Market Overview

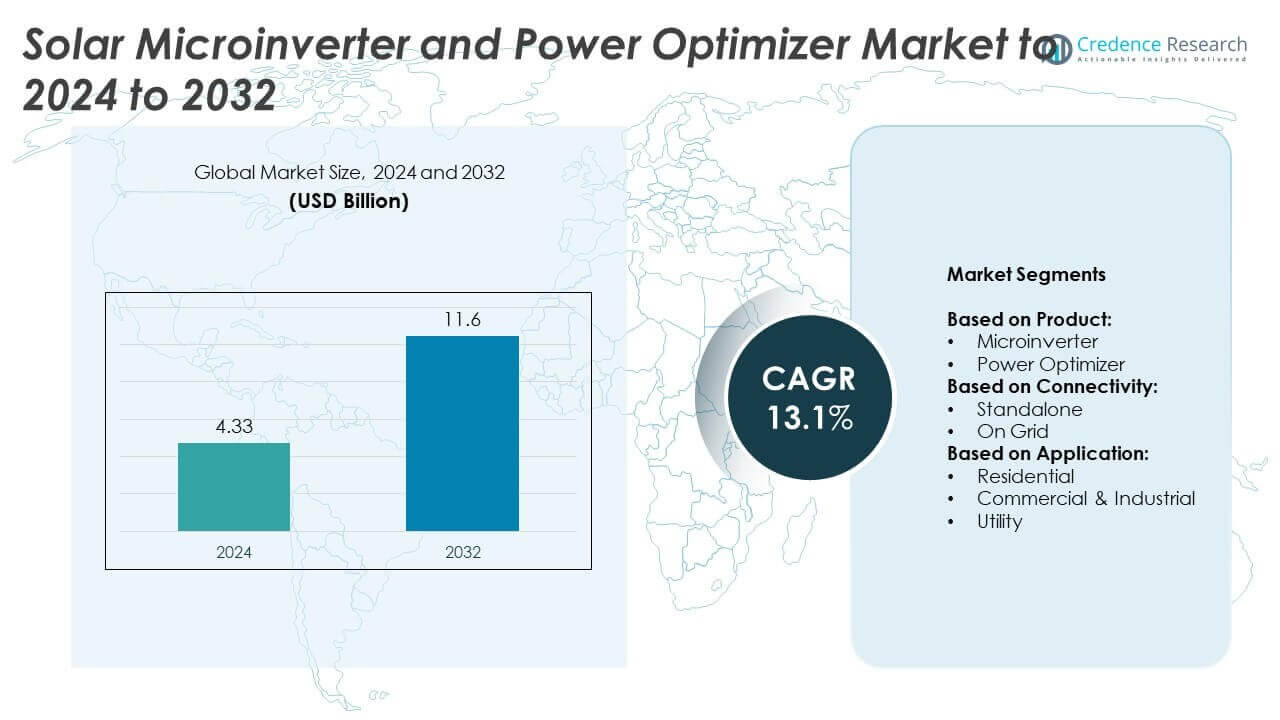

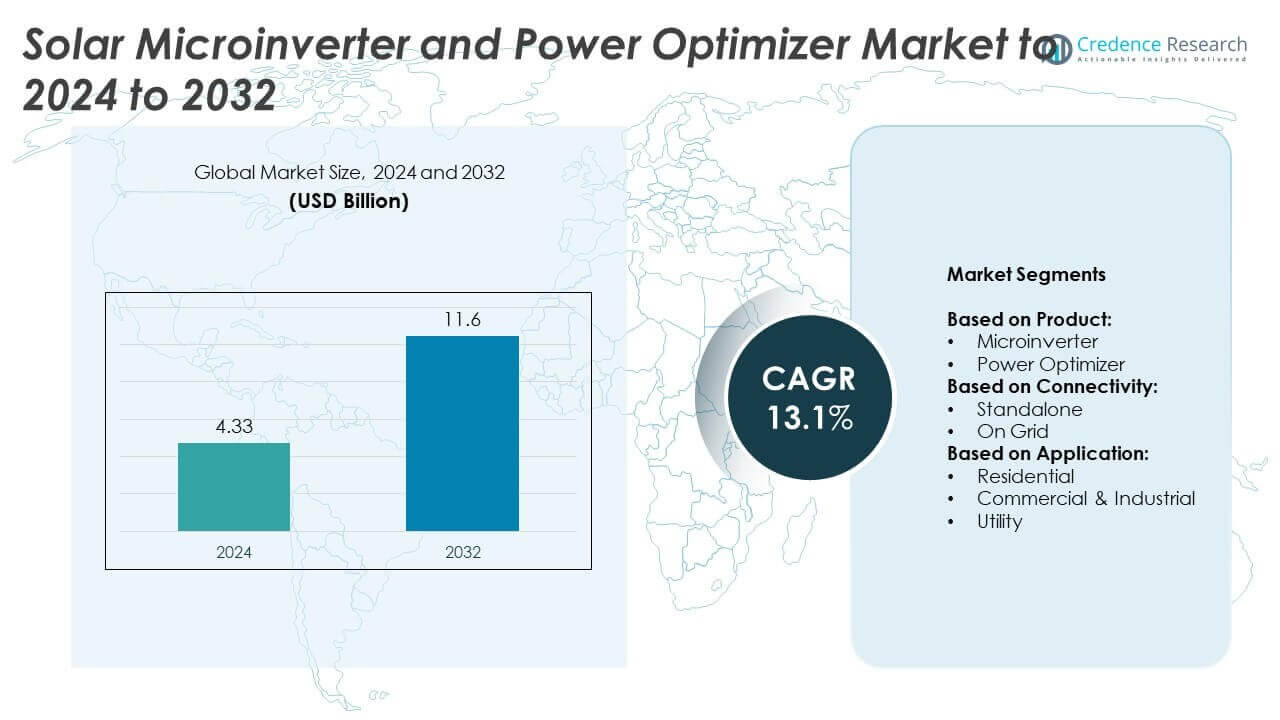

The Solar Microinverter and Power Optimizer Market size was valued at USD 4.33 Billion in 2024 and is anticipated to reach USD 11.6 Billion by 2032, at a CAGR of 13.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Solar Microinverter And Power Optimizer Market Size 2024 |

USD 4.33 Billion |

| Solar Microinverter And Power Optimizer Market, CAGR |

13.1% |

| Solar Microinverter And Power Optimizer Market Size 2032 |

USD 11.6 Billion |

The Solar Microinverter and Power Optimizer Market is driven by key players such as Infineon Technologies AG, APsystems, Huawei Technologies Co., Ltd., Enphase Energy, SolarEdge Technologies Inc., Fronius International GmbH, Tigo Energy, Inc., and Alencon Systems, LLC. These companies focus on technological innovation, smart energy integration, and expanding global distribution networks to strengthen their market positions. North America emerged as the leading region in 2024, accounting for 38% of the total market share, supported by strong rooftop solar adoption, favorable government incentives, and advanced energy management practices. Europe followed with 27%, driven by ambitious renewable energy targets and widespread residential solar projects, while Asia Pacific held 24% share, fueled by rapid urbanization and supportive policy frameworks.

Market Insights

Market Insights

- The Solar Microinverter and Power Optimizer Market was valued at USD 4.33 Billion in 2024 and is projected to reach USD 11.6 Billion by 2032, growing at a CAGR of 13.1%.

- Growth is fueled by rising rooftop solar installations, supportive government incentives, and the demand for improved safety and energy efficiency in residential and commercial projects.

- Key trends include integration with smart energy management systems, IoT-enabled monitoring, and growing adoption in emerging markets where falling solar costs are making installations more accessible.

- The market is highly competitive, with players focusing on innovation, portfolio expansion, and partnerships to strengthen global presence, while competition from traditional string inverters remains a challenge.

- North America led the market with 38% share in 2024, followed by Europe at 27% and Asia Pacific at 24%, while the microinverter segment dominated product categories with more than 55% share due to high residential adoption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

The product segment of the Solar Microinverter and Power Optimizer market is divided into microinverters and power optimizers. Microinverters dominated the segment in 2024 with over 55% market share. Their growing adoption is driven by enhanced reliability, module-level monitoring, and easy installation, which reduce performance losses from shading and dirt. Power optimizers are also witnessing steady growth due to their lower cost compared to microinverters, making them attractive for large-scale installations. Rising demand for higher energy yield and safety features continues to fuel the dominance of microinverters in residential and small commercial projects.

- For instance, Enphase Energy expects to achieve a long-term global microinverter manufacturing capacity of approximately 7.25 million units per quarter upon full ramp-up, with 5 million units of that capacity expected in the U.S.

By Connectivity

The connectivity segment includes standalone and on-grid systems, with on-grid systems holding the largest market share at nearly 70% in 2024. Their dominance is fueled by supportive government policies, net metering incentives, and large-scale rooftop solar installations in urban areas. On-grid systems provide better cost-efficiency and allow users to sell excess electricity back to the grid, increasing adoption in both residential and commercial sectors. Standalone systems remain relevant in off-grid areas but represent a smaller share due to higher battery integration costs and limited grid-independent infrastructure development.

- For instance, By June 30, 2024, SolarEdge reported shipping 873 MW(AC) of inverters and its first 20,000 “domestic content” power optimizers from its new Florida facility in the second quarter of 2024.

By Application

The application segment covers residential, commercial & industrial, and utility sectors, with the residential sector leading in 2024 at about 45% market share. The dominance of residential use is driven by rising rooftop solar adoption, supportive subsidies, and growing consumer demand for energy independence. Microinverters and power optimizers are particularly favored in homes due to their enhanced safety, module-level monitoring, and scalability. The commercial and industrial segment is expanding rapidly, supported by cost savings and sustainability goals. Meanwhile, utility-scale projects prefer centralized inverters, limiting the adoption of module-level technologies in that segment.

Key Growth Drivers

Rising Rooftop Solar Installations

The surge in residential and small commercial rooftop solar projects is a key growth driver. Homeowners and businesses are increasingly adopting solar panels due to supportive incentives, cost savings, and growing environmental awareness. Microinverters and power optimizers are preferred in these installations because they maximize energy yield from each panel and offer module-level monitoring. Their safety features also make them attractive for residential use. The rapid adoption of rooftop solar solutions across developed and emerging markets continues to push strong demand for these technologies.

- For instance, As of December 31, 2023, Sunrun’s total networked solar energy capacity was 6,689 MW.

Government Incentives and Policies

Supportive government policies and incentives remain a vital growth driver for the market. Programs such as net metering, tax credits, and feed-in tariffs are making solar energy more accessible and financially attractive. These schemes encourage both residential and commercial adoption, directly boosting the use of microinverters and power optimizers. Governments worldwide are also setting renewable energy targets to reduce carbon emissions, which further accelerates market penetration. Such policies continue to create a favorable environment for long-term growth in this sector.

- For instance, Sunnova ended 2023 with 419,200 customers, adding over 34,000 in Q4.

Focus on Energy Efficiency and Safety

The increasing emphasis on maximizing energy efficiency and ensuring electrical safety acts as another major growth driver. Microinverters and power optimizers reduce power losses caused by shading, dirt, or panel mismatch, thereby improving overall system output. In addition, these technologies lower fire risks with module-level shutdown features, which is gaining importance under evolving safety regulations. Consumers and installers recognize the reliability and performance benefits, particularly in residential and commercial sectors. The demand for safer, smarter solar solutions ensures sustained market momentum.

Key Trends & Opportunities

Integration with Smart Energy Solutions

One of the most significant trends is the integration of solar systems with smart energy platforms. Microinverters and power optimizers increasingly link with energy storage, smart meters, and home energy management systems. This integration allows real-time monitoring, energy optimization, and improved grid interaction. Growing demand for smart homes and commercial buildings opens new opportunities for these technologies. As digital platforms and IoT-enabled systems expand, the adoption of intelligent solar solutions will continue to grow, offering long-term opportunities for manufacturers.

- For instance, First Solar’s Alabama plant added 3.5 GW of U.S. module capacity in September 2024.

Growing Demand in Emerging Markets

Emerging economies represent a strong opportunity for market expansion. Countries in Asia-Pacific, Latin America, and Africa are witnessing rising solar adoption due to falling panel costs and increasing demand for affordable energy. Off-grid and hybrid solutions are particularly relevant in regions with unreliable grid infrastructure. While large utility projects still prefer central inverters, the residential and small commercial sectors in emerging markets create strong growth prospects for microinverters and power optimizers. This trend is expected to play a vital role in expanding the global market footprint.

- For instance, as of December 14, 2023, Tigo had surpassed 10 million MLPE devices deployed globally. Since 2007, these devices have enabled approximately 3.5 GW of total PV capacity to be deployed, with more than 1 GWh of daily solar production monitored by the company’s Energy Intelligence software across thousands of customer systems.

Key Challenges

Higher Initial Costs

One of the major challenges for the Solar Microinverter and Power Optimizer Market is the higher upfront cost compared to traditional string inverters. Although these technologies provide better performance and long-term savings, the initial investment can deter price-sensitive customers. This barrier is especially relevant in developing markets where budget constraints are higher. Limited awareness of long-term benefits also adds to the challenge. Reducing costs through large-scale manufacturing and technological advancements will be crucial to overcoming this restraint in broader adoption.

Competition from String Inverters

The strong presence of traditional string inverters presents another challenge to the growth of microinverters and power optimizers. String inverters remain the preferred choice in utility-scale projects due to lower costs and proven performance. This limits the penetration of advanced module-level technologies in large installations. Although microinverters and power optimizers excel in residential and small commercial sectors, scaling adoption in high-capacity systems remains difficult. Overcoming this competition will require continued innovation, cost reduction, and demonstrating superior efficiency in diverse applications.

Regional Analysis

North America

North America held the largest share of 38% in the Solar Microinverter and Power Optimizer Market in 2024. The region benefits from high rooftop solar adoption, favorable net metering policies, and strong consumer awareness of energy efficiency. The United States leads with extensive residential and commercial installations supported by incentives such as tax credits. Canada also contributes to growth through clean energy initiatives. The demand for advanced module-level power electronics is rising as consumers focus on safety and performance. This makes North America a critical hub for innovation and deployment in this sector.

Europe

Europe accounted for 27% of the market share in 2024, supported by ambitious renewable energy targets and government-backed incentives. Countries such as Germany, France, and the Netherlands are driving adoption with favorable feed-in tariffs and rooftop solar programs. The growing emphasis on energy efficiency and stringent safety regulations further boosts the demand for microinverters and power optimizers. Residential and small commercial projects dominate installations, while integration with storage and smart energy systems is becoming a notable trend. Europe’s regulatory framework and strong sustainability goals ensure steady growth for advanced solar technologies.

Asia Pacific

Asia Pacific captured 24% of the market share in 2024, emerging as one of the fastest-growing regions. China, India, Japan, and Australia are at the forefront, with rising solar installations driven by declining panel costs and government support. The region sees strong adoption in both residential and commercial sectors, particularly in urban areas. Microinverters and power optimizers are gaining traction as consumers demand efficient, safe, and scalable solutions. Growing urbanization, rapid digitalization, and supportive renewable energy policies position Asia Pacific as a major growth engine in the coming years.

Latin America

Latin America accounted for 6% of the market share in 2024, with Brazil and Mexico leading installations. Favorable government programs, increasing solar rooftop projects, and the need for distributed generation are driving adoption. Residential and commercial installations dominate, as consumers seek affordable and reliable energy solutions. While utility-scale projects often use string inverters, the demand for microinverters and power optimizers is steadily increasing in smaller systems. Limited awareness and higher upfront costs remain challenges, but falling prices and rising clean energy investments are creating opportunities for market growth in the region.

Middle East and Africa

The Middle East and Africa held a combined share of 5% in 2024, reflecting growing interest in renewable energy solutions. Countries such as the UAE, Saudi Arabia, and South Africa are investing in solar energy to diversify power generation and reduce reliance on fossil fuels. Rooftop solar adoption is expanding, particularly in residential and small commercial projects where efficiency and safety are critical. Although utility-scale adoption remains limited, government initiatives and declining solar technology costs are encouraging wider use. The region’s strong solar potential ensures gradual but steady growth for microinverters and power optimizers.

Market Segmentations:

By Product:

- Microinverter

- Power Optimizer

By Connectivity:

By Application:

- Residential

- Commercial & Industrial

- Utility

By Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Solar Microinverter and Power Optimizer Market features leading players such as Infineon Technologies AG, APsystems, Huawei Technologies Co., Ltd., Sun Sine Solution Private Limited, Ampt, LLC, Tigo Energy, Inc., Fronius International GmbH, Alencon Systems, LLC, Enphase Energy, ferroamp, Altenergy Power System Inc, SolarEdge Technologies Inc., Suzhou Convert Semiconductor Co., Ltd., and PCE Process Control Electronic GmbH. The market is characterized by strong competition, with companies focusing on technological advancements to enhance efficiency, safety, and reliability of solar systems. Strategies such as product innovation, portfolio expansion, and integration with smart energy management platforms are widely adopted. Firms are investing in partnerships and collaborations to expand their geographical reach and strengthen distribution networks. Growing demand for module-level monitoring, scalability, and compliance with evolving safety standards further drives innovation. Continuous efforts in reducing costs and enhancing product performance ensure long-term competitiveness in this rapidly evolving solar technology market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Infineon Technologies AG

- APsystems

- Huawei Technologies Co., Ltd.

- Sun Sine Solution Private Limited

- Ampt, LLC

- Tigo Energy, Inc.

- Fronius International GmbH

- Alencon Systems, LLC

- Enphase Energy

- ferroamp

- Altenergy Power System Inc

- SolarEdge Technologies Inc.

- Suzhou Convert Semiconductor Co., Ltd.

- PCE Process Control Electronic GmbH

Recent Developments

- In 2023, Enphase began the shipping its IQ8P microinverters in Mexico to support newer, high-power solar modules.

- In 2023, SolarEdge opened its manufacturing facility in Austin, Texas, to produce residential Home Hub Inverters.

- In 2023, Tigo introduced its EI Residential Solar Solution for the European market, which combines its MLPE products with new inverters and battery storage.

Report Coverage

The research report offers an in-depth analysis based on Product, Connectivity, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand strongly, driven by rising rooftop solar installations worldwide.

- Microinverters will continue to dominate residential projects due to safety and efficiency benefits.

- Power optimizers will gain traction in commercial systems for their cost-effectiveness and scalability.

- Integration with smart energy management systems will enhance adoption across regions.

- Supportive government incentives and renewable energy policies will sustain long-term growth.

- Emerging markets in Asia Pacific, Latin America, and Africa will present significant opportunities.

- Declining technology costs will make advanced solutions more accessible to price-sensitive customers.

- Competition with traditional string inverters will encourage continuous innovation.

- Growing demand for module-level monitoring and reliability will shape product development.

- Sustainability targets and decarbonization efforts will further strengthen global market adoption.

Market Insights

Market Insights