Market Overview

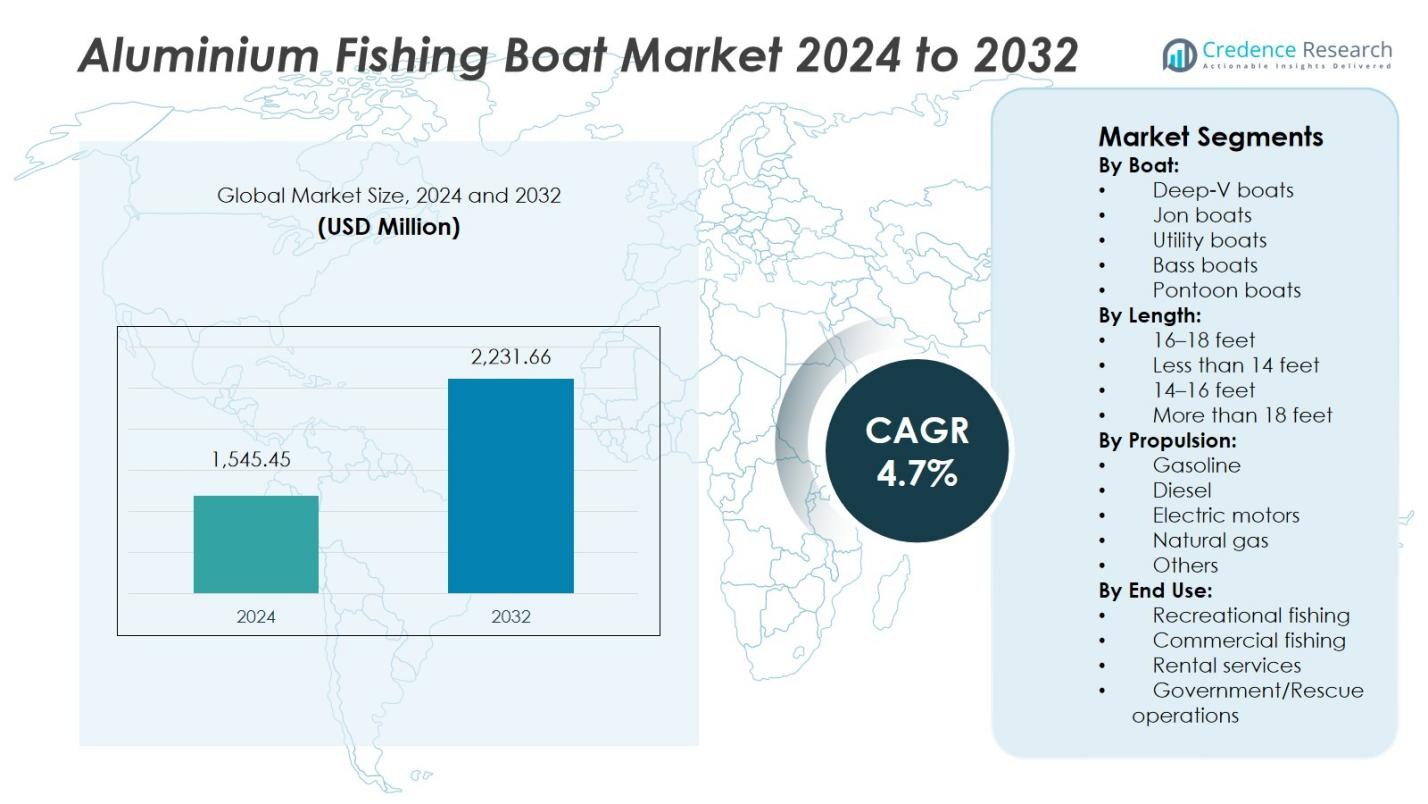

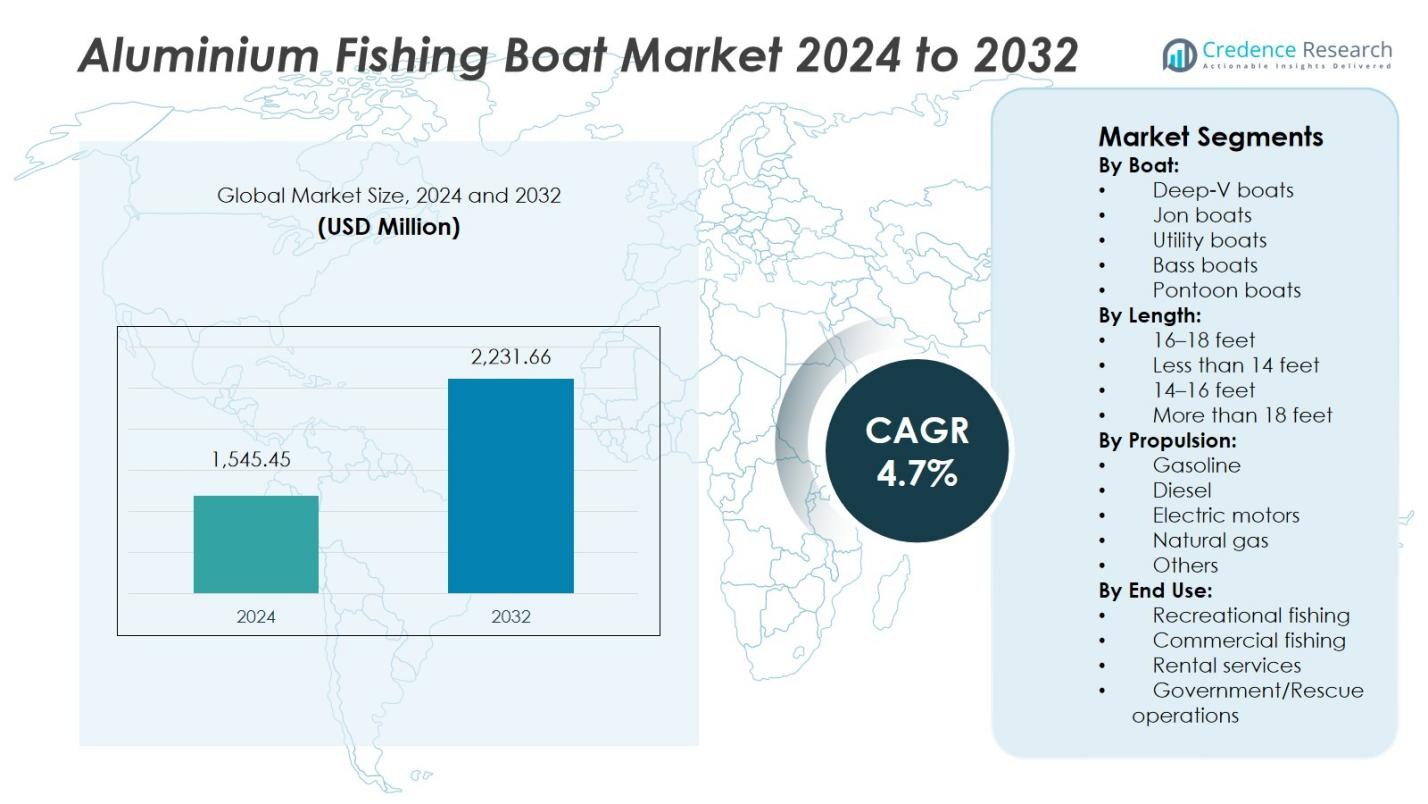

The Aluminium Fishing Boat Market size was valued at USD 1,545.45 million in 2024 and is anticipated to reach USD 2,231.66 million by 2032, growing at a CAGR of 4.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Aluminium Fishing Boat Market Size 2024 |

USD 1,545.45 Million |

| Aluminium Fishing Boat Market, CAGR |

4.7% |

| Aluminium Fishing Boat Market Size 2032 |

USD 2,231.66 Million |

The Aluminium Fishing Boat Market is led by prominent players such as G3Boats, White River Marine Group, Brunswick Corporation, XpressBoats, Alumacraft Boat, SeaArk Boats, SmokerCraft, MirroCraft, Princecraft Boats, and LegendBoats. These companies compete through product innovation, quality enhancement, and expanded distribution networks. Their focus on lightweight, corrosion-resistant designs and fuel-efficient propulsion systems drives customer preference across recreational and commercial segments. North America dominates the market with a 42% share in 2024, supported by high recreational fishing participation, advanced marine infrastructure, and established boat manufacturing facilities. Europe and Asia Pacific follow, showing growing demand from tourism and leisure boating sectors.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Aluminium Fishing Boat Market was valued at USD 1,545.45 million in 2024 and is expected to reach USD 2,231.66 million by 2032, growing at a CAGR of 4.7%.

- Rising participation in recreational and sport fishing, along with demand for durable and low-maintenance boats, is fueling market growth.

- Growing adoption of electric and hybrid propulsion systems, along with lightweight hull innovations, represents a major trend shaping future designs.

- The market remains competitive with leading players such as G3Boats, Brunswick, XpressBoats, and Alumacraft Boat focusing on advanced materials, efficiency, and customization.

- North America leads with a 42% share, followed by Europe at 23% and Asia Pacific at 21%, while deep-V boats dominate with 30.2% of total market revenue in 2024.

Market Segmentation Analysis:

By Boat Type

The market for aluminium fishing boats is led by the deep-V boats segment, which holds around 30.2% of revenue share in 2024. These vessels appeal because their V-shaped hull offers superior stability and smoother rides in choppier waters, making them popular for offshore and larger lake fishing. Rising demand from recreational anglers seeking versatility and durability boosts this segment, while newer models incorporate lightweight alloys and advanced design features to enhance performance and handling.

For instance, Finish Line Boats introduced a custom 9.5m aluminum sports fishing boat in 2024, constructed with high-grade 5083 marine aluminum for superior strength-to-weight ratio and corrosion resistance, and equipped with advanced Simrad navigation systems and integrated fish storage solutions for serious offshore anglers.

By Length

In terms of length, the 16–18 feet category dominates with 37% market share in 2024. This size strikes a practical balance easy to tow, store, and operate, yet large enough to carry multiple anglers and fishing gear. The versatility of this length, coupled with its affordability and suitability for both recreational and small commercial use, drives much of the demand for aluminium fishing boats worldwide. Increasing preference among hobbyist fishermen and rental operators further supports consistent growth in this mid-length segment across coastal and inland waterways.

For instance, Alumacraft Boat introduced advanced rod holders and live wells on their mid-length models, facilitating efficient fishing activities suitable for both hobbyist anglers and rental operators.

By Propulsion

Within the propulsion category, gasoline motors remain the dominant option, capturing the largest market share due to their wide fuel availability, cost-effectiveness, and compatibility with mid-sized aluminium boats. Their strength is reinforced by the popularity of recreational fishing in developed markets, where speed, range, and easy maintenance are key considerations. Manufacturers continue to focus on improving fuel efficiency and performance in gasoline-powered systems, further supporting their market leadership.

Key Growth Drivers

Rising Popularity of Recreational Fishing Activities

The aluminium fishing boat market is witnessing strong growth due to the increasing interest in recreational and sport fishing. Higher disposable incomes and outdoor lifestyle trends encourage consumers to invest in reliable and easy-to-maintain boats. Aluminium boats offer lightweight design, corrosion resistance, and fuel efficiency, making them ideal for both freshwater and saltwater use. Supportive initiatives by tourism authorities and growing participation in fishing tournaments across North America and Europe further boost market expansion and consumer adoption.

For instance, Silver unveiled two pure aluminium models in its popular Hawk series at the 2025 Helsinki Vene exhibition, combining modern design and high performance tailored for recreational fishing and watersports.

Advancements in Boat Design and Manufacturing Technologies

Continuous innovations in hull engineering, welding techniques, and propulsion systems are transforming aluminium boat performance. Manufacturers are adopting precision fabrication, automation, and advanced alloys to enhance strength, stability, and efficiency. Modern aluminium boats now integrate modular layouts, improved noise insulation, and hydrodynamic hulls that enhance comfort and handling. These design upgrades, combined with growing interest in customization, strengthen the market’s appeal among both professional anglers and recreational buyers seeking superior value and durability.

For instance, Echo Yachts leverages aluminium extrusions combined with friction stir welding (FSW) to build lighter, stronger, and more durable hulls, enhancing vessel performance and longevity.

Expanding Demand from Commercial and Rental Applications

Rising demand from small-scale commercial fishing, marine patrol, and rental services contributes significantly to market growth. Aluminium boats are preferred for their low maintenance needs, lightweight construction, and long service life. Their suitability for diverse marine environments makes them ideal for both inland and coastal operations. The growing tourism and adventure sports industries, especially in Asia Pacific and Latin America, drive rental fleet expansion, offering new opportunities for manufacturers and distributors in emerging markets.

Key Trends and Opportunities

Increasing Shift Toward Electric and Hybrid Propulsion

The growing emphasis on sustainability and fuel efficiency is driving a shift toward electric and hybrid propulsion in aluminium fishing boats. Advancements in battery technology and government incentives for clean marine mobility are encouraging manufacturers to develop eco-friendly models. Electric motors reduce noise and emissions, appealing to environmentally conscious consumers and operators in protected waterways. This trend opens new opportunities for companies focusing on green technologies, modular battery systems, and lightweight energy-efficient designs.

For instance, ePropulsion has developed electric propulsion systems for aluminium boats that deliver quiet, emission-free operation, extending ranges up to 60 nautical miles with lithium-ion battery packs of 40-80 kWh capacity.

Growth of Customization and Smart Features

The demand for personalized and technology-integrated aluminium boats is rising rapidly. Consumers increasingly seek models with smart dashboards, GPS integration, sonar systems, and ergonomic seating layouts. Manufacturers are offering modular design options that allow easy upgrades and tailored configurations to meet specific fishing styles. The integration of digital monitoring and connectivity features enhances convenience and safety, helping premium and mid-tier brands differentiate themselves and capture new customer segments globally.

For instance, Mercury Marine offers SmartCraft-compatible gauges that integrate GPS and sonar data, enabling users to monitor vessel speed, depth, and engine statistics seamlessly.

Key Challenges

Fluctuating Raw Material Costs

Volatility in aluminium prices poses a significant challenge for manufacturers, directly impacting production costs and profit margins. Global supply chain disruptions, energy price variations, and mining regulations contribute to unpredictable price trends. Smaller boat producers face difficulty in absorbing these fluctuations, often passing costs to consumers, which affects competitiveness. Maintaining stable sourcing agreements and adopting recycling strategies are essential to offset raw material risks and ensure consistent pricing structures across markets.

Environmental Regulations and Emission Standards

Stringent environmental policies governing emissions, noise levels, and material use present challenges for traditional boat manufacturers. Compliance with evolving maritime safety and emission norms demands investment in cleaner propulsion technologies and eco-friendly coatings. Smaller manufacturers may struggle with the cost of redesigning models to meet such standards. However, adapting to these regulations through innovation in design and propulsion can help sustain long-term growth while aligning with global sustainability goals.

Regional Analysis

North America

North America dominates the aluminium fishing boat market with a 42% market share in 2024. The region’s strong culture of recreational fishing, vast freshwater bodies, and high disposable income levels support steady demand. The United States leads regional sales, driven by widespread adoption of lightweight and durable aluminium boats among sport anglers. Canada also contributes significantly, benefiting from expanding inland fishing tourism and rental fleets. Manufacturers in the region focus on advanced propulsion systems, improved hull designs, and enhanced comfort features to cater to both casual and professional users.

Europe

Europe holds a 23% market share in the global aluminium fishing boat market, driven by the popularity of recreational fishing and marine leisure activities across Nordic and Western European nations. Countries such as Finland, Norway, and France lead demand due to extensive coastal and inland waterways. The region emphasizes sustainability, prompting adoption of electric and hybrid propulsion systems. Stringent marine safety regulations also encourage innovation in eco-friendly coatings and corrosion-resistant materials. Growing interest in compact, easily transportable aluminium boats further supports market expansion across European fishing communities.

Asia Pacific

Asia Pacific accounts for 21% market share in 2024 and represents the fastest-growing regional market. Rapid urbanization, expanding disposable incomes, and government promotion of marine tourism drive growth. China, Japan, and Australia are major contributors, with increasing participation in recreational and small-scale commercial fishing. Manufacturers are investing in locally optimized designs and affordable models suited for tropical and coastal conditions. The rising popularity of aluminium boats among first-time buyers and rental operators strengthens regional adoption, while improving marina infrastructure and coastal leisure development create sustained long-term demand.

Latin America

Latin America captures a 9% market share, supported by growing fishing activities across Brazil, Mexico, and Argentina. The region’s abundant coastal and river networks encourage the use of lightweight aluminium boats for both commercial and recreational purposes. Rising tourism in coastal destinations fuels higher rental and charter operations. Manufacturers are expanding their distribution networks and partnering with local assemblers to reduce costs and enhance accessibility. Increasing awareness of sustainable fishing practices and the growing appeal of leisure boating are expected to strengthen regional demand over the forecast period.

Middle East & Africa

The Middle East & Africa region holds an 5% market share in 2024, driven by expanding coastal tourism, marine surveillance, and small-scale fishing activities. Gulf countries are investing in marinas and coastal leisure projects, creating new opportunities for aluminium boat suppliers. In Africa, markets such as South Africa and Kenya show rising adoption of aluminium boats for inland and lake fishing. The region faces challenges from limited manufacturing capabilities, yet growing import availability and interest in affordable, durable vessels are expected to drive gradual growth over the coming years.

Market Segmentations:

By Boat:

- Deep-V boats

- Jon boats

- Utility boats

- Bass boats

- Pontoon boats

By Length:

- 16–18 feet

- Less than 14 feet

- 14–16 feet

- More than 18 feet

By Propulsion:

- Gasoline

- Diesel

- Electric motors

- Natural gas

- Others

By End Use:

- Recreational fishing

- Commercial fishing

- Rental services

- Government/Rescue operations

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the aluminium fishing boat market features major players such as G3Boats, White River Marine Group, Brunswick Corporation, XpressBoats, Alumacraft Boat, SeaArk Boats, SmokerCraft, MirroCraft, Princecraft Boats, and LegendBoats. These companies compete through innovation, brand reputation, and dealer network expansion. Leading manufacturers focus on lightweight hull designs, advanced welding techniques, and fuel-efficient propulsion systems to enhance performance and durability. Product diversification across recreational, commercial, and rental applications strengthens market reach. Strategic alliances, dealership growth, and regional manufacturing investments remain central to maintaining competitiveness. The integration of smart features, electric propulsion, and customizable layouts is becoming a key differentiator. Rising focus on eco-friendly production processes and corrosion-resistant alloys further supports long-term sustainability. Continuous product launches and upgrades reinforce brand presence, with North American manufacturers maintaining a dominant position while Asian and European brands expand through strategic partnerships and localized assembly operations.

Key Player Analysis

- LegendBoats

- SmokerCraft

- SeaArkBoats

- MirroCraft

- Brunswick

- XpressBoats

- G3Boats

- WhiteRiverMarineGroup

- PrincecraftBoats

- AlumacraftBoat

Recent Developments

- In May 2025, Arc Boat Company announced the upcoming launch of its “Arc Coast” 24-foot all-electric aluminium fishing boat, designed to combine sustainable propulsion with high-performance capabilities, with deliveries expected to begin in 2026.

- In January 2025, KingFisher Boats released the 23 XAC and 25 XAC heavy-gauge aluminum boats designed for both fishing and cruising.

- In February 2025, Silver Hawk expanded its Hawk series with two new pure-aluminum models (BRX and SCX) debuting at the Helsinki Vene 25 Båt exhibition.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Boat, Length, Propulsion, End Use and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The aluminium fishing boat market will witness steady growth driven by rising recreational fishing activities.

- Manufacturers will increasingly focus on lightweight, durable, and fuel-efficient boat designs.

- Electric and hybrid propulsion systems will gain wider adoption due to sustainability goals.

- Demand from rental and tourism-based operators will expand across coastal and inland regions.

- Smart navigation, GPS integration, and digital dashboards will become standard features.

- Customization and modular layouts will attract a broader base of recreational users.

- Asia Pacific will emerge as a major growth hub with rising disposable incomes.

- Strategic partnerships and dealership expansions will strengthen global distribution networks.

- Advances in corrosion-resistant coatings and alloys will enhance product longevity.

- Regulatory focus on eco-friendly materials and emission standards will shape future product innovations.