Market Overview

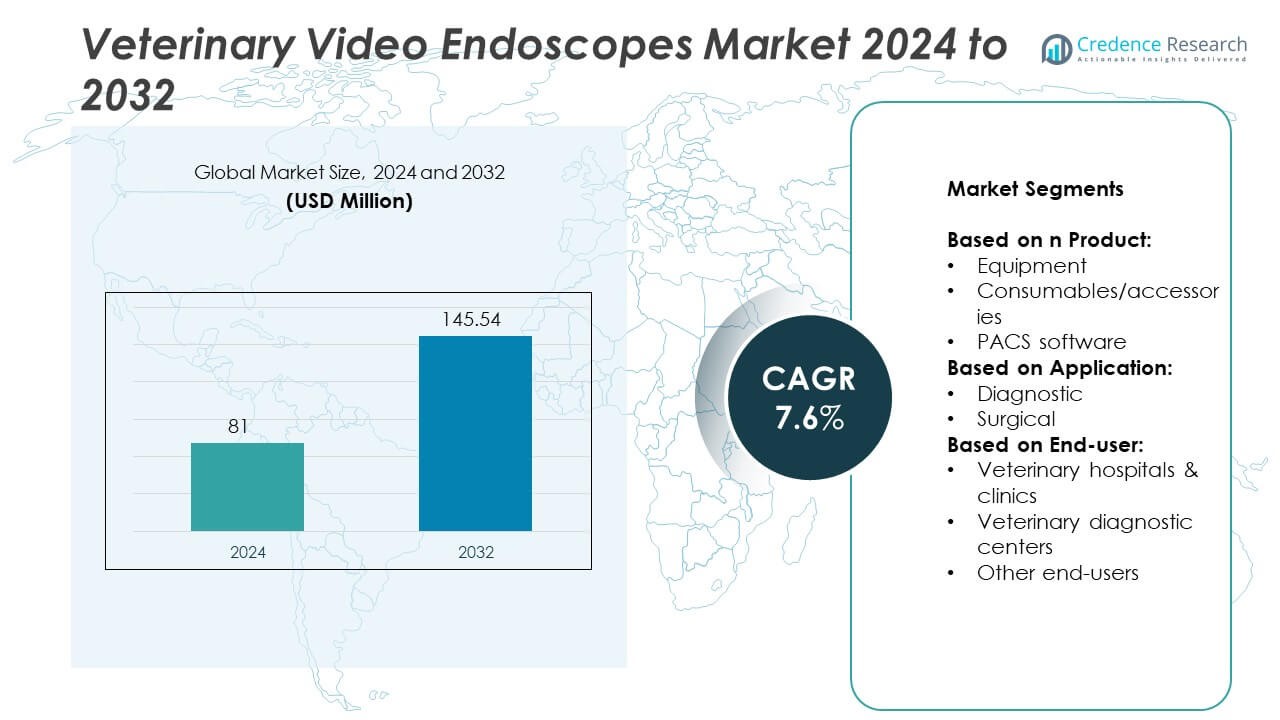

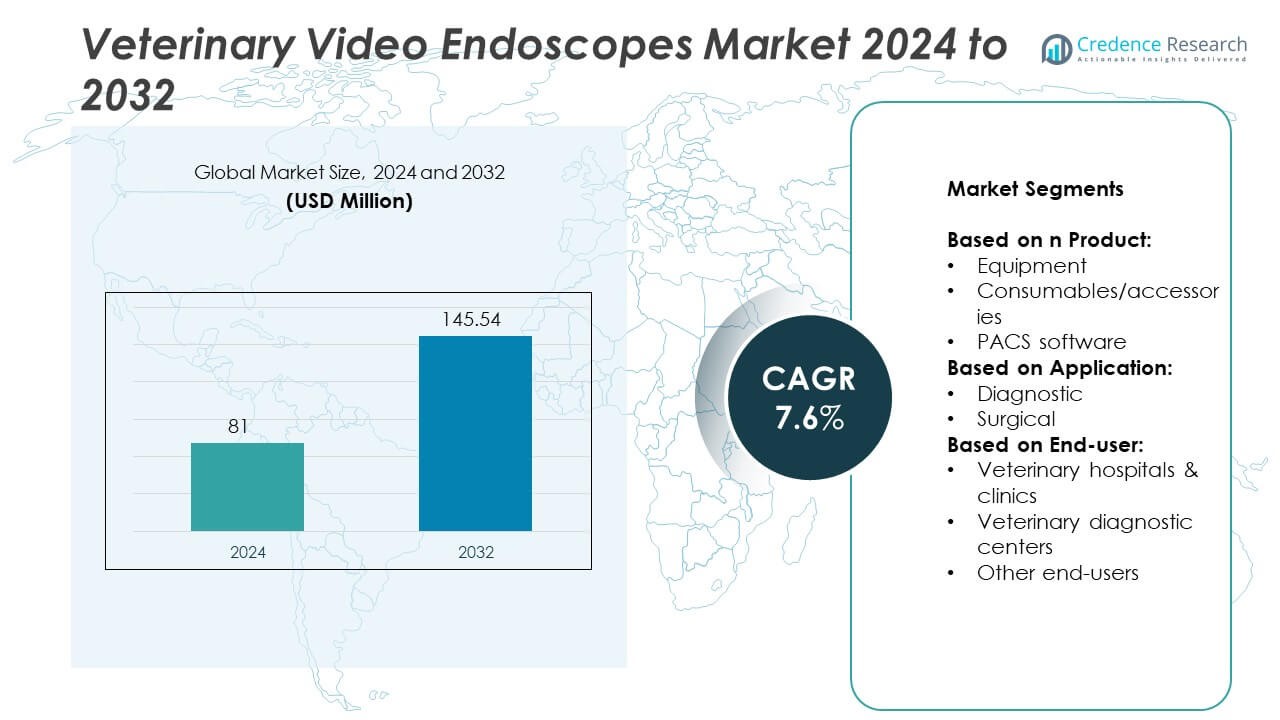

The Veterinary Video Endoscopes Market was valued at USD 81 million in 2024 and is projected to reach approximately USD 145.54 million by 2032, growing at a compound annual growth rate (CAGR) of 7.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Veterinary Video Endoscopes Market Size 2024 |

USD 81 Million |

| Veterinary Video Endoscopes Market, CAGR |

7.6% |

| Veterinary Video Endoscopes Market Size 2032 |

USD 145.54 Million |

The Veterinary Video Endoscopes market is driven by the rising demand for non-invasive diagnostic tools, increasing pet ownership, and advancements in imaging technology. Clinics seek equipment that offers real-time internal visualization, enabling accurate diagnosis and faster treatment decisions. The market also benefits from growing veterinary specialization and infrastructure development across emerging regions

The Veterinary Video Endoscopes market shows strong growth across developed and emerging regions. North America leads with widespread adoption of advanced veterinary technologies and a well-established clinical network. Europe follows with high standards for animal care and a growing focus on minimally invasive procedures. Asia Pacific is emerging as a high-potential market due to increasing pet ownership, improving veterinary infrastructure, and greater awareness of preventive diagnostics. Latin America and the Middle East & Africa present gradual growth supported by rising veterinary investments and expanding urban clinics. Key players shaping the market include Olympus Corporation, known for its advanced imaging systems, and KARL STORZ SE & Co. KG.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Veterinary Video Endoscopes market was valued at USD 81 million in 2024 and is projected to reach USD 145.54 million by 2032, registering a CAGR of 7.6% during the forecast period.

- Rising demand for non-invasive diagnostics and early disease detection in companion animals drives market growth, with veterinary clinics increasingly investing in advanced endoscopy systems for better patient outcomes.

- Key trends include the integration of AI-enabled imaging, wireless connectivity, and portable device formats that improve diagnostic accuracy and support use in remote or mobile veterinary settings.

- The market is competitive, with companies such as Olympus Corporation, KARL STORZ SE & Co. KG, Fujifilm, and Firefly Global focusing on technology innovation, product customization, and expanding global distribution networks.

- High equipment cost and lack of trained professionals in some regions restrain market penetration, particularly among small veterinary practices and in price-sensitive areas.

- North America leads the market with advanced clinical infrastructure and widespread adoption, followed by Europe with strong regulatory support and a growing number of veterinary specialists; Asia Pacific shows rapid growth driven by expanding pet care awareness.

- The market benefits from increased veterinary infrastructure investment, expansion of specialty clinics, and growing emphasis on preventive healthcare, creating strong long-term demand for video endoscopy solutions.

Market Drivers

Market Drivers

Rising Prevalence of Companion Animal Disorders Boosts Demand for Diagnostic Precision

The growing incidence of gastrointestinal, respiratory, and urogenital disorders in companion animals drives demand for accurate and early diagnostics. Pet owners increasingly seek advanced veterinary services, leading clinics to adopt innovative tools like Veterinary Video Endoscopes. These devices support internal visualization without invasive surgery, enabling better diagnosis and targeted treatment. Increasing pet ownership in urban regions further intensifies this demand. Animal healthcare providers prioritize solutions that minimize animal stress and recovery time. Veterinary Video Endoscopes offer a critical advantage by allowing real-time internal inspection with minimal discomfort.

- For instance, The average annual pay for a Veterinarian is about $121,076 a year, this translates to an approximate hourly rate of $58, a monthly salary of about $10,090, and a weekly pay of around $2,328.

Advancements in Imaging Technologies Drive Equipment Across Clinics

Technological improvements in optics, resolution, and digital integration have enhanced the functionality of Veterinary Video Endoscopes. High-definition imaging, improved maneuverability, and compatibility with electr Adoption onic health record systems contribute to faster diagnosis and documentation. Veterinary clinics benefit from more efficient workflows and improved procedural outcomes. Manufacturers continue to introduce systems with greater durability, portability, and user-friendly interfaces. These upgrades make it easier for smaller practices to invest in endoscopy solutions. Veterinary Video Endoscopes now support a broader range of diagnostic and surgical procedures.

- For instance, the number of veterinarians in the U.S. is only growing by 2.7% yearly, with 2,600 new vets graduating from veterinary colleges each year.

Growing Veterinary Infrastructure and Clinical Specialization Support Market Expansion

Expansion of veterinary hospitals, specialty clinics, and mobile veterinary services has increased access to advanced diagnostic procedures. Many veterinary institutions are now equipped with dedicated departments for internal medicine, gastroenterology, and minimally invasive surgery. This trend supports the integration of Veterinary Video Endoscopes into routine clinical use. With more trained professionals entering the veterinary sector, demand for advanced diagnostic tools continues to rise. Clinics focus on improving service quality to meet rising client expectations. It contributes to increased procurement of precision diagnostic devices.

Favorable Regulatory and Institutional Support Promotes Equipment Modernization

Government initiatives, funding programs, and academic collaborations support innovation in veterinary diagnostics. Several regions encourage the adoption of modern veterinary tools by offering subsidies or tax incentives for clinics upgrading equipment. Veterinary training institutions include endoscopic techniques in their curriculum to improve practitioner readiness. This ecosystem creates awareness and trust in the use of Veterinary Video Endoscopes. Veterinary product manufacturers benefit from easier approvals and clearer standards for clinical use. It encourages investment in R&D and faster product adoption.

Market Trends

Integration of Artificial Intelligence and Software Enhancements Elevates Diagnostic Accuracy

Veterinary clinics increasingly rely on software-assisted diagnostics to improve procedural outcomes and reduce operator dependency. Advanced Veterinary Video Endoscopes now feature AI-based image recognition that assists in detecting lesions and abnormalities with higher accuracy. These tools help veterinarians identify subtle signs of disease and streamline case documentation. Software platforms linked with video endoscopes enable real-time image sharing and remote consultations. It strengthens diagnostic collaboration, especially in multi-location practices. Clinics benefit from improved efficiency and greater diagnostic consistency.

- For instance, The Living Planet Index, provided by the Zoological Society of London (ZSL), tracks almost 35,000 vertebrate populations of 5,495 species from 1970-2020.

Rising Demand for Portable and Handheld Devices Enhances Operational Flexibility

Veterinary professionals working in field settings or mobile clinics prefer lightweight and battery-operated systems. Manufacturers now offer Veterinary Video Endoscopes with compact designs and wireless connectivity to support mobility. These devices allow real-time diagnostics outside traditional clinical environments. Portable models also reduce setup time and are easier to sterilize and maintain. It expands access to advanced diagnostics in rural or underserved areas. Veterinary professionals gain flexibility without compromising image quality or functionality.

- For instance, Firefly Global’s DE551 Wireless Veterinary Video Otoscope weighs just 185 grams and delivers 640×480 resolution video with up to 50x optical magnification, supporting wireless transmission up to 20 feet, enabling field veterinarians to perform high-quality ear and oral inspections without tethered equipment.

Increasing Focus on Minimally Invasive Procedures Influences Product Innovation

Veterinarians prioritize procedures that minimize stress and recovery time for animals. This trend drives demand for endoscopes that support less invasive techniques and faster post-operative outcomes. Veterinary Video Endoscopes are now engineered with slimmer insertion tubes, flexible articulation, and higher image resolution. It enables precise targeting of affected areas and reduces the need for exploratory surgeries. Clinics adopting such innovations report improved client satisfaction and better patient outcomes. Manufacturers focus on developing tools suited for both diagnostics and therapeutic interventions.

Expansion of Specialty Practices Spurs Equipment Customization and Niche Offerings

Veterinary specialization in areas such as cardiology, neurology, and gastroenterology has created demand for tailored endoscopic tools. Veterinary Video Endoscopes are now available with interchangeable heads and modular attachments suited for species-specific or organ-specific applications. It allows specialists to address complex diagnostic needs with greater precision. Equipment vendors offer product variants designed for exotic pets, large animals, and avian species. Clinics benefit from tools that align with their service focus. This shift drives product diversification and targeted innovation.

Market Challenges Analysis

High Equipment Cost and Maintenance Requirements Limit Broader Accessibility

The high initial cost of Veterinary Video Endoscopes creates a significant entry barrier for small and mid-sized veterinary clinics. Advanced models with high-resolution imaging, AI integration, and modular features often require substantial investment. Maintenance, calibration, and sterilization add to the total cost of ownership. It discourages adoption in price-sensitive regions and practices with limited capital. Many clinics rely on older diagnostic tools or refer patients to external facilities, which delays timely intervention. Limited access to financing or leasing options further constrains market penetration among independent veterinarians.

Technical Skill Gaps and Limited Training Impede Efficient Utilization

Veterinary Video Endoscopes require trained professionals for accurate usage, interpretation, and maintenance. Many veterinary institutions still lack specialized training programs for endoscopic procedures. It leads to underutilization of equipment or diagnostic errors in less experienced hands. Continuous learning is essential to stay updated with evolving device features and software upgrades. Clinics face challenges in allocating time and resources for staff training while managing routine operations. This skill gap affects clinical outcomes and reduces the return on investment for advanced diagnostic tools.

Market Opportunities

Expansion of Preventive Veterinary Care Creates Demand for Early Diagnostic Tools

Pet owners increasingly prioritize preventive healthcare, leading to a higher volume of routine check-ups and early-stage diagnostics. This shift encourages clinics to adopt tools that offer non-invasive internal examination capabilities. Veterinary Video Endoscopes support early detection of gastrointestinal, respiratory, and urinary tract conditions. It enables timely intervention and improves long-term animal health outcomes. Clinics offering advanced diagnostics differentiate their services in competitive markets. Growing awareness about chronic animal conditions further strengthens the case for regular endoscopic evaluations.

Untapped Potential in Emerging Markets Presents Room for Strategic Growth

Emerging economies in Asia, Latin America, and parts of Africa show rising demand for improved veterinary services. Urbanization, increasing pet ownership, and evolving livestock management practices drive this trend. Veterinary Video Endoscopes have significant growth potential in these regions, where diagnostic infrastructure is still developing. It opens opportunities for manufacturers to offer cost-effective and portable solutions tailored to local needs. Collaborations with veterinary schools, NGOs, and government agencies can help accelerate adoption. Localization of training and support services will further improve market reach and user confidence.

Market Segmentation Analysis:

By Product:

The equipment segment dominates the Veterinary Video Endoscopes market, driven by continuous advancements in imaging technology and increasing installation across clinics. High-definition endoscopes with improved flexibility and ergonomic designs remain in demand among veterinarians seeking accurate diagnostics and minimally invasive surgical capabilities. The consumables/accessories segment holds steady growth due to recurring demand for biopsy tools, sheaths, and cleaning components essential for routine operations. It supports procedural safety and device longevity. PACS software, while a smaller segment, gains traction as clinics invest in digital record-keeping and image management. Integration with video endoscopy systems enhances workflow efficiency and enables remote consultations.

- For instance, In the first half of 2025, about 1.9 million dogs and cats were adopted nationwide—a slight 1% decrease compared to the same period in 2024.

By Application:

The diagnostic segment leads the market, with Veterinary Video Endoscopes playing a crucial role in identifying internal conditions without surgical intrusion. Early detection of gastrointestinal, respiratory, and urogenital diseases remains a key priority for veterinarians. Surgical applications form a growing segment, supported by the increasing preference for minimally invasive procedures. It enables targeted treatment with reduced trauma and faster recovery. Clinics investing in endoscopic surgery solutions enhance their procedural capabilities and client satisfaction. This dual utility across diagnostics and interventions reinforces the value proposition of endoscopy systems.

- For instance, by the year January 2023, EndoTheia announced that it has been granted priority status by the FDA through the receipt of a Breakthrough Device designation for its technology.

By End-User:

Veterinary hospitals and clinics represent the largest end-user segment, with high adoption rates driven by patient volume and demand for comprehensive diagnostic services. These facilities benefit from integrated systems that support real-time imaging and immediate clinical decisions. Veterinary diagnostic centers show steady uptake, particularly in urban and specialized settings. It reflects the growing role of centralized labs in supporting veterinary practices with advanced tools. Other end-users, including academic institutions and mobile veterinary services, present emerging opportunities for cost-effective and portable endoscope solutions.

Segments:

Based on Product:

- Equipment

- Consumables/accessories

- PACS software

Based on Application:

Based on End-user:

- Veterinary hospitals & clinics

- Veterinary diagnostic centers

- Other end-users

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

It holds the largest share of the Veterinary Video Endoscopes market, accounting for approximately 38.5% of the global market in 2024. The region’s dominance is driven by strong infrastructure in veterinary healthcare, high pet ownership rates, and rising demand for advanced diagnostic tools. The United States leads the regional market, supported by a well-established network of veterinary hospitals and specialty clinics. Increasing awareness among pet owners regarding early disease detection encourages clinics to invest in endoscopic systems. Veterinary education institutions across the U.S. and Canada offer specialized training in endoscopy, which strengthens practitioner readiness and drives consistent equipment utilization. Manufacturers benefit from a favorable regulatory environment that accelerates product approvals and market access. The adoption of integrated PACS software and AI-supported diagnostic platforms continues to rise, positioning North America as the innovation hub for endoscopic veterinary solutions.

Europe

It represents the second-largest market for Veterinary Video Endoscopes, holding around 27.6% of the global market share. Countries such as Germany, the United Kingdom, and France drive growth through a robust network of veterinary practitioners and advanced clinical facilities. The market benefits from strong support for animal welfare and preventive care initiatives supported by both public and private sectors. Veterinary clinics across Europe actively invest in non-invasive diagnostic tools to comply with high clinical standards and client expectations. Growing specialization in veterinary fields such as internal medicine and gastroenterology promotes the adoption of video endoscopy systems. Increasing integration of imaging tools with digital workflow systems further enhances procedural efficiency. The region also sees steady demand from academic institutions and veterinary research centers, which supports consistent procurement of high-quality endoscopic equipment.

Asia Pacific

It is the fastest-growing region in the Veterinary Video Endoscopes market, capturing approximately 18.9% of global revenue in 2024. The growth is fueled by rising pet adoption rates, expanding middle-class populations, and increased spending on animal healthcare in countries like China, India, Japan, and South Korea. Veterinary infrastructure is rapidly evolving across the region, with a growing number of clinics adopting advanced diagnostic solutions. Governments and academic institutions actively support veterinary education and infrastructure modernization, which contributes to endoscope adoption. Multinational companies increasingly target Asia Pacific with portable, affordable equipment designed for diverse species and environments. The region’s increasing exposure to western veterinary practices and technologies also plays a key role in driving market acceptance. It remains a key focus for manufacturers seeking long-term growth and product localization strategies.

Latin America

It accounts for approximately 8.1% of the global Veterinary Video Endoscopes market. Brazil and Mexico are the leading countries in this region due to their growing urban pet populations and investments in veterinary care. The market is gradually evolving with increased awareness among veterinarians about minimally invasive diagnostic methods. Clinics are beginning to upgrade traditional diagnostic tools in favor of video endoscopy systems, particularly in urban centers. Challenges such as high equipment cost and limited training resources still limit widespread adoption in rural areas. International players are entering the market through local partnerships and training initiatives to improve accessibility. Continued investment in veterinary education and clinic modernization is expected to enhance market potential.

Middle East & Africa

It region holds the smallest share of the global market, contributing around 6.9% in 2024. While the market remains in its early development stage, growing pet care awareness and the rise of veterinary services in Gulf countries support modest growth. Countries such as the UAE and Saudi Arabia are investing in high-quality veterinary infrastructure, including specialty clinics and mobile veterinary units. In Africa, livestock management remains a key application area for veterinary diagnostics. The adoption of Veterinary Video Endoscopes is limited but gradually improving due to NGO involvement, government programs, and training partnerships. The market presents long-term opportunities, especially through affordable, durable, and portable diagnostic solutions tailored to local needs. With appropriate support, this region can witness steady growth in the coming years.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Firefly Global

- Fujifilm

- Steris

- Fritz Endoscopes GmbH

- MDS Incorporated

- Advanced Monitors Corporation

- Olympus Corporation

- KARL STORZ SE & Co. KG

- eKuore

- Biovision Veterinary Endoscopy, LLC

- Eickemeyer

Competitive Analysis

Key players in the Veterinary Video Endoscopes market include Olympus Corporation, KARL STORZ SE & Co. KG, Fujifilm, Firefly Global, Biovision Veterinary Endoscopy, LLC, Dr. Fritz Endoscopes GmbH, Eickemeyer, eKuore, Steris, MDS Incorporated, and Advanced Monitors Corporation. The market remains competitive, with companies focusing on innovation, product differentiation, and global expansion. Manufacturers continue to enhance imaging quality, device portability, and digital compatibility to meet the evolving needs of veterinary professionals. Customization for species-specific procedures and integration with diagnostic platforms are becoming standard features across new product lines. Companies are also strengthening their global presence through regional partnerships, local distribution networks, and targeted marketing strategies. Strong after-sales service, technical training, and user education contribute to brand loyalty and long-term customer retention. Competitive advantage increasingly depends on delivering reliable, cost-effective solutions that align with the operational demands of both high-volume veterinary hospitals and independent clinics.

Recent Developments

- In 2025, the veterinary video endoscopy of the gastrointestinal tract contributed to more than 46% of the market revenue.

- In March 2025, Firefly Global introduced the DE1250 Wireless Video Endo-Camera, a digital video camera for various endoscopic applications delivering high-quality live video streaming to PCs, used widely in ENT, gynecology, urology, and cosmetic practices.

- In January 2025, top decking trends focused on enhanced wood-grain textures in composite decking. Manufacturers concentrated on creating more realistic, natural-looking composite decking that mimics the aesthetic appeal of real wood without the maintenance requirements.

Market Concentration & Characteristics

The Veterinary Video Endoscopes market demonstrates moderate to high concentration, with a few established players dominating global sales through advanced technology offerings and broad distribution networks. It is characterized by rapid innovation, increasing demand for minimally invasive diagnostic tools, and growing integration of digital imaging and wireless capabilities. Product differentiation largely centers on image resolution, portability, and compatibility with clinical software platforms. The market features a mix of multinational corporations and niche companies focused on veterinary-specific solutions. Veterinary Video Endoscopes serve both large animal and companion animal practices, creating diverse requirements for device design and functionality. It supports clinical efficiency through real-time visualization, which helps in early diagnosis and targeted treatment. Purchasing decisions often depend on brand reputation, technical support, and product reliability, especially in high-throughput veterinary hospitals and specialty clinics. The market continues to evolve with rising demand from emerging economies and increasing emphasis on preventive veterinary care, positioning it for steady long-term expansion.

Report Coverage

The research report offers an in-depth analysis based on Product, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see steady growth due to increasing demand for minimally invasive diagnostic tools in veterinary care.

- Rising pet ownership and awareness about animal health will drive the adoption of advanced diagnostic technologies.

- Portable and wireless endoscope models will gain popularity among mobile veterinary practices and rural clinics.

- Integration of artificial intelligence in endoscopic imaging will enhance diagnostic accuracy and workflow efficiency.

- Training programs and educational initiatives will improve practitioner proficiency and boost equipment utilization.

- Demand for species-specific and application-specific endoscopy solutions will increase among specialized veterinary clinics.

- Cloud-based PACS software integration will support real-time data sharing and remote consultations.

- Emerging markets in Asia Pacific, Latin America, and the Middle East will offer strong growth opportunities.

- Strategic partnerships between manufacturers and veterinary institutions will support product development and adoption.

- Regulatory support and increased investment in veterinary infrastructure will further strengthen market expansion.

Market Drivers

Market Drivers