Market Overview

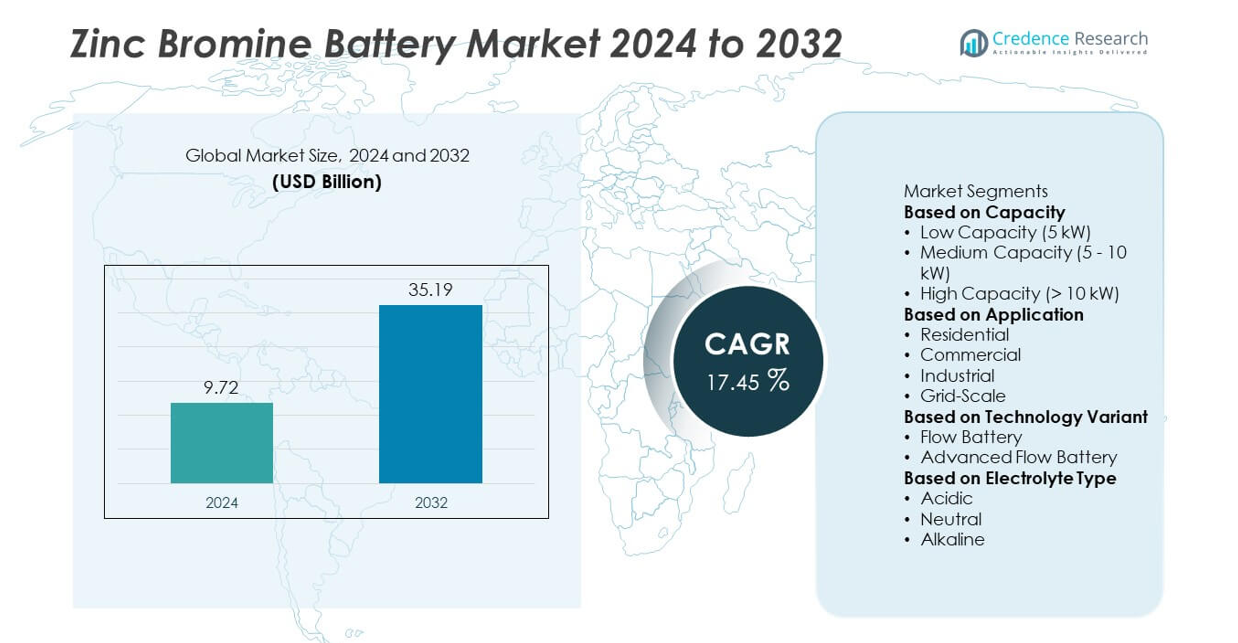

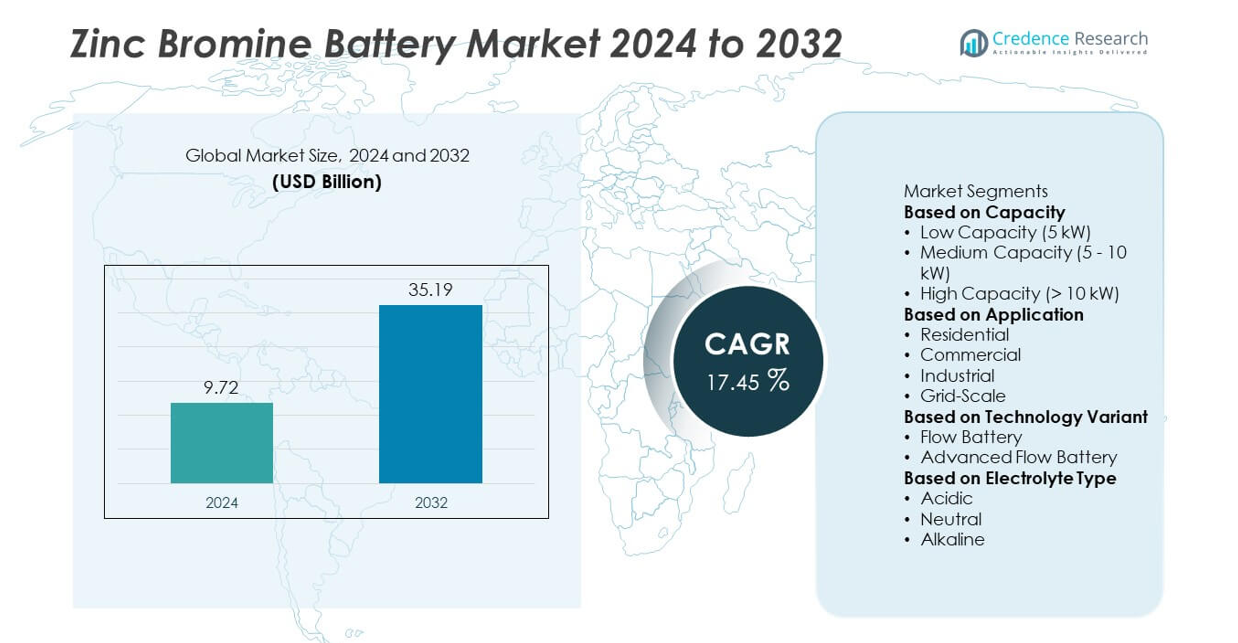

The Zinc Bromine Battery Market was valued at USD 9.72 billion in 2024 and is expected to reach USD 35.19 billion by 2032, growing at a CAGR of 17.45% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Zinc Bromine Battery Market Size 2024 |

USD 9.72 Billion |

| Zinc Bromine Battery Market, CAGR |

17.45% |

| Zinc Bromine Battery Market Size 2032 |

USD 35.19 Billion |

The Zinc Bromine Battery Market grows with rising demand for long-duration energy storage to support renewable integration and grid stability. It benefits from deep discharge capability, long cycle life, and safe non-flammable chemistry, making it ideal for utility, commercial, and off-grid applications. North America leads the Zinc Bromine Battery Market with strong adoption in utility-scale energy storage, microgrids, and commercial backup systems supported by robust government incentives and grid modernization programs. Europe follows with increasing deployment in renewable-heavy grids, particularly in Germany, the UK, and France, where long-duration storage supports decarbonization targets. Asia-Pacific shows rapid growth driven by large solar and wind installations in China, India, and Japan, along with rural electrification initiatives in Southeast Asia. Latin America and Middle East & Africa are emerging markets with rising interest in zinc-bromine solutions for mining operations, remote microgrids, and industrial applications. Key players shaping the market include Eos Energy Enterprises, Primus Power, and ViZn Energy Systems, which focus on scalable flow battery solutions. Companies such as StorEn Technologies and Sumitomo Electric Industries invest in electrolyte improvements and modular designs to enhance performance, reduce costs, and expand global deployment opportunities.

Market Insights

- The Zinc Bromine Battery Market was valued at USD 9.72 billion in 2024 and is projected to reach USD 35.19 billion by 2032, growing at a CAGR of 17.45%.

- Rising demand for long-duration storage solutions drives adoption in utility-scale, commercial, and off-grid projects.

- Modular system designs, digital monitoring, and scalable configurations enable easier deployment and operational efficiency.

- Leading players such as Eos Energy Enterprises, Primus Power, ViZn Energy Systems, StorEn Technologies, and Sumitomo Electric Industries focus on cost reduction, performance enhancement, and global expansion.

- High initial investment costs, raw material price volatility, and system complexity act as restraints, limiting adoption in cost-sensitive markets.

- North America leads growth with strong renewable integration efforts, Europe benefits from decarbonization initiatives, and Asia-Pacific shows fastest growth with large solar and wind installations.

- Opportunities arise from rural electrification, data center backup systems, and recycling-focused innovations that align with sustainability goals and circular economy initiatives.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Growing Demand for Long-Duration Energy Storage Solutions

The Zinc Bromine Battery Market grows with rising need for long-duration storage to balance renewable energy integration. Solar and wind projects increasingly require reliable energy storage to manage variability and ensure grid stability. It offers deep discharge capability and consistent performance over extended cycles, making it ideal for utility-scale applications. Governments and utilities invest in storage systems to meet decarbonization targets and support peak load management. Adoption of zinc-bromine technology reduces reliance on fossil-fuel-based backup power. These advantages position zinc-bromine batteries as a key solution for modern energy networks.

- For instance, Redflow Limited’s ZBM3 zinc-bromine flow battery module has a usable capacity of up to 10kWh per daily cycle, a continuous power rating of 3kW, and can tolerate 100% daily depth of discharge.

Rising Deployment in Microgrids and Remote Power Systems

Growing use of microgrids and off-grid energy solutions drives demand for zinc-bromine batteries. The Zinc Bromine Battery Market benefits from their ability to operate in harsh conditions with minimal maintenance. It supports rural electrification, military bases, and remote industrial facilities that require reliable backup power. Long cycle life and safe, non-flammable chemistry make them well-suited for critical infrastructure. Increasing focus on energy independence accelerates adoption of modular storage systems. This trend expands opportunities in developing regions with limited grid connectivity.

- For instance, Redflow has deployed its zinc-bromine batteries in off-grid projects, including a telecommunications application where modules operate in ambient temperatures from 10°C to 45°C without additional air conditioning. The batteries can be shipped and stored at 0% state of charge and fully discharged without damage, a benefit in remote deployments.

Supportive Government Policies and Investment Incentives

Global policies promoting clean energy transition encourage adoption of advanced energy storage technologies. The Zinc Bromine Battery Market gains from subsidies, tax credits, and funding programs aimed at deploying grid-scale storage. It aligns with initiatives to integrate more renewable energy into national power mixes. Public-private partnerships accelerate demonstration projects and commercial deployment. Strong regulatory frameworks create confidence for investors and utilities to adopt zinc-bromine solutions. These policy measures provide a robust foundation for market growth.

Technological Advancements and Cost Optimization Efforts

Continuous research improves the performance and efficiency of zinc-bromine batteries. The Zinc Bromine Battery Market benefits from innovations that enhance electrolyte formulation, reduce self-discharge, and extend lifespan. It drives down operational costs and improves energy density, making systems more competitive with lithium-ion alternatives. Manufacturers invest in scalable production facilities to meet rising global demand. Integration with digital monitoring systems improves system reliability and predictive maintenance. These advancements strengthen the market’s long-term competitiveness in stationary energy storage.

Market Trends

Increasing Focus on Grid-Scale and Renewable Integration Projects

The Zinc Bromine Battery Market shows strong growth in grid-scale energy storage applications. Utilities deploy these batteries to stabilize power supply and manage renewable fluctuations. It supports peak shaving, load balancing, and frequency regulation, improving overall grid efficiency. Growing investment in wind and solar farms creates demand for durable, long-duration storage solutions. Zinc-bromine systems provide long discharge durations, making them ideal for shifting renewable energy to evening peak hours. This trend strengthens their role in modernizing power infrastructure.

- For instance, ZBB Energy Corporation developed early systems like the 25 kW/50 kWh energy storage module demonstrated in 1994, with later systems for utility trials offering unit capacities up to 1 MW/3 MWh.

Adoption of Modular and Scalable Battery Systems

Manufacturers focus on developing modular systems that can be scaled to meet diverse energy requirements. The Zinc Bromine Battery Market benefits from flexible configurations suitable for commercial, industrial, and residential installations. It allows users to expand capacity over time without significant redesign. Prefabricated containerized solutions simplify deployment and reduce installation time. This modularity supports applications from small microgrids to large utility-scale projects. Growing preference for easy-to-deploy solutions accelerates adoption worldwide.

- For instance, the now-defunct company, originally ZBB Energy Corporation and later rebranded as EnSync, Inc., developed modular EnerStore V3 flow batteries. These zinc-bromide batteries were available in scalable systems, including 5 kW/20 kWh setups suitable for community energy storage.

Integration of Digital Monitoring and Remote Management Tools

Digitalization plays a key role in improving battery system performance and reliability. The Zinc Bromine Battery Market increasingly integrates IoT-based monitoring platforms for real-time data tracking. It enables predictive maintenance, reduces downtime, and optimizes energy usage. Remote management allows operators to monitor multiple sites from a single interface. Data analytics improve decision-making for utilities and facility managers. These digital capabilities enhance the value proposition for zinc-bromine systems.

Advancement in Recycling and Sustainability Practices

Sustainability initiatives drive research into recycling and reusing zinc and bromine components. The Zinc Bromine Battery Market benefits from closed-loop systems that reduce environmental impact. It supports circular economy goals by enabling recovery of materials for future battery production. Manufacturers invest in eco-friendly processes to meet regulatory requirements. Improved recyclability strengthens the appeal of zinc-bromine systems compared to toxic alternatives. This focus on sustainability aligns with growing demand for responsible energy storage solutions.

Market Challenges Analysis

High Initial Costs and Competitive Pressure from Lithium-Ion Batteries

The Zinc Bromine Battery Market faces challenges from high upfront costs and competition with lithium-ion technology. Capital expenditure for installation and supporting infrastructure can limit adoption in cost-sensitive projects. It must compete with lithium-ion systems that benefit from mature supply chains and economies of scale. Price volatility of raw materials, including zinc and bromine, further impacts system affordability. Developers must justify investment based on long lifecycle and safety benefits. These financial constraints slow penetration, particularly in small and mid-sized commercial applications.

Technical Limitations and Complexity in Maintenance

Zinc-bromine batteries require regular maintenance and have more complex electrolyte management compared to other chemistries. The Zinc Bromine Battery Market must address challenges related to self-discharge rates and operational efficiency in extreme temperatures. It can face limitations in high-power applications requiring rapid discharge. System complexity demands trained technicians, which can be difficult to source in remote areas. Limited awareness among end-users about the technology’s advantages creates hesitation in adoption. Addressing these issues is critical to improving reliability and building confidence among potential buyers.

Market Opportunities

Rising Demand for Long-Duration and Safe Energy Storage

The Zinc Bromine Battery Market holds strong opportunities in addressing the growing need for long-duration energy storage. Utilities and grid operators seek technologies that provide several hours of discharge to complement renewable energy. It offers non-flammable chemistry, making it safer than lithium-ion in critical infrastructure applications. Demand from commercial facilities, data centers, and hospitals creates opportunities for reliable backup systems. Expansion of microgrids in remote locations supports deployment of zinc-bromine solutions. These advantages strengthen its role in supporting energy transition initiatives globally.

Expansion into Emerging Markets and Industrial Applications

Emerging economies present significant growth potential as governments invest in energy infrastructure and renewable integration. The Zinc Bromine Battery Market benefits from projects focused on rural electrification and grid modernization. It enables cost-effective storage for industrial sites, mining operations, and islanded grids. Manufacturers explore partnerships to localize production and reduce system costs. Growing emphasis on circular economy principles also supports interest in recyclable battery chemistries. These factors create new revenue streams and encourage global adoption of zinc-bromine technology.

Market Segmentation Analysis:

By Capacity

The Zinc Bromine Battery Market is segmented by capacity into less than 100 kWh, 100–500 kWh, and above 500 kWh systems. Small-capacity systems below 100 kWh are used in residential and small commercial backup applications where energy demand is limited. It serves as a reliable option for remote cabins, telecom towers, and small-scale microgrids. Medium-capacity systems between 100–500 kWh find use in commercial facilities, community energy storage, and renewable energy projects requiring daily cycling. Large-scale systems above 500 kWh dominate utility projects, industrial microgrids, and data centers that require long-duration power supply. Rising demand for grid support and renewable integration accelerates investment in this segment. Manufacturers focus on modular designs to meet diverse capacity needs and enable future scalability.

- For instance, ZincFive has deployed its nickel-zinc batteries for immediate power applications across numerous locations, including data centers in partnership with companies like Vertiv. The company reported in June 2024 that it had delivered and contracted over 1 gigawatt of power solutions for mission-critical applications.

By Application

Applications include utility-scale energy storage, commercial and industrial backup, off-grid systems, and renewable energy integration. The Zinc Bromine Battery Market sees highest demand from utility-scale storage projects aimed at peak load shifting and frequency regulation. It plays a crucial role in balancing solar and wind power output. Commercial and industrial facilities adopt these batteries for energy cost management and uninterrupted power during outages. Off-grid systems rely on zinc-bromine chemistry for durability and reduced maintenance in harsh environments. Integration with renewable energy sources supports microgrid resilience and reduces fossil fuel dependence. This wide application base drives consistent growth across developed and emerging markets.

- For instance, Primus Power’s modular 125 kWh EnergyPod 2 batteries have been used for commercial applications, including managing demand charges. In utility-scale applications, Primus Power’s systems are designed to be scalable up to 25 MW, used for managing renewable variability and grid support.

By Technology Variant

Technology variants include flow battery systems with different electrode and electrolyte configurations. The Zinc Bromine Battery Market mainly uses zinc-bromine flow batteries, known for their deep discharge capability and long cycle life. It offers advantages such as high round-trip efficiency and non-flammable electrolyte composition. Emerging innovations focus on improving energy density and reducing system footprint for space-constrained installations. Researchers develop advanced membranes and electrolyte formulations to lower maintenance needs and extend service life. Growing investment in R&D supports commercialization of next-generation zinc-bromine systems. This focus on technology advancement strengthens competitiveness with lithium-ion and other flow battery chemistries.

Segments:

Based on Capacity

- Low Capacity (5 kW)

- Medium Capacity (5 – 10 kW)

- High Capacity (> 10 kW)

Based on Application

- Residential

- Commercial

- Industrial

- Grid-Scale

Based on Technology Variant

- Flow Battery

- Advanced Flow Battery

Based on Electrolyte Type

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds the largest share of the Zinc Bromine Battery Market, accounting for nearly 36% of the global market. The region benefits from strong investments in renewable energy projects and grid modernization programs. It sees high deployment of zinc-bromine systems in utility-scale applications, commercial facilities, and military microgrids. The United States leads demand with federal and state-level incentives supporting energy storage adoption. Canada contributes significantly with projects focused on remote community electrification and renewable integration. It also benefits from a growing emphasis on energy security and resilience against outages. Manufacturers invest in regional partnerships and demonstration projects to expand market presence.

Europe

Europe represents about 28% of the global market share, driven by its ambitious decarbonization targets and focus on long-duration energy storage. Countries such as Germany, the UK, and France deploy zinc-bromine batteries to stabilize renewable-heavy grids and support peak shaving. It gains traction in EU-funded pilot projects that showcase cost-effective alternatives to lithium-ion systems. Industrial and commercial facilities use these batteries to optimize energy costs and ensure backup power reliability. Regulatory support through clean energy policies accelerates adoption across member states. The region also focuses on circular economy solutions, which align well with recyclable zinc-bromine chemistries.

Asia-Pacific

Asia-Pacific accounts for nearly 25% of the global market, supported by rapid urbanization, rising energy demand, and expanding renewable capacity. China, India, and Japan lead regional growth, with large-scale solar and wind projects creating demand for long-duration storage. It benefits from government-backed initiatives promoting local manufacturing and energy security. Rural electrification projects in Southeast Asia adopt zinc-bromine batteries for reliable off-grid power. Industrial parks and commercial buildings also install these systems to manage peak demand and reduce energy costs. The region’s strong manufacturing base helps lower system costs and improve availability, supporting widespread adoption.

Latin America

Latin America holds around 6% of the global market share, driven by growing renewable energy deployment and need for grid stability. Brazil, Chile, and Mexico lead investments in solar and wind projects requiring long-duration storage solutions. It faces infrastructure challenges but benefits from international funding and partnerships to develop energy storage capacity. Zinc-bromine batteries are favored for remote mining sites and microgrids where maintenance access is limited. Local governments support pilot projects to demonstrate economic and technical feasibility. These initiatives create opportunities for expanding deployment across industrial and commercial sectors.

Middle East & Africa

The Middle East & Africa region accounts for nearly 5% of the global market share, with growth driven by energy diversification and microgrid projects. Gulf countries invest in large-scale renewable projects and adopt zinc-bromine batteries for grid balancing and backup power. It supports remote desalination plants, military bases, and critical infrastructure requiring reliable storage. South Africa leads adoption in Africa with initiatives to address grid instability and support industrial operations. Growing interest in energy independence and resilience drives demand across the region. Manufacturers explore partnerships with local utilities to establish a stronger presence in emerging markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

Competitive landscape of the Zinc Bromine Battery Market features leading players such as Eos Energy Enterprises, Primus Power, ViZn Energy Systems, StorEn Technologies, Sumitomo Electric Industries, ZincFive, RFB Power, Fluidic Energy, Imergy Power Systems, and VRB Energy. These companies focus on developing advanced zinc-bromine flow battery systems with improved efficiency, long cycle life, and enhanced safety features. Many invest in optimizing electrolyte chemistry, reducing self-discharge rates, and increasing energy density to compete with lithium-ion solutions. Strategic collaborations with utilities and renewable project developers expand their deployment footprint across grid-scale, commercial, and microgrid applications. Manufacturers emphasize modular, containerized systems to simplify installation and enable capacity expansion. Investments in digital monitoring, remote management, and predictive maintenance tools improve system reliability and reduce downtime. Competitive strategies also include cost optimization and partnerships for localized production to meet growing demand in emerging markets. Continuous innovation positions these players to capture rising demand for sustainable, long-duration storage solutions.

Recent Developments

- In February 2024, Enzinc, which focuses on nickel-zinc batteries rather than zinc-bromine, secured a $1.8 million grant to build a manufacturing demonstration line for its zinc anodes.

- In September 2023, Primus Power deployed a 1 MWh energy storage system using zinc bromine flow technology for grid-scale frequency regulation in Texas.

- In June 2023, ViZn Energy Systems announced a $25 million investment from the U.S. Department of Energy to support the development and commercialization of its zinc-bromine flow battery technology.

- In March 2023, Eos Energy Storage announced the commissioning of a 10 MW/40 MWh zinc-bromine flow battery project in California, the largest of its kind in the world.

Report Coverage

The research report offers an in-depth analysis based on Capacity, Application, Technology Variant, Electrolyte Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for zinc-bromine batteries will grow with expansion of renewable energy projects worldwide.

- Utilities will adopt these systems for grid balancing, peak shaving, and frequency regulation.

- Modular and containerized designs will make deployment faster and more cost-efficient.

- Technological improvements will enhance electrolyte stability and extend battery life cycles.

- Recycling and material recovery initiatives will support circular economy goals and sustainability.

- Adoption in microgrids, telecom towers, and remote industrial operations will accelerate.

- Integration with digital monitoring platforms will improve predictive maintenance and performance tracking.

- Partnerships between battery manufacturers and energy developers will expand global deployment opportunities.

- Cost optimization and localized manufacturing will make systems more competitive with lithium-ion alternatives.

- Rising focus on energy security will drive adoption in data centers, military bases, and critical infrastructure.