Market Overview:

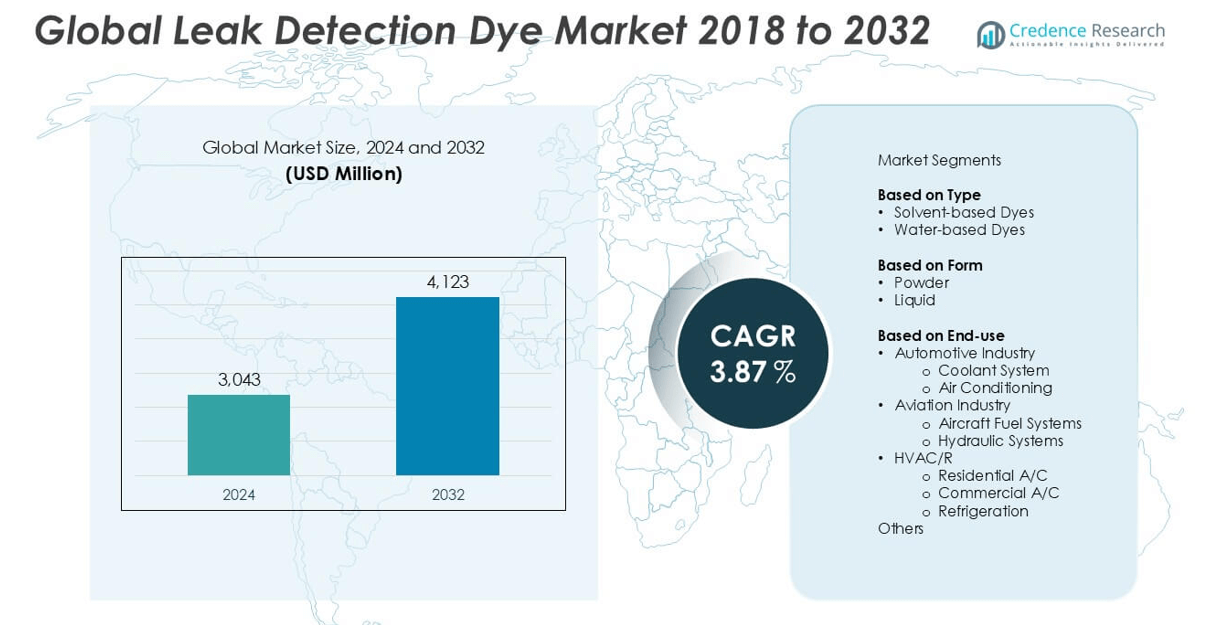

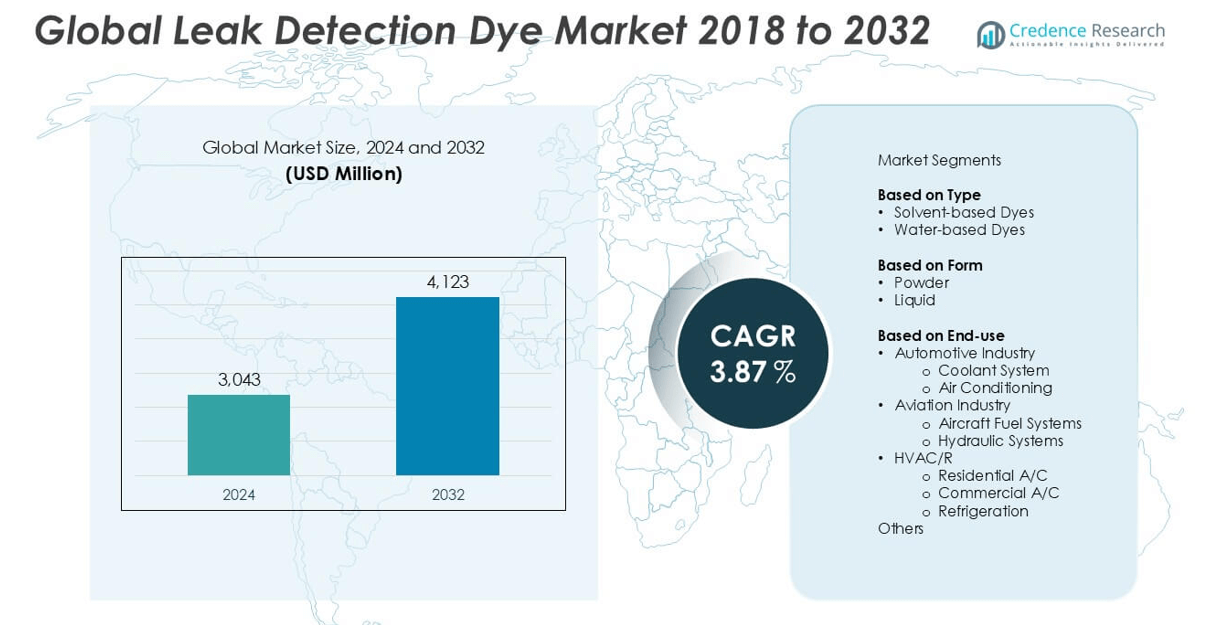

The Leak Detection Dye market size was valued at USD 3,043 million in 2024 and is anticipated to reach USD 4,123 million by 2032, growing at a CAGR of 3.87% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Leak Detection Dye Market Size 2024 |

USD 3,043 million |

| Leak Detection Dye Market, CAGR |

3.87% |

| Leak Detection Dye Market Size 2032 |

USD 4,123 million |

Top players in the Leak Detection Dye market include Spectronics Corporation, Chromatech Incorporated, Wurth Group, Cool Air Products, and Kingscote Chemicals, all of which maintain a strong global presence through diversified product portfolios and advanced detection technologies. These companies focus on product innovation, regulatory compliance, and expanding into emerging markets to gain a competitive edge. North America emerged as the leading region in 2024, accounting for 34% of the global market share, driven by stringent emission regulations, robust industrial infrastructure, and widespread adoption of preventive maintenance practices across automotive and HVAC/R sectors.

Market Insights

- The Leak Detection Dye market was valued at USD 3,043 million in 2024 and is projected to reach USD 4,123 million by 2032, growing at a CAGR of 3.87% during the forecast period.

- Market growth is driven by rising demand for preventive maintenance across automotive, HVAC/R, and industrial sectors, along with strict regulatory requirements for emission and fluid leak control.

- A key trend includes the shift toward eco-friendly, non-toxic, and water-based dye formulations, along with integration with smart diagnostic tools and UV technologies for faster and safer leak detection.

- The competitive landscape is moderately fragmented, with players like Spectronics Corporation, Wurth Group, and Chromatech Incorporated leading through innovation, geographic expansion, and sustainable product offerings.

- Regionally, North America held the largest share at 34%, followed by Europe at 27% and Asia Pacific at 22%; among segments, solvent-based and liquid form dyes dominated due to superior compatibility and ease of application.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

In the Leak Detection Dye market, solvent-based dyes dominate the type segment, accounting for the largest market share in 2024. Their strong compatibility with oils, refrigerants, and fuels used in automotive and HVAC/R systems drives their widespread adoption. These dyes are preferred for their superior visibility under UV light and long-lasting performance, making them ideal for industrial-grade leak detection. Water-based dyes, although gaining traction due to environmental and safety concerns, are more commonly used in low-risk or indoor systems. However, their lower durability and limited chemical compatibility constrain their broader application.

- For instance, Spectronics Corporation manufactures the GLO-AWAY™ series, a solvent-based dye that offers UV visibility up to 2,000 hours in sealed systems and can bedetected at concentrations as low as 1 ppm, supporting its industrial utility across diverse refrigerant and lubricant systems.

By Form

Among the two forms, liquid dyes hold the largest market share due to their ease of use, fast dispersion, and high solubility in a variety of fluids. Liquid dyes are extensively used across industries for real-time leak tracing without requiring complex preparation. Their popularity is particularly strong in the automotive and HVAC/R sectors, where rapid maintenance cycles demand efficient solutions. While powder dyes offer benefits such as longer shelf life and cost-effectiveness, their limited solubility and additional handling requirements make them less preferred for immediate applications, especially in high-performance environments.

- For instance, Cool Air Products offers AC SmartSeal Quick Shot, a liquid-based fluorescent dye product that disperses fully in under 45 seconds and is compatible with all refrigerants including R-410A and R-134a, providing field technicians with rapid diagnostics for HVAC and automotive leak repairs.

By End-use

The automotive industry leads the end-use segment, capturing the highest market share in 2024. Within this sector, coolant system applications are the most dominant, driven by the need for early leak detection to prevent overheating and engine damage. Additionally, leak detection dyes are vital in air conditioning systems for both preventive maintenance and repair diagnostics. The HVAC/R segment, especially in commercial A/C and refrigeration systems, follows closely due to increased demand for energy efficiency and regulatory compliance in cooling operations. Aviation and other industrial applications represent smaller yet steadily growing segments fueled by safety-critical maintenance requirements.

Market Overview

Rising Demand for Preventive Maintenance Across Industries

The increasing focus on preventive maintenance in sectors such as automotive, HVAC/R, and industrial manufacturing is driving the demand for leak detection dyes. These dyes enable fast, accurate identification of leaks, thereby reducing equipment downtime and maintenance costs. As operational efficiency becomes a priority, industries are integrating dye-based detection as part of their routine servicing. This proactive approach to system reliability and lifecycle management has significantly boosted the adoption of fluorescent and UV-reactive dyes in both aftermarket and OEM applications.

- For instance, Wurth Group’s leak detection system for automotive servicing incorporates UV dye detection capable of identifying leaks as small as 0.1 mL/min, enabling routine inspection intervals of every 10,000 km and minimizing breakdown risks in commercial fleets.

Expansion of Automotive and HVAC/R Sectors

The steady expansion of the automotive and HVAC/R sectors globally is a major driver for the leak detection dye market. With the growth in vehicle production and the increasing use of air conditioning systems in both residential and commercial spaces, the need for efficient and non-invasive leak detection tools is rising. Dyes are widely used in coolant systems, refrigerant lines, and engine fluids, enabling rapid diagnostics. Regulatory standards for environmental safety in refrigerant handling also encourage the adoption of dye-based systems for leakage control.

- For instance, J.C. Whitlam Manufacturing Co. supplies HVAC leak detection kits compatible with refrigerants like R-22, R-410A, and R-134a, which are capable of tracing leaks in systems up to 5 tons capacity, supporting diagnostics in both compact residential and large-scale commercial units.

Regulatory Push for Emissions Control and System Integrity

Stricter environmental regulations targeting refrigerant emissions and fluid leakage are encouraging the use of leak detection dyes. Government mandates and international protocols, such as the Kigali Amendment and F-Gas Regulation, emphasize the importance of detecting and addressing system leaks promptly. Leak detection dyes offer a compliant and cost-effective solution for industries aiming to meet these standards without disrupting operations. This regulatory environment is expected to sustain long-term growth for dye-based detection systems, particularly in energy-intensive and environmentally sensitive applications.

Key Trends & Opportunities

Shift Toward Eco-friendly and Biodegradable Dye Formulations

A growing trend in the leak detection dye market is the development of eco-friendly and biodegradable dye formulations. Manufacturers are responding to environmental concerns by introducing water-based, non-toxic, and low-VOC dyes. These products are gaining traction in indoor, consumer-facing, and environmentally regulated applications. This shift aligns with global sustainability goals and presents an opportunity for market players to differentiate their offerings while complying with evolving green regulations and consumer expectations.

- For instance, Kingscote Chemicals developed the TRACERLINE® TP-3940, a water-based fluorescent dye that meets OECD 301 biodegradability standards, with 99.3% degradation in 28 days, making it ideal for environmentally sensitive leak detection in residential HVAC and potable water systems.

Integration with Smart Diagnostic Tools and IoT Systems

The integration of leak detection dyes with smart diagnostic tools and IoT-based monitoring systems is opening new growth avenues. Advanced UV flashlights, camera-based detection systems, and digital sensors now enable more precise and automated leak detection. These technologies are increasingly used in high-value applications such as aerospace, pharmaceuticals, and high-performance HVAC systems. This trend supports predictive maintenance strategies and enhances operational transparency, creating opportunities for dye manufacturers to partner with technology firms and expand their product ecosystems.

- For instance, OceanTools Ltd. developed the DyeTector system, which integrates with ROVs and uses high-sensitivity optical sensors capable of detecting dye plumes in subsea environments at depths of up to 3,000 meters, enabling real-time data transmission for leak surveillance in offshore oil operations.

Key Challenges

Health and Safety Concerns Over Chemical Exposure

One of the significant challenges in the leak detection dye market is the health and safety concerns associated with chemical exposure. Certain solvent-based dyes contain volatile organic compounds (VOCs) or irritants that may pose risks to technicians and end users. Regulatory bodies are tightening restrictions on such substances, which may lead to reformulations or discontinuation of specific products. These compliance issues increase R&D costs and limit market accessibility for products that don’t meet safety standards.

Limited Performance in Harsh Operating Conditions

Leak detection dyes often face limitations in extreme conditions, such as high temperatures, pressures, or chemically aggressive environments. In such scenarios, dye visibility may degrade over time, or compatibility issues with system fluids may arise, compromising the reliability of detection. This restricts the application scope of certain dye types and necessitates the development of specialized formulations, which adds to manufacturing complexity and product costs.

Availability of Alternative Leak Detection Technologies

The availability of alternative technologies—such as electronic sniffers, ultrasonic detectors, and pressure-based systems—poses a competitive challenge to dye-based methods. While dyes are cost-effective and visually intuitive, other methods often offer faster detection and automation compatibility, especially in high-tech industries. As industries prioritize precision and non-invasive testing, dye-based systems must innovate to maintain relevance amid this growing competition.

Regional Analysis

North America

North America held the largest market share of approximately 34% in 2024, driven by robust automotive, HVAC/R, and industrial maintenance sectors. The United States, in particular, leads in adopting UV fluorescent dyes for preventive diagnostics due to stringent emission regulations and well-established infrastructure. Growing investments in smart maintenance technologies and the expansion of the aftermarket service industry continue to fuel demand. Additionally, the region’s strong presence of key manufacturers and early technology adoption gives North America a competitive edge in the leak detection dye market.

Europe

Europe accounted for around 27% of the global leak detection dye market share in 2024, supported by strong regulatory frameworks like the F-Gas Regulation and the EU’s climate goals. Countries such as Germany, France, and the UK actively employ dye-based leak detection systems in HVAC/R and industrial applications. The market is also witnessing a growing shift toward eco-friendly and biodegradable dye solutions. With increasing awareness about environmental sustainability and system efficiency, the demand for safe and reliable leak detection methods is expected to rise steadily across various European industrial and commercial sectors.

Asia Pacific

Asia Pacific captured approximately 22% of the leak detection dye market share in 2024, with China, India, and Japan emerging as key contributors. Rapid industrialization, rising automotive production, and expanding HVAC infrastructure are primary growth drivers. Cost-effective manufacturing capabilities and growing aftermarket services further boost the regional market. Government initiatives to curb emissions and adopt sustainable practices are prompting industries to adopt efficient leak detection systems. While solvent-based dyes remain dominant, demand for water-based variants is rising in eco-sensitive applications. The region presents significant growth opportunities due to its evolving regulatory environment and infrastructure development.

Latin America

Latin America held a modest 8% market share in 2024, with Brazil and Mexico leading regional adoption. The automotive and HVAC service sectors in these countries are driving demand for cost-effective and easy-to-use leak detection methods. However, limited regulatory enforcement and lack of awareness regarding preventive maintenance hinder broader adoption. Nonetheless, growing industrial activity and increased importation of UV-based leak detection kits suggest gradual market penetration. Manufacturers targeting emerging markets with low-cost and eco-friendly formulations are likely to benefit from untapped potential in the region over the forecast period.

Middle East & Africa (MEA)

The Middle East & Africa (MEA) region accounted for about 9% of the global leak detection dye market share in 2024. The demand is primarily concentrated in Gulf countries, where HVAC systems are extensively used due to harsh climates. Additionally, industrial maintenance in oil & gas and petrochemical sectors contributes to the market. However, the region’s adoption rate varies, with parts of Africa still underpenetrated due to limited infrastructure and awareness. Increased investments in commercial and industrial real estate, along with regulatory improvements, are expected to enhance the region’s market share in the coming years.

Market Segmentations:

By Type

- Solvent-based Dyes

- Water-based Dyes

By Form

By End-use

- Automotive Industry

- Coolant System

- Air Conditioning

- Aviation Industry

- Aircraft Fuel Systems

- Hydraulic Systems

- HVAC/R

- Residential A/C

- Commercial A/C

- Refrigeration

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Leak Detection Dye market is characterized by a mix of established global players and niche regional manufacturers, each focusing on innovation, product quality, and regulatory compliance. Leading companies such as Spectronics Corporation, Chromatech Incorporated, and Wurth Group dominate the market through their expansive product portfolios and strong distribution networks. These players emphasize research and development to introduce eco-friendly and UV-visible dyes tailored for diverse industrial applications, including HVAC, automotive, and aerospace. Mid-sized firms like Cool Air Products, Kingscote Chemicals, and Technical Lubricants International B.V. (TecLub) contribute to market competitiveness by offering specialized solutions and targeting emerging economies with cost-effective alternatives. Strategic partnerships, acquisitions, and geographic expansion are key tactics adopted to strengthen market positioning. Additionally, increasing demand for sustainable and non-toxic formulations is prompting players to invest in green chemistry. The market remains moderately fragmented, with opportunities for new entrants to innovate and cater to evolving industry regulations and end-user needs.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Spectronics Corporation

- Ocean Tools

- C. Whitlam Manufacturing Co.

- Pradeep Metal Treatment Chemicals Pvt. Ltd.

- Technical Lubricants International B.V. (TecLub)

- Chromatech Incorporated

- ROBERT KOCH Industries Inc

- Cool Air Products

- Kingscote Chemicals

- Wurth Group

- Organic Dyes and Pigments

- Anderson Manufacturing Company, Inc.

Recent Developments

- In October 2023, Spectronics released the GLO Seal syringe and adapter kit, a cost-effective solution that enables versatile application across various industries.

- In September 2023, Kingscote Chemicals introduced a new product line under the brand Bright Dyes®, offering tracer dyes in multiple formats, including tablets, liquids, powders, and waxes.

- In May 2022, Kent Automotive introduced LeakFinder leak detecting dyes. LeakFinder may be used to cover all car systems, including air conditioning, oil-based systems, and engine coolant.

- In Feb 2022, OceanTools, a global pioneer in subsea engineering, announced the debut of the D10 DyeTector, the world’s most effective dye, leak, and cement detection system. The D10 has optical components that detect the three principal dyes used for underwater detection: rhodamine, ultraviolet, and fluorescein. In addition to detecting leaks in subsea infrastructure, the D10 can detect dye applied to cement during drilling.

Market Concentration & Characteristics

The Leak Detection Dye Market exhibits a moderately fragmented structure with a mix of multinational corporations and specialized regional manufacturers. It maintains a balanced level of competition, with leading players focusing on product differentiation through eco-friendly formulations and UV-visible dye technologies. Companies target key sectors such as automotive, HVAC/R, industrial equipment, and aerospace to strengthen their customer base. The market shows strong demand in developed regions like North America and Europe, driven by regulatory enforcement and mature service industries. It is price-sensitive in emerging economies, where cost-effective products and simplified application methods attract attention. Product quality, ease of application, chemical compatibility, and environmental safety define core purchasing criteria. Entry barriers remain moderate due to the need for compliance with safety and environmental standards. Strategic partnerships and distribution networks play a critical role in market expansion. The market continues to evolve with growing interest in sustainable maintenance practices and increased integration of smart diagnostic tools.

Report Coverage

The research report offers an in-depth analysis based on Type, Form, End-use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The leak detection dye market will witness steady growth due to increasing demand for preventive maintenance across various industries.

- Adoption of eco-friendly and biodegradable dye formulations is expected to rise, driven by stricter environmental regulations.

- The automotive and HVAC/R sectors will continue to dominate market demand, particularly for UV-reactive and solvent-based dyes.

- Integration with smart diagnostic tools and IoT-based maintenance systems will enhance market penetration.

- Emerging markets in Asia Pacific and Latin America will offer new growth opportunities due to industrial expansion and infrastructure development.

- Regulatory compliance and safety standards will influence product development and drive innovation in dye composition.

- Manufacturers will focus on expanding their global distribution networks to capture untapped regional markets.

- Increasing use of dye-based detection in oil & gas, aerospace, and chemical industries will diversify end-use applications.

- Cost-effective, easy-to-use formulations will gain traction in price-sensitive and developing economies.

- Strategic collaborations and R&D investments will remain central to sustaining long-term competitive advantage.