Market Overview:

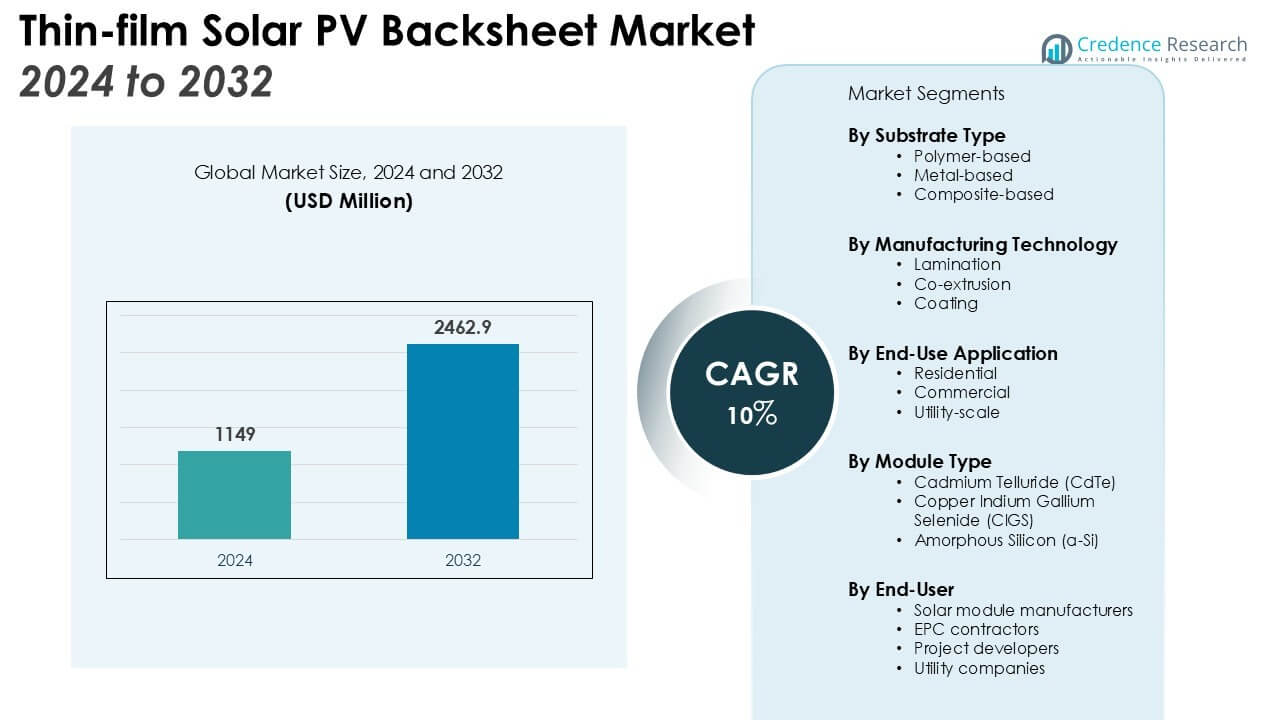

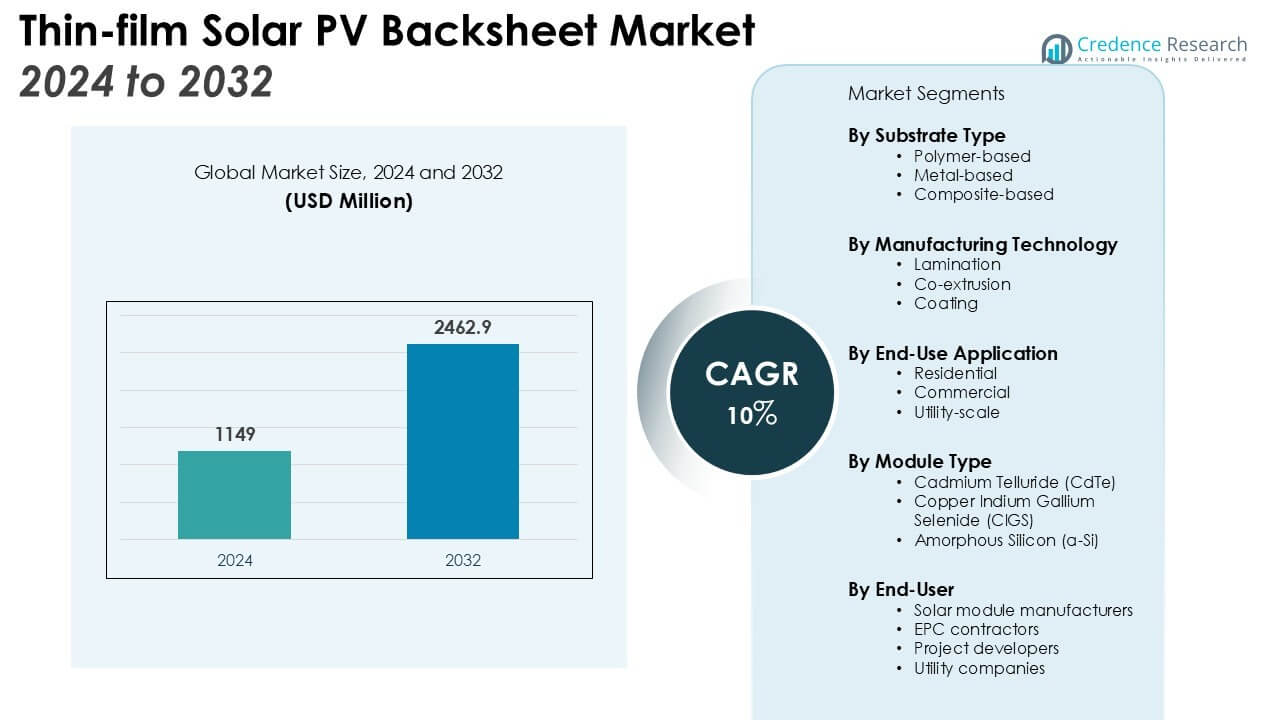

The Thin-film Solar PV Backsheet Market size was valued at USD 1149 million in 2024 and is anticipated to reach USD 2462.9 million by 2032, at a CAGR of 10% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Thin Film Solar PV Backsheet Market Size 2024 |

USD 1149 million |

| Thin Film Solar PV Backsheet Market, CAGR |

10% |

| Thin Film Solar PV Backsheet Market Size 2032 |

USD 2462.9 million |

Key drivers fueling the Thin-film Solar PV Backsheet Market include the increasing emphasis on renewable energy transition, supportive government policies, and ongoing advancements in thin-film cell efficiency. The market benefits from the rising trend of flexible and lightweight solar modules, which require specialized backsheet solutions for enhanced protection and longevity. Innovations in material science, focused on improving resistance to UV radiation and moisture, further strengthen product performance and market adoption. The growing focus on reducing the levelized cost of electricity (LCOE) is also prompting manufacturers to develop cost-effective and high-durability backsheet materials.

Regionally, Asia Pacific leads the Thin-film Solar PV Backsheet Market, propelled by extensive solar energy deployment in China, India, and Japan. North America and Europe also register significant growth, driven by favorable regulatory landscapes and investments in sustainable energy infrastructure, while emerging markets in Latin America and the Middle East offer new growth avenues for manufacturers. The presence of a robust manufacturing ecosystem and government-backed solar initiatives further reinforce the regional market outlook.

Market Insights:

- The Thin-film Solar PV Backsheet Market was valued at USD 1,149 million in 2024 and is forecast to reach USD 2,462.9 million by 2032, registering a CAGR of 10% from 2024 to 2032.

- The market is driven by strong global adoption of renewable energy, with governments and private sectors investing in solar projects to meet decarbonization targets and reduce fossil fuel dependence.

- Supportive policy frameworks, such as feed-in tariffs and solar tax credits, are accelerating market demand and encouraging investments in high-quality backsheet solutions to meet evolving safety and durability standards.

- Ongoing advancements in material science have enabled backsheets to offer superior resistance to UV radiation and moisture, which is essential for module longevity and performance in diverse environments.

- Manufacturers face challenges related to stringent regulatory standards, fluctuating raw material prices, and supply chain disruptions, prompting significant investments in quality assurance and procurement strategies.

- Asia Pacific leads the market with a 51% share, followed by North America at 23% and Europe at 18%; Latin America and the Middle East collectively hold 8%, each region shaped by unique policy and market dynamics.

- The trend toward flexible, lightweight thin-film modules and regional solar initiatives continues to expand product portfolios, ensuring that backsheet solutions meet the requirements of next-generation photovoltaic installations across key global markets.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Global Adoption of Renewable Energy and Thin-Film Technologies

The growing global shift toward renewable energy sources is significantly driving the Thin-film Solar PV Backsheet Market. Governments and private sectors are making substantial investments in solar projects to achieve decarbonization targets and reduce dependency on fossil fuels. Thin-film solar modules are increasingly favored for their cost efficiency, lightweight design, and adaptability in various installation environments. This trend has intensified the demand for advanced backsheet materials that enhance performance and extend the lifecycle of thin-film PV systems. The market is directly benefiting from the widespread push for sustainable energy infrastructure.

- For instance, First Solar inaugurated a new $1.1 billion manufacturing facility in Alabama, which will add 3.5 GW of annual production capacity for its thin-film modules.

Supportive Policy Frameworks and Government Incentives

National and regional authorities worldwide are implementing supportive policy frameworks and incentives to stimulate the growth of the solar industry. These initiatives include feed-in tariffs, renewable portfolio standards, and tax credits for solar installations. The Thin-film Solar PV Backsheet Market experiences accelerated demand as regulatory bodies set ambitious solar capacity targets and promote grid integration of photovoltaic technologies. Policy-driven growth is strengthening investments in high-quality backsheet products to ensure compliance with evolving safety and durability standards.

- For instance, the U.S. Inflation Reduction Act allocated USD 369 billion for energy and climate initiatives, marking the largest single federal investment in clean energy to date.

Advancements in Material Science and Backsheet Durability

Recent innovations in material science have transformed the performance and reliability of PV backsheets. Manufacturers are prioritizing materials that offer superior resistance to UV radiation, moisture, and environmental stress. These advancements are crucial for the longevity and safety of thin-film solar modules, particularly in harsh climatic conditions. The Thin-film Solar PV Backsheet Market is advancing as producers integrate enhanced polymers and multi-layered composite structures to meet industry demands for cost efficiency and improved durability.

Growing Demand for Flexible and Lightweight Solar Solutions

The trend toward flexible and lightweight solar modules is shaping the development of backsheet technologies. Architects, engineers, and developers prefer thin-film modules for building-integrated photovoltaics and portable power applications. This has led to a heightened need for backsheets that provide robust protection without adding excessive weight or rigidity. The market is expanding its product portfolio to support the evolving requirements of next-generation thin-film PV installations across commercial, residential, and utility-scale segments.

Market Trends:

Shift Toward High-Performance, Multi-Layered Backsheet Materials

Manufacturers in the Thin-film Solar PV Backsheet Market are intensifying their focus on the development of high-performance, multi-layered backsheet materials to meet stringent durability and reliability requirements. The industry is witnessing a pronounced transition from conventional single-layer solutions to advanced multi-layer composites, which offer enhanced resistance to UV radiation, moisture ingress, and electrical insulation failures. These materials improve the operational lifespan of thin-film solar modules, especially in challenging outdoor environments. Strong demand for backsheet innovations is driven by the need to optimize module performance and reduce operational costs for large-scale solar projects. It has prompted key players to invest in new product formulations and testing protocols, ensuring alignment with evolving international quality standards. This shift is reinforcing the market’s focus on both safety and longevity across all deployment scenarios.

- For instance, Maysun Solar’s TwiSun series modules utilize a double-glass design instead of a traditional backsheet, achieving an operational lifetime of up to 30 years.

Integration of Backsheet Solutions with Flexible and Custom Solar Module Designs

A notable trend in the Thin-film Solar PV Backsheet Market is the integration of backsheet technologies with increasingly flexible and customized solar module designs. The adoption of thin-film solar panels for building-integrated photovoltaics (BIPV), portable energy systems, and curved architectural surfaces is expanding rapidly. Manufacturers are responding by engineering backsheets that accommodate diverse shapes, sizes, and mechanical stresses while retaining optimal electrical insulation and environmental protection. The market is also seeing increased collaboration between module producers and material science firms to tailor backsheet features for specialized applications, including anti-reflective coatings and fire resistance. It continues to evolve with the industry’s push toward higher efficiency and aesthetically appealing solar solutions for both commercial and residential installations.

- For instance, Tesla’s Solar Roof tiles feature an installed module width of 1,140 mm, achieved by overlapping glass shingles that integrate seamlessly into rooflines while preserving PV functionality and wind, hail, and fire ratings [1140 mm].

Market Challenges Analysis:

Stringent Regulatory Standards and Quality Compliance Pressures

Manufacturers in the Thin-film Solar PV Backsheet Market face significant challenges in meeting stringent regulatory standards and quality compliance mandates. Evolving safety, durability, and environmental guidelines require continuous upgrades in material formulations and testing processes. It is imperative for producers to ensure that backsheets maintain optimal performance across diverse climatic conditions while adhering to international certification norms. Failure to comply may restrict market access and damage reputations. This dynamic drives up operational costs and demands significant investment in research, quality assurance, and product validation to stay competitive.

Price Volatility and Raw Material Supply Chain Constraints

Fluctuating raw material prices and supply chain disruptions present persistent obstacles for the Thin-film Solar PV Backsheet Market. Manufacturers contend with inconsistent costs for key polymers and specialty chemicals critical to backsheet production. Supply shortages or delays can hinder timely product delivery and erode profit margins, especially in a market environment sensitive to cost competitiveness. It is essential for market participants to develop resilient procurement strategies and diversify sourcing channels to reduce risk exposure and ensure business continuity in the face of global disruptions.

Market Opportunities:

Expansion of Distributed and Off-Grid Solar Applications

The Thin-film Solar PV Backsheet Market stands to benefit from the rising adoption of distributed and off-grid solar power solutions worldwide. Rural electrification initiatives and the demand for portable solar products in remote regions are fueling interest in lightweight and flexible thin-film modules. It is well positioned to supply advanced backsheet technologies that enable durability and performance in harsh or variable environments. Manufacturers have the opportunity to collaborate with solar developers and governments to design products tailored to specific off-grid applications. This trend presents a path for capturing new market segments while supporting the global push for energy access and sustainability.

Development of Eco-Friendly and Recyclable Backsheet Materials

Heightened environmental awareness is creating new opportunities for the Thin-film Solar PV Backsheet Market through the development of eco-friendly and recyclable backsheet solutions. Growing regulatory and consumer focus on sustainable manufacturing practices is prompting producers to innovate with non-toxic, recyclable, and bio-based materials. It can leverage advancements in green chemistry to create backsheets that reduce lifecycle environmental impact while maintaining high performance. Companies that prioritize sustainable product design are likely to gain competitive advantage and attract environmentally conscious customers in global markets. This opportunity aligns with broader industry goals to support circular economy principles in solar manufacturing.

Market Segmentation Analysis:

By Substrate Type

The Thin-film Solar PV Backsheet Market segments by substrate type into polymer-based, metal-based, and composite-based backsheets. Polymer-based backsheets hold the largest share due to their balance of flexibility, cost-effectiveness, and reliable barrier properties. Metal-based backsheets offer superior thermal and electrical conductivity, making them suitable for high-performance modules in demanding environments. Composite-based variants are gaining traction for their enhanced durability and ability to combine the strengths of both polymer and metal substrates.

- For instance, Coveme, a leading manufacturer, has an annual production capacity of 20GW for its dyMat® polymer-based backsheets.

By Manufacturing Technology

In terms of manufacturing technology, the market distinguishes between lamination, co-extrusion, and coating techniques. Lamination dominates the segment because it provides superior mechanical strength and environmental protection, supporting the longevity of thin-film modules. Co-extrusion is adopted for its efficiency in multi-layer integration, while coating technology finds use in applications that demand precise surface modifications and specialized functionalities. Each approach addresses specific performance requirements and production efficiency goals for module manufacturers.

- For instance, the Palo Alto Research Center (PARC) has developed a co-extrusion printing process for manufacturing solar cell gridlines that is capable of directly depositing features as small as 1 micrometer without contacting the substrate.

By End-Use Application

The Thin-film Solar PV Backsheet Market covers applications in residential, commercial, and utility-scale solar installations. Utility-scale projects represent the leading segment, driven by growing investments in large solar farms and grid-connected renewable energy infrastructure. Commercial applications are expanding due to the need for rooftop and building-integrated photovoltaics, while residential deployment benefits from rising awareness of clean energy and advancements in flexible thin-film technology. It continues to adapt segment offerings to meet evolving demands across diverse installation environments.

Segmentations:

- By Substrate Type:

- Polymer-based

- Metal-based

- Composite-based

- By Manufacturing Technology:

- Lamination

- Co-extrusion

- Coating

- By End-Use Application:

- Residential

- Commercial

- Utility-scale

- By Module Type:

- Cadmium Telluride (CdTe)

- Copper Indium Gallium Selenide (CIGS)

- Amorphous Silicon (a-Si)

- By End-User:

- Solar module manufacturers

- EPC contractors

- Project developers

- Utility companies

- By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Asia Pacific: Leading Regional Contributor

Asia Pacific commands 51% share of the Thin-film Solar PV Backsheet Market, driven by extensive solar infrastructure investments across China, India, Japan, and South Korea. Government-backed initiatives and aggressive renewable energy targets support robust demand for high-performance PV modules, driving consistent adoption of advanced backsheet technologies. The presence of major thin-film module manufacturers in the region strengthens local supply chains and fosters continuous innovation. It benefits from a skilled labor pool and favorable cost structures that encourage high-volume production and rapid technological scaling. This environment positions Asia Pacific as a vital hub for both manufacturing and end-user consumption within the global market landscape.

North America: Innovation-Driven Expansion

North America accounts for 23% of the Thin-film Solar PV Backsheet Market, supported by federal and state incentives, a mature solar ecosystem, and widespread integration of renewable power. Investments in grid modernization, coupled with rising demand for residential and commercial solar installations, drive the uptake of durable and efficient backsheet solutions. The region’s focus on research and development spurs the introduction of innovative, eco-friendly materials that address local climate challenges and evolving industry standards. It leverages partnerships between academic institutions, startups, and established manufacturers to accelerate commercialization of new backsheet technologies. This collaborative approach ensures continued competitiveness and adaptability in a dynamic regulatory environment.

Europe, Latin America, and the Middle East: Emerging Growth Regions

Europe holds 18% share of the Thin-film Solar PV Backsheet Market, while Latin America and the Middle East collectively contribute 8%. Europe’s market presence is supported by stringent sustainability mandates, a proactive approach to circular economy adoption, and consistent solar project rollouts in Germany, Spain, and France. Latin America and the Middle East present emerging opportunities, driven by increasing investments in solar capacity expansion and favorable government policies. Manufacturers are exploring strategic collaborations with local partners to adapt backsheet solutions to unique regional requirements such as extreme temperatures and arid conditions. It seeks to expand its presence in these markets by offering technologically advanced and climate-resilient products, enabling broader market penetration and mitigating risks associated with shifting economic and policy landscapes.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Coveris Advanced Coatings

- SaintGobain Performance Plastics

- Jolywood

- Byucksan

- SEKISUI Chemical

- Innovia Films

- Polyram

- KWANGJIN

- Mitsubishi Chemical

- DSM Dyneema

- Toho Chemical

- Suzhou Guotai International

- DuPont

- Solmax

- Toray

Competitive Analysis:

The Thin-film Solar PV Backsheet Market features strong competition among global and regional manufacturers focused on innovation, quality, and cost efficiency. Leading players such as 3M, DuPont, Krempel GmbH, Cybrid Technologies, and Arkema dominate through established portfolios and strategic investments in advanced materials. It remains highly dynamic, with companies prioritizing R&D to improve durability, environmental resistance, and customization for next-generation modules. Strategic collaborations with solar module producers and continuous expansion of manufacturing capabilities reinforce market leadership. Firms leverage technological advancements to meet evolving international standards and client requirements. Emerging players are entering the market by offering specialized solutions and flexible production processes. The Thin-film Solar PV Backsheet Market continues to evolve as companies respond to shifts in regulatory frameworks, supply chain demands, and the increasing global adoption of thin-film solar technologies.

Recent Developments:

- In July 2024, Coveris launched a new range of fibre-based hot-to-go packs designed for the heat-in-pack, eat-in-pack segment.

- In July 2025, Saint-Gobain announced the acquisition of Interstar Materials Inc., a leading North American manufacturer of high-performance pigments for all segments of concrete, strengthening its expansion in North America’s Construction Chemicals sector.

- In June 2025, Innovia Films launched the new Rayoart™ GWP82 Matt HOP, an 82 micron thick high opacity BOPP film with matt print coating for premium self-adhesive graphics applications.

Market Concentration & Characteristics:

The Thin-film Solar PV Backsheet Market exhibits moderate concentration, with a mix of established multinational players and innovative regional firms shaping the competitive landscape. Leading companies hold significant market shares due to strong R&D capabilities, robust distribution networks, and broad product portfolios tailored to evolving industry requirements. It features high barriers to entry, given the technical expertise and regulatory compliance required for backsheet production. The market prioritizes advanced material innovation, sustainability, and durability, with firms striving to meet stringent international standards. Continuous product differentiation and customer-centric solutions define the market’s characteristics, supporting its sustained growth and resilience in a dynamic renewable energy sector.

Report Coverage:

The research report offers an in-depth analysis based on Substrate Type, Manufacturing Technology, End-Use Application, Module Type, End-Use and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Advancements in tandem and next-generation thin-film modules, such as perovskite and CIGS, will drive demand for highly specialized backsheet solutions.

- The market will see increased integration of conductive and smart backsheets to boost overall module efficiency and enable enhanced monitoring.

- Rising emphasis on eco-friendly and recyclable backsheet materials will align product development with global sustainability targets.

- Growing investments in utility-scale and building-integrated photovoltaics will expand applications for thin-film solar backsheets.

- Demand for lightweight, flexible modules in off-grid and portable systems will create opportunities for advanced, durable backsheet technologies.

- Collaboration between material science firms and solar manufacturers will accelerate innovation in climate- and application-specific backsheet features.

- Suppliers offering UV-stable and moisture-resistant products will gain a competitive edge due to tightening quality and durability standards.

- National and regional subsidies, especially in Asia Pacific, will support R&D for ultra-thin, high-performance solar backsheets.

- Expansion in emerging markets across Latin America, the Middle East, and Africa will open new growth avenues for market participants.

- Introduction of smart backsheet technologies with built-in sensors will enable real-time diagnostics and performance optimization for solar installations.