Market Overview

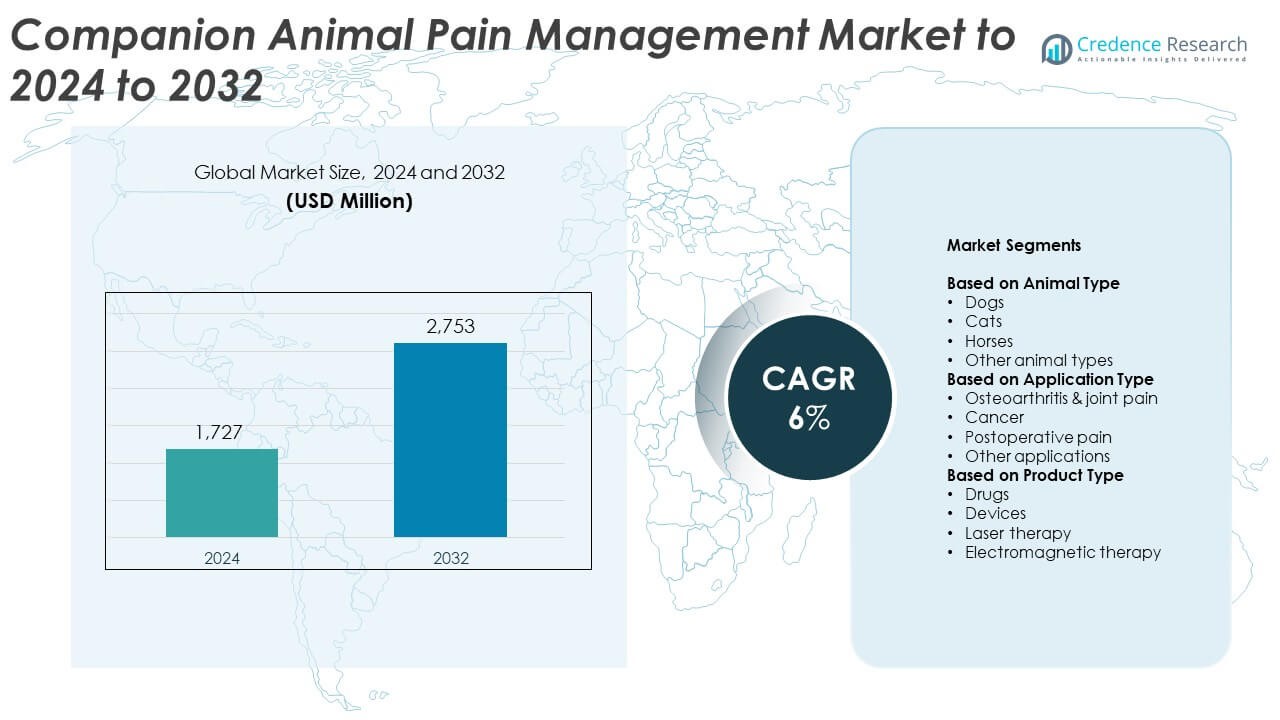

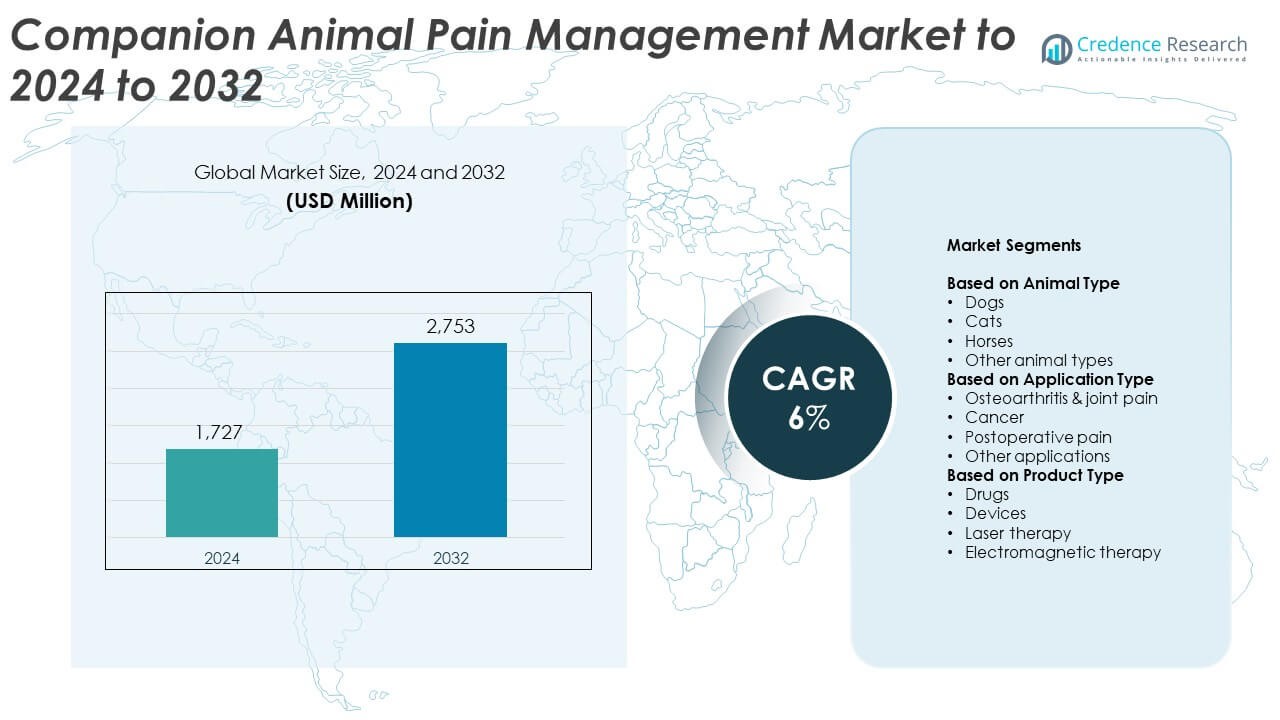

The Companion Animal Pain Management Market size was valued at USD 1,727 million in 2024 and is anticipated to reach USD 2,753 million by 2032, at a CAGR of 6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Companion Animal Pain Management Market Size 2024 |

USD 1,727 Million |

| Companion Animal Pain Management Market, CAGR |

6% |

| Companion Animal Pain Management Market Size 2032 |

USD 2,753 Million |

The Companion Animal Pain Management Market is led by major players such as Boehringer Ingelheim, Elanco, Zoetis, Merck, Dechra Pharmaceuticals, Ceva Sante Animale, Virbac, and Vetoquinol, along with emerging participants including INDIBA, PainTrace, and Companion Animal Health. These companies focus on innovative pain relief solutions, including biologics, laser therapy, and long-acting analgesics, to enhance treatment efficacy and compliance. North America dominated the market in 2024, holding a 40% share, supported by high pet healthcare expenditure and advanced veterinary infrastructure. Europe followed with a 32% share, driven by growing awareness of chronic pain management and adoption of multimodal therapeutic approaches.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Companion Animal Pain Management Market was valued at USD 1,727 million in 2024 and is projected to reach USD 2,753 million by 2032, expanding at a CAGR of 6%.

- Rising incidence of osteoarthritis, cancer, and chronic pain in pets is driving demand for advanced pain relief solutions across veterinary clinics and home care settings.

- Key trends include growing adoption of biologics, non-opioid therapies, and non-pharmacological treatments such as laser and electromagnetic therapy for long-term pain management.

- The market is moderately consolidated, with leading players investing in R&D, digital pain monitoring tools, and strategic partnerships to expand product reach and strengthen competitiveness.

- North America led with a 40% share in 2024, followed by Europe with 32%, driven by advanced veterinary infrastructure, while Asia Pacific held 18% and is expected to record the fastest growth due to rising pet ownership and improving healthcare access.

Market Segmentation Analysis:

By Animal Type

Dogs dominated the Companion Animal Pain Management Market in 2024, accounting for 57.9% of the total share. The dominance is driven by the high prevalence of arthritis, hip dysplasia, and postoperative pain among dogs. Rising pet ownership, increasing veterinary visits, and expanding use of NSAIDs and monoclonal antibodies for pain relief support growth. The segment benefits from advanced formulations and targeted therapies improving chronic pain management. Growing awareness among pet owners and rising expenditure on canine healthcare continue to reinforce the leadership of the dog segment.

- For instance, Zoetis reports that its monoclonal antibody therapy, Librela® (bedinvetmab), had approximately 25 million doses distributed globally as of February 2025, and more than 1 million dogs in the U.S. received the treatment since its U.S. commercial launch in October 2023.

By Application Type

Osteoarthritis and joint pain held the largest market share of 49.6% in 2024, attributed to the increasing incidence of degenerative joint diseases in aging pets. Rising adoption of multimodal pain management strategies, including NSAIDs, regenerative medicine, and physiotherapy, enhances treatment outcomes. Growing cases of obesity in pets further elevate joint-related pain conditions. Veterinary hospitals are focusing on early diagnosis and customized treatment plans to improve mobility and quality of life in pets, thereby strengthening the dominance of osteoarthritis and joint pain applications.

- For instance, Banfield’s State of Pet Health data showed a 66% rise in canine osteoarthritis diagnoses over 10 years, with 6.1% of dogs affected in 2018.

By Product Type

Drugs led the Companion Animal Pain Management Market in 2024, capturing a 64.3% share. Their dominance is supported by the wide use of nonsteroidal anti-inflammatory drugs, opioids, and corticosteroids for chronic and postoperative pain management. Continuous development of novel molecules and long-acting formulations enhances treatment convenience and efficacy. The rising adoption of biologics, such as monoclonal antibodies, is improving safety and reducing side effects. Increased availability of oral and injectable products through veterinary pharmacies further strengthens the leadership of the drugs segment.

Key Growth Drivers

Rising Incidence of Chronic Pain Disorders in Pets

The growing prevalence of chronic conditions such as osteoarthritis, cancer, and neuropathic pain among companion animals is driving market expansion. Aging pet populations and higher obesity rates contribute to increased joint and musculoskeletal disorders. Veterinary clinics are increasingly adopting advanced diagnostic tools to identify pain early and implement targeted treatments. The rising awareness of animal welfare and the availability of specialized pain management programs further enhance adoption rates across veterinary hospitals and home care settings.

- For instance, Nationwide has an actively insured base of over 1 million pets and has previously reported processing more than 3.5 million total annual claims.

Advancements in Veterinary Pharmaceuticals and Biologics

Continuous innovation in veterinary pain management drugs, including NSAIDs, opioids, and monoclonal antibodies, is a major market catalyst. Companies are developing long-acting and species-specific formulations to improve treatment outcomes and compliance. Biologic therapies are gaining preference due to fewer side effects and higher efficacy in chronic conditions. The availability of combination therapies and sustained-release products is helping veterinarians manage complex pain cases more effectively, boosting demand across both clinical and retail channels.

- For instance, the effectiveness program for Boehringer Ingelheim’s Metacam (meloxicam) oral suspension included two placebo-controlled, masked field studies to demonstrate efficacy in dogs with osteoarthritis pain. These studies involved a combined total of 277 dogs over 14 days.

Growing Pet Ownership and Healthcare Expenditure

Expanding pet ownership worldwide and rising willingness to spend on animal healthcare are accelerating market growth. Increasing disposable income and the humanization of pets are encouraging preventive healthcare adoption. Pet insurance coverage is expanding, making advanced pain therapies more accessible. Veterinarians are offering comprehensive pain management packages, including diagnostics, therapy, and rehabilitation, which further stimulate market revenue. These behavioral and economic shifts are supporting consistent demand for advanced veterinary pain solutions.

Key Trends & Opportunities

Integration of Non-Pharmacological Therapies

The adoption of complementary pain management approaches such as laser therapy, acupuncture, and physiotherapy is gaining traction. These methods offer non-invasive, long-term relief and help reduce reliance on pharmacological treatments. Veterinary clinics are investing in rehabilitation centers and advanced pain therapy equipment. The trend aligns with a growing preference for holistic and integrative veterinary medicine, encouraging broader acceptance of multimodal pain management strategies among pet owners.

- For instance, Companion Animal Health (LiteCure) reports it is a proven leader in the field of laser therapy with more than 2,000 units installed in veterinary practices

Digitalization and Remote Pain Monitoring

Technological integration through wearable devices and tele-veterinary platforms is transforming pain management practices. Smart collars and sensors allow continuous monitoring of animal activity, mobility, and stress levels. Remote diagnostics help veterinarians tailor therapy plans and assess treatment effectiveness in real time. This shift toward data-driven pain assessment is improving treatment precision, compliance, and follow-up care, creating significant opportunities for technology providers and clinics.

- For instance, Tractive reports 1.4 million active subscribers globally for its pet health and GPS trackers, generating large-scale activity and sleep datasets.

Key Challenges

High Cost of Advanced Pain Therapies

The expense associated with biologic drugs, advanced devices, and rehabilitation services poses a challenge to market penetration. Many pet owners, especially in developing regions, find these treatments unaffordable due to limited insurance coverage. High R&D and regulatory costs further increase the price of innovative therapies. This cost barrier limits access to advanced pain management options and slows market adoption among middle-income households.

Limited Awareness and Underdiagnosis of Pain in Animals

Many pet owners fail to recognize early signs of pain due to behavioral masking in animals. Lack of standardized pain assessment tools in small clinics further delays diagnosis and treatment. Insufficient veterinary training in pain management also restricts effective intervention. This underdiagnosis leads to chronic conditions going untreated, affecting animal welfare and reducing demand for specialized pain management products and services.

Regional Analysis

North America

North America held the largest share of the Companion Animal Pain Management Market in 2024, accounting for around 40% of global revenue. The region benefits from high pet ownership, advanced veterinary infrastructure, and greater awareness of animal welfare. Rising prevalence of chronic diseases such as arthritis and cancer in pets drives continuous demand for analgesics and biologic therapies. The presence of leading pharmaceutical companies and widespread insurance coverage further strengthens market leadership. Increasing adoption of advanced pain management solutions in veterinary hospitals continues to support regional dominance.

Europe

Europe accounted for approximately 32% of the Companion Animal Pain Management Market in 2024, driven by increasing adoption of advanced pain-relief therapies and strong regulatory support for animal health. The region’s market expansion is influenced by a growing aging pet population and the availability of specialized veterinary clinics. Rising awareness of chronic pain conditions and increased investment in companion animal welfare enhance adoption of multimodal treatments. Technological advancement in veterinary pharmaceuticals and devices across key countries, including Germany, France, and the United Kingdom, contributes to steady regional growth.

Asia Pacific

Asia Pacific represented about 18% of the Companion Animal Pain Management Market in 2024 and is expected to record the fastest growth through 2032. Expanding pet ownership, especially in China, India, and Japan, along with improving veterinary care infrastructure, is fueling demand. Rising disposable income, awareness of animal wellness, and availability of affordable treatment options are driving adoption. Local and international players are investing in research and partnerships to expand pain therapy accessibility. Increasing acceptance of non-pharmacological therapies and digital monitoring tools further accelerates market penetration.

Latin America

Latin America accounted for roughly 6% of the Companion Animal Pain Management Market in 2024, supported by increasing awareness of animal health and growing veterinary service availability. Countries like Brazil and Mexico are witnessing higher pet healthcare spending and expanding veterinary networks. Rising demand for cost-effective pain management drugs and non-invasive therapies contributes to gradual market growth. However, limited access to advanced technologies and uneven distribution of clinics across rural areas restrain faster adoption. Continued economic development and entry of multinational firms are expected to enhance regional opportunities.

Middle East & Africa

The Middle East & Africa captured nearly 4% of the Companion Animal Pain Management Market in 2024, representing the smallest regional share but showing steady improvement. Market growth is supported by expanding urban pet ownership and growing investment in veterinary facilities. The adoption of advanced pain management solutions is rising in developed urban areas, particularly within Gulf Cooperation Council countries. However, limited awareness and affordability challenges hinder broader market penetration. Increasing collaborations between global suppliers and local distributors are helping to expand treatment accessibility and regional outreach.

Market Segmentations:

By Animal Type

- Dogs

- Cats

- Horses

- Other animal types

By Application Type

- Osteoarthritis & joint pain

- Cancer

- Postoperative pain

- Other applications

By Product Type

- Drugs

- Devices

- Laser therapy

- Electromagnetic therapy

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Companion Animal Pain Management Market remains moderately consolidated, with key players including Boehringer Ingelheim, Elanco, Zoetis, Merck, Dechra Pharmaceuticals, Ceva Sante Animale, Virbac, Vetoquinol, Bimeda, Norbrook, Companion Animal Health, INDIBA, PainTrace, Chanelle Pharma, Vetnation Pharma, Aurora Pharmaceutical, and Mars leading industry development through innovation and portfolio diversification. Companies are emphasizing research in biologics, non-opioid analgesics, and multimodal pain therapy solutions to strengthen competitiveness. Strategic collaborations with veterinary clinics and research institutions are expanding access to advanced treatment options. Firms are also increasing investment in laser and electromagnetic devices to complement pharmacological therapies. Market participants are integrating digital technologies for real-time pain monitoring and personalized care. Expansion into emerging regions through partnerships and affordable product launches continues to shape the competitive environment. Growing demand for preventive and chronic pain management solutions encourages manufacturers to enhance quality, safety, and distribution networks, reinforcing long-term industry growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Boehringer Ingelheim

- Elanco

- Zoetis

- Merck

- Dechra Pharmaceuticals

- Ceva Sante Animale

- Virbac

- Vetoquinol

- Bimeda

- Norbrook

- Companion Animal Health

- INDIBA

- PainTrace

- Chanelle Pharma

- Vetnation Pharma

- Aurora Pharmaceutical

- Mars

Recent Developments

- In 2025, Dechra Pharmaceuticals gained FDA approval for Otiserene, a single-dose otitis externa therapy that helps manage inflammation and discomfort.

- In 2024, Ceva Santé Animale Acquired Scout Bio, a company focused on novel advanced therapies for pets, indicating a strategic move towards innovative solutions, which could include future biotherapeutics for pain management.

- In 2023, Mars, Incorporated Completed the acquisition of Heska Corporation, a provider of veterinary diagnostics and specialty solutions, enhancing its capabilities in diagnosing conditions like pain-inducing ailments.

Report Coverage

The research report offers an in-depth analysis based on Animal Type, Application Type, Product Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market is expected to experience steady growth driven by increasing pet healthcare awareness.

- Rising prevalence of chronic pain disorders such as osteoarthritis will boost long-term demand.

- Advancements in biologics and non-opioid pain relief therapies will expand treatment options.

- Integration of wearable monitoring devices will improve real-time pain assessment and management.

- Growing preference for non-pharmacological therapies like laser and electromagnetic treatments will increase adoption.

- Expansion of veterinary telehealth platforms will enhance access to pain management consultations.

- Pet insurance coverage will continue to improve affordability of advanced therapies.

- Pharmaceutical innovation will focus on safer, long-acting, and species-specific formulations.

- Increasing veterinary education and training in pain recognition will strengthen early intervention rates.

- Emerging markets in Asia and Latin America will offer significant growth potential through expanding veterinary infrastructure.