| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Airborne Wind Energy (AWE) Systems Market Size 2024 |

USD 344.8 million |

| Airborne Wind Energy (AWE) Systems Market, CAGR |

10.03% |

| Airborne Wind Energy (AWE) Systems Market Size 2032 |

USD 738.1 million |

Market Overview:

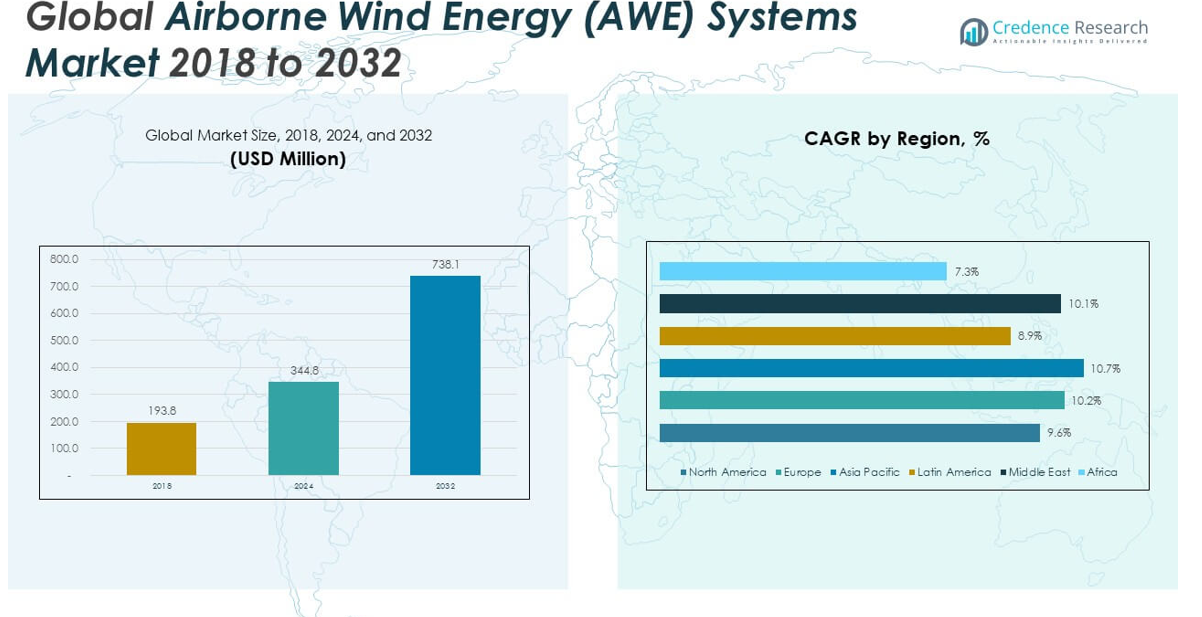

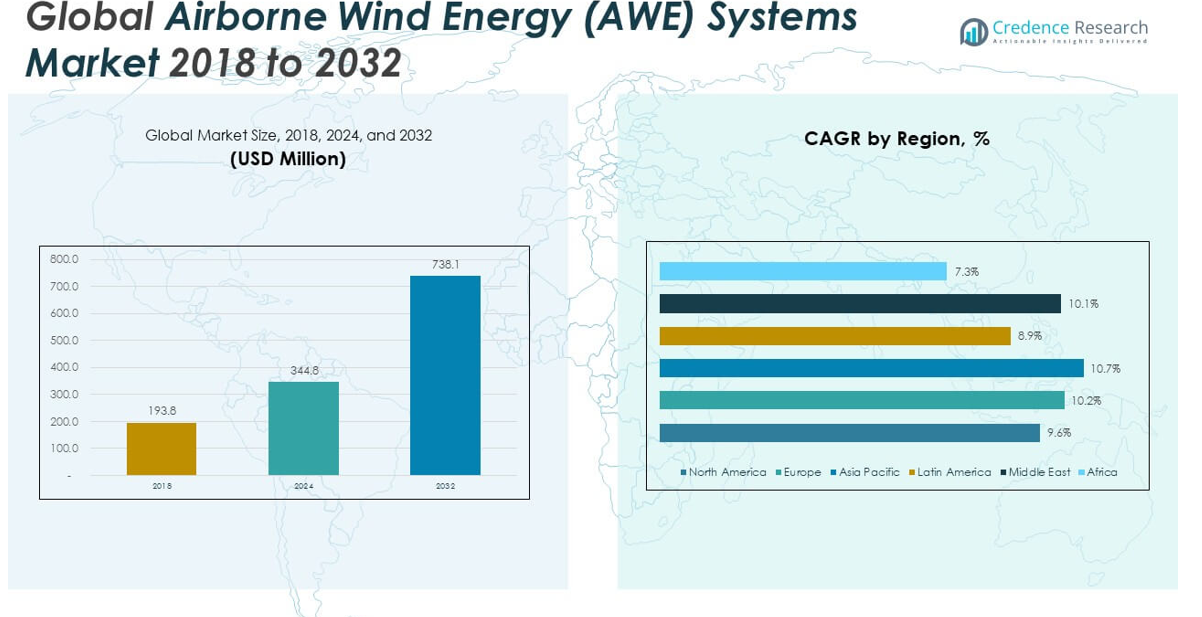

The Global Airborne Wind Energy (AWE) Systems Market size was valued at USD 193.8 million in 2018 to USD 344.8 million in 2024 and is anticipated to reach USD 738.1 million by 2032, at a CAGR of 10.03% during the forecast period.

Key drivers accelerating the adoption of airborne wind energy systems include the global emphasis on renewable energy generation, the need for scalable and modular clean energy systems, and the limitations of traditional wind turbines in capturing high-altitude wind resources. AWE systems operate at altitudes where wind is stronger and more consistent, offering up to five times more energy density compared to ground-level installations. This advantage translates into lower levelized costs of electricity (LCOE), especially in regions where conventional wind farms face land use restrictions, challenging terrain, or high infrastructure costs. Moreover, technological innovations in autonomous flight control, tether design, composite materials, and energy conversion mechanisms are enhancing system reliability, efficiency, and ease of deployment. Companies and governments are increasingly funding R&D and pilot demonstrations, recognizing the potential of AWE in offshore applications, military logistics, disaster response, and off-grid electrification. Policy support through renewable energy targets, subsidies, and research grants continues to play a pivotal role in enabling market growth and attracting new entrants. The modular design, minimal foundation requirements, and reduced material use further boost the environmental and economic appeal of these systems.

Regionally, North America currently leads the Global AWE Systems Market, driven by strong innovation ecosystems, access to venture capital, and progressive regulatory frameworks that favor renewable energy experimentation. The United States is home to several pioneering startups and pilot installations, with universities and research institutions actively contributing to technology development. Europe follows closely, with Germany, the Netherlands, and the United Kingdom emerging as early adopters. European countries benefit from robust government backing, ambitious decarbonization targets, and collaboration between industry and academia. Leading companies such as SkySails, Kitepower, and Ampyx Power are advancing large-scale demonstration projects that are influencing global best practices. In the Asia-Pacific region, the market is expanding rapidly due to surging energy demand, growing awareness of airborne wind energy benefits, and favorable wind conditions. Countries like China, India, and Japan are exploring AWE to complement their national renewable energy portfolios and reduce dependence on fossil fuels. Latin America, the Middle East, and Africa are currently in the exploratory phase, primarily targeting AWE systems for rural electrification and off-grid energy solutions. While infrastructure and regulatory challenges persist in these emerging regions, pilot programs and international partnerships are laying the groundwork for long-term growth.

Market Insights:

- The Global Airborne Wind Energy (AWE) Systems Market was valued at USD 193.8 million in 2018, reached USD 344.8 million in 2024, and is projected to reach USD 738.1 million by 2032, growing at a CAGR of 10.03% during the forecast period.

- AWE systems harness stronger, more consistent high-altitude winds—typically between 200 to 1,000 meters—delivering up to five times more energy density than conventional turbines installed at lower elevations.

- Government-driven support through renewable energy mandates, research grants, and demonstration project funding is stimulating market adoption and reducing entry barriers for startups and energy developers.

- Technological innovations such as autonomous flight control, AI-driven navigation, composite tethers, and lightweight airborne platforms are enhancing operational efficiency and lowering system deployment costs.

- North America currently leads the market, supported by venture capital, R&D infrastructure, and regulatory flexibility, while Europe follows with notable players like SkySails, Ampyx Power, and Kitepower executing pilot projects across Germany, the Netherlands, and the UK.

- Major challenges include technological immaturity, limited long-term performance data, and regulatory ambiguity surrounding airspace usage, which create delays in permitting and restrict large-scale implementation.

- Asia-Pacific, led by countries like China, India, and Japan, along with Latin America, the Middle East, and Africa, presents significant long-term potential for AWE systems in off-grid electrification, rural power supply, and renewable diversification where conventional wind infrastructure is impractical.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Growing Global Demand for Renewable and Decentralized Energy Sources:

The Global Airborne Wind Energy (AWE) Systems Market is gaining momentum as countries intensify their focus on renewable energy targets and carbon neutrality goals. Traditional wind and solar systems face geographic and land availability constraints, prompting the need for alternative technologies. AWE systems can generate power from high-altitude wind streams, which are stronger and more consistent, offering a reliable solution for distributed generation. This makes them suitable for off-grid, remote, and underserved areas where conventional infrastructure is costly or unfeasible. National and regional energy policies are increasingly supporting decentralized and modular power systems, placing airborne wind technology in a favorable position. It presents a pathway for cleaner, more resilient energy generation, particularly in the context of grid diversification and energy independence.

- For instance, SkySails Groupachieved a major milestone in 2024 by delivering the world’s first verified power curve for airborne wind energy, certified by windtest grevenbroich gmbh. This independent certification validates the ability of SkySails’ system to reliably harness high-altitude winds for clean energy generation, confirming its suitability for distributed and off-grid applications where conventional infrastructure is not feasible.

Technological Advancements in Materials, Control Systems, and Automation:

Ongoing improvements in autonomous flight control, lightweight composite materials, and tether durability are expanding the feasibility and commercial readiness of AWE systems. These advancements are improving energy capture efficiency, extending operational lifespan, and minimizing maintenance requirements. Autonomous kites, drones, and tethered wings can be deployed with minimal ground infrastructure, reducing the cost of installation and logistics. It benefits from innovations in onboard sensors, real-time weather prediction, and AI-based navigation, which enhance performance and reduce system failures. Enhanced control algorithms enable safe operation under varying wind conditions, addressing a key barrier in earlier designs. The integration of smart technologies is critical to optimizing power generation and ensuring economic competitiveness.

- For instance, the Ampyx Power AP2 prototypewas used in a validated dynamic system model, with real flight measurements confirming the accuracy of its flight dynamics and power production in crosswind operations. This prototype, referenced in peer-reviewed research, demonstrates how advanced flight control and aerodynamic optimization can be achieved and quantified through rigorous system modeling and field data.

Supportive Government Policies and Rising Public and Private Investments:

Incentives, grants, and pilot project funding are encouraging start-ups and research institutions to develop and demonstrate AWE technologies at scale. Governments in North America, Europe, and parts of Asia are incorporating airborne wind into clean energy portfolios and innovation roadmaps. It is attracting investments from both traditional energy players and venture capital firms interested in next-generation renewable solutions. Public-private partnerships are helping to accelerate commercialization by sharing risks and fostering infrastructure readiness. Regulatory flexibility in test zones and renewable integration frameworks is enabling faster adoption and deployment of airborne systems. This alignment between policy, capital, and innovation is a foundational driver for sustained market expansion.

Cost Efficiency and Scalability in Challenging Environments:

AWE systems require significantly less raw material, land, and construction effort compared to conventional wind turbines. This makes them ideal for use in locations with difficult terrain, limited road access, or environmental sensitivity. It enables scalable deployment models ranging from small mobile units for rural electrification to large offshore installations for grid-scale supply. Low transport and installation costs enhance feasibility in disaster-prone or energy-insecure regions. These systems also offer rapid setup and takedown, providing operational flexibility that fixed turbines lack. As manufacturing scales up and supply chains mature, airborne wind solutions are expected to compete more directly on price with established renewables.

Market Trends:

Transition from Prototype Development to Commercial Pilot Projects:

The Global Airborne Wind Energy (AWE) Systems Market is shifting from experimental research to structured pilot implementations. Companies are moving beyond laboratory-scale models to full-scale system demonstrations in real-world conditions. This shift reflects growing confidence in the technology’s viability and alignment with renewable energy goals. Several startups and energy firms are entering long-term testing phases, allowing them to validate performance, reliability, and integration with existing power infrastructure. These pilots are supported by academic partnerships and industry consortia that emphasize practical deployment over theoretical development. It demonstrates an important maturity step toward commercialization and broad market acceptance.

- For instance, Kitemillis constructing the world’s first AWE demonstration park in Norway, planning to deploy up to five 20 kW prototype systems. This transition from laboratory to real-world pilot projects is supported by partnerships with Norwegian utility Voss Energi and follows successful acquisitions and technology integrations, marking a significant step toward commercial readiness and grid integration.

Increased Interest in Offshore Airborne Wind Applications:

Offshore energy production is gaining traction, and AWE systems are being adapted for marine environments where conventional wind turbines face high costs and logistical hurdles. The ability of airborne systems to be mounted on floating platforms or deployed from vessels reduces seabed impact and infrastructure complexity. It provides a viable alternative for deep-water regions where fixed turbines are not feasible. Floating airborne units can tap stronger, steadier winds at higher altitudes while avoiding conflicts with shipping lanes and marine life zones. Developers are exploring modular offshore configurations to serve island grids, oil and gas platforms, and remote coastal installations. This trend is expanding the addressable market for airborne wind technology.

- For instance, the S. Department of Energy’s 2021 assessmenthighlights ongoing research and pilot activities specifically targeting offshore airborne wind energy. The report notes that AWE systems are being considered for deployment at altitudes between 200–800 meters, where they can operate above conventional turbine heights and offer new solutions for deep-water and offshore sites, supported by targeted resource measurement campaigns and validation efforts.

Growing Focus on Hybrid Renewable Energy Integration:

Energy developers are increasingly integrating AWE systems into hybrid configurations that combine wind, solar, and battery storage. This trend reflects the need for continuous, balanced power generation across varying environmental conditions. In hybrid models, airborne wind compensates for solar variability and supports grid stability during nighttime or cloudy periods. It allows energy providers to maximize land use and infrastructure by co-locating systems with complementary generation profiles. Some AWE systems are being evaluated for integration with hydrogen production units and microgrids, especially in remote areas. This trend supports broader energy diversification strategies and strengthens resilience against supply interruptions.

Standardization Efforts and Regulatory Framework Development:

Industry stakeholders are engaging in efforts to establish standards for design, safety, operation, and environmental compliance of AWE systems. Regulatory bodies in Europe and North America are beginning to draft guidelines to govern airborne wind operations in shared airspace. It is prompting coordination between aviation authorities, energy regulators, and developers to define safe altitude zones, air traffic management protocols, and licensing frameworks. Establishing clear rules will reduce uncertainty and improve investor confidence. Standardization is also supporting interoperability between components and facilitating technology benchmarking. These efforts are crucial to unlocking large-scale deployment and international market expansion.

Market Challenges Analysis:

Technical Uncertainties and Limited Operational Track Record:

The Global Airborne Wind Energy (AWE) Systems Market faces challenges related to technological immaturity and limited real-world deployment experience. Most systems remain in prototype or pilot stages, with few having undergone prolonged operation in diverse weather conditions. Issues such as system stability, tether entanglement, and control reliability under turbulent wind flow continue to pose engineering hurdles. Scaling up to utility-grade systems requires robust testing frameworks, which are often constrained by regulatory or funding limitations. It struggles with validating long-term performance and maintenance needs, especially in offshore or remote applications. Without proven operational benchmarks, many investors remain cautious about committing large-scale capital to the sector.

Regulatory Ambiguity and Airspace Integration Barriers:

The absence of established regulatory frameworks for airborne wind systems presents another significant challenge for market growth. AWE technologies operate in shared airspace, creating potential conflicts with aviation traffic, especially near populated or commercially active zones. Governments and aviation authorities have yet to define consistent rules on permitted flight altitudes, safety zones, or air traffic coordination. It faces delays in project approvals and difficulties securing permits due to these regulatory gaps. Insurance providers and utility operators often hesitate to engage with AWE projects lacking clear compliance standards. These regulatory ambiguities slow market entry and raise operational risks, particularly in cross-border or large-scale deployments.

Market Opportunities:

Emerging Demand in Off-Grid and Remote Energy Markets:

The Global Airborne Wind Energy (AWE) Systems Market holds significant opportunity in regions where conventional energy infrastructure is limited or economically unfeasible. Remote islands, mining sites, and rural communities often rely on costly diesel generators for electricity. AWE systems offer a portable, low-footprint solution capable of delivering clean power without extensive civil works. It can serve humanitarian operations, military bases, and temporary installations requiring flexible and reliable energy access. Governments and NGOs focused on energy equity are exploring these systems to expand electrification without large capital investments. This demand creates a pathway for commercial growth in emerging economies.

Commercialization Potential in Floating Offshore Wind Sector:

Offshore energy producers are actively seeking alternatives to traditional fixed-bottom wind turbines for deeper waters. The Global Airborne Wind Energy (AWE) Systems Market offers a compelling solution through systems that can be deployed on floating platforms with minimal seabed impact. It enables access to consistent, high-altitude winds in deep-sea regions where conventional turbines are impractical. The modularity and reduced material needs of airborne platforms support scalable offshore deployment. Energy developers are evaluating integration with floating solar and storage systems for hybrid offshore solutions. This trend opens new revenue channels for AWE companies targeting utility-scale offshore wind projects.

Market Segmentation Analysis:

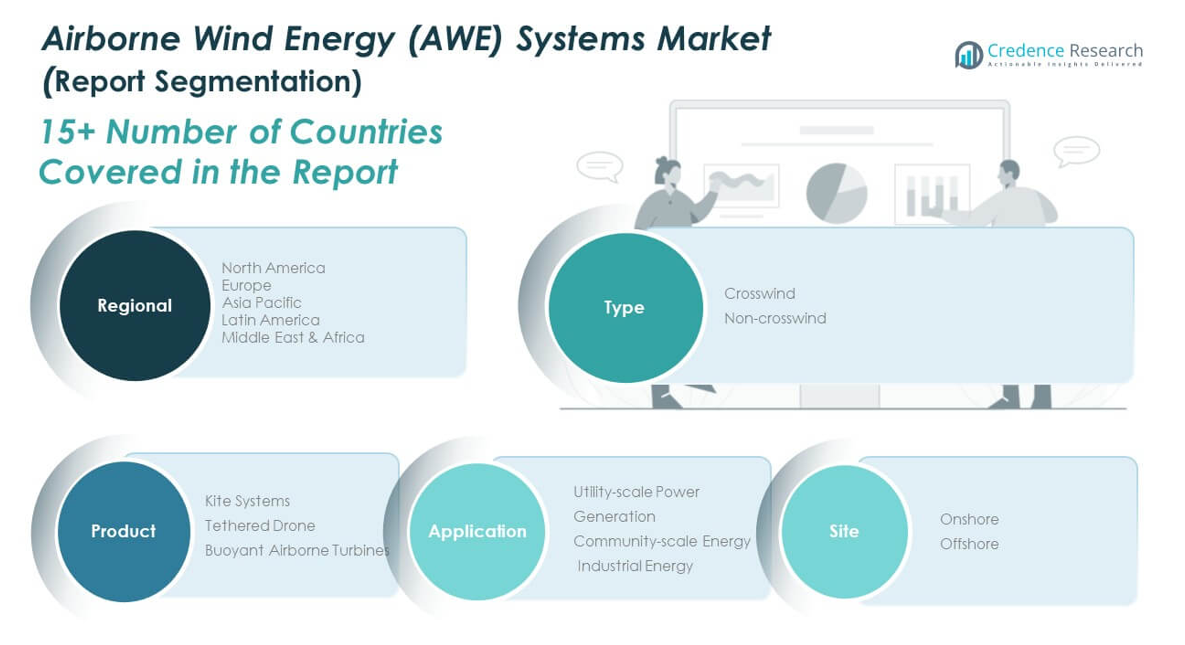

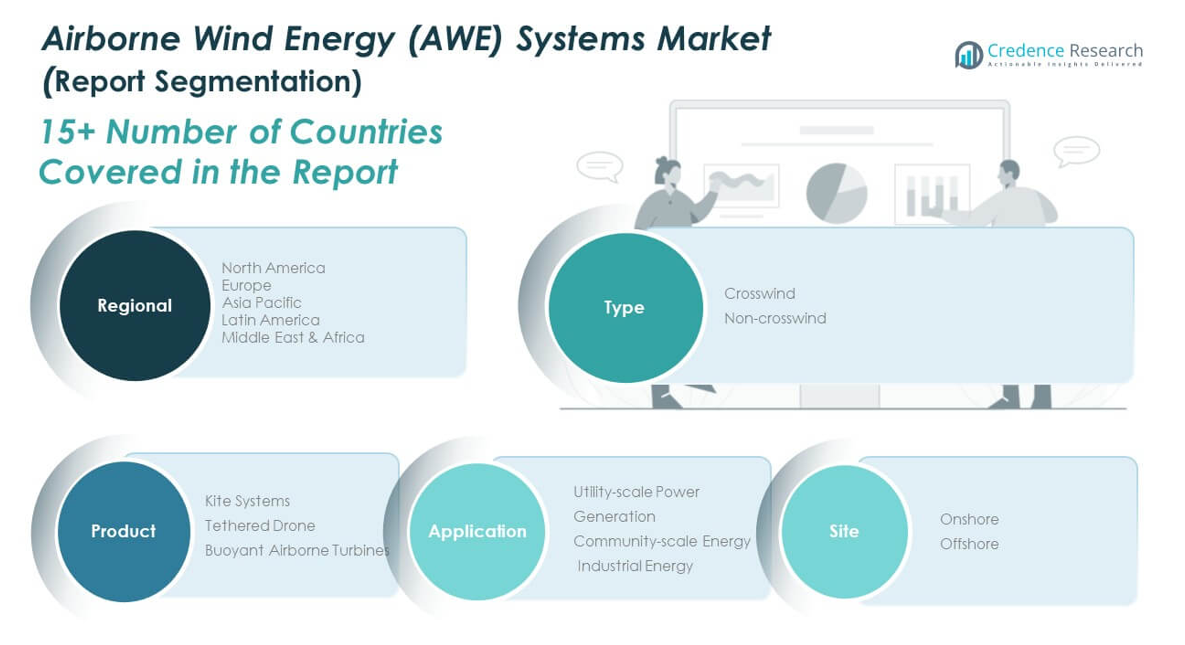

By Type

The Global Airborne Wind Energy (AWE) Systems Market includes crosswind and non-crosswind systems. Crosswind systems hold the larger share due to their higher energy output, driven by the aerodynamic motion of the airborne device across the wind flow. Non-crosswind systems are simpler and more suitable for early-stage deployments or areas with regulatory constraints, though they offer lower energy efficiency.

- For instance, a Chalmers University of Technology studymodeled and validated the flight and power production of crosswind AWES using real data from the Ampyx Power AP2, confirming that crosswind systems can achieve higher energy output due to their dynamic flight paths and aerodynamic efficiency.

By Product

The market segments into kite systems, tethered drones, and buoyant airborne turbines. Kite systems dominate the product landscape, offering proven performance and lower material requirements. Tethered drones are emerging as a viable alternative, offering precise control and adaptability in varied wind conditions. Buoyant airborne turbines, although at a nascent stage, are drawing interest for offshore deployments where infrastructure is limited.

- For instance, the SkySails Power kite systemis the first to have its power curve independently verified, demonstrating the technical maturity of kite-based AWE solutions and establishing a benchmark for future product development and commercial deployment in the airborne wind sector.

By Application

Utility-scale power generation leads in application, driven by the rising need for large-scale renewable capacity. Community-scale energy is expanding, especially in rural and remote regions that lack grid access. Industrial energy use is gradually increasing, as manufacturers seek clean and cost-effective alternatives to traditional power sources.

By Site

Onshore installations currently dominate due to accessibility and ease of permitting. Offshore deployments are expected to grow significantly, supported by stronger wind consistency and the need to minimize land use. Both segments offer distinct advantages depending on geographical and economic factors.

Segmentation:

By Type

By Product

- Kite Systems

- Tethered Drone

- Buoyant Airborne Turbines

By Application

- Utility-scale Power Generation

- Community-scale Energy

- Industrial Energy

By Site

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

The North America Airborne Wind Energy (AWE) Systems Market size was valued at USD 54.04 million in 2018 to USD 94.00 million in 2024 and is anticipated to reach USD 195.08 million by 2032, at a CAGR of 9.6% during the forecast period. North America leads the Global Airborne Wind Energy (AWE) Systems Market, driven by early-stage commercialization, innovation hubs, and robust funding activity. The United States dominates regional growth with strong support from research institutions, venture capital firms, and renewable energy mandates. It benefits from a flexible regulatory framework that supports experimental and pilot-scale energy technologies. Canada also contributes through localized applications in remote communities. Ongoing collaborations between academia and private companies strengthen the market’s foundation. North America remains a technology leader and testbed for future airborne wind applications.

Europe

The Europe Airborne Wind Energy (AWE) Systems Market size was valued at USD 44.14 million in 2018 to USD 79.32 million in 2024 and is anticipated to reach USD 172.05 million by 2032, at a CAGR of 10.2% during the forecast period. Europe holds a strong position in airborne wind technology with established players like SkySails, Kitepower, and Ampyx Power leading innovation. Germany, the Netherlands, and the United Kingdom spearhead deployment and testing activities. It benefits from clear regulatory pathways, strong policy incentives, and access to EU research funds. Governments and private utilities are investing in demonstration projects to assess utility-scale integration. The region’s focus on carbon neutrality and sustainable energy diversification aligns well with AWE’s potential. Europe is expected to maintain steady growth through technological maturity and market confidence.

Asia Pacific

The Asia Pacific Airborne Wind Energy (AWE) Systems Market size was valued at USD 61.58 million in 2018 to USD 113.83 million in 2024 and is anticipated to reach USD 255.90 million by 2032, at a CAGR of 10.7% during the forecast period. Asia Pacific is the fastest-growing region in the Global AWE Systems Market, supported by rising energy demand and clean energy targets. China, India, and Japan are leading investment and pilot projects to integrate AWE into broader national renewable frameworks. It benefits from large coastal and rural areas, suitable for both offshore and remote deployments. Policymakers are beginning to draft guidelines that accommodate airborne technologies. Private firms are forming partnerships with research bodies to build technical capacity. The region’s growth trajectory reflects its strategic energy priorities and population-driven energy needs.

Latin America

The Latin America Airborne Wind Energy (AWE) Systems Market size was valued at USD 11.20 million in 2018 to USD 18.77 million in 2024 and is anticipated to reach USD 36.91 million by 2032, at a CAGR of 8.9% during the forecast period. Latin America is in the early phase of AWE adoption, with market activity concentrated around rural electrification and off-grid power projects. Brazil, Argentina, and Chile are evaluating the feasibility of airborne systems in remote regions and difficult terrain. It offers a cost-effective alternative to diesel generation and large-scale infrastructure. Public-private pilot programs are gradually emerging to validate system viability. Energy planners are exploring AWE as a flexible complement to solar and hydropower assets. The region holds long-term potential with growing energy access demands.

Middle East

The Middle East Airborne Wind Energy (AWE) Systems Market size was valued at USD 13.99 million in 2018 to USD 25.04 million in 2024 and is anticipated to reach USD 54.03 million by 2032, at a CAGR of 10.1% during the forecast period. The Middle East is showing increased interest in airborne wind to support energy diversification and reduce reliance on fossil fuels. Countries such as the UAE and Saudi Arabia are investing in advanced energy technologies as part of their national transformation agendas. It aligns with offshore and desert-based deployment models that benefit from strong, consistent wind. Pilot initiatives are under discussion within renewable development zones and smart city frameworks. The region sees AWE as a clean solution with minimal land and water usage. Growth depends on continued regulatory development and international collaboration.

Africa

The Africa Airborne Wind Energy (AWE) Systems Market size was valued at USD 8.82 million in 2018 to USD 13.80 million in 2024 and is anticipated to reach USD 24.14 million by 2032, at a CAGR of 7.3% during the forecast period. Africa presents significant future opportunity for airborne wind systems, especially in underserved and off-grid regions. Countries such as South Africa, Kenya, and Egypt are exploring AWE as part of renewable energy and electrification strategies. It offers a cost-efficient and mobile alternative to traditional infrastructure in rural or fragile environments. International development agencies are supporting pilot projects to validate local viability. Progress is limited by regulatory gaps and financing hurdles, though interest continues to grow. The region is building capacity to enable broader deployment in the coming years.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Ampyx Power

- E-Kite Netherlands BV

- EnerKite GmbH

- Altaeros Energies

- eWind Solutions

- Kite Power Solutions, Ltd.

- Makani Power

- SkySails GmbH & Co. KG

- Windlift LLC

- Twingtec AG

- Omnidea, Lda

- Kitenergy S.r.l.

- kPower LLC

- Other Key Players

Competitive Analysis:

The Global Airborne Wind Energy (AWE) Systems Market is characterized by a dynamic mix of early-stage innovators, technology developers, and academic partnerships. Companies such as SkySails, Ampyx Power, Kitepower, and Altaeros Energies are leading the development and pilot deployment of scalable AWE solutions. It features high competition in R&D intensity, with players focusing on tether design, autonomous flight control, and offshore system adaptability. Strategic collaborations with governments, universities, and energy utilities are helping firms validate prototypes and secure regulatory support. The market remains fragmented due to the limited number of commercial-ready systems and the early maturity stage of most technologies. Startups are attracting venture capital and government grants, while established firms seek integration with renewable infrastructure portfolios. Competitive advantage is shaped by technological reliability, cost-efficiency, and regulatory compliance. As the technology advances toward commercialization, market positioning will depend on performance, scalability, and success in meeting safety and environmental standards.

Recent Developments:

- In May 2025, Kitepowerannounced the market entry of its Hawk system, a 30kW airborne wind energy solution, and revealed that its larger Falcon system, rated at 100kW, is coming soon. These systems are designed for mobile, temporary, and renewable wind energy generation, targeting applications such as off-grid construction sites and remote agricultural operations, and are currently being commercialized for real-world deployment.

- In March 2022, Ampyx Poweradvanced the development of its AP-3 airborne wind energy system by preparing for low-speed taxi tests as part of its ongoing technology validation program. The AP-3, which is the third major iteration of Ampyx Power’s system, comprises an autonomous aircraft, proprietary launching and landing mechanisms, and supporting ground infrastructure. This milestone is part of Ampyx Power’s broader effort to prove the efficacy and readiness of its airborne wind technology for commercial applications.

Market Concentration & Characteristics:

The Global Airborne Wind Energy (AWE) Systems Market exhibits low to moderate market concentration, with a limited number of players operating in the early commercial and prototype stages. It is characterized by high technological intensity, long development cycles, and strong dependence on public and private funding. Most companies are small to mid-sized innovators focusing on niche solutions tailored to specific applications such as offshore deployment or rural electrification. The market favors firms with strong intellectual property portfolios and engineering capabilities. Entry barriers remain high due to regulatory uncertainty, technical complexity, and limited field-tested data. It relies heavily on pilot programs, government grants, and strategic partnerships to advance development and build credibility. The market remains in a formative phase, with first-mover advantage likely to influence future leadership.

Report Coverage:

The research report offers an in-depth analysis based on by type, product, application, and site. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Global Airborne Wind Energy (AWE) Systems Market is expected to transition from prototype testing to early commercial deployment over the next decade.

- Growth will be supported by rising demand for clean energy in off-grid, remote, and high-wind-altitude locations.

- Technological advancements in autonomous flight systems, tether durability, and lightweight materials will improve efficiency and reliability.

- Offshore AWE systems will gain traction due to minimal infrastructure needs and access to steady high-altitude wind flows.

- Integration into hybrid renewable systems, including solar and storage, will enhance energy resilience and grid flexibility.

- Policy support, including R&D funding and test zone frameworks, will play a key role in accelerating market readiness.

- Emerging economies will drive adoption for rural electrification and microgrid applications where conventional infrastructure is limited.

- Competitive differentiation will hinge on cost per kilowatt-hour, scalability, and ease of installation.

- Collaborations between start-ups, energy utilities, and research institutes will shape commercialization strategies.

- Standardization and airspace regulations will evolve to support broader deployment and investor confidence.