Market Overview

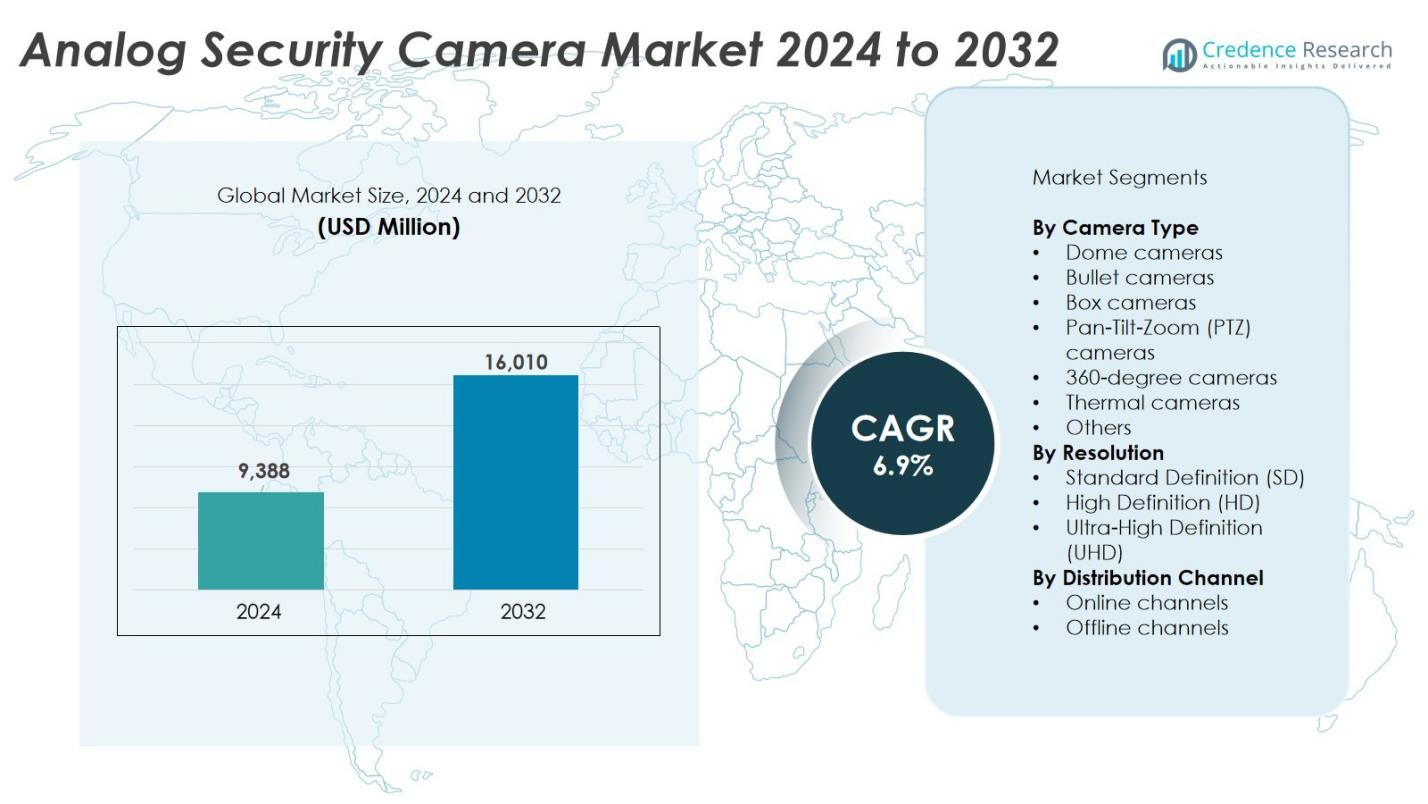

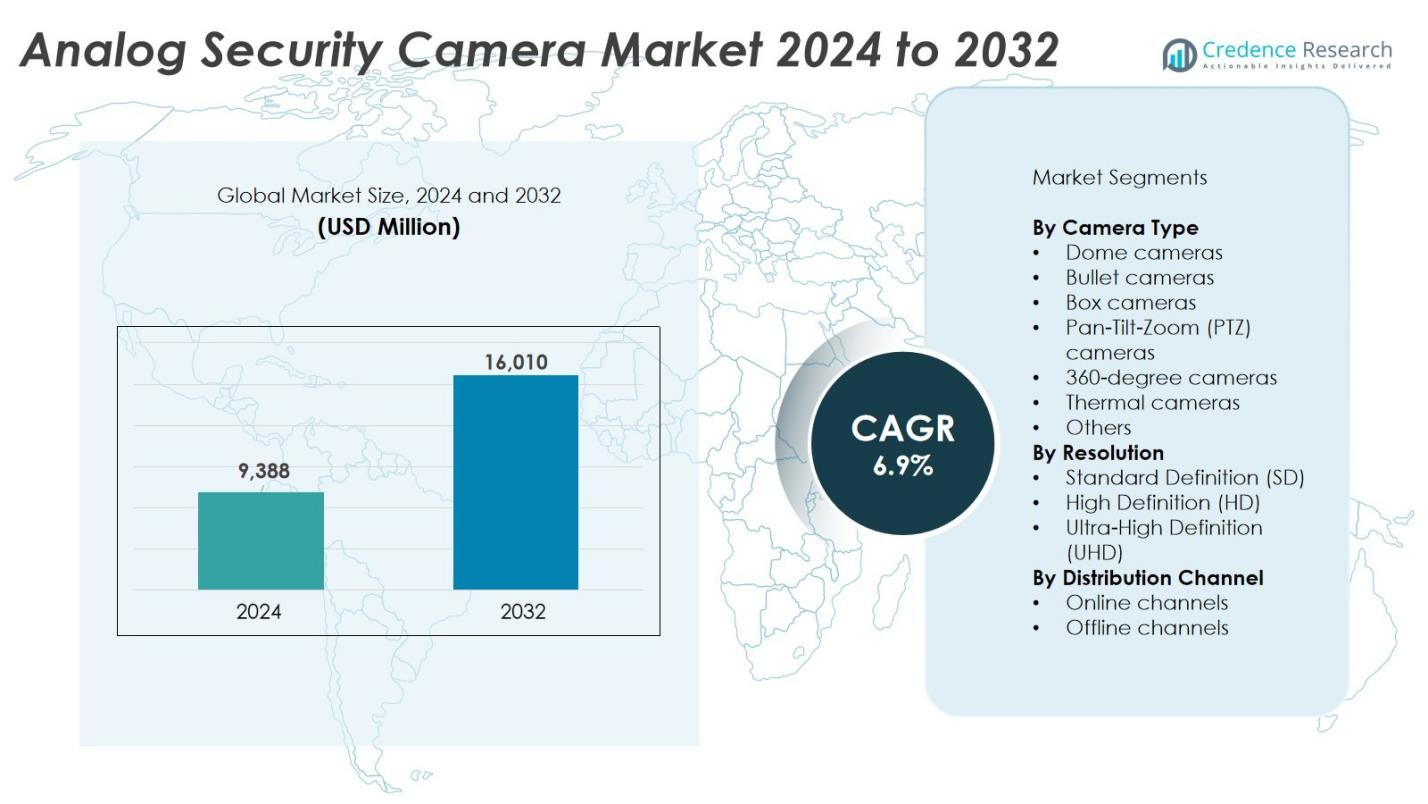

The Analog Security Camera Market size was valued at USD 9,388 million in 2024 and is anticipated to reach USD 16,010 million by 2032, growing at a CAGR of 6.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Analog Security Camera Market Size 2024 |

USD 9,388 Million |

| Analog Security Camera Market, CAGR |

6.9% |

| Analog Security Camera Market Size 2032 |

USD 16,010 Million |

The analog security camera market is dominated by key players such as Hikvision, Dahua Technology, Panasonic Corporation, Axis Communications, Bosch Security Systems, Honeywell International Inc., and ACTi Corporation. These companies lead through innovation in analog high-definition (AHD) and hybrid surveillance systems, offering enhanced image resolution, durability, and cost efficiency. Strategic collaborations, global distribution networks, and consistent product upgrades strengthen their market positions. Asia-Pacific emerges as the leading region, accounting for 35% of the global market share, driven by rapid urbanization, infrastructure growth, and strong demand for affordable surveillance systems across China, India, and Southeast Asia.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The analog security camera market was valued at USD 9,388 million in 2024 and is projected to reach USD 16,010 million by 2032, growing at a CAGR of 6.9%.

- Increasing demand for cost-effective surveillance and rapid infrastructure expansion are major drivers supporting market growth across commercial and residential sectors.

- Key trends include the shift toward hybrid and HD analog systems, enabling higher image quality and improved compatibility with digital monitoring solutions.

- The market is competitive, with companies like Hikvision, Dahua Technology, Panasonic Corporation, Bosch, and Honeywell leading through innovation and regional expansion.

- Asia-Pacific dominates with 35% share, followed by North America at 27%; the dome camera segment leads due to its versatility and wide adoption across urban surveillance and retail applications.

Market Segmentation Analysis:

By Camera Type

Dome cameras dominate the analog security camera market, holding the largest share due to their versatility and discreet design. They are widely used in commercial and residential settings for 360-degree surveillance coverage and vandal resistance. Bullet cameras also hold a notable share, favored for outdoor monitoring and long-distance visibility. Increasing installations in retail, transportation, and industrial sectors drive segment growth. The demand for PTZ and thermal cameras is also rising, supported by expanding smart surveillance networks and advancements in image clarity under low-light conditions.

- For instance, Pelco Incorporated’s “Spectra Analog Dome V Stainless Steel” analog dome camera offers a 30× optical zoom and delivers up to 740 TVL resolution in a rugged IP66 / –51 °C to 60 °C rated body.

By Resolution

The High Definition (HD) segment leads the market with the highest share, driven by its balance between affordability and superior image quality. HD analog cameras provide enhanced detail and facial recognition capabilities, making them ideal for public safety and traffic monitoring applications. The transition from Standard Definition (SD) to HD formats continues as users seek clearer video feeds for real-time analysis. Meanwhile, Ultra-High Definition (UHD) cameras are gaining traction in large-scale commercial and industrial facilities where precise visual data is essential for security management.

- For instance, Hikvision Digital Technology Co., Ltd.’s Turbo HD analog camera model DS-2CE76D0T-ITPFS supports 1920×1080 resolution (2 MP) and includes a minimum illumination of 0.01 Lux (F2.0) and IR range up to 20 m.

By Distribution Channel

Offline channels hold the dominant share in the analog security camera market due to strong dealer networks and direct consumer engagement. System integrators and local distributors play a crucial role in providing installation, after-sales support, and customization. However, online channels are witnessing rapid growth with the rise of e-commerce platforms and direct brand sales. Increasing customer preference for product comparisons, bulk discounts, and doorstep delivery is further boosting online distribution, particularly in small and medium enterprise (SME) and residential markets.

Key Growth Drivers

Rising Demand for Cost-Effective Surveillance Solutions

The growing need for affordable video surveillance in residential and small commercial spaces is driving analog camera adoption. Analog systems offer lower installation and maintenance costs compared to IP-based systems, making them attractive for budget-conscious users. Their plug-and-play functionality enables quick deployment without complex network setups. Advancements in analog high-definition (AHD) and high-efficiency video coding (H.265) technologies have improved image resolution and storage efficiency. These factors enhance their suitability for small-scale surveillance, fueling steady growth across emerging economies where cost-sensitive security solutions remain in high demand.

- For instance, Honeywell’s I-HABC-2005PI-LC delivers 2 MP AHD output, real-time transmission over long-distance coax, and supports AHD/TVI/CVI/CVBS multi-format output. Their plug-and-play functionality enables quick deployment without complex network setups.

Expanding Infrastructure Development and Urban Surveillance

Rapid urbanization and infrastructure expansion are creating strong demand for public safety and traffic monitoring systems. Governments and municipalities are deploying analog security cameras in schools, transit stations, and city centers for real-time surveillance. Construction projects and industrial facilities also rely on analog systems for site monitoring and safety compliance. Continuous investments in smart city programs, particularly across Asia-Pacific and the Middle East, are further increasing deployment. Analog cameras’ proven reliability in large-scale networks supports sustained demand in both public and private infrastructure projects.

- For instance, Hikvision’s specialized Intelligent Traffic System (ITS) cameras were chosen for a city-traffic deployment covering 650 urban roadway poles. These advanced IP-based camera units leverage deep learning algorithms to support real-time vehicle detection and automatic license-plate capture.

Technological Advancements in Analog Video Transmission

Innovations in high-definition analog formats such as HD-TVI, HD-CVI, and AHD are reshaping the analog surveillance landscape. These technologies enable high-resolution video transmission over coaxial cables without latency, improving image quality without requiring network upgrades. The integration of infrared night vision, motion detection, and remote monitoring features enhances camera performance across lighting conditions. Manufacturers are also focusing on hybrid DVR systems that support both analog and IP inputs, ensuring flexibility during system upgrades. Such advancements strengthen analog cameras’ competitiveness and extend their lifecycle in mixed surveillance environments.

Key Trends & Opportunities

Integration of AI and Hybrid Surveillance Systems

The analog camera market is witnessing a growing shift toward hybrid surveillance models combining analog and IP technologies. AI-enabled digital video recorders (DVRs) now support real-time analytics such as motion detection, facial recognition, and object tracking, enhancing security outcomes. This integration allows legacy analog systems to gain smart capabilities without full system replacement. As industries embrace predictive surveillance and automated alerts, hybrid configurations present a cost-efficient transition path. This trend offers significant opportunities for vendors to develop AI-compatible analog solutions for modern security applications.

- For instance, hybrid DVRs like the one described by Optiview support 8 analog plus 8 IP camera inputs in one unit.

Growth in Emerging Economies and SMB Adoption

Developing regions across Asia-Pacific, Latin America, and Africa are becoming major growth hubs for analog security cameras. Small and medium businesses, retail outlets, and educational institutions in these areas prefer analog systems for their affordability and ease of maintenance. Local governments also deploy analog networks for perimeter and traffic surveillance, benefiting from lower bandwidth requirements. The availability of locally manufactured cameras and supportive public safety initiatives further boost adoption. Market participants focusing on region-specific pricing and distribution strategies can capture substantial opportunities in these fast-expanding economies.

- For instance, IDIS reports that more than 16.5 million cameras worldwide use its advanced surveillance technology across various industries and applications globally.

Rising Focus on Retrofitting and System Upgrades

An increasing number of organizations are upgrading their existing analog systems with high-definition and hybrid analog solutions. This retrofit trend is driven by the need to enhance image clarity and system efficiency without replacing entire infrastructure setups. DVR-based upgrades offer a seamless way to integrate HD analog cameras into legacy systems. The retrofit opportunity also extends to older public and private surveillance networks that need modernization. Manufacturers offering backward-compatible devices and scalable upgrade options are well-positioned to capture long-term contracts in this evolving market.

Key Challenges

Competition from IP-Based Surveillance Systems

The growing popularity of IP and cloud-based security systems poses a major challenge to the analog camera market. IP cameras offer superior scalability, wireless connectivity, and advanced analytics, attracting enterprise customers. The increasing adoption of cloud storage and remote monitoring solutions is further reducing demand for traditional analog systems. Although analog technology continues to evolve, its limitations in data integration and network flexibility hinder its competitiveness. To sustain market share, analog camera manufacturers must focus on hybrid models and value-driven pricing to bridge the technological gap.

Limited Scalability and Integration Constraints

Analog security cameras face scalability and integration challenges in modern surveillance ecosystems. Unlike IP systems, analog setups require separate cabling for each camera, increasing infrastructure complexity as networks expand. Additionally, analog systems lack native support for centralized cloud storage, analytics integration, and multi-site monitoring. These technical constraints restrict deployment in large enterprises and smart city projects that demand real-time, data-driven insights. Overcoming these limitations through hybrid and modular architectures remains essential for the analog camera industry to maintain long-term relevance and operational efficiency.

Regional Analysis

North America

North America holds a 27% share of the analog security camera market, driven by strong adoption across commercial, industrial, and government sectors. The United States dominates the region, supported by extensive surveillance infrastructure and regulatory emphasis on public safety. Demand remains steady in small businesses and residential setups due to cost-effective installation options. Manufacturers focus on hybrid analog-HD upgrades and system integration to maintain competitiveness. The replacement of older systems with HD analog models continues to sustain market growth across institutional and municipal surveillance applications.

Europe

Europe accounts for 23% of the market share, supported by robust demand from transportation, retail, and manufacturing industries. The region emphasizes modernization of legacy surveillance systems with HD analog and hybrid cameras. Countries such as Germany, the U.K., and France lead adoption, driven by infrastructure upgrades and security compliance mandates. Vendors focus on energy-efficient, vandal-resistant, and high-resolution camera solutions to meet regional standards. The market is further strengthened by the presence of key players offering customized solutions for indoor and outdoor surveillance environments.

Asia-Pacific

Asia-Pacific leads the analog security camera market with a 35% share, fueled by large-scale infrastructure projects and rapid urbanization. China, India, and Japan are major contributors due to strong government-led safety initiatives and expanding commercial real estate. The region’s cost-sensitive consumers prefer analog systems for their affordability and ease of installation. Continuous investment in smart city programs and industrial surveillance supports further market penetration. Local manufacturers are expanding production capacity and offering competitive pricing, making Asia-Pacific the primary hub for analog camera manufacturing and deployment.

Latin America

Latin America holds a 9% share of the analog security camera market, driven by increasing adoption in retail, transportation, and residential security. Brazil and Mexico are the leading contributors due to heightened concerns about urban crime and property safety. The market benefits from growing investments in public surveillance infrastructure and private security services. Analog systems remain popular for their low cost and reliable performance in small-scale monitoring. Regional distributors and integrators are expanding service networks to improve accessibility and enhance product availability across key cities.

Middle East & Africa

The Middle East & Africa region accounts for 6% of the market share, supported by security upgrades in commercial and critical infrastructure sectors. The UAE, Saudi Arabia, and South Africa are leading markets, emphasizing surveillance in airports, oil facilities, and public areas. Government-driven safety regulations and smart city projects are stimulating demand for analog and hybrid camera solutions. Although IP-based systems are gaining traction, analog cameras retain a strong presence due to cost benefits and durability in high-temperature environments. Regional players focus on tailored solutions for diverse environmental conditions.

Market Segmentations:

By Camera Type

- Dome cameras

- Bullet cameras

- Box cameras

By Resolution

- Standard Definition (SD)

- High Definition (HD)

- Ultra-High Definition (UHD)

By Distribution Channel

- Online channels

- Offline channels

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The analog security camera market features intense competition among global and regional manufacturers focusing on innovation, affordability, and large-scale distribution. Leading companies such as Hikvision, Dahua Technology, Panasonic Corporation, Axis Communications, Bosch Security Systems, Honeywell International Inc., and ACTi Corporation dominate through strong product portfolios and broad geographic reach. These players emphasize advancements in analog high-definition (AHD) and hybrid camera systems to enhance image quality and compatibility with digital infrastructures. Strategic collaborations, mergers, and partnerships with system integrators strengthen their market presence. Companies are also investing in AI-integrated DVRs, night vision technology, and remote monitoring capabilities to improve system efficiency and attract small and medium enterprise clients. As competition intensifies, manufacturers differentiate through energy-efficient designs, localized production, and extended after-sales services to secure long-term customer relationships and expand their footprint in both developed and emerging markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Panasonic Corporation

- Bosch Security Systems

- ACTi Corporation

- Hikvision

- Axis Communications

- Dahua Technology

- Honeywell International Inc.

- Hangzhou Hikvision Digital Technology Co. Ltd.

- Hitron Systems Inc.

- HANWHA Corp

Recent Developments

- In June 2025, Honeywell International Inc. introduced its new 50 Series CCTV portfolio, designed and manufactured in India to meet enterprise-grade surveillance needs and strengthen its presence in the analog security segment.

- In January 2024, Xiaomi launched the 360 Home Security Camera 2K with Wi-Fi support and infrared LEDs. The Mi 360° Home Security Camera 2K uses ultra-clear HD technology to capture more detailed images. The fully upgraded lens effectively reduces light refraction for clearer & more detailed images.

- In July 2023, D-Link, a global leader in networking and connectivity, announced the launch of its Made in India range of Surveillance solution christened ‘Indigenous Series’. This is in line with D-Link’s commitment to governments ‘Make in India’ vision, that focuses on local manufacturing. D-Link Indigenous series includes a range of IP-based cameras and network video recorders.

Report Coverage

The research report offers an in-depth analysis based on Camera, Resolution, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue growing steadily with rising adoption in residential and small business surveillance.

- Hybrid analog-HD systems will gain traction for offering cost-effective upgrades to existing setups.

- AI-enabled DVRs will enhance real-time analytics and improve overall monitoring efficiency.

- Demand for high-resolution and night-vision analog cameras will strengthen across public and industrial sectors.

- Manufacturers will focus on energy-efficient and weather-resistant camera designs.

- The Asia-Pacific region will maintain its leadership due to expanding infrastructure and urban security needs.

- Local production and regional distribution networks will improve affordability and accessibility.

- Integration of analog systems with cloud-based monitoring solutions will rise.

- Continuous R&D will drive improvements in image clarity and transmission distance.

- Strategic collaborations and mergers will help companies expand global market presence and competitiveness.