Market Overview

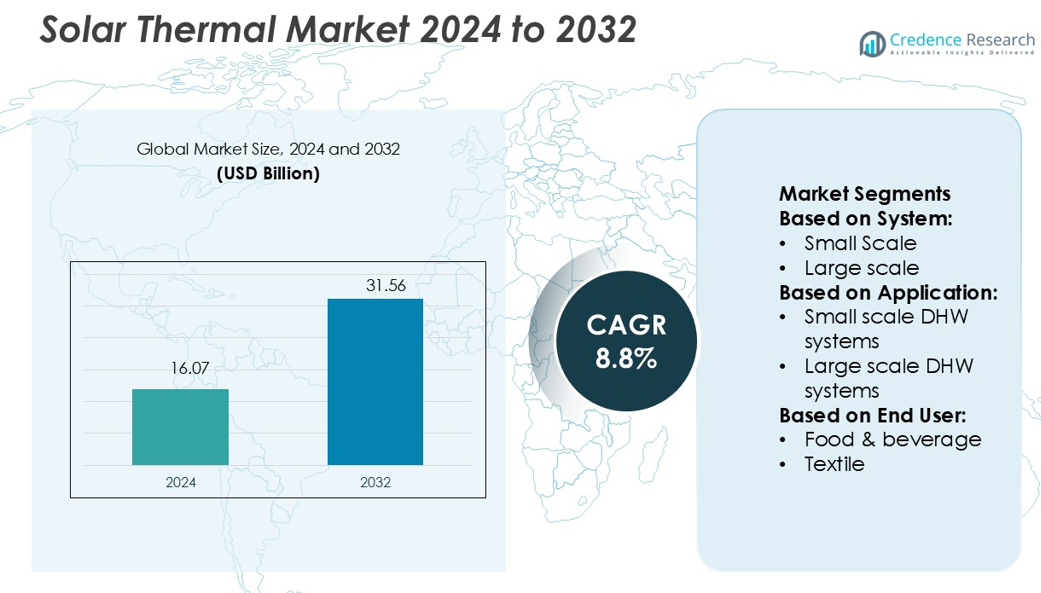

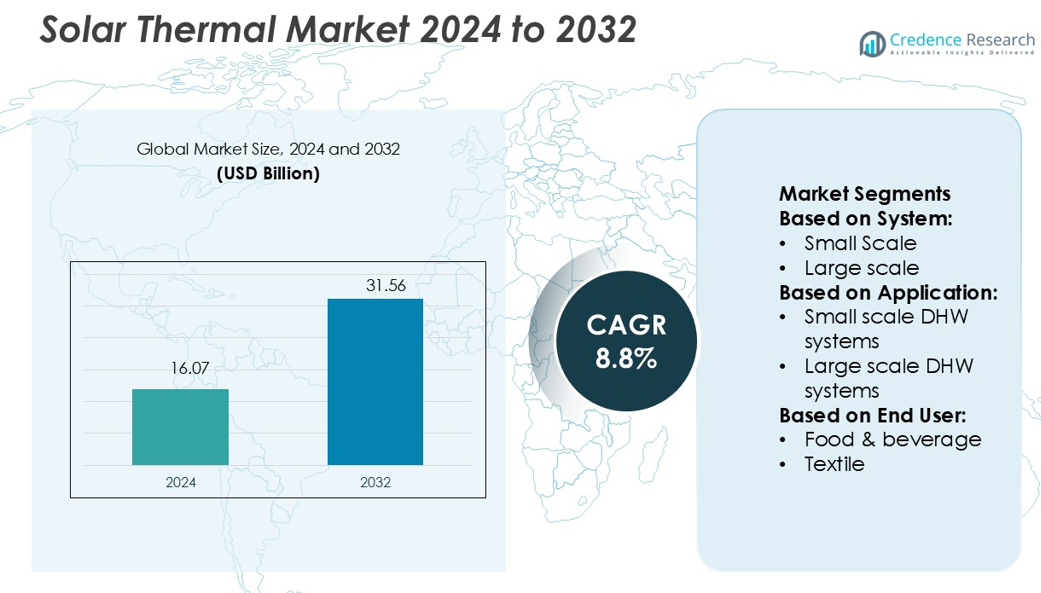

Solar Thermal Market size was valued USD 16.07 billion in 2024 and is anticipated to reach USD 31.56 billion by 2032, at a CAGR of 8.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Solar Thermal Market Size 2024 |

USD 16.07 billion |

| Solar Thermal Market, CAGR |

8.8% |

| Solar Thermal Market Size 2032 |

USD 31.56 billion |

The solar thermal market features strong competition from top players including Ritter XL Solar, Photon Energy Systems Limited, Ormat Technologies, Inventive Power, GREENoneTEC Solarindustrie, Next Source, Módulo Solar, Linuo Ritter, CONA Solar, and G2 Energy. These companies focus on advancing system efficiency, expanding industrial applications, and strengthening hybrid energy integration to capture wider market opportunities. Europe emerges as the leading region with a 32% market share, supported by well-established district heating networks, stringent carbon reduction policies, and continuous investment in large-scale solar thermal projects. This dominance reflects the region’s commitment to energy transition and sustainability.

Market Insights

- The Solar Thermal Market size was valued at USD 16.07 billion in 2024 and is expected to reach USD 31.56 billion by 2032, growing at a CAGR of 8.8%.

- Rising industrial heat demand in sectors such as chemicals, textiles, and food processing drives market expansion, supported by sustainability goals and government incentives.

- Key players focus on efficiency improvements, storage innovations, and hybrid energy integration, while Europe leads with 32% share, followed by North America at 36% and Asia Pacific at 22%.

- High initial investment costs and competition from solar PV and heat pumps act as restraints, impacting adoption in small-scale residential and commercial applications.

- By application, large-scale domestic hot water systems dominate with 38% share, while the chemical industry leads end-use with 33%, supported by strong demand for reliable renewable heating solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By System

In the solar thermal market, large-scale systems dominate with nearly 62% share due to their ability to provide centralized heating for industrial and district-level applications. These installations benefit from government incentives, utility-scale integration, and higher efficiency in meeting large energy demands. Small-scale systems, while important for residential and small commercial uses, hold a smaller share. The dominance of large-scale systems is further driven by the rising focus on decarbonizing industrial processes and reducing reliance on fossil-fuel-based heating solutions.

- For instance, Ritter XL Solar commissioned a 3,388 m² vacuum-tube collector field in Wels, Austria, which supplies district heating networks with operating temperatures between 75 °C and 100 °C, demonstrating scalability for urban energy systems.

By Application

Large-scale domestic hot water (DHW) systems account for the highest share at 38%, as they cater to institutional buildings, hotels, and commercial complexes with consistent demand for hot water. Their dominance is supported by the reliability of thermal storage and favorable cost-per-unit heating output. Swimming pool heating and solar combi systems follow as niche applications, while small-scale DHW systems find adoption in households. Growing emphasis on energy-efficient building designs and supportive policy frameworks further strengthens the position of large-scale DHW systems in this segment.

- For instance, GREENoneTEC operates eight highly automated robotic production lines that together achieve an annual output of over 1,600,000 m² of flat-plate collector panels.

By End User

The chemical industry leads the end-use segment with a 33% share, as thermal energy plays a critical role in chemical processing, distillation, and drying operations. High process heat requirements make solar thermal a viable solution for reducing fuel costs and carbon emissions. The food and beverage sector follows closely, using solar heating for pasteurization, cleaning, and drying applications. Textile, metal processing, and mining industries are also increasingly adopting solar thermal systems, driven by both sustainability goals and the need to stabilize long-term energy costs.

Market Overview

Rising Industrial Heat Demand

The growing need for process heat in industries such as chemicals, food and beverage, and textiles is a major driver for the solar thermal market. These sectors require medium to high-temperature heat, which solar thermal systems can efficiently provide while reducing dependence on fossil fuels. Companies are adopting large-scale solar heating systems to meet sustainability targets and lower operational costs. Government-backed incentives and carbon reduction commitments further accelerate adoption, making industrial demand a critical force behind market growth.

- For instance, Módulo Solar’s MAXOL Full Plate 2.0 model (model “FP 1.20.0 LE sc”) has been certified by SRCC under OG-100 standards. Its gross area is 2.031 m², with a net aperture area of 1.886 m², a fluid capacity of 2.2 litres, and a test pressure rating of 1,500 kPa.

Supportive Government Policies and Incentives

Government support through subsidies, tax benefits, and renewable energy targets strongly influences solar thermal adoption. Countries in Europe, Asia, and North America have introduced regulatory frameworks that encourage solar thermal integration in residential, commercial, and industrial sectors. Incentives for district heating systems and carbon-neutral industrial operations create favorable conditions for deployment. Additionally, initiatives promoting renewable-based heat reduce financial barriers for end users, ensuring steady market expansion. This strong policy environment continues to drive investment in solar thermal infrastructure worldwide.

- For instance, Linuo Ritter has a significantly larger annual production capacity than initially stated, having reported figures as high as 2 million m² of solar collectors and 5 million sets of solar water heaters.

Growing Focus on Decarbonization

Global efforts to decarbonize heating, which contributes significantly to carbon emissions, are propelling the solar thermal market. Industries and municipalities are increasingly replacing fossil-fuel-based heating systems with solar-powered alternatives. Solar thermal solutions reduce greenhouse gas emissions while offering long-term cost stability. This transition aligns with corporate sustainability goals and international climate agreements. The push for net-zero emissions by 2050 reinforces adoption, making solar thermal technology a strategic investment in clean energy transformation and environmental responsibility.

Key Trends & Opportunities

Integration with District Heating Networks

District heating networks present a growing opportunity for solar thermal systems. Countries in Europe and Asia are increasingly integrating solar thermal plants to provide clean, large-scale heating to urban communities. This integration reduces dependency on gas-fired boilers and improves efficiency through centralized storage systems. Expanding urbanization and rising heat demand strengthen this trend. As utilities seek reliable renewable options, solar thermal becomes an attractive solution, creating opportunities for scaling deployment across both developed and emerging markets.

- For instance, G2 Energy has delivered over 20 battery energy storage system (BESS) projects in the UK with a combined installed capacity of 700 MWh, providing critical grid balancing and frequency response functions.

Technological Advancements in Storage Solutions

Thermal energy storage innovations are transforming solar thermal efficiency and reliability. Advanced storage materials, such as molten salts and phase-change materials, extend heat supply even during low solar radiation. This enables continuous operation for industrial and residential applications, boosting system competitiveness. Improved storage also supports hybrid models combining solar thermal with biomass or geothermal energy. As storage costs decline, opportunities for wider adoption expand, particularly in regions with fluctuating energy demands or limited grid infrastructure.

- For instance, Molten salt storage tanks are used in the industry for thermal energy storage, with typical operating temperatures around 400 °C, and can be scaled to provide dispatchable energy after sunset.

Key Challenges

High Initial Investment Costs

The capital-intensive nature of solar thermal projects remains a key challenge. Large-scale systems, particularly those for industrial or district heating applications, demand significant upfront spending on installation, land, and equipment. While operational costs are low, the long payback period discourages small businesses and households. Limited financing options and competing technologies, such as solar PV with electric boilers, also hinder adoption. Overcoming this barrier requires supportive financing models and broader policy frameworks to attract investment and lower entry costs.

Competition from Alternative Renewable Technologies

Solar thermal faces strong competition from alternative renewable solutions, particularly solar photovoltaics (PV) and heat pumps. PV systems are often cheaper and easier to deploy, while electric heat pumps offer efficient heating with lower maintenance needs. Falling PV costs and rapid grid electrification further challenge solar thermal’s market share. This competitive pressure limits adoption in certain regions, where policymakers and industries prioritize electrification pathways. Addressing this challenge requires highlighting solar thermal’s unique advantages in industrial heat and large-scale applications.

Regional Analysis

North America

North America holds a 36% share of the solar thermal market, driven by strong adoption in the United States and Canada. Industrial applications such as food processing, textiles, and chemicals contribute significantly to demand. The region benefits from well-established research infrastructure, supportive renewable energy policies, and rising corporate sustainability commitments. Growth is further supported by government incentives for district heating and industrial decarbonization projects. While competition from solar PV is strong, the demand for medium to high-temperature industrial heat ensures solar thermal maintains a robust position in North America’s renewable energy landscape.

Europe

Europe accounts for 32% of the solar thermal market, supported by high adoption in countries such as Germany, Spain, and Denmark. Strong regulatory frameworks and carbon-neutral targets drive deployment in residential, commercial, and district heating systems. Large-scale district heating networks, particularly in Northern and Eastern Europe, enhance the region’s dominance. Technological advancements in storage and integration with hybrid systems also support growth. The European Union’s emphasis on reducing fossil fuel dependence and enhancing energy efficiency ensures continued expansion, with industries and municipalities adopting solar thermal systems as part of long-term decarbonization strategies.

Asia Pacific

Asia Pacific represents 22% of the solar thermal market, with China and India leading adoption. Industrial growth, urbanization, and rising energy demand fuel significant investment in solar thermal technologies. Supportive government policies, such as subsidies for renewable heating and industrial decarbonization programs, accelerate adoption. In China, large-scale installations are widely used in residential and commercial hot water applications, while India focuses on industrial uses in textiles, food processing, and chemicals. Increasing focus on reducing carbon emissions and improving energy security positions Asia Pacific as one of the fastest-growing regions in the global solar thermal market.

Latin America

Latin America holds a 6% share of the solar thermal market, with Brazil, Mexico, and Chile emerging as key contributors. Rising demand for cost-effective renewable heating solutions in households and industries is fueling adoption. Government initiatives promoting clean energy and the availability of abundant solar resources strengthen regional growth. Solar thermal systems are increasingly used for residential hot water supply, swimming pool heating, and small-scale industrial applications. Although the market faces challenges from limited financing options, expanding urbanization and supportive renewable energy policies provide a foundation for steady growth across Latin America.

Middle East and Africa

The Middle East and Africa account for 4% of the solar thermal market, primarily supported by high solar radiation levels and growing demand for sustainable heating. Countries such as South Africa, Saudi Arabia, and the United Arab Emirates are investing in large-scale solar thermal projects for both residential and industrial purposes. The technology is being adopted in food and beverage, chemicals, and mining industries to reduce reliance on fossil fuels. However, high capital costs and limited awareness hinder wider adoption. Despite these challenges, strong solar potential and rising sustainability goals create growth opportunities in the region.

Market Segmentations:

By System:

By Application:

- Small scale DHW systems

- Large scale DHW systems

By End User:

By Geography

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Competitive Landscape

The solar thermal market is shaped by key players such as Ritter XL Solar, Photon Energy Systems Limited, Ormat Technologies, Inventive Power, GREENoneTEC Solarindustrie, Next Source, Módulo Solar, Linuo Ritter, CONA Solar, and G2 Energy. The solar thermal market is increasingly competitive, driven by innovation, policy support, and rising industrial demand for clean heat solutions. Companies are focusing on enhancing system efficiency, reducing installation costs, and integrating advanced storage technologies to strengthen their position. The market also benefits from growing interest in hybrid systems that combine solar thermal with other renewable sources to ensure reliability and cost-effectiveness. Strategic moves such as partnerships, joint ventures, and technology collaborations are common, enabling firms to expand global reach and adapt to regional energy needs. Emphasis on sustainability, decarbonization, and compliance with renewable energy targets continues to shape competitive dynamics.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In May 2025, SOFAR launches PowerIn and PowerMagic Mini for C&I Energy Systems. The launches, presented over two consecutive days, highlight the company’s ongoing push for innovation in Europe’s fast-evolving clean energy sector.

- In May 2025, Husk Power Systems launched a dedicated residential rooftop solar service called BEEM, aimed at making the transition to solar energy simple, fast, and affordable for homeowners across India. The service offers a one-stop solution for residential solar photovoltaic (PV) systems.

- In April 2025, Gulf Warehousing Company (GWC) Q.P.S.C. announced the launch of one of the GCC’s largest private solar energy projects, supercharging its sustainability efforts and cementing its role as a trailblazer in green logistics.

- In April 2025, Hitachi Industrial Equipment Systems launched a next-generation inverter system to support stable, resilient power grids. This cutting-edge system helps stabilize electric power systems during the global transition to renewable energy by simulating the stabilizing effects once provided by large power plants.

Report Coverage

The research report offers an in-depth analysis based on System, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The solar thermal market will expand with increasing adoption in industrial heating applications.

- District heating networks will integrate more solar thermal plants to reduce fossil fuel reliance.

- Advances in thermal energy storage will enhance system efficiency and reliability.

- Hybrid systems combining solar thermal with biomass or geothermal energy will gain traction.

- Governments will strengthen policy incentives to accelerate renewable heating transitions.

- Emerging markets will witness rising demand due to urbanization and energy security needs.

- Innovations in collector design will improve cost-effectiveness and performance.

- Corporate sustainability goals will drive large-scale adoption in manufacturing sectors.

- Competition with solar PV and heat pumps will push further technological differentiation.

- Global decarbonization targets will solidify solar thermal’s role in clean energy strategies.