| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Water-based Defoamers Market Size 2024 |

USD 696.8 Million |

| Water-based Defoamers Market, CAGR |

5.80% |

| Water-based Defoamers Market Size 2032 |

USD 1,093.9 Million |

Market Overview

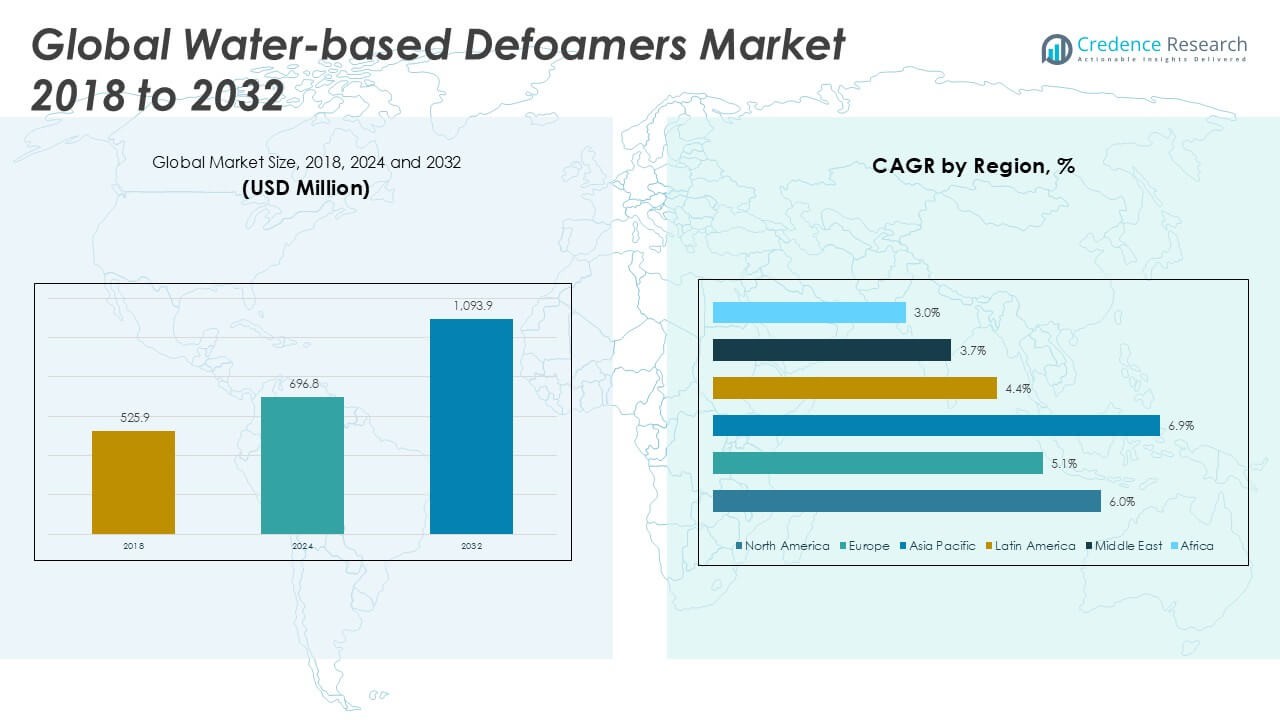

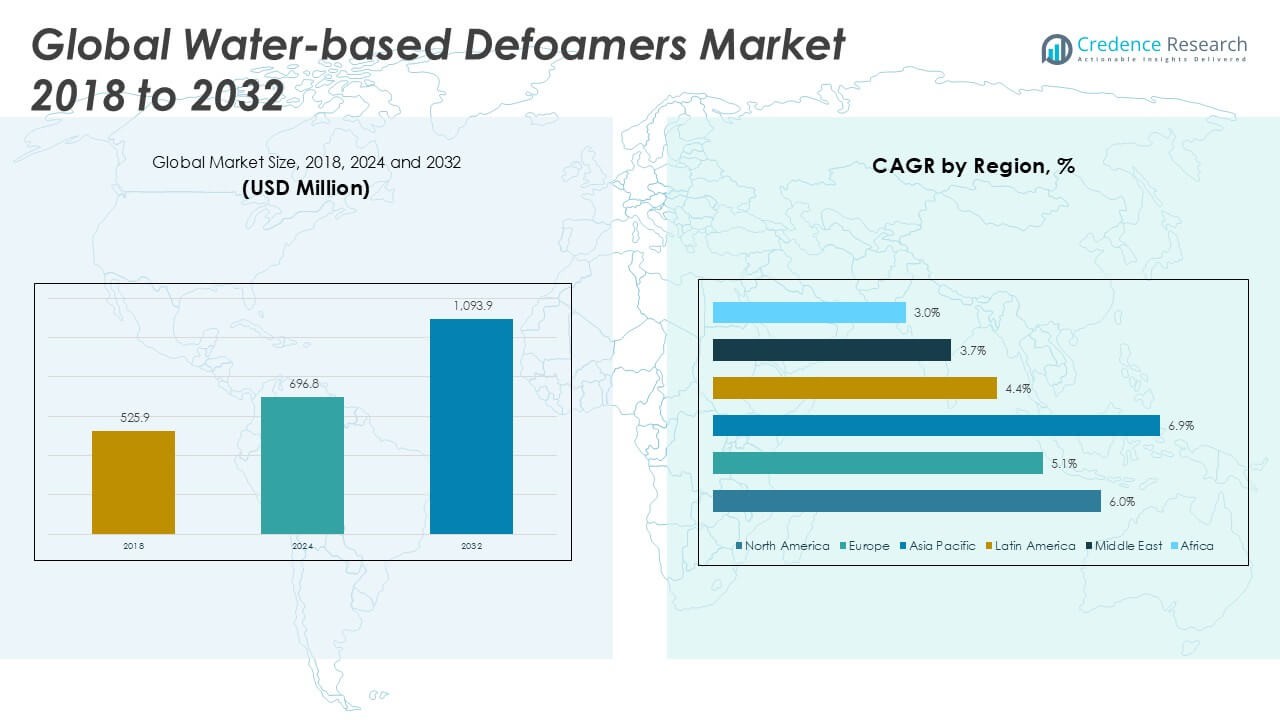

The Global Water-based Defoamers Market is projected to grow from USD 696.8 million in 2024 to an estimated USD 1,093.9 million based on 2032, with a compound annual growth rate (CAGR of 5.80% from 2025 to 2032.

Rising environmental regulations and customer demand for sustainable additives drive market growth. Bio-based surfactants and low-VOC defoamers gain traction as formulators seek greener alternatives. Growth in municipal and industrial wastewater infrastructure, particularly in emerging economies, underpins steady uptake. Digital simulation tools and collaborative development agreements accelerate formulation optimization. Producers differentiate through cost-effective, tailor-made solutions that address specific foam challenges in high-throughput processes.

North America commands a sizeable share, supported by stringent environmental mandates and established end-use industries. Asia Pacific leads in growth rate, fueled by rapid industrialization and expanding water treatment capacities in China and India. Europe maintains stable expansion through strict eco-product standards and mature manufacturing sectors. Key players shaping the competitive landscape include AkzoNobel, BASF, Evonik, Ashland, and Solvay, each focusing on localized manufacturing, strategic partnerships, and continuous innovation to strengthen market positions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The market expands from USD 696.8 million in 2024 to USD 1,093.9 million by 2032 at a 5.80 % CAGR.

- Tightened discharge and VOC limits propel adoption of water-based defoamers in wastewater and chemical processes.

- Growth in pulp & paper, paints & coatings, and textile processing boosts demand for efficient foam control solutions.

- Matching solvent-based defoamer efficiency under high shear and extreme pH slows adoption.

- Certification expenses and raw material price swings pressure margins and delay new product launches.

- Rapid industrialization in China and India drives 38 % of global volume with high growth potential.

- Combined they hold roughly 47 % of global revenue, supported by stringent environmental standards and mature end-use sectors.

Market Drivers

Stricter Environmental Standards Increase Demand

Stricter environmental regulations around foam control in wastewater and chemical processes drive demand for efficient defoamers. The Global Water-based Defoamers Market responds to limits on volatile organic compounds and restrictions on silicone emissions. Manufacturers adapt formulations to meet regional guidelines in North America and Europe. It ensures compliance with permit requirements and reduces operational risks for end users. Regulators enforce penalties for non-compliance, increasing motivation to adopt water-based solutions. This dynamic pushes suppliers to innovate and expand production capacity.

- For instance, in 2024, BASF reported an annual production of more than 35,000 metric tons of water-based defoamers at its European facilities to meet the growing demand driven by updated EU environmental regulations.

Expansion of End-Use Industries Fuels Growth

Surge in pulp and paper output elevates need for foam suppression in pulping and paper-making lines. The Global Water-based Defoamers Market benefits from investments in large-scale chemical plants and municipal treatment facilities. It supports operations in textile dyeing and coating processes by preventing defects. Growing production volumes in paints and coatings also increase demand for reliable defoamers. Industry players pursue volume contracts to secure steady supply and favorable pricing. This trend stimulates production expansions at key manufacturing sites worldwide.

- For instance, according to the American Forest & Paper Association, U.S. paper and paperboard mills consumed over 12,400 metric tons of water-based defoamers in 2023 to maintain quality and efficiency in high-volume production lines.

Shift Toward Eco-Friendly Defoaming Agents

Consumer preference for sustainable products places pressure on formulators to avoid petrochemicals. The Global Water-based Defoamers Market offers bio-based alternatives that meet green chemistry criteria. It delivers performance equal to conventional defoamers while reducing environmental footprint. Market leaders partner with biotechnology firms to develop biodegradable surfactants. This collaboration accelerates approval under eco-label programs and reduces cost barriers. Such progress boosts conversion from solvent-based to water-based systems.

Advances in Formulation Technologies Enhance Efficiency

Research teams leverage simulation tools to design defoamer particles with precise release profiles. The Global Water-based Defoamers Market sees faster product development cycles through these digital platforms. It applies polymer science to improve foam collapse rate without compromising stability. Manufacturers adopt advanced analytical methods to validate performance under extreme temperatures and pH levels. This approach reduces trial errors and accelerates scale-up for volume production. Customers receive customized products that suit specific process requirements.

Market Trends

Expansion of Bio-Based Surfactants in Foam Control

The Global Water-based Defoamers Market embraces eco-friendly bio-based surfactants. It reduces dependency on petrochemicals and enhances biodegradability. Manufacturers refine formulations to match performance of silicone-based agents. It meets stricter discharge and effluent standards in wastewater treatment plants. Customers recognize improved operational stability across high-temperature or high-shear processes. Suppliers invest in pilot-scale facilities to validate new chemistries before full commercial rollout.

- For instance, BASF reported the successful scale-up of bio-based surfactant production to 3,000 metric tons annually at its Ludwigshafen site, supporting the use of sustainable defoamers in industrial water treatment.

Adoption of Digital Formulation Platforms Accelerates Development

The Global Water-based Defoamers Market integrates digital formulation platforms to reduce innovation cycles. It leverages simulation models to predict foam collapse under varied process conditions. Formulators apply high-throughput screening methods to evaluate compound compatibility. It shortens time to market by cutting trial and error in pilot plants. Companies standardize data collection to refine algorithm accuracy across product lines. R\&D teams collaborate with software providers to tailor tools for specific industrial applications.

- For instance, Evonik’s digital formulation initiative screened over 1,200 candidate compounds for water-based defoamers in a single year using automated high-throughput platforms, significantly accelerating new product introductions.

Cross-Industry Partnerships Drive Novel Enzyme-Based Defoamers

The Global Water-based Defoamers Market sees partnerships between chemical producers and biotech firms. It fosters joint research to develop enzyme-based defoamers with superior performance. Suppliers combine expertise to optimize molecular structures for targeted foam control. It extends application range in paints, papermaking and food processing. Project teams perform small-scale trials at customer sites to validate results. They share resources to accelerate scale-up and reduce costs.

Targeted Regional Expansion Strengthens Global Presence

The Global Water-based Defoamers Market targets emerging economies in Asia Pacific and Latin America. It responds to rapid expansion of municipal wastewater facilities and pulp mills. Distributors establish local blending plants to ensure timely supply and lower logistics costs. It aligns product portfolios with regional regulations and raw material availability. Customers receive technical support through onsite laboratories and field engineers. Market entrants explore joint ventures to fast-track market entry and gain local expertise.

Market Challenges

Complex Regulatory Compliance and Rising Certification Costs

The Global Water-based Defoamers Market faces complex regulatory demands across regions. It requires reformulations to meet evolving discharge and safety standards. Companies confront high costs for testing and certification of new products. Manufacturers operate under varied permissible emission limits that necessitate detailed documentation. End users hesitate to adopt unproven solutions without clear compliance records. Suppliers invest in third-party audits to maintain market access. This environment amplifies entry barriers for smaller producers.

- For instance, in a laboratory evaluation, the defoamer EMULTROL DFM OL-4 was tested by adding a 0.16% dose to 150 grams of water-based acrylic adhesive, followed by intense stirring at 500 rpm for 5 minutes, demonstrating the rigorous and quantifiable approach required for product validation and compliance in this sector

Balancing Performance Expectations with Raw Material Volatility

Performance criteria for foam suppression often conflict with environmental goals. The Global Water-based Defoamers Market struggles to match solvent-based alternatives under extreme conditions. Customers demand consistent quality despite fluctuations in raw material prices. Fluctuating costs for surfactants and polymers strain profit margins. Producers seek alternative supply sources to reduce dependency on few vendors. This balancing act slows product rollout and jeopardizes forecast accuracy. Smaller firms may exit when inability to secure cost-effective ingredients persists.

Market Opportunities

Growing Demand in Emerging Water and Wastewater Infrastructure Projects

The Global Water-based Defoamers Market can tap into infrastructure investments in Asia, Africa, and Latin America. Governments upgrade water treatment plants to meet stricter environmental goals. It can position products for municipal and industrial sectors. Local blending facilities reduce delivery time and lower logistics cost. Manufacturers partner with engineering contractors to secure long-term supply agreements. They bundle technical support and on-site training to enhance customer adoption. This strategy captures market share in underpenetrated regions.

Innovation through Customized and Hybrid Formulation Partnerships

Collaboration with biotech firms offers development of enzyme-based formulations. The Global Water-based Defoamers Market benefits from cross-industry R\&D projects. It can introduce hybrid chemistries that deliver superior performance under extreme pH and temperature. Digital analytics tools enable real-time monitoring of foam control efficiency. Suppliers can license proprietary technologies to accelerate new product launches. Customers gain tailored solutions for complex process challenges. This approach drives premium pricing and strengthens customer loyalty.

Market Segmentation Analysis

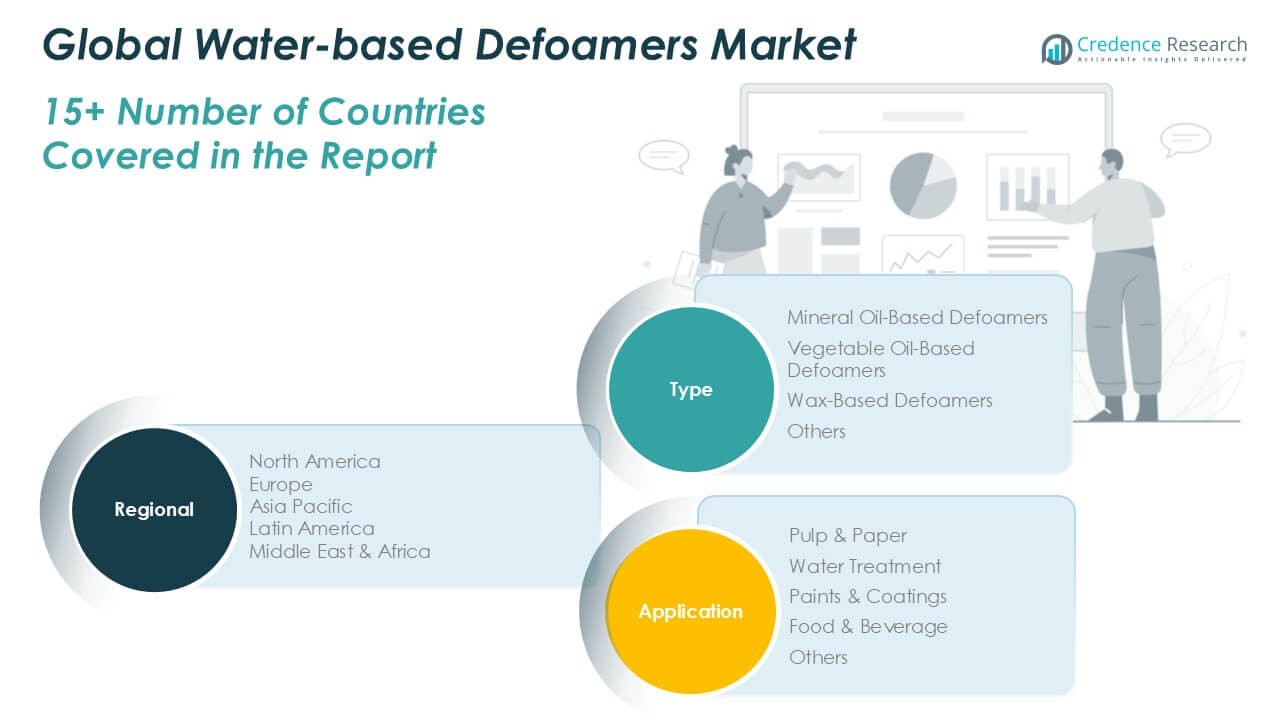

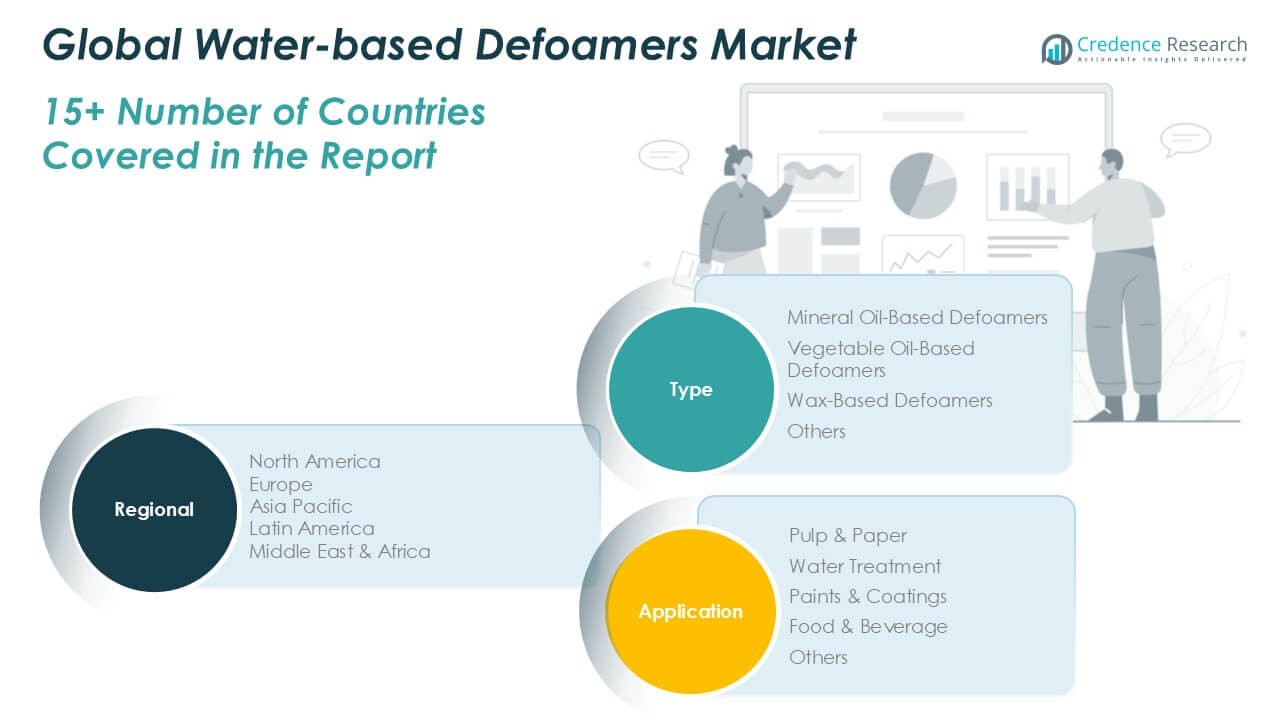

By Type

The Global Water-based Defoamers Market divides into mineral oil-based, vegetable oil-based, wax-based, and other formulations. Mineral oil-based defoamers dominate volume share through consistent performance in high-shear operations, while vegetable oil-based products gain revenue share via eco-friendly credentials. Wax-based defoamers offer targeted foam knockdown in paper and textile processes. Other specialty blends, including silicone-free chemistries, contribute niche demand in food and pharmaceutical sectors. It balances performance, cost, and regulatory compliance. Manufacturers optimize component ratios to meet specific process requirements. These efforts support a balanced mix of high-volume, low-margin products and premium, higher-margin offerings.

- For instance, according to a 2024 survey by a leading chemical industry association, more than 180,000 metric tons of mineral oil-based water-based defoamers were produced globally, compared to approximately 60,000 metric tons of vegetable oil-based and 35,000 metric tons of wax-based formulations.

By Application

The Global Water-based Defoamers Market covers pulp & paper, water treatment, paints & coatings, food & beverage, and other end uses. Pulp & paper segment holds the largest volume share due to extensive foam control needs in pulping operations. Water treatment secures significant revenue share by addressing stringent discharge limits. Paints & coatings leverage defoamers to prevent surface defects and improve finish quality. Food & beverage operations adopt food-grade formulations to meet safety standards. Other applications include textiles, adhesives, and oilfield processes. It aligns product design with each sector’s operational parameters. Suppliers tailor service and technical support to strengthen adoption across diverse industries.

- For instance, industry data from 2024 show that the pulp & paper sector consumed over 120,000 metric tons of water-based defoamers globally, making it the largest application segment by volume.

Segments

Based on Type

- Mineral Oil-Based Defoamers

- Vegetable Oil-Based Defoamers

- Wax-Based Defoamers

- Others

Based on Application

- Pulp & Paper

- Water Treatment

- Paints & Coatings

- Food & Beverage

- Others

Based on Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America Water-based Defoamers Market

The Water-based Defoamers Market in North America reached USD 181.2 million in 2024 and it should climb to USD 256.0 million by 2032 at a CAGR of 6.0%. Demand stems from wastewater treatment upgrades and pulp & paper expansions across the U.S. and Canada. Strong environmental mandates drive replacement of solvent-based defoamers. It holds roughly 26.0 % of the global market. Manufacturers deploy local blending centers to shorten lead times. Regional technical support hubs strengthen customer relationships.

Europe Water-based Defoamers Market

The Water-based Defoamers Market in Europe recorded USD 146.3 million in 2024 and it should reach USD 206.8 million by 2032 at a CAGR of 5.1%. Regulatory pressure from EU directives fuels demand for low-VOC defoamers. It accounts for 21.0 % of the global market. Key end users include chemical processors and municipal treatment facilities. Producers adapt formulations to meet REACH requirements. Suppliers maintain R\&D centers in Germany and France.

Asia Pacific Water-based Defoamers Market

The Water-based Defoamers Market in Asia Pacific stood at USD 264.8 million in 2024 and it should hit USD 467.1 million by 2032 at a CAGR of 6.9%. Rapid industrial growth in China, India, and Southeast Asia fuels demand. It commands about 38.0 % of the global market. Expanding paper mills and textile plants generate high-volume consumption. Local manufacturing partnerships drive cost efficiencies. Technical training services support new plant startups across the region.

Latin America Water-based Defoamers Market

The Water-based Defoamers Market in Latin America valued USD 48.8 million in 2024 and it should grow to USD 83.1 million by 2032 at a CAGR of 4.4%. Brazil and Mexico lead adoption in pulp & paper and wastewater sectors. It holds nearly 7.0 % of the global market. Economic reforms attract investments in water infrastructure. Suppliers establish distribution channels to ensure supply continuity. It partners with toll blenders for regional customization.

Middle East Water-based Defoamers Market

The Water-based Defoamers Market in the Middle East reached USD 31.4 million in 2024 and it should rise to USD 48.1 million by 2032 at a CAGR of 3.7%. Petrochemical and desalination industries drive incremental demand. It covers 4.5 % of the global market. Regional blending hubs ensure compliance with local standards. Suppliers collaborate with engineering firms on large-scale projects. This cooperation secures long-term contracts in GCC countries.

Africa Water-based Defoamers Market

The Water-based Defoamers Market in Africa hit USD 24.4 million in 2024 and it should advance to USD 32.8 million by 2032 at a CAGR of 3.0%. South Africa and Egypt spearhead demand in mining and municipal sectors. It captures approximately 3.5 % of the global market. Infrastructure upgrades promote foam control adoption. Suppliers adapt logistics strategies to navigate remote locations. Technical support teams work with local operators to improve process efficiency.

Key players

- BASF SE

- Evonik Industries AG

- Dow Inc.

- Wacker Chemie AG

- Air Products and Chemicals, Inc.

- Ashland Global Holdings Inc.

- Kemira Oyj

- Shin-Etsu Chemical Co., Ltd.

- Elementis PLC

- MÜNZING Chemie GmbH

- Momentive Performance Materials Inc.

- BYK-Chemie GmbH (Altana AG

- Elkem ASA

- Hydrite Chemical Co.

Competitive Analysis

The Water-based Defoamers Market competitive landscape features several global and regional players vying for market share. It displays high product innovation driven by environmental regulations and end-user performance requirements. Leading firms invest in localized production to reduce lead times and optimize logistics. Mid-tier companies differentiate through niche formulations and dedicated technical support. Cost pressures push all participants to secure reliable raw material sources and improve operational efficiency. Collaboration between chemical producers and biotech firms yields advanced enzyme-based defoamers. Market consolidation through strategic partnerships and acquisitions further intensifies competition. New entrants face significant certification costs and established brand loyalty.

Recent Developments

- In June 2024, Wacker Chemie AG debuted a new biodegradable water‑based defoamer aimed at textile applications, reinforcing its sustainable solutions portfolio

Market Concentration and Characteristics

The Water-based Defoamers Market displays moderate concentration, with leading chemical producers capturing roughly half of global revenue through established brands and extensive distribution networks. It benefits from high entry barriers including regulatory certification and specialized formulation expertise. Mid-tier firms secure niche segments by offering tailored solutions and technical support. Regional players maintain local supply advantages through blended products and on-site services. Competitive dynamics revolve around cost control, raw material sourcing, and rapid product development. Customers prioritize suppliers with proven performance under varied process conditions and strong compliance records. Continuous innovation in bio-based and enzyme-enhanced defoamers further shapes market structure.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Companies will accelerate development of bio-based defoamers that meet stricter environmental regulations. They will scale pilot programs to validate performance under diverse industrial conditions.

- Manufacturers will integrate digital analytics to monitor foam levels in real time. They will adjust defoamer dosing automatically to optimize chemical use and reduce operational costs.

- Suppliers will expand regional production hubs in Asia Pacific and Latin America. They will partner with local distributors to shorten lead times and improve service responsiveness.

- Chemical producers will form strategic alliances with biotech firms to create enzyme-enhanced formulations. They will leverage molecular engineering to target foam control in specialty applications.

- R\&D teams will develop tailored defoamer blends for critical end uses like pulp & paper and paints. They will collaborate with end users to customize products for specific process parameters.

- Investment in water infrastructure upgrades will drive increased demand for defoamers in municipal treatment. Companies will propose turnkey solutions combining product supply with technical training for operators.

- Regulatory agencies will tighten discharge and effluent standards globally. Manufacturers will prioritize low-VOC and biodegradable formulations to maintain compliance.

- Circular economy principles will guide raw material selection and packaging design. Producers will adopt recyclable containers and source surfactants from waste-derived feedstocks.

- Industry consolidation will accelerate through mergers and acquisitions of niche formulators. Larger players will absorb specialized firms to broaden portfolios and access new technologies.

- Brands will pursue sustainability certifications and eco-labels to differentiate offerings. They will command premium pricing for verified green products and strengthen customer loyalty.