Market Overview

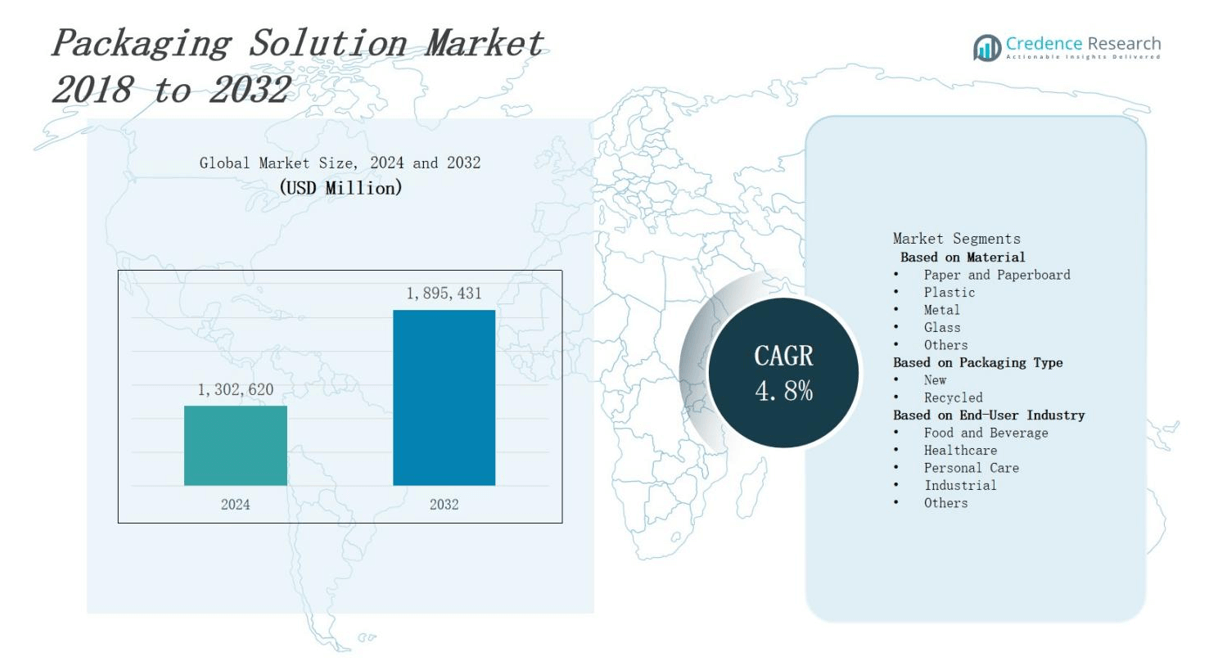

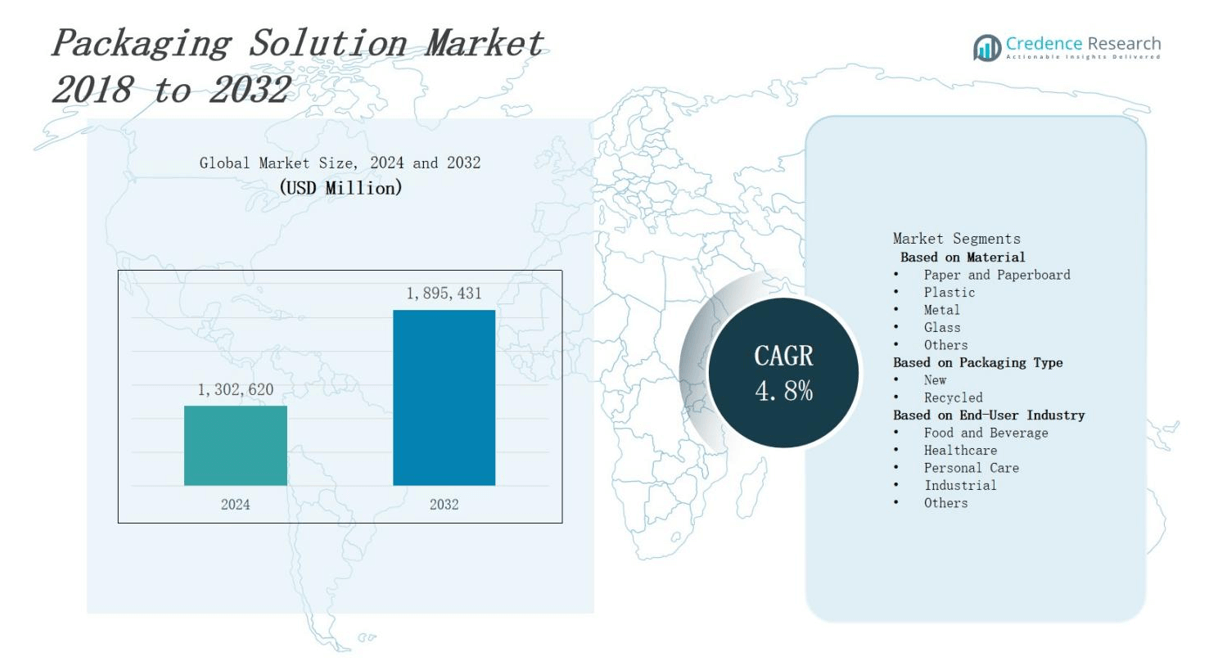

The packaging solution market is projected to grow from USD 1,302,620 million in 2024 to USD 1,895,431 million by 2032, registering a CAGR of 4.8%.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Packaging Solution Market Size 2024 |

USD 1,302,620 million |

| Packaging Solution Market, CAGR |

4.8% |

| Packaging Solution Market Size 2032 |

USD 1,895,431 million |

Rising e‑commerce volumes and consumer demand for sustainable packaging drive investment in lightweight, recyclable materials. Advanced automation and robotics streamline production, reduce labor costs, and increase throughput. Integration of smart technologies like RFID and IoT sensors enhances supply chain visibility and quality control. Regulatory pressures on waste reduction prompt development of biodegradable films and compostable substrates. Brands deploy digital printing and customization to differentiate products and engage consumers. Collaboration between packaging manufacturers and logistics providers accelerates design adoption. Data analytics optimize inventory management. These factors fuel growth in the packaging solution market by improving overall efficiency, sustainability and customer experience.

Geographical analysis reveals Asia Pacific 40%, Europe 25%, North America 20%, Middle East & Africa 8% and Latin America 7% share. The packaging solution market thrives on regional dynamics: North America favors automated, smart systems; Europe demands sustainable, recyclable formats; Asia Pacific seeks high‑volume, low‑cost solutions; Latin America adapts lightweight designs; Middle East & Africa requires durable packages. Players—Mondi Group, Silgan Holdings Inc., DS Smith Plc, Crown Holdings, Inc., International Paper Company, Ball Corporation, Smurfit Kappa Group PLC, WestRock Company, Amcor PLC and Sealed Air Corporation—drive innovation and partnerships.

Market Insights

- The packaging solution market will expand from USD 1,302,620 million in 2024 to USD 1,895,431 million by 2032 at a CAGR of 4.8%.

- Rising e‑commerce volumes and demand for sustainable packaging drive adoption of lightweight, recyclable materials.

- Automation, robotics and IoT sensors streamline production, cut labor costs and boost throughput.

- Regulatory mandates on waste reduction prompt development of biodegradable films and compostable substrates.

- Asia Pacific commands 40% share; Europe holds 25%; North America captures 20%; Middle East & Africa reaches 8%; Latin America accounts for 7%.

- Supply chain disruptions and raw material price volatility force manufacturers to diversify suppliers and increase buffer stocks.

- Leading players deploy digital printing, circular‑economy strategies and pursue mergers to maintain competitive edge.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising E‑Commerce Demand Spurs Material Innovation

Pioneering growth in e‑commerce channels fuels demand for efficient packaging formats. Consumers insist on protective, lightweight designs and strong brand presence. The packaging solution market offers recyclable substrates and custom-fit systems. Manufacturers invest in material innovation to cut weight and cost. Companies adopt modular platforms that match diverse product dimensions. Driving supply chain agility strengthens competitive advantage and promotes sustainability. It reduces operational carbon emissions and boosts market growth.

- For instance, Avery Dennison integrates smart packaging with NFC and QR codes to enhance product tracking, consumer engagement, and sustainability in e-commerce deliveries.

Regulatory Pressure and Sustainability Mandates Drive Innovation

Strict environmental regulations push companies to develop biodegradable and compostable packaging solutions. Governments set targets for waste reduction and recycling rates to curb landfill growth. The packaging solution market responds by introducing bio‑based recyclable polymers. Suppliers optimize formulations to comply with evolving standards and consumer expectations. Brands highlight eco‑credentials to differentiate products on shelves. It aligns circular economy principles with profit objectives. This focus fuels research into renewable materials.

- For instance, Australian startup Perflute uses patented fiber-based materials that are recyclable, compostable, biodegradable, and made from post-consumer recycled feedstocks, producing alternatives to plastic bubble wrap with superior protection.

Advanced Automation and IoT Integration Enhance Efficiency

Introduction of automation and robotics transforms packaging lines with precise, high‑speed operations. IoT‑enabled equipment monitors performance and maintenance needs in real time. The packaging solution market leverages data analytics to predict faults and optimize throughput. Companies integrate machine learning into quality control to reduce defects. Suppliers install smart sensors for temperature, humidity, and shock tracking. It lowers downtime and enhances product safety. These improvements strengthen efficiency and cost management.

Customization and Strategic Collaborations Drive Differentiation

Brands demand digital printing and tailored designs to engage consumers and enhance shelf appeal. Virtual prototyping tools accelerate design validation and shorten time to market. The packaging solution market adopts modular graphic platforms for customization. Packaging providers form partnerships with material innovators to access substrates. It employs augmented reality labels for interactive experiences, data capture. Focus on personalization fosters brand loyalty. This strategy increases market competitiveness and revenue potential.

Market Trends

Rapid Adoption of Digital Printing and Personalization

Companies adopt digital printing techniques to produce high‑resolution graphics and variable data labels. The packaging solution market leverages these technologies to deliver small batch runs that support brand differentiation. Brands commission custom designs that align with seasonal promotions and regional preferences. Suppliers integrate inline inspection systems for quality assurance. It reduces lead times and inventory costs. Digital platforms link design approval workflows with production scheduling to improve responsiveness and customer engagement.

- For instance, Coca-Cola’s “Share a Coke” campaign used variable data printing to create personalized labels with individual names, enabling large-scale customization that was not feasible with traditional printing.

Integration of Predictive Analytics and AI Tools

Manufacturers deploy predictive analytics and AI‑driven algorithms to forecast demand and optimize production schedules. The packaging solution market uses machine learning models to predict maintenance needs and minimize downtime. Engineers implement sensor networks to capture real‑time performance data and trigger alerts. It enables proactive adjustments that increase line efficiency and reduce waste. Data dashboards provide actionable insights for operations managers. This approach strengthens supply chain resilience and supports strategic planning.

- For instance, Tetra Pak expanded its AI-driven predictive maintenance in March 2024, allowing continuous monitoring of equipment to reduce downtime and enhance production efficiency.

Shift to Lightweight and Sustainable Materials

Consumer preference for eco‑friendly solutions drives research into bio‑based plastics and compostable substrates. The packaging solution market introduces lightweight structures that maintain strength while reducing material use. Producers collaborate with material scientists to develop fibers and films that meet regulatory standards. It enhances recyclability and lowers carbon footprint. Manufacturers test barrier coatings that preserve product freshness without chemicals. These innovations meet corporate sustainability goals and satisfy consumer expectations for responsible packaging.

Expansion of E‑Commerce and Last‑Mile Solutions

E‑commerce expansion increases demand for protective packaging in last‑mile delivery. The packaging solution market adopts modular box designs and inflatable cushions to secure items during transit. Logistics firms integrate tracking devices and smart tags to monitor location and condition. It supports rapid order fulfillment and returns management. Providers invest in standardized pallet systems that simplify handling and reduce transit damage. This trend enhances customer satisfaction and strengthens brand reputation.

Market Challenges Analysis

Supply Chain Disruptions, Raw Material Price Volatility, and Lead Time Uncertainty

The packaging solution market faces frequent supply interruptions due to geopolitical conflicts and transport bottlenecks. It experiences price swings in resin, paper, and metal, which inflate production budgets. Extended lead times force manufacturers to hold excess inventory. Suppliers struggle to guarantee just‑in‑time delivery without premium fees. It hinders capacity planning and erodes profit margins. Companies must diversify supplier bases to secure critical inputs. Limited buffer stock options increase exposure to sudden shortages.

Complex Regulatory Landscape, Recycling Mandates, and Escalating Cost Pressures

The packaging solution market must navigate new regulations on waste reduction, recyclability, and material provenance. It contends with region‑specific standards that force product redesign. Compliance audits add administrative workload and increase certification expenses. Companies face higher costs for eco‑labels and supply chain traceability. It challenges small and mid‑size suppliers with limited compliance resources. Firms invest in lifecycle analysis tools to prove environmental performance. Budget constraints restrict adoption of sustainable packaging technologies.

Market Opportunities

Expansion in Emerging Economies and Untapped Sectors

The packaging solution market can tap growing demand in developing regions where consumption patterns evolve. Companies can tailor solutions for pharmaceuticals, cosmetics, and specialty foods. It can use infrastructure investments to scale production facilities locally. Firms can introduce lightweight, cost‑effective formats for small retailers. Localized packaging designs can meet cultural preferences and regulatory requirements. Partnerships with regional distributors reduce entry barriers. This growth widens the customer base and accelerates revenue streams. Companies can integrate channel‑specific packaging for direct‑to‑consumer e‑commerce and subscription box services. It can leverage government incentives for local manufacturing and sourcing partnerships.

Technological Innovation and Collaborative Ventures

The packaging solution market can harness digital printing and augmented reality for premium consumer experiences. It can deploy AI‑driven analytics to optimize supply chains and reduce waste. Suppliers can invest in bio‑based polymers to meet sustainability goals. Joint ventures with material scientists can yield next‑generation substrates. It can pilot circular economy models with recycling firms. These approaches strengthen brand loyalty and open new revenue channels. It can explore blockchain‑enabled traceability to assure authenticity and partner with e‑retailers. Companies can invest in renewable‑energy powered facilities to lower costs and carbon footprint.

Market Segmentation Analysis:

By Material

The packaging solution market divides materials into paper and paperboard, plastic, metal, glass and others. It uses paper and paperboard to offer sustainable, lightweight formats. It employs plastic for cost‑effective, flexible designs that resist moisture. It applies metal to deliver durability and premium appearance. It selects glass for inert, high‑end applications. It integrates composite and hybrid substrates under “Others” to meet niche performance requirements.

- For instance, in plastic packaging, Tetra Pak employs polyethylene-based coatings to create moisture-resistant and flexible liquid cartons.

By Packaging Type

The packaging solution market segments offerings into new and recycled packaging. It drives innovation with new formats that incorporate advanced barrier films and smart labels. It expands recycled packaging options to meet regulatory mandates and consumer demand. It sources post‑consumer materials to support circular economy goals. It certifies recycled content to ensure quality and safety. It balances performance and sustainability criteria to optimize total cost of ownership.

- For instance, Zotefoams has developed ReZorce mono-material barrier packaging, which won the Product Innovation award in 2024 for its recyclable design that replaces multi-material composites in beverage cartons, supporting circular economy initiatives.

By End‑User Industry

The packaging solution market adapts solutions for food and beverage, healthcare, personal care, industrial and other sectors. It supplies food and beverage clients with tamper‑evident and high‑barrier formats. It equips healthcare providers with sterile, traceable packaging. It designs personal care containers that combine aesthetics and functionality. It provides industrial customers with rugged, protective systems. It customizes offerings for emerging applications, including electronics and specialty chemicals.

Segments:

Based on Material

- Paper and Paperboard

- Plastic

- Metal

- Glass

- Others

Based on Packaging Type

Based on End-User Industry

- Food and Beverage

- Healthcare

- Personal Care

- Industrial

- Others

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America drives demand for innovative packaging formats in food, healthcare and consumer goods. The packaging solution market features rigid, flexible and smart designs. Manufacturers deploy automation to boost throughput. It guarantees compliance with stringent safety standards. It secures a market share of 20%. It supports rapid prototyping for custom orders. It fosters strategic partnerships with logistics providers.

Europe

Europe prioritizes sustainable and recyclable packaging solutions across industries. The packaging solution market supplies compostable films and mono‑material containers. Companies optimize processes to meet EU waste directives. It enforces strict quality audits. It holds a market share of 25%. It integrates digital labels for traceability. It collaborates with research institutes on bio‑based substrates.

Asia Pacific

Asia Pacific exhibits the fastest growth in consumer and industrial packaging. The packaging solution market adapts low‑cost, high‑volume production. Suppliers expand facilities in China, India and Southeast Asia. It offers barrier coatings for perishables. It commands a market share of 40%. It taps rising e‑commerce demand. It invests in regional distribution networks.

Latin America

Latin America embraces lightweight, cost‑effective packaging formats. The packaging solution market delivers corrugated boxes and pouches. Companies tailor designs to suit tropical climates. It strengthens local manufacturing hubs. It captures a market share of 7%. It leverages free‑trade agreements to reduce tariffs. It trains workforce on quality control.

Middle East & Africa

Middle East & Africa seek durable packaging for harsh environments. The packaging solution market provides metal drums and rigid plastics. Suppliers comply with import regulations and halal standards. It deploys UV‑resistant coatings. It secures a market share of 8%. It builds service centers to support after‑sales. It explores renewable energy for production.

values digital print, circular economy strategies and automation. Companies deploy advanced barrier films and smart labels to differentiate products. It measures success by speed of delivery, material performance and compliance with safety standards. Firms streamline their supply chains through vendor consolidation and strategic alliances. It tracks competitor investments in bio‑based polymers and recycled content. Brand owners expect flexible formats and swift customization, which fuels co‑development projects. It monitors regional expansions and capacity increases to forecast price movements. New entrants use e‑commerce platforms to engage clients directly. It compels established players to shorten lead times and lower total cost of ownership. Mergers and acquisitions continue to reshape industry structure and enhance service portfolios.

Recent Developments

- On January 20, 2025, Smurfit Westrock launched an all‑paper stretch wrap designed for pallet transportation, reducing plastic use while supporting greener supply chains.

- In February 2023, SEE announced the completion of its acquisition of Liquibox, a company specializing in Bag-in-Box sustainable fluids and liquids packaging solutions, for $1.15 billion.

- In November 2024, Amcor and Berry announced an all-stock merger combining their consumer and healthcare packaging solutions businesses to create a global leader, expected to generate $650 million in annual earnings synergies.

- On May 29, 2025, Ball Corporation partnered with Açaí Motion® to debut an ASI‑certified natural energy drink can that blends sustainable design with certified beverage packaging.

Market Concentration & Characteristics

Top-tier providers hold dominant positions in the packaging solution market, with the leading five companies controlling more than half of global revenues. It features moderate fragmentation, where mid‑size firms compete on niche applications and regional strengths. High capital requirements for advanced machinery and automation create entry barriers. It values continuous innovation in materials, digital printing and smart technologies to meet evolving customer demands. Strategic mergers and acquisitions accelerate scale advantages and expand geographic reach. It faces regulatory scrutiny on sustainability, driving investments in recyclable and bio‑based substrates. Customer focus on total cost of ownership motivates suppliers to offer integrated services, including design support and after‑sales maintenance. It balances global standardization with localized offerings to optimize logistics and compliance. Continuous R&D collaboration with material scientists and technology partners defines market competitiveness.

Report Coverage

The research report offers an in-depth analysis based on Material, Packaging Type, End-User Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Packaging Solution Market embraces augmented reality labels to boost consumer engagement.

- Companies develop bio‑based polymers to meet stricter environmental regulations.

- Digital printing adoption accelerates to enable rapid customization and shorter lead times.

- Automation and robotics infiltration increases to enhance production efficiency and reduce errors.

- IoT‑enabled sensors become standard to track product conditions throughout the supply chain.

- Blockchain traceability gains traction to ensure authenticity and bolster transparency.

- Circular economy initiatives expand through partnerships with recycling firms and material suppliers.

- Virtual prototyping tools improve design validation and cut development cycles.

- Regional manufacturing hubs proliferate to reduce logistics costs and meet local demand.

- Cross‑industry collaborations drive innovation in functional coatings and barrier technologies.