customers.

- For example, Ruggable LLC offers washable, customizable rugs, allowing customers to select unique patterns and sizes that fit their home décor. This trend is particularly evident in high-end residential and commercial spaces where bespoke designs are highly valued. Custom-designed carpets provide added exclusivity and appeal, making them a preferred choice among discerning customers.

Rise of Smart Carpets with Integrated Technology

Smart carpets are emerging as an innovative trend in the North America Carpets and Rugs Market. With the integration of sensors, heating systems, and other technologies, these carpets offer additional functionality beyond their traditional role. Smart carpets can detect motion, monitor air quality, and even regulate temperature, providing increased convenience and energy efficiency. As consumers seek more technologically advanced products, smart carpets are becoming a niche yet promising segment in the market. The demand for smart home solutions drives the need for carpets that can contribute to a more connected living environment.

- For instance, smart carpets developed by companies like Floorcoverings are equipped with embedded sensors that track foot traffic and adjust room temperature to optimize comfort. These carpets can also detect motion and monitor air quality, providing increased convenience and energy efficiency.

Increasing Popularity of Luxury and High-End Carpets

Luxury carpets are becoming increasingly popular in the North America Carpets and Rugs Market, particularly among high-income households and commercial properties. These carpets are often made from premium materials like wool, silk, and cotton and feature intricate designs that elevate the aesthetic appeal of any space. The growing desire for luxury interiors and the willingness to invest in high-quality products are key drivers of this trend. Consumers are choosing luxury carpets for their durability, comfort, and status, and these products are now seen as an essential element of high-end home décor.

Growth of Online Retail and E-Commerce for Carpets

E-commerce is transforming the North America Carpets and Rugs Market by offering consumers the convenience of online shopping. As more people turn to online platforms for their purchasing needs, companies in the market are enhancing their digital presence. Online retailers are providing detailed product descriptions, customer reviews, and virtual design tools, which help consumers make informed decisions. This trend is especially popular among younger generations who are more accustomed to shopping online. The rise of online platforms is expanding the market reach, providing manufacturers with new opportunities to connect with a broader audience.

Market Challenges Analysis:

Rising Raw Material Costs and Supply Chain Disruptions

The North America Carpets and Rugs Market faces challenges due to the increasing cost of raw materials, which significantly impacts production costs. Prices for essential materials such as wool, nylon, and cotton fluctuate, causing uncertainty in cost planning for manufacturers. Additionally, supply chain disruptions, particularly in the wake of global events, have led to delays in sourcing and delivering raw materials. These challenges increase the financial pressure on companies in the market. Manufacturers must find ways to optimize their supply chains and reduce costs without compromising product quality to remain competitive.

Pressure to Meet Environmental Regulations

Environmental regulations are becoming stricter across North America, and the carpets and rugs industry must adapt to these changes. Companies face pressure to meet evolving regulations on the use of harmful chemicals, waste management, and recycling standards. Adhering to these standards often requires significant investments in technology and manufacturing processes. The increasing emphasis on sustainability means that companies must continuously innovate to comply with these regulations while meeting consumer demand for eco-friendly products. These challenges pose barriers to growth but also provide opportunities for those who can adapt quickly.

Market Opportunities:

Growing Demand for Eco-Friendly and Recyclable Carpets

Eco-conscious consumers are driving demand for environmentally friendly carpets in the North America Carpets and Rugs Market. As sustainability becomes a key factor in purchasing decisions, manufacturers are encouraged to develop products made from recycled fibers and renewable materials. Carpets with low environmental impact, such as those made from organic cotton or wool, are gaining traction. Manufacturers can capitalize on this trend by expanding their eco-friendly product lines and meeting the increasing consumer demand for sustainable flooring solutions.

Innovative Product Offerings with Technological Features

The integration of technology into carpets presents significant growth opportunities in the North America Carpets and Rugs Market. Innovative products such as smart carpets that feature sensors for air quality monitoring or built-in heating systems are attracting interest. These products cater to the growing demand for multifunctional home décor that offers convenience and energy efficiency. Manufacturers who invest in developing and marketing these high-tech carpets have the potential to capture a lucrative market segment focused on smart home innovations.

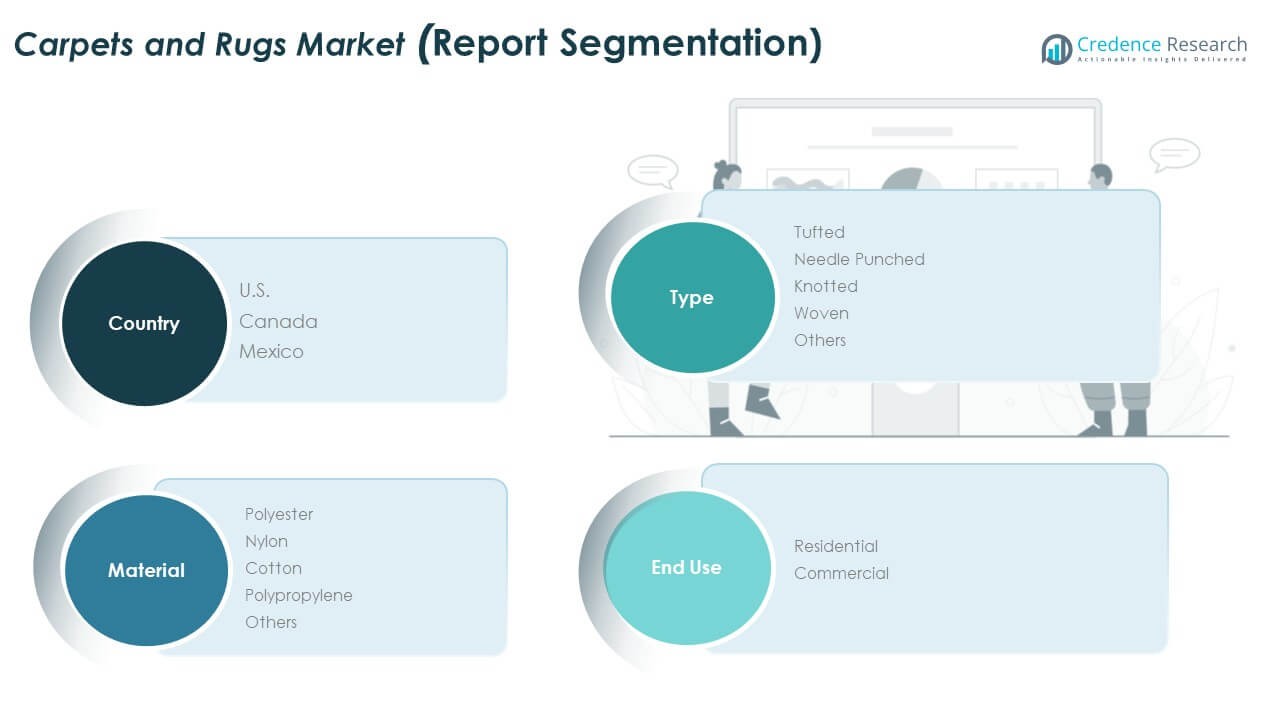

Market Segmentation Analysis:

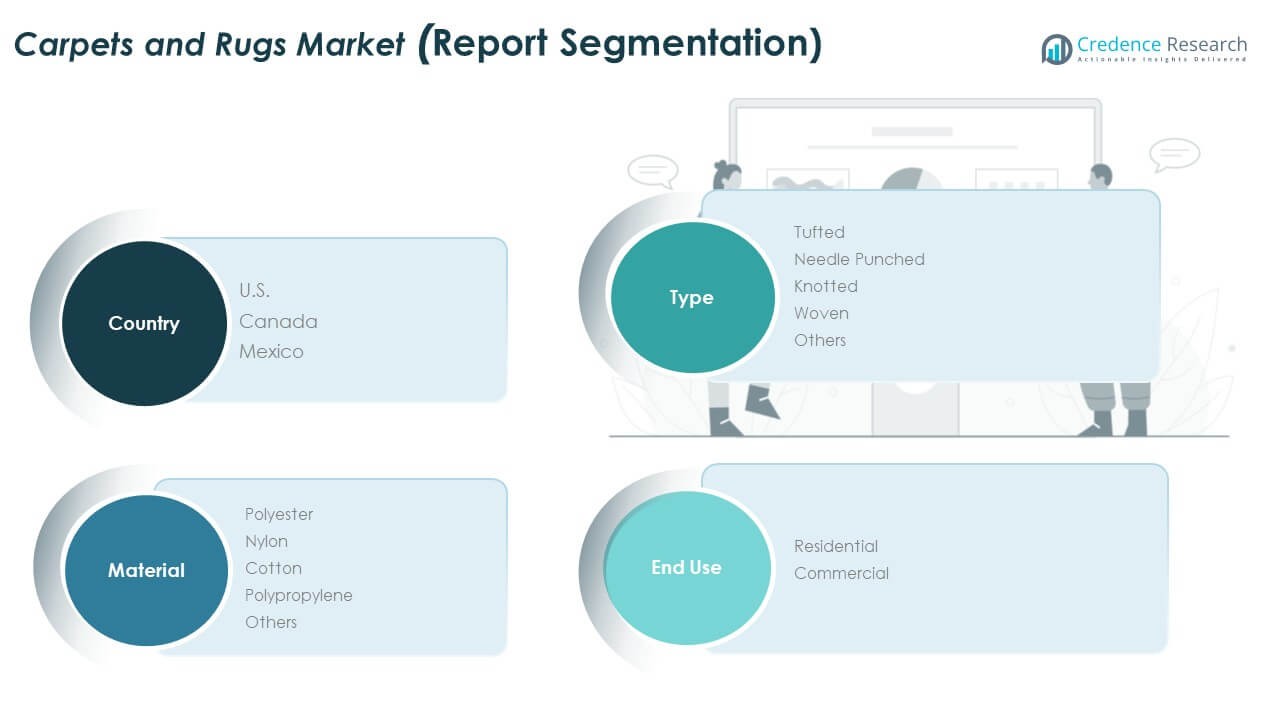

By Type

The North America Carpets and Rugs Market is primarily segmented into tufted, needle-punched, knotted, woven, and other types. Tufted carpets dominate the market due to their affordability and versatility, making them popular in both residential and commercial applications. Needle-punched carpets are known for their durability and are commonly used in industrial environments and high-traffic areas. Knotted carpets, with their intricate craftsmanship, serve the premium market, while woven carpets are valued for their durability and aesthetic appeal. The “Others” category caters to custom designs, which meet niche market demands.

- For example, Mohawk Industries, a major player, produces tufted carpets using advanced technology that ensures both durability and design flexibility. Needle-punched carpets are known for their durability and are commonly used in industrial environments and high-traffic areas.

By Material

Polyester, nylon, cotton, polypropylene, and other materials drive the material segment of the North America Carpets and Rugs Market. Polyester remains a popular choice due to its affordability and ease of maintenance. Nylon dominates due to its resilience, strength, and ability to withstand high traffic, making it ideal for commercial applications. Cotton offers a natural alternative and is favored for its comfort, while polypropylene provides water resistance and durability. Other materials cater to specific needs, such as eco-friendly products or specialized uses.

- For example, Shaw Industries uses nylon in its carpets to ensure long-lasting performance, particularly in high-traffic spaces like office buildings and hotels.

By End-Use

The end-use segment is divided into residential and commercial applications. The residential sector is a significant driver, as consumers invest in carpets and rugs for aesthetic and functional purposes. Commercial applications, including offices, hotels, and retail spaces, also contribute to market growth due to the demand for durable, high-quality flooring solutions that enhance ambiance and comfort.

By Application / Region

The North America Carpets and Rugs Market is segmented by region, with the U.S., Canada, and Mexico playing key roles. The U.S. holds the largest market share due to its vast consumer base and high demand across residential and commercial sectors. Canada and Mexico also experience growing demand, driven by urbanization and rising disposable incomes in both countries.

Segmentation:

By Type:

- Tufted

- Needle-Punched

- Knotted

- Woven

- Others

By Material:

- Polyester

- Nylon

- Cotton

- Polypropylene

- Others

By End-Use:

By Application / Region:

Regional Analysis:

United States

The United States holds the largest share of the North America Carpets and Rugs Market, commanding over 70% of the region’s total revenue. This dominance is attributed to the high demand for both residential and commercial flooring solutions. The U.S. benefits from a large, diverse consumer base and a thriving construction industry, which continues to drive demand for carpets and rugs. The market is further supported by a growing preference for sustainable and high-quality products, alongside significant technological advancements in carpet manufacturing. Key commercial sectors such as hospitality, retail, and office spaces contribute to the market’s continued growth, with U.S. consumers increasingly opting for durable, stylish, and multifunctional carpets. As the largest economy in the region, the U.S. market remains highly competitive, with numerous domestic and international players vying for market share.

Canada

Canada is another key market in North America, accounting for approximately 15% of the regional market share. The demand for carpets and rugs in Canada is fueled by steady growth in both residential and commercial sectors. The country’s urbanization trends, coupled with an increase in disposable incomes, have significantly contributed to the demand for home décor products, including flooring solutions. Furthermore, Canadian consumers are increasingly drawn to eco-friendly options, such as carpets made from sustainable materials. The market is characterized by a strong preference for durable, high-performance materials, with advancements in carpet technology meeting the growing demand for low-maintenance products. Canada’s steady economic growth and rising homeownership rates are expected to continue driving market expansion.

Mexico

Mexico holds a smaller share of the North America Carpets and Rugs Market, but it has experienced significant growth in recent years, contributing around 10% to the regional market share. The demand for carpets and rugs in Mexico is rising due to increased urbanization, with more middle-class households investing in home improvement products. Both residential and commercial sectors are showing growth, particularly in areas with a rising demand for office spaces and retail environments. The country’s increasing awareness of sustainability has also driven the adoption of eco-friendly carpet materials. As the Mexican economy grows, demand for high-quality and affordable flooring options is expected to continue rising, making it a promising market for future growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Mohawk Industries, Inc.

- Shaw Industries Group, Inc.

- The Dixie Group, Inc.

- Interface, Inc.

- Beaulieu of America

- Engineered Floors LLC

- Ruggable LLC

- Kaleen

- JAVI Home

- The Royalty Carpet Mills Inc.

Competitive Analysis:

The North America Carpets and Rugs Market is highly competitive, with several established players dominating the industry. Key companies, such as Mohawk Industries, Shaw Industries, and Interface, are continuously innovating to maintain their market positions. These companies leverage a strong distribution network, strategic partnerships, and advanced manufacturing technologies to meet consumer demand for both aesthetic and functional flooring solutions. As consumer preferences shift toward eco-friendly products, companies are focusing on sustainable offerings to enhance their market presence. The competitive landscape is further intensified by the growing demand for luxury and customizable carpets, prompting companies to diversify their product portfolios. Innovation, sustainability, and cost-efficiency remain the key drivers for competition in the market.

Recent Developments:

- In September 2025, Ruggable announced its most significant product evolution: All-in-One, one-piece washable rugs designed for simplified modern living. The launch includes two distinct textures—Tufted and Plush—with the first release featuring 7 new Tufted styles and 9 new Plush styles in four sizes. Ruggable also launched its latest Founders collection with 17 new pieces, the first collection entirely available in the new Tufted All-in-One texture, with pricing starting at $119.

- In January 2025, Ruggable teamed up with Architectural Digest to unveil a new design collaboration focused on 2025 interior design trends. This 10-piece collection drew inspiration from anticipated design movements and highlighted three distinct styles, reinforcing Ruggable’s position as a design-forward brand in the machine-washable home textiles market.

- In January 2025, Engineered Floors revealed its comprehensive 2025 hard surface strategy with an ambitious expansion of its PureGrain brand, introducing 132 new SKUs across five distinct product lines. These include PureGrain High-Def featuring innovative digital printing technology, PureGrain Comfort introducing 24 new Wood Plastic Composite SKUs, PureGrain Endure offering Stone Plastic Composite options, PureGrain Renew providing a PVC-free laminate alternative, and PureGrain Flex with flexible application options. This expansion demonstrates Engineered Floors’ commitment to addressing diverse market demands and sustainability concerns.

Report Coverage:

The research report offers an in-depth analysis based on type, material, end-use, and region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The market will continue to experience growth driven by increasing demand for eco-friendly flooring solutions.

- Innovations in manufacturing technology will lead to more durable, sustainable, and customizable carpet options.

- The demand for luxury and high-end carpets is expected to rise in both residential and commercial sectors.

- Growing urbanization and residential construction will support sustained market demand in North America.

- E-commerce and online retail will play an increasingly significant role in the distribution of carpets and rugs.

- Technological integration, such as smart carpets with integrated sensors, will be a major growth driver.

- The focus on sustainability will prompt more companies to adopt greener production practices.

- Rising consumer preferences for multifunctional products will further propel the demand for carpets with added features like soundproofing.

- Competitive pressures will encourage larger players to invest in acquisitions, mergers, and strategic partnerships.

- The North America Carpets and Rugs Market will see strong growth in Canada and Mexico as their construction and real estate sectors expand.