Market Overview:

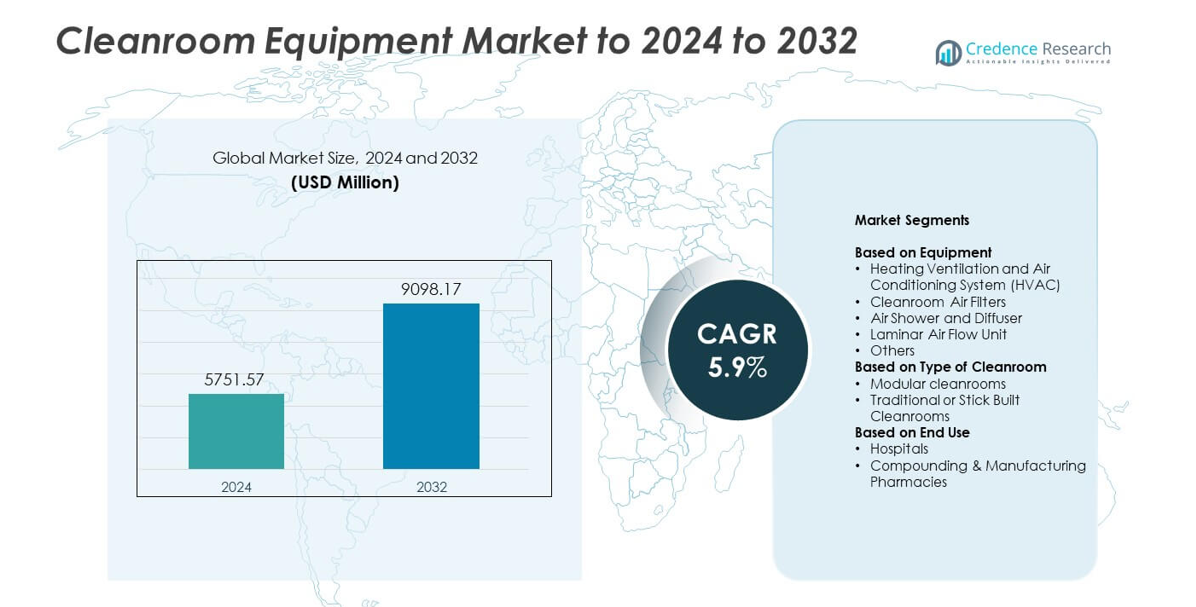

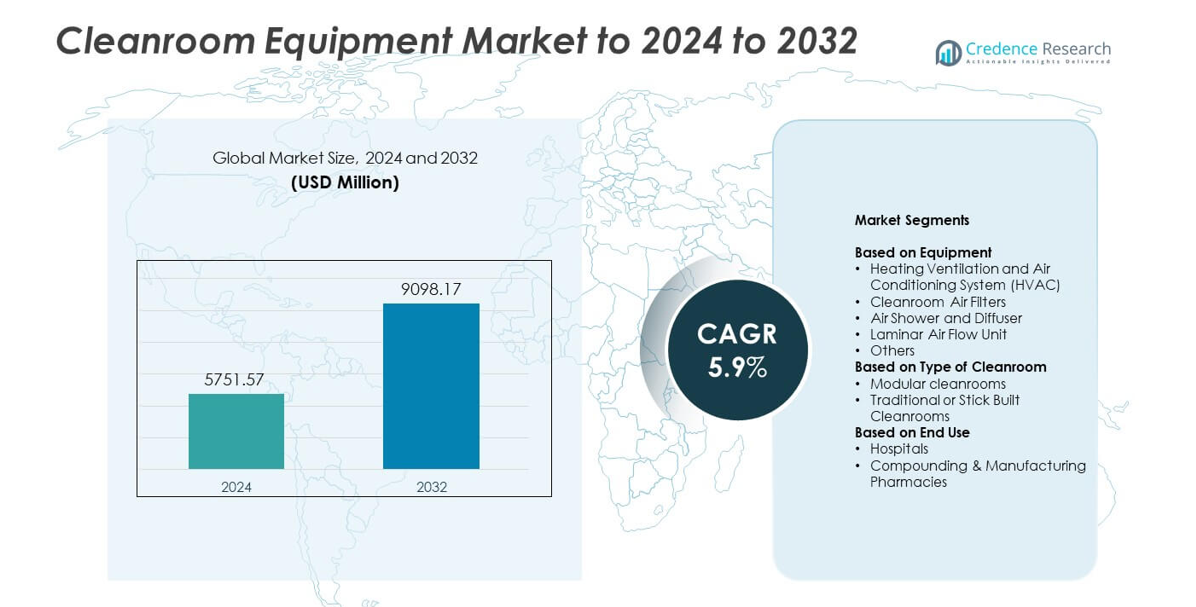

Cleanroom Equipment Market size was valued USD 5751.57 Million in 2024 and is anticipated to reach USD 9098.17 Million by 2032, at a CAGR of 5.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cleanroom Equipment Market Size 2024 |

USD 5751.57 Million |

| Cleanroom Equipment Market, CAGR |

5.9% |

| Cleanroom Equipment Market Size 2032 |

USD 9098.17 Million |

The cleanroom equipment market is led by prominent players such as Clean Air Products, Terra Universal, Inc., HVAX, Airomax Airborne LLC, Labconco, Integrated Cleanrooms Technologies Pvt. Ltd., MECART, Abtech, Angstrom Technology, and Cleanrooms Depot, Inc. These companies focus on developing advanced HVAC systems, filtration units, and modular cleanroom solutions that meet global contamination control standards. North America dominated the market with a 38.6% share in 2024, driven by strong demand from pharmaceutical, semiconductor, and biotechnology sectors. Europe followed with a 27.4% share, supported by stringent regulatory frameworks and technological advancements, while Asia Pacific captured 25.8%, fueled by rapid industrialization and growing healthcare investments.

Market Insights

- The cleanroom equipment market was valued at USD 5751.57 million in 2024 and is projected to reach USD 9098.17 million by 2032, registering a CAGR of 5.9% during the forecast period.

- Growing demand from pharmaceutical, biotechnology, and semiconductor sectors drives market expansion, supported by strict contamination control standards and rising investments in high-tech manufacturing facilities.

- Trends such as modular cleanroom adoption, IoT-enabled monitoring, and energy-efficient HVAC systems are reshaping industry operations and improving compliance efficiency.

- The market remains moderately consolidated, with key players focusing on automation, innovation, and regional expansion to strengthen competitiveness across diversified end-use industries.

- North America dominated the market with a 38.6% share in 2024, followed by Europe at 27.4% and Asia Pacific at 25.8%, while modular cleanrooms led by equipment type with a 63.4% share, reflecting a strong shift toward flexible and scalable infrastructure solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Equipment

Heating Ventilation and Air Conditioning (HVAC) systems dominated the cleanroom equipment market with a 48.2% share in 2024. Their leadership stems from their essential role in maintaining temperature, humidity, and particulate control in critical environments. HVAC systems enable consistent airflow, filtration, and pressure regulation to ensure contamination-free operations in semiconductor, pharmaceutical, and biotechnology facilities. The demand for energy-efficient and digitally controlled HVAC units is rising as manufacturers prioritize sustainability and automation. Cleanroom air filters and laminar air flow units are also expanding due to tighter ISO standards and growing biopharma production capacity.

- For instance, Daikin Applied’s Custom Air Handler is rated up to 129,000 CFM, supporting high-airflow cleanroom HVAC needs.

By Type of Cleanroom

Modular cleanrooms accounted for 63.4% of the cleanroom equipment market in 2024, emerging as the dominant type. Their growth is driven by faster installation, scalability, and reduced operational downtime compared to traditional stick-built structures. Modular systems support flexible layouts and compliance with ISO and GMP standards, making them ideal for expanding production in pharmaceuticals and electronics. The increasing need for cost-efficient and easily upgradeable facilities further fuels adoption. Demand for modular solutions also benefits from growing investment in biologics and precision manufacturing sectors requiring rapid cleanroom deployment.

- For instance, Mecart, established in 1974, is a North American manufacturer specializing in controlled environments with a proven track record of more than 3,000 completed projects worldwide for various applications including cleanrooms, laboratories, and acoustic enclosures.

By End Use

Hospitals led the cleanroom equipment market with a 54.7% share in 2024. The dominance is attributed to the rising need for sterile environments in operating theaters, isolation wards, and diagnostic laboratories. Increased healthcare infrastructure spending and strict infection control regulations are propelling cleanroom installations. Additionally, the surge in compounding and manufacturing pharmacies is contributing to market growth as they adopt advanced air filtration and laminar flow systems for safe drug preparation. The emphasis on patient safety, contamination prevention, and regulatory compliance continues to strengthen hospital cleanroom demand globally.

Key Growth Drivers

Rising Demand from Pharmaceutical and Biotechnology Industries

The expansion of pharmaceutical and biotechnology sectors is a major driver of cleanroom equipment demand. Stringent regulatory standards from the FDA and EMA are pushing manufacturers to maintain sterile production environments. The increasing production of vaccines, biologics, and personalized medicines further accelerates cleanroom installations. Continuous investments in biopharmaceutical research and the rise of contract manufacturing organizations are enhancing the need for advanced HVAC, filtration, and monitoring systems to ensure contamination-free operations.

- For instance, Thermo Fisher’s Lebanon site includes 92,000 sq ft of cleanroom space for single-use bioprocess assemblies.

Increasing Semiconductor and Electronics Manufacturing Activities

The rapid growth of semiconductor and electronics manufacturing is boosting demand for cleanroom equipment globally. As chip fabrication requires ultra-clean environments, companies are expanding facilities with high-efficiency HVAC, laminar flow, and filtration units. The surge in demand for advanced chips used in AI, electric vehicles, and consumer electronics supports this trend. Technological innovation and government incentives for semiconductor self-reliance in Asia-Pacific and North America are further driving investments in controlled manufacturing spaces.

- For instance, Intel’s Ohio project phase includes 600,000 sq ft of cleanroom production space.

Expansion of Healthcare Infrastructure and Hospital Cleanrooms

Growing healthcare infrastructure investments worldwide are propelling the adoption of cleanroom equipment. Hospitals are increasingly installing sterile environments for surgical units, intensive care, and pharmaceutical compounding. Regulatory compliance with ISO and GMP standards is enhancing demand for air showers, diffusers, and air filtration systems. The rise in infectious diseases and medical research activities continues to emphasize the need for contamination control, making hospitals a key end-use sector for cleanroom technologies.

Key Trends and Opportunities

Integration of IoT and Automation in Cleanroom Systems

The adoption of IoT-enabled monitoring and automated systems is transforming cleanroom operations. Smart sensors are increasingly used to track air quality, pressure differentials, and particulate levels in real time. Automation enhances efficiency by reducing manual intervention and minimizing contamination risks. Manufacturers are leveraging data analytics to optimize energy use and predictive maintenance, reducing operational costs. The integration of digital control systems is creating new opportunities for vendors offering intelligent and energy-efficient cleanroom equipment.

- For instance, the TSI AeroTrak® 7110 remote particle counter operates at a 1 CFM flow rate, accurately measures particles from 0.1 to 10 µm, and supports both Ethernet (TCP/IP) and serial Modbus RTU connectivity for seamless facility monitoring system integration.

Rising Focus on Energy Efficiency and Sustainability

Sustainability is emerging as a major trend in cleanroom design and equipment manufacturing. Companies are prioritizing low-energy HVAC systems, recyclable materials, and modular setups to reduce carbon emissions. Governments and regulatory agencies are encouraging green certifications, promoting the use of energy recovery units and high-efficiency filters. The growing emphasis on sustainable manufacturing processes across industries presents long-term opportunities for cleanroom equipment suppliers focused on eco-friendly innovations.

- For instance, Camfil’s Absolute V HEPA range reaches H14 efficiency at 99.995% MPPS and handles airflows above 3,400 m³/h.

Increasing Adoption of Modular Cleanroom Solutions

The modular cleanroom trend continues to gain momentum due to flexibility and cost-effectiveness. Industries prefer modular systems for faster installation, scalability, and ease of maintenance. These setups allow seamless upgrades and reconfiguration to meet evolving production needs. The approach supports faster facility expansion in pharmaceuticals, electronics, and healthcare sectors. This growing shift toward modularity provides manufacturers with opportunities to deliver standardized yet customizable cleanroom equipment solutions worldwide.

Key Challenges

High Initial Investment and Maintenance Costs

The significant upfront costs associated with cleanroom construction and equipment installation pose a major challenge. Maintaining optimal operational standards also demands regular servicing and calibration of HVAC systems, filters, and monitoring devices. Small and mid-sized enterprises often face budget constraints, limiting adoption. Additionally, compliance with evolving ISO and GMP regulations adds to the cost burden. Balancing quality control with affordability remains a key barrier to broader market penetration, particularly in developing economies.

Shortage of Skilled Workforce for Cleanroom Operations

Operating and maintaining cleanroom environments requires trained professionals with technical expertise in contamination control and system management. The global shortage of skilled technicians is affecting operational efficiency across industries such as pharmaceuticals, electronics, and healthcare. Inadequate training programs and limited awareness of cleanroom protocols contribute to system inefficiencies. Companies are increasingly investing in workforce development and digital training platforms to overcome this talent gap, but the shortage continues to restrain market growth.

Regional Analysis

North America

North America dominated the cleanroom equipment market with a 38.6% share in 2024. The region’s growth is driven by strong pharmaceutical production, advanced semiconductor fabrication, and expanding biotechnology research. The United States leads with major investments in vaccine manufacturing, life sciences facilities, and chip fabrication plants supported by the CHIPS and Science Act. Increased adoption of energy-efficient HVAC systems and high-performance filtration units also supports market expansion. Canada’s growing medical device and pharmaceutical sectors further contribute to regional demand for modular and compliant cleanroom solutions.

Europe

Europe held a 27.4% share of the cleanroom equipment market in 2024, supported by the region’s focus on stringent regulatory compliance and technological advancement. Countries such as Germany, the United Kingdom, and France are leading in pharmaceutical and biomanufacturing cleanroom adoption. The European Union’s emphasis on GMP standards and clean production facilities strengthens equipment demand. Rising semiconductor production in countries like Ireland and the Netherlands is also boosting the need for precision air control systems. Investments in green and energy-efficient cleanroom solutions further shape regional market development.

Asia Pacific

Asia Pacific accounted for 25.8% of the cleanroom equipment market in 2024, emerging as one of the fastest-growing regions. The expansion of electronics, semiconductor, and pharmaceutical manufacturing in China, Japan, South Korea, and India is driving demand. Government incentives supporting chip fabrication and biopharma facilities fuel investments in advanced HVAC and filtration systems. Rapid industrialization, increasing healthcare infrastructure, and adoption of modular cleanrooms are strengthening regional market growth. The rise in foreign investments and partnerships is further supporting cleanroom equipment suppliers across major Asia Pacific economies.

Latin America

Latin America represented 5.2% of the cleanroom equipment market in 2024. The region’s growth is led by expanding pharmaceutical and healthcare sectors, particularly in Brazil and Mexico. Rising government initiatives to enhance drug manufacturing quality and export competitiveness are promoting cleanroom adoption. The increasing establishment of local production facilities for generics and vaccines supports equipment demand. Gradual adoption of modular cleanroom systems and growing awareness of contamination control practices are fostering steady market growth across Latin American countries despite budgetary constraints.

Middle East and Africa

The Middle East and Africa accounted for 3.0% of the cleanroom equipment market in 2024. The region is witnessing gradual growth due to expanding healthcare infrastructure and investments in biotechnology and pharmaceutical manufacturing. The United Arab Emirates and Saudi Arabia are leading in developing advanced medical facilities and research centers adhering to ISO cleanroom standards. Growing collaborations with international cleanroom suppliers are improving market accessibility. Although adoption remains limited compared to other regions, rising focus on healthcare modernization and industrial diversification is expected to drive future demand.

Market Segmentations:

By Equipment

- Heating Ventilation and Air Conditioning System (HVAC)

- Cleanroom Air Filters

- Air Shower and Diffuser

- Laminar Air Flow Unit

- Others

By Type of Cleanroom

- Modular cleanrooms

- Traditional or Stick Built Cleanrooms

By End Use

- Hospitals

- Compounding & Manufacturing Pharmacies

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The cleanroom equipment market features key players such as Clean Air Products, Terra Universal, Inc., HVAX, Airomax Airborne LLC, Labconco, Integrated Cleanrooms Technologies Pvt. Ltd., MECART, Abtech, Angstrom Technology, and Cleanrooms Depot, Inc. The market is characterized by strong competition focused on product innovation, compliance with ISO and GMP standards, and technological advancement in HVAC and air filtration systems. Companies are investing in modular equipment designs, energy-efficient solutions, and automation technologies to improve operational performance and sustainability. Strategic partnerships, mergers, and global expansions are helping vendors strengthen their supply chain capabilities and regional presence. Increasing demand from the pharmaceutical, semiconductor, and biotechnology sectors encourages continuous R&D to enhance cleanroom safety and precision. The integration of IoT-based monitoring systems and digital control technologies is emerging as a key differentiator, enabling real-time environmental management and predictive maintenance for improved reliability and efficiency in cleanroom operations.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In 2024, Labconco launched redesigned Logic Biosafety Cabinets that feature an updated operating system (MyLogic OS or Logic OS) with status-lite airflow cues and airflow verification from the front window on an eye-level, line-of-sight touchscreen display, aimed at simpler, safer operation.

- In 2024, HVAX expanded its Mumbai HQ footprint and completed a landmark oncology cleanroom project in Nigeria.

- In 2023, Terra Universal launched a new line of pass-through cleanroom cabinets with integrated interlock systems, designed to reduce contamination during material transfers across clean zones.

Report Coverage

The research report offers an in-depth analysis based on Equipment, Type of Cleanroom, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The cleanroom equipment market will continue expanding due to growth in semiconductor and pharmaceutical manufacturing.

- Increasing adoption of modular cleanroom systems will enhance flexibility and scalability across industries.

- Automation and IoT integration will improve real-time monitoring and operational efficiency in cleanroom facilities.

- Energy-efficient HVAC and filtration technologies will gain traction to meet sustainability goals.

- Rising investments in biologics and vaccine production will create consistent demand for sterile environments.

- Asia Pacific will emerge as a major hub for cleanroom equipment production and installation.

- Regulatory compliance and GMP standards will drive continuous upgrades in cleanroom infrastructure.

- Demand for contamination-free spaces in hospitals and laboratories will grow with healthcare advancements.

- Manufacturers will focus on AI-based predictive maintenance and smart air management systems.

- Strategic collaborations and mergers among key players will accelerate technological innovation and market expansion.